Credit Card Step By Step - Part 1 - Setup

This "Step-by-Step" series is intended to provide you with

an orderly progression of procedures and procedural

considerations.

The actual details and expansive explanations are contained

elsewhere in the Help pages and will be referred to by link

to follow at the end of each page, where applicable.

This Step-by-Step page is dedicated to setting up your system

in readiness for Credit Card processing.

When you have completed a full review of all the steps,

you should be:

Setting Up For Credit Card Processing

There are five areas in Collect! that require coordination

and/or configuration when you begin using the module.

There are two preliminary steps to complete before being able

to access and use this interface.

You require licensing from Comtech Systems Inc. to enable

the Billing Tree Module on your site. For pricing information

and acquisition, please contact us at 250-391-0466 or email

sales@collect.org.

You require an active account with Billing Tree. They will

provide you with a url/web address access to the Credit Card

Gateway. This information is entered for the module electronic

access and is also what you would use to directly enter the website

portal externally via your Internet browser.

Credit Card Transaction Types

Collect! ships with several pre-set Transaction types

for use with Billing Tree.

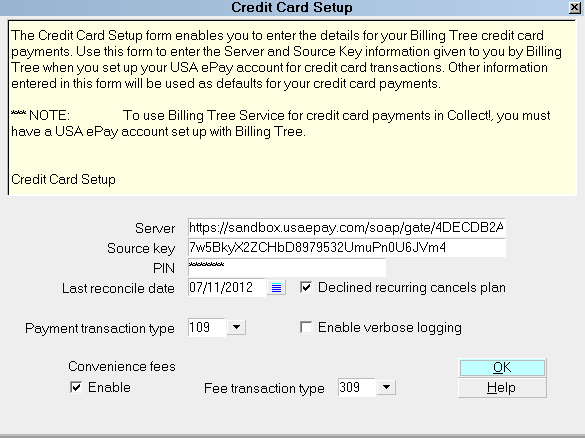

The Credit Card Setup screen is where you predefine

the Transaction Types you want the module to use for

processing your credit cards.

Credit Card Setup

By default, the module will use the following

Transaction Types, but you may select and set up

others if you were already using any of the

below-captioned codes for other purposes:

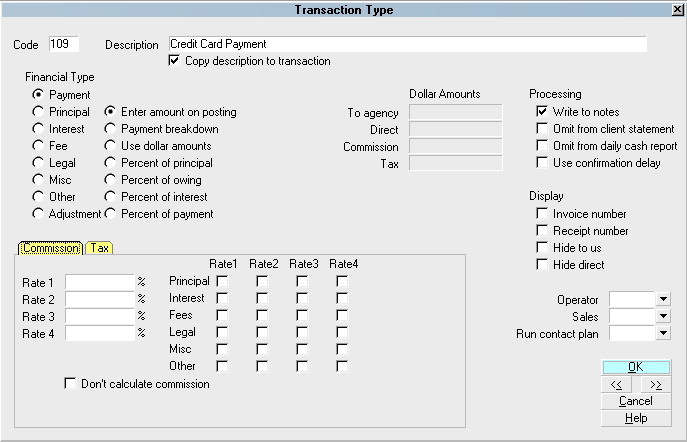

109 - Payment

309 - Convenience Fee

To view the Transaction Types and their internal

settings, your menu path is \System\ Financial Settings

\Transaction Types. This launches a view of your

Transaction Type list of existing codes, and from

there, you can view/create/ edit as needed.

The default settings and general use for each of

the Transaction Types are described below.

All three of the Fee/Charge codes are preset

to "Omit from client statement" and

"Omit from daily cash report".

All three of the Fee/Charge codes are preset

to "Omit from client statement" and

"Omit from daily cash report".

If your company reports fees/ charges to your client

and considers these revenue transactions, these

default settings will need to be modified to suit

your operational preferences.

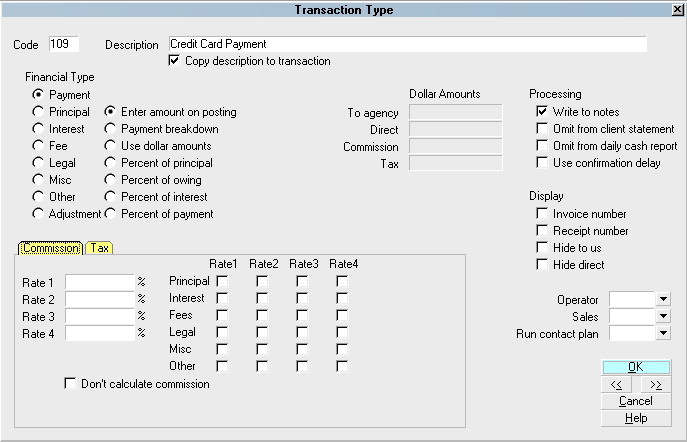

Credit Card Payment

This is a Financial Type "Payment" with a Description

of "Credit Card Payment".

