Entering NSF Accounts

This tutorial explains the basics of entering NSF Accounts

into Collect! This includes entering debtor information and

also transaction information that records the debt.

An NSF account is not a regular account where a check

payment was returned to you from the bank as NSF.

Rather, it is an account given to you from a client requesting

that you collect on an NSF payment they received. Because

the account arrives at your doorstep already in an NSF state,

additional steps must be taken to track extra information,

such as the check number of the original NSF check.

The steps for entering NSF accounts are:

- Preparing to enter NSF accounts

by ensuring that you have an Original Principal

Transaction Type and a Fee Transaction Type to use for

NSF Accounts

- Creating your NSF accounts and

entering debtor and check information

- Posting NSF account financial information

for the debt

The rest of this document explains these steps in

detail.

This tutorial assumes that each account entered

represents one individual debt. If you have several debts

belonging to the same debtor, it is assumed that they are

each entered as a separate account in Collect! This is the

most efficient approach for keeping track of NSF accounts,

for both your agency and your client. Collect!'s account

matching features may be used to group related accounts

together, further improving efficiency.

This tutorial assumes that each account entered

represents one individual debt. If you have several debts

belonging to the same debtor, it is assumed that they are

each entered as a separate account in Collect! This is the

most efficient approach for keeping track of NSF accounts,

for both your agency and your client. Collect!'s account

matching features may be used to group related accounts

together, further improving efficiency.

Preparing To Enter NSF Accounts

Before entering any NSF accounts, please ensure that

the following two transaction types exist in your database,

- Original Principal - Transaction Type 196

- NSF Account Fee - Fee Transaction Type 305

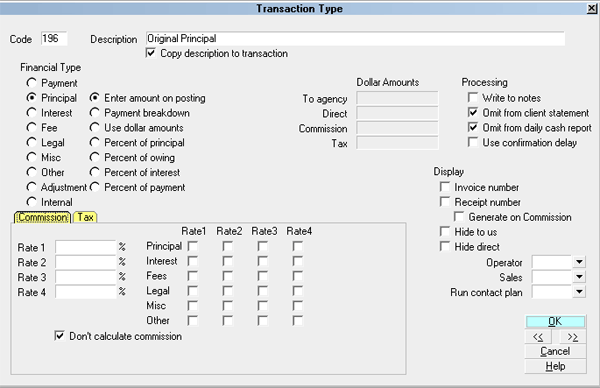

Original Principal Transaction Type

The Original Principal transaction type must have the

Code 196. It must have Principal

selected in the section labeled Account,

and Enter amount on posting selected

as the amount.

Original Principal Transaction Type 196

This transaction type will be used to post the amount of the

original NSF payment the debt is based on.

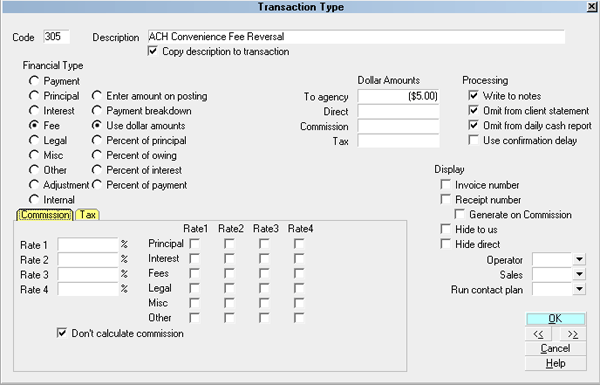

NSF Account Fee Transaction Type

The NSF Account Fee transaction type is not a required

transaction type for Collect!'s regular operations, but it is a

necessity when working with NSF Accounts. It can use any

code within the range of 301 to 399. It should have a check

in the box labeled Copy description to transaction.

In the section labeled Account, it must

have Fee selected.

Select Use dollar amounts as the amount.

This will display several additional fields on the right side of

the form. The field labeled To Agency

should be filled in with whatever amount your client charges

for NSF fees.

The settings labeled Don't calculate commission

and Don't calculate tax should be

selected.

NSF Account Fee Transaction Type

You may also wish to select additional options, as shown

in the screen shot. Settings such as Omit from

daily cash report, and Omit form client

statement depend on how you handle fees and

what you want to show your client.

