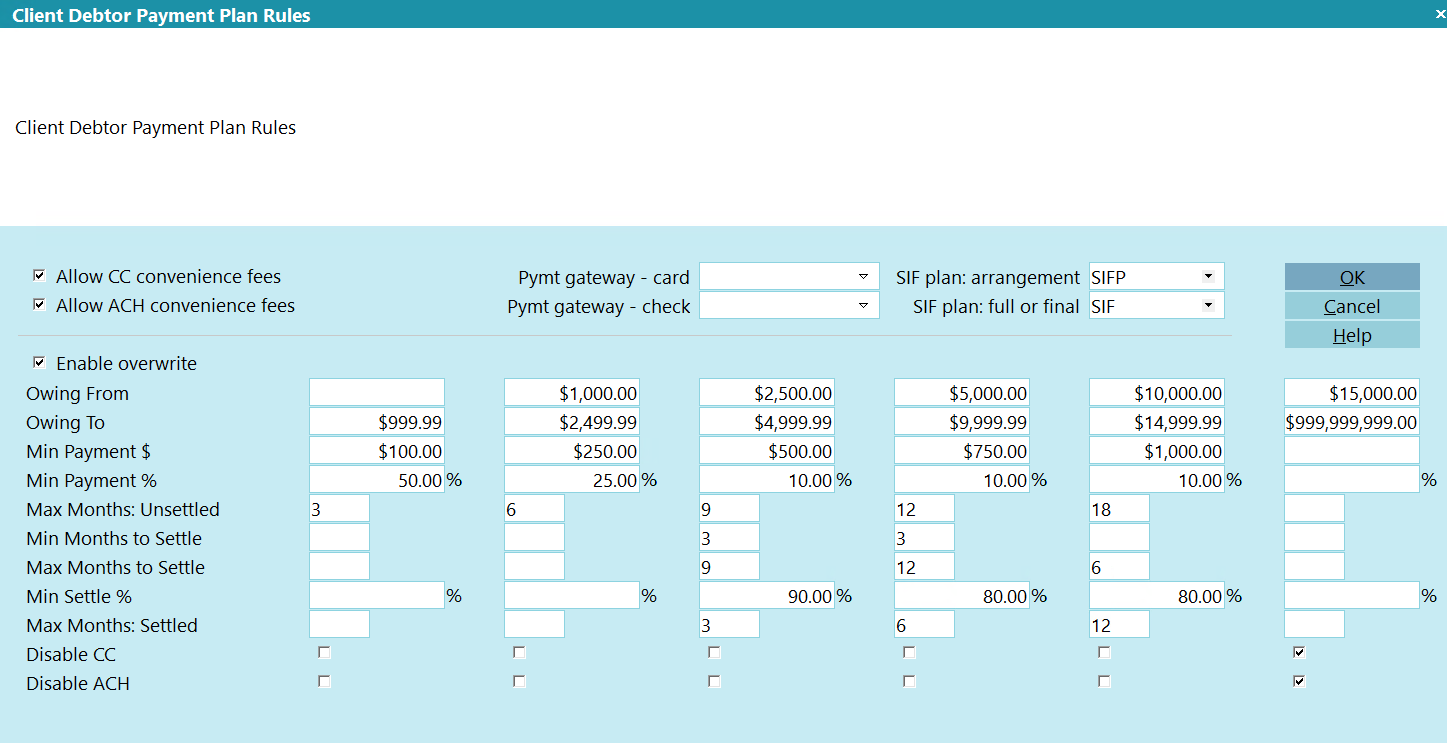

Client Debtor Payment Plan Rules

The Client Debtor Payment Plan Rules screen is where you

can define overrides to the rules for the Debtor Consumer

portal for payment plans and settlements.

This form is accessed via the "Dbtr Portal" button in the

bottom right corner of the Client Settings form.

Client Debtor Payment Plan Rules

Allow CC Convenience Fees

Check this box ON to allow convenience fees to be charged

on credit/debit card type payments taken for this client.

This option is enabled on a client-by-client basis.

This option is enabled on a client-by-client basis.

Allow ACH Convenience Fees

Check this box ON to allow convenience fees to be charged

on ACH/check type payments taken for this client.

This option is enabled on a client-by-client basis.

This option is enabled on a client-by-client basis.

Pymt Gateway - Card

If you have several payment gateways configured for different

areas or trust accounts, such as state-by-state, then you can

define which card gateway to use for this client; otherwise,

leave it blank.

