Variable Interest

The Variable Interest feature enables you to easily and

automatically calculate variable interest rates on your accounts

based on an underlying interest rate index table. You can

have one or several Principal transactions on each account.

Collect! uses the Payment Date of each Principal transaction,

plus 1 day, for the initial "Calculate interest from date".

Subsequent calculations are read from the date ranges

and interest rates contained in the interest rate index.

Variable Interest is a licensed extension module.

Contact us for pricing if you require this

functionality.

Variable Interest is a licensed extension module.

Contact us for pricing if you require this

functionality.

If you are entering Judgments in Collect!, ensure you have

verified with your legal counsel that this is the calculation

of choice before enabling a Variable Interest calculation

on Judgment accounts.

There are several parts to the Variable Interest feature:

Variable Interest Rate Index

The interest rate index is a CSV file that you create with

two columns, representing the Interest Start Date and

Interest Rate. Enter the date ranges and interest rates that

you require. Each Interest Start Date is the date you want

Collect! to start using the interest rate listed in the

corresponding Interest Rate column.

Example:

| Interest Start Date | Interest Rate |

| 01/01/2008 | 7.50 |

| 06/01/2008 | 8.65 |

| 01/01/2009 | 9.75 |

| 03/01/2009 | 9.80 |

| 06/01/2009 | 9.90 |

| 09/01/2009 | 10.0 |

These columns do not have labels. The column

headings above are for demonstration purposes, only.

These columns do not have labels. The column

headings above are for demonstration purposes, only.

Sample CSV

Each entry has to be on its own line.

"01/01/2008","7.50"

"06/01/2008","8.65"

"01/01/2009","9.75"

"03/01/2009","9.80"

"06/01/2009","9.90"

"09/01/2009","10.0"

Even if you have not entered your dates in a completely

date ordered sequence, the system will apply an

ascending sort order when it reads the interest

rates file.

Even if you have not entered your dates in a completely

date ordered sequence, the system will apply an

ascending sort order when it reads the interest

rates file.

Save your settings as a CSV in the cv11\bin\vinterest

folder.

After editing the interest rates table and saving your

CSV, it is necessary to logout of Collect! completely

and log back in to read the new changes.

After editing the interest rates table and saving your

CSV, it is necessary to logout of Collect! completely

and log back in to read the new changes.

Date Format

Collect! uses the settings from the Date Format screen when

reading the variable interest CSV.

System date format is accessed by the menu path

"System\ Preferences\ Options, Sounds and Colors\Date Format".

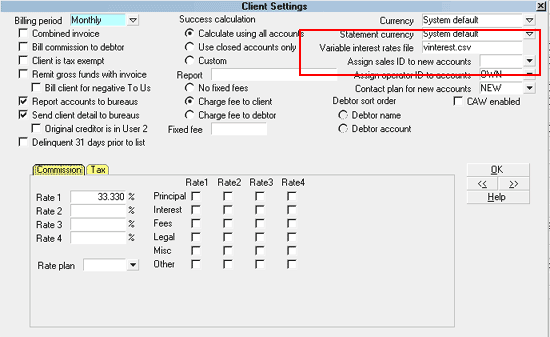

Client Settings

You must specify which clients will use this interest

rate index.

Select and enter a client for whom you are setting up

variable interest, and click the Advanced button

in the lower right corner of the screen. This will

open the Client Settings screen. In the upper right corner

of this screen, the third field down is called Variable

interest rates file. In this field, enter the

filename of the CSV file you created.

Variable Interest Rates File

If you have several clients with different

requirements, you can create an interest rate

index CSV for each one. Just name each uniquely

and place them all in the cv11\bin\vinterest folder.

If you have several clients with different

requirements, you can create an interest rate

index CSV for each one. Just name each uniquely

and place them all in the cv11\bin\vinterest folder.

After placing CSV files in the "vinterest" folder, you must completely

logout of Collect! and log back in again. This is the only way that

the new interest rate table(s) will be read by the session you have

initiated.

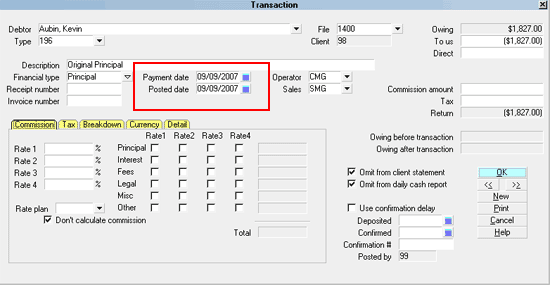

Debtor Interest Detail

Please examine any Principal Transactions

existing on each account and ensure that you

agree with the date in the Payment Date field.

