How To Setup Transaction Types

This document explains the concept of Transaction Type in Collect!. It will help you use existing

transaction types in the right way and create your own.

Transaction types are an integral part of Collect!, and are used for recording and organizing

financial information. The Financial Type field in the Transaction form determines how Collect! will

process a transaction. Payments, Fees, Interest, Adjustments, Legal are examples of these Financial

Types.

For convenience and reporting, Collect! organizes Transaction Types into groups of 100, with the

100, 200, 300, 400, 500 and 600 codes actually reserved as titles for the group they represent. Each

series roughly represents one of the Financial Types. For instance, the 100 series is reserved for

Payment types. However, it is the Financial Type setting that actually determines how a transaction

is processed.

Financial Type Setting Determines Transaction Type

Transaction types are used when printing client and debtor trust account reports. The reports provide

a dated summary of financial transactions, and then show a breakdown of the financial activities,

usually organized by Transaction series, such as 100's, 200's and so forth. Using these groups will

help you with the organization of your own reports.

For example, Group 100 defines all basic transactions such as payment from a Debtor to the agency by

check or cash, payments from the Client to the agency and other details.

Several groups are predefined, including Original Principal and Interest, Legal Expenses, Interest,

and Other Expenses.

The Demonstration database in Collect! ships with many predefined transaction types. You can

copy any of these to the Masterdb database.

The Demonstration database in Collect! ships with many predefined transaction types. You can

copy any of these to the Masterdb database.

Even though we have supplied a standard list of transaction types, the code is capable of

storing 4 characters, which means you can put in your own. Some are system reserves as per

"System Reserved Types" below.

Even though we have supplied a standard list of transaction types, the code is capable of

storing 4 characters, which means you can put in your own. Some are system reserves as per

"System Reserved Types" below.

Viewing The List Of Transaction Types

The following list contains all the transaction types provided for you by Collect! You can modify

these if you need to or add your own, depending on your business needs.

