Transaction Type

Transaction types give you the ability to categorize transactions

for accounting and reporting. Through the Transaction Type form

you set options to control calculations, breakdown payments,

assign a specific operator and a sales person, designate a contact

plan to run, and set the commission rate. You may

view and modify existing transaction types in Collect! and

create your own new ones. By setting up transaction types

for the way you do business, you can automate many basic

aspects of posting and processing your transactions.

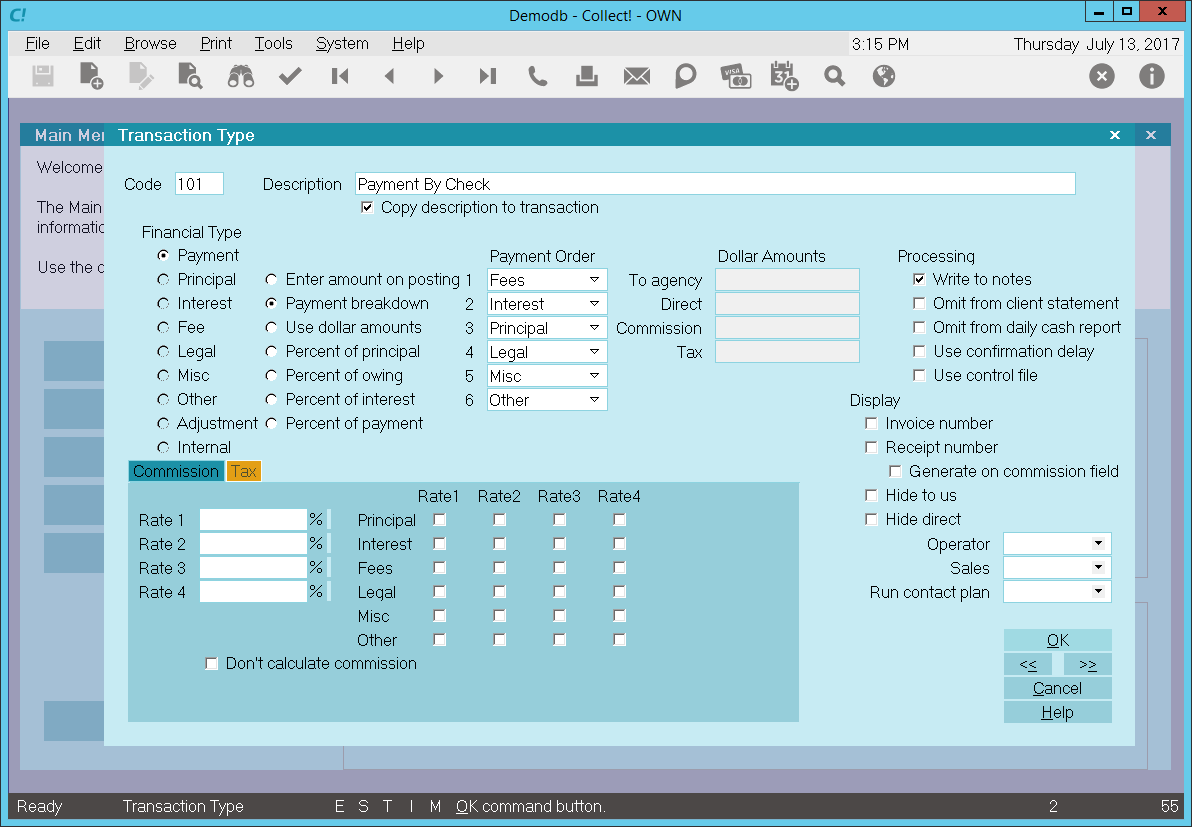

Transaction Type

The Transaction Type form displays many settings that

can be used to manage posting financial transactions

to your accounts.

Predefined Transaction Types

Collect! provides many pre-defined transaction types in the

Demonstration database for basic types of transactions you

may expect to handle. You can copy any of these to the

Masterdb database.

Transaction types are divided into groups of 100. The

actual "centenary" markers are used as a header for

the group. Although these markers have no settings,

you can reference the description when building reports.

This a handy way to provide a title for a group of

transactions on your reports.

