Credit Card Setup

WARNING: This document applies to the legacy payment processing

module. For the current payment processing module,

please go to Payment Processing Setup.

WARNING: This document applies to the legacy payment processing

module. For the current payment processing module,

please go to Payment Processing Setup.

The Credit Card Setup window is where you enter the details

for your credit card payment preferences

and login credentials to the Credit Card Gateway.

To access the setup screen, your menu path is

"System\Preferences\Payment Processing Setup\Credit Card Setup".

Credit Card Setup

Server

This is where you enter the url (web

address) of the Payment Provider Credit

Card Gateway.

Customers using Payment Processing Partners:

Contact Support to setup the integration.

USA ePay customers:

https://usaepay.com/soap/gate/4DECDB2A

Userid

Enter your UserID assigned to you by

the Payment Provider. It is typically a random

series of letters and numbers about 25

digits long.

Password

Enter your password assigned to you

by the Payment Provider. It is typically numeric.

A globally set UserID and password will be

presented to high level users (1, 10 & 99)

much like a 'Remember Me' login presents

anywhere else - it will be auto-filled. If

there are no changes to the info, these

users need only click OK to proceed to

the next screen. All other user levels

will not see or be presented with the

signon popup once it has

been globally configured.

Last Reconcile Date

This is the last date that "Reconcile Credit

Card History" was run successfully. If you have

never run "Reconcile Credit Card History,"

enter today's date.

The Last Reconcile Date should NOT be

manually manipulated once you are actively

using your interface and you have started

running "Reconcile Credit Card History"

batch processes.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will prompt you during the reconciliation

process to confirm that you want to proceed.

If you run the task via the Task Scheduler,

Collect! will not run the reconciliation

and will put an entry in the Application Log

that the task failed.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will prompt you during the reconciliation

process to confirm that you want to proceed.

If you run the task via the Task Scheduler,

Collect! will not run the reconciliation

and will put an entry in the Application Log

that the task failed.

Payment Transaction Type

Select the Transaction Type that you want

to use for your credit card payments. This

Transaction Type must already exist in your list

of Transaction Types and it must be

a Financial Type "Payment".

Declined Type

When payments are returned as Declined, you can

elect to have the system post a transaction.

If this field is blank, no transaction will be

posted. You can check the CREATE REVIEW FOR DECLINES

box below as an alternative.

Select the Transaction Type that you want

to use for your credit card declines. This

Transaction Type must already exist in your list

of Transaction Types. We do not recommend using

one that has a Financial Type "Payment" as that

will affect the Payment date field on the

Debtor form.

Convenience Fees

You are able to select the preference to

allow or disallow the charging of convenience

fees in general. You must also select on a

per Client basis in the Client Advanced Setting

screen which of your clients will allow the

convenience to be charged to its debtors.

To charge convenience fees, it is every

site's individual responsibility to ensure

you are lawfully able to charge these fees

in your your region and as per your clients'

individual wishes in this regard.