100 PAYMENTS AND SYSTEM

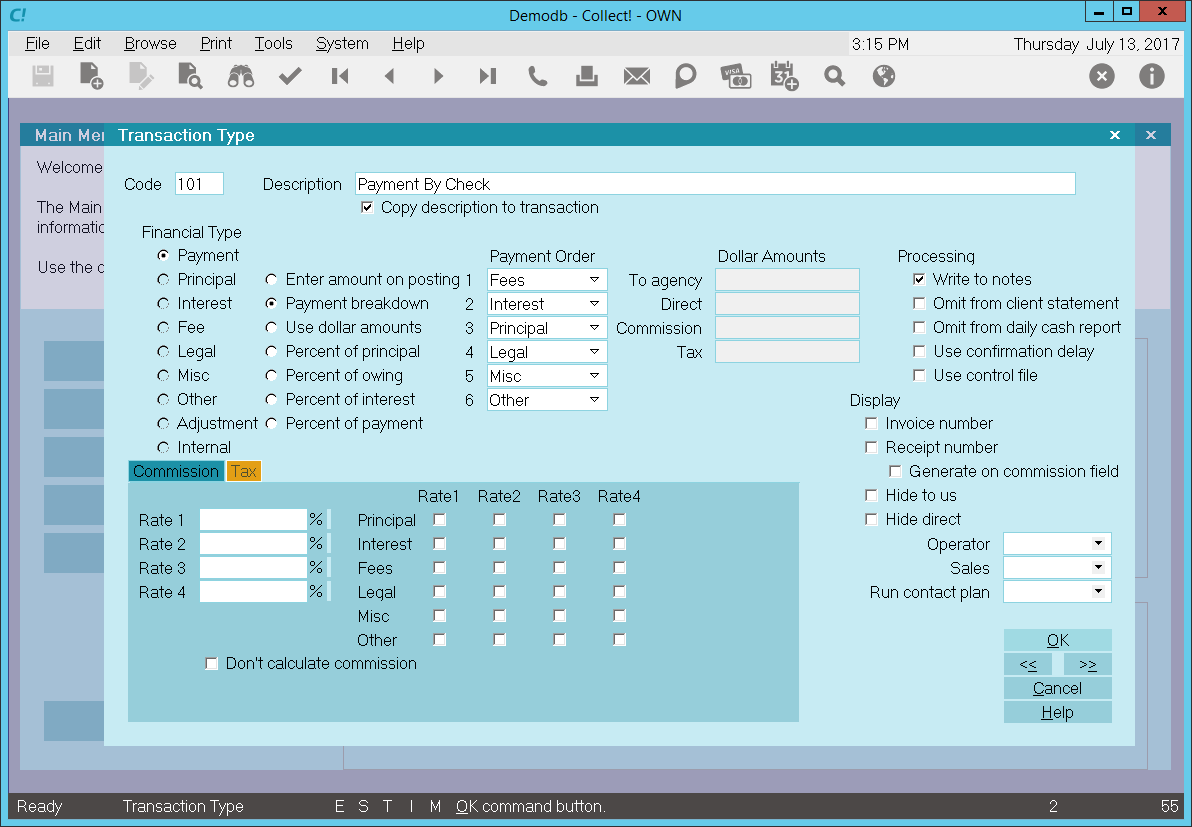

101 Check Payment

102 Cash Payment

103 Payment Out of Court

104 Money Order Payment

105 Returned NSF Check

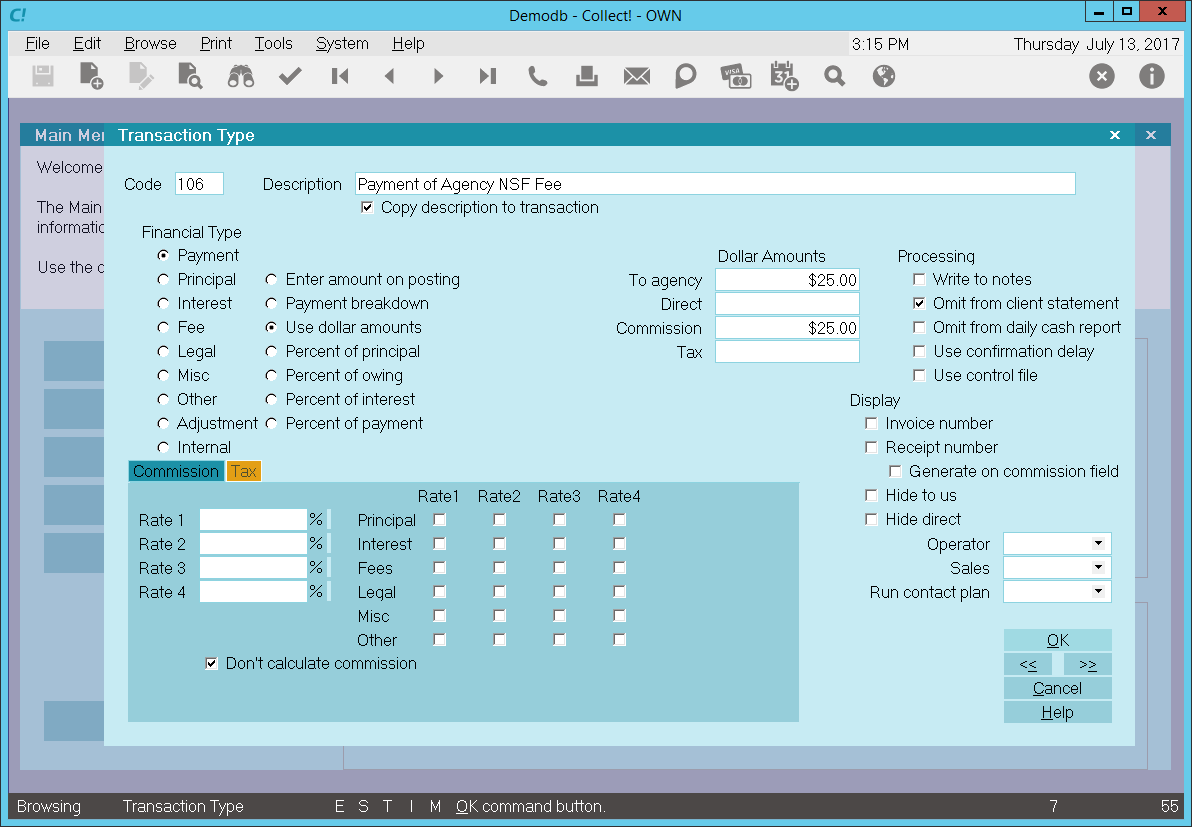

106 Payment of Agency NSF Fee

107 Check Payment Taken By Phone

108 Debtor Over Payment

109 Credit Card Payment

110 ACH Payment

111 Direct Payment to Client

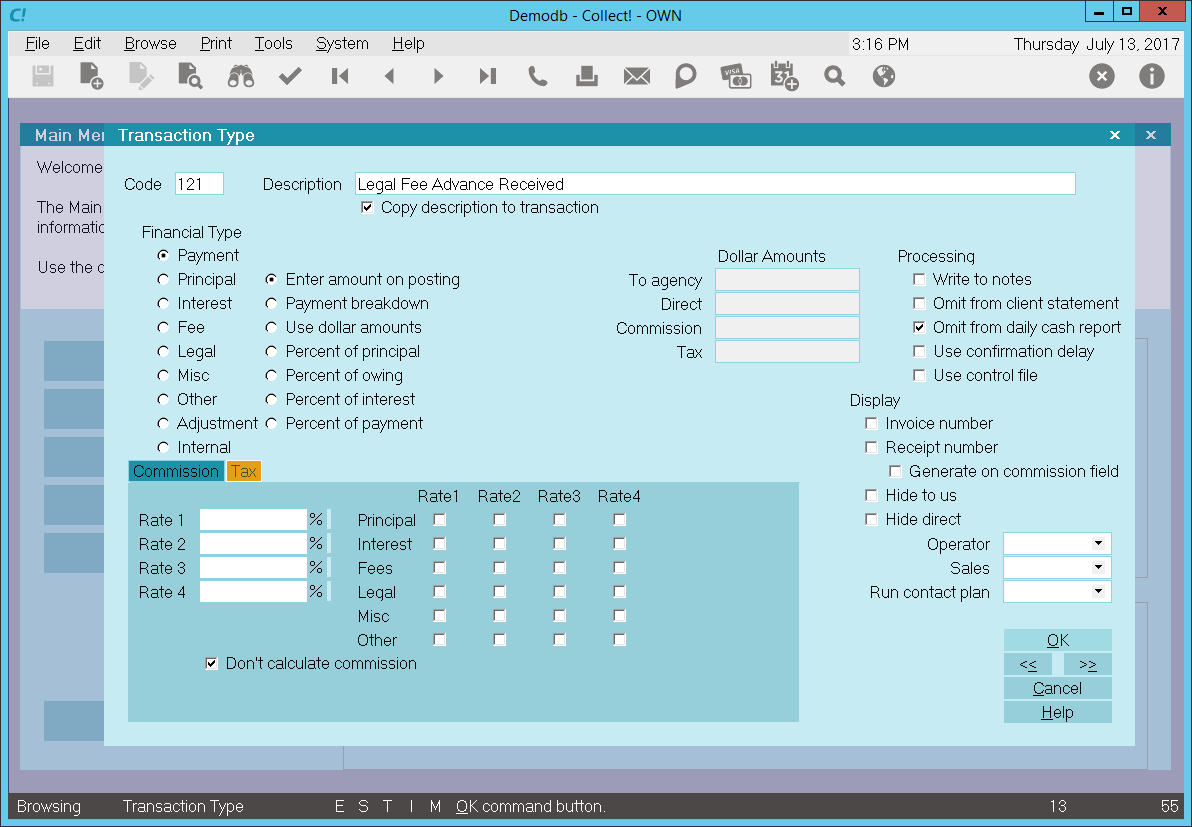

120 Attorney Fee Payment

122 Court Cost Payment

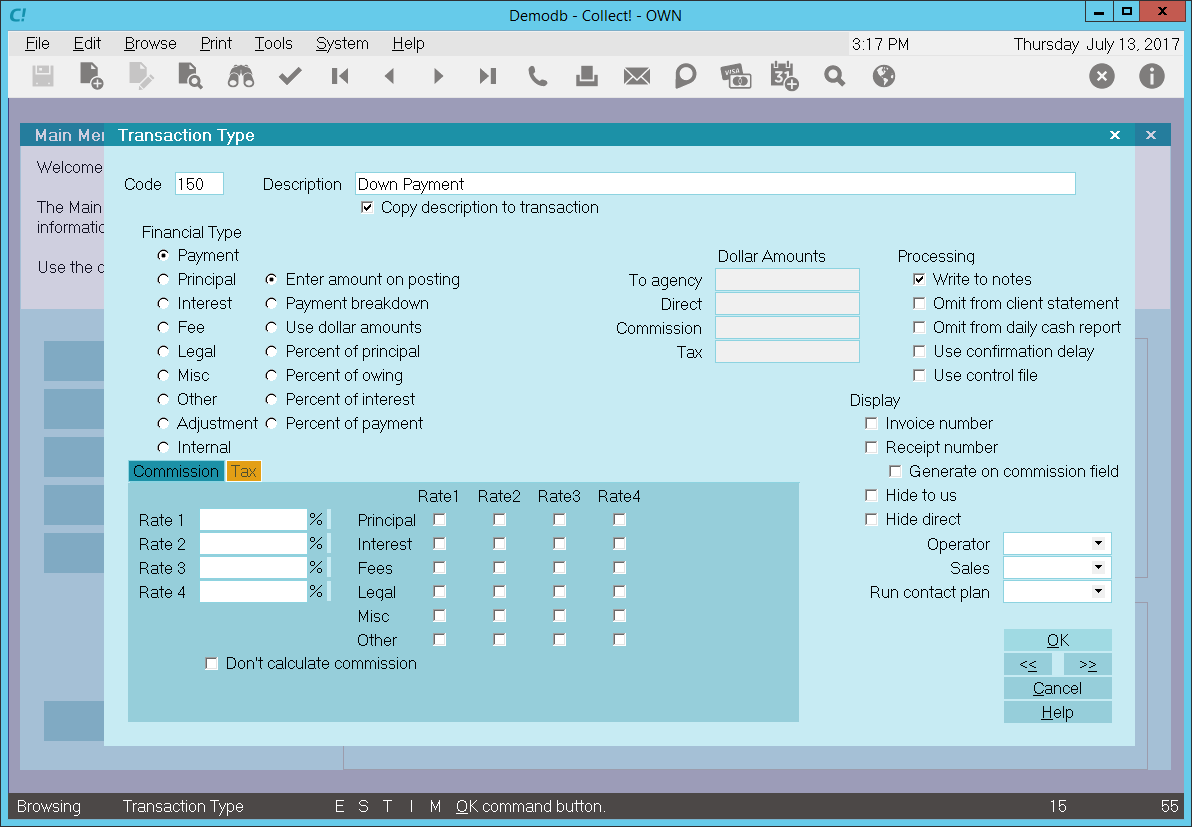

150 Down Payment

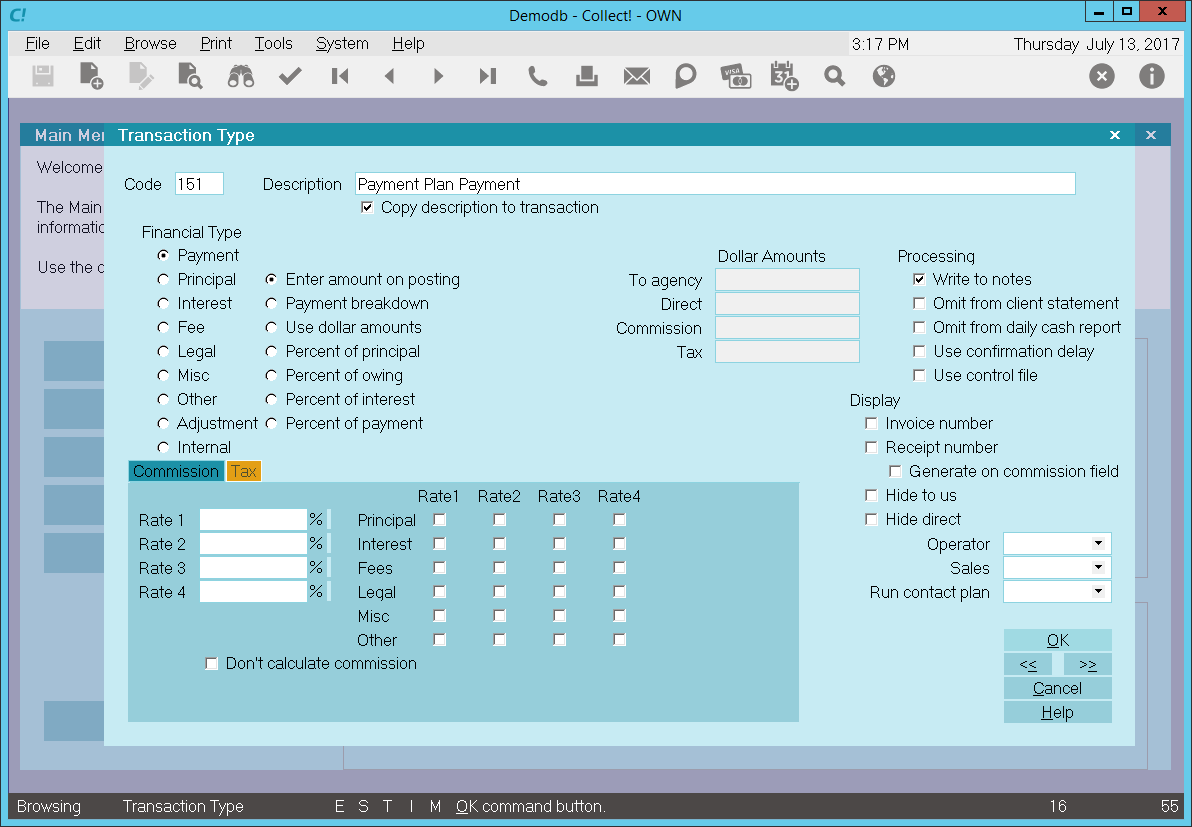

151 Payment Plan Payment

160 Monthly Billing Amount

193 Payment Plan Initial Discount

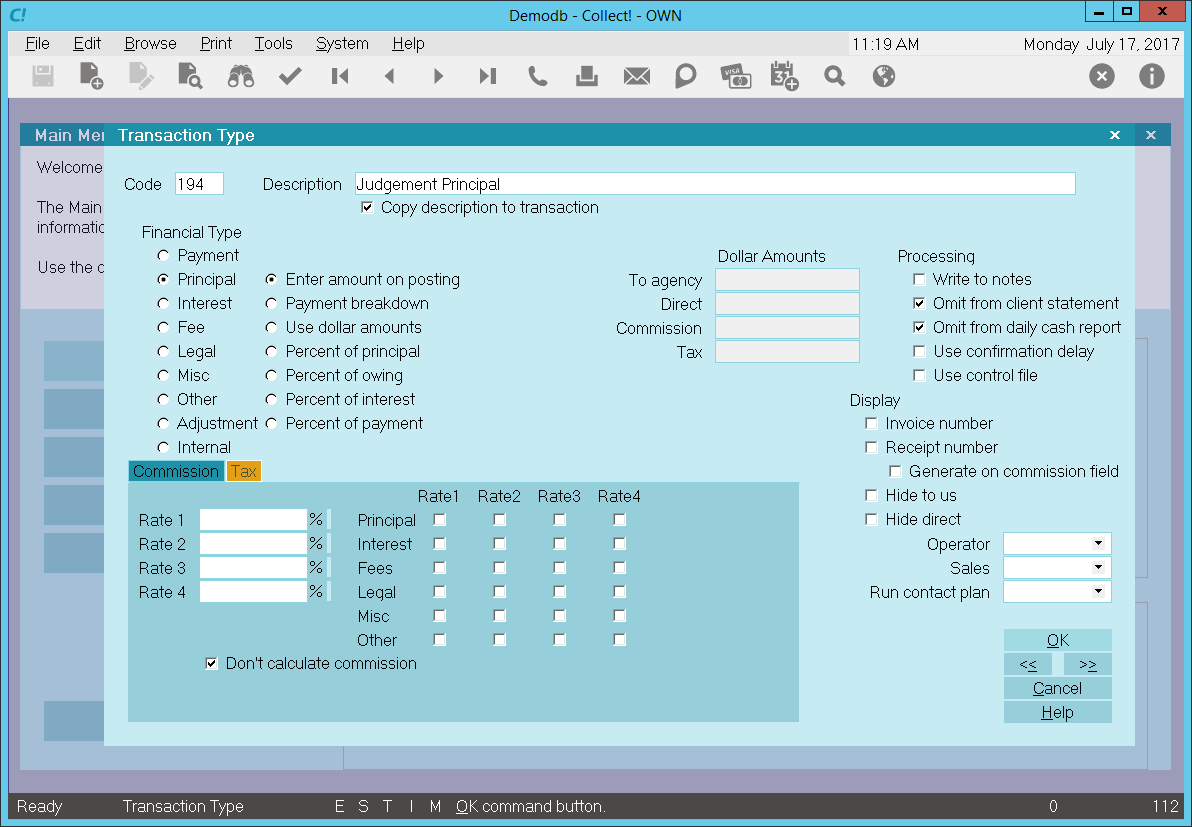

194 Judgment Principal

195 Judgment Interest

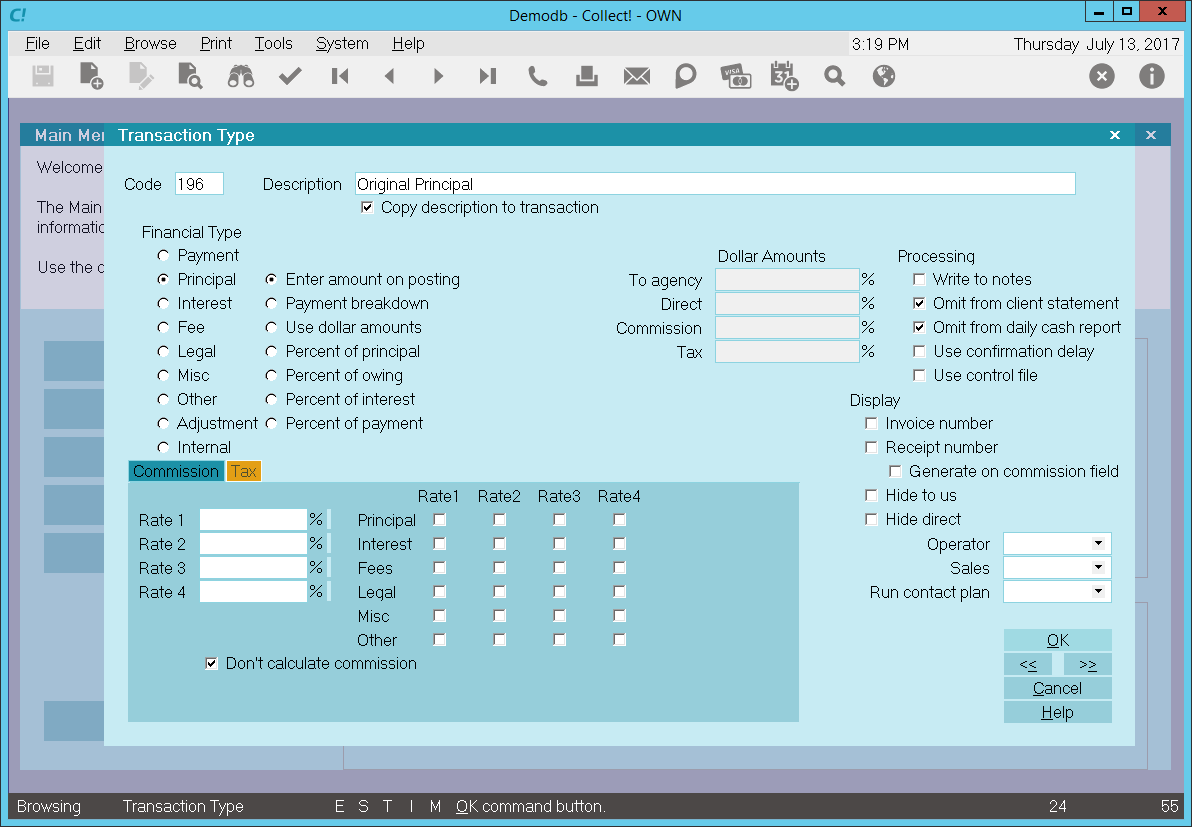

196 Original Principal

197 Original Interest

200 LEGAL FEES

201 Court Cost Charge

202 Attorney Fees Charge

294 Judgement Legal Costs

300 FEES

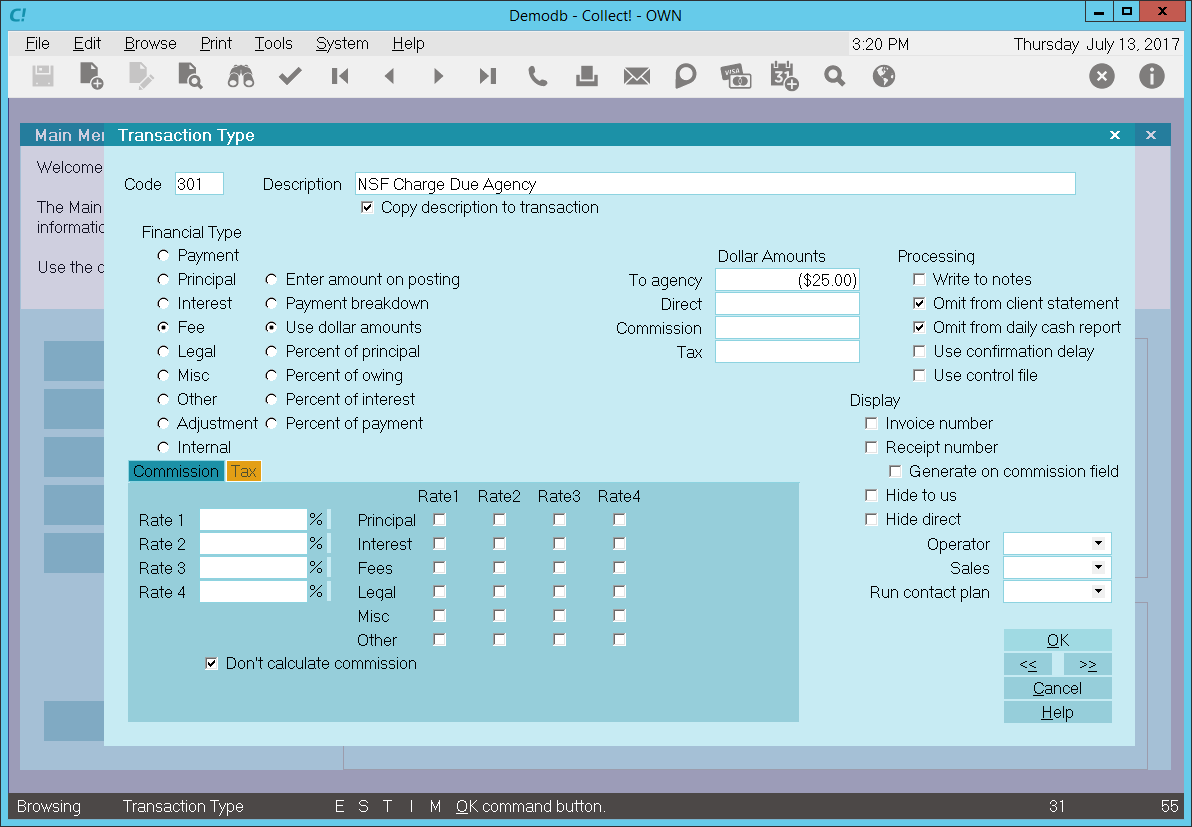

301 NSF Charge Due Agency

302 Closing Fee

303 Locate Fee

305 ACH Convenience Fee Reversal

307 ACH Convenience Fee

309 Credit Card Convenience Fee

310 Service Charge

320 Payment Plan Late Fee

340 Daily Storage Fee

350 Payment Plan Service Charge

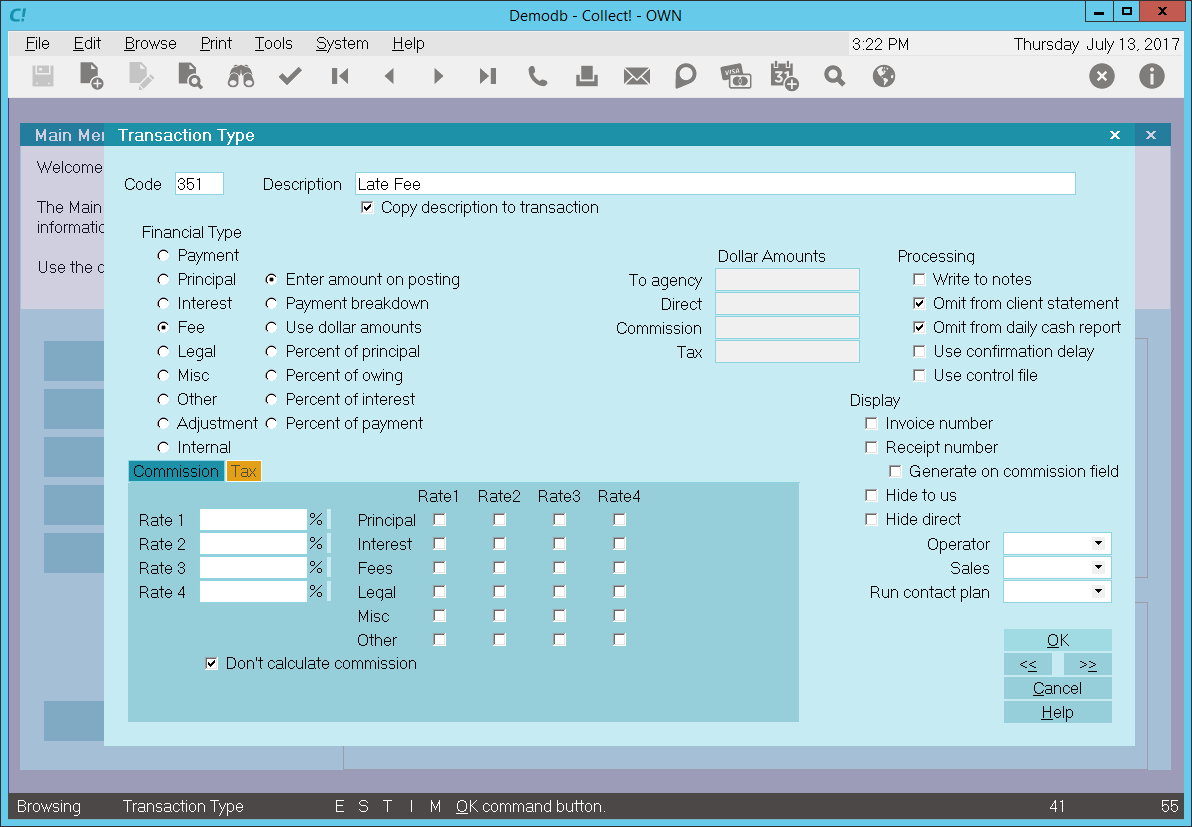

351 Late Fee

394 Judgement Court Costs

397 Client Fee

398 Debtor Fee

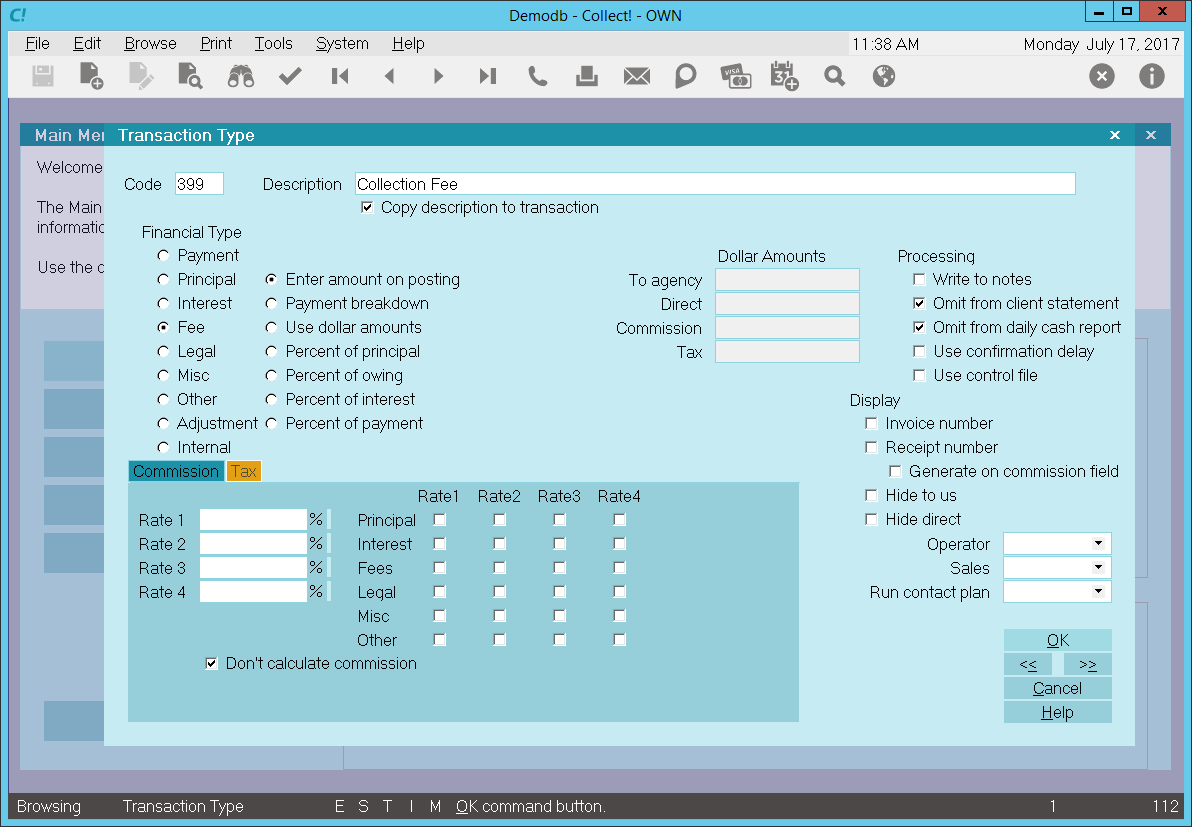

399 Collection Fee

400 INTEREST

401 Interest Adjustment

402 Accrued Compound Interest

495 Additional Judgement Interest

499 Total Accrued Interest

500 ADJUSTMENTS

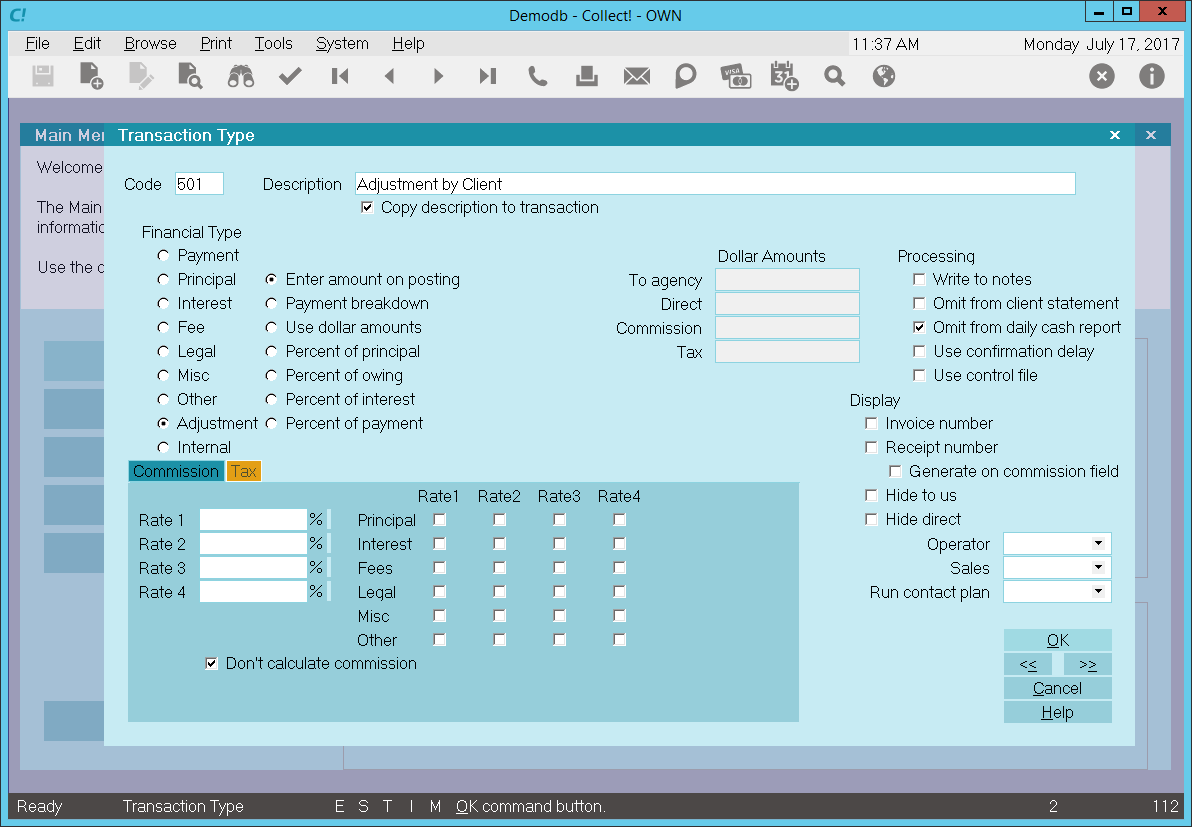

501 Adjustment by Client

502 Adjustment by Court Order

503 Adjust Judgement Principal

599 Adjustment through Upgrade

600 INTERNAL EXPENSES

601 Agency Internal Expenditure

Each one of these transaction types has its own settings, set in the Transaction Type form for that

type.

To view the settings for these transaction types, pull down the System menu and choose

Financial Settings, Transaction Types. The complete list of transaction types available to

you will be displayed. Click on your choice to open the Transaction Type form and view the

settings.

To view the settings for these transaction types, pull down the System menu and choose

Financial Settings, Transaction Types. The complete list of transaction types available to

you will be displayed. Click on your choice to open the Transaction Type form and view the

settings.

You should leave code 100, 200, 300 and 400 etc. as titles for the group they represent.

Then use codes 101, 201, 301, 401, 501, 601 as the starting points for the transaction types

you want to list in the group. You can also create your own groups and codes with up to 4

characters and then build reports that reference transactions with these codes.

You should leave code 100, 200, 300 and 400 etc. as titles for the group they represent.

