User's Guide - Working Accounts

This user's guide is an orientation to familiarize

all Operator types with Collect! basics.

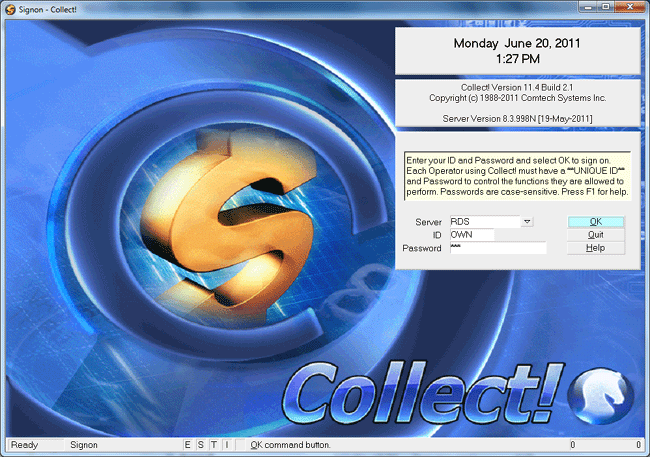

Starting Collect!

Once you have launched Collect!, you will see the splash

screen below.

Collect! Splash Screen

Enter your login credentials in the ID and Password fields

indicated.

IDs display as block capital letter entries irrespective

of how you input the ID. Passwords are case sensitive. If

you get an 'invalid' message, check your cap-locks and retry.

Depending on your site's preferences, your password may be

all lowercase, uppercase or a mixture of cases. Your entry

must match exactly.

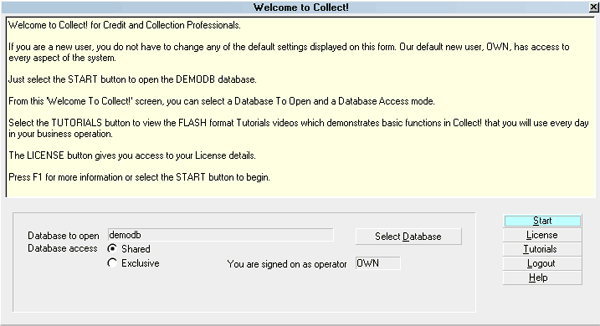

When you have entered your login credentials, you will be

advanced to the Welcome screen.

Welcome To Collect!

Click START to enter the program.

Your Operator Type and User Level will determine what screen

you are presented with next. Administration/Data Entry/Management

see a Main Menu screen while collection personnel are navigated

directed to their WIP windows.

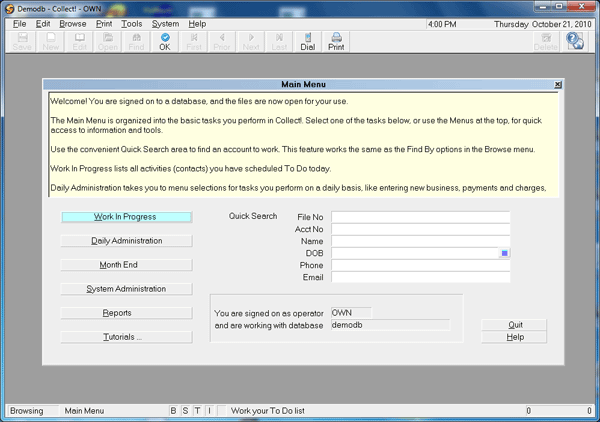

Main Menu

The choices in the Main Menu are described in the User's

Guide - Administration.

