ACH Step By Step - Part 3 - Recurring Payment Schedule

This "Step-by-Step" series is intended to provide you with an orderly

progression of procedures and procedural considerations.

The actual details and expansive explanations are contained elsewhere in

the Help pages and will be referred to by link to follow at the end of

each page, where applicable.

This Step-by-Step page is dedicated to all aspects concerning Recurring ACH

Payments.

When you have completed a full review of all the steps, you should be:

Posting A Recurring ACH Payments Schedule

You can post an ACH payments schedule for a series of

withdrawals from a payer's bank account to be made at regular

intervals.

Recurring ACH payments are stored in Collect!

immediately, but they are NOT uploaded to Billing

Tree until a transaction in the series has become

current-dated AND your site has run its batch

Reconcile ACH History process. This is opposite

of how the module manages recurring Credit Card

arrangements. With recurring credit card plans,

the schedule is held exclusively on the Billing

Tree Gateway for PCI compliance and is uploaded to

them once you click Submit.

Recurring ACH payments are stored in Collect!

immediately, but they are NOT uploaded to Billing

Tree until a transaction in the series has become

current-dated AND your site has run its batch

Reconcile ACH History process. This is opposite

of how the module manages recurring Credit Card

arrangements. With recurring credit card plans,

the schedule is held exclusively on the Billing

Tree Gateway for PCI compliance and is uploaded to

them once you click Submit.

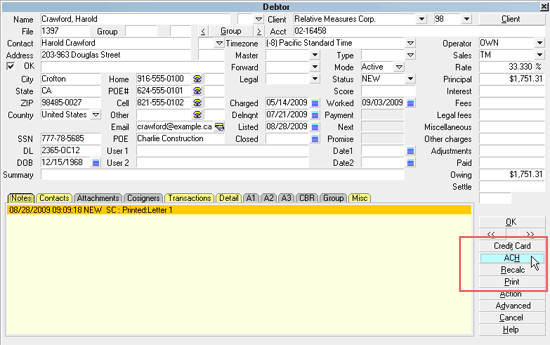

To access the menu to reach the debtor banking intake screen,

click the ACH button in the lower right corner of the main Debtor

screen. This will open the ACH Payment Tasks menu.

Select the ACH button

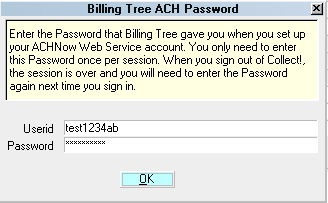

If this is the first time you are accessing this screen,

after signing into Collect!, you will be prompted to enter

your ACH UserId and Password.

If this is the first time you are accessing this screen,

after signing into Collect!, you will be prompted to enter

your ACH UserId and Password.

Billing Tree ACH Password

Once you enter your UserID and Password, they stay in effect until

you log out of your current session of Collect!.

If you have entered global login credentials into the

ACH Payments Setup screen, it will be stored

and used each time you login Collect!. You will not be

prompted to enter a Password unless you are any of

User Levels 1, 10 or 99. These levels will always

be prompted and need to simply click OK to

advance to the next screen if there are no changes.

If you have entered global login credentials into the

ACH Payments Setup screen, it will be stored

and used each time you login Collect!. You will not be

prompted to enter a Password unless you are any of

User Levels 1, 10 or 99. These levels will always

be prompted and need to simply click OK to

advance to the next screen if there are no changes.

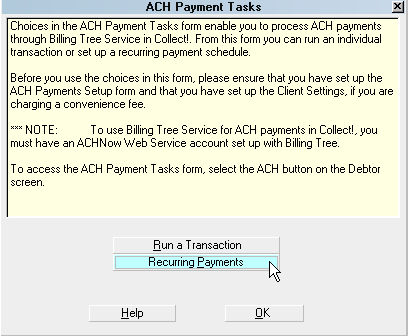

When the ACH Payment Tasks menu is displayed, click the

Recurring Payments button.