Then use codes 101, 201, 301, 401, 501, 601 as the starting points for the transaction types

you want to list in the group. You can also create your own groups and codes with up to 4

characters and then build reports that reference transactions with these codes.

System Reserved Types

System Reserved Types are used by internal processes in Collect!. They should be left alone. If you

plan to customize Collect! in an extreme manner, please consult with Technical Support.

194 Judgment Principal

195 Judgment Interest

196 Original Principal

197 Original Interest

294 Judgement Legal Costs

394 Judgement Court Costs

397 Client Fee

398 Debtor Fee

399 Collection Fee

499 Total Accrued Interest

599 Adjustment through Upgrade

1081 Original Fees, Prior to Assignment

1082 Original Legal, Prior to Assignment

1083 Original Misc, Prior to Assignment

1084 Original Other, Prior to Assignment

1085 Original Paid to Client, Prior to Assignment

If these codes do not appear in your Transaction Type list, then they will appear as numbers in your

trust reports, rather than with text titles. You should create these codes in your Transaction Type

list if they are not there. These Transaction Type codes are required, and should not be changed.

Most of the others can safely be modified.

Print A List Of All Settings

To view all of the transaction types available in Collect!, pull down the System menu and choose

Financial Settings, Transaction Types. A list will display. You could pull down the Print menu and

choose Quick Print from the list of choices. When prompted, say "Yes" to details. This will give you

a complete list of the transaction types and their settings.

Using The Predefined Transaction Types

Press F1 from the Transaction form and the Transaction Types form to get Help on the fields in these

form. Using this information and the list above, pick the transaction types that you need.

Examine the settings of these transaction types to be sure they will act as you expect them to. Most

of the types can be modified. However, you should be sure of what you are doing when you make changes

to existing Transaction Type settings. These settings have been chosen to perform in a certain way.

Creating Your Own Transaction Types

The easiest way to create a new transaction type is to copy an existing type, or heading, give it

a new Code number, in the same general group, and a new Description. Then modify the settings to

suit your needs.

Each group heading has default settings that generally apply to the whole group. You can copy

the heading as a template for your new type and the basic settings will be set already.

Each group heading has default settings that generally apply to the whole group. You can copy

the heading as a template for your new type and the basic settings will be set already.