The system uses the Payment Date of each

Principal transaction, plus 1 day for the initial

"Calculate interest from date".

Please examine any Principal Transactions

existing on each account and ensure that you

agree with the date in the Payment Date field.

The system uses the Payment Date of each

Principal transaction, plus 1 day for the initial

"Calculate interest from date".

Principal Transaction

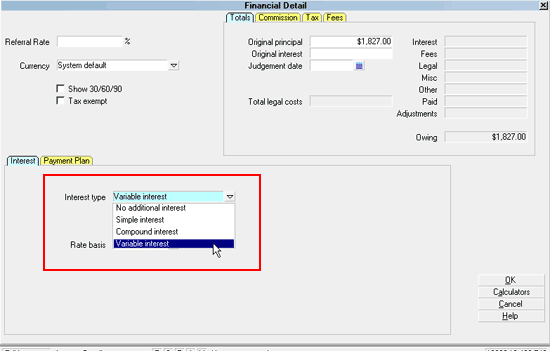

To enter the Interest Detail screen on a debtor, click into a

Principal amount field on the front face of the debtor screen.

This will open the Financial Detail window. The Interest Detail

Tab is located in the mid-screen, left side of the screen.

Once you have entered the Interest Detail Tab, you then click the

Interest Type drop-down arrow and select Variable

Interest from the pick list.

Interest Type Variable Interest

Collect! 'hides' most of the other usual interest settings you

would expect to see for simple interest because for variable

interest, the same fields are not user-defined but predicated

by the CSV rate table created. You can select the appropriate

Rate Basis.

Select "Ordinary" for your Rate Basis if you want to

dynamically calculate the interest taking into

consideration the number of days in each year.

If you select one of the other options for

Rate Basis, this will be the value the system

will use for every interest period in your Variable

Interest Rates file, regardless of the actual number

of days in the year.

Select "Ordinary" for your Rate Basis if you want to

dynamically calculate the interest taking into

consideration the number of days in each year.

If you select one of the other options for

Rate Basis, this will be the value the system

will use for every interest period in your Variable

Interest Rates file, regardless of the actual number

of days in the year.

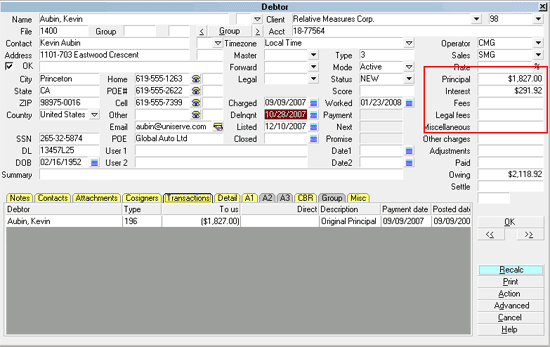

As soon as you close the Financial Detail screen, Collect!

calculates the interest for the account and displays it in

the Debtor's Interest field.

Total Interest Calculated and Displayed

The calculation of interest is dynamically reset according to

your settings. You must RECALC the Debtor to see any new changes.

When using Variable Interest, you should recalc

all your accounts each day.

When using Variable Interest, you should recalc

all your accounts each day.

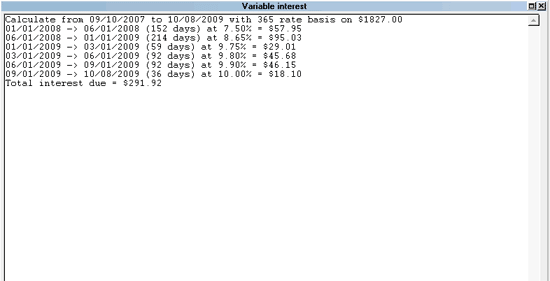

Examining Variable Interest Rate Breakdown

Once you have initially set up the Variable Interest feature,

it is a good idea to follow the accounts and verify that your

calculations are giving expected results. This would indicate

that your rate tables are typo free. It is recommended to

activate a debug switch to assist you with your initial follow-ups

on how your Variable Interest calculations are doing.

To enable the summary window popup, you set switch

ON for Enable internal debug checks which

is located by the menu path \System\Preferences\Options,

Sounds and Colors. Place a check in the box beside the

option "Enable internal debug checks".

This switch is meant for debugging only. It should

not be left on for normal usage of Collect!.

This switch is meant for debugging only. It should

not be left on for normal usage of Collect!.

Once this feature is enabled, you will see an interest breakdown

summary displayed whenever you view the Debtor.