Select the RECURRING PAYMENTS button

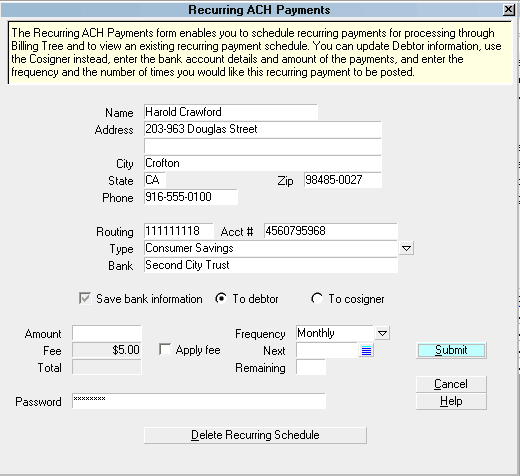

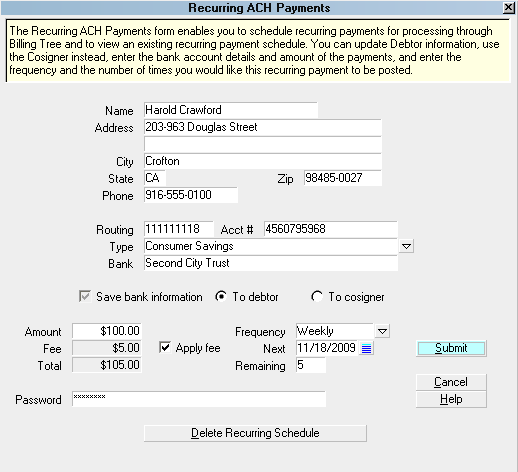

This will open the Recurring ACH Payments screen. For a detailed

description of each Field on this screen please see Recurring ACH Payments.

Recurring ACH Payments

Press F1 from the Recurring ACH Payments screen to see

details for each field in this window.

Press F1 from the Recurring ACH Payments screen to see

details for each field in this window.

When you are ready to submit the payment schedule, click the

SUBMIT button.

Ready to Submit a Recurring ACH Schedule

The module will give you a popup confirming it has completed

all the internal steps to apply your recurring arrangement

and that the steps were completed successfully.

ACH Schedule Configured Successfully

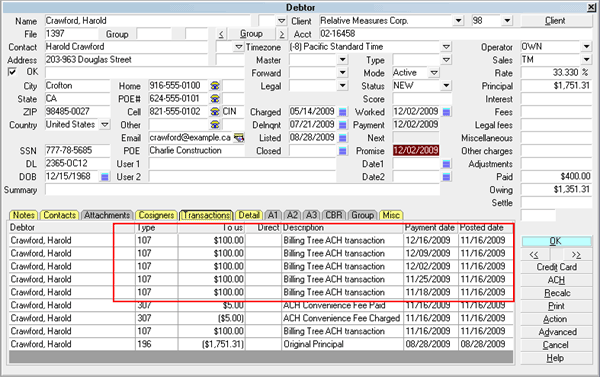

You will see in the Transaction Tab for the debtor that all of the

line items covering your entire arrangement period are now

appearing with Payment Dates entered according to the schedule you

set up.

ACH Transaction Schedule Posted

These post-dated transactions do not affect your current balance

on account because the due dates are in the future and the software

doesn't consider them as finalized transactions until they have

been finalized by the module via Reconcile ACH History as they

come due.

Depending on your site's preference settings in ACH Setup, the

Posted Date will either be blank or contain the date that the

arrangement was created. In both cases, as the payments come

due and are submitted to Billing Tree for processing, the Posted

Dates will become populated with the date they finalized.

The module will not post the convenience fees until each payment

is processed successfully by Billing Tree, as will be triggered

by the return of a confirmation number through the Reconcile

ACH History batch processes.

Recurring ACH payments are not completed until you run Reconcile ACH

History.

