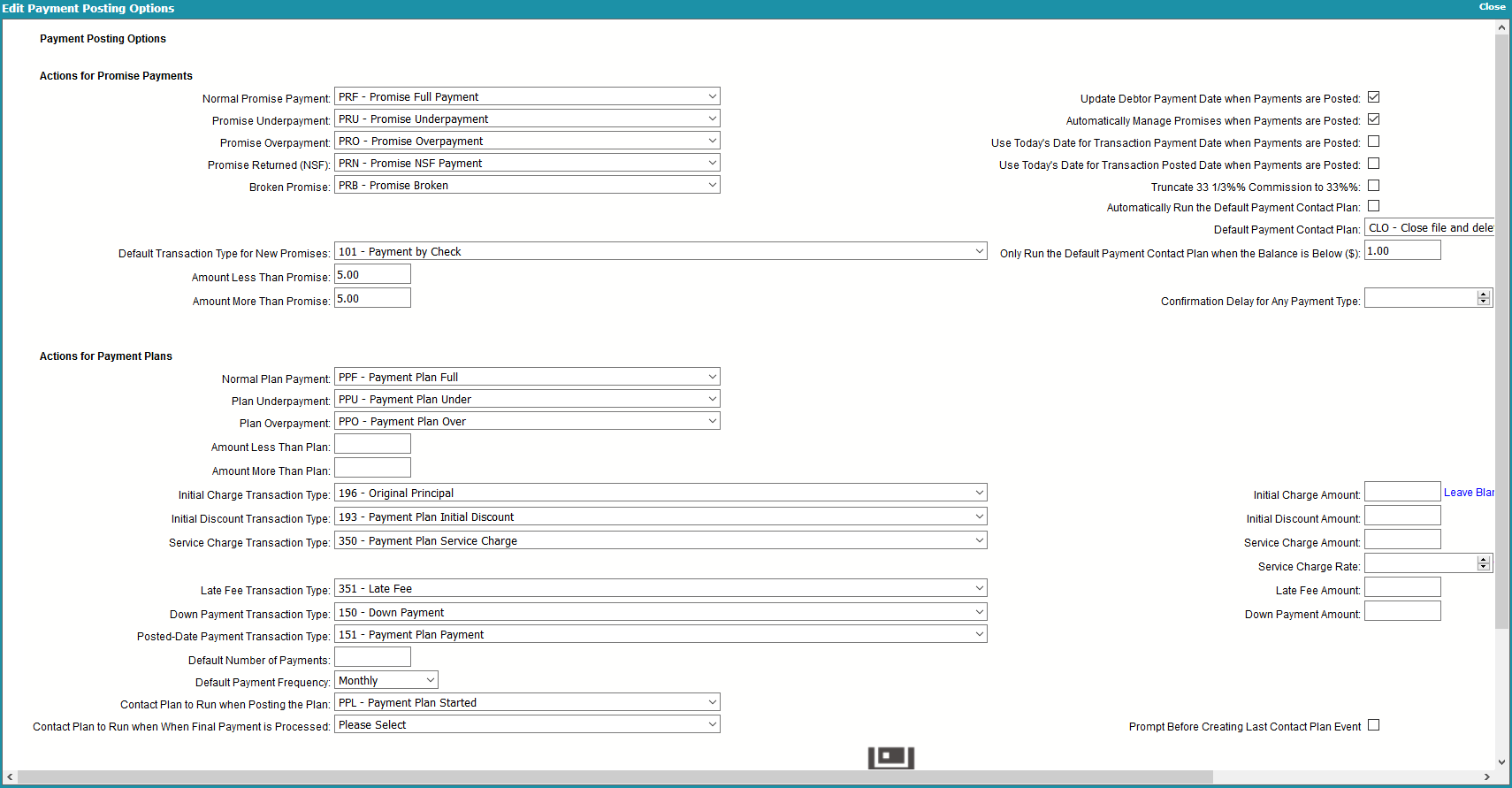

Web Host Payment Posting Options

The Payment Posting Options form is used for setting actions

performed when a payment is posted to an account. Each action

is a contact plan that runs automatically when the payment

posting condition is true.

You can manage promises and payment plans and determine

what to do when accounts are paid in full.

You may have a policy to close all accounts below a certain

balance, or run a certain contact plan when a payment is

received. With Collect! you can automate the logical

procedures for managing promised payments, administering

payment plans and posting normal payments received in the

course of daily operation.