Copy A Transaction Type

- Choose System, Financial Settings, Transaction Types to display the list of types in your

system.

- Use the up and down arrows to locate and highlight the type or heading that you wish to

copy.

- Make sure it is highlighted and press CTRL+C. You will be informed that you have copied

data.

- Press OK and then press CTRL+V. The list will now contain a duplicate copy of the transaction

type or heading that you copied.

- Click on one of the copies to open the Transaction Type form for you to modify.

- Give your copy a new Code number and a new Description to begin to create your own transaction

type.

Create A Transaction Type Group

To add group 700, for example, to the Transaction Type list:

- Open the Transaction Type List.

- Press F3 to create a new Transaction Type.

- Enter 700 as the Code to identify the group.

- Type in a general Description that applies to each transaction type in this new group.

The Description you use to label the group is used in trust account reports as the title of

the Transaction group.

The Description you use to label the group is used in trust account reports as the title of

the Transaction group.

- Choose the default settings that will generally apply to transaction types in this group.

These settings can be modified for each individual transaction type that you create in the

group.

- Press F8 to save your work.

Now, when you view the list of transaction types, this new group will display.

Transaction Type Form

Click Here to View this Form.

Click Here to Close this Form.

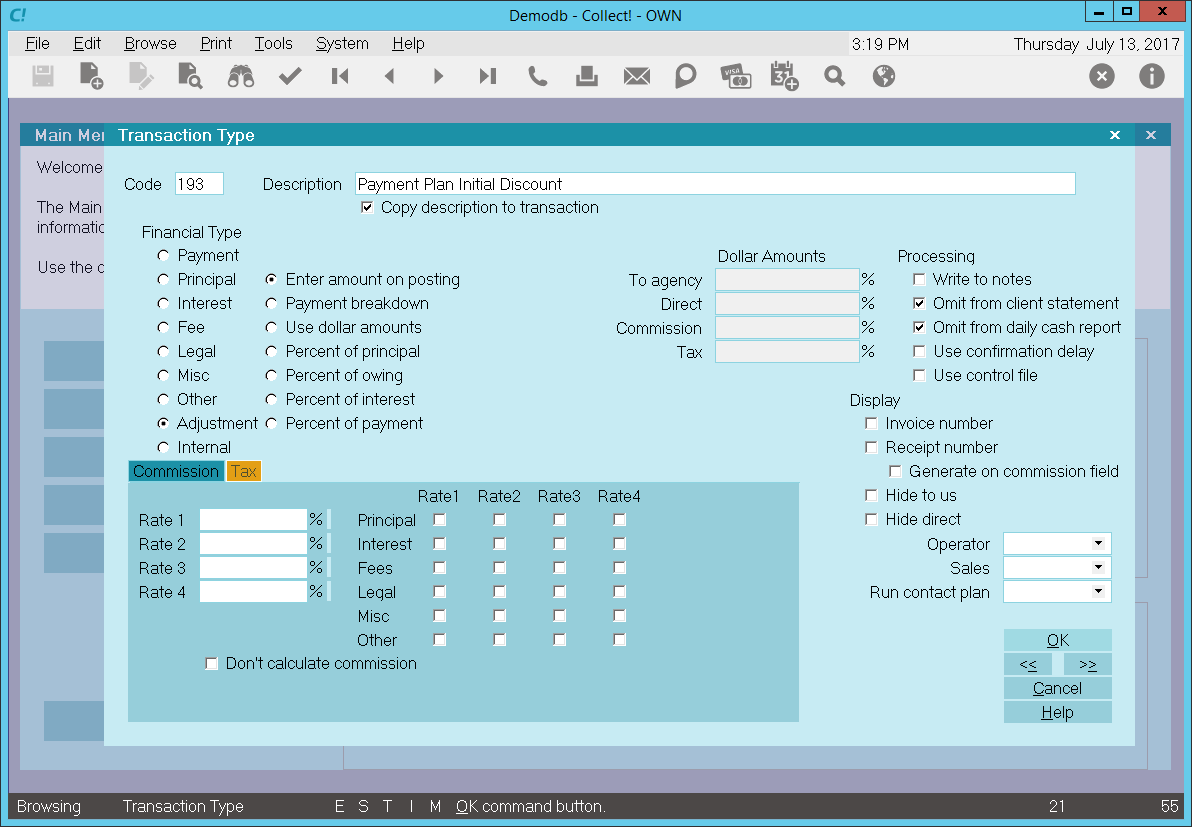

Transaction types give you the ability to categorize transactions

for accounting and reporting. Through the Transaction Type form

you set options to control calculations, breakdown payments,

assign a specific operator and a sales person, designate a contact

plan to run, and set the commission rate. You may

view and modify existing transaction types in Collect! and

create your own new ones. By setting up transaction types

for the way you do business, you can automate many basic

aspects of posting and processing your transactions.

Transaction Type

The Transaction Type form displays many settings that

can be used to manage posting financial transactions

to your accounts.

Predefined Transaction Types

Collect! provides many pre-defined transaction types in the

Demonstration database for basic types of transactions you

may expect to handle. You can copy any of these to the

Masterdb database.

Transaction types are divided into groups of 100. The

actual "centenary" markers are used as a header for

the group. Although these markers have no settings,

you can reference the description when building reports.

This a handy way to provide a title for a group of

transactions on your reports.

The following list contains all the transaction types

provided for you by Collect!. Each one of these transaction

types has its own settings. These are set in the Transaction

Type for that specific Code, (e.g. 102, 303 etc.) You can

modify these if you need to or add your own, depending on

your business needs. You should seriously consider how

your business operates before making any changes to the

existing system.

Please refer to How To Setup Transaction Types for more

information.

Code

This field shows the Code for this Transaction Type.

The Code identifies the type of transaction you are

posting. Whenever you post transactions, you pick

the Code from the list of Transaction Types and

all the settings for that type are copied into the

Transaction form.

The default codes are organized in groups of 100 with

the "centenary codes", i.e. 100, 200, 300 etc.

used as titles for the group. The code field can

hold more characters, so you can use your own

codes.

Please note that some Codes are reserved for automations.

If you do not use those automations, then you can

re-purpose or remove those code. Please refer to the

Help Topic How To Setup Transaction Types for a

current list.

Description

This is a brief description of the Transaction Type.

For codes 100, 200, 300, 400, and 500, the Description

should be the title you want to see in your

Trust Account Report for the section that lists

transactions in each group.

Copy Description To Transaction

Switch this ON with a check mark so that whenever

you post a transaction of this Transaction Type, the

Description will automatically be copied to the

transaction's Description field.

Financial Type

The Financial Type setting determines the financial category

of each transaction. Financial types can be Payment,

Principal, Interest, Fee, Legal, Misc, Other, Adjustment, or

Internal. The dotted radio button in this column sets the

transaction's financial type. This is very important for processing

money amounts when a transaction is posted. The money

amount of the transaction will be allotted to the financial area

you choose here, that is, Payment, Principal, Interest, Fee,

Legal, Misc, Other, Adjustment or Internal.

Payment

Place a dot in this radio button to flag this Transaction

Type as a Payment. Transactions will be posted as

payments to the debtor's account and will be totaled in

the Paid field on the Debtor screen as well as being

calculated in financial statements and reports.

Principal

Place a dot in this radio button to flag this Transaction

Type as Principal. Transactions will be posted as principal

to the debtor's account and will be totaled in the Principal

field on the Debtor screen as well as being calculated

in financial statements and reports.

Interest

Place a dot in this radio button to flag this Transaction

Type as Interest. Transactions will be posted as interest to

the debtor's account and will be totaled in the Interest field

on the Debtor screen as well as being calculated in financial

statements and reports.

Debtor's total interest is Original Interest plus any

Accrued Interest minus any positive transactions posted

to the debtor's Interest account.

Fee

Place a dot in this radio button to flag this Transaction

Type as a Fee. Transactions will be posted as fees to

the debtor's account and will be totaled in the Fees field

on the Debtor screen as well as being calculated in

financial statements and reports.

Fees = all transactions posted to the debtor's

Fee account.

To charge a fee, post the amount as a debit to the

debtor's Fee account. To post a debtor payment to cover

a fee, post the amount as a credit to the debtor's Fee

account.

Legal

Place a dot in this radio button to flag this Transaction

Type as a Legal Fee. Transactions will be posted as

legal fees to the debtor's account and will be totaled in

the Legal Fees field on the Debtor screen as well as

being calculated in financial statements and reports.

Misc

Place a dot in this radio button to flag this Transaction

Type as Miscellaneous. Transactions will be posted

as miscellaneous transactions to the debtor's account

and will be totaled in the Miscellaneous field on the

Debtor screen as well as being calculated in financial

statements and reports.

Other

Place a dot in this radio button to flag this Transaction

Type as an Other type. Transactions will be posted in

the Other category on the debtor's account and will be

totaled in the Other Charges field on the Debtor screen

as well as being calculated in financial statements

and reports.

Adjustment

Place a dot in this radio button to flag this Transaction

Type as an Adjustment. Transactions will be posted

as adjustments to the debtor's account and will be

totaled in the Adjustments field on the Debtor screen

as well as being calculated in financial statements

and reports.

Adjustments = all transactions posted to the

debtor's Adjustment account.

Posting a credit to the account reduces the debtor's

Owing. A debit increases the debtor's Owing.

Internal

Place a dot in this radio button to flag this Transaction

Type as Internal. Transactions will be posted to the

debtor's account for tracking purposes. However, the

amount will not affect either the Debtor's totals or the

Client's Commission or Return.

The Internal transaction type is used for

tracking internal agency expenses

connected with a particular account. These

expenses are borne entirely by the agency

and do not affect either the Debtor or Client

financials in any way.

The Internal transaction type is used for

tracking internal agency expenses

connected with a particular account. These

expenses are borne entirely by the agency

and do not affect either the Debtor or Client

financials in any way.

Enter Amount On Posting

If you place a dot in this radio button, when each

transaction is posted, the user must fill in the

amount of the transaction.

If this option is used for Payments, Collect! will use the

default internal breakdown order of: Other, Misc, Legal, Fees,

Interest, and finally Principal.

For user-defined breakdown, select the PAYMENT BREAKDOWN option.

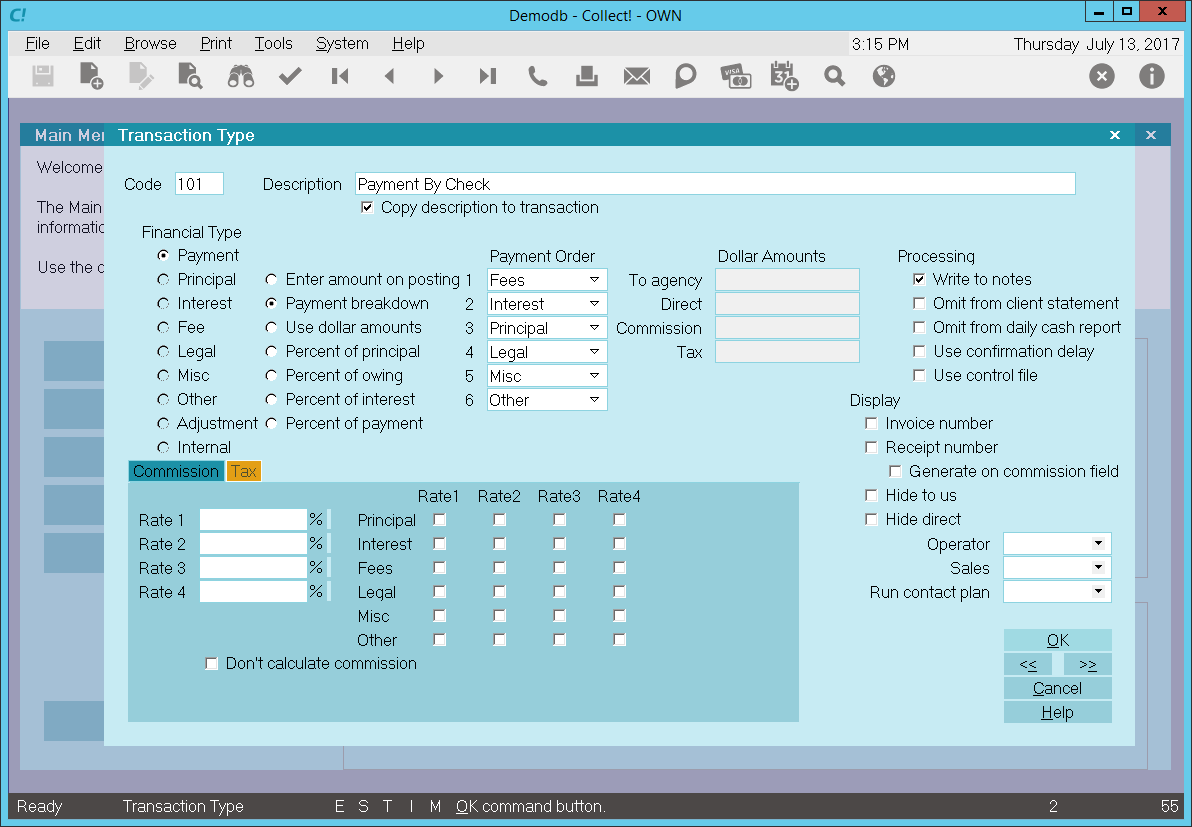

Payment Breakdown

This function enables you to post payments broken

down into to Fees, Interest, Principal, Legal, Misc

and Other. Place a dot in this radio button to select

this option.

When you enable Payment Breakdown, additional fields

become visible where you can select the order that

you want to use for distributing the payment amount.

By default, Collect! posts to Fees, then Interest,

and finally to Principal. You can change this order and

optionally add additional breakdown order for Legal,

Misc and Other financial types. Please refer to the section

below on Payment Breakdown and Compound Interest for

further details.

