Introduction To Debtor Information

The purpose of this topic is to simplify how you think

about Debtor information. Generally, 4 important

areas of information relate to your Debtor:

- Demographics,

- Contact phone numbers and trace leads,

- Extra client detail, and

- Financials - how much does the debtor owe.

You will find that for anything you have, Collect! has a place

to store it. But, before you begin that data entry, you have

to make some decisions about what your entry standards are

going to be. The following are examples of the types of

decisions to be made:

Data entry standard examples:

1. Block capitals for the debtor name/address info or

sentence English? (only first letter of each word capitalized).

2. Dates MM/DD/YYYY or DD/MM/YYYY?

3. Certain piece(s) of extra client supplied data that is

going into a user defined field. Pick the same field for

that piece of data all the time. Rename the alias name

of the field to identify that piece of data if the client

is big enough and the use of the field is exclusive for

that item.

We recommend not allowing individual users to decide to put

something in User 1 one day and Summary the next, then

User 2 the time after that. You will additionally find

your needs to draw data from user defined fields into

reports a more reliable and expected end result if you are

consistent in where you store specific types of information.

Likewise the entry style of the data. Example, if a User 1

field contains the referring Doctor's name, then decide if

all entries will be "Dr. James Smith" or "Doctor J. Smith"

or "Dr James Smith". The use of abbreviations and

punctuation marks (in the example above, use of periods

or not) will affect your report appearance.

4. Phone numbers. Are you entering them as numerics

stripped of any hyphens or parentheses, i.e. 5552451212

OR, are you entering them as 555-245-1212. Because you

may want future automations and lookup features to make

decisions based on the presence of absence of said

non-numerics. We don't recommend using (555)245-1212 as

the leading parenthesis will prevent certain types of

logic from being able to detect if a phone number is

present in the field or not. Specifically, if you want

to eventually use the system to find 'skip' files (no

phones), then an area code encased in brackets will

interfere with a 'Schedule if' conditional that will

be looking for the first position being greater than

zero. A Bracket symbol will not give the expected

result and a file with a phone number could be sent

to a trace desk.

You can set a software switch to prevent staff from being

able to free-form update Phone fields if your preference is

no non-numerics. Click "System\ Preferences\Options, Sounds

and Colors" and then check the box On for "Only numerics in

phone fields".

5. SSN. Is your standard going to be to enter

the number all 9 digits with no spaces, SSN is 555555555 or

as the format of 555 55 5555. If your portfolios are of

the types that collectors will need to be doing lookups

by SSN, you may wish to adopt the no spaces/no non-numerics

format and set your preference switch accordingly.

You can set a software switch to prevent staff from being

able to free-form update SSN fields if your preference is

no non-numerics. Click "System\Preferences\Options, Sounds

and Colors" and then check the box On for "Only numerics in

SSN".

6. Do you collect internationally? If not, the use

of the Country code will get redundant on letters,

reports and client statements. You may choose to leave

this field blank and/or comment out the field in reports

or letters that call for it as part of a client, debtor

or agency address.

Putting two slashes in front of a printable field code

that is left-flush with the margin will comment out that

line and prevent that field from being expressed.

Example; the following is a standard debtor address block

that you may see in letters. The country code is the last

field, @de.co. As below, it will either express if something

redundant (like United States or Canada) is in there, or,

create a blank line in your letter if the field is blank.

@de.na<

@de.ad< @de.a1<

@de.ci<, @de.st< @de.zi<

@de.co<

This is the same address block with the country code

commented out. The integrity of the coding remains

intact for legacy and troubleshooting purposes, but the

unwanted field will not express.

@de.na<

@de.ad< @de.a1<

@de.ci<, @de.st< @de.zi<

//@de.co< 06/09/2015 Commented out country code.

7. We recommend using the standard 2 digit State (or

Province) codes of your region and not entering the

name of the state/province in full words. This will

allow your State field to be ascending/descending sortable

and maintain another data convention that will be reflected

in your letters and report outputs. As well, in some countries,

postal services will not accept envelopes that have non-standard

abbreviations for their provinces/states.