Edit Payment Posting Options

Payment Posting

When you post a payment the following sequence occurs:

- The Default contact plan specified is run (if there is one).

Please be careful here. If you run a contact

plan that closes a debtor, the debtor will no longer appear

in your WIP List and may be effectively "lost" to your

system.

Please be careful here. If you run a contact

plan that closes a debtor, the debtor will no longer appear

in your WIP List and may be effectively "lost" to your

system.

- The plan associated with the transaction type is

run (if there is one).

A contact plan set in the transaction type

you are posting is executed before any further action

is taken using the Payment Posting Options you have

set. So it is important that no conflicting plans are set

up by accident in your transaction types.

A contact plan set in the transaction type

you are posting is executed before any further action

is taken using the Payment Posting Options you have

set. So it is important that no conflicting plans are set

up by accident in your transaction types.

- The appropriate payment posting plan is run (if there is

one).

Update Debtor Payment Date When Payments Are Posted

Switch ON to automatically write the current date

to the debtor's Payment date whenever a Payment

transaction is posted to the account.

Automatically Manage Promises When Payments Are Posted

Switch ON to have Collect! manage promised payments.

Collect! will advance the debtor's Promise date when the

promise is met. Specified contact plans for full

payment, underpayment, overpayment, NSF

payment and broken payment conditions are called

when necessary.

When this switch is ON and a payment is posted,

Collect! automatically fills in Promise details

based on the Promise contact's promised Amount

and the setting for Transaction Type in the

Payment Values form.

SWITCHED ON

When this switch is ON and you save the posted

transaction, Collect! checks the payment amount

against the amount promised. If the promise amount

is met, the debtor's Promise date is advanced.

Collect! calls the contact plan associated with full,

under or over payment, NSF or broken payment,

as needed.

If you are a large office where the person posting

payments has little or no knowledge of the accounts

they are posting to, switch this ON to control what

happens for over and under payment. This enables

you to send the file to an account manager for review

in exceptional cases.

When a payment is posted, Collect! examines contact

and transactions, checking for promised payments. If

a promise is found, Collect! fills in the transaction

details as soon as you open a new Transaction form.

You may then edit the payment being posted if needed.

SWITCHED OFF

When this switch is OFF and you save the posted

transaction, Collect! does not advance the debtor's

Promise date, and does not call any contact plan.

You are manually in control of whatever happens next.

If you are a small office where the person posting

payments has some knowledge of the accounts

being posted to, you can leave this switch OFF and

manage your promises manually.

When this switch is OFF and you post a new

transaction, Collect! will not fill in the details

automatically. If you select a Payment transaction

Type, then, if a promise is found, Collect! fills in the

transaction details. You may then edit the payment

being posted if needed.

To access the Payment Values form, select

the ADVANCED button on the

Payment Posting Options form.

To access the Payment Values form, select

the ADVANCED button on the

Payment Posting Options form.

Use Todays Date For Transaction Payment Date When Payments Are Posted

By default, when a Promise exists on an account

and the Due Date is in the future, Collect! will use the date

of the next Promise for the Payment Date in any new

transactions. When this switch is set, Collect! will always

use the current date for the Payment Date by default

when a new Transaction is posted.

This is only in effect when the Promise Due

Date is greater than today, "Automatically

manage promises when posting" is

switched ON and the transaction is a

PAYMENT type transaction.

This is only in effect when the Promise Due

Date is greater than today, "Automatically

manage promises when posting" is

switched ON and the transaction is a

PAYMENT type transaction.

Use Todays Date For Transaction Posted Date When Payments Are Posted

By default, when a Promise exists on an account and the

Due Date is in the future, Collect! will use the date of the

next Promise for the Posted Date in any new transactions.

When this switch is set, Collect! will always use the current

date for the Posted Date by default when a new Transaction

is posted.

This is only in effect when the Promise Due

Date is greater than today, "Automatically

manage promises when posting" is switched

ON and the transaction is a PAYMENT

type transaction.

This is only in effect when the Promise Due

Date is greater than today, "Automatically

manage promises when posting" is switched

ON and the transaction is a PAYMENT

type transaction.

TRUNCATE 33.3% PERCENT COMMISSION TO 33%

Switch ON to truncate 33% commission rates. When this switch

is OFF, a 33.3% commission is calculated as 1/3.

