ACH Payments Setup

The ACH Payments Setup window is where you enter the details

for your Billing Tree ACH payments preferences

and login credentials to the ACH Gateway.

To access the setup screen, your menu path is

"System\Preferences\Payment Processing Setup\ACH Payments Setup".

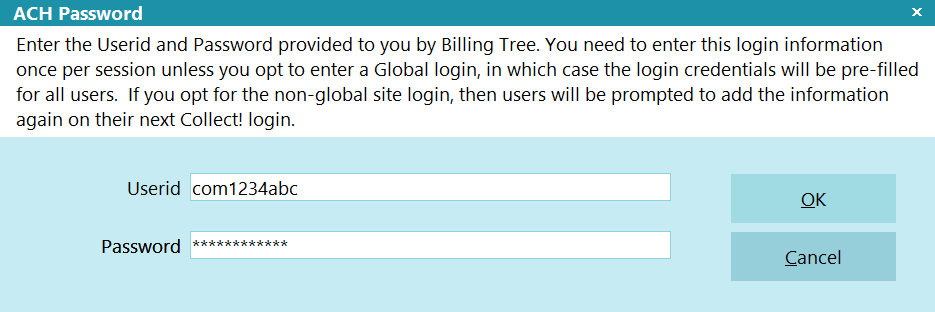

Billing Tree ACH Password

Per Session ACH Logins

You can set up different user accounts at Billing Tree if

you need to set different transaction limits for your collectors.

For example, if entry level collectors are not to be permitted to

set up an ACH payment amount higher than $500, then this can be

controlled at the Billing Tree login level. Advise your Billing

Tree Representative of your requirements in this regard when you

set up your account with so that you have enough logins to meet your

needs.

If you use multiple signons with the module, you will need to run a

batch Reconcile ACH History for EACH login, SEPARATELY, that your

company uses.

Set ACH Login Globally

You can enter your UserID and Password ACH Setup window located

in the menu path "System\Preferences\ Billing Tree Setup\ACH Setup".

It will be stored and used each time users sign into Collect!.

Excepting User Levels 1, 10 & 99, your other users levels will not

see the PIN prompt at all after the global login is created.

User Levels 1, 10 & 99 need only click OK to accept the auto-filled

default login credentials.

The information to be entered in the ACH Setup screen is described below.

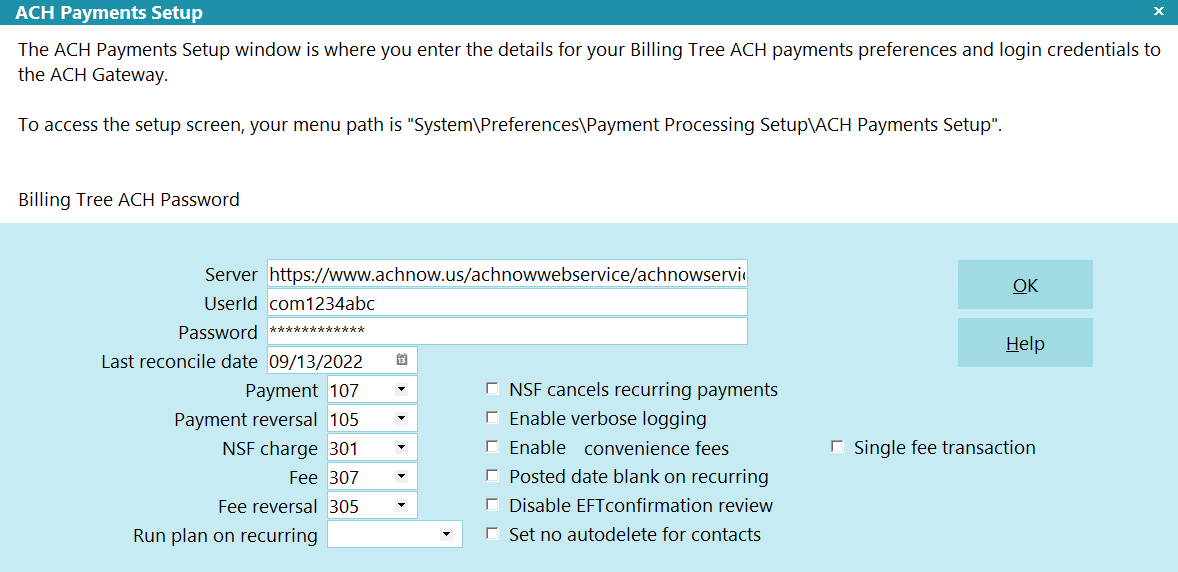

ACH Payments Setup

Server

This is where you enter the url (web address)

of the Billing Tree ACH Gateway.

https://www.achnow.us/achnowwebservice/achnowservice.asmx?WSDL

Userid

Enter your Billing Tree assigned UserID.

