Credit Reporting Functional Description

Credit Bureau Reporting (CBR) allows you to send account

information to credit bureaus in a standard format.

WARNING: Credit reporting affects people's credit history and

is not to be taken lightly. YOU ARE RESPONSIBLE FOR THE

DATA YOU SEND. These instructions help you control the

information you publish about a person's credit history. Instructions

in no way replace thinking! Never send data if errors or warnings

are displayed when publishing your credit report. Always verify

the data that you think the bureau received by pulling credit reports

on accounts you have reported. Do not assume!

WARNING: Credit reporting affects people's credit history and

is not to be taken lightly. YOU ARE RESPONSIBLE FOR THE

DATA YOU SEND. These instructions help you control the

information you publish about a person's credit history. Instructions

in no way replace thinking! Never send data if errors or warnings

are displayed when publishing your credit report. Always verify

the data that you think the bureau received by pulling credit reports

on accounts you have reported. Do not assume!

Introduction

Collect! supports both credit grantors and third party collection

agency credit reporting.

To understand Credit reporting, we can break it down into its

constituent parts and look at the basic conditions that apply.

This can help us understand and control our operations more

effectively.

Accounts have a life. They start by being opened, they live a while,

and then eventually they are closed. Hopefully, they are paid in

full by then. Accounts live two simultaneous lives. They exist in

the Collect! database and they can also exist in the credit

bureau databases. You control the Credit Bureau Reporting (CBR)

life of an account with the credit reporting controls in Collect!

When you close an account in Collect! this does not

remove any data from the credit bureau databases. You must

specifically send a Close CBR status to the credit bureaus

when you want to report an account paid in full or closed for

any other reason.

When you close an account in Collect! this does not

remove any data from the credit bureau databases. You must

specifically send a Close CBR status to the credit bureaus

when you want to report an account paid in full or closed for

any other reason.

Basic Credit Reporting Operation

The three states in the CBR life of an account are:

1. Creation

2. Existence

3. Closure

Credit reporting information is sent to the credit bureaus every

month. You manually tell Collect! to generate the files for each

bureau. When you create the CBR files, Collect! will check each

account to help catch obvious errors in your data and will report

any errors to you.

You create a CBR account when you first turn on CBR reporting on

the account. The account must first exist in the Collect! database.

Collect! uses the default CBR settings from the Credit Bureau Preferences

dialog to fill in the new account CBR settings. You can change the

settings on an account by account basis to accurately reflect the

information reported to the credit bureaus.

When you turn on CBR reporting on an account, Collect! transmits

the CBR information with the next batch of data you send to the

bureaus.

During its CBR life, you can control the status of the account to

reflect the payment history. Depending on how Collect! and the

account are configured, Collect! may also automatically set

certain values for credit reporting. Collect! calls a special

Check Metro Report function whenever the account balance is

changed. This is described more fully below.

One very important piece of information is

the 'Delinquency Date' on the debtor dialog. This affects a

person's credit rating so use it carefully.

One very important piece of information is

the 'Delinquency Date' on the debtor dialog. This affects a

person's credit rating so use it carefully.

Once you send a 'Close' status to the bureaus, no further reports

are transmitted by Collect!. Your credit ratings set the final payment

rating of the account when you close the account.

Several CBR status codes reflect closed accounts.

Collect! ignores accounts with closed CBR status codes and

does not transmit any further CBR data after an account has a

CBR closed status. CBR status codes 13 and 61 - 65 are considered

closed CBR accounts. Once a credit report is sent on one of

these account status codes, Collect! will not send any more

reports to the bureau on that account.

Several CBR status codes reflect closed accounts.

Collect! ignores accounts with closed CBR status codes and

does not transmit any further CBR data after an account has a

CBR closed status. CBR status codes 13 and 61 - 65 are considered

closed CBR accounts. Once a credit report is sent on one of

these account status codes, Collect! will not send any more

reports to the bureau on that account.

If the status code is not one of the closed types, then Collect!

can automatically report your account information to the

bureaus monthly or as needed.