Automatically Run The Default Contact Plan

Switch ON to run a contact plan every time you

post or edit a payment. The plan you run can perform

conditional event scheduling based on amount

owing, debtor status, or other criteria you choose.

If you want to run the default plan only when the

debtor's Owing falls below a threshold level,

enter the amount in the 'Run only when balance

below' field.

If you want to process and close accounts

manually, leave this switch OFF.

To flag this field, select it with your mouse

or, while you are in this field, press your space

bar to toggle the switch off or on.

Default Payment Contact Plan

Enter the ID Code of the default contact plan to run

automatically when posting a payment.

This plan runs before any plan attached

to a Transaction Type or any of the

contact plans chosen for other payment

conditions in the Payment Posting

Options form.

This plan runs before any plan attached

to a Transaction Type or any of the

contact plans chosen for other payment

conditions in the Payment Posting

Options form.

Be careful here. Running a contact plan that closes

a debtor removes this debtor from your WIP List.

The debtor may appear "lost" to the system.

Only Run The Default Contact Plan When Balance Below

Enter a dollar value in the field. The default automatic

contact plan will run only when the debtor's Owing falls below

the amount entered. For example, if you enter 50,

the contact plan will be invoked automatically only

when an account Owing drops below $50.00.

Leave this field blank to always run the

contact plan regardless of the Owing amount.

Confirmation Delay For Any Payment Type

Enter a number of days to delay reporting transactions

posted with switched ON. You

can enter a number from 0 to 999 in this field. Collect!

uses this number when generating statements. Please

refer to Transaction Confirmation Delay for details.

Promise Contact Actions

The payment conditions listed here apply when there

is a Promise contact set up on an account. Full, under

and over payments, NSF and broken promise payments

may each cause a plan to run. This requires that you

have switched ON 'Automatically manage promises'.

Collect! does four things with Promise contacts:

- When a debtor has a Promise Contact, the debtor

Promise field displays the date the payment is due.

If this date passes by without a payment posted, the

promise becomes delinquent and the field is displayed

in red when the debtor totals are recalculated.

- When a payment is posted, Collect! checks

for Promise contacts and fills in the transaction

details for your confirmation.

- If the contact contains a Repeat Value, the contact is

forwarded to the future date when the promised payment

is posted.

- When a promised payment is posted, Collect! runs the

appropriate contact plan for full payment, under payment,

or over payment, NSF or broken promise.

Normal Promise Payment

Select the ID Code of a contact plan to run for 'Normal Promise

payment'. When the full amount of a Promise contact

payment is posted, Collect! will run this plan.

Promise Underpayment

Select the ID Code of a contact plan to run for 'Promise

under payment'. When less than the full amount of a

Promise contact payment is posted, Collect! will run this

plan.

Promise Overpayment

Select the ID Code of a contact plan to run for 'Promise

over payment'. When more than the full amount of a

Promise contact payment is posted, Collect! will run

this plan.

Promise NSF Payment

Select the ID Code of a contact plan to run for 'Promise

NSF payment'. When you post a transaction for a negative

amount due to an NSF payment returned because of

insufficient funds, Collect! will run this plan.

Broken Promise

Select the ID Code of a contact plan to run for 'Promise

broken payment'. When you run your daily batch process

for broken promises, Collect! will run this plan for any

delinquent promise that is found. This works when you

switch ON 'Broken promises' in the Select Contacts To Process

form.

A promise is considered delinquent when no

payment has been posted during the past

payment period, (i.e., week, month or

whatever Repeat period is displayed in

the Promise Contact.)

A promise is considered delinquent when no

payment has been posted during the past

payment period, (i.e., week, month or

whatever Repeat period is displayed in

the Promise Contact.)

Transaction Type For New Promises

Choose the default Transaction Type to be posted for

promised payments.

The ID and Description of the transaction type will

be copied into the promise transaction when you

post promises.

To set details for any transaction type, select System

from the top menu bar and then select Financial Settings,

Transaction Types.

Please examine the details of the

Transaction Type that you choose. Does it

contain any settings that conflict with your

value and posting settings?

Please examine the details of the

Transaction Type that you choose. Does it

contain any settings that conflict with your

value and posting settings?

Amount Less Than Promise

Enter an amount in this field that the Debtor is allowed

to be under the promised amount.

