Credit Card Step By Step - Part 3 - Recurring Payments

This "Step-by-Step" series is intended to provide you with

an orderly progression of procedures and procedural

considerations.

The actual details and expansive explanations are contained

elsewhere in the Help pages and will be referred to by link

to follow at the end of each page, where applicable.

This Step-by-Step page is dedicated to all aspects concerning

Recurring Credit Card Payments.

When you have completed a full review of all the steps,

you should be:

- Able to post Recurring Credit Card Payments

- Able to save credit card information

- Able to read the payment details from the transaction

- Familiar with running the reconcile

Posting A Recurring Credit Card Payments Schedule

You can set up a credit card payment schedule for a series

of credit card debits to be made at regular intervals. The

module will upload the details to Billing Tree, where the terms

and details of the arrangement are stored, and the system will

automatically debit the payer's card when each payment comes due.

A payment due on today's date will always have a lag time between

that due date and when you see the transaction is posted in

Collect!. This is because the Reconcile Credit Card History

batch process submits the transaction on the due date and it

will not be until the day after that you will receive the

download approval or decline, as Billing Tree doesn't submit

its own daily transactions to the banking institutions until

its end of day.

Recurring Credit Card Schedules are dependent on

the Reconcile Credit Card History process being

run daily as it is this batch process which downloads

processed credit card payments which have become due

and are now approved for posting.

Recurring Credit Card Schedules are dependent on

the Reconcile Credit Card History process being

run daily as it is this batch process which downloads

processed credit card payments which have become due

and are now approved for posting.

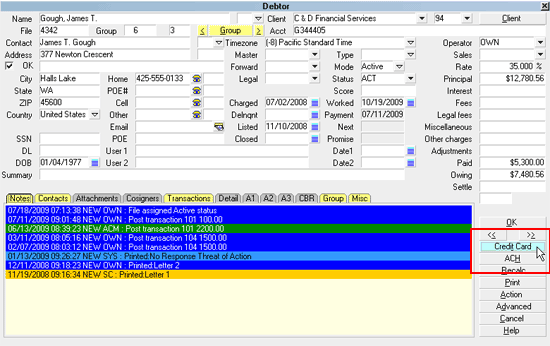

Select the CREDIT CARD button on the Debtor screen in the lower

right corner to access the Credit Card Payment Tasks menu.

Select the Credit Card button

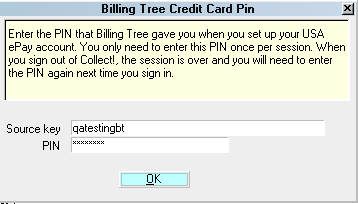

If this is the first time you are accessing this screen, after signing

into Collect!, you will be prompted to enter your Billing Tree

Credit Card login credentials.

Billing Tree Credit Card PIN

Once you enter your Source Key and PIN, they stay in

effect until you sign out of your current Collect! session.

If you have entered your PIN into the

Credit Card Setup screen, it will be

stored and used each time you log into

Collect!. You will not be prompted to

enter a PIN. Only User Levels 1, 10 and 99

will see the prompt. Click OK to advance to

the next screen if there are no changes.

If you have entered your PIN into the

Credit Card Setup screen, it will be

stored and used each time you log into

Collect!. You will not be prompted to

enter a PIN. Only User Levels 1, 10 and 99

will see the prompt. Click OK to advance to

the next screen if there are no changes.

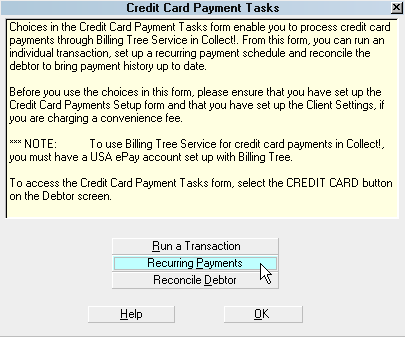

When the Credit Card Payment Tasks menu is displayed,

select the RECURRING PAYMENTS button.

