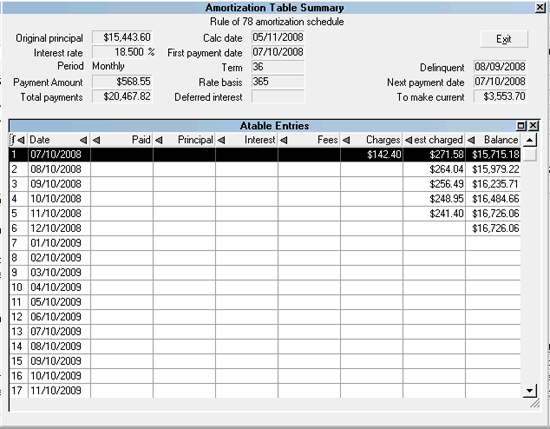

Amortization Table Summary

The Amortization Table Summary displays all the details

of the debtor's payment schedule for amortized loans.

Information is read from the debtor's Financial Detail

settings. In the A Table Entries subform, all calculations are

displayed for the complete payment schedule for the

account's balance.

Amortization Table Summary

The Amortization Table Summary may be accessed

in two ways.

1. When viewing the Debtor form, select the

Interest field to display the Financial Detail form. In

the Interest section, select the AMORTIZATION

button. This is only active when you have selected a

Compound Interest - Amortized loan setting.

2. When viewing the Debtor form, select the

Owing field to display the Debtor Financial Summary.

Then select the button labeled Atable Schedule.

This is only displayed when you have selected a

Compound Interest - Amortized loan setting.

Original Principal

This is the amount of the original debt, calculated from

all transactions posted to the 'Principal' account.

Interest Rate

This is the annual percent rate at which the account

is charged interest. This rate is divided into appropriate

periods for the interest calculations.

Period

This is the frequency for compounding interest and

converting it to principal. For Amortized loans, this

field also determines the frequency of payments due

on this account.

Payment Amount

This is the amount of the payment for a term loan. It

is calculated from the information entered in the

Financial Detail form in the Interest section.

Total Payments

This is the total principal and interest that will have been

paid upon completion of all payments in an orderly manner.

Rule Of 78 Amortization Schedule

This section displays all financial details for

a Rule of 78 amortization schedule. This is displayed

if Amortized Loan - Rule of 78 is

switched ON in the Financial Detail form for the account.

Normal Amortization Schedule

This section displays all financial details for

a Normal amortization schedule. This is displayed

if Amortized Loan - Normal is

switched ON in the Financial Detail form for the account.

Calc Date

This is the date from which interest will be calculated. It

is normally the Start Date for the loan.

First Payment Date

This is the date that the first payment is due. It is only

visible when you are using Amortized loans.

From the date one period before the First Payment Date,

the loan is calculated according to the term and

interest rate defined.

The amortization schedule is calculated using the original

principal plus the accrued interest compounded daily on

the original loan amount from the date one period before

the specified First Payment Date.

Normally, the system expects the First Payment Date to

be one period after the Calculate Interest From Date.

Term

This is the term of the Amortized loan. For example,

a 2-year loan with a monthly payments (a monthly Period)

has a Term of 24.

This is used to calculate the payment amount, the

total plan payments and the early payoff amount.

Rate Basis

This is the number of days used as the basis for calculating

interest. This setting is taken from the Financial Detail.

Deferred Interest

An amount displays in this field when the First Payment Date

is more than one period after the Calculate Interest From Date.

This amount is added into the Total Payments amount and

figures into the Payment Amount.

Delinquent

This is the date that the payment went "delinquent." It is usually

the date that a full period has passed without a payment being

posted to the account. When this happens, the interest for the

skipped period is added to the Balance.

Next Payment Date

This is the date of the next payment according to the

schedule of payments. It is the next "current" payment

date and does not reflect any unpaid interval.

To Make Current

This calculation displays the amount necessary to cover

all missed payments and accrued interest to bring the

account up to schedule.

Atable Entries

This subform displays all details of payments and interest

calculations for the payment schedule.

To print this to the Browser for easy viewing, select

the Print icon from the top toolbar from the top menu bar and

then select Quick Print. Select Printer Setup and make sure

there is a dot in the radio button labeled Print Via Browser.

Close the Printer Setup form. Select Printer and then Preview

and then select the PRINT button. This will display the table in

your Internet browser.

To print this to the Browser for easy viewing, select

the Print icon from the top toolbar from the top menu bar and

then select Quick Print. Select Printer Setup and make sure

there is a dot in the radio button labeled Print Via Browser.

Close the Printer Setup form. Select Printer and then Preview

and then select the PRINT button. This will display the table in

your Internet browser.

Exit

Select this button to close the Amortization Table Summary

and return to the previous form.

See Also

- Interest Detail

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org