WARNING: This is the only type that can use the multi-rate

settings with commission. Enter Amount on Posting,

Use Dollar Amounts, and the Percentage Of types

will only use Rate 1 for the commission amount.

WARNING: This is the only type that can use the multi-rate

settings with commission. Enter Amount on Posting,

Use Dollar Amounts, and the Percentage Of types

will only use Rate 1 for the commission amount.

Use Dollar Amounts

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the dollar amount of the transaction (as a number

from 1 to 100.). When the user posts a transaction of

this Transaction Type, the dollar amount will automatically

be copied to the correct field on the transaction.

Remember that a positive amount is a

credit to the account!

Remember that a positive amount is a

credit to the account!

Percent Of Principal

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Principal of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percentage and the amount will automatically be copied

to the correct field on the transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

Percent Of Owing

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Owing of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percentage and the amount will automatically be copied

to the correct field on the transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

Percent Of Interest

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Interest of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percent of any Accrued Interest and the amount will

automatically be copied to the correct field on the

transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

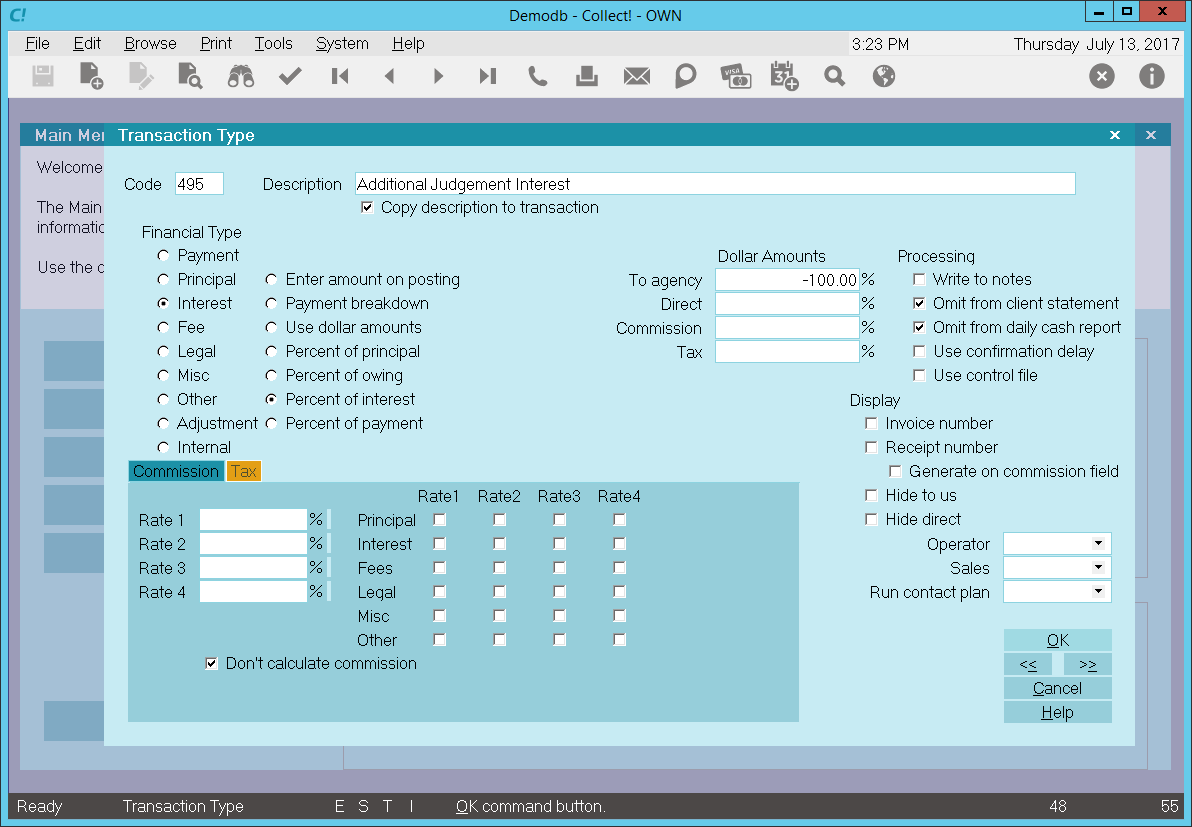

For example, we created a 499 Transaction Type

with Account Interest, 'Percent of interest' turned on,

and -100 in the To Us field. This takes any current

Accrued Interest on the account and posts it as a

transaction.

Combining this with the Edit Contact Event

to roll forward the 'Calculate interest from

date' in the Financial Detail form, you can

create interesting and very powerful

automation effects. For an example, please

refer to Help topic,

Accrued Interest - Tracking Month by Month.

Combining this with the Edit Contact Event

to roll forward the 'Calculate interest from

date' in the Financial Detail form, you can

create interesting and very powerful

automation effects. For an example, please

refer to Help topic,

Accrued Interest - Tracking Month by Month.

Percent Of Payment

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Payment of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percentage based on the value in the Payment Amount

field in the Debtor's Financial Details and the amount will

automatically be copied to the correct field on the transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

Payment Order

These fields are visible only when you have

selected "Payment breakdown." These fields allow

you to choose the order in which Collect! will apply

the payment amount to the debtor's account when a

transaction of this Transaction Type is posted. Select

the down arrow to view a pick list where you can

choose Fees, Interest, Principal, Legal, Misc or Other.

You can also select a blank [-] from the pick list to limit

your breakdown to fewer than the six financial

type categories.

1

Select the down arrow next to this field to choose

the first category to pay off when applying payments

of this Transaction Type to the debtor's account.

2

Select the down arrow next to this field to choose

the second category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first choice.

3

Select the down arrow next to this field to choose

the third category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first two choices.

4

Select the down arrow next to this field to choose

the fourth category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first three choices.

5

Select the down arrow next to this field to choose

the fifth category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first four choices.

6

Select the down arrow next to this field to choose

the sixth category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first five choices.

Dollar Amounts

You can enter amounts in this area when you select "Use

dollar amounts." Enter the actual dollar amount in the

appropriate field. Collect! will use this amount whenever

you post a transaction of this type.

Remember that a positive dollar amount

is a credit to the debtor's account.

Remember that a positive dollar amount

is a credit to the debtor's account.

To Agency

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent

for this Transaction Type. Enter an amount or percent

that will automatically be copied to the To Agency field

when creating a transaction of this Transaction Type.

Direct

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent for

this Transaction Type. Enter an amount or percent that

will automatically be copied to the Direct field

when creating a transaction of this Transaction Type.

Commission

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent for

this Transaction Type. Enter an amount or percent that

will automatically be copied to the Commission field

when creating a transaction of this Transaction Type.

The Commission tab contains many fields for

setting commission rates if you want to set

them at the Transaction Type level. Please

see Commission and Tax Calculations

below.

The Commission tab contains many fields for

setting commission rates if you want to set

them at the Transaction Type level. Please

see Commission and Tax Calculations

below.

Tax

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent for

this Transaction Type. Enter an amount or percent that

will automatically be copied to the Tax field when

creating a transaction of this Transaction Type.

The Tax tab contains many fields for setting

tax rates if you want to set them at the

Transaction Type level. Please

see Commission and Tax Calculations

below.

The Tax tab contains many fields for setting

tax rates if you want to set them at the

Transaction Type level. Please

see Commission and Tax Calculations

below.

Processing

Several switches can be set to determine how you

will handle the reporting aspects when transactions

of this Transaction Type are posted.

Write To Notes

Switch this ON with a check mark if you want Collect!

to write a note to the debtor's Notes whenever a

transaction of this type is posted.

Omit From Client Statement

Switch this ON with a check mark if you want Collect!

to exclude transactions of this type when the client

statement is generated for each period. You can

override this when a particular transaction is being

posted, if needed.

Omit From Daily Cash Report

Switch this ON with a check mark if you want Collect!

to exclude transactions of this type when you print

your Daily Cash report. You can override this when

a particular transaction is being posted, if needed.

Use Confirmation Delay

Switch this ON to delay reporting transactions posted

with this Transaction Type. This is useful for allowing

time for a check to clear. The number of days delayed

is taken from the Payment Posting Options form.

Please refer to How to Use Confirmation Delay of Transactions

for details.

Use Control File

Switch this ON with a check mark to tell Collect! to run a

control file whenever a transaction is posted using this

Transaction Type. When this switch is enabled, a "control file"

field becomes visible where you can enter the name of the

control file you want to use.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

When enabled, Collect! will not perform any transaction breakdown

for payments. It is assumed that all financial calculations are

handled in the control file.

Control File

Enter the name of the control file you want Collect! to run

whenever a transaction is posted using this Transaction.

Collect! will add the ".ctf" extension.

The control file you enter here will be automatically entered

into the "Control file" field whenever you create a transaction

using this Transaction Type.

This field is only visible when the "Use control file" switch

is enabled.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

Display

Several switches can be set to determine what fields

you display when posting a transaction of this

Transaction Type and to automatically generate

invoice and receipt numbers.

Invoice Number

Switch this ON with a check mark if you want Collect!

to automatically assign an Invoice Number to

transactions of this type.

Invoice Numbers need these requirements:

- This switch must be turned ON with a check mark.

- The transaction must be posted as "Fees."

- The amount posted must be a negative amount (debit)

To Agency or Direct, or must be a positive (credit)

Commission amount.

If these conditions are not met, Collect does not assign

an Invoice Number even if the switch is ON.

The Invoice Number is determined by adding

one to the highest numbered invoice already

in Collect!. You can change an existing

Invoice Number so that Collect! will start at a

number of your choice.

The Invoice Number is determined by adding

one to the highest numbered invoice already

in Collect!. You can change an existing

Invoice Number so that Collect! will start at a

number of your choice.

Receipt Number

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers need these requirements:

- This switch must be turned ON with a check mark.

- The transaction must be posted to the Payment

account.

- The amount posted must be a positive payment

(credit) To Agency.

If these conditions are not met, Collect will not assign

a Receipt Number even if the switch is ON.

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission Field."

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission Field."

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

Generate On Commission Field

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers will be generated if:

- The "Receipt Number switch is also ON."

- The transaction must be posted to the Payment

account.

- The transaction must be posted as a positive amount

(credit) to Commission.

Hide To Us

Switch this ON with a check mark to hide the "To Us" field

whenever this Transaction Type is selected.

Use this switch if you want to organize your transaction

types according to Direct or To Us payments. This

function simplifies work for the user, as they don't have

to decide whether to post the transaction in the To Us

or Direct field.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Hide Direct

Switch this ON with a check mark to hide the "Direct" field

whenever this Transaction Type is selected.

Use this switch if you want to organize your transaction

types according to Direct or To Us payments. This

function simplifies work for the user, as they don't have

to decide whether to post the transaction in the To Us

or Direct field.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Commission And Tax Calculations

Several switches can be set to determine how you will

handle calculations relating to transactions of this

Transaction Type. You can set several rates and

also apply the rates to different financial types.

Please refer to Help topic, Commission and

Help topic, Tax for details.

Rates set in these areas are used when a

transaction of this Transaction Type is posted. These

rates override the debtor's Commission Rate or Rate

Plan which would ordinarily be used to calculate

commission for a payment.

Rates set in these areas are used when a

transaction of this Transaction Type is posted. These

rates override the debtor's Commission Rate or Rate

Plan which would ordinarily be used to calculate

commission for a payment.

Don't Calculate Commission

Switch this ON with a check mark to tell Collect!

NOT to calculate commission whenever a transaction

of this type is posted. You can override this when a

transaction is being posted, if needed.

Don't Calculate Tax

Switch this ON with a check mark to tell Collect!

NOT to calculate tax whenever a transaction of this

type is posted. You can override this when a

transaction is being posted, if needed.

Operator

Select the down arrow, or press F2, to view the list

of Operators. A choice in this field forces the

transaction to be posted to the Operator ID selected.

This is useful for transactions that you don't want

included in the standard Operator commission reports.

For example, payments to pre-collect accounts should

probably be assigned to either the system or to

management, to avoid inclusion in any particular

operator's Transaction Summary Reports.

Sales

Select the down arrow, or press F2, to view the list

of Operators. A choice in this field forces the

transaction to be posted to the Sales ID selected.

This is useful for transactions that you don't want

included in the standard Operator commission reports.

For example, payments to pre-collect accounts should

probably be assigned to either the system or to

management, to avoid inclusion in any particular

operator's Transaction Summary Reports.

Run Contact Plan

Select the down arrow, or press F2, to view the list

of Contact Plans. Select a contact plan to run when

a Transaction of this Type is posted. The contact

plan displayed is this field will run automatically as the

transaction is saved. This is useful for setting up custom

contact schedules that depend on the type of payment

or debit posted.

POST PAYMENT SEQUENCE

When you post payments with contact plans, the

sequence of events is as follows:

- A transaction record is created.

- Debtor totals are recalculated.

- The Transaction Type specific Contact Plan is

run.

- The default Payment Posting Contact Plan is run,

if there is one set up in Payment Posting Options.

This plan is run BEFORE any Contact Plan

you set up in the Payment Posting Options

form. This is due to the fact that the

transaction plan may do more processing

like posting a reversal to split the payment

across a group, which will alter the OWING

amount.

This plan is run BEFORE any Contact Plan

you set up in the Payment Posting Options

form. This is due to the fact that the

transaction plan may do more processing

like posting a reversal to split the payment

across a group, which will alter the OWING

amount.

Delete

This button is visible only on the list of all Transaction

Types. Select this to delete the highlighted item from

the list.

Edit

This button is visible only on the list of all Transaction

Types. Select this to open and modify the highlighted

Transaction Type.

New

This button is visible only on the list of all

Transaction Types. Select this to open a new

blank Transaction Type form.

