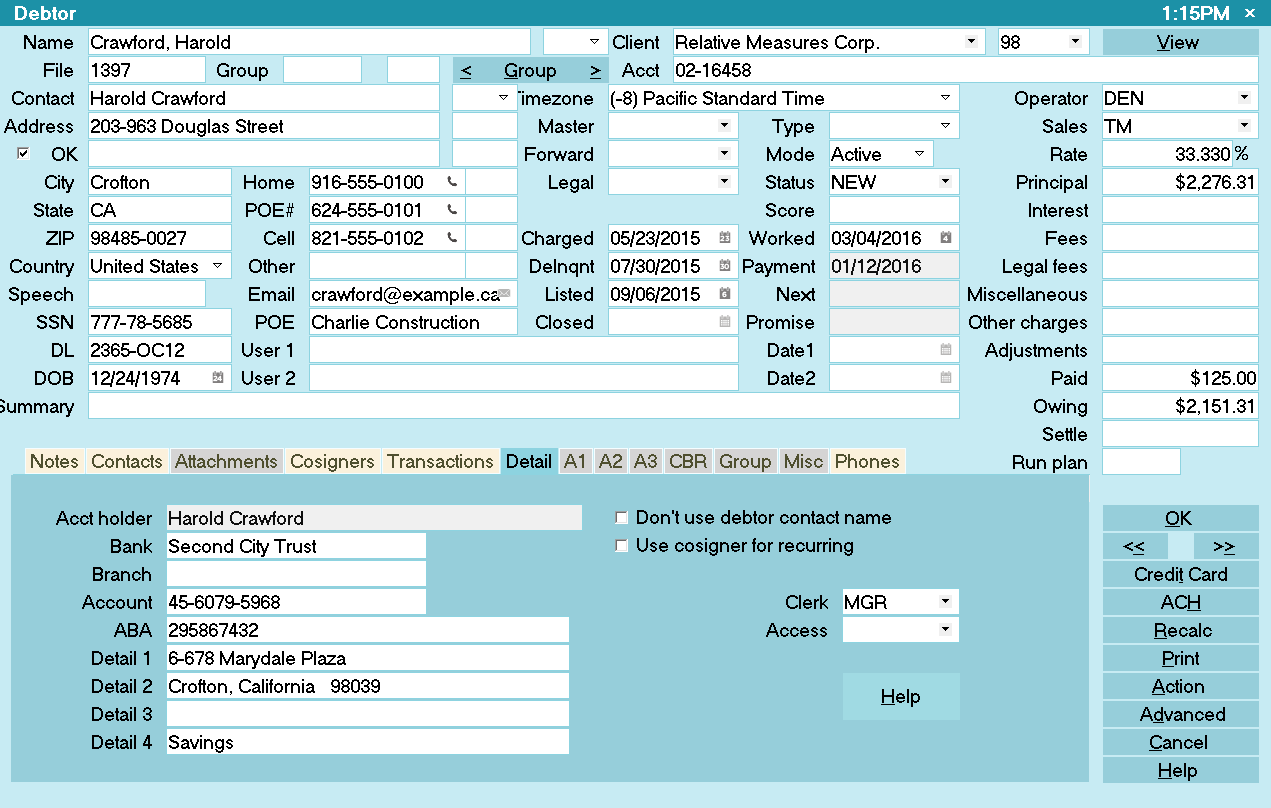

Debtor Detail

The Debtor Detail form shows additional information about

each debtor. It stores settings for restricting access to

the Debtor account when you are using Account Access Control.

The Debtor Detail can store any information needed for

reference purposes. If you plan to print debtor checks in

Collect!,using Take Checks Over The Phone, then certain

information must be entered as outlined below so that it can

be printed on your checks.

Debtor Detail

You can access the Debtor Detail form by choosing the

Detail tab on the Debtor form.

Acct Holder

This field displays the name of the bank account holder.

