How To Use Archiving

When you have Clients and Debtors that you are not working, you can move them into the Archive tables. This removes them from

the main tables to improve performance. All associated records are transferred with the accounts. So cosigners, transactions,

notes, contacts and attachments are archived as well. This is very useful if you have thousands of historical contacts and

transactions slowing down your response time.

Accounts are readily accessible, even though they are archived. You can still work with the accounts, view them, look at their

notes, financial details, print reports and summaries. However they are Read Only and you cannot edit any of the archived

records. At any time, you can easily restore the accounts from Archive and they are returned to your working database.

There are a few things to keep in mind when working with archived clients and debtors.

1. If you archive a client, all the client's debtors are archived. You can't restore just one. But if the client is not

archived, you can archive one or more debtors and restore them individually, if needed.

2. You can use Browse, Find By to search for records by Name and File Number in the archived accounts, but you must have the

archive database open.

3. If you intend to archive accounts, you should ensure that all financials are finalized on the account. If you archive an

account that has not been reported on a month end statement, the financial information will not be included when you generate

your statements.

4. If you intend to archive accounts, you should ensure that you have recalculated any debtors that you intend to archive. You

should also recalc the client. Please be aware that if you press RECALC on the the Client form, it does not recalc the

underlying debtors. If you archive accounts that have not been properly recalculated, the Client totals may appear incorrect in

your working database.

Archiving Records

1. Browse a Debtor or Client (or tagged list of debtors or clients)

2. Navigate to Tools\Archive

3. Select Archive this Record.

If you attempt to archive an entire client after previously archiving one or more of the client's debtors, Collect!

will created a second copy of the Client with the debtors archived at the time of the archiving of the client. In

other words, if you archive a client today, the archive table will have a copy of the client with any debtors archived

If you attempt to archive an entire client after previously archiving one or more of the client's debtors, Collect!

will created a second copy of the Client with the debtors archived at the time of the archiving of the client. In

other words, if you archive a client today, the archive table will have a copy of the client with any debtors archived

before today, then a second copy of the clients with the debtors archived as of today.

Collect! will refresh the underlying Debtor or Client list immediately after you archive accounts.

Opening The Archive Section

At any time, you can switch into the Archive section by opening the list of archived clients or archived debtors. When you

close these lists, Collect! returns to your active working section. Select Browse Archived Records to switch into the Archive

section.

When the Archive section is open, you can perform searches and print reports on the archived accounts.

When the Archive section is open, you can perform searches and print reports on the archived accounts.

Working With Archived Accounts

When you Recalc Clients, totals for archived debtors are included in the calculations.

When you search for archived accounts, you may use partial names and file numbers. Remember that you must be in the Archive

database first. So select Browse, Archived Clients or Browse, Archived Debtors before doing a search.

Client and Debtor Notes are accessible for archived accounts, but they are Read Only.

Transactions, Cosigners, Attachments and all other details can be viewed in Read Only mode for archived accounts.

You can print analysis and summary reports for your archived accounts, but once again, you must be in the Archive section. So

select Browse, Archived Clients or Browse, Archived Debtors before printing your report if you want to retrieve information

from archived accounts.

You cannot work in both sections, active and archived, at once. So you cannot print a report with data pulled from

both sections at the same time.

You cannot work in both sections, active and archived, at once. So you cannot print a report with data pulled from

both sections at the same time.

Restoring Records

1. Browse Archive records via Browse\Archived Records\Archived Debtors (or Clients)

2. Select a Debtor or Client (or tagged list of debtors or clients)

2. Navigate to Tools\Archive

3. Select Restore from Archive.

Collect! will refresh the underlying Debtor or Client list immediately after you restore accounts from the archive tables.

Cancel Archive Or Restore

You can cancel the archiving or restoring process by hitting the ESC key. Collect! will finish processing whatever record it is

on before escaping from the Archive process.

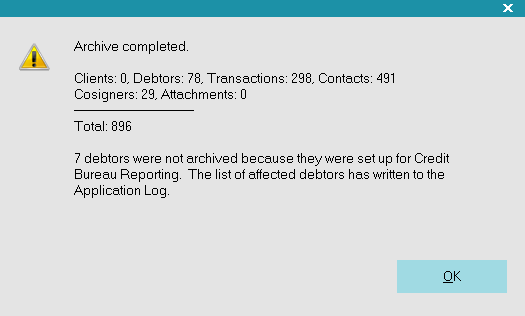

When archiving or restoring accounts, Collect! will show you exactly how many accounts and related records are actually being

archived or restored.

Restoring Archived Accounts

Archiving And Report Credit

If a Debtor in your system is still being reported to the Credit Bureaus and you attempt to include this account in an archiving

procedure, Collect! will not archive the account.

A message will inform you of this.

Debtor with Report Credit Switched ON not Archived

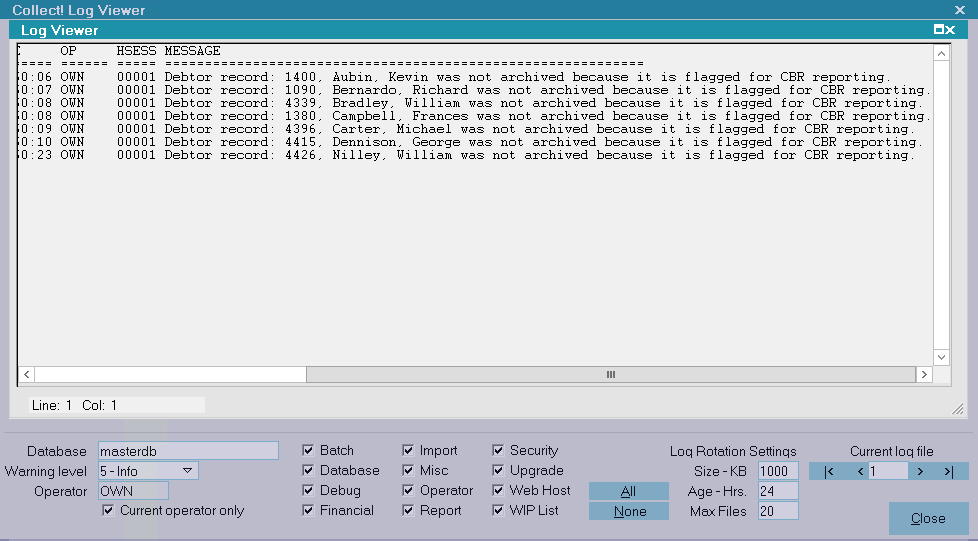

Account details are written to the Collect! Application Log so that you can find the skipped Debtor or Debtors.

Application Log entry for failed archiving attempt

Please complete all credit reporting before archiving accounts. Collect! does not report any accounts that are in the

Archive database.

Please complete all credit reporting before archiving accounts. Collect! does not report any accounts that are in the

Archive database.

Troubleshooting

If you have deleted a Client from your working database, and that Client has archived debtors, you will receive a message when

you try to run Restore.

Select OK to recreate the Client in your working database. This recreated Client will contain only the Debtors that you just

restored from the Archive database. The information in the Client form will be whatever was archived originally. If you made

changes to the Client in your working database, before you deleted it, these will not be restored if they did not exist in the

Archive database client "placeholder."

Archiving In The Scheduler

You can use Collect!'s Task Scheduler to automatically archive inactive accounts. There are several options for setting your

criteria when you configure the Archive Accounts task.

Please refer to Help topic How to Configure Scheduler Tasks for details.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org