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

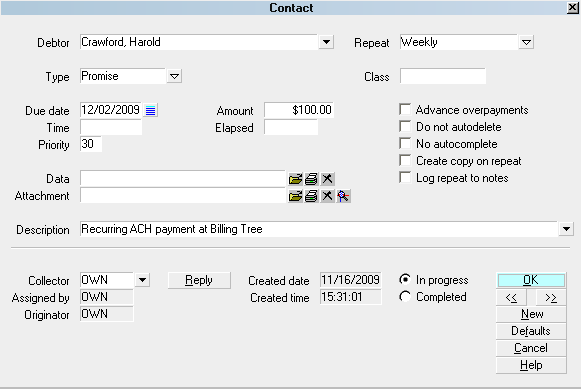

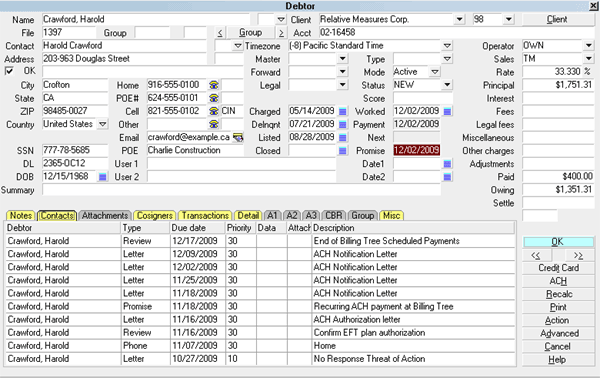

The module creates a Promise Contact that will stay in the

Collector's WIP to assist in keeping track of the the payment

schedule.

Promise Contact for Recurring ACH Payments

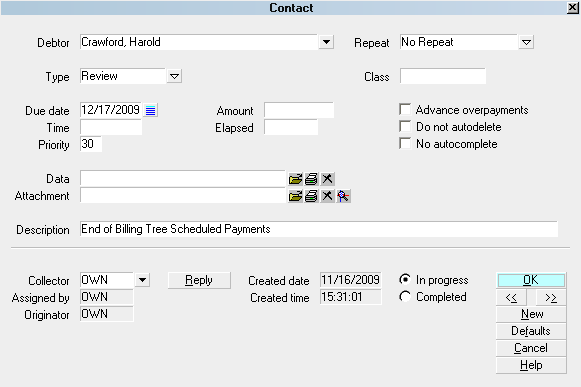

The module creates a Review Contact that is future dated to

remind you of the end of the payment schedule.

Review Contact for Recurring ACH Payments

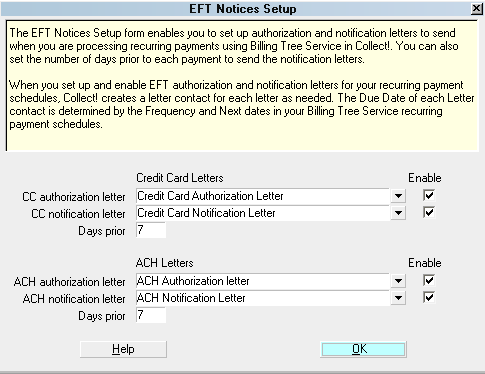

EFT notices will be automatically scheduled according to the

options you chose when you set up your EFT Notices Setup.

EFT Notices Setup

EFT Notices and Reviews

The following information centers on other knowledge needed about

fields, functions and internal automations pertaining to creating

Recurring ACH Payment arrangements:

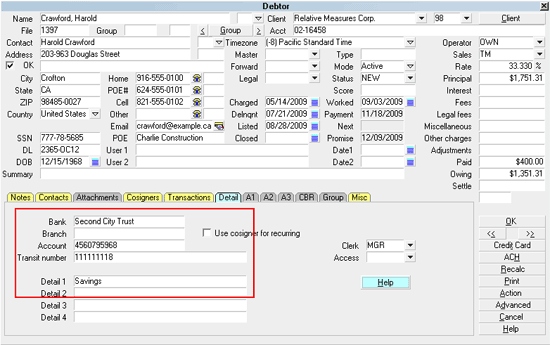

Save Bank Information

The switch to "Save bank information" invokes a writeback

of information as you entered it into the Payment intake

window and stores it in the Debtor Detail Tab OR in the

Cosigner's information, with the Class ACH Payer. Older

versions of Collect! use "Other" as the Class.

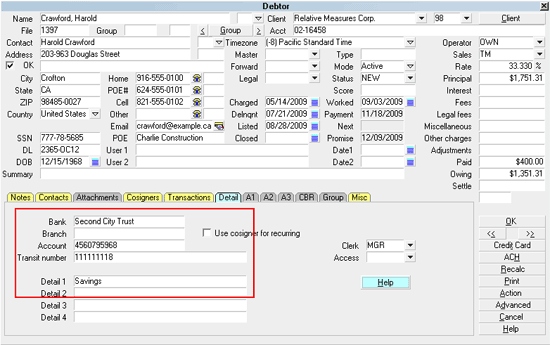

This is the example of saved to the Debtor:

Bank Information Saved to Debtor Detail

Bank is the payer's Bank.