The following list contains all the transaction types

provided for you by Collect!. Each one of these transaction

types has its own settings. These are set in the Transaction

Type for that specific Code, (e.g. 102, 303 etc.) You can

modify these if you need to or add your own, depending on

your business needs. You should seriously consider how

your business operates before making any changes to the

existing system.

100 PAYMENTS AND SYSTEM

101 Check Payment

102 Cash Payment

103 Payment Out of Court

104 Money Order Payment

105 Returned NSF Check

106 Payment of Agency NSF Fee

107 Check Payment Taken By Phone

108 Debtor Over Payment

109 Credit Card Payment

110 ACH Payment

111 Direct Payment to Client

120 Attorney Fee Payment

122 Court Cost Payment

150 Down Payment

151 Payment Plan Payment

160 Monthly Billing Amount

193 Payment Plan Initial Discount

194 Judgment Principal - don't modify

195 Judgment Interest - don't modify

196 Original Principal - don't modify

197 Original Interest - don't modify

200 LEGAL FEES

201 Court Cost Charge

202 Attorney Fees Charge

294 Judgement Legal Costs - don't modify

300 FEES

301 NSF Charge Due Agency

302 Closing Fee

303 Locate Fee

305 ACH Convenience Fee Reversal

307 ACH Convenience Fee

309 Credit Card Convenience Fee

310 Service Charge

320 Payment Plan Late Fee

340 Daily Storage Fee

350 Payment Plan Service Charge

351 Late Fee - don't modify

394 Judgement Court Costs - don't modify

397 Client Fee - don't modify

398 Debtor Fee - don't modify

399 Collection Fee - don't modify

400 INTEREST

401 Interest Adjustment

402 Accrued Compound Interest

495 Additional Judgement Interest

499 Total Accrued Interest - don't modify

500 ADJUSTMENTS

501 Adjustment by Client

502 Adjustment by Court Order

503 Adjust Judgement Principal

599 Adjustment through Upgrade - don't modify

600 INTERNAL EXPENSES

601 Agency Internal Expenditure

Code

This field shows the Code for this Transaction Type.

The Code identifies the type of transaction you are

posting. Whenever you post transactions, you pick

the Code from the list of Transaction Types and

all the settings for that type are copied into the

Transaction form.

These codes are organized in groups of 100 with

the "centenary codes", i.e. 100, 200, 300 etc.

reserved as titles for the group.

- 100 PRINCIPAL

- 101-199 Principal and Interest

- 200 LEGAL

- 201-299 Legal Expenses

- 300 OTHER

- 301-399 Other Expenses

- 400 INTEREST

- 401-499 Interest Adjustments

- 500 ADJUSTMENTS

- 501-599 Other Adjustments

- 600 INTERNAL EXPENSES

- 601-699 Agency Internal Expenses

Please note that you should leave codes 100, 200, 300, 400, 500

and 600 as titles for each group. This conveniently divides

your types and Collect! uses these in trust reports as

column headings. Use codes 101, 201, 301, 401, 501, 601 as

the starting codes for transaction types you want to list in

each group. You can also create your own groups and codes

and then create reports to reference transactions posted with

these codes.

Please note that Collect! uses the following

transaction types internally so they should

not be deleted or modified.

Please note that Collect! uses the following

transaction types internally so they should

not be deleted or modified.

194 Judgment Principal

195 Original Judgment Interest

196 Original Principal

197 Original Interest

351 Late Fee

397 Client Fee

398 Debtor Fee

399 Fee for Agency Commission

Description

This is a brief description of the Transaction Type.

For codes 100, 200, 300, 400, and 500, the Description

should be the title you want to see in your

Trust Account Report for the section that lists

transactions in each group.

Copy Description To Transaction

Switch this ON with a check mark so that whenever

you post a transaction of this Transaction Type, the

Description will automatically be copied to the

transaction's Description field.

Financial Type

The Financial Type setting determines the financial category

of each transaction. Financial types can be Payment,

Principal, Interest, Fee, Legal, Misc, Other, Adjustment, or

Internal. The dotted radio button in this column sets the

transaction's financial type. This is very important for processing

money amounts when a transaction is posted. The money

amount of the transaction will be allotted to the financial area

you choose here, that is, Payment, Principal, Interest, Fee,

Legal, Misc, Other, Adjustment or Internal.

