Discrepancy Contacts

When upgrading from a version prior to versions CV8.2.2 OR CV10.2.2,

Collect! recalculates each account due to changes in financials.

If there is any difference in the Owing after this recalculation,

a discrepancy contact is created. A contact is created for each

discrepancy.

A built-in a checking program runs during the upgrade. This writes

a discrepancy contact to any account with one of the differences

listed below. This contact is assigned to the operator you are

signed in as when you run your upgrade and will appear in your

WIP List. The Originator and Assigned By fields are filled with the

operator signed in for the upgrade.

A brief area code is displayed in the Description field of the

discrepancy contact to help you determine the reason for

the discrepancy. These codes are listed below. Contacts for

upgrade discrepancies under $0.10 are marked completed.

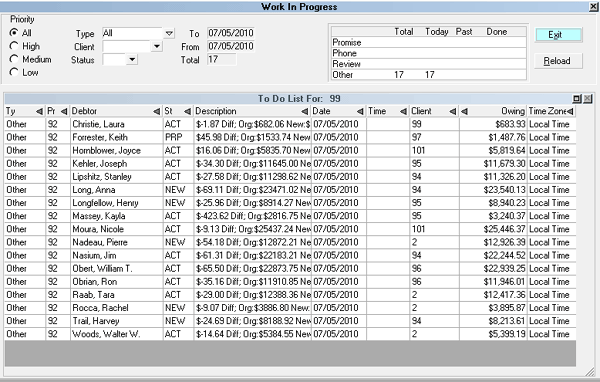

After the upgrade, open your Work In Progress List to view the

accounts where the debtor's Owing changed during the upgrade.

Your WIP List may contain several contacts like the one below.

Discrepancy Contacts in WIP List

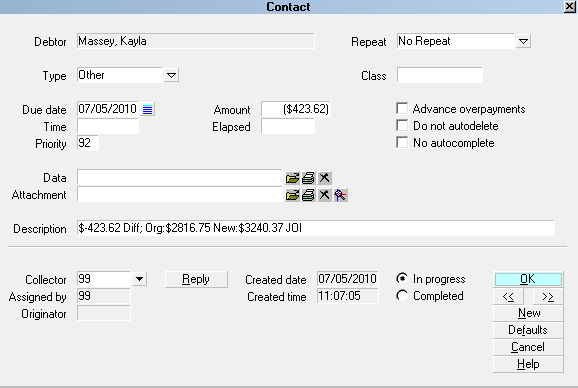

When you open these contacts, the Description field contains

details of the Owing amounts before and after the upgrade and

the brief area code, if applicable.

Discrepancy Contact Details

You can use the Manage Upgrade Contacts utility

available through the top menu bar, Tools, Utilities, to handle

these contacts. Please refer to the document of the same

name before running the utility as there are a few settings

that must exist in your database for the utility to run

successfully.

You can use the Manage Upgrade Contacts utility

available through the top menu bar, Tools, Utilities, to handle

these contacts. Please refer to the document of the same

name before running the utility as there are a few settings

that must exist in your database for the utility to run

successfully.

The areas below may have affected the debtor's Owing for the

accounts you see in the WIP List.

1. Different Original Principal or Judgement Principal

IAL - Original Principal corrected

JAL - Judgement Principal corrected

These tend to be caused by changes in the way Collect!

stacks judgement and principal transactions in

versions CV8.2.2 and newer.

2. Principal Transactions posted after the Calculate interest

from date.

IPD - Principal Posted Date occurred after the Calculate interest

from date.

Multiple 196 Original Principal transactions are allowed with

each being posted to the Principal amount on the day the

transaction is posted. If this date is after the Calculate interest

from date, there will be no accrued interest prior to the date

of each Original Principal transaction. When there are

multiple 196 transactions, the interest calculation for each

begins with its posted date. Since these are no longer

summed together for calculating from the Calculate interest

from date, as in previous versions, this may result in a decrease

of the debtor's Owing.

3. NSF Posting.

No code currently for this change.

Previously, NSF transactions had to be posted with the same

payment date as the original transaction. Now the transaction

list is scrutinized more rigorously to match the NSF transaction

to the most recently posted transaction with the same amount.

This change may increase the Owing amount by the amount of

incorrectly posted NSFs.

4. Judgements and Calculate Interest from Date.

JID - Calculate interest from date occurs prior to the

Judgement Date.

The Judgement Date did not automatically overwrite the

Calculate interest from date, making it possible to have

a judgement account with interest calculating prior to

the Judgement Date. The interest calculation date is

now automatically adjusted to the Judgement Date when

the interest calculation date is found to be prior to the

Judgement. This may reduce the Owing amount.

5. Judgements and Original Interest.

JOI - Judgement has an Original Interest amount.

If the Original Interest field happens to have a value in it after

a judgement is applied, this interest is no longer added to the

Owing. This change may reduce the Owing amount by the

amount of the Original Interest.

6. Posting Payment transactions without an associated

Interest Payment transaction.

No code currently for this change.

It is no longer necessary to explicitly post interest transactions for

non- breakdown payment transaction types.Previously, these

payment transactions reduced the principal amount directly.

With 8.2, the breakdown rule is applied automatically, paying

fees, then interest and finally principal. The changed calculations

may increase the Owing amount.

7. Late Fee Grace Days.

No code currently for this change.

Before 8.2.2, late fees were applied a day earlier. This minor

change may decrease the Owing by the late fee amount for this

one day difference.

8. Breakdown transactions can now force order of payment

assignment. Previously, breakdown calculations were

hard-coded to pay fees, interest and then principal. This is

an option you can now control by setting the breakdown order

in the Transaction Type form. This change may alter the

Owing amount.

IB - interest account with breakdown corrected. This is used

when a transaction is found, belonging to a debtor who has

interest turned on, that uses the Payment Breakdown option

and has been corrected.

IBB - is used whenever a debtor's interest amount has been

corrected by the upgrade, but the Principal and Judgement

amounts remain the same. This would indicate that the

payment breakdown settings have been altered to correct

bad interest from a faulty payment breakdown.

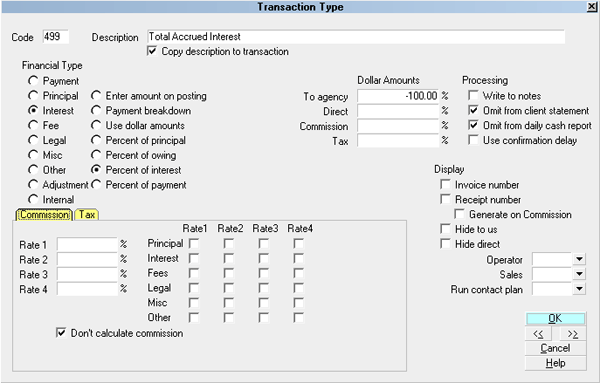

9. Total accrued interest posted when closing an account.

When you close an account with interest being calculated,

Collect! will post a Total Accrued Interest Transaction,

Type 499, to the account to store the total amount of interest

accrued. Collect! requires the 499 Transaction Type

with the correct settings. You can copy Transaction

Type 499 from your Demo database to your Master. To

create this Transaction Type yourself, please use the

settings shown in the image below.

Transaction Type 499

See Also

- Upgrading Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org