How To Manage Post-Dated Checks

This document presents ideas and solutions for handling promised

payments with Collect!'s Take Checks Over the Phone feature.

Take Checks Over the Phone allows you to accept banking

information over the phone and to print a check or a batch of

checks for debtor payments. Setting up this feature and using it

for single payments is discussed in How To Take Checks Over the Phone.

You can use this same feature for post-dated checks and

promised payments as discussed in this topic.

The Post-Dated Checks package is available for download

at the Collect! Member Center.

Download Post-Dated Checks Package

It is important to note that creating post-dated

checks works with future payment dates. If you enter today's

date in the procedure that is described below, it may give

unexpected results. This routine is for post-dated checks.

For ordinary checks by phone - not post-dated, please refer to

How To Take Checks Over the Phone.

It is important to note that creating post-dated

checks works with future payment dates. If you enter today's

date in the procedure that is described below, it may give

unexpected results. This routine is for post-dated checks.

For ordinary checks by phone - not post-dated, please refer to

How To Take Checks Over the Phone.

There are several possible solutions. We will discuss a few

of the most common scenarios.

- Single

This would be a promise to pay one amount at a future date.

- Revolving

This would be a promised payment of a consistent amount

at consistent intervals, monthly, for instance.

- Varying

This would be any specific number of payments that are

promised on staggered dates.

Legal statutes in most areas require that a letter

precedes the withdrawal of post-dated amounts to inform the

debtor that the funds will be withdrawn from their account. So

our solutions include scheduling and printing this letter, as well

as sending a confirmation letter when the agreement to take

checks over the phone is first contracted.

Legal statutes in most areas require that a letter

precedes the withdrawal of post-dated amounts to inform the

debtor that the funds will be withdrawn from their account. So

our solutions include scheduling and printing this letter, as well

as sending a confirmation letter when the agreement to take

checks over the phone is first contracted.

Post-Dated Check Setup

To use this sample, there are several areas that need to be

visited in Collect! to set up the items we need for this feature.

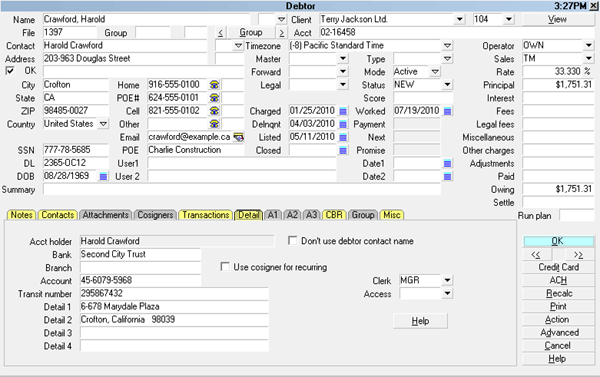

1. Bank Information

As with all check printing in Collect!, the Debtor's Bank

information must be entered into the Debtor Detail. That

is not covered in this topic. Please refer to Help topic,

How To Take Checks Over the Phone for information

about correctly entering Bank Account details.

Bank Information in Debtor Detail

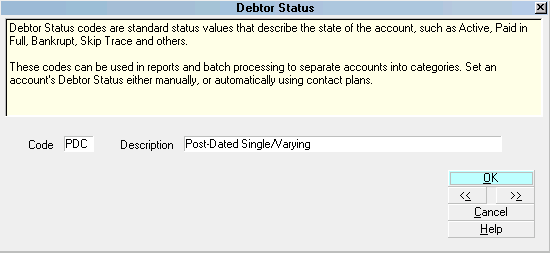

2. Create Status Codes

We need two Debtor Status Codes:

PDC - Post-dated Single/Varying

RPD - Post-dated Revolving

Creating A New Status Code

1. Select System from the top menu bar and then select

Contact Management Settings, Status Codes from the

drop-down choices. The Debtor Status list is displayed

showing all Status Codes currently defined in your system.

When creating status codes, use descriptions that

clearly explain what the Debtor Status is for the particular

code. This will make it easier to pick the correct code

form the list.

When creating status codes, use descriptions that

clearly explain what the Debtor Status is for the particular

code. This will make it easier to pick the correct code

form the list.

