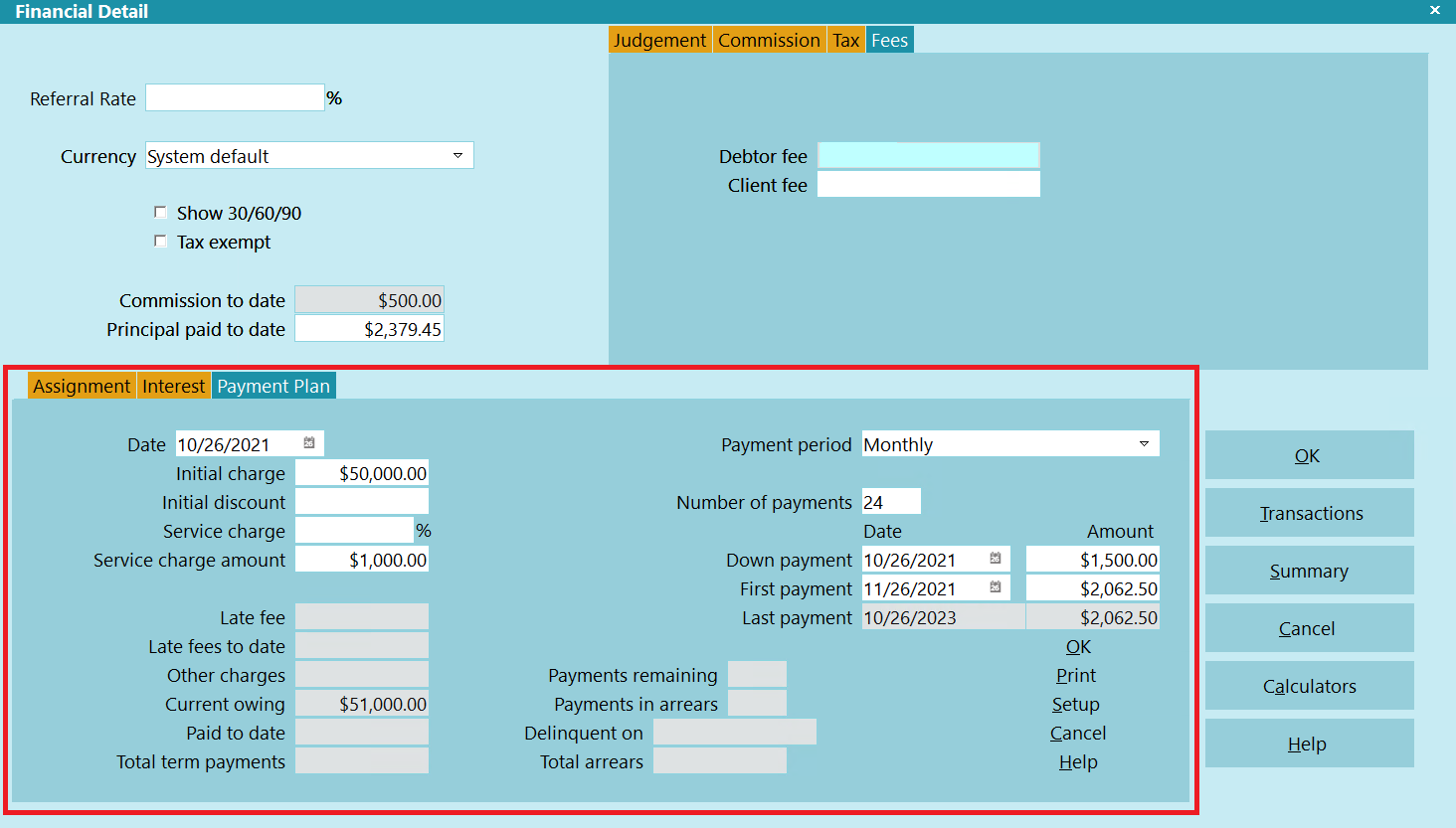

Payment Plan

The Payment Plan section of the Financial Detail form is

used to schedule equal regular payments when a debtor

has contracted to pay a debt in a timely consistent

manner. Payment plans help you plan income and keep

on top of contractual payment agreements.

Payment Plan Details

Payment plans let you schedule promised payments and

print coupon booklets. This is useful for credit grantor or

whenever a service or product is sold with a contractual

payment agreement. Collect! automatically handles

background tasks for your company when you

set up a payment plan for your clients. Transactions

are posted for the entire plan with dates ranging into the

future as far as necessary to satisfy the debt. Posted

Dates are left blank to be filled in when each payment is

received.

Only use a Payment Plan if you are reasonably

sure that payments will be met consistently!!

If there is any chance that the payments will not be

regular or consistent, you are advised to use Promise contacts

instead for a more loosely structured "payment plan."