This transaction type will be used to represent the fee charged

when the original payment went NSF.

Creating Your NSF Accounts

An NSF account is represented in the same manner as any

other account you receive from a client, with a few notable

exceptions. You will still enter the debtor information as

you have received it from the client, including the name,

address and contact information.

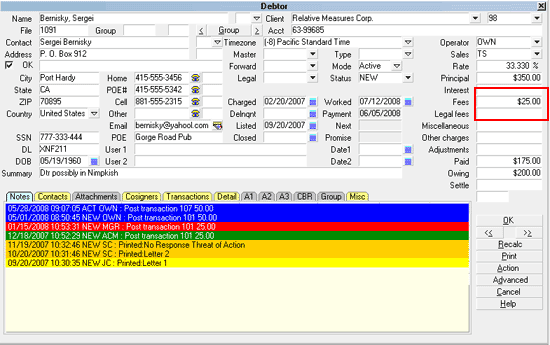

The status should be entered as NEW, ACT, or whichever

status code you use to represent new accounts. The

NSF status code should NOT be used, as this code

is reserved for debtors from whom your business has received

an NSF check.

The special considerations for NSF Accounts are:

- Check Number

- Account Type

- Charged Date

Check Number

It is recommended that you enter the check number into

the Debtor's Acct (account number) field. This field is used by

default in Collect! reports to represent the check number. If

your client supplies you with a separate account number,

you may use the Debtor's User 1 field to store the check

number. Use whichever is most convenient for your method

of operation.

Account Type

As shown in the screen shot below, the Type field

should be set to NSF.

Charged Date

If you are reporting to credit bureaus, the Charged Date on the

account MUST be the date of the original check. If you are not

and will never report this account to a credit bureau, you may

set up the dates however you wish.

The screen shot below is an example of a Debtor form

filled out as an NSF Account.

Debtor Information for NSF Account

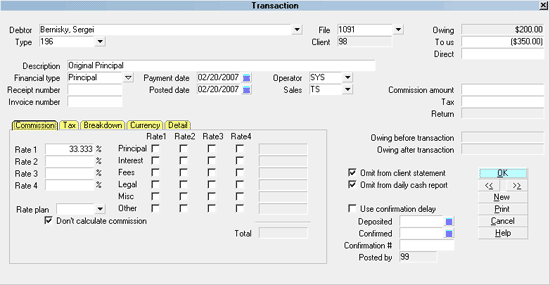

Posting NSF Account Financial Information

The financial information for a new NSF account consists

of two transactions - Original Principal and NSF Account

Fee.

The screen shot below is an example of the 196 Original

Principal transaction, used to track the amount of the

original NSF payment.

Original Principal - NSF Account

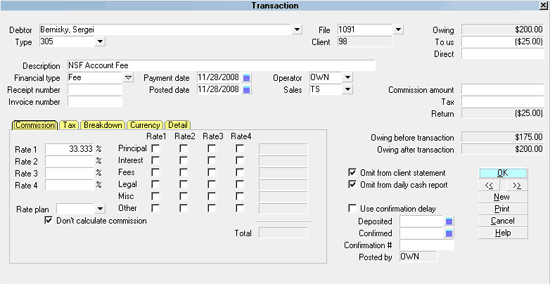

The screen shot below is an example of the NSF Account

Fee transaction, used to track the amount of the fee

charged for the NSF payment.

NSF Account Fee

To post these transactions, select the TRANSACTIONS tab

and then select the NEW button to bring up a blank Transaction

form. Create the two transactions, filling out the relevant

information as you have received it from your client.

Wrapping Things Up

After completing the setup and entering each NSF account

along with its financial information, you should have complete

records of all of your clients' NSF debtors, giving you more

than enough information to begin collecting.

Although these accounts can be managed in much the same

way as any other debtor in your database, further tutorials on

the subject will examine specialized strategies, including

developing an NSF account letter series, and managing

payments to NSF accounts to lend more flexibility and

efficiency to day to day operations.

See Also

- Transaction Type Basics - Introduction/Accessing

- Transaction Type Samples

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org