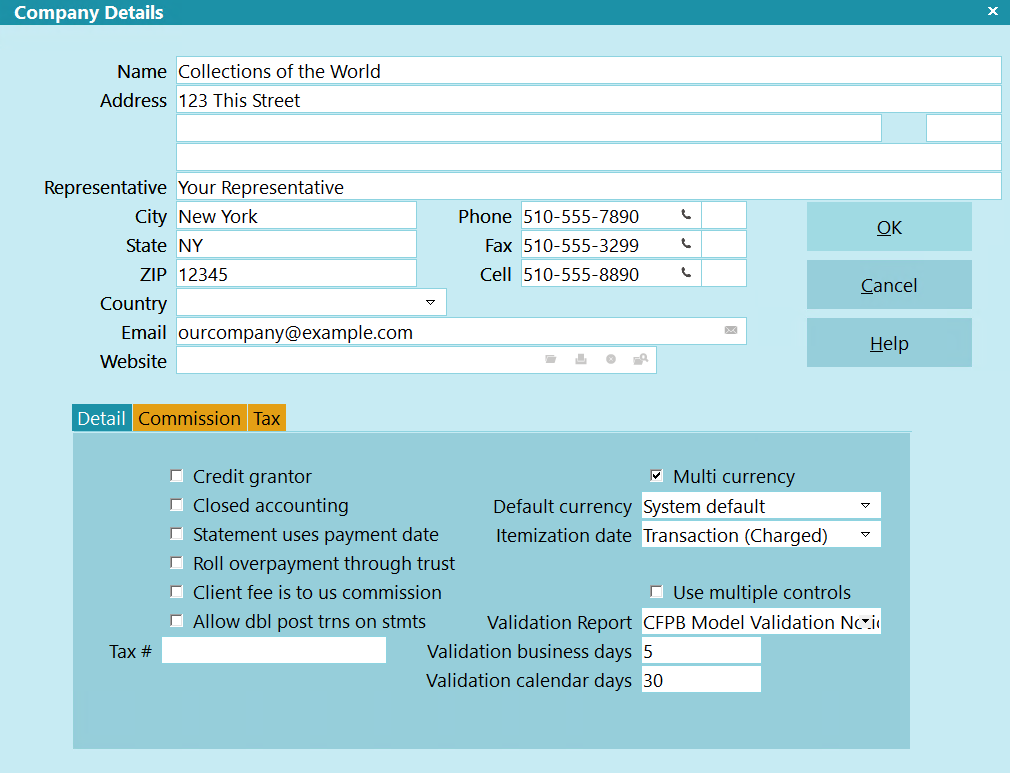

Company Detail

This section of the Company Details form enables you

to enter several settings at the global level to be used by

Collect! for calculations and reporting. These are

described below.

Company Details

Credit Grantor

This switch is used for credit reporting and changes some

functionality on the debtor records. Switch it ON with a

check mark if you are a Credit Grantor. Leave it OFF if you

are operating a Collection Agency.

If you are unsure, please leave this switched OFF, or check

with your CBR representative to verify whether or not you

are reporting as a Credit Grantor. Many aspects of Collect!'s

financial calculations and credit reporting depend on this

switch being set accurately.

With this switch checked, the following areas are affected:

- Collect! will handle Delinquent Dates automatically

when posting transactions.

- Whenever an account is recalculated, Collect! will add a

line to the notes of any debtor with revolving compound

interest set to Amortized. This note line will display

the dollar value to bring the account to current.

- Collect! will use the 30/60/90 values shown for the

Debtor when setting the Credit Reporting status of

the account. These are visible when 'Show 30/60/90'

is switched ON in the debtor's Financial Detail form.

- The debtor information output to file for credit bureau

reporting will follow the specifications for reporting as

a Credit Grantor.

FOR CBR: When the Credit Grantor switch is ON, you

may go into Client Settings and switch OFF 'Send

client details to bureaus' as this is not required when

you are reporting as a credit grantor.

Collect! allows 2 types of reporting:

Credit Grantor and Collection Agency (default).