Select the RECURRING PAYMENTS button

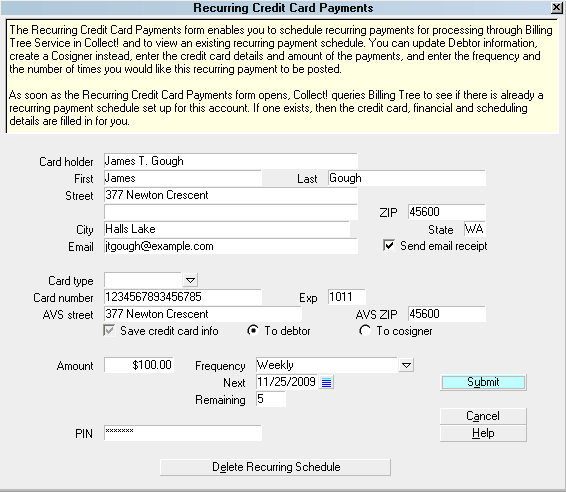

This will open the Recurring Credit Card Payments screen.

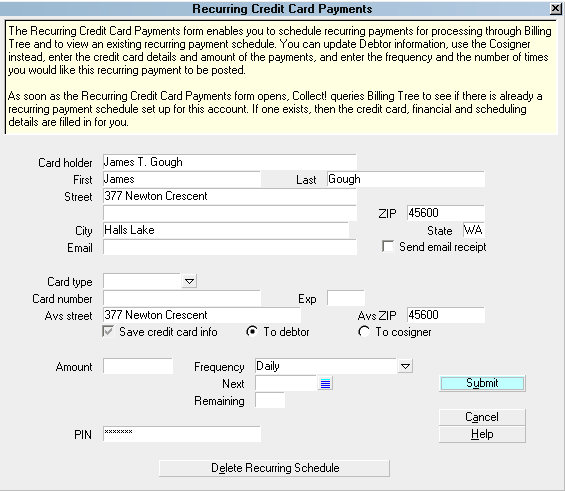

Recurring Credit Card Payments

Information from the Debtor Name and Address fields will

be auto-filled for you, and you may input the rest of the

indicated fields.

Some information in the popup will be auto-filled for you and

the rest requires input. A field-by-field description of entry

fields may be found on the Help page

called Recurring Credit Card Payments.

Special points of note on this intake screen are:

a) A valid billing address for the card holder is required.

b) A valid 2-character state code is required.

c) A valid zip code is required. The transaction

will be rejected if an attempt to put in a placeholder,

non-valid zip is attempted in the absence of one which

is known.

d) If you enabled convenience fees for this debtor's client,

the check box will be accessible and require your endorsement

to charge the convenience fee by checking the "Apply fee"

box first, before you see the fee amount populate.

You can fill in the rest of the details. The "Save

credit card details" box is presented both checked ON and

read-only greyed out. This is because the module must

save the information for a recurring schedule so that

there is parity between Collect! and Billing Tree to match

the transactions during Reconcile Credit Card History

batch processes. What you may select, is whether you want

to save this information in PCI compliant format to the

Debtor, or to the Cosigner with the Class designation of

CC Payer. Older versions of Collect! use "Other" as the

Class.

If you have enabled convenience fees for credit

credit cards in general, and specifically

for this client, you still will not see

the usual Apply Fee and Fee Amount fields

on the intake screen. These remain hidden

because Credit Card legislation dictates that

you may not charge a fee on more than the

first transaction in a recurring schedule.

The module will automatically apply your

flat fee with your Setup designated transaction

type on the first payment of every recurring

schedule you process through the module.

If you have enabled convenience fees for credit

credit cards in general, and specifically

for this client, you still will not see

the usual Apply Fee and Fee Amount fields

on the intake screen. These remain hidden

because Credit Card legislation dictates that

you may not charge a fee on more than the

first transaction in a recurring schedule.

The module will automatically apply your

flat fee with your Setup designated transaction

type on the first payment of every recurring

schedule you process through the module.

Click the SUBMIT button to submit the payment schedule to the

Credit Card Gateway on the Billing Tree site.

Ready to Submit Recurring Credit Card Payments Schedule

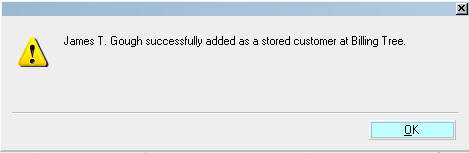

You will receive an acknowledgement like the following popup.