By default, the Debtor's Contact name is entered here.

You can modify this by switching ON "Don't use debtor

contact name" if the bank account is held in a different

name.

Don't Use Debtor Contact Name

Switch this ON with a check mark to enable editing on

the Acct Holder field. This lets you enter a different name

of the bank account holder is not the Debtor.

Bank

Enter the name of the debtor's bank. This is required if you

are using Take Checks Over The Phone. The name should be

the same as the name on the debtor's actual checks.

Branch

Enter the Branch of the debtor's bank. This is optional. The

information from this field can be pulled when printing

checks taken over the phone for the debtor.

Account

Enter the debtor's Bank Account Number. This is required

if you are using Take Checks Over The Phone.

This field must be either digits or a dash. [ - ] It must be no

more than *** MAXIMUM 12 places *** including any dashes.

This number must match the actual account number on the

debtor's checks.

If you require more than 12 places to enter

the debtor's Bank Account Number, please

phone Comtech for instructions to modify the

report. Otherwise, if you print more than 12

places to the Account Number, it will overwrite

some of the Transit Number.

If you require more than 12 places to enter

the debtor's Bank Account Number, please

phone Comtech for instructions to modify the

report. Otherwise, if you print more than 12

places to the Account Number, it will overwrite

some of the Transit Number.

Please refer to the Help topic How to Take Checks Over The Phone

for information on using the bank fields for checks.

Please refer to the Help topic How to Take Checks Over The Phone

for information on using the bank fields for checks.

Transit Number

Enter the Transit or ABA Number of the debtor's bank. This is

required if you are using Take Checks Over The Phone.

*** IMPORTANT *** This field MUST be 9 places ONLY.

It is digits and can contain a dash [ - ] The TOTAL

places MUST BE 9, including all digits and the dash.

This is also called the Routing Number. It must match the

Transit Number on an actual check from the debtor's bank.

Access

This field is tied to Collect!'s account access security

system. You can use it to restrict access to the account

to an Operator or a Team.

From this field's pick list, choose the Operator or Team

ID that you want to be able to access this account.

When you restrict access to an account in this way,

you must switch ON the security settings on the Operator

form, as well. Please see How to Restrict Access to Accounts for

more information to use this security feature.

If you want to restrict access to several Operators,

create a Sales Team containing the Operators' IDs.

Then choose the Sales ID from the Access field's

pick list.

If you want to restrict access to several Operators,

create a Sales Team containing the Operators' IDs.

Then choose the Sales ID from the Access field's

pick list.

Use Cosigner For Recurring

This switch is used for the Billing Tree Module when you

are using payer and billing information from a Cosigner.

Collect! turns the switch ON for you, if required, when

you are creating your recurring payment schedule.

There is no need to set it manually yourself.

For ACH payments, please refer to Help topic,

How to Take Billing Tree ACH Payments for details.

For credit card payments, please refer to Help topic,

How to Take Billing Tree Credit Card Payments for details.

Clerk

This field is for an Operator ID or an Operator Team ID.

The Clerk field is for your own use. It is also tied into

the account access security system. So you could use

it to grant access to this account to an Operator or a Team,

similarly to the Access field. Please see

How to Restrict Access to Accounts for more information.

If you are not using account access control, you can use

the Clerk field to enter the ID of an operator who handles

your banking transactions, for example.

Detail 1

A field available for miscellaneous

details. For check printing, this MUST be the debtor's

bank address first line, i. e. Street address.

Detail 2

A field available for miscellaneous

details. For check printing, this MUST be the debtor's

bank address second line, i. e. City, State Zip Code.

Detail 3

A field available for miscellaneous details.

Detail 4

A field available for miscellaneous details.

Help

Press this button for help on the Debtor Detail

form and links to related topics.

Cancel

Selecting this button will ignore any changes that you

may have made and return you to the previous form.

OK

Selecting this button will save any changes that you

may have made and return you to the previous form.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org