Payment

Place a dot in this radio button to flag this Transaction

Type as a Payment. Transactions will be posted as

payments to the debtor's account and will be totaled in

the Paid field on the Debtor screen as well as being

calculated in financial statements and reports.

Principal

Place a dot in this radio button to flag this Transaction

Type as Principal. Transactions will be posted as principal

to the debtor's account and will be totaled in the Principal

field on the Debtor screen as well as being calculated

in financial statements and reports.

Interest

Place a dot in this radio button to flag this Transaction

Type as Interest. Transactions will be posted as interest to

the debtor's account and will be totaled in the Interest field

on the Debtor screen as well as being calculated in financial

statements and reports.

Debtor's total interest is Original Interest plus any

Accrued Interest minus any positive transactions posted

to the debtor's Interest account.

Fee

Place a dot in this radio button to flag this Transaction

Type as a Fee. Transactions will be posted as fees to

the debtor's account and will be totaled in the Fees field

on the Debtor screen as well as being calculated in

financial statements and reports.

Fees = all transactions posted to the debtor's

Fee account.

To charge a fee, post the amount as a debit to the

debtor's Fee account. To post a debtor payment to cover

a fee, post the amount as a credit to the debtor's Fee

account.

Legal

Place a dot in this radio button to flag this Transaction

Type as a Legal Fee. Transactions will be posted as

legal fees to the debtor's account and will be totaled in

the Legal Fees field on the Debtor screen as well as

being calculated in financial statements and reports.

Misc

Place a dot in this radio button to flag this Transaction

Type as Miscellaneous. Transactions will be posted

as miscellaneous transactions to the debtor's account

and will be totaled in the Miscellaneous field on the

Debtor screen as well as being calculated in financial

statements and reports.

Other

Place a dot in this radio button to flag this Transaction

Type as an Other type. Transactions will be posted in

the Other category on the debtor's account and will be

totaled in the Other Charges field on the Debtor screen

as well as being calculated in financial statements

and reports.

Adjustment

Place a dot in this radio button to flag this Transaction

Type as an Adjustment. Transactions will be posted

as adjustments to the debtor's account and will be

totaled in the Adjustments field on the Debtor screen

as well as being calculated in financial statements

and reports.

Adjustments = all transactions posted to the

debtor's Adjustment account.

Posting a credit to the account reduces the debtor's

Owing. A debit increases the debtor's Owing.

Internal

Place a dot in this radio button to flag this Transaction

Type as Internal. Transactions will be posted to the

debtor's account for tracking purposes. However, the

amount will not affect either the Debtor's totals or the

Client's Commission or Return.

The Internal transaction type is used for

tracking internal agency expenses

connected with a particular account. These

expenses are borne entirely by the agency

and do not affect either the Debtor or Client

financials in any way.

The Internal transaction type is used for

tracking internal agency expenses

connected with a particular account. These

expenses are borne entirely by the agency

and do not affect either the Debtor or Client

financials in any way.

Enter Amount On Posting

If you place a dot in this radio button, when each

transaction is posted, the user must fill in the

amount of the transaction.

Payment Breakdown

This function enables you to post payments broken

down into to Fees, Interest, Principal, Legal, Misc

and Other. Place a dot in this radio button to select

this option.

When you enable Payment Breakdown, additional fields

become visible where you can select the order that

you want to use for distributing the payment amount.

By default, Collect! posts to Fees, then Interest,

and finally to Principal. You can change this order and

optionally add additional breakdown order for Legal,

Misc and Other financial types. Please refer to the section

below on Payment Breakdown and Compound Interest for

further details.

WARNING: This is the only type that can use the multi-rate

settings with commission. Enter Amount on Posting,

Use Dollar Amounts, and the Percentage Of types

will only use Rate 1 for the commission amount.

WARNING: This is the only type that can use the multi-rate

settings with commission. Enter Amount on Posting,

Use Dollar Amounts, and the Percentage Of types

will only use Rate 1 for the commission amount.

Use Dollar Amounts

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the dollar amount of the transaction (as a number

from 1 to 100.). When the user posts a transaction of

this Transaction Type, the dollar amount will automatically

be copied to the correct field on the transaction.