2. Select the NEW button at the bottom of the form and a

blank Debtor Status form will display.

The Debtor Status form is very simple. However,

the codes you create can have far-reaching effects as you

work your accounts.

The Debtor Status form is very simple. However,

the codes you create can have far-reaching effects as you

work your accounts.

3. Enter PDC in the Code field and Post-dated Single/Varying

in the Description field.

PDC Debtor Status Code

4. Select OK and your Code is added to the list and can be

accessed anywhere Debtor Status Codes are used in Collect!.

5. Repeat Steps 2 through 4 and create your RPD status code.

Type Post-dated Revolving in the Description field for this

status code.

3. Create/Import Letters And Reports

Several reports were created to implement the Post-Dated Check

routine.

Letters

Single/Varying PDC Confirm

Confirms that a check will be posted for a single transaction.

Revolving PDC Confirm

Confirms that a revolving Promise to pay has been started and

gives the date the check will be posted.

Revolving PDC Withdrawal

Alerts the debtor that a check has been posted in a

revolving Promise and gives the date the next check

will be posted.

Also, the Checks reports that shipped with Collect! are

included. If you already have them in your database, you

can rename the old ones before importing the new ones.

Checks

Check - Form #1000

This replaces the current report by the same name.

Please rename the old one if you have it in your system!.

Check - Form #1000 Batch

This replaces the current report Check - Form #1000 - Batch.

The new report can be used for all your batch printing of

checks, even the ones that are not for post-dated checks.

Please rename the old report if you have it in your system!.

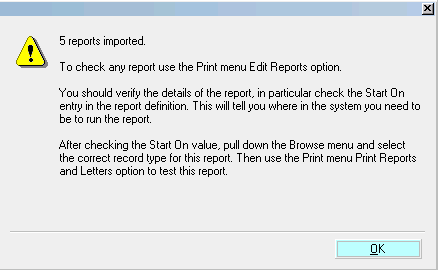

These reports are contained in one file

named pdctemplate.rpt. Please import this

into your database as described below.

How To Import These Letters And Reports

1. Select Print from the top menu bar and then select

Customize Printing from the drop-down choices.

2. From the submenu, select Import Report Template. The

Import Collect! Report dialog will display. Navigate to the

directory where the report file is that you want to import.

3. Highlight the pdctemplate.rpt file and select OPEN or

double-click on the file to open it.

4. Your reports will be imported immediately and a message

will be displayed informing you that a number of reports have

been imported.

5 Reports Imported

5. To check the reports, select Print from the top menu bar

and the select Customize Printing, Edit Report Template.

The Report Definition list will open, displaying all the reports in

your working database.

6. You will find your newly imported reports typically, at the

bottom of the list.

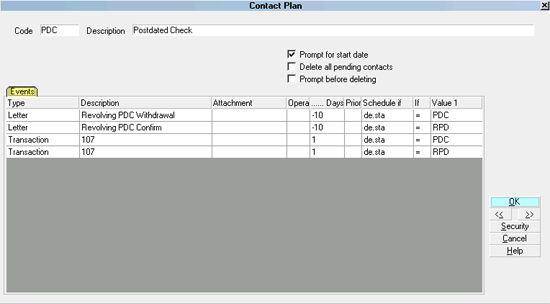

4. Create/Import Contact Plans

There are two contact plans that implement the post-dated

check routine. Please import them into your system.

Contact Plans

pdc.cpl - PDC

This runs the plan to schedule letters and payments.

zz1.cpl - zz1

This schedules the revolving letter to precede each withdrawal

when they are promised at consistent intervals, monthly,

for instance.

How To Import These Contact Plans

1. Select System from the top menu bar and then select

Contact Management Settings from the drop-down choices.

2. From the submenu, Import Contact Plan. The Import

Collect! Contact Plan dialog will open. Navigate to

the location of the *.cpl files. Each file must be imported.

3. Select the first file, pdc.cpl, and press OK. Your contact plan

will be imported immediately and a message will be displayed.

The message will contain the full name of the contact plan

you imported.

4. Open the form again and select the second file, zz1.cpl,

and press OK. Your contact plan will be imported immediately

and a message will be displayed.

5. To view the plans, select Contact Plans, View from the

System, Contact Management Settings menu.