8. If you plan on reporting to any of the Credit

Bureaus, establish correct address format standards

right from the outset. Your local Post Office will

have a handbook which describes what is or is not

an acceptable addressing format. The reason for this

is to ensure not only is your mail not rejected

by the postal service but that both the Collect!

Credit Bureau Module and the Credit Bureaus themselves

will reject addresses not submitted in correct format.

Example of a correctly formatted address:

123 - 55 Somewhere St.

New York, NY 12345

Example of an incorrectly formatted address insofar

as the credit bureaus are concerned:

55 Somewhere Street

Apt #123

New York, New York, 12345

9. Collector Notes. Do you want them to write in

block caps all the time or regular sentence English.

If you employ live skip tracers, do you want their

notes to be block caps or sentence English? Some

agencies have collectors write in block caps and tracers

in lower case so that at a glance, who wrote the notes

is distinguishable. You also have the ability to color

code your users notes by selecting a specific color in the

Operator Setup for each user level's notes.

For sites using any feature build of CV11, colored notes

are characterized by the color defining the BACKGROUND of the

note field, as selected in "System\ Rights\ Operator", Detail

Tab. The text will be black.

For sites using CV12 and higher, the background of notes

remains a uniform beige while the TEXT is what is colored.

This is a new feature which Collect! is proud to be offering.

The preference is still defined in the same Operator Setup

screen, in the Detail Tab. Color options are as numerous

as there are Hex color codes to choose from. Use your favorite

Internet site that offers colors and the Hex codes needed to

represent them. A sample site to try is

"http://www.color-hex.com/color-names.html".

10. Have you created Action/Result codes for your

collectors to use that negate perfunctory note entry

such as Tel Res - No Answer (or Tel Res - NA) etc. and

standardize how you want certain actions to be

notated in your accounts note history? This improves

your collector efficiency if they can enter a 3 digit

Run Plan to input static notes instead of having to

redundantly type them all day.

11. Have you designated which windows you want collectors

to use for any other office specific requirement, AND

updated the pick lists so that said windows/entry screens

are ready for them? Example, if you will be utilizing the

Cosigners Tab for the Other Parties as well (as it is

designed for), have you updated the pick list for the Class

in that window to include all the different designators that

you may wish such as NOK, AKA, Reference, Relative etc.

Perhaps you wish to drill down farther and update the pick list

for Cosigner Type to include designations like Mom, Dad, Brother,

Sister, MIL, FIL, B/F, G/F, etc.

12. Have you reviewed the Financial preferences that will

govern the behavior of how Transactions will behave? See

the Help page called Transaction Type. Your preferences

for these must be set and uniform from the beginning if you

wish to have reliable results.

13. Are you a credit reporting agency? If so, you will need to

purchase a license for the add-on CBR Module (call Administration

if you have not yet done this) and implement some entry standards

to ensure your monthly (or more frequent) reporting takes place

with the least amount of rejects needing review.

This means there are some key client and debtor entry areas to be

aware of:

- Company Details. You need to ensure you have a complete

company name and address in your Company Details. This information

is written from this file to the Header Record of the Metro2

file you will send out to your bureaus of choice.

- Credit Bureau Setup. You need to complete the

"System\Preferences\Credit Bureau Setup" screen with the required

entry fields updated. See the Help page "How To Setup Credit

Reporting".

- Client Setup. You need to choose a Type in the upper right

corner of the Client setup screen. This is actually the bureau's

creditor classification field. The pick list shipping default

should not be changed as these are exactly what options are

acceptable in the Metro2 output file for Equifax, Trans Union and

Experian. No others will be accepted. The field left as "Unknown"

(the default when you set up a new client) will be rejected

by the Collect! CBR Module.

- Advanced Client Settings. Check ON "Report accounts to

bureaus" and "Send client detail to bureaus". This latter is

the K1 segment that includes the mandatory creditor name as

part of the submission.

- Make sure to enter EITHER a Delinquency or Charged Date

into your debtor accounts. The Collect! CBR Module requires

at least one of these fields to be present, because the

credit bureaus require that the correct age of the account be

reflected at time of reporting. Absence of dates in both

fields will cause the CBR Module to reject the account. It

can be updated and will be picked up by the next output

process.

