Rule Of 78's

When lenders use the Rule of 78's, they distribute the

total finance charge over all payments, but charge more

interest early in the loan period and less later, compared

to other methods. The Rule of 78's is also called the "sum

of digits" because it gets its name from summing the

digits 1 through 12 - the number of months in a one year

loan. Yes, this is 78.

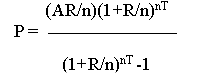

Here is how the Rule of 78's is applied to a Amortized

loan. Interest is calculated as described in the topic

Amortized Loan - Normal. (The formulas are repeated

below but you will have to refer to the aforementioned

topic for details.)

Payment Amount

P = Payment

A = Amount borrowed

R = Annual Interest Rate

n = number of compound payments per year.

T = time in years.

nT = Term, the total number of payments in the loan schedule. This

is the number of periods per year multiplied by the number of years.

This is the exponent. In the formula, 1 + the Interest Rate(R/n) is

multiplied by itself as many times as the value of the Term(nT).

Total Plan Payments

TP = P x T

TP = Total Plan Payments

P = Payment Amount

T = number of Payments (Term)

Total Interest

TI = TP - A

TI = Total Interest

TP = Total Plan Payments

A = Amount Borrowed

When you know the Total Interest through the calculations

above, you can calculate interest rebate using Rule of 78's.

Interest Payments

First, you need the Sum of the number of payments.

For instance, if the Term is 12 monthly payments, the

summation of 12 payments is

1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9 + 10 + 11 + 12 = 78

The amount of interest to be paid per payment is calculated

as follows.

12/78 x Total Interest = First Payment

11/78 x Total Interest = Second Payment

- and so on until...

1/78 x Total Interest = Final Payment

This rule applies to long term loans the same way.

For example, a 24-month loan - where the sum of

the digits 1 through 24 is 300 - would have a first

month's interest payment that is 24/300 of the

total interest. The second month would be 23/300

and so on.

A three year loan, 36 months - where the sum of

the digits 1 through 36 is 666 - would have a first

month's interest payment that is 36/666 of the total

interest, second month would be 35/666 and so on.

The above fractions are applied to the Total

Interest amount. The remainder of the Payment amount

would be applied to outstanding principal. As the months

go by, the interest portion decreases and the principal

is paid off faster. However, the interest portion is a

fixed amount determined by the Rule of 78's. It is not

recalculated each time from outstanding principal.

The above fractions are applied to the Total

Interest amount. The remainder of the Payment amount

would be applied to outstanding principal. As the months

go by, the interest portion decreases and the principal

is paid off faster. However, the interest portion is a

fixed amount determined by the Rule of 78's. It is not

recalculated each time from outstanding principal.

The amount applied to Principal is

Payment Amount - Interest for Payment = Applied to Principal.

Early Payout Amount

If the loan is paid off before the full Term has expired, there

is usually an interest rebate. The borrower did not have the

money as long as originally planned and did not accumulate

as much interest on the loan. However, the lender depends

on the interest as payment for lending money. This is the

financial charge of the loan. If a loan is paid off early, the

portion of interest that is left is less with Rule of 78's and

this benefits the lender.

For instance, if a 12-month loan is paid in 10 months,

2/78 of the Total Interest - the 11th payment and

1/78 of the Total Interest - the 12th and final payment

is all the remaining financial charge left unpaid. So 75/78 of the

Total Interest has already been paid. Only 3/78 of the Total Interest

is saved by paying the loan early.

To calculate the Early Payout Amount, first determine the

number of payments remaining. Then calculate the Interest

amount saved as shown above.

It is very straightforward:

1. Each payment is numbered from 1 to the total number in the

Term. (12 or 24 or 36 or whatever)

2. The bottom part of the fraction is figured by "summing the

digits." (78 or 300 or 666 or whatever)

3. Interest left to pay is calculated as described above.

If a 36-month loan is paid in 30 months, for instance, the amount

of interest left to be refunded or deducted from the total outstanding

debt is the following.

1/666 of the Total Interest +

2/666 of the Total Interest +

3/666 of the Total Interest +

4/666 of the Total Interest +

5/666 of the Total Interest +

6/666 of the Total Interest = 21/666 of the Total Interest that must

be rebated to the borrower.

This is the Interest Amount Saved and is used to calculate

Early Payout Amount.

Early Payout Amount = OP + TI - IAS - PP - IP

OP = Original Principal

TI = Total Interest

IAS = Interest Amount Saved

PP = Principal Paid

IP = Interest Paid

Another formula which gives the Interest Amount Saved is

the following.

Another formula which gives the Interest Amount Saved is

the following.

(No. of months remaining + 1) x (No. of months remaining)

divided by (No. of months in Term + 1) x (No. of months in Term)

This gives the same result as above.

Early Payoff Penalty

When a loan is paid off a great deal sooner than expected, the

borrower can actually experience a penalty. This is because

Rule of 78's calculates higher interest percentages in earlier

months than other types of calculating. This interest is still

due according to the agreement made, even though the

actual calculation of interest would not be as high.

For instance, borrowing $10,000 for two years at 12% would

amount to $1297.65 in Total Interest (using a 365 day year.)

If this loan is paid after only four months, the actual interest on the

amount and the length of time would be $377.61.

Using Rule of 78's, the interest charge for the first four months amounts

to $389.30. (Using the formulas given above.)

This is an additional 3% interest.

As a rule:

1. The higher the interest rate, the greater the penalty amount.

2. The earlier the prepayment in relation to the term, the greater

the penalty amount.

So, if you are a lender, you benefit from Rule of 78's. If you are a

borrower, you should try to avoid it.

WARNING: Some states have usury and other laws that may

limit the use of the Rule of 78's.

WARNING: Some states have usury and other laws that may

limit the use of the Rule of 78's.

Rate Basis

For "Rule of 78" accounts, the Rate Basis is only a factor if the

first payment is deferred. A deferred payment is a payment where

the First Payment Date is more than one Period away from the

Calculate Interest From Date. Interest is calculated on this

difference and the current Rate Basis is a factor in this calculation.

See Also

- Amortized Loan - Normal

- Interest Detail

- How To Make An Interest Adjustment

- How To Setup Amortized Interest

- How To Use The Amortization Schedule

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org