Credit Card Schedule Stored at Billing Tree

You will not see the credit card payment processed

and posted in the Transaction Tab on the account

until (a) the next payment due date has arrived and

(b) your office has submitted a Reconcile Credit

Card History batch processing file for download of

the payment confirmation.

You will not see the credit card payment processed

and posted in the Transaction Tab on the account

until (a) the next payment due date has arrived and

(b) your office has submitted a Reconcile Credit

Card History batch processing file for download of

the payment confirmation.

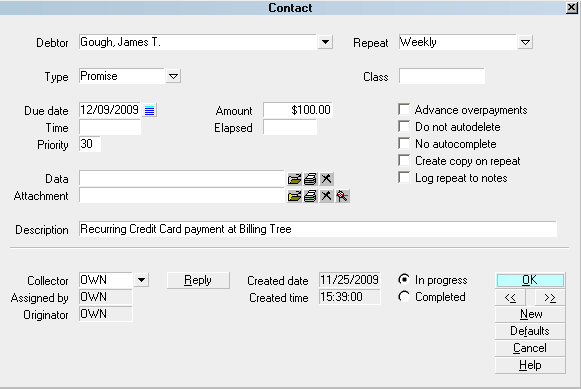

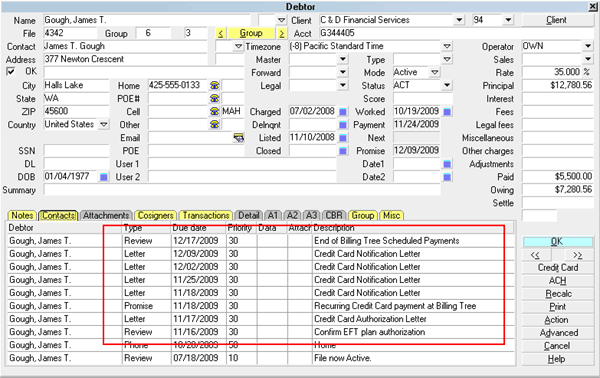

As part of the automation, a Promise contact to keep track of the

payment schedule is posted.

Promise Contact for Recurring Credit Card Payments

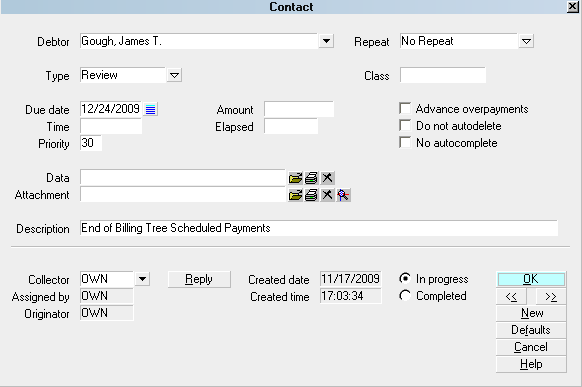

Also part of the automation, the module proactively

schedules a Review now that is forward due-dated so that

there is an implanted reminder of when the recurring schedule

has ended and it may be time to do any of renegotiate your

next level of payment plan, send a PIF release and close your file, etc.

Review Contact for Recurring Credit Card Payments

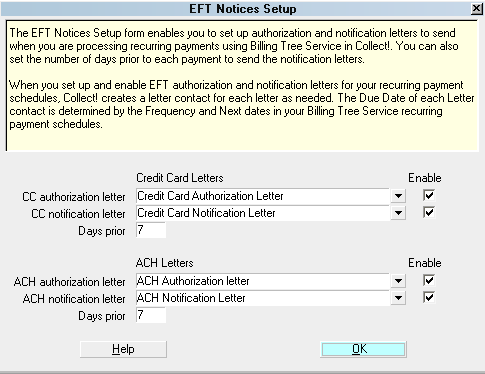

If you set up EFT Notices, the module will automatically

schedule those letters to be sent in the requisite timelines

designated in your module preference settings.

EFT Notices Setup

EFT Notices and Reviews

Save Credit Card Info

The "Save credit card info" switch is ON and read-only,

greyed out. Your choices in a recurring intake screen

with respect to this option are to save the card information

to either "To Debtor" or "To Cosigner", but the info must

be saved. The module requires the information so that

future uploads/downloads between itself and Billing Tree

have the requisite information to ensure transaction matching

integrity for the course of the recurring payment schedule.