Agents And Third Party Collectors

If you are a third party collector (you don't own the accounts

yourself) you need to ensure the Credit Grantor switch is

turned OFF in the Credit Bureau Preferences form.

Creating Collection Accounts

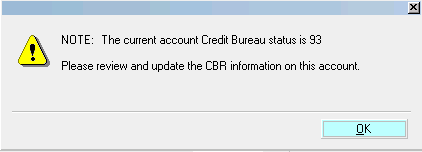

Upon creating the account, its CBR status should be initially

set to status '93 - collection account'. The next CBR report

you produce will contain any new accounts you created

during the reporting period.

Working Collection Accounts

During the CBR life of the account, when something is changed

on the account, Collect! recalculates the account total Owing

and then calls the Check Metro Report function. The CBR status

is set to 93 if the amount owing is $1.00 or more. If the owing is

less than $1.00, the CBR status is set to '62 - paid in full

collection account'.

The next CBR report you produce will contain any changes to

your accounts.

CBR status codes other than 93 and 62 are not supported in

Agent and Third Party operation.

Closing Collection Accounts

You can manually set the CBR status to close an account, or

Collect! will automatically set the CBR status to '62 - paid in

full collection account' when the account balance falls

below $1.00. The next CBR report you send will contain the

Closed status for the account and Collect! will not send

any further credit reports on that account.

Credit Grantors

When you own the accounts yourself, you can track the whole

life of the account. Your company details are reported in the

K1 segment.

The Credit Grantor switch should be turned on in the

Credit Bureau Preferences form.

A perfect account would start as status '11 - current

account' and close with status code '13 - paid in full' with

nary a change in between. Sadly accounts

don't always follow such an excellent payment history.

Various CBR status codes are used to report the delinquency

of an account.

Depending on the interest settings of an account, Collect! can

help manage account CBR status reporting. Interest calculation

modes are described below. Collect! manages account status

for accounts with compound interest. Collect! sets the

delinquency date on compound interest accounts whenever an

account is 31 days or more overdue. Accounts that are not

using compound interest can use other mechanisms to set

delinquency dates.

Creating Credit Accounts

Upon creating the account, its CBR status should be initially

set to status '11 - current account'. The next CBR report you

produce will contain any new accounts you created during the

reporting period.

Working Credit Accounts

During the CBR life of the account, when something is changed

on the account, Collect! recalculates the account total Owing

and then calls the Check Metro Report function.

The Check Metro Report function only changes CBR settings

if the existing account status is one of 11, 71, 78, 80 and 82 - 84.

Any status outside that range is considered manually set, and

Collect! does not affect manually set CBR status codes.

Collect! sets the CBR status codes on managed accounts based

on the delinquency date of the account. The status is set to Current

account, 30, 60, 90,120, 150 and 180 Days delinquent.

Current Accounts

When a debtor makes payments on time, the Delinquency date

should be clear, and all CBR status reports should reflect

status '11 - Current account'.

Delinquent Accounts

The delinquency date in Collect! is used to determine account

delinquency status.

For compound interest accounts with a fixed monthly payment

amount, Collect! calculates the delinquency date. On other types

of interest accounts, you can manually set the delinquency date,

or you can use promise contacts or pending transactions to

automatically calculate the delinquency date.

When you post a payment, Collect! checks the delinquency

date and sets the account CBR status accordingly.

Closing Credit Accounts

When an account is paid in full (CBR status 13) the last

CBR status before the close status was set is used to

determine the Payment Rating of the account. If they had

been late in paying and then, suddenly, paid the account off,

then the payment rating will reflect the delinquency status

before the final payment in full.

When an account that is CBR status '11 - current

account' is closed or paid in full, it should have a

payment rating of ' 0 ' to indicate the account was current

when it was closed.

Only accounts with Amortized compound interest

are automatically closed by Collect!

When you close an account with no interest or other

manual types of interest, you will want to set the Payment

Rating in the Credit Bureau form to accurately reflect the

delinquency at the time you manually close the account.

