When an investor lends money to a borrower, the borrower must pay back the money originally borrowed

and also the fee charged for the use of the money, called Interest. From the investor's point of

view, interest is income from invested capital. The capital originally invested is called the

Principal.

At Simple Interest, the interest is computed during the whole time, or Term, of the loan, at the

stated Annual rate of interest. This interest is computed on the Original Principal until a payment

is made, or on Remaining Principal after a payment is made.

There are two possible ways to use the information above for computing Simple Interest in Collect!:

Simple interest is calculated by multiplying the Principal by a given Interest Rate. The interest

amount is not added to the Principal. However, it is added to the debtor's Owing. When a payment

is made on the Principal, Interest from then on is calculated on the what is left of the Principal

amount. Any time a Principal payment is made, Interest is calculated on the new remaining amount.

When a debtor makes a payment, the amount is applied to reduce outstanding Interest amounts first.

Any remainder is applied to reducing the Principal. From then on, interest is calculated on the

Remaining Principal.

Click Here to Close this Form.

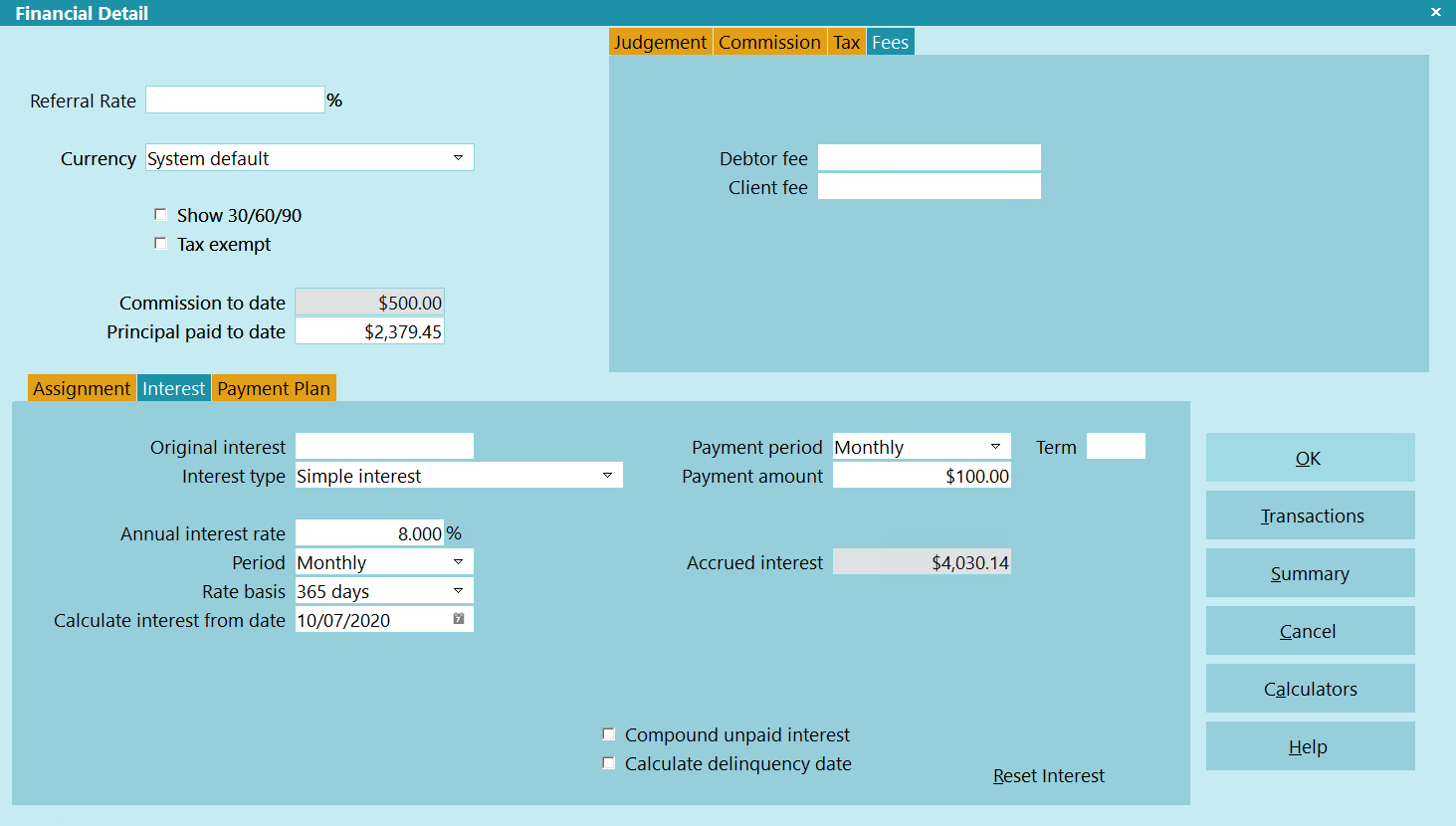

The Interest Detail section of the Financial Detail form

displays all the current settings for calculating interest on

the debtor's account. It also holds any original interest or

judgment interest amounts. The Interest Detail has many

different fields, depending on the type of interest you choose.

You can simply record Original Interest and note that there

is No Additional Interest or you can give Collect! the

information needed to calculate any standard type of interest.

Financial Detail

Each type of interest requires different information and is

calculated in a particular way according to industry standards.

Since this can get quite complicated, topics are available to

explain each type of interest.

To access this form, select the Principal field on

the Debtor form. This will display the Financial Detail

form. Select the Interest tab.

To access this form, select the Principal field on

the Debtor form. This will display the Financial Detail

form. Select the Interest tab.

Original Interest

This is the amount of the interest already charged

on the account at the time the account was listed

with you. The amount is added to the debtor's owing.

It is included in the amount of Total Interest displayed

