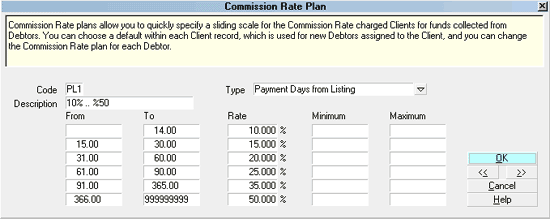

Commission Rate Plan Basics

Commission Rate Plans provide flexible methods

of meeting Client requirements for complex contingency terms

which change on scales mitigated by ranges of criteria.

As at the current shipping version CV11.6.2.2, the types of

rate plans that are supported in the software are as follows:

- Age

- List Amount

- Payment Amount

- Paid To Date

- Payment Days From Listing

- Payment Days From Delinquent

- Payment Days From Charged

- Remaining Balance

For these rate plans to work successfully, there are two

important considerations:

- That your plans are constructed such that

each level in a scaled rate properly intersects

with the next level in a smooth progression that

leaves no area in the defined data-set unaccounted

for. Example - if your plan is List Amount based

and the first tier is $0.00 to $500.00, your

second tier in the plan would start at $500.01

and NOT at $501.00 because the latter will leave

any account assigned in a balance range of

$500.01 to $500.99 unaccounted for in the tier

definition.

- For greatest new account input efficiency, it

makes sense to have the appropriate rate plan

affixed to each Client BEFORE you begin entering

new accounts. This will allow the rate plans to

be embedded with the Client driven rate plan as

they are being entered rather than having to

rely on an operator to remember to insert one on

every account AND not to have any typo errors

in the process of manually entering them. Having

your Clients properly defined in advanced not

only saves on human resource time, it mitigates

the margin for error if the insertion of such an

important piece of information is reliant on an

automated process rather than a person.

Once a Rate Plan is attached to a Debtor, all

transactions of the Financial Type "Payment" will

be managed as per the rules set out in the rate

plan. It is an operational choice whether to ascribe a

Rate Plan entry for a flat rate (i.e. 25% and no

Levels or Tiers) or whether to simply hardcode flat

rates onto Clients and into Debtors.

If your operation is small and very few Clients utilize

true Multi-Level Rate Rlans, reserving them ONLY

for those few Clients who need them may be the

simplest method.

If your operation is larger and you have many Clients

who utilize unique Rate Plan structures, there is

merit to having operational standardization which

dictates that all Clients have defined Rate Plans.

Large Clients that change their terms often get

their own unique Rate Plans to prevent any changes

made to one Client's contingency structure

inadvertently affecting other Clients who may be

sharing that plan.

Commission Rate Plan Screen

Accessing Commission Rate Plan

The Commission Rate Plan setup menu can be

accessed three ways. Which way you choose will be determined by

your Operator level access rights and navigational preferences.

- Using the menu bar at the top of screen, the menu path

is "System\ Financial Settings\ Commission Rate Plans". Once

inside, your list of existing plans will be presented with

the customary buttons to Delete/ Edit/New entry.

- From the Main Menu, the path is from the buttons on the left

side of the screen, " System Administration\Setup and

Configuration\ Plans and Reference Tables\Commission Rate Tables".

- Or, while on ANY screen which has a "Rate plan" field

attached to a pick list pulldown menu, specifically

a Debtor Commission Tab or Client Commission Tab,

you may make a selection from the list to update or modify

the record you are on for the list which shows you the

selection of all currently available plans in the system.

See Also

- Client Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org