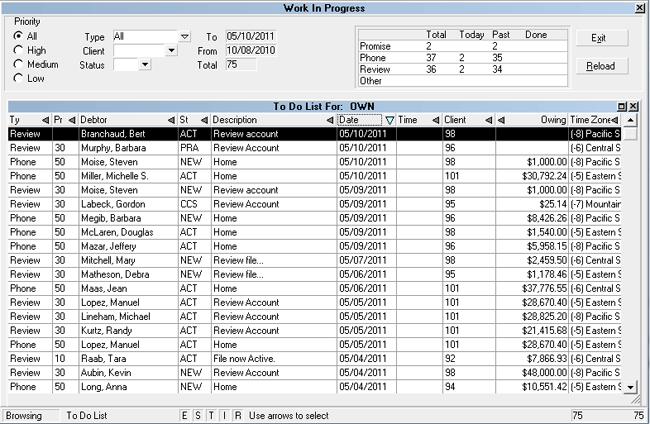

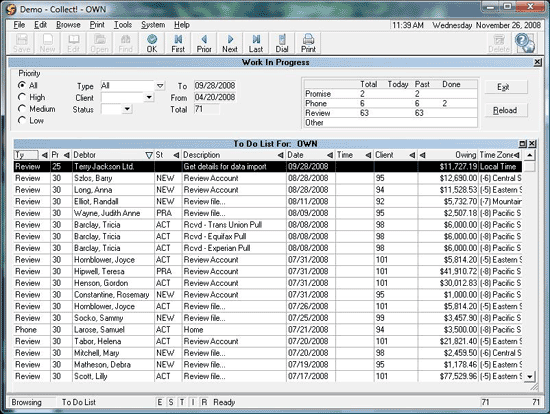

Work In Progress

For collection personnel, the WIP screen provides all-points access

necessary to work their accounts.

Daily Collection Activities

As your WIP list is generating, it will be gathering all accounts

which have a scheduled, In Progress contact associated with

your Operator ID which is dated for the current day PLUS

anything which you had in Priors (dated prior to current but not

yet worked).

Work In Progress To Do List

Entering The To Do List

The list displays contacts scheduled to be worked today. It is

called your " To Do List." What you see in your list depends on

how your office as configured your WIP settings. Typically, it

is contact event types Review, Phone, Promise and Other which are

used to build a collector WIP list.

The following describes the significance of the screen features

and options available to you.

TO DO LIST COLUMNS

Collect! ships with default list views, meaning the columns

being shown and order they appear in are general. A highly

popular feature in the software is the ability to customize your

list views to present you with the information that is most

relevant to you and restructure the column order to meet your

own preferences.

By right-clicking your mouse on the column header row, you

will be presented with the options of adding or removing

columns from your view. You can also click into the label of

a column to expand or narrow the width to suit your view as well

as drag-and-drop the column to a different position in the column

order.

The same capability to modify list views exists for most browse

lists in the system.

Any columned list in Collect! which shows you it has a triangle

on the right end of column label is an indicator that you may

sort that column in ascending or descending order by clicking your

mouse on that triangle.

In the upper portion of the WIP screen, you will see a series of

radio buttons and drop-down picklist menu options. These are your

Filtering options. By making selections within these pick lists,

your WIP will regenerate, showing only those accounts which meet

the selected criteria.

For collections personnel, these sub-WIP tools allow for strategic

working of accounts. For administration and management, these tools

provide easy access to desk counts and inventory breakdown data for

operations monitoring and metrics.

Type is the kind of contact event that you

have scheduled; Phone, Promise, Review, or Other.

Priority is a value from 1 to 99 that indicates

how urgent you designated this contact event to be. It may be used

to further sub-WIP your accounts within the same Type. For example,

a Priority 99 can be used to alert you to handle this right away,

while a 20 may indicate non-primetime hour attention.

Debtor is the name of the debtor whose

account the contact refers to.

Status is the Status on the debtor's account.

Description is what you have typed into this line

when the contact event was created. Collectors can use this as their

'next step' note to themselves to negate redundant noteline review

each time an account is scheduled to be worked. Events scheduled

by automated processes will have a generic description which is

associated with the Contact Plan that was used to insert the event.

For example, your office may have " New Business - Work Account" in the

description line of Review contacts created when new listings are

entered. Phone events do not permit free-form description entry; they

require selection from a picklist of which phone you plan to dial on

your next contact.

Date is the scheduled work date.

Time may be used to time queue an account. Use

this feature to meet a specific request for call-back, night calls

and when you are endeavoring to adhere to attempts at different times

of day standards in your workplans. It is important to NOT time queue

every account on your desk. This may cause non-timed accounts to

be left unworked due to the over-queuing of timed calls.

Client is the Client Number for the debtor's

account.