109 - Payment

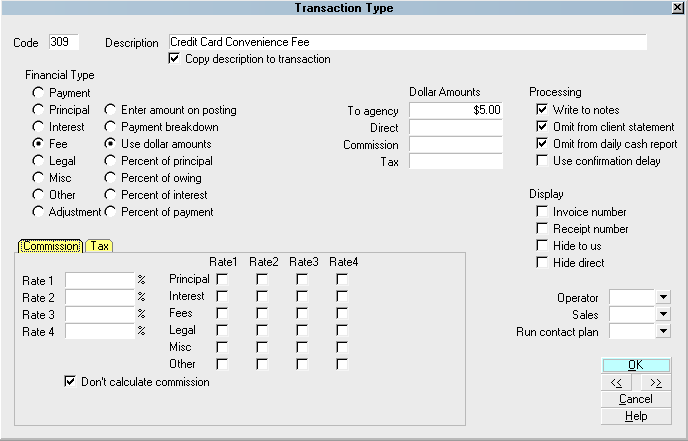

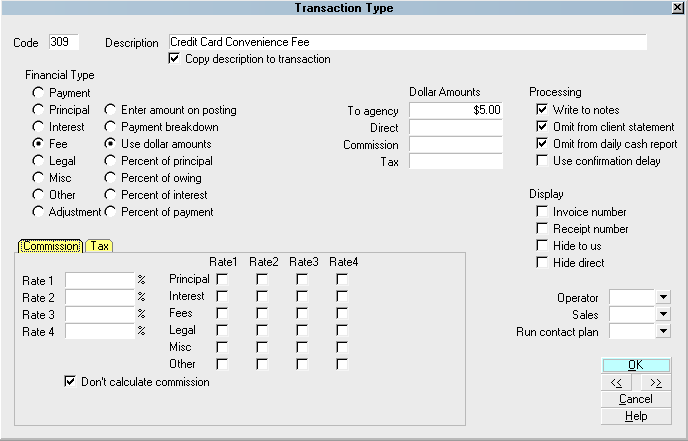

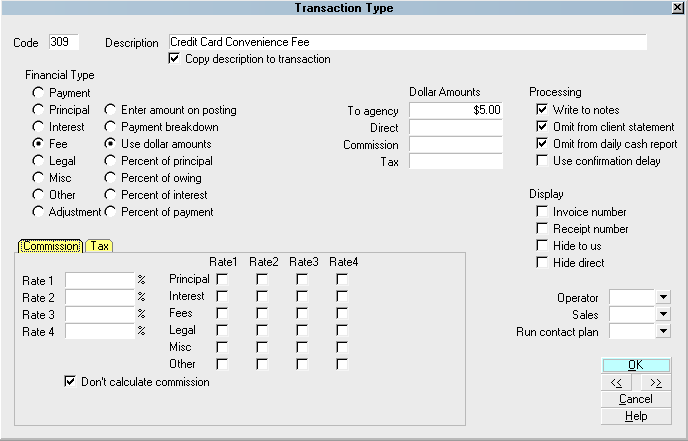

Credit Card Convenience Fee

This is a Financial Type "Fee" with a Description

of "Credit Card Convenience Fee" used for posting

the add-on cost you may be charging to debtors

when your process credit cards.

309 - Convenience Fee

As a function of credit card regulatory legislation

compliance, the interface has three inherent functionalities

which it will not allow the end- user to override:

1. You may add on a flat fee ONLY

as a charge. It will not allow you to set your

convenience fee, under any transaction type

number, shipping standard or newly created, to

add a percentage of the payment amount.

2. You may add a credit card convenience fee

only ONCE in a recurring

payment schedule. It will be applied to the

first payment in the recurring series.

3. You will not be presented with a user defined

entry field that will allow you to input a

charge amount free-hand at the per transaction

posting level. Once the "Apply Fee" check box

is enabled on a single or recurring payment

screen, the flat fee amount defined in your

Transaction Type setup screen is the only

figure you will be presented with as being

added on to the payment being taken. This

will appear as a greyed-out, read-only

amount field.