For example, enter 1.00 here, and if they have a

promise due for $100.00 the Debtor can send a

payment for $99.00 and it is still considered a

fulfilled promise. However, even if they send $98.99,

the payment is considered an underpayment, and

the Underpayment Contact Plan will be called.

This is for Promise contacts as created manually

or by using contact plans.

Amount More Than Promise

Enter an amount that the Debtor's payment can

be over the promised amount.

For example, enter 1.00 here, and if they have a

promise due for $100.00 the Debtor can send a

payment for $101.00 and it is still considered a

fulfilled promise. However, even if they send $101.01,

the payment is considered an overpayment, and the

Overpayment Contact Plan will be called.

This is for Promise contacts as created manually

or using contact plans.

Payment Plan Actions

Using the Payment Plan feature, the payment conditions

listed here apply when there is a Payment Plan set up

on an account. Full, under and over payments may each

cause a plan to run. This requires that you have switched

ON 'Automatically manage promises'.

Collect! does three things with Payment Plans:

- When a debtor has a promised transaction, the debtor

Promise field displays the date the payment is due.

If this date passes by without a payment posted, the

promise becomes delinquent and the field is displayed

in red when the debtor totals are recalculated.

- When a payment is posted, Collect! checks to see

if there are any promise payment transactions and

fills in the transaction details for your confirmation.

- When a promised payment is posted, Collect! runs

the appropriate contact plan for full payment, under

payment, or over payment.

Press F2 or select the down arrow at the right of

each field below to pick from the list of contact plans

in the system.

Normal Plan Payment

Select the ID Code of a contact plan to run for 'Plan

full payment'. When the full amount of a payment plan

payment is posted, Collect! will run this plan.

Plan Underpayment

Select the ID Code of a contact plan to run for 'Plan

under payment'. When less than the full amount of a

payment plan payment is posted, Collect! will run this

plan.

Plan Overpayment

Select the ID Code of a contact plan to run for 'Plan

over payment'. When more than the full amount of a

payment plan payment is posted, Collect! will run this

plan.

Amount Less Than Plan

Enter an amount in this field that the Debtor

is allowed to be under the promised amount.

For example, enter 1.00 here, and if they have

a promise due for $100.00 the Debtor can send

a payment for $99.00 and it is still considered a

fulfilled promise. However, even if they send $98.99,

the payment is considered an underpayment,

and the Underpayment Contact Plan will be called.

This is for promised transactions, as scheduled in a

Payment Plan for this Debtor. Promise transactions

have a payment date but no posted date.

Amount More Than Plan

Enter an amount in this field that the Debtor is

allowed to be over the promised amount.

For example, enter 1.00 here, and if they have a

promise due for $100.00 the Debtor can send a

payment for $101.00 and it is still considered a

fulfilled promise. However, even if they send $101.01,

the payment is considered an overpayment, and

the Overpayment Contact Plan will be called.

This is for promised transactions as scheduled in a

Payment Plan for this Debtor. Promise transactions

have a payment date but no posted date.

If the payment plan transaction types do not exist in

your system, please set them up. Suggested settings are listed

below for each transaction type. These transaction types are

used for reporting purposes, and to calculate fees, charges

and payments that apply to the debtor's payment plan. You will

want to ensure that they work as you expect them to before you

post the plan to an account. If you run a contact plan on posting,

please ensure that this plan exists in your system and works as

you expect it to before you post the plan.

If the payment plan transaction types do not exist in

your system, please set them up. Suggested settings are listed

below for each transaction type. These transaction types are

used for reporting purposes, and to calculate fees, charges

and payments that apply to the debtor's payment plan. You will

want to ensure that they work as you expect them to before you

post the plan to an account. If you run a contact plan on posting,

please ensure that this plan exists in your system and works as

you expect it to before you post the plan.

Initial Charge Transaction Type

This transaction type is usually Original Principal 196.

It should already exist in your Transaction Type list

available when you select System from the top menu

bar and then select Financial Settings, Transaction Types.

The Code is in the 100 Transaction

Type group since it is an initial

payment or charge.

The Code is in the 100 Transaction

Type group since it is an initial

payment or charge.

Please refer to Transaction Type for a Sample of Original Principal

to see the suggested settings for this Transaction Type.

Initial Charge Amount

This is the default amount for the initial charge.

