How To Report A Settlement To The Credit Bureau

Below you will find the correct method of reporting a Settlemen in Full (SIF) to the credit bureaus to ensure that:

* You are compliant as a data furnisher under the most current version of the METRO2 Guidelines

* Consumers do not have meritorious grounds to pursue you legally, claiming 'damages' because of an

incorrectly updated or an incorrectly reported paid collection

If your site reports SIF accounts as Paid in Full (PIF) after adjusting the balance to zero,

the following would not apply. This is strictly for sites that distinguish between PIF and

SIF and report these as two distinct types of paid collections to the credit bureaus.

If your site reports SIF accounts as Paid in Full (PIF) after adjusting the balance to zero,

the following would not apply. This is strictly for sites that distinguish between PIF and

SIF and report these as two distinct types of paid collections to the credit bureaus.

The following represents the full series of steps that are required to get a SIF accurately to the credit bureau(s).

WARNING: Order of Operations DOES Matter!

WARNING: Order of Operations DOES Matter!

1. Post your SIF payment as normal.

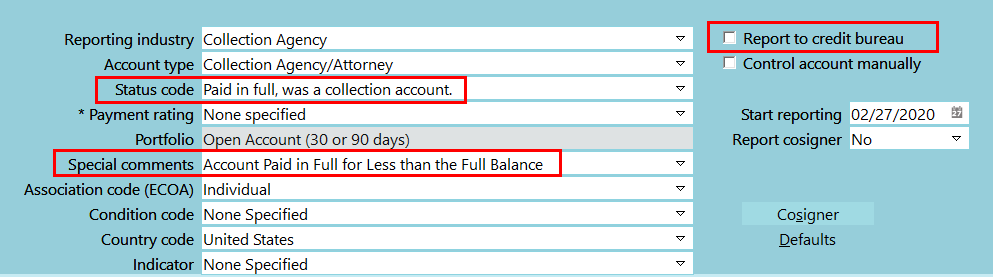

2. Click into your CBR tab on the account and select the drop-down menu beside the label Special comments.

a. From the pick list displayed, select Account Paid in Full for Less than the Full Balance.

b. Exit the CBR tab without changing anything else.

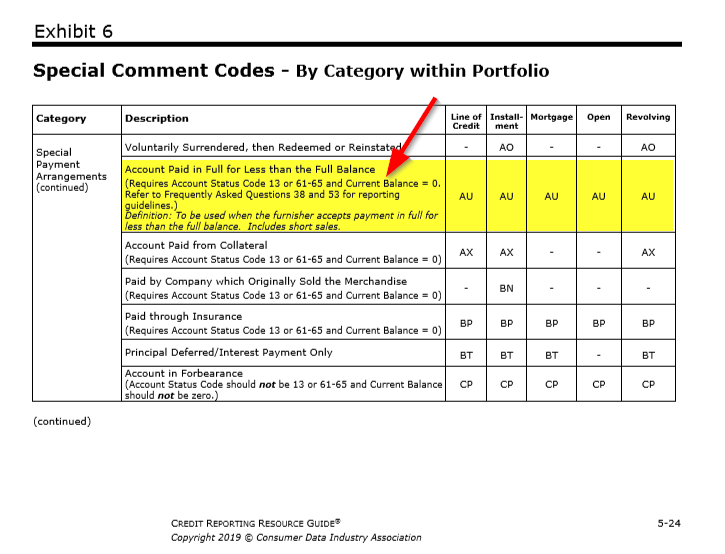

c. This will create a Metro2 Contact event In Progress that evidences an SC (Special Comments) code of AU.

Pandemic Special Comments Code AW (Affected by Natural or Declared Disaster) can be removed at this

juncture if it was in place because the account is being reported as paid in full for less than the full balance.

Pandemic Special Comments Code AW (Affected by Natural or Declared Disaster) can be removed at this

juncture if it was in place because the account is being reported as paid in full for less than the full balance.

3. Return to the Transactions Tab and post a transaction with Financial Type Adjustment to zero out the balance.

a. This will modify the In Progress Metro2 so that the AS code changes from 93 to 62.

b. It will turn OFF the account from future CBR reporting.

This can be blended into your SIF contact plan for process efficiency.

This can be blended into your SIF contact plan for process efficiency.