Insofar as the end- user is concerned, this information is

stored in PCI compliant masked format to protect the card

holder's privacy and card security in your system.

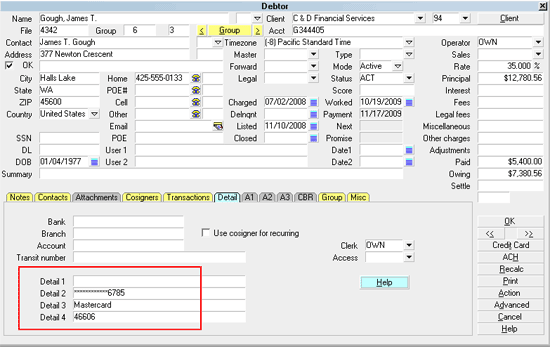

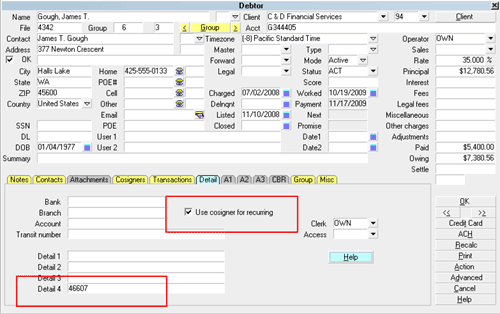

If the debtor is the CC Payer, then the details

will be saved into the Detail Tab off the debtor main screen.

Credit Card Info Saved to Debtor Detail

Detail 2 is the masked Credit Card Number.

Detail 3 is the Credit Card type.

Detail 4 is Billing Tree's unique Client

Number for the stored debtor. *** IMPORTANT: Don't

change this number!

Reminder that the module does write to fields

in the Debtor and Transaction Detail Tabs.

If you currently utilize these fields for

any site proprietary reason, contact Technical

Services to go over your options to move

data to new locales before rolling out usage

of this module. It will overwrite fields

in the designated tabs.

Reminder that the module does write to fields

in the Debtor and Transaction Detail Tabs.

If you currently utilize these fields for

any site proprietary reason, contact Technical

Services to go over your options to move

data to new locales before rolling out usage

of this module. It will overwrite fields

in the designated tabs.

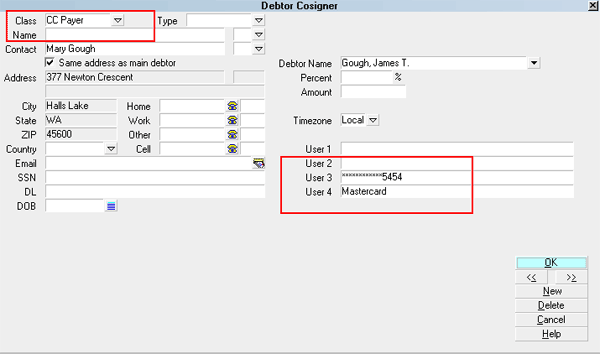

Save Credit Card Info To Cosigner

Alternatively, you can save the card info to a Cosigner who

either a responsible party on the debt or is a third party

payer. A third party payer will auto-setup with the Cosigner

Class to CC Payer. Older versions of Collect!

use "Other" as the Class.

Name, Address and Credit Card Info Saved to Cosigner

User 3 is the masked Credit Card Number.

User 4 is the Credit Card type.

You may designate only one CC Payer Cosigner

and one Recurring Credit Card Schedule

at a time, per debtor file.

You may designate only one CC Payer Cosigner

and one Recurring Credit Card Schedule

at a time, per debtor file.

When you save the credit card information to the Cosigner,

the Client # is still stored in the Debtor Detail 4 field

because the stored client is always the Debtor.

Client Number in Debtor Detail

Detail 4 is Billing Tree's unique Client

Number for the stored client. *** IMPORTANT: Don't

change this number!