- Make sure to turn ON your new debtors for credit reporting.

This can be done either manually by clicking into the CBR Tab

when an individual account is being data entered, or can be done

as a Batch Process from a tagged list of accounts you have

entered that day. See the Help topics " Credit Report Details",

" Prepare Accounts for Reporting to Credit Bureau" and " Select

Bureau Report Details".

14. If you have clients with different Remittance/Statement

cycles (i.e. Monthly, Biweekly etc.), it is important to

have these clients properly set for their cycles right from

the beginning.

15. The shipping default for clients is Net Remit types. If

you have clients for whom you remit as Gross or Combined, these

settings should be set for these clients from the beginning.

16. If you have client balance forwards from Receivables before

your cutover to Collect!'s software, these can be (manually) input

into created Invoice/ Statements. The timing of these entries and

methodology is a more advanced task. Contact Technical Services

at 250-391-0466 for info and pricing to accomplish this task.

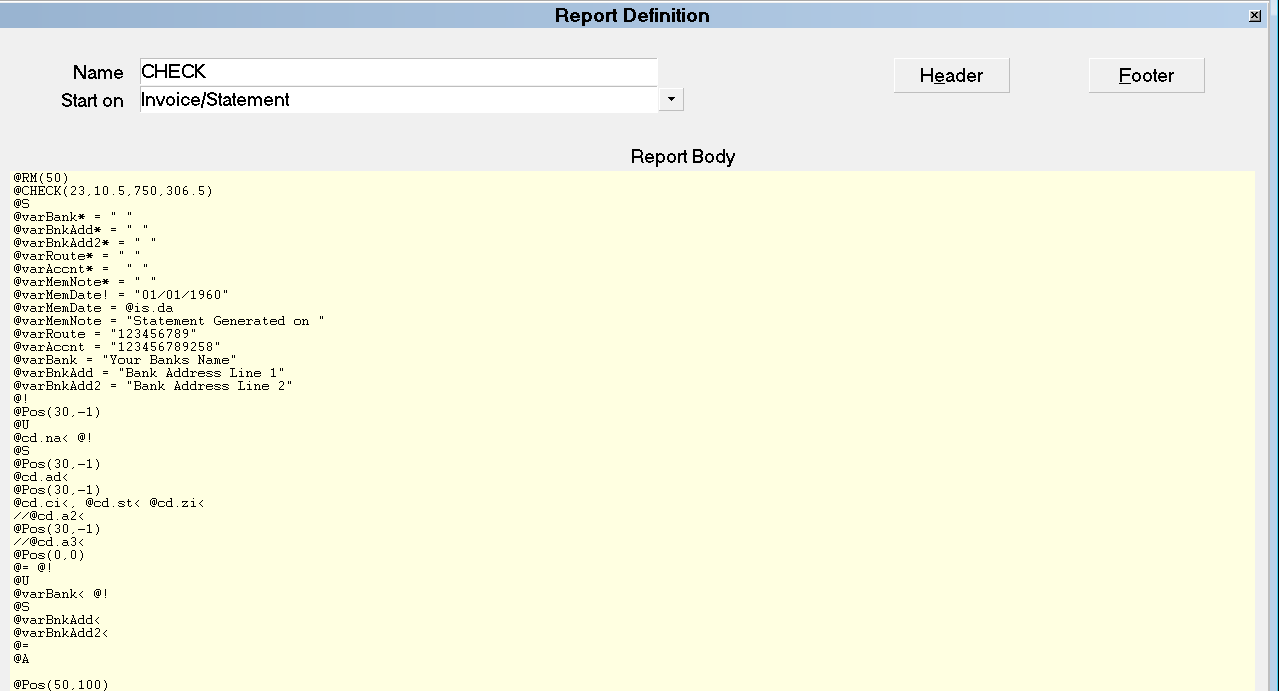

17. Do you intend to use Collect!'s CHECK, GCHECK, and CCHECK

forms? These are the check outputs that would be created when

you generate Statement/Invoices. If so, there are input fields

that need to be completed for your banking name, address and

Routing/ABA/account # details. If you use custom check stock

but would still like them output by Collect!, contact Technical

Services at 250-391-0466 for pricing to have your check reports

modified to output to your preferred check stock format.