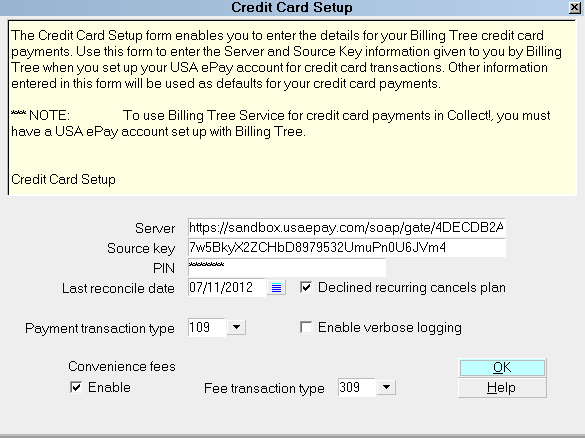

Credit Card Setup

Once you have set up your account with Billing Tree,

and received your login credentials, you can enter

the necessary information into the Credit Card Setup

screen.

Credit Card Setup

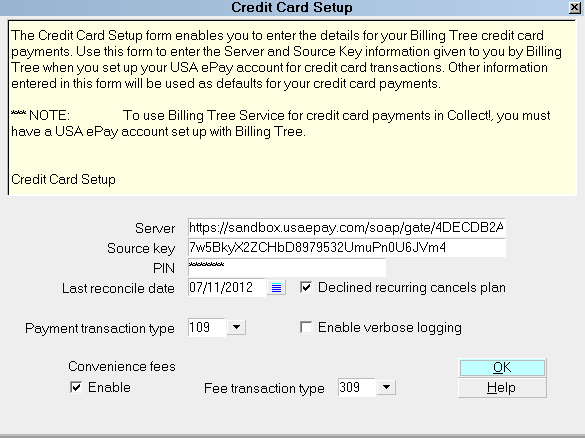

The Credit Card Setup screen enables you to enter the details for

your Billing Tree credit card payments. Use this screen to enter the

Server and Source Key information given to you by Billing Tree

when you set up your USA ePay account for credit

card transactions. Other information entered in this screen

will be used as defaults for your credit card payments.

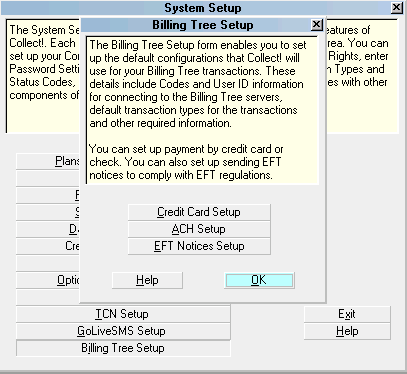

To access this setup area, your menu path is,

"System\Preferences\ Billing Tree Setup".

Billing Tree Setup

Select the CREDIT CARD SETUP button.

Credit Card Setup

This is where you enter the login credentials which

your Billing Tree Representative provided you with for

access to the Credit Card Gateway.

Server, Source Key And PIN

Use this screen to enter the Server (url), Source Key (login) and

PIN ( password) information given to you by Billing Tree for access

to the Credit Card Gateway. The remainder of information you will

enter in this screen will be used as the default settings for your

credit card payments.

The module prefills in the Transaction Types that will be

used for each part of the credit card payment posting,

including convenience fees. It is not necessary to make any

changes to these choices unless your site is already using

one of the displayed Transaction Types for another purpose

in your operation. If you need to make changes to the

Transaction Type codes that the module will use, ensure that

the switch settings of your new codes match the switch

settings of those that originally shipped with Collect! preset

for these purposes.

Payment Transaction Type

Select the Transaction Type that you want to use for your

Billing Tree credit card payments. The selected type must already

exist in your list of Transaction Types and it must be a

Financial Type "Payment".

By default, the module will use the following transactions:

109 - Payment

309 - Convenience Fee

To view the Transaction Types and their internal settings, your

menu path is "System\ Financial Settings\Transaction Types". This

launches a view of your Transaction Type list of existing codes,

and from there, you can view/create/edit as needed.

The default settings and general use for each of

the Transaction Types are described below. If your company

reports fees/charges to your client and considers these

revenue transactions, these default settings will need

to be modified to suit your operational preferences.

All three of the Fee/Charge codes are preset

to "Omit from client statement" and

"Omit from daily cash report".

All three of the Fee/Charge codes are preset

to "Omit from client statement" and

"Omit from daily cash report".

Credit Card Payment

This is a Financial Type "Payment" with a Description

of "Credit Card Payment".

109 - Payment

Credit Card Convenience Fee

This is a Financial Type "Fee" with a Description

of "Credit Card Convenience Fee" used for posting

the add-on cost you may be charging to debtors

when your process credit cards.