If there is any chance that the payments will not be

regular or consistent, you are advised to use Promise contacts

instead for a more loosely structured "payment plan."

Date

The reference date for this plan. Other dates

are based on this reference.

Initial Charge

This is the amount of the Original Principal.

It is copied from the Debtor Principal field if you

entered an amount for Principal. If the transaction

doesn't exist already, a transaction will be posted

for this amount when you activate the Payment Plan.

If this field is blank, enter the amount of the debt.

If you are using the system for periodic billing, this

is the sum of all transactions matching the Initial Charge

Transaction Type in the Payment Plan Setup form.

Initial Discount

This is the amount of an initial discount.

You may offer discounts or other credits. This value

allows you to track any credits posted.

The service charge is affected by this amount. See

Service Charge below for more information.

Service Charge

This is the Service Charge rate in percent per month.

When you enter a service charge rate, the service charge

amount is calculated from that rate. If you leave the rate

empty, you can manually enter a service charge amount.

The calculation for service charge is:

Service Amount = initial charge - initial credit - down payment

Service Charge = service amount X service charge rate X number of months

Service Charge Amount

If you entered a Service Charge rate, this charge is

calculated automatically. Otherwise, enter a dollar

amount to charge the Debtor a service fee.

See above Service Charge for calculation details if

you entered a Service Charge rate.

Payment Period

Select a period between payments for this plan.

If you select monthly, and the starting

date is the 31st, 30th or 29th, the system

will schedule payments on the highest

date available for each month. For example,

a 6 month plan starting on January 31st,

will have a second payment scheduled for

February 28th, since there is no 31st of

February.

If you select monthly, and the starting

date is the 31st, 30th or 29th, the system

will schedule payments on the highest

date available for each month. For example,

a 6 month plan starting on January 31st,

will have a second payment scheduled for

February 28th, since there is no 31st of

February.

Press F2 to pick from the list.

Number Of Payments

Number of payments, excluding any down payments.

For example, if you leave the down payment blank

and enter 6 payments, the Debtor will make 6 payments.

If you enter a down payment amount and 6 payments,

the Debtor first pays the down payment amount and then,

makes 6 additional payments for the remaining balance.

Payment period can be set in the Payment Plan Setup

form available from the Setup button. Choose from several

options, from monthly to daily, etc.

Days

Enter the number of days between payments.

This field is only displayed when the Payment Period

is set to Number Of Days.

Down Payment

Enter the Date of the Down Payment. To pick from

a Calendar press F2.

To schedule a number of days in the future, type

the number and press Enter.

For example, to set to 7 days in the future, type 7

and press Enter.

Down Payment Amount

Enter the amount of the Down Payment. It may be loaded

automatically, depending on your payment plan settings.

First Payment

Enter the Date of the First Payment. To pick from a

Calendar, press F2.

To schedule a number of days in the future, type

the number and press Enter.

For example, to set to 7 days in the future, type 7

and press Enter.

Payment Amount

Enter the amount of the First Payment. It may be loaded

automatically, depending on your payment plan settings.

Last Payment

The Date of the Last Payment.

When Collect! calculates the payments for this plan,

the last payment Date and Amount will display in the

Date and Amount fields here.

Last Payment Amount

The Amount of the Last Payment.

Several fields on the Payment Plan

form display information for your

information only. They cannot be

altered and are grayed out. These

fields are listed below.

Several fields on the Payment Plan

form display information for your

information only. They cannot be

altered and are grayed out. These

fields are listed below.

Late Fee

This amount is taken from settings in the Payment

Plan Setup for Late Fee Transaction and Late Fee

Amount.

Late Fees To Date

This amount is taken from transactions information

for this Debtor.

Other Charges

This amount is taken from transactions information

for this Debtor.

Current Owing

This amount is displayed from the Debtor's Owing

field in the Debtor from.

Paid To Date

This amount is displayed from the Debtor's Paid

field in the Debtor from.

Total Term Payments

This is the total dollar amount of the payments

scheduled in this payment plan.

Payments Remaining

Number of payments remaining in plan. Collect!

calculates this automatically depending on the

settings you choose for the plan.

Payments In Arrears

This is the number of missed payments.

Delinquent On

This is the date the account went delinquent.

Total Arrears

This is the total value amount of missed payments.

OK

Select this to save any changes you have

made and return you to the previous form.

Print

Select this to bring up the Print Report list of reports and

letters that can be printed form the Payment Plan form.

Setup

Select this option to display the Payment Plan Setup

form where you can enter default values to be used

when setting up similar payment plans on a number

of accounts.

Cancel

Select this to ignore any changes you have

made and return you to the previous form.

Help

Press this button for help on the Payment Plan form

and links to related topics.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org