Help

Select this button for help on the Transaction Type

form and links to related topics.

Cancel

Select this button to ignore any changes you may

have made and return to the previous form.

OK

Select this button to save any changes you have

made and return to the previous form.

<<

Select this button to navigate to the

previous record in the database.

>>

Selecting this button to navigate to the

next record in the database.

Payment Breakdown And Compound Interest

When you use Compound Interest you MUST post the

Original Principal amount as a Transaction Type 196.

When posting payments, transaction types MUST have

the Payment Breakdown option set so that Collect! can,

by default deduct, fees first, then accrued interest,

and finally principal. You may adjust this payment

breakdown order when creating your Payment Breakdown

transaction types. Please be sure you know what you

are doing if you deviate from the default order, i.e.

Fees, then Interest, then Principal.

Results of the payment disbursement will be reflected in

several areas of the Financial Detail form accessed by

selecting the Principal or Interest field on the Debtor form.

Selecting the Owing field will display the

Debtor Financial Summary. Selecting the other

financial fields will display the

Debtor Transaction Summary.

Selecting the Owing field will display the

Debtor Financial Summary. Selecting the other

financial fields will display the

Debtor Transaction Summary.

Compound interest calculations produce a

running balance of principal, interest, fees and

adjustments. When using Compound Interest, you

MUST post transactions using Payment Breakdown.

Payment breakdown also works with Simple Interest

as well as Compound Interest.

Compound interest calculations produce a

running balance of principal, interest, fees and

adjustments. When using Compound Interest, you

MUST post transactions using Payment Breakdown.

Payment breakdown also works with Simple Interest

as well as Compound Interest.

Create A Transaction Type

As described above, you can copy an existing type or heading and modify it.

Or, you can press F3 when you are viewing the transaction type list or an individual transaction type.

This will display a new blank transaction type form for you to fill out. (Or press the NEW button on

the toolbar or the NEW button at the bottom of the transaction type list.)

Transaction Type Settings

Each Transaction Type has its own unique settings. These control report printing options, calculations,

commission rate, perhaps running a Contact Plan, assigning operators and sales persons to transactions.

There are over twenty settings on the Transaction Type form that you can choose from to setup a

particular Transaction Type. The ability to select a Contact Plan to run offers many more choices as

well. (This means that once you know what your business needs are, you can create uniquely customized

transaction types to automate your transaction posting operations.)

Each section heading in the Transaction Type list has default settings that generally apply

to any new transaction type that you create in that category. You can use these settings as

a starting point when you create your transaction types.

Each section heading in the Transaction Type list has default settings that generally apply

to any new transaction type that you create in that category. You can use these settings as

a starting point when you create your transaction types.

- From the Transaction and the Transaction Types forms, press F1 for Help about the fields on

both of these forms. You should be aware of how closely they are connected with each

other.

- Use the information available from Help to fill in Code, Description and Copy description to

transaction. You can also use the default settings in the header sections to get you

started.

Remember that this Transaction Type should be meaningful to you and fit the way you do

business. It enables you to categorize your transactions but you must decide what categories

mean something to you.

Remember that this Transaction Type should be meaningful to you and fit the way you do

business. It enables you to categorize your transactions but you must decide what categories

mean something to you.

- Make choices in the Financial Type section as needed, using the F1 Help results to guide you.

The Financial Type determines how the transaction is processed and totaled.

- The second column of the Financial Type section pertains to the Transaction and Debtor forms.

The choices set the way information is displayed and calculated. A payment can be categorized

and broken down into Interest, Fees, Adjustment and Principal in any order you need.

If you want to see the payment breakdown for this Transaction, switch ON "Payment breakdown"

in the Transaction Type form. Several fields on the Transaction form are only visible when

this switch is turned on. These fields relate to Principal, Fees, and Interest. Review help

on those topics.

If you want to see the payment breakdown for this Transaction, switch ON "Payment breakdown"

in the Transaction Type form. Several fields on the Transaction form are only visible when

this switch is turned on. These fields relate to Principal, Fees, and Interest. Review help

on those topics.

The Help available when you press F1 from the Transaction form will give you a good explanation

of these payment breakdown aspects. Categorizing your transactions using payment breakdown

gives you very detailed information for reporting and tracking purposes.

The Help available when you press F1 from the Transaction form will give you a good explanation

of these payment breakdown aspects. Categorizing your transactions using payment breakdown

gives you very detailed information for reporting and tracking purposes.

- The Processing section allows you to change the defaults for adding transaction information to

statements and reports.

- The Commission and Tax tabs give you choices for Commission and Tax calculation.

- The Display section can hide To Us or Direct fields on the Transaction form. This makes it

easier for the user to know where to enter the dollar amount when a transaction is posted.

Also, Collect! can create an Invoice or Receipt number automatically if you switch on these

settings for a particular Transaction Type. Please refer to the Help available on Transaction

for more information about numbering receipts and invoices.

- Choose an Operator and transactions of this type will be posted to this Operator. This may be

used for calculating Operator commissions. Press the arrow in this field to display a list of

operators in the system.

- Choose a Sales ID and transactions of this type will be posted to this Sales person. This may

be used for calculating Sales commissions. Press the arrow in this field to display a list of

Sales IDs in the system.

- Choose a Contact Plan to run when transactions of this type are saved. Press the arrow in this

field to display a list of available contact plans.

- You can set a Commission Rate to use with this Transaction Type. This rate will be used instead

of the normal Commission Rate in the Debtor form.

WARNING: Commissions and Taxes are generally left blank as they will override the client settings.

They may be set in scenarios that involve non-payment type transactions.

WARNING: Commissions and Taxes are generally left blank as they will override the client settings.

They may be set in scenarios that involve non-payment type transactions.

Transaction Posting Event Sequence

The sequence of events when you post a transaction is:

- A transaction record is created and calculated.

- Debtor totals are recalculated.

- The Transaction Type specific Contact Plan is run.

- The Default Payment Posting Contact Plan is run.

Summary

Several basic transaction types are needed to handle the transactions that you post every day. You

may find that Collect! has already provided the types and settings you need to begin using

transaction types.

If your needs are not met by the predefined transaction types, you can modify existing types or

create your own. Please have an idea of the transaction types that you need and the particular

settings you would like to apply before you begin to construct your own system for organizing your

accounts.

Transaction Type Samples

Principal Transaction Types - This transaction type is needed if you are going to

apply interest, apply a judgment, or add more principal at a later date. If you are not using any

of the above items then you can skip this transaction type.

Interest Transaction Types - This transaction type is needed if you are applying

interest or applying a judgment with interest amounts. If you are not using any interest amounts,

then you can skip this transaction type.

Payment Transaction Types - This transaction type is needed for posting all payments.

Payment transactions control all aspects of payment posting, keeping track of who is posting credits

or debits to your accounts.

Legal Transaction Types - This transaction type is needed if you are applying any

legal fees to the account. These are transactions are kept together and calculated as total legal

fees on an account.

Other Expenses Transaction Types - This Fees transaction type is needed if you are

applying additional charges, such as a closing fee, late fee, or a service charge, to the account.

Any fee that is not a legal fee uses this transaction type.

Adjustment Transaction Types - This transaction type is needed if you are applying

adjustments to Principal, Interest, or Fees, or to adjust the Owing of any account.

Internal Transaction Types - This transaction type may be used for tracking internal

expenses on a particular account. This transaction does not affect either the Debtor's or the Client's

financials in any way. It is just for keeping track of internal expenses borne entirely by the agency.

Original Principal Sample

The Original Principal transaction type is needed if you are going to apply interest, apply a

judgment, or add more principal at a later date. If you are not using any of the above items,

then you can skip this transaction type.

By default, Collect! ships and uses the 196 Original Principal transaction type shown below when it

is required to perform interest or judgment calculations.

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Details form.

You may enter an Original Principal amount using the Financial Detail form accessed from the

Debtor form's Principal field. If you have no need of anything more complicated, this is all

you have to do to record the Original Principal for the account.

You may enter an Original Principal amount using the Financial Detail form accessed from the

Debtor form's Principal field. If you have no need of anything more complicated, this is all

you have to do to record the Original Principal for the account.

The sample shown below sets the Original Principal amount when entering a new debtor. There are several

instances when you will need this.

- If you ever intend to apply interest of any type,

- need to add more principal later,

- use Collect!'s judgment functions,

- use payment plans as a credit grantor,

then you will want to apply this transaction type to the account.

Original Principal Transaction Type 196

When you create a 196 Original Principal transaction on a debtor account, the description from the

transaction type form will be copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the

time of posting the transaction.

Entering a negative amount in either the To Us or Direct field will add to the debtor's Principal

amount. If more than one of these transaction types is posted to an account, the total will be

calculated automatically and displayed in the Principal field on the Debtor form.

Entering a positive amount will reduce the amount of Principal. Interest will be recalculated

accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions,

interest is calculated on the resulting principal total after each transaction's payment date. For

more details please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 196 Original Principal

transaction to an account. You may override any setting when posting the transaction.

Judgment Principal Sample

The Judgment Principal transaction type is needed if you are going to apply interest or add more

principal at a later date. If you are not using any of the above items, then you can skip this

transaction type.

By default, Collect! ships and uses the 194 Judgment Principal transaction type shown below when it

is required to perform interest or judgment calculations.

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Judgment Principal field on the

Financial Details form.

You may enter an Judgment Principal amount using the Financial Detail form accessed from the

Debtor form's Principal field. If you have no need of anything more complicated, this is all

you have to do to record the Judgment Principal for the account.

You may enter an Judgment Principal amount using the Financial Detail form accessed from the

Debtor form's Principal field. If you have no need of anything more complicated, this is all

you have to do to record the Judgment Principal for the account.

Any transactions with a Payment Date that is before the Judgment Date will be excluded from

the Debtor's financial calculations. Collect! assumes that the Judgment awarded will factor

in all previous transactions.

Any transactions with a Payment Date that is before the Judgment Date will be excluded from

the Debtor's financial calculations. Collect! assumes that the Judgment awarded will factor

in all previous transactions.

The sample shown below sets the Judgment Principal amount. There are several instances when you will

need this.

- If you ever intend to apply interest of any type,

- need to add more principal later,

- use Collect!'s judgment functions,

- use payment plans as a credit grantor,

then you will want to apply this transaction type to the account.

Judgment Principal Transaction Type 194

When you create a 194 Judgment Principal transaction on a debtor account, the description from the

transaction type form will be copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the

time of posting the transaction.

Entering a negative amount in either the To Us or Direct field will add to the debtor's Principal

amount. If more than one of these transaction types is posted to an account, the total will be

calculated automatically and displayed in the Principal field on the Debtor form.

Entering a positive amount will reduce the amount of Principal. Interest will be recalculated

accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions,

interest is calculated on the resulting principal total after each transaction's payment date. For

more details please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 194 Judgment Principal

transaction to an account. You may override any setting when posting the transaction.

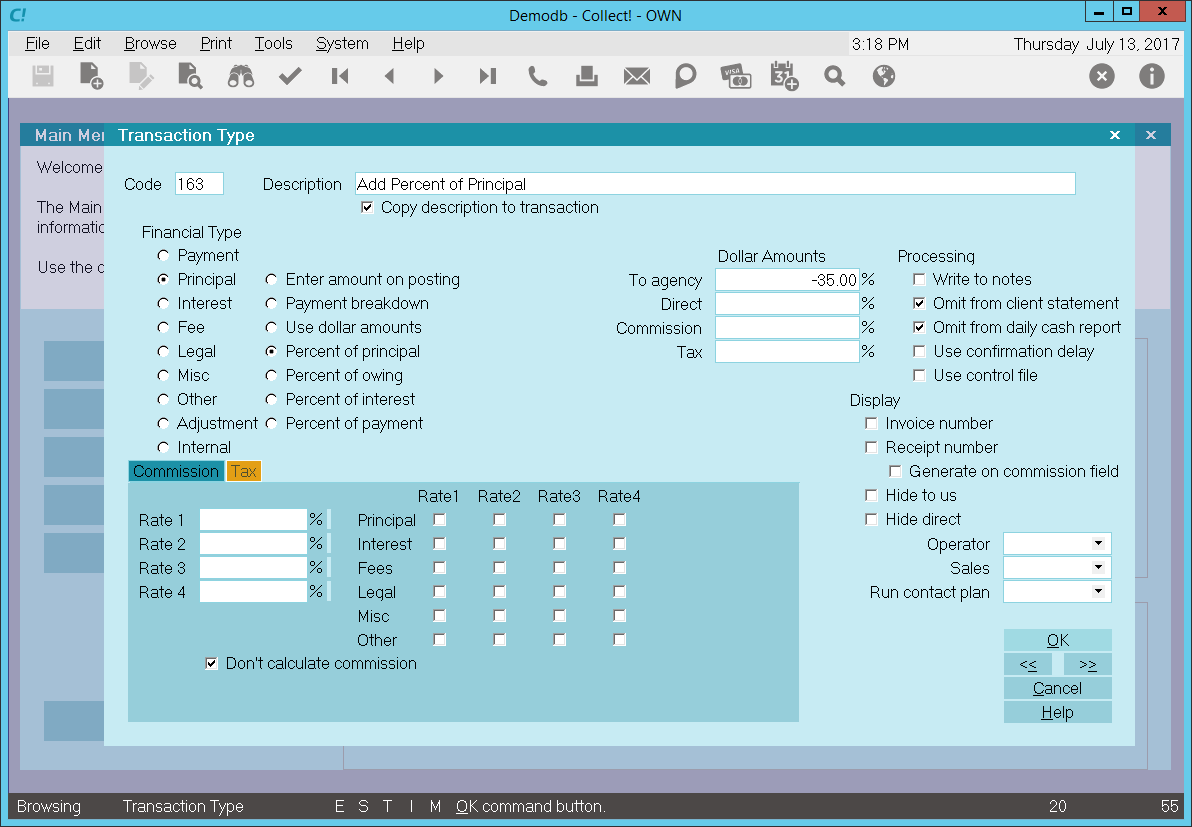

Add Percent Of Principal To Principal Sample

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Detail form.