Remember that a positive amount is a

credit to the account!

Remember that a positive amount is a

credit to the account!

Percent Of Principal

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Principal of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percentage and the amount will automatically be copied

to the correct field on the transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

Percent Of Owing

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Owing of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percentage and the amount will automatically be copied

to the correct field on the transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

Percent Of Interest

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Interest of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percent of any Accrued Interest and the amount will

automatically be copied to the correct field on the

transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

For example, we created a 499 Transaction Type

with Account Interest, 'Percent of interest' turned on,

and -100 in the To Us field. This takes any current

Accrued Interest on the account and posts it as a

transaction.

Combining this with the Edit Contact Event

to roll forward the 'Calculate interest from

date' in the Financial Detail form, you can

create interesting and very powerful

automation effects. For an example, please

refer to Help topic,

Accrued Interest - Tracking Month by Month.

Combining this with the Edit Contact Event

to roll forward the 'Calculate interest from

date' in the Financial Detail form, you can

create interesting and very powerful

automation effects. For an example, please

refer to Help topic,

Accrued Interest - Tracking Month by Month.

Percent Of Payment

When you place a dot in the radio button to select this

option, four additional fields appear, labeled To agency,

Direct, Commission and Tax. In the appropriate field,

enter the Percent of Payment of the transaction (as a

number from 1 to 100.) When the user posts a transaction

of this Transaction Type, Collect! will calculate the correct

percentage based on the value in the Payment Amount

field in the Debtor's Financial Details and the amount will

automatically be copied to the correct field on the transaction.

Remember that a positive percent is a

credit to the account!

Remember that a positive percent is a

credit to the account!

Payment Order

These fields are visible only when you have

selected "Payment breakdown." These fields allow

you to choose the order in which Collect! will apply

the payment amount to the debtor's account when a

transaction of this Transaction Type is posted. Select

the down arrow to view a pick list where you can

choose Fees, Interest, Principal, Legal, Misc or Other.

You can also select a blank [-] from the pick list to limit

your breakdown to fewer than the six financial

type categories.

1

Select the down arrow next to this field to choose

the first category to pay off when applying payments

of this Transaction Type to the debtor's account.

2

Select the down arrow next to this field to choose

the second category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first choice.

3

Select the down arrow next to this field to choose

the third category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first two choices.

4

Select the down arrow next to this field to choose

the fourth category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first three choices.

5

Select the down arrow next to this field to choose

the fifth category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first four choices.

6

Select the down arrow next to this field to choose

the sixth category to pay off when applying payments

of this Transaction Type to the debtor's account.

Select a blank [-] to limit your breakdown to your

first five choices.

Dollar Amounts

You can enter amounts in this area when you select "Use

dollar amounts." Enter the actual dollar amount in the

appropriate field. Collect! will use this amount whenever

you post a transaction of this type.

Remember that a positive dollar amount

is a credit to the debtor's account.

Remember that a positive dollar amount

is a credit to the debtor's account.

To Agency

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent

for this Transaction Type. Enter an amount or percent

that will automatically be copied to the To Agency field

when creating a transaction of this Transaction Type.

Direct

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent for

this Transaction Type. Enter an amount or percent that

will automatically be copied to the Direct field

when creating a transaction of this Transaction Type.

Commission

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent for

this Transaction Type. Enter an amount or percent that

will automatically be copied to the Commission field

when creating a transaction of this Transaction Type.

The Commission tab contains many fields for

setting commission rates if you want to set

them at the Transaction Type level. Please

see Commission and Tax Calculations

below.

The Commission tab contains many fields for

setting commission rates if you want to set

them at the Transaction Type level. Please

see Commission and Tax Calculations

below.

Tax

You can enter amounts in this field when you have

chosen to enter an actual dollar amount or percent for

this Transaction Type. Enter an amount or percent that

will automatically be copied to the Tax field when

creating a transaction of this Transaction Type.

The Tax tab contains many fields for setting

tax rates if you want to set them at the

Transaction Type level. Please

see Commission and Tax Calculations

below.

The Tax tab contains many fields for setting

tax rates if you want to set them at the

Transaction Type level. Please

see Commission and Tax Calculations

below.