In Company Details, if you DON'T check Credit Grantor

box in the Detail tab, then you are reporting as a

Collection Agency. If you DO check Credit Grantor,

the software will ALSO check the box in

Credit Bureau Setup for 'Report as credit grantor'.

This Industry indicator in the Company Details

automatically controls the report output so that

instead of reporting Trade Line information as a

Credit Grantor, a Collection Agency is reporting

the fields that go into the Public section

of a credit report.

Collect! allows 2 types of reporting:

Credit Grantor and Collection Agency (default).

In Company Details, if you DON'T check Credit Grantor

box in the Detail tab, then you are reporting as a

Collection Agency. If you DO check Credit Grantor,

the software will ALSO check the box in

Credit Bureau Setup for 'Report as credit grantor'.

This Industry indicator in the Company Details

automatically controls the report output so that

instead of reporting Trade Line information as a

Credit Grantor, a Collection Agency is reporting

the fields that go into the Public section

of a credit report.

Closed Accounting

With this switch ON, when a statement is generated, the

transactions referenced in the statement are locked to

Read Only. This prevents editing or deleting of these

transactions after the statements are generated.

With this switch ON, Collect! will also skip transactions

already connected to an invoice line record, thus

preventing a transaction from being on an invoice more

than once.

If you ever come across a transaction and all

the fields are "grayed out," this means that

this transaction is on a statement currently in

your system. You can return to this form,

uncheck this to switch it OFF, correct or

delete your transaction and regenerate your

statement. However, a better solution would

be to leave the switch ON, post a new correct

transaction and then post a transaction to off

balance the amount of the erroneous one.

If you ever come across a transaction and all

the fields are "grayed out," this means that

this transaction is on a statement currently in

your system. You can return to this form,

uncheck this to switch it OFF, correct or

delete your transaction and regenerate your

statement. However, a better solution would

be to leave the switch ON, post a new correct

transaction and then post a transaction to off

balance the amount of the erroneous one.

Statement Uses Payment Date

By default, Collect! uses the transaction POSTED DATE

to see if it fits into the date range when generating

invoice/statements. If you would rather use the transaction

PAYMENT DATE, just switch that ON here. Remember that

this is on a go forward basis. So, only statements generated

from now on will use the Payment Date.

Roll Overpayment Through Trust

This switch affects the behavior of statements and trust

reports when dealing with client overpayments, refunded

commissions and NSFs.

This switch is designed specifically for our Australian

clients, whose country has very demanding trust

account laws and auditing practices. When using this

switch, please test and verify that the results are as

you expect.

When this switch is ON:

Net Remit Clients

If a client overpays (or we refund a fee or record an NSF).

a) If the overpayment amount can be covered by the amount

received to us that is in the trust account, then we simply send

the money back to the client.

b) If the amount held in trust from to us payments is less than

the amount we need to send the client including overpayment,

then the full amount of To Us is sent to them, and any remaining

credit appears as a negative value in the 30 day field.

Gross Remit Clients

The current statement's TOTAL field shows the SUBTOTAL

minus PAYMENTS plus the TOTAL from the previous

statement.

For Gross Remit clients, the 30 DAYS field shows the TOTAL

from the previous statement.

a) If a Client owes the agency from previous statements, the

amount is totaled into the 30 days field as a POSITIVE value.

b) If a Client overpays or has additional money coming to

them from previous statements, the amount is totaled in

the 30 days field as a NEGATIVE value.

30 DAYS = Previous TOTAL (positive or negative)

TOTAL = SUBTOTAL - PAYMENTS + 30 DAYS

This switch requires special statement reports

and a modified trust report. Please request these

from Comtech if you intend to use this switch.

This switch requires special statement reports

and a modified trust report. Please request these

from Comtech if you intend to use this switch.

Client Fee Is To Us Commission

By default, Collect! puts client fees into the DIRECT COMM

field on the Invoice/Statement form. Switch this ON to

have Collect put the client fees into the TO US COMM

field instead on the Invoice/Statement form. Remember that

this is on a go forward basis.