Account is the payer's Bank Account Number.

Transit Number is the Bank ABA routing number.

Detail 1 is the Bank Account type.

The module will overwrite any information that

is currently stored in the Debtor Detail Bank,

Account, ABA and Debtor Detail 1 fields.

The module will overwrite any information that

is currently stored in the Debtor Detail Bank,

Account, ABA and Debtor Detail 1 fields.

Contact Technical Services if you need assistance migrating historical

information that you may have stored in these fields BEFORE you go live

with your ACH payments. A special Attachments Tab window can be created

for you and data migrated so that you retain whatever other information

you may have previously been storing in the Debtor Detail Tab.

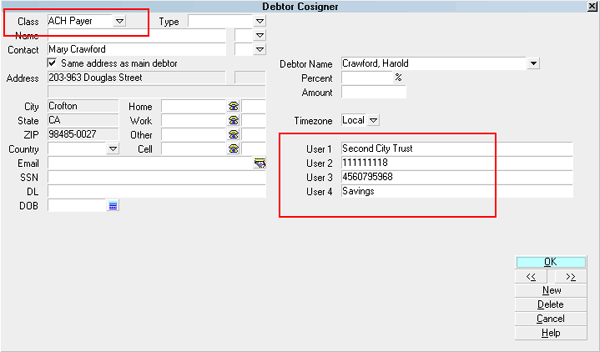

Alternatively, you can save the banking information to a Cosigner window,

with the Class designation ACH Payer. Older versions of Collect! use "Other"

as the Class.:

Name, Address and Bank Information Saved to Cosigner

User 1 is the payer's Bank.

User 2 is the Bank ABA routing number.

User 3 is the payer's Bank Account Number.

User 4 is the Bank Account type.

Debtor Detail

Like all the Tabs in the lower portion of Collect! main windows,

the Debtor Detail Tab is a sub-window that is actually a separate entity

from the main Debtor screen. The Detail Tab is pre-configured for use as

a storage site for banking information, and can be utilized for any

end-user defined purpose or preference.

This sub-window becomes a consideration because the module uses it to

store information obtained during the ACH payment screen intake. Bank name,

account and routing numbers are auto-written from the ACH Single or

Recurring payment entry screen into the Detail Tab.

If your company has any data storage convention that uses areas in

the Detail Tab, you may wish to contact Technical Services to

discuss your options to migrate this information

into a special Attachment Tab window we can create for you

BEFORE you rollout live with the module.

If your company has any data storage convention that uses areas in

the Detail Tab, you may wish to contact Technical Services to

discuss your options to migrate this information

into a special Attachment Tab window we can create for you

BEFORE you rollout live with the module.

This will ensure your data isn't lost and the module's function is not

being impeded by staff removing what it writes into this Tab.

Bank Information Saved to Debtor Detail

Bank is the payer's Bank.

Account is the payer's Bank Account Number.

Transit Number is the Bank ABA routing number.

Detail 1 is the Bank Account type.

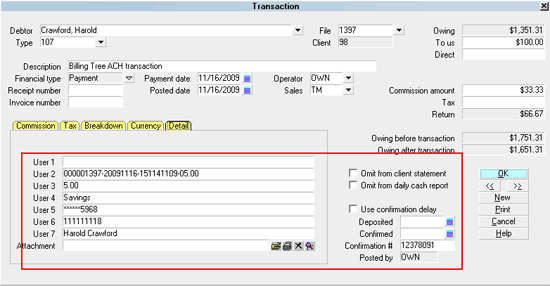

Transaction Details

When ACH payments are reconciled, Billing Tree uploads confirmations

to your system and stores the confirmation details to the Transaction

Details Tab for the line item it matches for the debtor. This

information will come as a result of Reconcile ACH History on either a

per debtor or company-wide batch process.

Transaction Details

Banking unique tracking and confirmation details are stored on each debtor

record as follows:

User 2 is a unique

Reference # {filenumber-date-time-fee}.

User 3 is the fee amount.

User 4 is the Bank Account type.

User 5 is the masked Bank Account Number.

User 6 is the Bank's ABA routing number.

User 7 is the Payer, either the Debtor or

the Cosigner.

Confirmation # is a unique Transaction ID

assigned to this ACH payment during the Billing Tree process.

