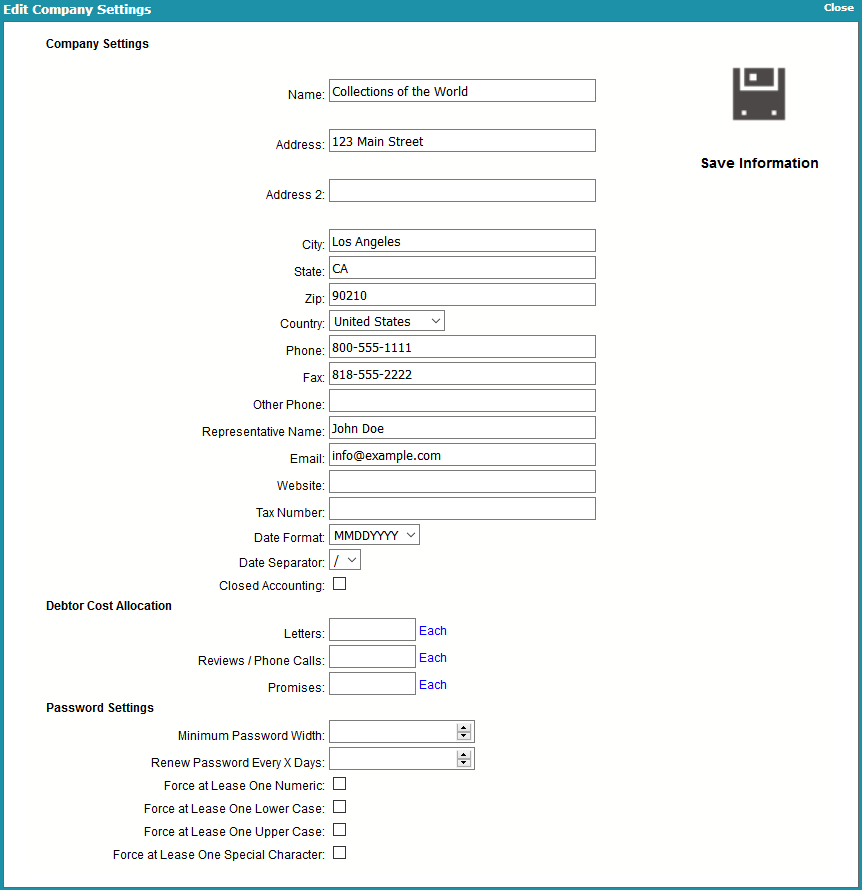

Web Host Company Settings

The Company Details form stores name and address information

about your company. This can be printed on reports and letters

and is used in credit bureau reporting. Some Client Settings

values are set up automatically for you based on information you

enter in the additional fields on this form.

Edit Company Settings

Name

Enter the name of your company as you would

like it to appear on reports and letters. If you

are using the credit reporting module,

please enter your company's name as you would

like it to appear in credit bureau Metro2

output file header records.

Address

Enter your Street Address. There are two

address lines on this screen. The

information you enter in these lines

can be pulled into reports and letters.

The information in these three lines is

also included in header record of your credit

bureau Metro2 output files.

The format with which you enter your

information is up to each agency. However,

we recommend using Postal Addressing

Standards that are applicable to your

country. These are generally available

by looking up the website of the postal

service for your region.

Example:

Name - Your Company Name Goes Here

Address - Your Company Address

Address 2 - Company Addr2

Representative - Default Report Name or Leave Blank

City - Your Company City

State - Your 2 Position State/Province Code

Zip - Your Zip/Postal Code

Country - Choose From Pick List or Leave Blank

Email - Any Company Email Address or Leave Blank

Address 2

This address field can hold your second

address line or other information you may

wish to store for later use/output to

reports or letters.

State

Enter your agency's State Code.

ZIP

Enter your agency's ZIP/Postal Code.

Country

Optional. Use the drop-down arrow pick

list to select your Country OR leave blank

if you do not wish to see this field

expressed in reports/letters.

Phone

Enter your main office Phone number.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all look-ups by phone

in your system. Look-ups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

If you use the Credit Bureau module, the

Phone number is required and is output

to the header record of the Metro2 formatted

text file when created. The Credit Bureau

module will strip out any non-numeric data

automatically and will use a maximum of 10

digits in compliance with the Metro2 File

Format specifications.

Fax

This Fax number field is pulled into

many of the sample reports and letters.

Other Phone

Optional. The Other Phone number is another phone

number for your company. It is not included

in default shipping sample reports/letters.

Representative Name

Optional. Enter the name of your company

representative. This may be the Owner

or President's name.

Email

Optional. This field is used to enter your

agency's central email address or the email

address of your main representative.

Website

Optional. This field can hold the web address

to your website.

Tax Number

This is your Tax registration ID number. It is printed on

statements and invoices. Every time you issue a receipt

or charge for the tax on your commissions, you have to

include your Tax #. If you do not charge tax, you probably

don't need this field.

Date Formats

This is the format that you want you dates to

output to. Here are the available options:

MONTH DAY YEAR (MMDDYYYY)

DAY MONTH YEAR (DDMMYYYY)

YEAR MONTH DAY (YYYYMMDD)

Date Separator

The separator character is by default '/' (forward slash).

This can also be changed to '-'.

Closed Accounting

With this switch ON, when a statement is generated, the

transactions referenced in the statement are locked to

Read Only. This prevents editing or deleting of these

transactions after the statements are generated.

With this switch ON, Collect! will also skip transactions

already connected to an invoice line record, thus

preventing a transaction from being on an invoice more

than once.

If you ever come across a transaction and all

the fields are "grayed out," this means that

this transaction is on a statement currently in

your system. You can return to this form,

uncheck this to switch it OFF, correct or

delete your transaction and regenerate your

statement. However, a better solution would

be to leave the switch ON, post a new correct

transaction and then post a transaction to off

balance the amount of the erroneous one.

If you ever come across a transaction and all

the fields are "grayed out," this means that

this transaction is on a statement currently in

your system. You can return to this form,

uncheck this to switch it OFF, correct or

delete your transaction and regenerate your

statement. However, a better solution would

be to leave the switch ON, post a new correct

transaction and then post a transaction to off

balance the amount of the erroneous one.

Letters

Optional. This field can be used to enter

average cost associated with Letters.

When an operator opens the Debtor Form, it

will display a graph with the Cost Allocations.

Reviews / Phone Calls

Optional. This field can be used to enter

average cost associated with Reviews or

Phone Calls.

When an operator opens the Debtor Form, it

will display a graph with the Cost Allocations.

Promises

Optional. This field can be used to enter

average cost associated with Promises.

When an operator opens the Debtor Form, it

will display a graph with the Cost Allocations.

Minimum Password Width

Enter the minimum number of characters the user

must enter for their password. If they enter less than

this number of characters when renewing their

password, the system will warn them and will not

accept the password until it is at least this number of

characters. Leave this field blank to allow operation

with no passwords.

Renew Password Every

Enter a number of days. After this time the user is

prompted to renew their password. Leave this blank

if you want the system to never prompt to renew

passwords.

Force At Least One Numeric

Switch this ON with a check mark and the system

will make sure the user has entered at least one

number in their password.

Force At Least One Lower Case

Switch this ON with a check mark and the system

will make sure the user has entered at least one

lower case character in their password.

Force At Least One Upper Case

Switch this ON with a check mark and the system

will make sure the user has entered at least one

upper case character in their password.

Force At Least One Special

Switch this ON with a check mark and the system

will make sure the user has entered at least one

non-alphanumeric character in their password.

Collect! automatically locks out an account after

3 failed attempts to login.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org