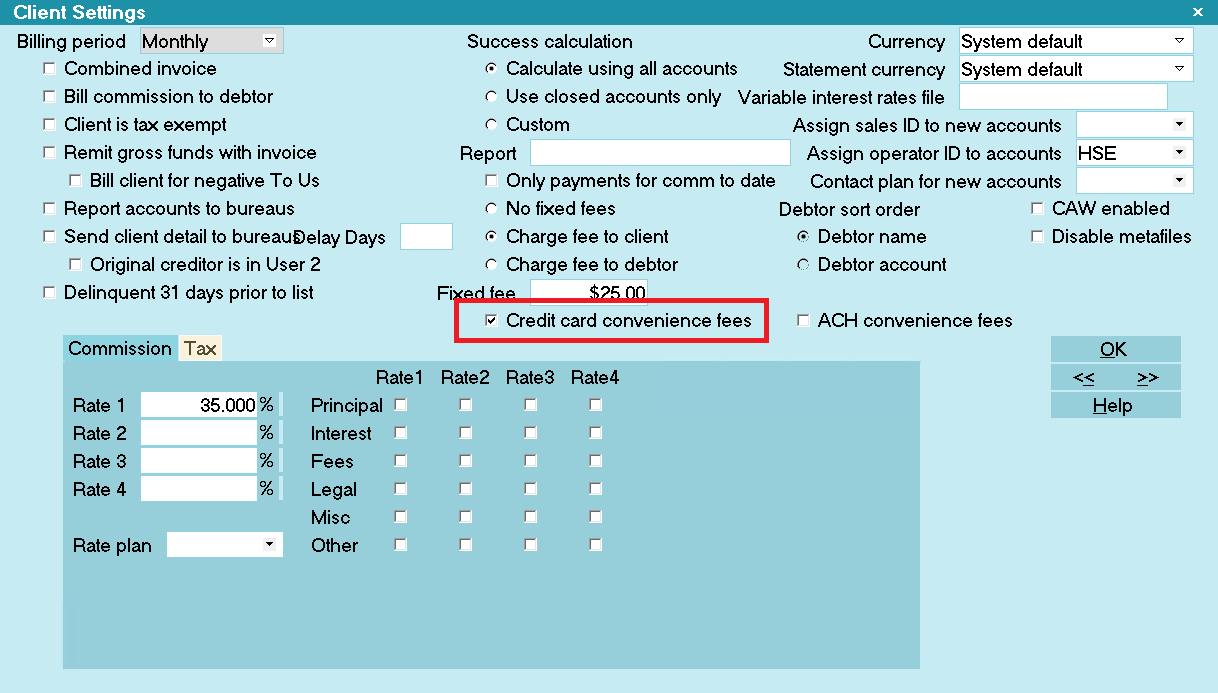

If your company is going to be charging convenience fees

to debtors for Credit Card payments, in addition to enabling the

feature in the Credit Card Setup window, you do need to enable an

indicator in each client Advanced Settings screen in order

to enable the fees for that specific client.

Click the Advanced button in the lower right corner of the

client screen and you will see a screen as follows, and

the "Credit Card convenience fees" switch is shown in the red box.

Client Settings screen

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

Enable Convenience Fees

Switch this ON with a check mark if you want

to allow the addition of a Convenience Fee

when processing credit card payments. You

must also select a Transaction Type to use

for the fee.

If you switch this ON, then any Clients

whose Debtors may be charged this fee

must also have the "Credit card

convenience fees" switch enabled in their

Client Advanced Settings screens.

Single Fee Transaction

Switch this ON with a check mark if you want

to only post one fee transaction for the fee

amount. The payment will reflect the full

amount of the payment.

Switch this OFF if you want the system to post

the fee transaction, the a payment to fee, then

the payment transaction separately with payment

amount less the fee.

Fee Transaction Type

Choose the Transaction Type that you want

to use for credit card Convenience Fees. This

Transaction Type must already exist in your

list of Transaction types and it must be a

"Fee" type with the fee amount or percentage

to use entered.

If you have switched ON "Enable" for

convenience fees, then you must select

a Transaction Type to use for applying

the fee.

Declined Recurring Cancels Plan

Click this ON with a check mark to set your

preference that any declined card is to cancel

the payment plan on the account. The end-user

is responsible for ensuring any arrangements

stored on the source Payment Provider Gateway are

completely deleted at the source if this is the

action intended. The Collect! module functions

to disassociate its own automations when triggered

by a declined card.

The built-in functionality will automatically

mark your Promise Contact as Stopped, change

your Due Date in the Review Contact marking

the end of the original terms to be the same

as the delete date and also delete any remaining

CC Notification letters scheduled.

Auto Reconcile

Click this ON with a check mark to automatically

reconcile a debtor when a credit card payment

is posted on it. Each time a credit card payment

is posted, Collect! will contact the Payment Provider

to see if there are any other payments that are

missing.

Enable Verbose Logging

Click this ON with a check mark to enable

verbose message logging to the Application Log

for troubleshooting your credit card

payment processes.

It is recommended to enabled this switch so that

Technicians have all information available if

any assistance is required with any interface

issues.

Disable EFT Confirmation Review

Click this ON with a check mark to stop Collect!

from creating the review contact that is dated

2 days before the payment is due with the description

of "Confirm EFT plan authorization."

Set No Autodelete For Contacts

Click this ON with a check mark to enable Collect!

to check the 'Do not autodelete' box on all contacts

created for recurring payments.

Create Review For Declines

Click this ON with a check mark to have Collect!

create a review contact when a declined payment

is posted to an account.

Use Grp Owing For Final Payment

When the second to last payment of a Recurring Payment Plan

is processed, Collect! will adjust the final payment down

if the remaining owing is less than the payment amount.

Click this ON with a check mark to have Collect! use

the Group Owing instead of the Debtor's owing.

If this box is checked, when the account with

the payment plan reaches $0.00, the Letter and

Review Contacts will move to the next account

in the group with the highest balance. If you

have Manage Group Promises enabled on the

Account Matching Settings, then the Promise

Contact will also move to the same account.

If this box is checked, when the account with

the payment plan reaches $0.00, the Letter and

Review Contacts will move to the next account

in the group with the highest balance. If you

have Manage Group Promises enabled on the

Account Matching Settings, then the Promise

Contact will also move to the same account.

The payment arrangement with the gateway will

still process on the same account. We recommend

that you download and enable a contact plan from

the Member Center that reverses the payment and

posts it to another group member.

The payment arrangement with the gateway will

still process on the same account. We recommend

that you download and enable a contact plan from

the Member Center that reverses the payment and

posts it to another group member.

Run Plan On Recurring

Whenever a recurring plan is setup, this plan will run

automatically.

Disable Downloads

Check this box to disable downloads during the reconciliation

process. This box should be checked if you are migrating

from the legacy payment processing module to the new

module, while using the same payment provider.

OK

Select OK to close the Credit Card Setup window.

Help

Select the HELP button for help on Credit Card Setup

and related topics.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org