in the Interest Detail for this debtor. This field is

ignored if you have entered a judgment against

the debtor.

Interest Type

This field allows you to choose the type of interest on

the account. The possible selections are listed below.

No Additional Interest

Select No Additional Interest if you do not want

Collect! to calculate interest on this account.

Simple Interest

When you set this switch Collect! calculates

Simple interest. You must also enter an

Annual interest rate and a Calculate interest

from date. You can choose a 360, 364 or 365

day calculation year.

Notice that the Reset Interest form is accessible

from this setting.

Compound Interest

When you set this switch Collect! calculates Compound interest

on this account.

Compound interest calculations are far more detailed and Collect!

allows you to enter all necessary information by displaying

additional fields on the Interest Detail form.

Options include:

- Revolving Compound Interest

- 360, 364 or 365 days or Ordinary

- Amortized Loan - Normal or Rule of 78's

When you use Compound Interest, you MUST

post the Original Principal amount as a

Transaction (Type 196). Any Principal amount

entered into Original Principal directly is

overwritten as Collect! uses the total of all

Principal transactions to arrive at the Original

Principal.

When you use Compound Interest, you MUST

post the Original Principal amount as a

Transaction (Type 196). Any Principal amount

entered into Original Principal directly is

overwritten as Collect! uses the total of all

Principal transactions to arrive at the Original

Principal.

Compound interest calculations produce a running balance of

principal, interest, fees and adjustments. You MUST use

Payment Breakdown transaction types for posting any

payments to an account with Compound Interest switched

ON. Please see the Help topic Transaction Type for more

information and look for the section on Payment Breakdown.

Variable Interest

When you select Variable Interest, Collect! reads the

Interest Rates and Start Dates from the interest CSV

chosen for this account's client through the Client Settings

form.

You must have already created an interest

rate table CSV and placed it in the

Collect\bin\vinterest folder or the specified

Global Folder.

You must have already created an interest

rate table CSV and placed it in the

Collect\bin\vinterest folder or the specified

Global Folder.

Please refer to Help topic, How to Use Variable Interest

for details.

Variable Interest is a licensed extension module.