Interest Calculation Breakdown

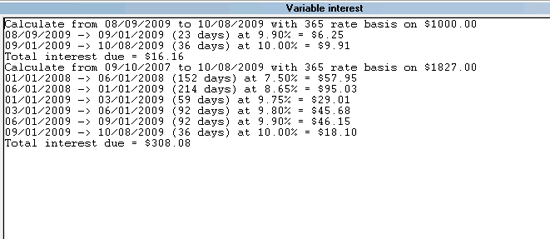

When you have more than one Principal transaction, the system

shows you the breakdown for each principal amount.

Interest Calculation for Two Principal Amounts

Variable Interest Calculations

Variable Interest calculations use the formula:

I = A((1+R/N))^n)-1)

I = Interest due

A = Assessment amount (Ex. 1827.00)

R = Annual interest rate (Ex. 9.00)

N = Number of days in the year (Ex. 365)

n = Number of days in the date window (Ex. 180)

Example:

On $1827 at 9%:

01/01/2009 -> 06/30/2009 (180 days) at 9.00% = $82.90

82.90 = 1827((1+.09/365)^180)-1)

The number of days in the year (N) is determined by

the Rate Basis you set in the Interest Detail.

Select "Ordinary" if you want to dynamically

determine the number of days in each year. Select

one of the other options (360, 364 or 365) if you

want to use a fixed number of days in the year for

every interest period in your table.

The number of days in the year (N) is determined by

the Rate Basis you set in the Interest Detail.

Select "Ordinary" if you want to dynamically

determine the number of days in each year. Select

one of the other options (360, 364 or 365) if you

want to use a fixed number of days in the year for

every interest period in your table.

When using Variable Interest, you should batch RECALC

your debtor accounts every day.

When using Variable Interest, you should batch RECALC

your debtor accounts every day.

For debugging purposes, the calculations may be displayed

when you access the Debtor screen, as above-noted. Rates

are set as soon as accounts are recalculated either

by opening a Debtor, or through \Tools\Recalculate.

Interest is simple interest, floating point values are truncated,

immaterial Interest Detail fields are hidden and calculation is

based solely on the CSV interest rate table.

Collect! uses the Principal transaction's Payment Date

plus 1 day as the Calculate Interest Start Date.

Collect! uses the Principal transaction's Payment Date

plus 1 day as the Calculate Interest Start Date.

Multiple Principal transactions are each calculated separately

from Payment Date plus 1 day and totals are added into the

Interest Field on the Debtor screen. Switching on "Enable

internal debug checks" displays a calculation summary to initially

assist you with verifying the calculations for each interest

bearing Principal transaction applicable on the account. This

is a temporary measure meant to assist with preliminary stages and

should be turned off once the process is vetted and confirmed

working soundly, meaning the CSV tables created are accurate.

Payments

When a payment is posted to an account, it will affect the

Variable Interest calculations if the payment reduces the

account's outstanding Principal. Depending on the agreements

between the debtors and the creditors, you may have your payment

hierarchy set with the Collect! shipping default which applies

payments to Fees, then Interest, then Principal, OR, you may

be using a modified hierarchy that applies all payments to

Principal first. Any payment that reduces the total Principal

will result in interest being calculated on the new, reduced

Principal amount.

You control payment breakdown hierarchy with options

set in \System\ Financial Settings\Transaction

Types windows. Each Financial Type Payment

transaction should have the default order of

operations set to match your agency's preference.

You control payment breakdown hierarchy with options

set in \System\ Financial Settings\Transaction

Types windows. Each Financial Type Payment

transaction should have the default order of

operations set to match your agency's preference.

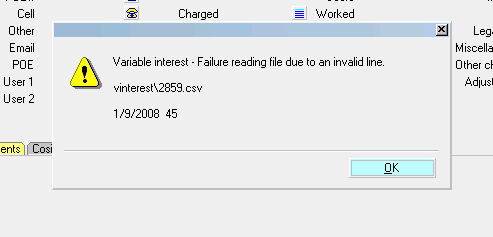

Troubleshooting Variable Interest

There are a few situations that may result in an error when

using the Variable interest feature.

Failure Reading CSV File

This error may occur if you have failed to create the CSV

properly. The format must be standard, as displayed above.

If there is a typo in any of the cells, you will get this message.

Invalid Line in Interest CSV

The message shows you the error. There is no comma

between the values for the date and the rate.

Failure Opening CSV File

This message usually indicates a file named differently from

what you have in your Client Settings. Go to the client,

click the Advanced button to enter the Client Settings screen,

and compare what you have entered in the "Variable interest

rates file" field with the actual name you stored in the

CV11\bin\vinterest folder.

Failure Opening CSV File

See Also

- Interest Detail

- Client Settings

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org