PDC Contact Plan

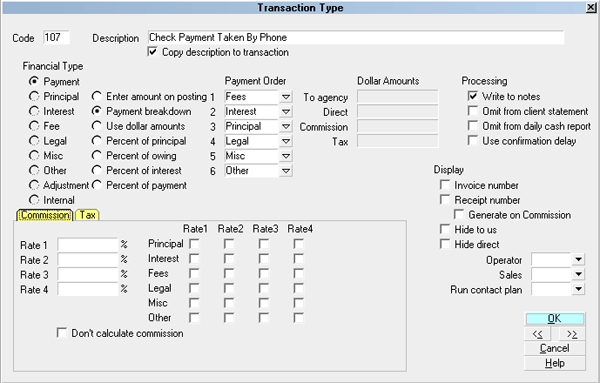

5. Create/Modify Transaction Type 107

Next, we will modify this transaction type to run the

contact plan, zz1.

1. Select System from the top menu bar and then select

Financial Settings from the drop-down choices. Select

Transaction Types from the side menu and a list of

Transaction Types will display.

2. Highlight Code 107 - Check Payment Taken By Phone

by using the up/down arrow keys.

3. From the button selections at the bottom of the dialog box

select EDIT to open the Transaction Type 107 form.

4. Locate the "Run contact plan" field at the lower right hand

corner of the form.

5. Select Contact Plan zz1 from the pick list or type it into

the field.

Run zz1 Plan from Transaction Type 107

6. Select OK all the way back to the Main Menu.

Post-Dated Check Operation

Whether your collectors set the post-dated operation

in motion or send a WIP to an operator of your choice depends

on you. We will document the process from the point where the

correct operator is looking at the debtor's account and is ready

to enter the information to set post-dated checks in motion.

Whether your collectors set the post-dated operation

in motion or send a WIP to an operator of your choice depends

on you. We will document the process from the point where the

correct operator is looking at the debtor's account and is ready

to enter the information to set post-dated checks in motion.

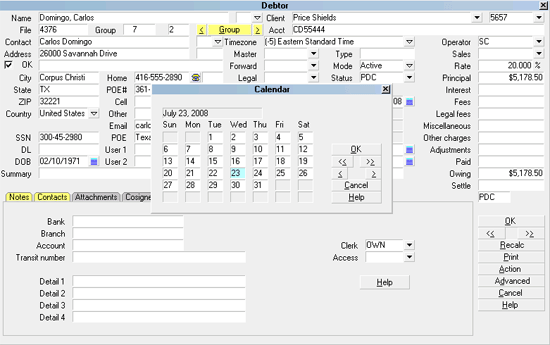

1. Change the Debtor's status code as follows:

PDC

This means one SINGLE check promised at a future date

OR several checks promised on various staggered dates.

RPD

This means an amount promised at consistent intervals, for

instance, monthly promised payments.

2. Type in PDC in the Action field to run the scheduling plan.

You will be prompted for a Start Date and then events will

trigger based on the code in the Debtor's Status Code field.

You should select the date that the Promise is due.

Enter Date of Promised Payment

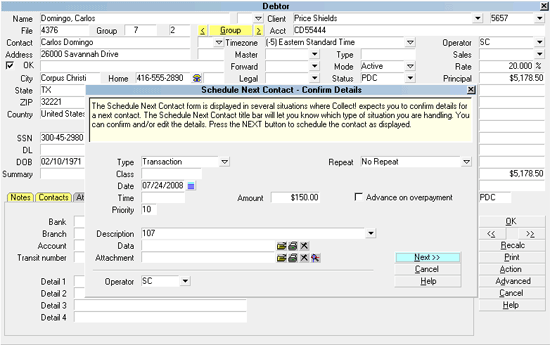

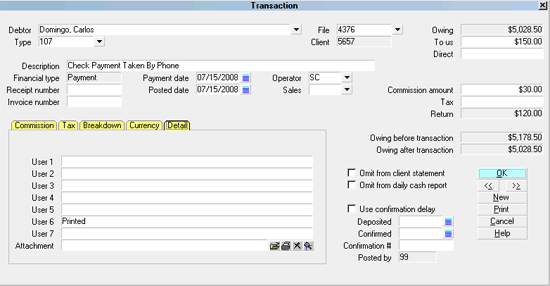

3. Enter appropriate information regarding the transaction

amount and date the amount is to be withdrawn. Note that

the earliest date that should be entered is tomorrow.