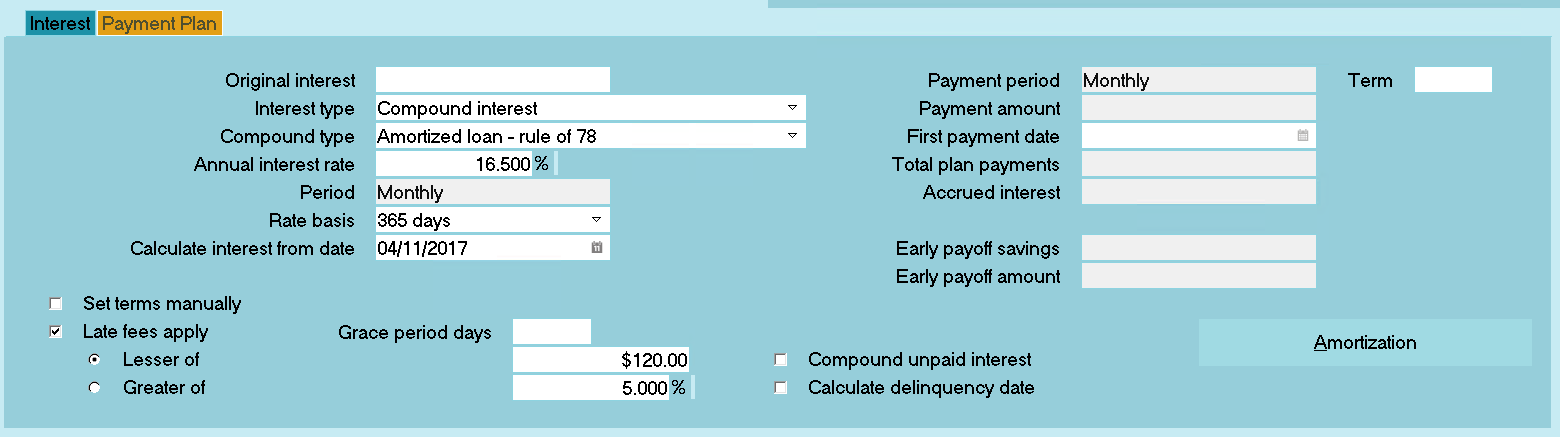

Compound Type

When Compound Interest is selected on an account, this

field presents you with the option to select one of

three types of Compound Interest listed below.

Revolving Compound Interest

When you choose Compound Interest and switch on

Revolving compound interest, the Period field becomes

visible. Refer to subheading Period below for details. Other

fields have been described above.

This switch causes Collect! to calculate compound

interest on a revolving basis.

Please enter an Annual interest rate. For instance,

enter 15 for 15%.

Choose a Period. This is the frequency for compounding

interest and converting it to principal.

Enter a 'Calculate interest from' date. If this is left blank,

Collect! will use the debtor's Listed Date unless there is

an earlier Charged Date. Setting this switch disables the

calculations supporting term payments.

When you use Compound Interest, you MUST

post the Original Principal amount as a

Transaction (Type 196). Any Principal amount

entered into Original Principal directly is

overwritten as Collect! uses the total of all

Principal transactions to arrive at the Original

Principal.

When you use Compound Interest, you MUST

post the Original Principal amount as a

Transaction (Type 196). Any Principal amount

entered into Original Principal directly is

overwritten as Collect! uses the total of all

Principal transactions to arrive at the Original

Principal.

Compound interest calculations produce a running balance of

principal, interest, fees and adjustments. You MUST use

Payment Breakdown transaction types for posting any

payments to an account with Compound Interest switched

ON. Please see the Help topic Transaction Type for more

information and look for the section on Payment Breakdown.

Amortized Loan - Rule Of 78

See Help topic How to Use the Rule of 78 Interest for details

of this type of Amortized loan calculation. To display

information relating to fixed term loans, select of the

Amortized loan radio buttons.

Amortized Loan - Normal

See Help topic How to Use Amortized Loan - Normal Interest

for details of this type of Amortized loan calculation. To

display information relating to fixed term loans, select

of the Amortized loan radio buttons.

Annual Interest Rate

This is the Annual percent rate at which the account

is charged interest. This rate is divided into appropriate

periods for the interest calculations. This rate is used to

calculate the periodic interest rate and the equivalent

daily rate.

For example, when using a Monthly period, there are 12

periods per year, so the periodic rate is the Annual interest

rate divided by 12. Similarly, when using the Biweekly

period, the number of periods in a year is 26. The periodic

rate is therefore the Annual interest rate divided by 26. The

periodic rate is used to calculate interest payable over a period.

After entering a rate in this field, other details

update automatically when you tab out of the field.

After entering a rate in this field, other details

update automatically when you tab out of the field.

This field is hidden if you are using Variable Interest.

Period

This is the frequency for compounding interest and

converting it to principal. For Amortized loans, this

field also determines the frequency of payments due

on this account. This field is set to MONTHLY and

READ ONLY for Amortized loans.

This field is hidden if you are using Variable Interest.

Rate Basis

When Compound Interest is selected, this field allows you

to select a Rate Basis. This is the number of days Collect!

will consider to occur in a year. Depending on local laws

and/or contractual requirements, you can select from one

of the options listed below.

365 Days

Interest is calculated on a 365 day year.

364 Days

Interest is calculated on a year of 7 days and 52 weeks,

which totals 364 days. This is used when you need

weekly compounding on daily interest. It results in 52

equal 7 day periods.

