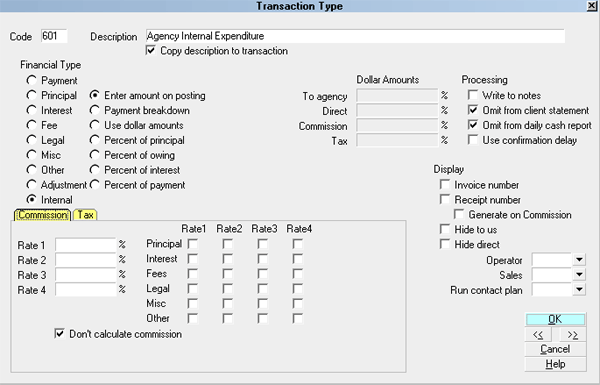

Transaction Type Sample - Agency Internal Expenditure

The Internal transaction type enables you to track expenses

incurred by you for a particular account. When you cannot

recoup your expenses from the Debtor or the Client, you may

still want to track them for the account.

An Internal transaction does not affect the Debtor's Owing

or any Client financials, such as Commission or Return.

It simply gives you a way to track internal expenses on an

account.

The screen shot below shows the settings for the

Agency Internal Expenditure Transaction Type.

Agency Internal Expenditure - Internal Transaction Type

The rest of this document explains the settings shown

above.

By default, Collect! ships with a number of Payment type

transaction samples. Collect! uses the 600 series for

internal type transactions, but any Financial Type dotted

as "Internal" will be processed as an internal type transaction.

A check mark in the box labeled Copy

Description To Transaction copies the Description

from the Transaction Type form when you create a 601

Agency Internal Expenditure transaction on a debtor account.

The Internal radio button is dotted to keep track of

internal expenses for the account.

Any transaction flagged as an Internal type, with an amount

either in the To Us or Direct field, will NOT affect the balance

of the Owing amount displayed on the Debtor form.

An amount in the transaction's Commission field will NOT

affect your agency commission amount.

The Internal transaction type is used for tracking

expenses on an account that are borne entirely by the

agency. They do not affect either the Debtor's or the Client's

financials in any way.

The Internal transaction type is used for tracking

expenses on an account that are borne entirely by the

agency. They do not affect either the Debtor's or the Client's

financials in any way.

Reporting check box, Omit from client statement.

is switched ON with a check mark so that this transaction

in not included in the client statement. This transaction is for

your own internal accounting and your client will not be made

aware of it.

Reporting check box, Omit from daily cash report

is switched ON with a check mark. This transaction is for

your own internal accounting and will not be reflected in your

Daily Cash report.

Calculations check box, Don't calculate commission

is switched ON with a check mark so that commission is not

calculated on this transaction.

Calculations check box, Don't calculate tax

is switched ON with a check mark so that tax is not calculated on

transaction.

The way you handle your business will

help you decide whether or not to enable any other

optional settings.

The way you handle your business will

help you decide whether or not to enable any other

optional settings.

Display is set to leave both the To Us and the Direct

fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be

used as default values when posting this transaction

type. You may want to set the Operator or Sales values

to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting

this transaction type.

No commission rate has been set to override the

commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you

when you post a 601 Agency Internal Expenditure

transaction to an account. You may override any setting

when posting the transaction.

To view all Internal transactions posted to an

account, open the Debtor Financial Summary and

select the Internal tab. To access this form, select the

Fees field on the Debtor form.

To view all Internal transactions posted to an

account, open the Debtor Financial Summary and

select the Internal tab. To access this form, select the

Fees field on the Debtor form.

See Also

- Transaction Type Basics - Introduction/Accessing

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org