309 - Convenience Fee

As a function of credit card regulatory legislation

compliance, the interface has three inherent functionalities

which it will not allow the end-user to override:

- You may add on a flat fee ONLY

as a charge. It will not allow you to set your

convenience fee, under any transaction type

number, shipping standard or newly created, to

add a percentage of the payment amount or other

percentage type of charge application.

- You may add a credit card convenience fee

only ONCE in a recurring

payment schedule. It will be applied to the

first payment in the recurring series.

- You will not be presented with a user defined

entry field that will allow you to input a

charge amount free-hand at the per transaction

posting level. Once the "Apply Fee" check box

is enabled on a single or recurring payment

screen, the flat fee amount defined in your

Transaction Type setup screen is the only

figure you will be presented with as being

added on to the payment being taken. This

will appear as a greyed-out, read-only

amount field.

Convenience Fees

The module enables you to add a convenience fee to the credit

card transaction you are processing PROVIDED you are permitted

by law and your client to do so. This is a default setting that

may be overridden on an individual basis if it is enabled as a

default preference. If it is not enabled at the setup level,

you will not be able to activate it on a per transaction basis.

In addition to enabling the fee on this setup screen, you must

also enable the ability to charge this fee on a per Client basis

in the Advanced screen of your Client setups.

Client Advanced Settings screen

The Credit Card Convenience Fee is is a Financial Type "Fee"

transaction code for posting credit card payments.

309 - Convenience Fee

Enable

Switch this ON with a check mark if you want to allow the

addition of a Convenience Fee when processing credit card

payments. You must select a Transaction Type to use for

the fee if you will be charging the fee.

Last Reconcile Date

The Last Reconcile Date is the last date that "Reconcile Credit

Card History" was run successfully. If you are just setting up

your preferences and have never run "Reconcile Credit Card

History," enter the date immediately PRIOR to when you will

begin to use the module. This ensures that the that the first

time you use the batch Reconcile process, that your date surveyed

will be the actual date that you launch use of the module.

When you start using the " Reconcile Credit Card History"

function as part of your daily process, the date stored in

this field will be updated automatically every time you run a

successful reconciliation. It is this date tracking and

cross-checking with the Billing Tree Gateway that ensures

payments which gave already been processed and reported back

to your system do not become duplicated.

The Last Reconcile Date should NOT be

manually manipulated once you are actively

using your interface and you have started

running "Reconcile Credit Card History"

batch processes.

The Last Reconcile Date should NOT be

manually manipulated once you are actively

using your interface and you have started

running "Reconcile Credit Card History"

batch processes.

Declined Recurring Cancels Plan

Switch this ON with a check mark to cancel any payment plan

on the account if a recurring credit card payment is declined

by Billing Tree.

Enable Verbose Logging

Switch this ON with a check mark to enable message logging to

your Application Log.

It is recommended to turn this ON.

It is recommended to turn this ON.

Save an close, after all your preferences have been input.

OK

Select OK to close the Credit Card Setup screen.

Help

Select the HELP button for help on Credit Card Setup and related topics.

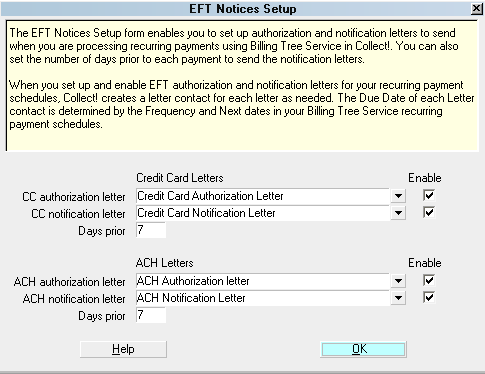

You must decision if you will be using EFT Notices

on your recurring credit card payments. The menu path

to make these choices is "System\Preferences\Billing Tree

Setup\ EFT Notices Setup".

EFT Notices Setup

In compliance with EFT requirements, the Billing Tree Module

is equipped to automatically schedule authorization letters

and EFT notices for recurring credit card and recurring

ACH payments. This may be accessed in the Billing Tree Setup

menu located in the menu path "System\Preferences\Billing Tree

Setup".

EFT Notices Setup

It is each site's responsibility to ensure that any

letters sent to debtors are compliant in format

and content with legislation and regulations in

your region. SAMPLE letters shipped with Collect!

or available on the Member Center are SAMPLE only

and intended to be examples of style templates

for your own modification(s).