Reconcile ACH Payments

It is necessary to regularly synchronize your system

with Billing Tree's records for ACH payments. This is your

only way of finding out if any transaction has since been

reversed from when your office posted the payment and also,

if there are any unmatched payments your office needs to be

aware of, and whether the Gateway has been in receipt of

external payments directly at the Billing Tree webpage

without having passed through your office or the module at all.

Specifically, the reconciliation process does the following

logical steps:

It surveys your system to see if there are currently any

ACH payments with payment dates which have become due but have

not yet been uploaded to Billing Tree for processing.

It downloads any reversals of payments that Billing

Tree has received since the last time your office has done

a reconciliation and writes a Process Summary Report. See

Reconcile ACH History, topic Processing Summary.

It downloads any external payments it has received which your

site you may not be aware of because the debtor paid directly on the

ACH Gateway using their Collect! file number as the account number.

If collectors are experiencing difficulty with debtors not

wanting to disclose their banking information to strangers

over the phone, this objection can be countered by offering the

debtor the opportunity to pay by themselves at the ACH Gateway.

Just make sure they use their Collect! file number as their unique

account number identifier. Your office will receive the payment

on the next reconciliation after the amount has been processed.

If collectors are experiencing difficulty with debtors not

wanting to disclose their banking information to strangers

over the phone, this objection can be countered by offering the

debtor the opportunity to pay by themselves at the ACH Gateway.

Just make sure they use their Collect! file number as their unique

account number identifier. Your office will receive the payment

on the next reconciliation after the amount has been processed.

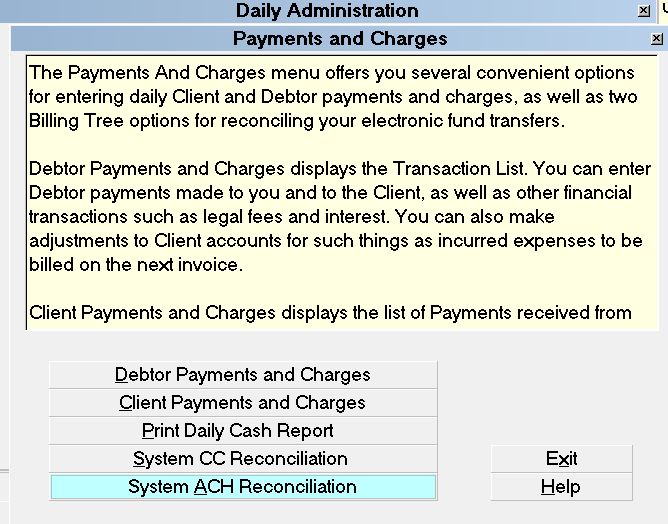

To access the batch process to Reconcile your ACH Payments for the day is located

via the menu path " Daily Administration\ Payments and Charges\Reconcile ACH History".

Reconcile ACH History

Select the Reconcile ACH History button to run

your process.

The system maintains records of when it did its last reconcile and

has fail-safes in place to prevent previously downloaded payments

from being posted a second time. You are free to reconcile as

many times as you need to throughout the course of the day.

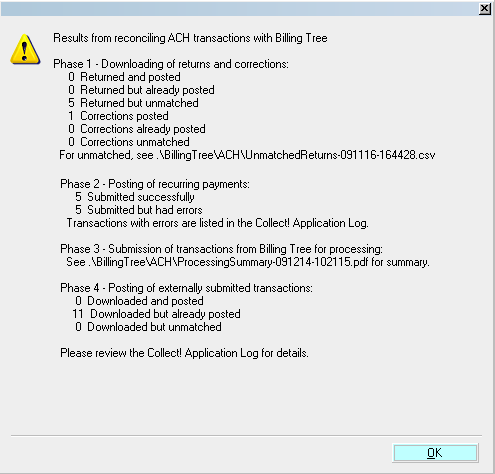

Reconcile ACH History Results

If Billing Tree returns unmatched transactions that require

manual review, they will be stored in an Unmatched Returns

file that bears a current date and time stamp in the

folder along this path "CV11\bin\BillingTree\ACH".

It also writes a detailed log into the path

"CV11\bin\BillingTree\ACH\achnow.txt".

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

Users of CV11.6.2.7 and higher who are also licensed

for the Scheduler Module now have an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

See Also

- Billing Tree Topics

- Reconcile ACH History

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org