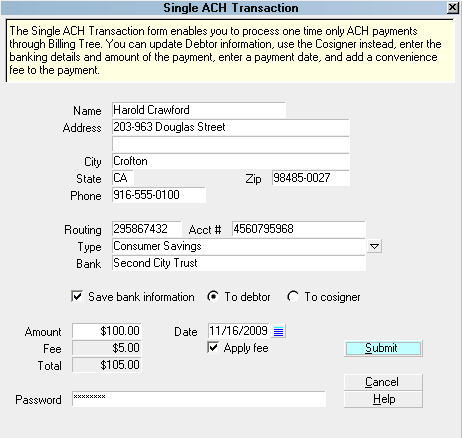

Single ACH Transaction

The Single ACH Transaction screen allows you to submit

a one-time ACH payment for an individual debtor. From

this screen you can:

- update Debtor information

- create a Cosigner Payer

- enter the details

- enter the amount of the payment

- enter a payment date

- add a convenience fee to the payment

Single ACH Transaction

To access this screen, click the ACH button in the lower

right corner of the main debtor screen. You will see

two choices in the menu ACH PAYMENT TASKS popup.

Choose RUN A TRANSACTION to enter the SINGLE ACH

TRANSACTION window.

Or

Choose RECURRING PAYMENTS to enter a post-dated

ACH arrangement.

When you post a single ACH payment, the transaction is

written in Collect! immediately and uploaded to Billing

Tree, and processing confirmation is returned to Collect!.

If the transaction is later charged back for any reason,

the Reconciliation process will write a reversal. A

separate transaction for the convenience fee, if applicable,

is also posted in Collect! and processed same day.

When you run Reconcile ACH History from the menu path

" Daily Administration\ Payments and Charges\Reconcile ACH",

transactions which are due for processing in the date

range since your last reconciliation are uploaded while any

chargebacks or new payments made directly on the ACH portal

are downloaded. Any unmatched transactions are written to

an exception report located in the path CV11\bin\BillingTree\ACH.

We recommend that sites run their Reconcile ACH History

daily. Multiple times per day is permissible; no

duplication of payments or reversals can occur.

We recommend that sites run their Reconcile ACH History

daily. Multiple times per day is permissible; no

duplication of payments or reversals can occur.

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

Name

Enter the payer's name if it is different

from the debtor name already displayed.

By default, this field is filled with the

Name from the Debtor screen. You can edit this

name as needed for the transaction. If you

choose to save this information, the system

will update the Debtor screen for you. If

it is a third party payer with a different

name than any responsible party on the debt,

select "To Cosigner". The system will save

this information by creating a new Cosigner

window with the Class ACH Payer. This Class

must exist in your Cosigner pick list. Older

versions of Collect! use "Other" as the Class.

Address

Enter the payer's Street Address. By default,

this field is filled from the Debtor screen.

By default, this field is filled with the

Address from the Debtor screen. You can

edit this as needed for the transaction.

If you choose to save this information,

the system will update the Debtor screen

for you. If you are entering the info for a

third party payer, the system will include

this address.

Address 2

This is an optional second Address line.

By default, this field is filled from the

Debtor screen.

By default, this field is filled with the

Address 2 from the Debtor screen. You can

edit this as needed for the transaction. If

you choose to save this information, the

system will update the Debtor screen for

you. If you are entering the info for a

third party payer, the system will include this

Address 2.

City

Enter the payer's City. By default, this

field is filled from the Debtor screen.

By default, this field is filled with the

City from the Debtor screen. You can edit

this as needed for the transaction. If you

choose to save this information, the system will

update the Debtor screen for you. If you are

entering the info for a third party payer,

the system will include this City.

State

Enter the payer's two character State code.

By default, this field is filled from the

Debtor screen. This is a required field by

the correct 2-digit code.

By default, this field is filled with the

State from the Debtor screen. You can edit

this as needed for the transaction. If you

choose to save this information, the system

will update the Debtor screen for you. If

you are entering the info for a third party

payer, the system will include this State.

ZIP

Enter the payer's ZIP code. By default,

this field is filled from the Debtor

screen. Make sure your zip is valid.

Billing Tree REJECTS records with invalid zip

codes.

By default, this field is filled with the

Zip from the Debtor screen. You can edit

this as needed for the transaction. If you

choose to save this information, the system

will update the Debtor screen for you. If you

are entering the info for a third party payer,

the system will include this Zip.