Pymt Gateway - Check

If you have several payment gateways configured for different

areas or trust accounts, such as state-by-state, then you can

define which chekc gateway to use for this client; otherwise,

leave it blank.

Enable Overwrite

Check this box ON to override the global rules defined on

the Debtor Portal Payment Plan Rules form.

WARNING: ALL rules are overridden, including 0.00 values,

so make sure that everything is configured as expected.

WARNING: ALL rules are overridden, including 0.00 values,

so make sure that everything is configured as expected.

If your payment plan rules are the same as the global

settings, but your settlement rules are based on the

client, then you can use a Control File or Writeback

Report to keep the payment plan rules in sync.

If your payment plan rules are the same as the global

settings, but your settlement rules are based on the

client, then you can use a Control File or Writeback

Report to keep the payment plan rules in sync.

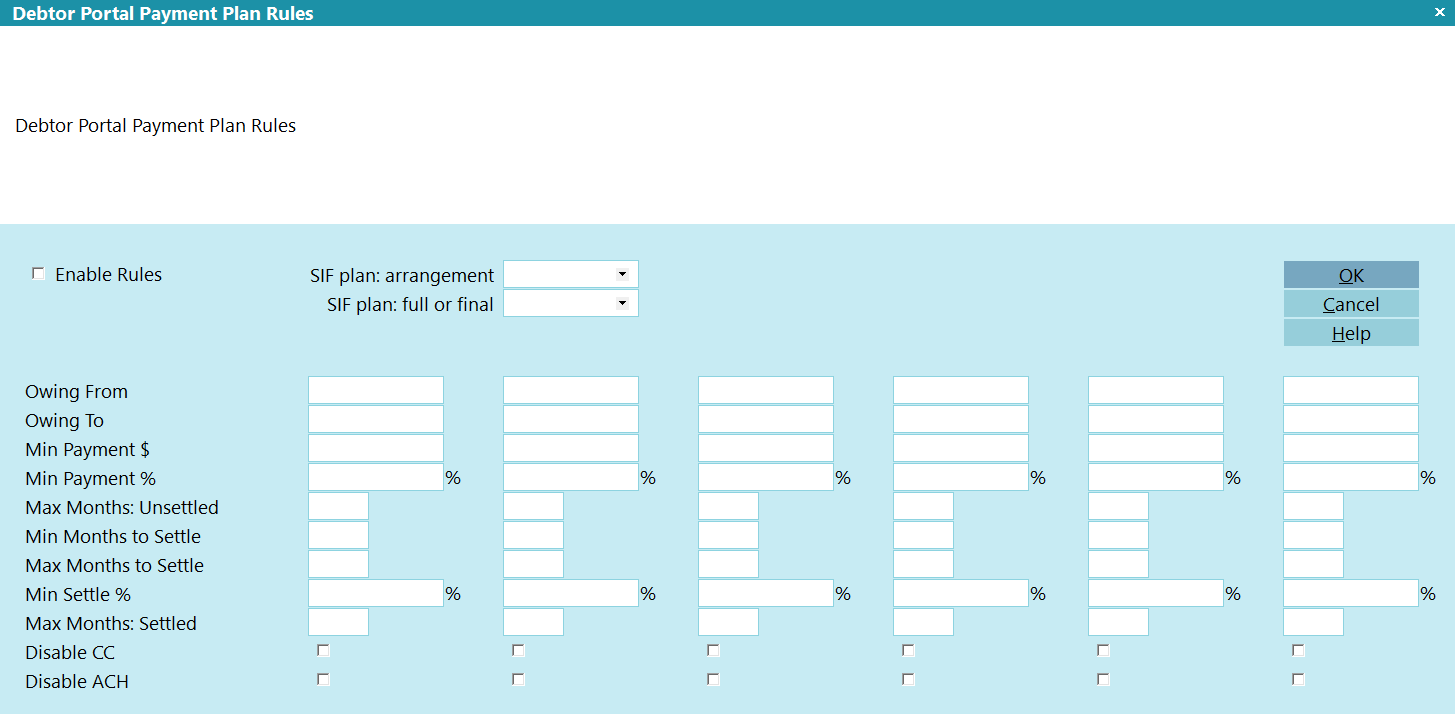

Debtor Portal Payment Plan Rules Form

The remaining fields the Client Debtor Payment Plan Rules form are

identical to the ones on the Debtor Portal Payment Plan Rules

form.