The sample shown below will add 35% of the current principal to any previous principal amount. Use

this transaction type to add a percentage of the principal to the principal at the time of posting.

Percent Of Principal - Principal Transaction Type

When you post a 163, Add Percentage of Principal principal transaction to a debtor account, the

description from the transaction type form will be copied to the transaction being posted.

The 'Percent of principal' radio button is switched ON to allow you to set the percentage you wish

to be used at the time of posting the transaction. In this sample, -35% of the current principal will

be automatically filled into the To Us field when posting. Collect! will use the current Principal

amount and add 35% of this value to the previous principal posted to the account.

Entering a negative percentage in either the To Us or Direct field will add to the debtor's Principal

amount. If more than one of these transaction types is posted to an account, the total will be

calculated automatically and displayed in the Principal field on the Debtor form.

Entering a positive percentage will reduce the amount of Principal. Interest will be recalculated

accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions,

interest is calculated on the resulting principal total after each transaction's payment date. For

more details please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 163 + Percent of

Principal principal transaction to an account. You may override any setting when posting the

transaction.

Add Percent Of Owing To Principal Sample

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Detail form.

The sample shown below will add 5% of the current Owing to any previous Principal amount. Use this

transaction type for adding to the principal a percentage of the owing at the time of posting.

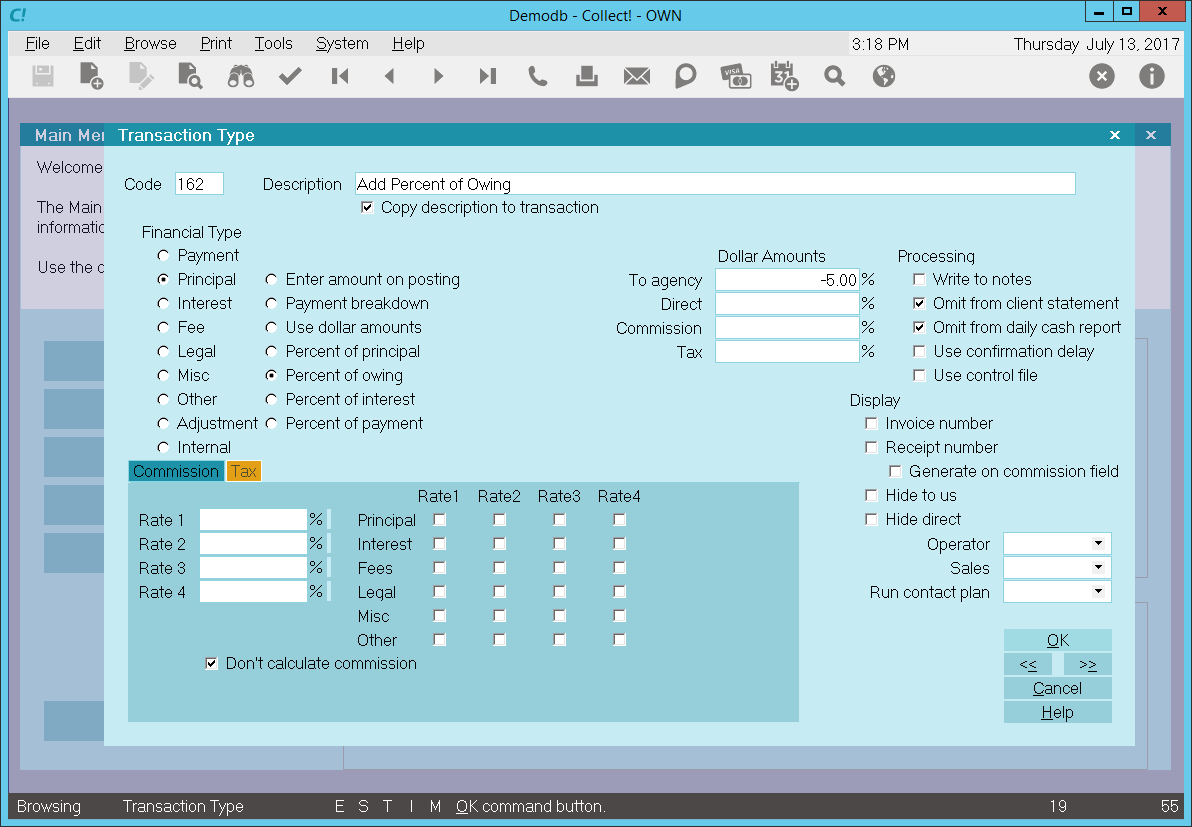

Percent Of Owing - Principal Transaction Type

When you post a 162, Add Percent of Owing principal transaction to a debtor account, the description

from the transaction type form will be copied to the transaction being posted.

The 'Percent of owing' radio button is switched ON to allow you set the percentage you wish to be

used at the time of posting the transaction. In this sample, -5% of the current Owing will be

automatically filled into the To Us field when posting. Collect! will use the current Principal

amount and add 5% of this value to the previous principal posted to the account.

Entering a negative percentage in either the To Us or Direct field will add to the debtor's Principal

amount. If more than one of these transaction types is posted to an account, the total will be

calculated automatically and displayed in the Principal field on the Debtor form.

Entering a positive percentage will reduce the amount of Principal. Interest will be recalculated

accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions,

interest is calculated on the resulting principal total after each transaction's payment date. For

more details please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 162 + Percent of Owing

principal transaction to an account. You may override any setting when posting the transaction.

Additional Principal Sample

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Detail form.

The sample shown below will add to any previous Principal amount. Use this transaction type for

adding to the principal, for example, monthly for services or equipment. Other examples might be

monthly charges for a membership, or charging for additional services or features your company

may offer.

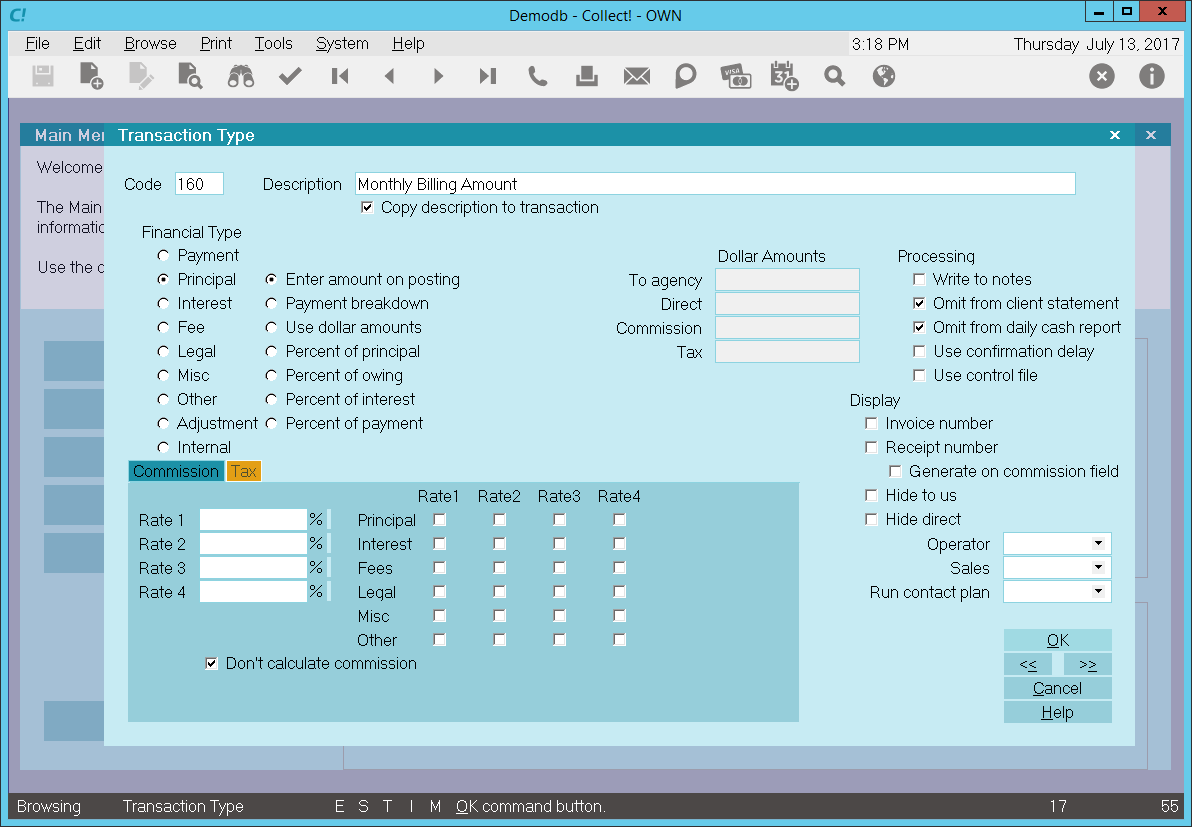

Monthly Billing Amount - Principal Transaction Type

When posting a 160, Monthly Billing Amount principal transaction to a debtor account, the description

from the transaction type form will be copied to the transaction being posted.

The 'Use dollar amounts' radio button is switched ON to allow you set the amount you wish to be used

at the time of posting the transaction. In this sample, -$53.20 will be automatically filled into

the To Us field when posting.

Entering a negative amount in either the To Us or Direct field will add to the debtor's Principal

amount. If more than one of these transaction types is posted to an account, the total will be

calculated automatically and displayed in the Principal field on the Debtor form.

Entering a positive amount will reduce the amount of Principal. Interest will be recalculated

accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions,

interest is calculated on the resulting principal total after each transaction's payment date. For

more details please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 160 Monthly Billing

Amount principal transaction to an account. You may override any setting when posting the transaction.

Add Accrued Interest To Principal Sample

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Detail form.

The sample shown below will add the total outstanding Accrued Interest to any previous Principal

amount. Use this transaction type to add to the Principal the monthly outstanding accrued interest.

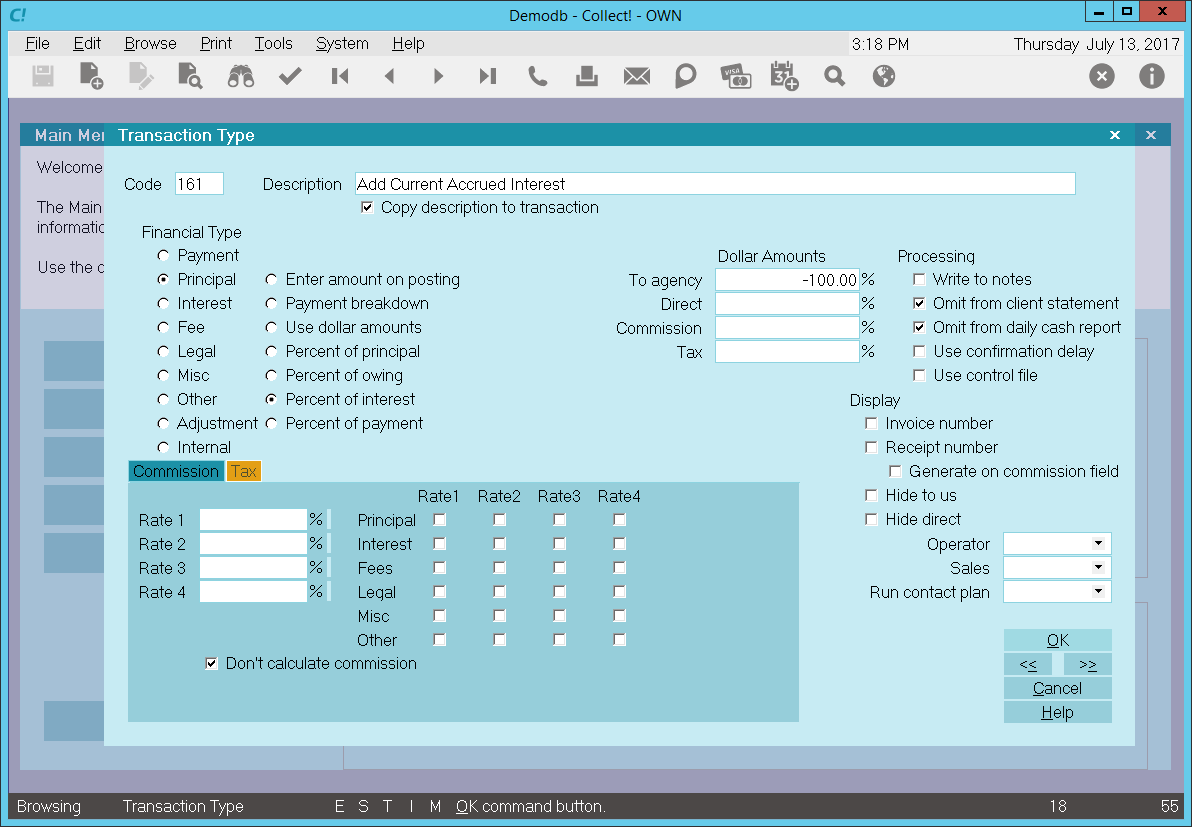

Accrued Interest - Principal Transaction Type

When posting a 161, Add Current Accrued Interest principal transaction to a debtor account, the

description from the transaction type form will be copied to the transaction being posted.

The 'Percent of Interest' radio button is switched ON to allow you set the amount you wish to be used

at the time of posting the transaction. In this sample, -100% will be automatically filled into the

To Us field when posting. Collect! will use the current Accrued Interest amount and add 100% of this

value to the previous Principal posted to the account.