Allow Dbl Post Trns On Stmts

By default, Collect! does not allow a transaction to appear on

more than one statement. This is to prevent double reporting.

Switching this ON will disable this fail-safe feature.

WARNING: This option should not be used unless you have a

complete understanding of your remittances to your

client and what impact this will have on Statements.

WARNING: This option should not be used unless you have a

complete understanding of your remittances to your

client and what impact this will have on Statements.

Multi Currency

Switch this ON to display currency symbols, (e.g. dollar

signs, denarii, pounds, francs), in your reports and letters

and in Collect! forms. When this is switched ON, Collect!

uses the Regional Settings in your Windows

system. (Default format, $99,999.99. Yours may be different,

depending on your global region.) Set up your regional settings

to show your currency symbols. Then, with ' Multi Currency' ON,

Collect! reads these regional settings to determine how to

display your numbers.

With this switch OFF, you manually control how you display

your numbers in reports and letters.

If you are in a situation where funds come to you

in different currencies, this switch allows you to

keep track of them visually. Switching this ON

displays multiple currency fields on several

different forms. You will notice additional fields

on Financial Detail, Transaction, and

Invoice/Statement. The information in these

currency fields can be pulled into reports and

letters but Collect! does not do exchange rate

calculations at present.

If you are in a situation where funds come to you

in different currencies, this switch allows you to

keep track of them visually. Switching this ON

displays multiple currency fields on several

different forms. You will notice additional fields

on Financial Detail, Transaction, and

Invoice/Statement. The information in these

currency fields can be pulled into reports and

letters but Collect! does not do exchange rate

calculations at present.

Default Currency

Select the currency to use for your accounts.

Currently this is for your information.

Itemization Date

The itemization date is copied down to new Clients when they

are created. When sending your first letter to a Debtor,

the itemization date is a reference date for the account balance.

For example, if your client uses the Transaction Date

as the Itemization Date, and the Client also charged

Interest, then the Balance at Itemization must be the

original Transaction amount, without interest.

For example, if your client uses the Transaction Date

as the Itemization Date, and the Client also charged

Interest, then the Balance at Itemization must be the

original Transaction amount, without interest.

Tax #

This is your Tax registration ID number. It is printed on

statements and invoices. Every time you issue a receipt

or charge for the tax on your commissions, you have to

include your Tax #. If you do not charge tax, you probably

don't need this field.

Use Multiple Controls

By Default, the Contact Controls are divided by Type. Each types

functionality will only appear in the applicable module. For

example, the Phone rule will only apply to Phone calls.

Checking this box will change the behavior of Contact Controls.

The Type field on Contact Controls will be replaced with a

single entry call Multiple.

When a process runs, like a letter or phone call, all Contact

types will be evaluated to see if the total contacts of all types

exceeds the maximum allowed.

Validation Report

If you have specified a Validation Report here or in a

Contact Control record, then when a letter is sent to a Debtor

(Contact marked done via print, email, or text), Collect! will

update the Validation Date on the Debtor form with the send date

plus the number of business and calendar days specified below

or the Contact Control record.

Example, if you specify Letter 1 for the Validation Report,

5 business days, and 30 calendar days, then when Letter 1

is printed, Collect! will take the current date, add 5

days (excluding Saturday, Sunday, and holidays), then add

30 days (including weekends and holidays).

Example, if you specify Letter 1 for the Validation Report,

5 business days, and 30 calendar days, then when Letter 1

is printed, Collect! will take the current date, add 5

days (excluding Saturday, Sunday, and holidays), then add

30 days (including weekends and holidays).

Collect! will use a near match on the name in order to

accommodate cosigner and language variants of the notice.

Please refer to the Help topic

How To Send The Validation Notice for more information.

Collect! will use a near match on the name in order to

accommodate cosigner and language variants of the notice.

Please refer to the Help topic

How To Send The Validation Notice for more information.

Validation Business Days

The number of business days (excluding Saturday, Sunday, and

holidays) to use when calculating the Validation End date.

Validation Calendar Days

The number of calendar days (including weekends and holidays)

to use when calculating the Validation End date.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org