360 Days

Interest is calculated on a 360 day year.

Ordinary

Interest is calculated on a 12 month year

without considering number of days.

Calculate Interest From Date

In Simple and Revolving Compound Interest calculations,

this is the date from which interest will be calculated. It

is normally the Start Date for the loan. Collect! will

automatically use the debtor's Listed Date as the

calculation start date, unless there is an earlier Charged

Date on the account.

You can adjust the 'Calculate interest from date'

as needed, just make sure that if you have an

Original Principal 196 Transaction on the

account, the Payment Date is not LATER than

the date you want to start calculating interest.

You can adjust the 'Calculate interest from date'

as needed, just make sure that if you have an

Original Principal 196 Transaction on the

account, the Payment Date is not LATER than

the date you want to start calculating interest.

WARNING: When you enter a Judgment Date in

the Financial Detail form, the 'Calculate

interest from date' automatically changes to

the Judgment Date and previously accrued

interest is erased. If you wish to preserve a

record of any interest accrued prior to

Judgment, please refer below to the

section heading Reset Interest BEFORE

entering the Judgment Principal and

Judgment Date.

WARNING: When you enter a Judgment Date in

the Financial Detail form, the 'Calculate

interest from date' automatically changes to

the Judgment Date and previously accrued

interest is erased. If you wish to preserve a

record of any interest accrued prior to

Judgment, please refer below to the

section heading Reset Interest BEFORE

entering the Judgment Principal and

Judgment Date.

For Amortized Loans, interest is calculated from this

date when 'Delay Payment' is switched ON. When 'Delay

Payment' is switched OFF, this field is ignored.

This date is actually related to the payment

and posted date of the principal transaction(s)

related to this debtor's owing. You could post

a loan in January and not start interest

calculations until March, simply by working

the transaction posting vs. interest

calculation dates.

This date is actually related to the payment

and posted date of the principal transaction(s)

related to this debtor's owing. You could post

a loan in January and not start interest

calculations until March, simply by working

the transaction posting vs. interest

calculation dates.

See Total Term Calculations below.

This field is hidden if you are using Variable Interest.

Variable Interest File

This field is only used when you are using the

Variable Interest extension module. Enter the

exact name of the file containing your interest

rates table. A file name entered here will supercede

the file name entered at the client level.

Payment Period

Select a frequency for compounding interest and converting

it to principal. For Amortized loans, this field also sets the

frequency of payments due on this account. This field is set

to MONTHLY and READ ONLY for Amortized loans.

Enter a Payment Period and Payment Amount

and then create a Promise. The "Repeat"

and "Amount" will populate automatically.

Enter a Payment Period and Payment Amount

and then create a Promise. The "Repeat"

and "Amount" will populate automatically.

Payment Amount

When you are using No Interest, Simple Interest or

Compound Interest -- Revolving Compound Interest, use

this field to type in an amount you want the debtor to

pay on a term basis. You must also create a Promise Contact

and set the Repeat Period. Then Collect! can automatically

manage the promise payments, underpayments and

overpayments. Please refer to How To Manage Contacts

for details.

Enter a Payment Period and Payment Amount

and then create a Promise. The "Repeat"

and "Amount" will populate automatically.

Enter a Payment Period and Payment Amount

and then create a Promise. The "Repeat"

and "Amount" will populate automatically.

When you are using Compound Interest -- Amortized Loan, this

is the amount of the payment for a term loan. It is calculated from

the information entered in the Interest Detail form. This field is

read only unless you set terms manually.

You can manually enter a Payment Amount if you

switch ON 'Set Terms Manually'. This is only an

option when you are using Amortized - rule of 78.

You can manually enter a Payment Amount if you

switch ON 'Set Terms Manually'. This is only an

option when you are using Amortized - rule of 78.

See Total Term Calculations below.

First Payment Date

You can optionally delay the date of the first payment

for a Amortized loan.

From the date one period before the First Payment Date,

the loan is calculated according to the term and

interest rate defined.

The amortization schedule is calculated using the original

principal plus the accrued interest compounded daily on

the original loan amount from the date one period before

the specified First Payment Date.

Normally, the system expects the First Payment Date to

be one period after the Calculate Interest From Date.

See Total Term Calculations below.

Total Plan Payments

This is the total principal and interest that will have been

paid upon completion of all payments in an orderly manner.

Accrued Interest

This is the amount of unposted interest that has accrued on

this account. When you reset the interest to post a 499

transaction, this field resets to zero and will display

the new accrued amount until posted.

