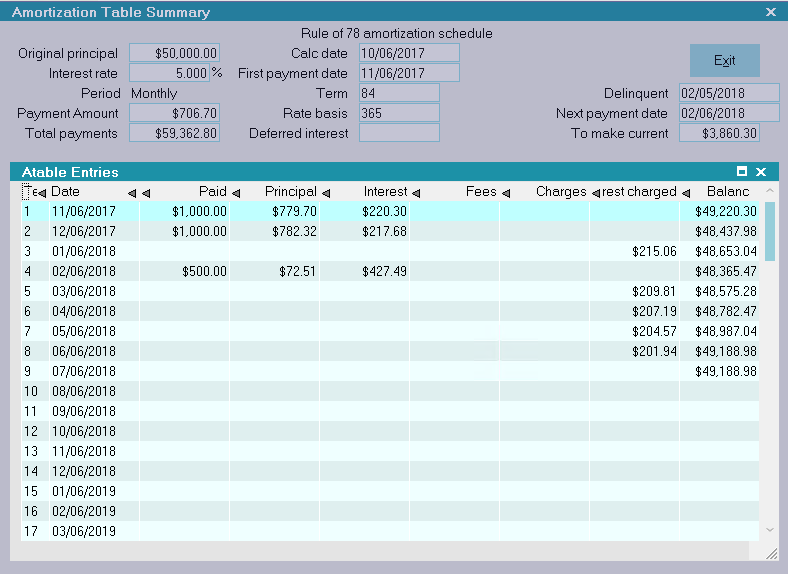

Atable Entries

The Atable Entries form displays all details of payments and

interest calculations for the amortization payment schedule.

This includes break down of payments into amounts paid to

Principal and paid to Interest, Remaining principal and Interest

negated.

Amortization Table Summary

To print this to the Browser for easy viewing, please

see How To Use the Amortization Schedule.

To print this to the Browser for easy viewing, please

see How To Use the Amortization Schedule.

This table is divided into three sections:

- Actual account activity

- Running payment schedule, including

- declining principal and interest

- owing

- amount of each payment applied to principal and interest

- Actual account balances.

Actual Account Activity

The first ten columns in this table record actual

account activity.

This includes payment amount and breakdown,

fees, charges and outstanding interest, balance

and CBR status.

Term

This is the number of the Term payment the line entry

refers to. The total number of payments in this column

is taken from the Term set up for the schedule.

Date

This is the Date the Term payment is due. This is taken

from the payment setup. It is determined by the First

Payment Date and the period of the loan.

Paid

This column shows the actual amount posted to the

account as a payment. Normally, this would be the

same as the Payment Amount agreed upon in the

schedule.

Principal

This columns is the portion of the payment that is

applied to Principal.

Interest

This column is the portion of the payment that is applied

to Interest. When payments are missed, the interest

is displayed in the Interest Charged column and is

added to the Balance.

Fees

This column is the portion of the payment that is applied

to Fees. Normally, this is the same as an amount in

the Charges column.

Charges

This column shows any fees charged for the period, such

as late fees. This amount is added to the Balance.

Interest Charged

This is Interest that is outstanding for the period

because a Term payment was missed or underpaid.

This amount is added to the Balance and is figured

into the next payment's breakdown.

Legal Paid

This column is the portion of the payment that is applied

to Legal. Normally, this is the same as an amount in

the Legal Charged column.

Legal Charged

This column shows any legal fees charged for the period.

This amount is added to the Balance.

Misc Paid

This column is the portion of the payment that is applied

to Misc. Normally, this is the same as an amount in

the Misc Charged column.

Misc Charged

This column shows any misc fees charged for the period.

This amount is added to the Balance.

Other Paid

This column is the portion of the payment that is applied

to Other. Normally, this is the same as an amount in

the Other Charged column.

Other Charged

This column shows any other fees charged for the period.

This amount is added to the Balance.

Balance

This is the Balance Owing on the account. This

amount diminishes as payments are made. If

payments are missed, the Interest accumulates

and is added to the Balance. Charges are also

added into this amount.

CBR

This is the CBR Status of the account. If you are

using Credit Bureau Reporting, the account will be

reported with the Status Code shown here. This

Code may change depending on the account activity

for the reporting period.

Running Payment Schedule

The next five columns in this table display the payment

contract set up in the amortization schedule. If payments

are made regularly and on time, the amounts in these

columns indicate the declining principal, interest, owing,

and payment breakdown. Missed payments or

underpayments will affect this running schedule.

Original Principal

The amounts in this column show the declining principal

as payments are made regularly and on time. This column

will always show figures as originally calculated when the

schedule was set up.

Original Interest

The amounts in this column show the interest calculated

on the principal for the term. This column will always show

figures as originally calculated when the schedule was set up.

Original Owing

The amounts in this column show the declining owing

as payments are made regularly and on time. This column

will always show figures as originally calculated when the

schedule was set up.

Original To Principal

The amounts in this column show the amount of the

Term payment that will be applied to principal. The

amounts in this column will fluctuate if a payment is

missed or underpaid.

Original To Interest

The amounts in this column show the amount of the

Term payment that will be applied to interest. The

amounts in this column will fluctuate if a payment is

missed or underpaid.

Actual Account Balances

The last two columns in this table show the actual

outstanding balance for the account and the outstanding

interest.

Remaining Principal

This is the actual principal amount still owing on the

account. This amount may fluctuate depending on

missed payments, overpayments or underpayments.

Total Interest Negated

This column keeps track of interest accumulated

when payments are missed. The amount in this

column is applied to interest when a payment is

made. If necessary, it may take several payments

to satisfy the outstanding interest before an amount

is applied to principal again.

Summary

The Atable Entries table is a very comprehensive

representation of account activity and interest details.

You may run the Amortize Running report from the

Demodb database for a condensed version of this table.

If you do not have this report in your Demo, please

request it from Collect! Technical Services.

Email Collect!

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org