No Interest

A No Interest account is considered by Collect! to be a

revolving account, and the default CBR status code

is '11 - Current account' unless a delinquency date is set.

A zero balance results in a CBR status code 11.

A No Interest account is only considered closed to CBR if

you manually set the account status to 13 or 61 - 65.

If the last CBR status was a 13 or 61 - 65 (any closed status)

it ignores the account for CBR purposes as the account

has been reported as closed to the bureaus.

When an account has one of the automated status codes,

Collect! checks the account status and updates the CBR

status code to reflect current account conditions as follows:

If the account does not have the delinquency date set,

then the CBR status is set to '11 - Current Account'.

If the account has a delinquency date, then the CBR status

code is set to 11, 71, 78, 80, 82, 83 or 84 depending

on the number of days between the delinquency date and

the date the file is being reviewed.

To automatically set delinquency date, create a promise

type contact. The due date of the promise contact is the

promise date on the debtor form. If the promise date is 31 days

or more overdue, the delinquency date is calculated as promise

date plus 31 days.

Simple Interest

A Simple Interest account is considered by Collect! to be

a revolving account, and the default CBR status code

is '11 - Current account' unless a delinquency date is set.

A zero balance results in a CBR status code 11.

A Simple Interest account is only considered closed to CBR if

you manually set the account status to 13 or 61 - 65.

If the last CBR status was a 13 or 61 - 65 (any closed status)

it ignores the account for CBR purposes as the account

has been reported as closed to the bureaus.

When an account has one of the automated status codes,

Collect! checks the account status and updates the CBR

status code to reflect current account conditions as follows:

If the account does not have the delinquency date set,

then the CBR status is set to '11 - Current Account'.

If the account has a delinquency date then the CBR status

code is set to 11, 71, 78, 80, 82, 83 or 84, depending

on the number of days between the delinquency date and

the date the file is being reviewed.

To automatically set delinquency date, create a promise

type contact. The due date of the promise contact is the

promise date on the debtor form. If the promise date is 31 days

or more overdue, the delinquency date is calculated as promise

date plus 31 days.

Revolving Compound Interest

A Revolving Compound Interest account is considered by Collect!

to be a revolving account, and the default CBR status code

is '11 - Current account' unless a delinquency date is set. A zero

balance results in a CBR status code 11.

A Revolving Compound Interest account is only considered closed

to CBR if you manually set the account status to 13 or 61 - 65.

If the last CBR status was a 13 or 61 - 65 (any closed status)

it ignores the account for CBR purposes as the account

has been reported as closed to the bureaus.

When an account has one of the automated status codes,

Collect! checks the account status and updates the CBR

status code to reflect current account conditions as follows:

If the account does not have the delinquency date set

then the CBR status is set to '11 - Current Account'.

If the account has a delinquency date then the CBR status

code is set to 11, 71, 78, 80, 82, 83 or 84, depending

on the number of days between the delinquency date and

the date the file is being reviewed.

To automatically set delinquency date, create a promise

type contact. The due date of the promise contact is the

promise date on the debtor form. If the promise date is 31 days

or more overdue, the delinquency date is calculated as promise

date plus 31 days.

Normal Amortized Loan

This is considered an open account by Collect!

The default CBR status code is '11 - Current account' unless a

delinquency date is set. A zero balance results in a CBR status

code 13.

If the last CBR status was a 13 or 61 - 65 (any closed status)

Collect! ignores the account for CBR purposes as the account

has been reported as closed to the bureaus.

When an account has one of the automated status codes,

Collect! checks the account status and updates the CBR

status code to reflect current account conditions as follows:

If the account does not have the delinquency date set

then the CBR status is set to '11 - Current Account'.

If the account has a delinquency date then the CBR status

code is set to 11, 71, 78, 80, 82, 83 or 84, depending

on the number of days between the delinquency date and

the date the file is being reviewed.

Delinquency date is set by the interest calculation routines.

Rule Of 78 Amortized Loan

This is considered an open account by Collect!