The following is the inside of the CHECK report indicating the

fields you need to complete before you generate your first

Statements/Invoices.

Bank Info Update for New Site Checks

The fields where you want to input the correct information

between the quotes to replace the "placeholder" information are:

@varRoute = "123456789"

@varAccnt = "123456789258"

@varBank = "Your Banks Name"

@varBnkAdd = "Bank Address Line 1"

@varBnkAdd2 = "Bank Address Line 2"

If you have Gross and/or Combined remittance type clients, you will

want to do the same things for the report names GCHECK and CCHECK.

Follow the menu path " Print\ Customize Printing\ Edit Report

Template" and this will bring up your print menu window called

Report Definition. Select the report called CHECK. This will

open up the report body on your screen. Click into the yellow

colored "Report Body" and it will turn white. You are now in

Edit mode. Scroll to where you see the insert lines above and

input your bank routing #, your bank account #, your bank name,

bank Address and bank City, State Zip into lines where indicated.

Then click OK to save or press F8. Repeat this process for

GCHECK and CCHECK if you have Gross or Combined remittance type

clients, as a generate statement run will output three

different types of checks to go with the different types of

statements.

If you are a Canadian or Bahamian site, you will want

to request that Technical Services update your

CHECK / GCHECK / CCHECK as well as Statement /

GStatement / CStatement for the spelling of

"cheque" in place of "check" where applicable in

these documents. Canadian sites will also need to

update "US Funds" to "Canadian Funds" in two sports

on each of the three check reports.

If you are a Canadian or Bahamian site, you will want

to request that Technical Services update your

CHECK / GCHECK / CCHECK as well as Statement /

GStatement / CStatement for the spelling of

"cheque" in place of "check" where applicable in

these documents. Canadian sites will also need to

update "US Funds" to "Canadian Funds" in two sports

on each of the three check reports.

18. If you would like your logo to added to the Statement/Invoice

forms that Collect! outputs as its shipping default type, OR,

other customizations, contact Technical Services for 250-391-0466

for pricing.

19. Have you set up your Contact Plan for initial use? Example,

the system ships with a NEW contact plan as a sample. Use this as

a template to decide how you want your new business to be activated.

Items to consider:

- What do you want the initial status to be? NEW is a common

site favorite but this can be changed to be NBS if you have a

different preference.

- Do you have a letter series that you want to imbed right

away? A Letter1 that goes at day 0, Letter2 that goes at day

30, Letter3 that goes at day 45 (or any delay date timeline)?

- Would you like a Review or Phone Contact Event to be inserted

to get the account on a collection desk right away or with a delay

in the event of a letter hold period in your region?

- Any other date driven activities that can be set up at the

time the account is listed? i.e. 90 day Mgr or Auditor Reviews, etc.

20. Do you have your dunning letters set up? If you are a new to

Collect!, you may wish to have our Technical Services team set up

your first letters so that go forward, you have samples to follow.

Call or email Technical Services for pricing at 250-391-0466 or

support@collect.org.

21. Do you have specific reports that you are required to send to

your clients, like New Business Acknowledgements (called Client

Acknowledgements in Collect!) or Monthly Inventory reports (called

Client Status Reports in Collect!), or client performance metrics

(such as Client Analysis 12 Months, Monthly Batch Analysis, and

Monthly Spindown in Collect!)? Please review the shipping

default reports. If you require customized reporting to meet

your clients' requirements, please call or email Technical

Services at 250-391-0466 or support@collect.org.

With these actionable items preplanned for and attended to in advance,

you will find your migration and usage of the Collect! system to be

smooth and seamless.

If you'd like to purchase any training or orientation time to

augment your Collect! system launch, contact Technical Services

at 250-391-0466.

See Also

- Accounting Topics

- Debtor Financials Basics

- Transaction Type

- How to Enter a New Client

- Debtor

- How To Setup Credit Reporting

- Credit Report Details

- Prepare Accounts For Reporting To Credit Bureau

- Select Bureau Report Details

- How To Use the Help Menu

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org