Entering a negative percentage in either the To Us or Direct field will add to the debtor's Principal

amount. If more than one of these transaction types is posted to an account, the total will be calculated

automatically and displayed in the Principal field on the Debtor form.

Entering a positive percentage will reduce the amount of Principal. Interest will be recalculated

accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions,

interest is calculated on the resulting principal total after each transaction's payment date. For

more details please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 161 + Current Accrued

Interest principal transaction to an account. You may override any setting when posting the transaction.

Original Interest Sample

The Original Interest Transaction Type is needed to keep track of any original interest charged

to the account prior to receiving the account. If you do not need to keep this information separate,

then you can skip this transaction type.

By default, Collect! ships and uses the 197 Original Interest transaction type shown below when it is

required to post an original interest amount.

You may adjust or add to the Interest amount using Interest transaction types other than the 197

Original Interest transaction type. Unlike Principal transactions, only the first original interest

transaction type will populate the Original Interest field on the Interest Details form. Any other

197 original transaction types will be ignored.

If you need to apply only original interest and no further interest, you may enter an Original

Interest amount using the Interest Details form accessed from the Debtor form's Interest field. If

you have no need of anything more complicated, this is all you have to do to record Original Interest

for the account.

For those users who use a more detailed or complex reporting method, posting an Original interest

transaction provides more information about the interest amount. With a transaction you can set

Payment and Posted Dates, choose to show or not show the transaction on statements, and assign

operator ID's for tracking and commission purposes.

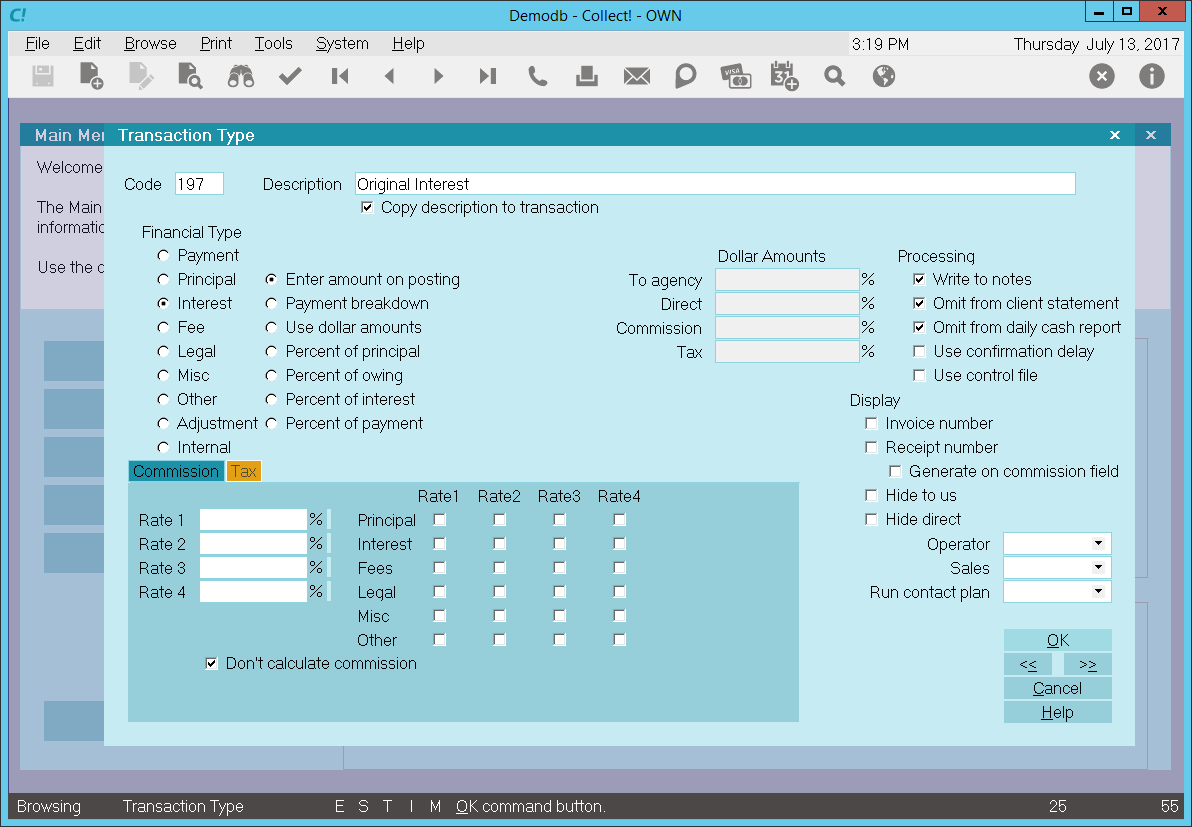

Original Interest - Interest Transaction Type

When you create a 197 Original Interest transaction on a debtor account, the Description from the

Transaction Type form is copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the

time of posting the transaction.

Entering a negative amount in either the To Us or Direct field adds to the debtor's Original Interest

amount. The amount will be set in the Interest Details Original Interest field and displays as a

positive amount.

Entering a positive amount reduces the amount of Original Interest. Interest will be recalculated

accordingly.

WARNING: If more than one Original Interest transaction types is posted to an account, only the

first original interest transaction will be displayed in the Original Interest field.

WARNING: If more than one Original Interest transaction types is posted to an account, only the

first original interest transaction will be displayed in the Original Interest field.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the Daily Cash Report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 197 Original Interest

transaction to an account. You may override any setting when posting the transaction.

Original Judgment Interest Sample

The Original Judgement Interest Transaction Type is needed to keep track of any original judgement

interest charged to the account as part of the Judgement. If you do not need to keep this information

separate, then you can skip this transaction type.

By default, Collect! ships and uses the 195 Original Judgement Interest transaction type shown below

when it is required to post an original judgement interest amount.

You may adjust or add to the Interest amount using Interest transaction types other than the 195

Original Judgement Interest transaction type. Unlike Principal transactions, only the first original

interest transaction type will populate the Original Judgement Interest field on the Financial Details

form. Any other 195 original transaction types will be ignored.

If you need to apply only original interest and no further interest, you may enter an Original

Judgement Interest amount using the Financial Details form accessed from the Debtor form's Principal

field. If you have no need of anything more complicated, this is all you have to do to record Original

Judgement Interest for the account.

For those users who use a more detailed or complex reporting method, posting an Original Judgement

Interest transaction provides more information about the interest amount. With a transaction you can

set Payment and Posted Dates, choose to show or not show the transaction on statements, and assign

operator ID's for tracking and commission purposes.

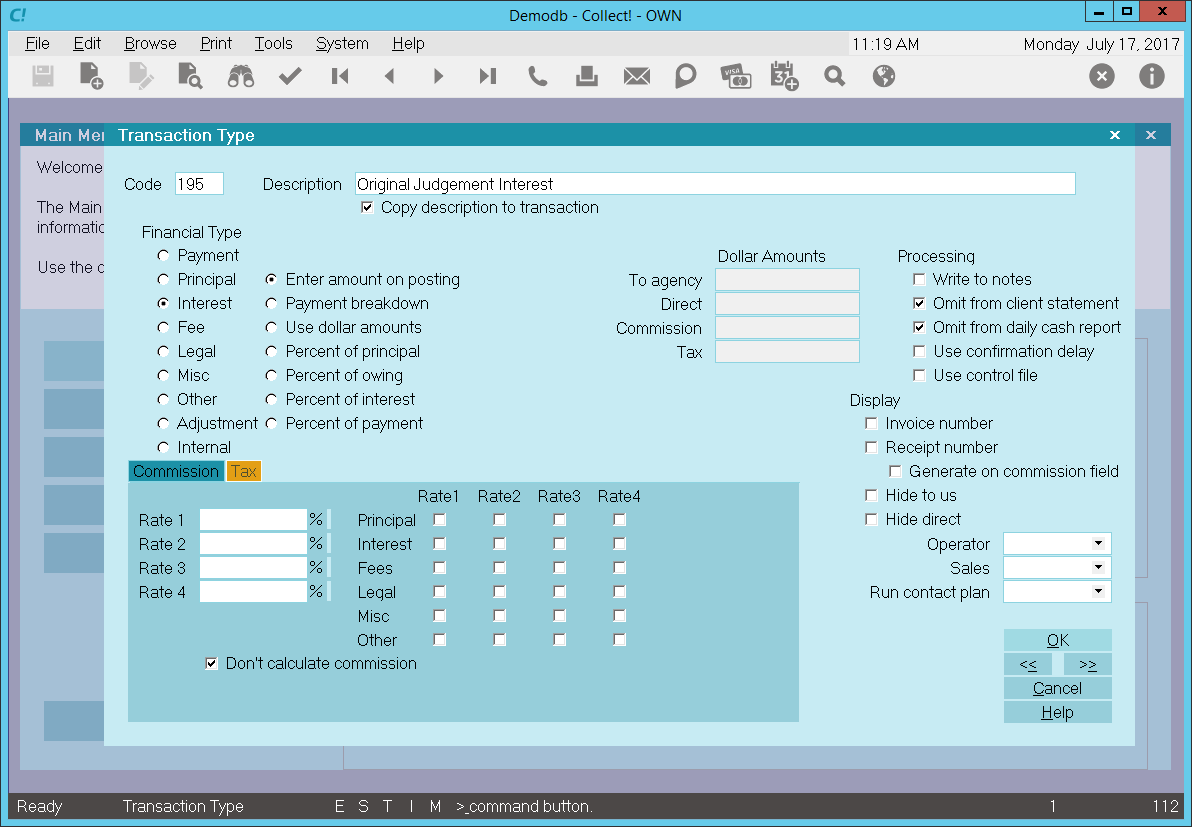

Original Judgment Interest - Interest Transaction Type

When you create a 195 Original Judgment Interest transaction on a debtor account, the Description

from the Transaction Type form is copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the

time of posting the transaction.

Entering a negative amount in either the To Us or Direct field adds to the debtor's Original Interest

amount. The amount will be set in the Interest Details Original Interest field and displays as a

positive amount.

Entering a positive amount reduces the amount of Original Judgment Interest. Interest will be

recalculated accordingly.

WARNING: If more than one Original Judgment Interest transaction types is posted to an account,

only the first original interest transaction will be displayed in the Original Judgment

Interest field.

WARNING: If more than one Original Judgment Interest transaction types is posted to an account,

only the first original interest transaction will be displayed in the Original Judgment

Interest field.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the Daily Cash Report.

Calculations are checked not to calculate commission and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the

transaction or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this

transaction type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to

always have operator and sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 195 Original Judgment

Interest transaction to an account. You may override any setting when posting the transaction.

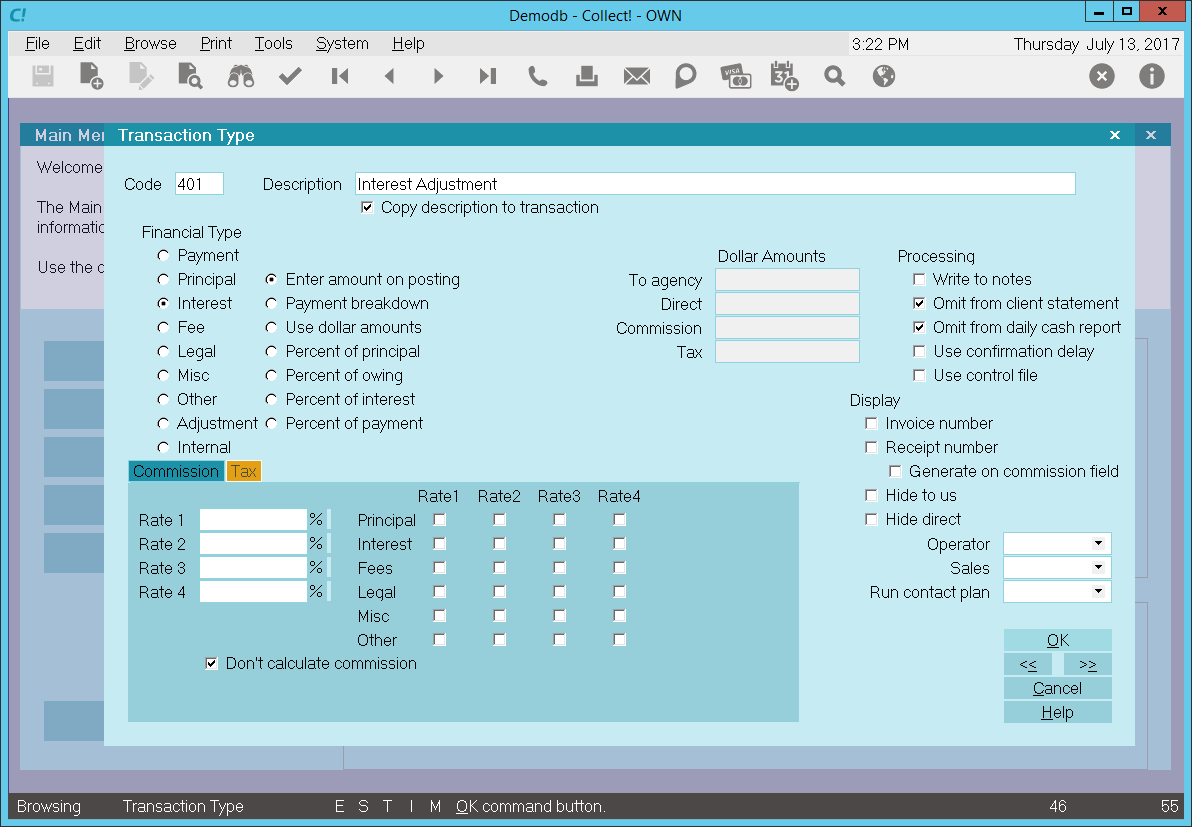

Interest Adjustment Sample

You may adjust or add to the interest amount using Interest Transaction Types. Multiple interest