The default CBR status code is '11 - Current account' unless a

delinquency date is set. A zero balance results in a CBR status

code 13.

If the last CBR status was a 13 or 61 - 65 (any closed status)

Collect! ignores the account for CBR purposes as the account

has been reported as closed to the bureaus.

When an account has one of the automated status codes,

Collect! checks the account status and updates the CBR

status code to reflect current account conditions as follows:

If the account does not have the delinquency date set

then the CBR status is set to '11 - Current Account'.

If the account has a delinquency date then the CBR status

code is set to 11, 71, 78, 80, 82, 83 or 84, depending

on the number of days between the delinquency date and

the date the file is being reviewed.

Delinquency date is set by the interest calculation routines.

Reference Tables

These tables show all the codes currently used in credit reporting.

Status Codes

The following is a list of all CBR status codes.

05 - Account transferred to another office

11 - Current account

13 - Paid in full

61 - Paid in full; voluntary surrender

62 - Paid in full; collection account or claim

63 - Paid in full; was a repossession

64 - Paid in full; was a charge off

65 - Paid in full; a foreclosure was started

71 - 30 days

78 - 60 days

80 - 90 days

82 - 120 days

83 - 150 days

84 - 180 days

88 - Filed with govt. for insured portion on balance on defaulted loan

89 - Deed received in lieu of foreclosure on a defaulted mortgage

93 - Seriously past due, and/or assigned to collections

94 - Foreclosure/ credit grantor sold collateral to settle mortgage

95 - Voluntary surrender

96 - Merchandise taken back by grantor; may be a balance due

97 - Unpaid balance reported as a loss by credit grantor

DA - Delete entire account from credit bureau

DF - Delete entire account due to confirmed

fraud (fraud investigation completed)

Managed Status Codes - Third Party Collections

The following status codes are supported by Collect! in

Agency/Third Party Collections mode.

93 - Seriously past due/assigned to collections

62 - Paid in full collection account or claim

Managed Status Codes - Credit Grantor

The following CBR status codes are supported by Collect!

in Credit Grantor mode.

11 - Current account

13 - Paid in full

71 - 30 days

78 - 60 days

80 - 90 days

82 - 120 days

83 - 150 days

84 - 180 days

Closed Status Codes

Collect! ignores accounts with the following CBR status codes

and considers the accounts closed for CBR reporting.

05 - Account transferred to another office

13 - Paid in full

61 - Paid in full; voluntary surrender

62 - Paid in full; collection account or claim

63 - Paid in full; was a repossession

64 - Paid in full; was a charge off

65 - Paid in full; a foreclosure was started

Manual Status Codes - Credit Grantor

Collect! does not automatically change any credit reporting information

on accounts with the following CBR status codes. If you set an account

to any one of these CBR status codes, you must manually make changes

to the account CBR status as needed. Collect! will not make any changes

even when an account is paid in full!

88 - Filed with govt. for insured portion on balance on defaulted loan

89 - Deed received in lieu of foreclosure on a defaulted mortgage

93 - Seriously past due, and/or assigned to collections

94 - Foreclosure/ credit grantor sold collateral to settle mortgage

95 - Voluntary surrender

96 - Merchandise taken back by grantor; may be a balance due

97 - Unpaid balance reported as a loss by credit grantor

DA - Delete entire account from credit bureau

DF - Delete entire account due to confirmed

fraud (fraud investigation completed)

Paid Account in Full when Status was 93

Status Codes And Payment Ratings

| Status | Payment Rating |

| 11 | 0 |

| 71 | 1 |

| 78 | 2 |

| 80 | 3 |

| 82 | 4 |

| 83 | 5 |

| 84 | 6 |

| DEFAULT - Any payment rating manually set on the account. |

Summary

This topic is an attempt to clarify the mystique of correct credit

reporting. Please use it in conjunction with the manual supplied

by your credit reporting bureau. Check your reporting procedures

carefully to be sure you are entering data accurately and getting

the results you expect when you run your reports.

See Also

- Credit Bureau Reporting Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org