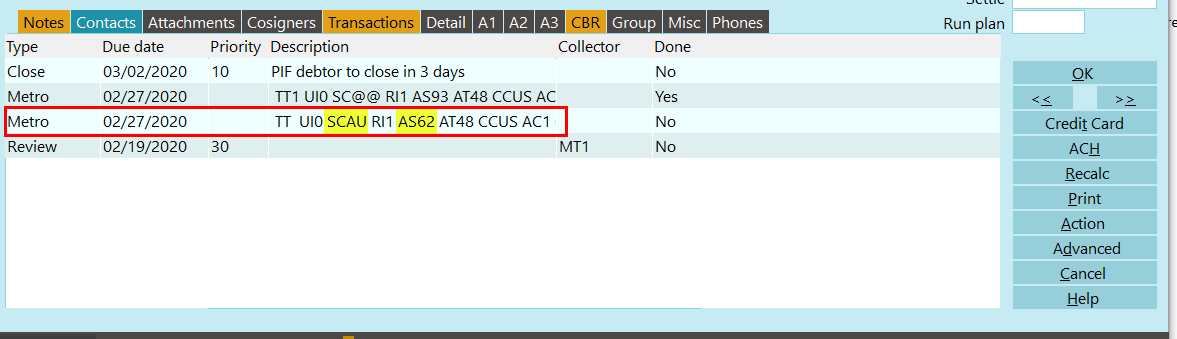

The resultant Metro2 Contact would appear as below. The AS62 identifies Paid in Full

and the SCAU modifies that context to mean 'for less than the full balance'.

Metro Contact with AS62 and SCAU

The CBR tab would appear as follows. Note that the Report to credit bureau switch is now OFF.

This happened automatically when the Adjustment was posted and the Owing zeroed out.

CBR Tab

The METRO2 stipulation which requires this is as below.

Exhibit 6 of the Metro2 Guide

If your site is the Creditor (first party collections), there may be need of a different Account Status (AS)

code besides the 62. They are defined as follows:

| AS Code | Metro2 Description |

| 13 | Paid in full |

| 61 | Paid in full; voluntary surrender |

| 62 | Paid in full; collection account or claim |

| 63 | Paid in full; was a repossession |

| 64 | Paid in full; was a charge off |

| 65 | Paid in full; a foreclosure was started |

For internal inventory management purposes, other events that sites may choose to execute in their SIF Contact Plans are:

* Write a noteline that the account is SIF

* Update the Collect! status code to SIF

* Send Release Letter (optional/agency preference)

* If you have a global PIF Contact Plan in your Payment Posting Options that is set to automatically run on

all accounts which attain a zero Owing, you do not need to add a Close event; the PIF Contact Plan will run by

itself when the Adjustment posts and already includes a Close Mode event as part your site's workflow, if applicable.

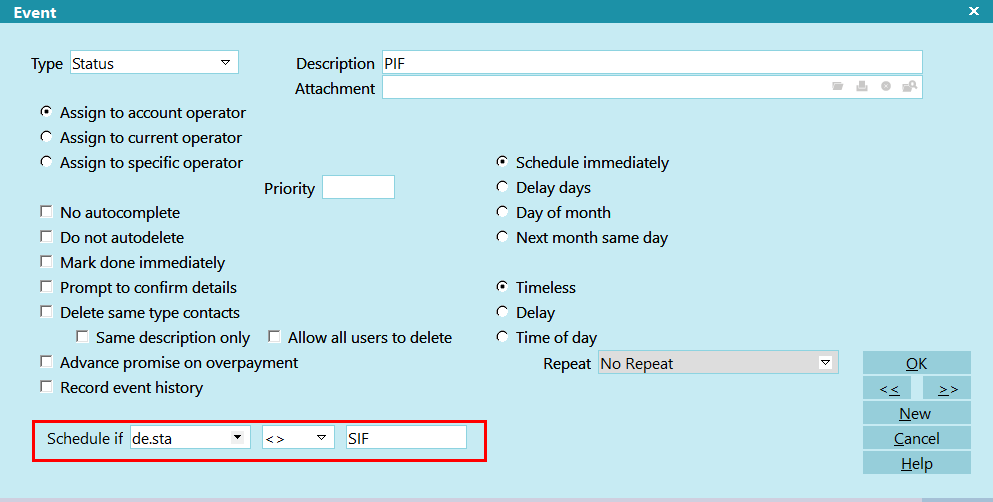

If your Default Payment Options Contact Plan is PIF, you can add a Schedule IF condition on the Status Event

so that your SIF status is not changed if it was on the account prior to the Adjustment to zero the

Owing being processed.