If no interest is calculated, then this field displays zero.

In the case of Revolving Compound interest, this

represents the amount of interest that will be paid

when the next payment is made. In the case of a

Amortized Loan, this is the amount of interest

currently due, based on the Rule of 78's and the

date of the most recent payment.

The Accrued Interest field shows the outstanding

interest on this account, while the debtor's Interest

field and the Total Interest field in the Interest Details

reflect the Original Interest plus all the Accrued Interest

that has accumulated over the time that interest is

being calculated on this account.

When there is a Judgment, all interest is

calculated from the Judgment Date and

prior activity on the account is ignored.

Please refer to the section heading

Reset Interest for more details.

When there is a Judgment, all interest is

calculated from the Judgment Date and

prior activity on the account is ignored.

Please refer to the section heading

Reset Interest for more details.

Early Payoff Savings

Early payoff savings is the amount the debtor will save

in uncharged interest if the account is paid in full on the

current date. This calculation uses the Rule of 78's

based on the loan term.

In the case of a term account with a

delayed first payment, interest is calculated

for the term, and then the rule of 78's is

applied over the reduced term when the

first delayed payment is made. In other

words, a 36 month term loan where the 1st

payment is delayed for three months uses

the rule of 78's, based on 34 actual

payment terms.

In the case of a term account with a

delayed first payment, interest is calculated

for the term, and then the rule of 78's is

applied over the reduced term when the

first delayed payment is made. In other

words, a 36 month term loan where the 1st

payment is delayed for three months uses

the rule of 78's, based on 34 actual

payment terms.

Early Payoff Amount

This is the amount the debtor would need to pay to

completely pay the loan off before the current period end.

Term

This is the term of the loan. This field is visible

only for all interest types. Its primary use is for

Amortized Interest loans.

FOR CBR: This field is visible for all interest

types in case you are reporting to the credit

bureau as a Credit Grantor. If you are a credit

grantor reporting an installment loan, you must

fill in this field. The value should be the number

of months for a loan or the number of years for

a mortgage.

Examples of Term:

A 2-year loan with a Monthly period, that is, monthly

payments, has a Term of 24.

See Total Term Calculations below.

TOTAL TERM CALCULATIONS

We calculate the total term payments using the

Calculate interest from date and standard

amortization equations. From there we calculate

a periodic payment amount based on the number

of periods in the total payment schedule (factoring in a

First payment date, if entered) and then the total

plan payments are calculated by multiplying the

periodic payment amount by the number of

payments. This takes care of rounding details to

give accurate total payments.

Please refer to help topics on the different types

of interest.

Set Terms Manually

This switch is visible only when Amortized Loan - Rule of 78

is selected. When this is switched ON, you can enter

a value in the Payment Amount field. When it is switched

OFF, the Payment Amount field is read only and Collect!

calculates the amount based on your other settings.

Turn this switch ON (check mark) to manually

enter the Payment Amount. When it is switched

OFF, the Payment Amount field is read only

and cannot be modified.

Collect! uses the Payment Amount to calculate the total

payments over the Term (minus any periods delayed for

first payment). From this, Collect! then derive the Total

Interest Amount.

The Total Interest Amount is used when posting

payments to determine the amount of interest

due in the current period when the Transaction Type

specifies a Payment breakdown.

Late Fees Apply

Interest Detail form with Late Fees Apply

Check this box to enable Late fee details.

Late fee information currently is for informational purposes

only, and is not used for automation.

This will be developed further as time permits.

In reality, Collect! compounds interest on a periodic basis.

Missed payments simply cause the accrued interest to increase,

such that when the next payment is made, more interest is

deducted than would have been if the payment had been made

within the scheduled period.

What legal implications this has, we do

not know! Please review our legal disclaimers

before using interest calculation functions.

What legal implications this has, we do

not know! Please review our legal disclaimers

before using interest calculation functions.

Grace Period Days

This is the number of days allowed from the payment

due date before a late charge is applied.

Lesser Of

The late fee will be calculated as the lower of either

the entered amount or the percent of the payment.

If you have entered only the percent, Collect! will

calculate only the one value. If both the percent

and entered dollar amount have been entered,

Collect! will apply the lower value.

Greater Of

The late fee will be calculated as the greater of either

the entered amount or percent of the payment.

If you have entered only the percent, Collect! will

calculate only the one value. If both the percent

and entered dollar amount have been entered, Collect!

will apply the higher value.

Late Fee Amount

This is the late fee amount.