Owing is the Balance on the debtor's account.

Timezone tells you which of the timezones that

debtor account is located in on the basis of area code on the

phone number(s). Use Sort in this column to assist you in

making the most efficient use of legal calling hours. For example,

if you are located in a Pacific timezone, you can start Eastern night

calls by sorting your timezone column for Eastern accounts anytime

after 3pm in your local timezone.

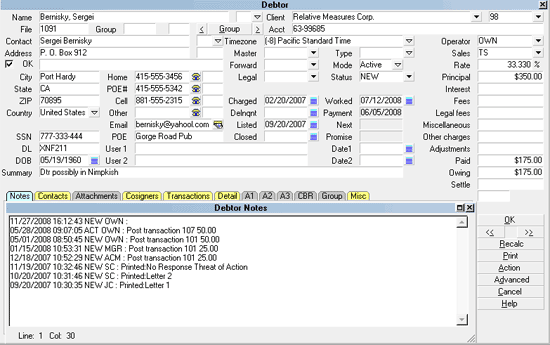

Debtor Screen Basics

Viewing Account Information

The Debtor screen contains all known information about the

debtor since it was received by your office. The upper portion

of the screen contains the tombstone details and demographic

contact information known about the account. The upper right

corner identifies which client this debtor owes. Below the

client information and client account number, you will see the

financial summary information down the right side of the screen.

This shows you to-date totals of what is owing in any of principal,

interest, costs and also a total of what has been paid to-date, if

applicable.

The Tabs running horizontally in the lower part of the screen are

separate sub-folders associated with the account. When a tab is

grey in color, there is nothing in it. When it is yellow, see this

as the 'light is on' and something is in there to be viewed.

Any tab which opens with 2 small square buttons in the upper right

corner of the tab display is a window which may be expanded to

full screen size by clicking on the square. The tab contents will

return to regular size when you click the square a second time. You

may exit the tab view by clicking the "x" to close it or by pressing

your Esc key.

In addition to the Tabs, there is further information on the account

which may be viewed by clicking into fields of selecting from the

bank of buttons in the lower right corner of the screen, beneath the

OK button.

Any screen you enter may be exited by clicking an associated "x" in

the corner of the pop-up window or by pressing your Esc key. In other

views, you may be prompted to acknowledge a pop-up by clicking an OK

button or clicking on a choice for Yes (or No).

Actions you can take on a debtor screen include review all existing

information, add notes, add payment plan, post a payment, establish

your next work date by adding a new contact event, update address

information (depending on your User permissions), update status,

send a letter, send an internal request to a coworker or manager

via contact event, or run a contact plan to invoke one or more

events.

Navigation around the screen is via your mouse point/click or if

you prefer keyboarding, you can use your Tab key to migrate from

field to field on the screen.

Viewing Debtor Notes

A complete set of notes on the debtor may be viewed by selecting

the Notes tab on the Debtor screen. Click into the Notes area. In

addition to the tab window expansion, if you are presented with a

scroll bar on the right of the tab display, then there is additional

information which you can't currently see because it doesn't fit in

the regular/contracted tab display size. Use the scroll bar to page

down through additional information if you do not wish to expand the

tab display to full screen.

Typing Debtor Notes

Unlimited notes may be entered either free-hand by clicking into

the Note tab body area, you will be presented with a prefilled

date/time/user ID stamp and a flashing cursor waiting for you entry.

It is also possible to enter notes via action/result contact plans

which your office may set up to eliminate redundant noteline entry.

For example, a Contact Plan action/result code could be defined to do

all of auto-write a noteline such as "Tel Res - NA" for you as well as

update your account status code from NEW to ACT once it has been worked.