Phone

Enter the payer's Phone number. By default,

this field is filled from the Home phone

number on the Debtor screen.

By default, this field is filled with the

Phone from the Debtor screen. You can edit

this as needed for the transaction. If you

choose to save this information, the system

will update the Debtor screen for you. If

you are entering the info for a third party

payer, the system will include this Phone.

Routing

Enter the Routing number for the Bank

that this ACH payment will be drawn from.

This is a 9-digit number and must match

the routing number of the payer's bank.

When this transaction is processed, it is

stored in the Debtor Detail Tab, in the

ABA field, or stored to the Cosigner, if

you choose to "Save bank information".

Acct #

Enter the payer's Bank Account Number.

This must be the account that the ACH

payment will be drawn from.

When this transaction is processed, it

is stored in the Debtor Detail Tab,

Account field, or to the Cosigner, if

you choose to "Save bank information".

Type

Select the Type of bank account from the

pick list provided.

When this transaction is processed, it

is stored in the Debtor Detail Tab,

field label Detail 1, or to the Cosigner,

if you choose to "Save bank information".

Bank

Enter the name of the Bank this ACH payment

will be drawn from.

When this transaction is processed, it is

stored in the Debtor Detail Tab, Bank field,

or to the Cosigner, if you choose to

"Save bank information".

Save Bank Information

Activate this option with a check mark

if you want to save the entered bank

information to the debtor's Detail Tab,

or to the Cosigner window.

To Debtor

This option will update the information

on the Debtor account and in the Debtor

Detail Bank, Account, ABA and Detail 1

fields, if you choose to "Save bank

information".

This does overwrite any information that

is presently entered into any of the target

fields.

To Cosigner

Clicking the radio button for Cosigner

will only be permitted if you have entered

a name that is different from the auto-filled

primary debtor name. This will create a Cosigner

window if you choose to "Save bank information".

Amount

Enter the Amount of the ACH payment you are

about to process.

Date

Select the payment Date of the ACH payment

you are about to process.

Fee

This field displays the amount of the

Convenience Fee.

This field is Read Only. You must check

the "Apply fee" box for the amount of the

convenience fee to auto-fill. Unless

you have enabled each client to allow

ACH convenience fees, the Fee amount

will remain blank and the "Apply fee"

check box will also be Read Only and

not accessible. See Advanced Client

Settings for more information.

Apply Fee

Check this ON to activate the convenience

fee for this transaction and invoke display

of the fee amount to be applied when the

payment is processed.

If you have not enabled convenience fees

for this Client, then the Apply Fee

field will be greyed out. Please refer to

Advanced Client Settings for details.

Total

This is the total amount that will be drawn

from the bank account used for this transaction.

This includes the amount for the convenience fee,

if applicable.

The fee transaction is posted separately from

the payment amount. The Total displayed is

the sum of both the payment and the

convenience fee amounts being withdrawn

from the debtor's bank account for this

transaction.

Password

This is your Billing Tree ACH Password. This

is prefilled for you automatically after you

have entered it for the first time for the

current session.

Help

Select the HELP button for Help on Single ACH

Transaction and related topics.

Cancel

Select the CANCEL button to close this

screen without submitting the payment to

Billing Tree.

Submit

Select the SUBMIT button when you are sure

that you have entered all the required

information correctly for the payment you

are about to process.

When you select SUBMIT, the payment will be

posted in Collect! and processed by Billing

Tree when your company next runs "Reconcile

ACH History".

You must run daily reconciles to keep your

transaction uploads to Billing Tree current

and your records up-to-date with NSFs received

by Billing Tree along with external payments

which debtors may be making directly on the

ACH Gateway.

Transaction Details

After you have successfully processed a

single ACH payment, you can view the resulting

posting immediately in the Transaction Tab of

the debtor account. You will receive a unique

Reference Number in the User 2 field of the

Transaction Detail Tab when ACH has cleared

a payment. The Transaction Tab will also

have a posting of the convenience fee,

if applicable.

NSF Payments

When you reconcile ACH history, the module

will download any reversals for payments not

yet received in Collect!. Reversals would be

any transaction which failed to clear, such as an

NSF, Stop Payment or Hold. The convenience

fee is also reversed provided your ACH Setup

window contains reversal transaction type

codes to be used.

See Also

- Billing Tree Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org