Late Fee Percent

This is the percent of the scheduled payment that

is calculated as a late fee.

Amortize With Effective Rate

This field is displayed only when Normal Amortization is

selected as the interest mode. It is currently OFF by default.

When it is enabled and the rate basis is set to anything other than

'Ordinary', the payment amount and total plan payments are

recalculated based on the effective interest rate.

The effective interest rate is not the same as the the nominal rate

that is displayed on the interest form. It is calculated

automatically to compensate for the fact that the total plan payments

is calculated using a monthly rate and the accrued interest breakdown

is calculated using a daily rate.

When 'Ordinary' is selected as the rate basis, the total plan payments

is calculated normally using the nominal rate but the accrued interest

on the payment breakdown is now calculated using a monthly rate.

With the 'Amortize with effective rate' turned on, the

PAYMENT AMOUNT x TERM = TOTAL PLAN PAYMENTS

With the switch turned off it falls back to the previous behavior

of having extra principal left over after completing all the

scheduled payments.

Additionally, the per payment interest breakdown now uses the simple

interest formula instead of the compound interest formula to determine

the interest accrued in a month which is how it should have originally

worked.

Apply Charges Last

This field is only visible when amortized interest is

selected. Historically, all outstanding fees were removed from the

total paid for the period prior to being applied to the interest and

principal. If this switch is turned on, the outstanding fees are no

longer removed from the payment. This will result in an outstanding

balance at the end of the term equal to the total charges that have

accrued over the life of the term.

Compound Unpaid Interest

Turn this switch ON (check mark) to add unpaid interest

to the next month's Principal when a payment is missed.

This switch applies only to Amortized Loan - Normal.

Amortization

This button is only active when using Amortized

Interest. When you select the Amortization Schedule

button, the Amortization Table Summary is displayed

with all scheduled payment details based on your

settings.

Reset Interest

This button is visible only when using Simple or

Revolving Compound Interest. Select Reset Interest

to change the dates and interest rate used in

interest calculations for this account. Collect!

prompts you to capture the interest accrued to stop

date as a transaction of Type 499. Then you can enter

a new interest rate, if necessary, and a new date to

restart interest calculations. This is useful for recording

interest accrued prior to Judgment, but you must do

it BEFORE putting in your Judgment Principal and

Judgment Date! Please see the Help topic

Reset Interest for more details.

Calculate Delinquency Date

This field is in effect only when 'Report as credit grantor'

is switched ON in the Company Details form.

When this is switched ON, Collect! will calculate the

Delinquency Date in the following manner. If there is

a promise that is at least 31 days past due, Collect! will

calculate the Delinquency Date as the Promise Date

plus 31 days.

If this is not switched ON, Collect! will not calculate the

Delinquency Date.

FOR CBR: When this switch is ON for Credit

Grantors and Collect! calculates the

Delinquency Date, the Status Code in

the Credit Bureau Detail tab will update

accordingly to show the correct "Days

past due" for amortized interest accounts.

Amortized Loan Requirements

- Please enter an Annual interest rate. Collect! will

divide this rate appropriately when you choose a

Period.

- Choose a frequency Period for compounding interest and

scheduling debtor payments.

- Enter a Term. This is the total number of payments. For

instance, a 4-year loan paid monthly has a Term of 48.

- Enter a Calculate interest from date. If this is left

blank, Collect! will use the debtor's Listed Date,

unless there is an earlier Charged Date.

- Optionally, you can define a First Payment Date.

Interest is accrued on a daily basis from the date of

the loan (Calculate interest from date) to the date

one period before the First Payment Date.

Promises With Interest Details

When you are entering Interest Details for an account, you

can set up a Payment Period and a Payment Amount in

the Interest Detail form. Then, when you create a Promise

Contact, Collect! will automatically fill the Repeat value and

the Amount on the Promise to match the values you entered

in the Interest Detail form.

Accrued and Total Interest amounts display. Accrued Interest is outstanding. When a payment is made,

it is first applied to reduce the Accrued Interest. The Debtor form always displays the Total

Interest accumulated during the time of the debt.

Interest calculations can be reset if there is a Judgement or change in interest rate. Press the

Reset Interest button.

If you are having trouble balancing the financials, you can start Collect! with the "/calclog"

parameter. When a Debtor is opened, and the recalc is run, the recalc process will output the

financial calculations to a text file. The contents of the file can be put into Microsoft

Excel for analysis. Please refer to the Help topic How to Use the Financial Calculation Log

for more information.

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org