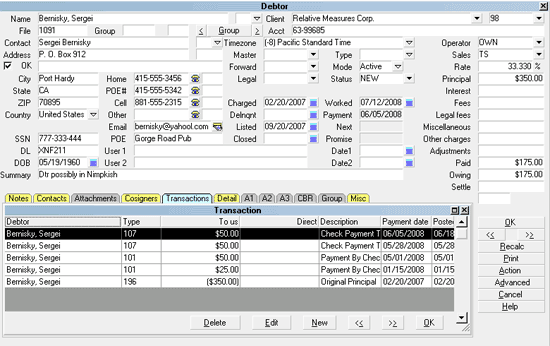

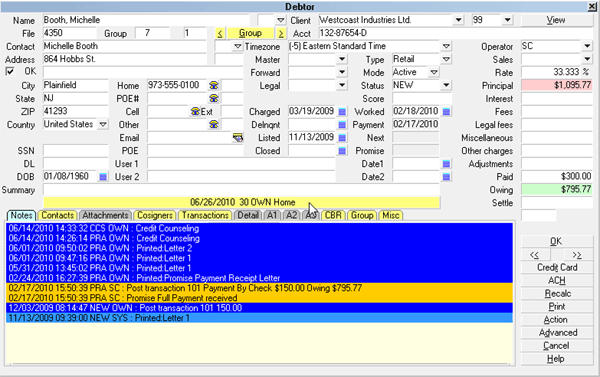

Viewing Payment History

Select the Transactions tab to view a list of individual payments

made as well as any charges levied on this account. Click into the

Transactions area and scroll down to view the entire list of line

entries, or, expand the window to full screen by clicking the square

in the right corner.

Debtor Payment History

Summary payment information may be displayed by clicking into the Owing

field on the main debtor screen to obtain the Debtor Financial

Summary pop-up. This window shows you totals for original amount(s),

paid amount(s), accrued amount(s) for interest/ other costs or charges,

arriving at the balance owed and displaying this with a breakout into

the balance component parts.

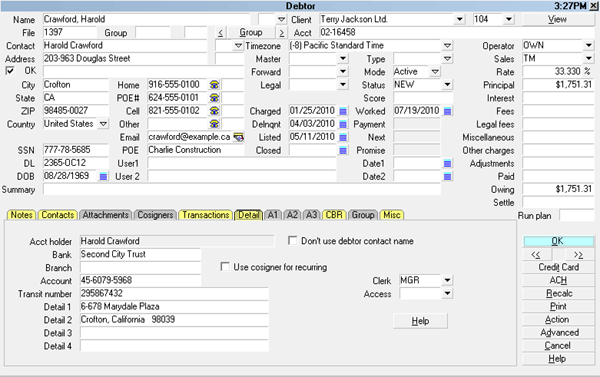

Viewing Additional Account Information

Additional information pertaining to the account is stored in the

Detail, Attachments, Cosigners, Credit Bureau, and Group tabs.

Select the Detail tab to enter bank account information.

Debtor Detail

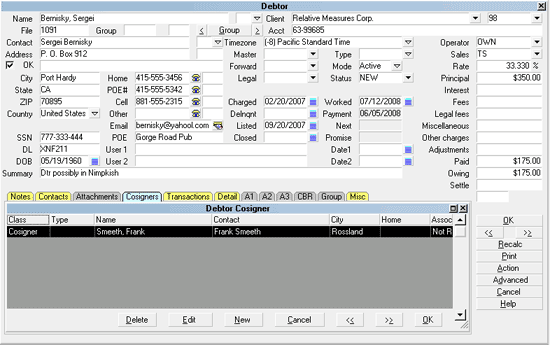

Select the Cosigner tab to enter either additional responsible

parties on the debt AND use this feature to store associated information

such as employer, attorney, references, next of kin, spouse (not

responsible), alternate or previous address details, and alias names.

Utilizing the window Class and Type descriptors allows you to set up

as many windows as you need for each account to store relevant data.

Debtor Cosigners

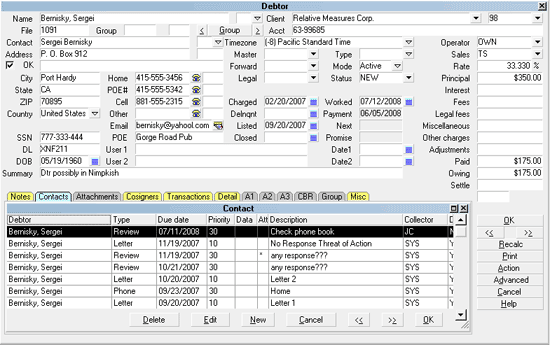

Viewing Contact History

Select the Contacts tab to view a list of all contacts for

this debtor. Within this tab you will see the full complement of

events which have taken place on this account including letters sent,

how many updates have been sent to the Credit Bureau (if applicable)

as well as all collector and manager events completed.