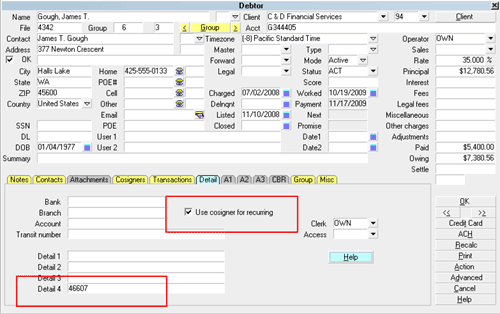

Use Cosigner For Recurring

When you select "To Cosigner" to store your payer

information, Collect! switches ON "Use cosigner for

recurring" in the Debtor Detail screen.

Use Cosigner for Recurring

Use Cosigner for Recurring is a switch

Collect! uses to reconcile payments when you have

used the Cosigner as the Payer. *** IMPORTANT: Leave

this switch ON if the Payer is the Cosigner.

You MUST leave this switch ON for the duration

of your payment schedule so that module

can verify the credit card information

during Reconcile Credit Card History

uploads/downloads.

You MUST leave this switch ON for the duration

of your payment schedule so that module

can verify the credit card information

during Reconcile Credit Card History

uploads/downloads.

Transaction Details

Collect! does not evidence posting of any recurring

credit card payments until you run Reconcile Credit

Card History. To keep your files up-to-date with all

card approvals/declines, you should run your batch

process to reconcile at least once per business day.

The additional benefit to doing so is that if any debtors

made external payments directly on the Billing Tree Gateway

and not through your office and the module, is that these

payments are also downloaded and posted to your system

with the Reconcile process. For more detailed information,

see RECONCILE CREDIT CARD HISTORY in these pages.

Debtors who wish to pay externally must use their Collect! file

number as their unique account number when paying directly on the

Billing Tree website.

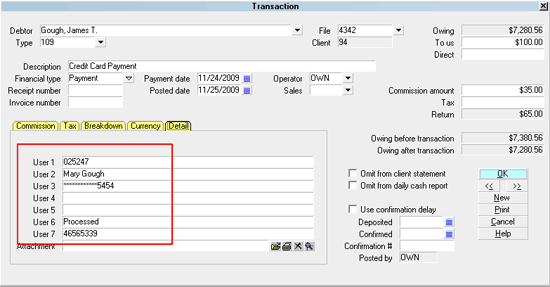

There is specific information that you will see written

to the Transaction Detail Tab when a recurring payment

has been approved and posted into the system.

Transaction Details

Credit card, unique tracking and confirmation details are stored as follows:

User 1 is the Authorization Code.

User 2 this field stores the Payer's name

if the Payer is not the Debtor.

User 3 is the masked Credit Card Number.

User 6 displays "Processed" for successful submits.

User 7 is the unique Transaction Reference Number

assigned to this credit card payment.

Reconcile Credit Card History

The Reconcile Credit Card History is a batch process that

queries Billing Tree for all credit card payments processed

by them but which have not yet been posted in Collect!.

The parameters include those transactions processed

by Billing Tree since the Last Reconcile date stored in

Collect!, new declines or chargebacks, and unreported external

payments made by debtors directly at the Billing Tree Gateway (and

provided they have used their Collect! file number as their unique

identifier on the Gateway website).

Reconcile Credit Card History

Debtors may enter their own payments directly at

the Billing Tree website provided they are

advised to use their Collect! file number as

their unique identifier.

Debtors may enter their own payments directly at

the Billing Tree website provided they are

advised to use their Collect! file number as

their unique identifier.