It is each site's responsibility to ensure that any

letters sent to debtors are compliant in format

and content with legislation and regulations in

your region. SAMPLE letters shipped with Collect!

or available on the Member Center are SAMPLE only

and intended to be examples of style templates

for your own modification(s).

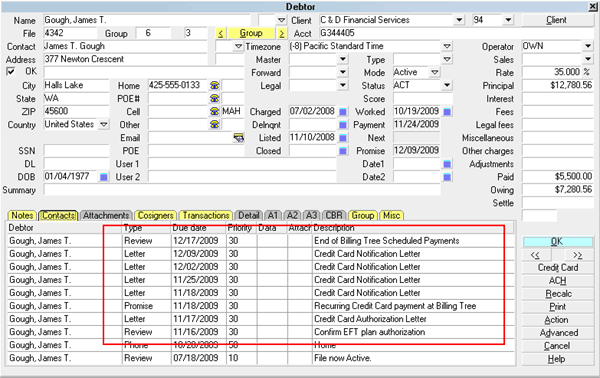

When you post a recurring credit card payments schedule, the

system will automatically schedule letters and reviews according

to your EFT Notices setup.

EFT Notices and Reviews

View EFT Notices

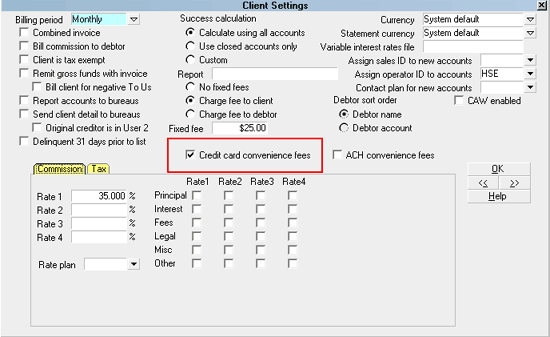

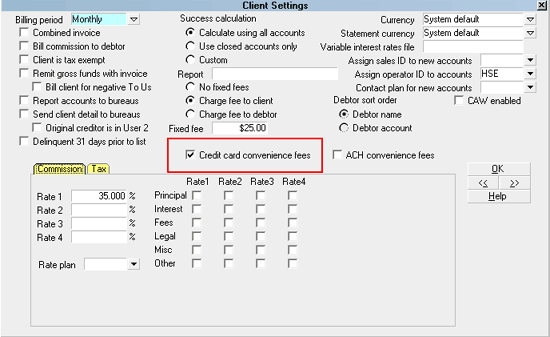

Convenience Fee Client Advanced Settings

If you are going to charge convenience fees when posting

credit card payments, you need to enable this both at the

Billing Tree Credit Card Setup level and ALSO at the Client

level for each Client that permits you to add this fee to

their accounts.

Open the Client Settings screen by selecting the ADVANCED

button in the lower right corner of the Client main entry

screen and switch ON "Credit card convenience fees" by

checking the box provided.

Client Settings screen

The module will charge only one convenience fee

per recurring schedule on the first

transaction. This is in compliance with

credit card regulations which prohibit

these fees on more than the first payment

in any recurring schedule.

The module will charge only one convenience fee

per recurring schedule on the first

transaction. This is in compliance with

credit card regulations which prohibit

these fees on more than the first payment

in any recurring schedule.

Debtor Detail Tab

Like all the Tabs lower portion of Collect! main windows,

the Debtor Detail Tab is a sub-window that is actually a

separate entity from the main Debtor screen. The Detail

Tab is pre-configured for use as a storage site for banking

information, and can be utilized for any end-user defined

purpose or preference.

This sub-window becomes a consideration because the module

uses it to store information obtained during the Credit Card

payment screen intake. PCI compliant card information is

auto-written from the Single or Recurring payment entry

screens into the Detail Tab.

If your company has any data storage convention that uses

areas in the Detail Tab, you may wish to contact

Technical Services to discuss your options to migrate

this information into a special Attachment Tab window

we can create for you BEFORE you rollout live with the

module.

If your company has any data storage convention that uses

areas in the Detail Tab, you may wish to contact

Technical Services to discuss your options to migrate

this information into a special Attachment Tab window

we can create for you BEFORE you rollout live with the

module.

This will ensure your data isn't lost and the module's

function is not being impeded by staff removing what it writes

into this Tab.

What exactly the module will write into this tab

will be covered in more detail in the

Credit Card Step by Step - Part 2 - Single Payment topic.

Posting Payments

After you have entered the settings and decided on the

operational issues described so far, you are ready to

begin posting Credit Card payments to your accounts.

Proceed to Credit Card Step by Step - Part 2 - Single Payment

section of this series.

See Also

- Billing Tree Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org