If you need to see the contents of any letter sent, highlight the

letter event of interest and click on it to open. In the line

labeled "Attachment", you will see the word [METAFILE]. This means

there is an image of the letter and what it contained exactly as it was

sent on the indicated date that the contact event was completed.

Contact Schedule

From a WIP list, you will select a contact event to work and click on

it to open the file.

WIP Scheduled Debtor Account

The yellow bar beneath the "Summary" field displays

information from the contact event you selected from your WIP

list. The reason for this is two-fold; (a) it saves keystrokes

in that you do not need to stop to open your Contact tab and

(b) it identifies exactly which contact item you selected in

the event that you have more than one scheduled contact with

the same work date on the same debtor account.

When you have completed all the work you wish to do on this

account today and are ready to advance to the next account

in your queue, you need to do 2 things before advancing. Each

site will make an individual decision as to how they want

contact events to be managed; voluntarily or by automatic

prompt. Please see your management to find out which process

you should follow:

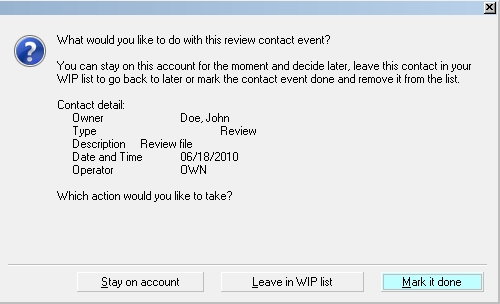

If your office is using WIP Option "Always show next contact

when" switch checked On:

1. After selecting and working your WIP account, click the

right pointing arrow key (under the OK button) to advance to the

next account. You will receive 2 pop-ups. The first will ask

you to choose between marking the current contact event done,

leaving it in your WIP or staying on the account. If you are

done, proceed to step 2.

2. Click the Mark it Done button.

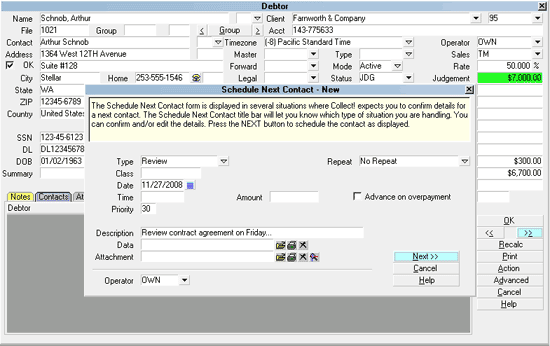

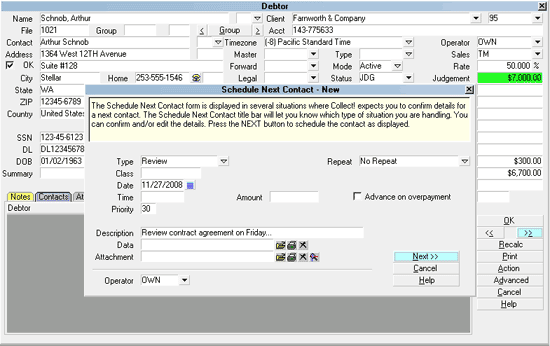

3. You will immediately be presented with the second pop-up

which will be the item you need to setup your next work date

by assigning a new contact event with a new date to be worked.

Schedule the Next Contact

If your office has not using the "Always show next contact

when" feature:

1. Click into the Contacts Tab, and then click the New button or

F3 to generate a fresh event window to set your next work date.

Choose the contact Type and Date for your next event and enter

your 'next step' Description, if applicable.

2. Click the double arrow button pointing right under the OK

button on the main debtor screen. You will receive another pop-up.

3. Choose whether to Mark it Done, Leave it in WIP list or

Stay on Account. If you are ready to advance to the next file,

and you do not need to return to this account for any reason

today, choose Mark it Done. If you need to return to it today,

click Leave it in WIP list. You will then be advanced to the

next account or back to your WIP list itself.