Click Here to View this Form.

Click Here to Close this Form.

The Debtor Portal Payment Plan Rules screen is where you

can define rules for the Debtor Consumer portal for payment

plans and settlements.

This form is accessed via the menu path "System\Preferences\Payment

Processing Setup\Debtor Portal Rules".

Debtor Portal Payment Plan Rules

Rules are defined here globally. You can then enable

overrides on a client-by-client basis.

You can even leave all the rules blank here, and only

set them on a client-by-client basis.

You can even leave all the rules blank here, and only

set them on a client-by-client basis.

Enable Rules

Check this box ON to enable the rules feature. Even if

nothing else is defined here, this box must still be set.

SIF PLAN: ARRANGEMENT

Enter a Contact Plan to run when a payment arrangement

is created.

SIF PLAN: FULL OR FINAL

Enter a Contact Plan to run when a Settle in Full occurs

in a single payment, or when the final payment of a payment

arrangement is processed.

WARNING: In order to prevent a race condition where the

Contact Plan will run before the final payment,

the SIF Plan will be scheduled for the day

following the final payment.

WARNING: In order to prevent a race condition where the

Contact Plan will run before the final payment,

the SIF Plan will be scheduled for the day

following the final payment.

Payment Plan and Settlement Rules

The following section has 6 possible ranges of rules. Not

all ranges need to be used, but the Owing From and Owing To

values should cover 0.00 to 999,999,999.00.

Owing From

Enter the lower boundary for this range.

Owing To

Enter the upper boundary for this range.

WARNING: If you overlap boundaries, such as 0.00 to 1,000.00

and 1,000.00 to 2,500.00, then the lower rules will

be used. To prevent this, use the boundary, less

a penny. For example: 0.00 to 999.99 and 1,000.00

to 2,499.99, or 0.00 to 1,000.00 and 1,000.01 to

2,500.00.

WARNING: If you overlap boundaries, such as 0.00 to 1,000.00

and 1,000.00 to 2,500.00, then the lower rules will

be used. To prevent this, use the boundary, less

a penny. For example: 0.00 to 999.99 and 1,000.00

to 2,499.99, or 0.00 to 1,000.00 and 1,000.01 to

2,500.00.

Minimum Payment Dollar

When setting up a payment plan, this is the minimum dollar value

of a payment in a month. Enter the minimum payment amount for

a month.

This value is compared to the calculated value from Minimum

Payment Percentage and the higher of the 2 values is used.

This is a monthly value, so a value of $100, with

a weekly payment plan would mean a minimum payment

of $50 per week.

This is a monthly value, so a value of $100, with

a weekly payment plan would mean a minimum payment

of $50 per week.

Minimum Payment Percentage

When setting up a payment plan, this is the minimum percentage value

of a payment in a month. Enter the minimum payment percentage for

a month.

This value is compared to the value from Minimum Payment Dollar

and the higher of the 2 values is used.

MAXIMUM MONTHS: UNSETTLED

This field applies to payment plans that are not part of a

settlement.

Enter the maximum number of months that a payment plan can

go on for.

This is number of months, not number of payments, so

a value of 12 on a weekly payment plan would be a

maximum of 52 payments.

This is number of months, not number of payments, so

a value of 12 on a weekly payment plan would be a

maximum of 52 payments.

Minimum Months Before Offering Settlement

Enter the number of months after the Debtor's Listed Date

before a settlement can be offered.

If the value is 0, then settlements will be available

immediately after placement.

Maximum Months To Offer Settlement

Enter the number of months after the Debtor's Listed Date

where settlement options will be available to the Debtor.

If the value is 0, then settlements will be available

indefinitely.

Minimum Settlement Percentage

Enter the lowest percentage amount that an account can be

settled for. For example, if the value is 80%, then the

account cannot be settled for less than 80%.

If the value is 0.00, then settlements will be disabled.

MAXIMUM MONTHS: SETTLED

This field applies to payment plans that are part of a

settlement.

Enter the maximum number of months that a payment plan can

go on for.

Disable CC

Check this box ON to disable credit/debit card payments.

You can use this to disable card payments on balances

over a certain amount to avoid high convenience fees.

You can use this to disable card payments on balances

over a certain amount to avoid high convenience fees.

Disable ACH

Check this box ON to disable ACH/check payments.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org