Enter Details of Post-Dated Transaction

It is important to note that creating a post-dated

check transaction works with future payment dates. If you

enter today's date in the transaction contact, it may give

unexpected results. This routine is for post-dated checks.

For ordinary checks taken over the phone, not post-dated,

please refer to Help topic, How To Take Checks Over the Phone.

It is important to note that creating a post-dated

check transaction works with future payment dates. If you

enter today's date in the transaction contact, it may give

unexpected results. This routine is for post-dated checks.

For ordinary checks taken over the phone, not post-dated,

please refer to Help topic, How To Take Checks Over the Phone.

4. If this is a VARYING type of post-dated payment, then

run PDC again, as many times as needed, until you have

entered amounts and dates for all promised

payments. ONLY do this if the dates are staggered

and inconsistent AND you have chosen status code PDC.

Collect! will schedule transaction and letter contacts

according to the choices you have made.

Status code PDC with contact plan PDC run once will schedule

one confirmation letter and one transaction with no repeats

and will be posted on the date entered. Run contact plan PDC

again as needed to schedule additional transactions to be

posted on staggered dates that you enter.

Status code RPD with contact plan PDC run once will schedule

one confirmation letter and one transaction that is set to repeat

Monthly. When the transaction is posted, a confirmation letter

will be scheduled informing the debtor of the next payment due.

Scheduled letters and transactions must be processed

using batch processing to be printed or posted.

This is described below.

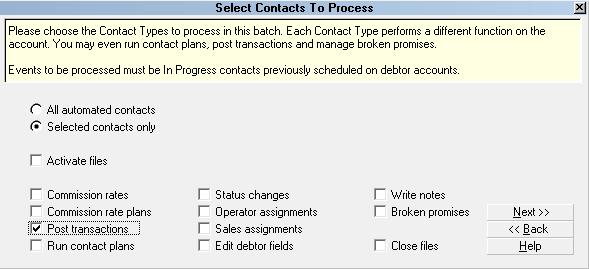

Post-Dated Batch Processing

To complete the scheduling of letters and posting the

transactions, you will have to run your batch processes.

This will post the appropriate transactions and print

the confirmation and withdrawal letters.

1. Every evening, do your Scheduled Batch Letters.

2. Each morning Process all contacts previously scheduled

and make sure the choice 'transactions' is chosen. Check

to ensure that transactions have been posted.

Process Transaction Contacts

All that remains is the printing of the checks. This is

accomplished with a report as described below.

Post-Dated Check Printing

When you are ready to print your checks, use the report

called Check - Form #1000.

BE SURE TO PICK THE CORRECT REPORT! This report

will pick up ANY check by phone transactions that have not

been printed yet, even those scheduled through an ordinary

checks taken by phone transaction and not yet printed. The

report is set up to only print transactions posted up to and

including today, not transactions with future posted dates.

The report inserts the word "printed" into the User 6 field

of the Transaction after the check is printed.

Check Printed

This ensures that it will not be printed again, even if you

have to start the batch again for any reason. It will pick up

where you left off since any printed checks will now

have "printed" in the transaction and will not be picked up again.

If you print this report to screen to look at the results,

"printed" is still inserted into the User 6 field. When you try

to print it for "real" to the printer, it won't print. So, you have

to go into the transaction and remove the word "printed"

from the User 6 field first.

If you print this report to screen to look at the results,

"printed" is still inserted into the User 6 field. When you try

to print it for "real" to the printer, it won't print. So, you have

to go into the transaction and remove the word "printed"

from the User 6 field first.

Billing Tree Module For Post-Dated Payments

The Billing Tree module enables you to process credit card and

ACH payments electronically through Collect!'s Billing Tree

connection. This is a full-featured solution for managing single

and recurring payments made by credit card or by bank draft.

External payments posted at the Billing Tree web site are

also reconciled and posted within Collect!. Recurring

scheduled payments are fully managed within Collect!'s

promised payment system.

See Also

- How To Take Checks Over the Phone

- Billing Tree Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org