Take Checks Over The Phone

Imagine having the Debtor's check immediately when you

call for a payment due. You can dramatically increase your

collections and eliminate waiting for payment by mail.

Take Checks Over The Phone helps you reduce risk

and boost your bottom line.

Take control of when you get payments! Take advantage of how

easy and convenient it can be to receive check payments over

the phone, fax or Internet.

How It Works

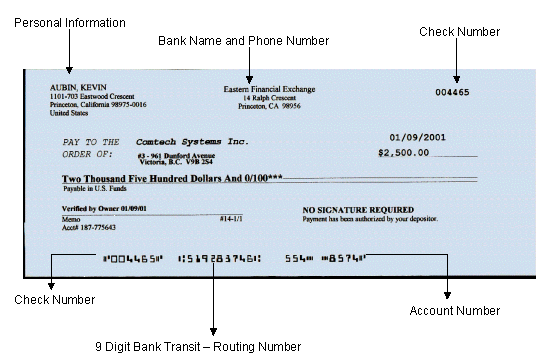

- Your client gives you authorization to process their

payment - either verbally or in writing - along with their

Bank Account information. This includes Account Name

and Account Number, Bank Transit (Routing) Number

and Bank Branch Number, as well as the complete Bank Name

and Bank Address. See below.

- You enter their check information, which only takes

a few minutes.

- You can then print out the check.

- The printed check can then be deposited into your bank

account the same way you deposit all your checks.

Benefits

- No more lost payments

- Deposit checks same day

- No more waiting for checks to arrive in the mail

- Increase your income

- Client signature is not required

- No prior bank approval needed

- Client authorization is accepted verbally or written

- Easy data entry, then print checks on any of the

following printers - Laser, bubble or inkjet printer

- Legal payment method recognized by the banks

as a Paper Draft

- The signature area of the check will carry the following.

This draft authorized by your

depositor NO SIGNATURE REQUIRED

Frequently Asked Questions

1) Is this legal?

Yes! Bank drafts are 100% legal as long as you have permission

from the person who signs on the account. This allows you to take

the required information by phone, fax or Internet. Federal banking

regulations and the Uniform Commercial Code permit this process.

This complies with FTC Regulations 16 CFR 310. You can have

your payment in full immediately.

2) Who Signs the check?

No signature is required to deposit these checks. In place of a signature,

the following line is printed in the signature area.

This draft authorized by your

depositor NO SIGNATURE REQUIRED

3) Do I need special paper?

Yes, you will need special paper - Form #1000 form. This can be

purchased at most office supply stores or online at a number of

different retailers.

Try http://www.g7ps.com

and look for check paper. You can also find these forms at your local

office supply store.

Try http://www.g7ps.com

and look for check paper. You can also find these forms at your local

office supply store.

4) Do I need magnetic toner?

Most banks have upgraded the check processing applications and no

longer require magnetic ink. The checks can be scanned digitally.

Therefore, most will not have any problem. If they do, they will process

manually and may ask you to get magnetic ink if they are processing

a very large quantity of checks for you daily. We suggest that you

simply deposit the checks without it.

Using Billing Tree For Check Payments

Collect!'s Billing Tree Module enables you to process credit

card and ACH payments electronically through Collect!'s Billing

Tree connection. This is a full-featured solution for managing

single and recurring payments made by credit card or by bank

draft. External payments posted at the Billing Tree web site are

also reconciled and posted within Collect!. Recurring

scheduled payments are fully managed within Collect!'s

promised payment system.

This module is included in every Collect! Version 11.3.4.1

and newer licensed in the United States.

See Also

- How To Print Checks

- How To Take Checks Over The Phone

- Report Sample for predefined Check - Form #1000 report

- Billing Tree Module

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org