For example, you might offer a course for a

fixed price. You could enter that price here

and whenever you create a new payment plan

this amount is loaded into the payment plan's

initial charge field unless the Debtor already has

an original principal amount.

Initial Discount Transaction Type

This is the transaction type for any credits toward

the initial charge. The value of this field affects the

service charge calculation.

The Code is in the 100 Transaction

Type group since it is an initial payment

or charge.

The Code is in the 100 Transaction

Type group since it is an initial payment

or charge.

Please refer to

Transaction Type for a Sample of Payment Plan Initial Discount

to see the suggested settings for this Transaction Type.

Initial Discount Amount

Enter a default discount if used.

Service Charge Transaction Type

This is the Transaction Type for service charges.

The Code is in the 300 Transaction Type

group since it is a Fee.

The Code is in the 300 Transaction Type

group since it is a Fee.

Please refer to

Transaction Type for a Sample of Payment Plan Service Charge

to see the suggested settings for this Transaction Type.

Service Charge Amount

An optional default amount for the Payment Plan

Service Charge. Enter a default fixed service fee

if you don't use the service rate.

Service Charge Rate

This is the service fee rate.

This rate is copied into the payment plan and used

to calculate the service fee. This is a monthly rate.

Late Fee Transaction Type

This is the Transaction Type for any Late Fees.

The Code is in the 300 Transaction Type

group since it is a Fee.

The Code is in the 300 Transaction Type

group since it is a Fee.

Please refer to Transaction Type for a Sample of Late Fee

to see the suggested settings for this Transaction Type.

Late Fee Amount

Amount charged for late payments.

Late fees are not assessed automatically.

Down Payment Transaction Type

This is the Transaction Type for a Down Payment.

The Code is in the 100 Transaction

Type group since it is an initial

payment or charge.

The Code is in the 100 Transaction

Type group since it is an initial

payment or charge.

Please refer to Transaction Type for a Sample of Down Payment

to see the suggested settings for this Transaction Type.

Down Payment Amount

Default amount of a down payment.

Post-Dated Payments Transaction Type

This is the Transaction Type for a Payment.

The Code is in the 100 Transaction

Type group since it is an initial

payment or charge.

The Code is in the 100 Transaction

Type group since it is an initial

payment or charge.

Please refer to

Transaction Type for a Sample of Payment Plan Payment

to see the suggested settings for this Transaction Type.

Default Number Of Payments

This is the default number of payments the

Debtor makes.

This number can be changed with each payment plan

you create and is simply a default value.

Default Payment Frequency

Select a time between payments. This is a default value.

You can change this on a per payment plan basis.

If you select monthly, and the starting date is

the 31st, 30th or 29th, the system will

schedule payments on the highest date

available for each month. For example a 6

month plan starting on January 31st will have

a second payment scheduled for

February 28th since there is no 31st of

February.

If you select monthly, and the starting date is

the 31st, 30th or 29th, the system will

schedule payments on the highest date

available for each month. For example a 6

month plan starting on January 31st will have

a second payment scheduled for

February 28th since there is no 31st of

February.

This setting affects the way the service fee is calculated.

Contact Plan To Run When Posting The Plan

When a plan is posted, run this Contact plan.

This can be used to send letters of agreement and reminder

notices and schedule reviews as necessary.

The default plan in the Collect! Demonstration database is

PPL, Payment Plan Started. This plan changes the Debtor's

Status and writes a Note that a payment plan has started.

You may want to send a letter of acknowledgment and

perhaps schedule a review. If so, you can add your own

additional events to the default PPL plan or change the

code here to a different plan that you want Collect! to run

whenever you post a payment plan to an account.

If you use coupon books, the plan you run on

posting may contain an event to queue the

coupon book for your letter batch.

If you use coupon books, the plan you run on

posting may contain an event to queue the

coupon book for your letter batch.

Contact Plan To Run When Final Payment Is Processed

Select a contact plan to run on the date of the

last payment in your schedule. Collect! will create

a Plan Contact with a Due Date that matches the

Payment Date of the last Transaction posted in

your payment plan schedule.

If you re-schedule your payment plan, Collect! will

update the Plan Contact so that it always matches

the last Payment Date in your schedule.

You can also trigger this Plan Contact to be created

when you manually enter Transactions. Please refer

to Help topic,

How to Run a Contact Plan on the Last Payment Date

for details.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org