Password

Enter your Billing Tree assigned Password.

Last Reconcile Date

This is the last date that Reconcile ACH

History was run successfully. If you have never

run " Reconcile ACH History," enter the date

that you established your account with Billing

Tree. Future reconcile attempts will query

transactions between this date and the day

that they are run, inclusively.

Collect! updates this field automatically

when you complete your reconciles successfully.

Except for a new module initialization, there

is not an occasion you shouldn't have

enter/modify the date you see in this field.

New module initializations should enter the

date immediately BEFORE the actual date

you start to use the module/start entering

payments.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will prompt you during the reconciliation

process to confirm that you want to proceed.

If you run the task via the Task Scheduler,

Collect! will not run the reconciliation

and will put an entry in the Application Log

that the task failed.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will prompt you during the reconciliation

process to confirm that you want to proceed.

If you run the task via the Task Scheduler,

Collect! will not run the reconciliation

and will put an entry in the Application Log

that the task failed.

Payment

Select the Transaction Type that you want

Collect! to use for your Billing Tree ACH

payments. This Transaction Type must already

exist in your list of Transaction Types and it

must be set up as a Financial Type "Payment".

You may wish to use the shipping default

transaction type 107.

Payment Reversal

Select the Transaction Type that you want

Collect! to use for transactions created to

offset previously posted payments when they

are returned as NSF. This Transaction Type

must already exist in your list of

Transaction Types and it must be a Financial

Type "Payment". You may wish to use the

shipping default transaction type 105.

NSF Charge

Select the Transaction Type that you want

Collect! to use for transactions created to

charge an NSF fee to the Debtor's account

when a payment reversal is posted. This

Transaction Type must already exist in

your list of Transaction Types and it should

be a Financial Type "Fee". You may wish

the shipping default transaction type 301.

Leave this field blank if you do not want

to charge an NSF fee for transactions

returned NSF from Billing Tree.

Convenience Fees

Collect! enables you to add a convenience

fee to the ACH transaction you are processing.

This is a default setting that may be

overridden on an individual basis.

To charge convenience fees, it is each site's

responsibility to ensure that they are

allowed to do this in your jurisdiction

and according to your agreement with

your Clients.

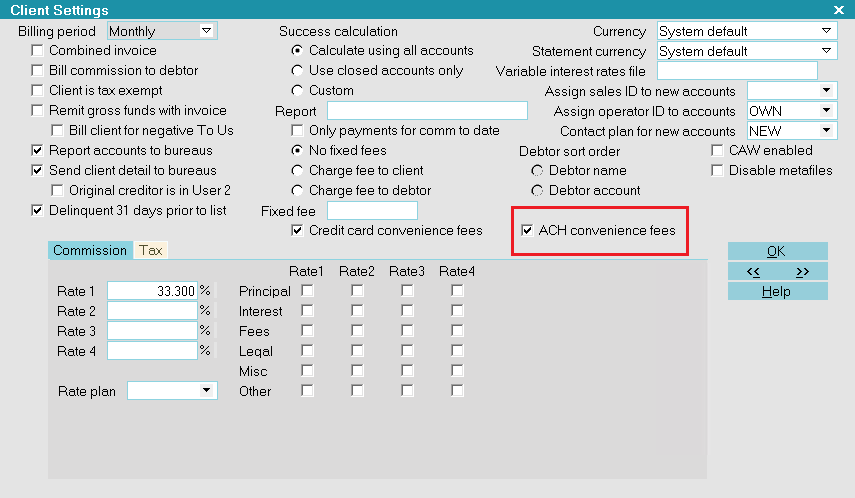

If your company is going to be charging convenience fees

to debtors for ACH payments, in addition to enabling the

feature in the ACH Setup window, you do need to enable an

indicator in each client Advanced Settings screen in order

to enable the fees for that specific client.