Processing

Several switches can be set to determine how you

will handle the reporting aspects when transactions

of this Transaction Type are posted.

Write To Notes

Switch this ON with a check mark if you want Collect!

to write a note to the debtor's Notes whenever a

transaction of this type is posted.

Omit From Client Statement

Switch this ON with a check mark if you want Collect!

to exclude transactions of this type when the client

statement is generated for each period. You can

override this when a particular transaction is being

posted, if needed.

Omit From Daily Cash Report

Switch this ON with a check mark if you want Collect!

to exclude transactions of this type when you print

your Daily Cash report. You can override this when

a particular transaction is being posted, if needed.

Use Confirmation Delay

Switch this ON to delay reporting transactions posted

with this Transaction Type. This is useful for allowing

time for a check to clear. The number of days delayed

is taken from the Payment Posting Options form.

Please refer to How to Use Confirmation Delay of Transactions

for details.

Use Control File

Switch this ON with a check mark to tell Collect! to run a

control file whenever a transaction is posted using this

Transaction Type. When this switch is enabled, a "control file"

field becomes visible where you can enter the name of the

control file you want to use.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

When enabled, Collect! will not perform any transaction breakdown

for payments. It is assumed that all financial calculations are

handled in the control file.

Control File

Enter the name of the control file you want Collect! to run

whenever a transaction is posted using this Transaction.

Collect! will add the ".ctf" extension.

The control file you enter here will be automatically entered

into the "Control file" field whenever you create a transaction

using this Transaction Type.

This field is only visible when the "Use control file" switch

is enabled.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

Display

Several switches can be set to determine what fields

you display when posting a transaction of this

Transaction Type and to automatically generate

invoice and receipt numbers.

Invoice Number

Switch this ON with a check mark if you want Collect!

to automatically assign an Invoice Number to

transactions of this type.

Invoice Numbers need these requirements:

1. This switch must be turned ON with a check mark.

2. The transaction must be posted as "Fees."

3. The amount posted must be a negative amount (debit)

To Agency or Direct, or must be a positive (credit)

Commission amount.

If these conditions are not met, Collect does not assign

an Invoice Number even if the switch is ON.

The Invoice Number is determined by adding

one to the highest numbered invoice already

in Collect!. You can change an existing

Invoice Number so that Collect! will start at a

number of your choice.

The Invoice Number is determined by adding

one to the highest numbered invoice already

in Collect!. You can change an existing

Invoice Number so that Collect! will start at a

number of your choice.

Receipt Number

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers need these requirements:

1. This switch must be turned ON with a check mark.

2. The transaction must be posted to the Payment

account.

3. The amount posted must be a positive payment (credit)

To Agency.

If these conditions are not met, Collect will not assign

a Receipt Number even if the switch is ON.

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission Field."

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission Field."

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

Generate On Commission Field

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers will be generated if:

1. The "Receipt Number switch is also ON."

2. The transaction must be posted to the Payment

account.

3. The transaction must be posted as a positive

amount (credit) to Commission.

Hide To Us

Switch this ON with a check mark to hide the "To Us" field

whenever this Transaction Type is selected.

Use this switch if you want to organize your transaction

types according to Direct or To Us payments. This

function simplifies work for the user, as they don't have

to decide whether to post the transaction in the To Us

or Direct field.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Hide Direct

Switch this ON with a check mark to hide the "Direct" field

whenever this Transaction Type is selected.

Use this switch if you want to organize your transaction

types according to Direct or To Us payments. This

function simplifies work for the user, as they don't have

to decide whether to post the transaction in the To Us

or Direct field.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Switch ON both the "Hide To Us" and "Hide

Direct" to force the User to post to

Commission. This is useful, at times, for

posting fees and prepayment amounts.

Commission And Tax Calculations

Several switches can be set to determine how you will

handle calculations relating to transactions of this

Transaction Type. You can set several rates and

also apply the rates to different financial types.

Please refer to Help topic, Commission and

Help topic, Tax for details.

Rates set in these areas are used when a

transaction of this Transaction Type is posted. These

rates override the debtor's Commission Rate or Rate

Plan which would ordinarily be used to calculate

commission for a payment.