If your Default Payment Options Contact Plan is PIF, you can add a Schedule IF condition on the Status Event

so that your SIF status is not changed if it was on the account prior to the Adjustment to zero the

Owing being processed.

Schedule If on Debtor Status

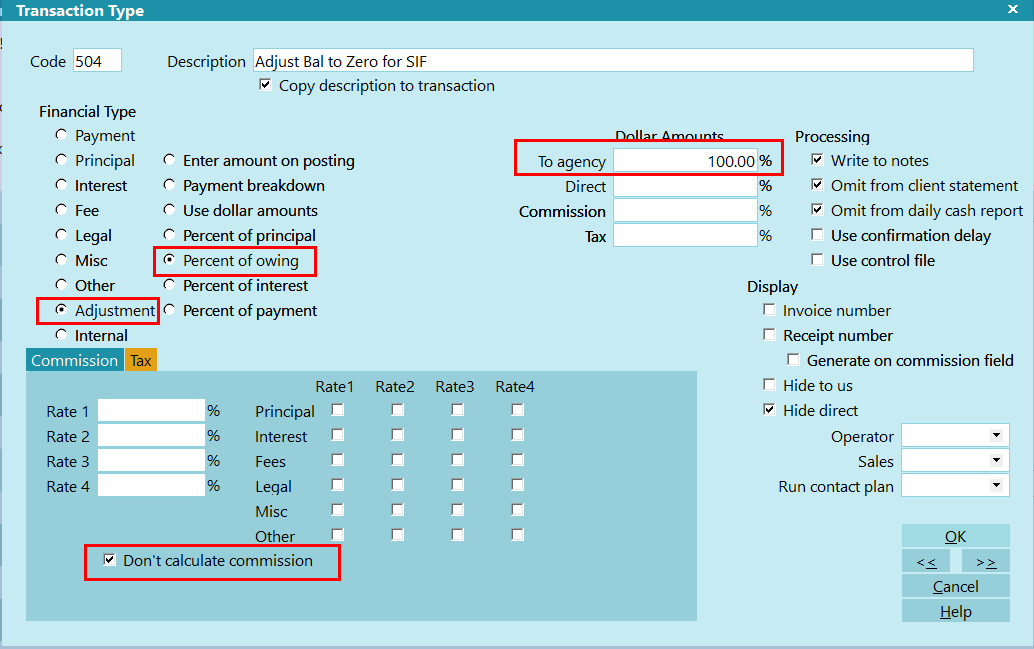

* Post a credit adjustment for 100% of owing (Step 3 for CBR reporting of SIF), set up as follows:

Adjustment Transaction Type Example

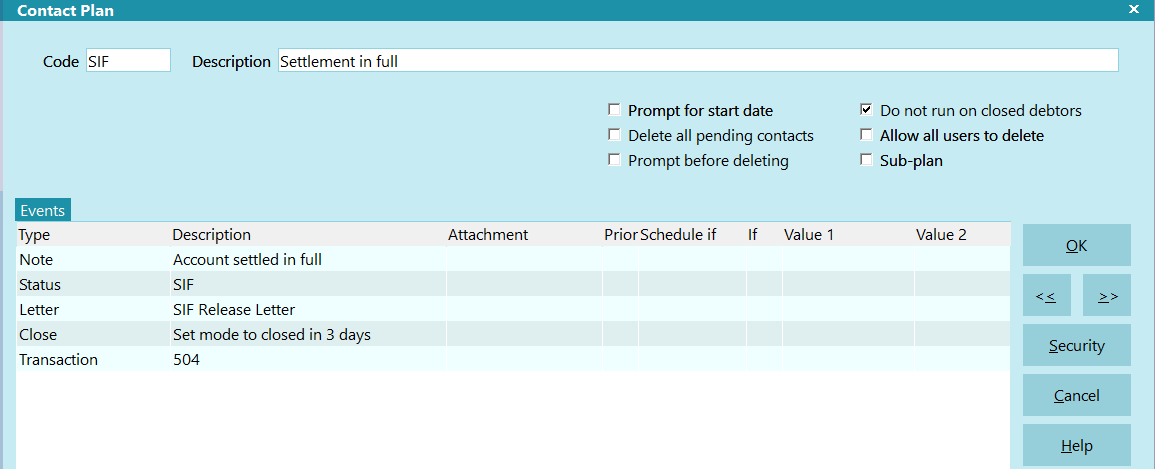

An example Contact Plan would look like the following:

Example SIF Contact Plan

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org