Click the Advanced button in the lower right corner of the

client screen and you will see a screen as follows, and

the "ACH convenience fees" switch is shown in the red box.

Client Settings screen

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

Enable

Click to switch this ON with a check mark if

you want to allow the addition of a Convenience

Fee when processing ACH payments. You must also

select a Transaction Type to use for the fee.

If you switch this ON, you must also switch ON

the "ACH convenience fees" located in the

Advanced Client Settings screen in your

client setup screens. Contact our office if

you have a volume of clients to turn on for

assistance with a handy bulk write back report

to do them all at once.

Fee

Select the Transaction Type that you want

Collect! to use for your ACH Convenience Fee.

This Transaction Code must already exist in your

list of Transaction Types and it must be a

Financial Type "Fee" with the fee amount

entered. You may wish to use the shipping

default transaction type 307.

Fee Reversal

Select the Transaction Type that you want

Collect! to use to offset previously posted

fees when a payment reversal is posted.

This Transaction Type must already exist in

your list of Transaction types and it must be

a Financial Type "Fee" with the fee amount

entered. You may wish to use the shipping

default transaction type 305.

Run Plan On Recurring

Whenever a recurring plan is setup, this plan will run

automatically.

NSF Cancels Recurring Payments

Switch this ON with a check mark to tell

Collect! to remove any future dated

"Payment" type transactions from the

Debtor's account when any recurring ACH

payments are returned NSF.

If you have enabled EFT notification,

then any pending EFT notification letters

will also be deleted.

Enable Verbose Logging

Click to switch this ON with a check mark

to enable verbose message logging to the

Application Log for troubleshooting your

Billing Tree ACH payment processes.

It is recommended to enable logging

on a new install of the module so that any

system-to-system handshaking issues are

detailed in the Application Log and

available to the Comtech and Billing Tree

technicians. Both sides will be able to

more readily identify and solve any issues

which may arise if the Log information is

available.

Posted Date Blank On Recurring

This switch provides the preference option

to either have the interface (a) write the

date the arrangement was set up into the

the Posted Date OR (b) leave the Posted Date

blank for each transaction written into the

transaction tab for a Recurring ACH

arrangement.

If you leave the switch unchecked, it will

use the date the arrangement was set up.

If you use this preference, you should also

see Company Details, "Statement uses payment

date" preference switch to decision how your

system will select which transaction date range

to include on your client Remittance

Statements: (i) the Payment Date range or the

(ii) Posted Date range. If you do not check

this Company Detail switch ON when leaving this

ACH Setup switch OFF, then a consequence would

be inclusion of ACH payments that have not taken

place yet and showing up on a single month's

client Statement/ Invoice.

If you check this switch ON, then your

Recurring ACH arrangements will be written

to the Transaction Tab with the applicable

Payment Dates and Posted Dates will remain

blank until the payment is finalized/processed

via Reconcile ACH History. At that time, the

blank Posted Date field will be updated

to be the actual Posted Date. If you use

this preference, and all your transactions

of any type contain an actual Posted Date,

then you would also want to leave the

Company Detail switch for "Statement uses

payment date" switched OFF (unchecked).

Disable EFT Confirmation Review

Click this ON with a check mark to stop Collect!

from creating the review contact that is dated

2 days before the payment is due with the description

of "Confirm EFT plan authorization."

Set No Autodelete For Contacts

Click this ON with a check mark to enable Collect!

to check the 'Do not autodelete' box on all contacts

created for Billing Tree recurring payments.

Single Fee Transaction

Switch this ON with a check mark if you want

to only post one fee transaction for the fee

amount. The payment will reflect the full

amount of the payment.

Switch this OFF if you want the system to post

the fee transaction, the a payment to fee, then

the payment transaction separately with payment

amount less the fee.

OK

Select OK to close the ACH Payments Setup

screen.

Help

Click the HELP button to be auto-navigated

to our webpage, Help Documents, for more info

on ACH Payments and related topics.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org