Prompt to Complete the Contact

4. Click the double arrow pointing right to advance to

the next account in your WIP list.

Schedule the Next Contact

It is necessary to enter a next work date contact event.

Accounts which do not have an In Progress contact scheduled

no longer appear in a WIP list and become an 'orphaned'

account. Orphaned accounts can be located and sent back

to the current collector's WIP or an alternate operator's

ID by running an internal inventory management report that

will insert a current dated Review event with a Description

of Forgotten.

We recommend that each site run the Orphaned

Account Search report weekly. It is located

in the menu path "Tools\ Utilities".

We recommend that each site run the Orphaned

Account Search report weekly. It is located

in the menu path "Tools\ Utilities".

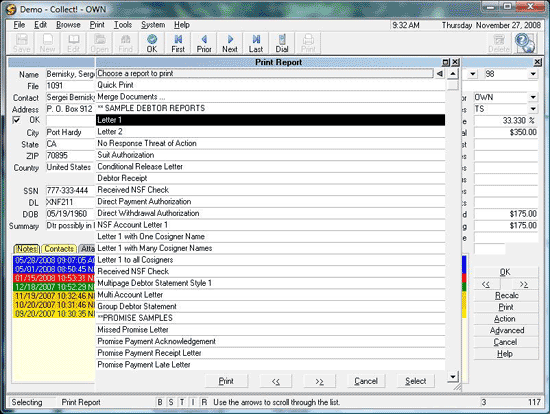

Letters On Demand

While administration/clerical departments will be looking

after scheduled letters to be printed, collectors may have

occasions where outputting a letter must be created/printed

immediately.

Printing a single letter on a specific account right away

is accomplished in these easy steps:

1. The account to receive the letter needs to be on your

screen.

2. Depending on personal preference and user level, there

are two ways to access the Print menu: (a) by clicking

the Print button in the lower right hand corner where

the OK button is located, or (b) by clicking the drop-down

menu Print from the top of the screen and selecting the

option Reports and Letters.

A list of available letters/ reports is displayed.

Printing a Letter Immediately

3. Select the letter you want to print and either click on it or

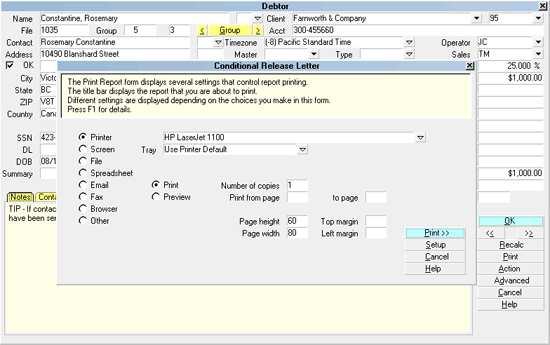

press the Enter key. You will get a pop-up to launch the print

task as follows:

Print Window

The configured default printer name will appear as the

device your letter is going to be sent to. To select

a different network printer, click the drop-down arrow

at the end of the field displaying the printer name an

select which device you wish to have the print job sent

to.

4. Click the button labeled Print>> and your letter will

be sent to the chosen printer to be produced.

If you have opened the Print Menu and can't see

any of the debtor letters you expect to

see, then you are likely in one of the

associated account Tabs and not really on

the main debtor file. The solution is to

exit the Print Menu, click into the background

in the upper portion of the debtor account

display to re-establish your location in the

system and retry clicking Print. This time

you should see debtor related reports/letters

in the menu listing.

If you have opened the Print Menu and can't see

any of the debtor letters you expect to

see, then you are likely in one of the

associated account Tabs and not really on

the main debtor file. The solution is to

exit the Print Menu, click into the background

in the upper portion of the debtor account

display to re-establish your location in the

system and retry clicking Print. This time

you should see debtor related reports/letters

in the menu listing.

All reports and letters have a designation of where in the

system they may be initiated from. For example:

Anywhere - a report which may be run from any

part of the system.

Debtor - must be run from a debtor list or an

individual debtor file.

Client - must be run from a client list or an

individual client.

See Also

- Topics Collections

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org