Rates set in these areas are used when a

transaction of this Transaction Type is posted. These

rates override the debtor's Commission Rate or Rate

Plan which would ordinarily be used to calculate

commission for a payment.

Don't Calculate Commission

Switch this ON with a check mark to tell Collect!

NOT to calculate commission whenever a transaction

of this type is posted. You can override this when a

transaction is being posted, if needed.

Don't Calculate Tax

Switch this ON with a check mark to tell Collect!

NOT to calculate tax whenever a transaction of this

type is posted. You can override this when a

transaction is being posted, if needed.

Operator

Select the down arrow, or press F2, to view the list

of Operators. A choice in this field forces the

transaction to be posted to the Operator ID selected.

This is useful for transactions that you don't want

included in the standard Operator commission reports.

For example, payments to pre-collect accounts should

probably be assigned to either the system or to

management, to avoid inclusion in any particular

operator's Transaction Summary Reports.

Sales

Select the down arrow, or press F2, to view the list

of Operators. A choice in this field forces the

transaction to be posted to the Sales ID selected.

This is useful for transactions that you don't want

included in the standard Operator commission reports.

For example, payments to pre-collect accounts should

probably be assigned to either the system or to

management, to avoid inclusion in any particular

operator's Transaction Summary Reports.

Run Contact Plan

Select the down arrow, or press F2, to view the list

of Contact Plans. Select a contact plan to run when

a Transaction of this Type is posted. The contact

plan displayed is this field will run automatically as the

transaction is saved. This is useful for setting up custom

contact schedules that depend on the type of payment

or debit posted.

POST PAYMENT SEQUENCE

When you post payments with contact plans, the

sequence of events is as follows.

1. A transaction record is created.

2. Debtor totals are recalculated.

3. The Transaction Type specific Contact Plan is run.

4. The default Payment Posting Contact Plan is run,

if there is one set up in Payment Posting Options.

This plan is run BEFORE any Contact Plan

you set up in the Payment Posting Options

form. This is due to the fact that the

transaction plan may do more processing

like posting a reversal to split the payment

across a group, which will alter the OWING

amount.

This plan is run BEFORE any Contact Plan

you set up in the Payment Posting Options

form. This is due to the fact that the

transaction plan may do more processing

like posting a reversal to split the payment

across a group, which will alter the OWING

amount.

Delete

This button is visible only on the list of all Transaction

Types. Select this to delete the highlighted item from

the list.

Edit

This button is visible only on the list of all Transaction

Types. Select this to open and modify the highlighted

Transaction Type.

New

This button is visible only on the list of all

Transaction Types. Select this to open a new

blank Transaction Type form.

Help

Select this button for help on the Transaction Type

form and links to related topics.

Cancel

Select this button to ignore any changes you may

have made and return to the previous form.

OK

Select this button to save any changes you have

made and return to the previous form.

<<

Select this button to navigate to the

previous record in the database.

>>

Selecting this button to navigate to the

next record in the database.

Payment Breakdown And Compound Interest

When you use Compound Interest you MUST post the

Original Principal amount as a Transaction Type 196.

When posting payments, transaction types MUST have

the Payment Breakdown option set so that Collect! can,

by default deduct, fees first, then accrued interest,

and finally principal. You may adjust this payment

breakdown order when creating your Payment Breakdown

transaction types. Please be sure you know what you

are doing if you deviate from the default order, i.e.

Fees, then Interest, then Principal.

Results of the payment disbursement will be reflected in

several areas of the Financial Detail form accessed by

selecting the Principal or Interest field on the Debtor form.

Selecting the Owing field will display the

Debtor Financial Summary. Selecting the other

financial fields will display the Debtor Transaction Summary.

Selecting the Owing field will display the

Debtor Financial Summary. Selecting the other

financial fields will display the Debtor Transaction Summary.

Compound interest calculations produce a

running balance of principal, interest, fees and

adjustments. When using Compound Interest, you

MUST post transactions using Payment Breakdown.

Payment breakdown also works with Simple Interest

as well as Compound Interest.

Compound interest calculations produce a

running balance of principal, interest, fees and

adjustments. When using Compound Interest, you

MUST post transactions using Payment Breakdown.

Payment breakdown also works with Simple Interest

as well as Compound Interest.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org