Metro 2 Format - Base Segment

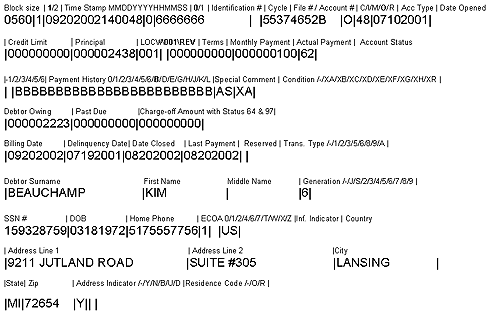

The Base Segment is the second segment of a credit reporting file.

It contains the primary consumer's identification information and

the account transactional information.

In the image below, the fields in the Base Segment are

partitioned and identified. Actually, this is one long string of

data in the reporting file.

In the tables below,

- Field is the Metro 2 Format Field number

- Field Name is taken from the Metro 2 Format. Refer to the Field

Number and Field Name when you are trying to determine CBR

requirements for particular areas.

- Length and Position can be used as reference points

when you are examining actual data in the report as Collect!

generates it.

- Source is the field in Collect! where the information is

pulled from, or some sort of internal value, as indicated.

| Base Segment |

| Field | Field Name | Length | Position | Source |

| 1 | Record Descriptor | 4 | 1-4 | Record length |

| 2 | Processing Indicator | 1 | 5 | Processing instruction |

| 3 | Time Stamp | 14 | 6-19 | Contact created Date and Time |

| 4 | Correction Indicator | 1 | 20 | Internal |

| 5 | Identification Number | 20 | 21-40 | Credit Bureau Setup Identification # |

| 6 | Cycle Identifier | 2 | 41-42 | Cycle Reporting -- BLANK |

| 7 | Consumer Account Number | 30 | 43-72 | Debtor File # or Client Account # |

| 8 | Portfolio Type | 1 | 73 | Credit Report Details Portfolio |

| 9 | Account Type | 2 | 74-75 | Credit Report Details Account Type |

| 10 | Date Opened | 8 | 76-83 | Debtor Listed Date |

| 11 | Credit Limit | 9 | 84-92 | ZERO FILL |

| 12 | Highest Credit or Original Loan Amount | 9 | 93-101 | Debtor Principal |

| 13 | Terms Duration | 3 | 102-104 | 1 |

| 14 | Terms Frequency | 1 | 105 | BLANK |

| 15 | Scheduled Monthly Payment Amount | 9 | 106-114 | ZERO FILL |

| 16 | Actual Payment Amount | 9 | 115-123 | Payment Transactions Amount |

| 17A | Account Status | 2 | 124-125 | Credit Report Details Status Code |

| 17B | Payment Rating | 1 | 126 | BLANK |

| 18 | Payment History Profile | 24 | 127-150 | B - No Payment History |

| 19 | Special Comment | 2 | 151-152 | Credit Report Details Special Comments |

| 20 | Compliance Condition Code | 2 | 153-154 | Credit Report Details Condition Code |

| 21 | Current Balance | 9 | 155-163 | Debtor Owing |

| 22 | Amount Past Due | 9 | 164-172 | ZERO FILL |

| 23 | Original Charge-off Amount | 9 | 173-181 | ZERO FILL |

| 24 | Billing Date | 8 | 182-189 | Credit Report Date |

| 25 | FCRA Compliance/Date of First Delinquency | 8 | 190-197 | Debtor Delnqnt or zero filled if Current |

| 26 | Date Closed | 8 | 198-205 | Metro Contact Date or zero filled if not Closed |

| 27 | Date of Last Payment | 8 | 206-213 | Debtor Payment |

| 28 | Reserved | 17 | 214-230 | BLANK |

| 29 | Consumer Transaction Type | 1 | 231 | Internal |

| 30 | Surname | 25 | 232-256 | Debtor Name |

| 31 | First Name | 20 | 257-276 | Debtor Name |

| 32 | Middle Name | 20 | 277-296 | BLANK |

| 33 | Generation Code | 1 | 297 | Debtor Generation |

| 34 | Social Security Number | 9 | 298-306 | Debtor SSN# |

| 35 | Date of Birth | 8 | 307-314 | Debtor DOB |

| 36 | Telephone Number | 10 | 315-324 | Debtor Home |

| 37 | ECOA Code | 1 | 325 | Credit Report Details Association Code (ECOA) |

| 38 | Consumer Information Indicator | 2 | 326-327 | Credit Report Details Indicator |

| 39 | Country Code | 2 | 328-329 | Debtor Country |

| 40 | First Line of Address | 32 | 330-361 | Debtor Address |

| 41 | Second Line of Address | 32 | 362-393 | Debtor Address Line 2 |

| 42 | City | 20 | 394-413 | Debtor City |

| 43 | State | 2 | 414-415 | Debtor State |

| 44 | Postal/Zip Code | 9 | 416-424 | Debtor Zip |

| 45 | Address Indicator | 1 | 425 | Debtor Address OK |

| 46 | Residence Code | 1 | 426 | BLANK |

The next table clearly displays each database field name from

Collect! to help you determine more easily where information

is coming from.

| Base Segment Record Database Fields |

| Metro 2 Field Name | Database Form and Field | Length | Position |

| Identification Number | Credit Bureau Setup Identification # | 20 | 21-40 |

| Consumer Account Number | Debtor File # or Client Account # | 30 | 43-72 |

| Portfolio Type | Credit Report Details Portfolio | 1 | 73 |

| Account Type | Credit Report Details Account Type | 2 | 74-75 |

| Date Opened | Debtor Listed Date | 8 | 76-83 |

| Highest Credit or Original Loan Amount | Debtor Principal | 9 | 93-101 |

| Actual Payment Amount | Payment Transactions Amount | 9 | 115-123 |

| Account Status | Credit Report Details Status Code | 2 | 124-125 |

| Special Comment | Credit Report Details Special Comments | 2 | 151-152 |

| Compliance Condition Code | Credit Report Details Condition Code | 2 | 153-154 |

| Current Balance | Debtor Owing | 9 | 155-163 |

| FCRA Compliance/Date of First Delinquency | Debtor Delnqnt | 8 | 190-197 |

| Date of Last Payment | Debtor Payment | 8 | 206-213 |

| Surname | Debtor Name | 25 | 232-256 |

| First Name | Debtor Name | 20 | 257-276 |

| Social Security Number | Debtor SSN# | 9 | 298-306 |

| Date of Birth | Debtor DOB | 8 | 307-314 |

| Telephone Number | Debtor Home | 10 | 315-324 |

| ECOA Code | Credit Report Details Association Code (ECOA) | 1 | 325 |

| Consumer Information Indicator | Credit Report Details Indicator | 2 | 326-327 |

| Country Code | Debtor Country | 2 | 328-329 |

| First Line of Address | Debtor Address | 32 | 330-361 |

| Second Line of Address | Debtor Address Line 2 | 32 | 362-393 |

| City | Debtor City | 20 | 394-413 |

| State | Debtor State | 2 | 414-415 |

| Postal/Zip Code | Debtor Zip | 9 | 416-424 |

| Address Indicator | Debtor Address OK | 1 | 425 |

Collect! uses the 426 character format when creating

the credit reporting file in Metro 2 Format.

Collect! uses the 426 character format when creating

the credit reporting file in Metro 2 Format.

For more information, please refer to your

credit reporting manual or consult with your

credit bureau representative.

See Also

- Credit Reporting Functional Description

- Credit Bureau Reporting Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org