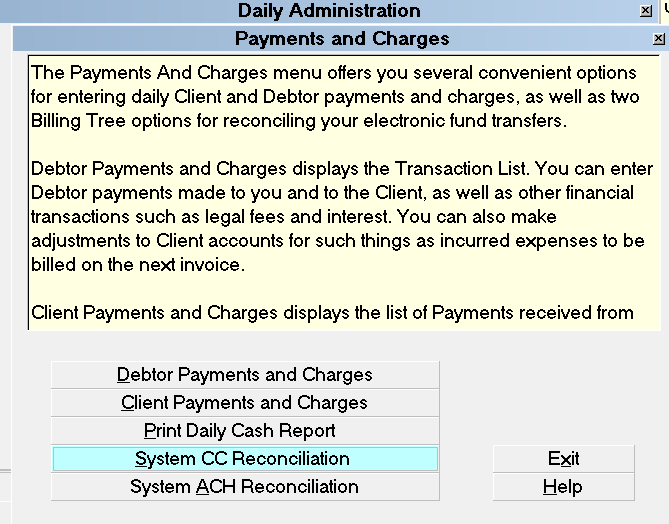

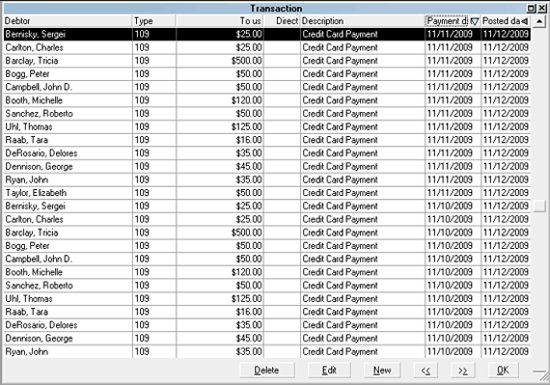

Credit Card Transactions Posted

To download the latest batch of credit card approved payments

not yet posted in Collect!, you access through the menu path

of " Daily Administration\ Payments and Charges\Reconcile Credit

Card History".

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

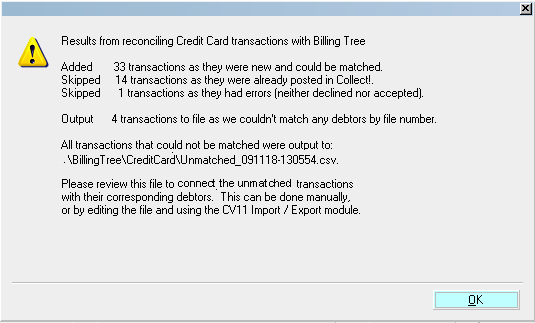

Once the process is invoked, as information is exchanged

between Collect! and Billing Tree you will see a summary

screen to let you know what actions were taken. If payments

cannot be matched, i.e. if there was a file number entry

error directly in the Gateway website OR some edit in Collect!

subsequent to the arrangement entry was made causing a

mismatch in data, the module saves all pertinent payment

exception information to a file that you can use to

manually post the transactions mismatches once you have

located the accounts and matched the payments to the files.

Reconcile Credit Card History Results

If any unmatched transactions are returned, the module stores

the information in a file in the "CV11\bin\BillingTree\CreditCard"

folder as a CSV called Unmatched with a date/time stamp to make

the name unique: i.e. Unmatched-150519-153321 is May 19th, 2015

created at HH:MM:SS of 15:33:21.

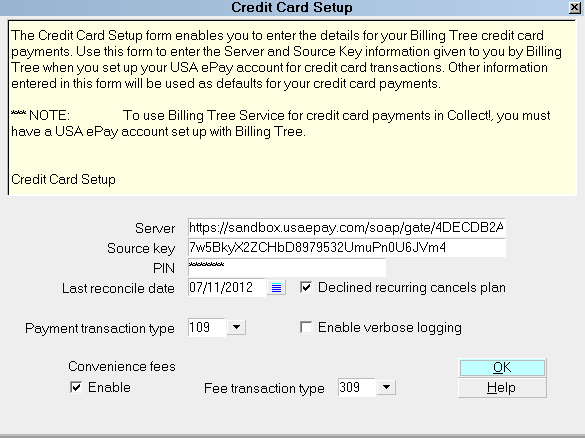

If a credit card is declined when an attempt is made by Billing

Tree to process a recurring payment, then Collect! processes

the payment as "Declined" and uses your settings from the

Credit Card Setup options.

Credit Card Setup

As of version CV11.6.2.9, if a file number match is made during

reconciliation but the transaction is skipped or errored out

for any reason, you will now see a Noteline logged to the specific

debtor account that the transaction belongs to identifying

what was skipped or errored. The noteline will be prefixed

"Failed Transaction:" and indicate that an "Error" occurred,

as well as provide the Payment Date and amount. This is a

transaction that would need to be manually reviewed for what

caused the issue and corrective action would depend on what was

ascertained as root cause (i.e. was the transaction manually

modified between upload of transaction and download of process

confirmation).

It also writes a detailed log into the path

"CV11\bin\BillingTree\CreditCard\usaepay.txt".

See Also

- Billing Tree Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org