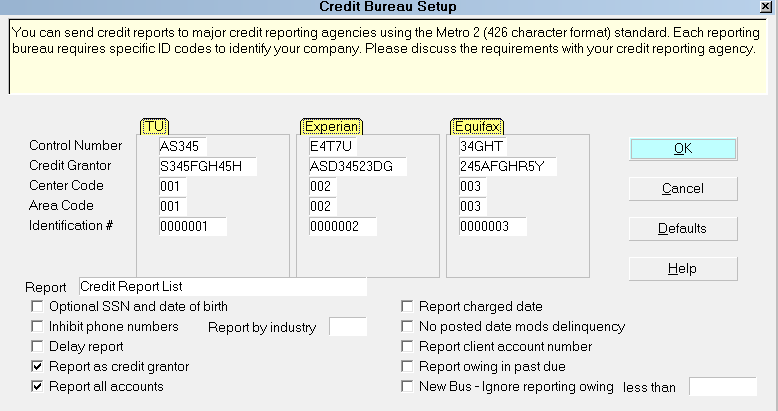

Credit Bureau Setup

You can send credit reports to major credit reporting agencies

using the Metro 2 (426 character format) standard. Each reporting

bureau requires specific ID codes to identify your company. Please

discuss the requirements with your credit reporting agency.

Credit Bureau Setup form

Once you start reporting to the credit bureaus, the Debtor's file number

must not change while the account is being reported on.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

Credit Reporting Agencies

Collect! provides for reporting to the three major credit reporting agencies:

Trans Union

Experian

Equifax

Reporting Credit With Collect!

When you setup your credit bureau reporting correctly, Collect! takes care

of all the details by automatically scheduling a Metro contact for each

debtor that you want to report. After you report, Collect! forwards this

contact for the next reporting period. Collect! tracks changes in the debtor's

profile for credit bureau purposes and reports the correct codes to the

bureau.

Please refer to Credit Report Details for more information. This

form is accessed from the Debtor screen. It is where you keep track of

the debtor's status for credit reporting purposes.

Please refer to Credit Report Details for more information. This

form is accessed from the Debtor screen. It is where you keep track of

the debtor's status for credit reporting purposes.

Default Values

It is important to fill in all fields for the credit bureau(s) of your choice

in the Credit Bureau Setup form. USE THE DEFAULT VALUES listed

below, if you have not been supplied an actual value from your

credit bureau.

Control Number

The Program Identifier or Control Number contains a

unique identification number assigned to you by the

credit reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Your unique subscriber codes will be placed at the top of the

file that Collect! creates for you to send to the credit bureau.

If reporting to Experian, place the D-Number into

the Control Number field.

Uc

TRANS UNION PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Wco

EXPERIAN PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Xco

EQUIFAX PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Credit Grantor

This is called the Subscriber Code in Trans Union terminology.

(Alpha numeric, length 10)

This is called the Subscriber Code in Experian terminology.

(Alpha numeric, length 10)

This is called the Membership Number in Equifax terminology.

For Equifax subscribers, enter the 10 character ID code

provided by Equifax here. (Alpha numeric, length 10)

Your unique subscriber codes will be placed at the top of the

file that Collect! creates for you to send to the credit bureau.

If reporting to Equifax and/or Trans Union, place the

Subscriber ID they give you into the Credit Grantor field.

Ug

TRANS UNION CREDIT GRANTOR

This is called the Subscriber Code in Trans Union terminology.

(Alpha numeric, length 10)

Wg

EXPERIAN CREDIT GRANTOR

This is called the Subscriber Code in Experian terminology.

(Alpha numeric, length 10)

Xg

EQUIFAX CREDIT GRANTOR

This is called the Membership Number in Equifax terminology.

For Equifax subscribers, enter the 10 character ID code

provided by Equifax here. (Alpha numeric, length 10)

Center Code

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Uce

TRANS UNION COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Wce

EXPERIAN COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Xce

EQUIFAX COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Area Code

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Ua

TRANS UNION AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Wa

EXPERIAN AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Xa

EQUIFAX AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Identification #

The Identification Number is used to uniquely identify a

credit grantor. Report your internal code to identify each

branch, office and/or credit center where information is

verified. This number must be unique and at least five digits

long. Note that the entire field should never be zero, blank

or 9 filled. This field must be consistent on a month to

month basis. Notify your credit bureau representative before

changing this code.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 7)

UID

TRANS UNION IDENTIFICATION #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 7)

Wid

EXPERIAN IDENTIFICATION #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 7)

Xid

EQUIFAX IDENTIFICATION #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 7)

File Location

When the *.001 files are created, they will be placed

in the CV11\bin\cbr folder.

Report

This is the name of the summary report listing all Debtors

sent to the credit bureaus. The default report lists Debtor

name, principal, owing etc. You can edit the report to suit

your needs.

Optional SSN And Date Of Birth

Switch ON 'Optional SSN and Date of Birth' to prevent

Collect! from checking the debtor for a valid SSN

or DOB when reporting to the bureau. When checked,

Collect! will NOT stop accounts that are missing an

SSN and also missing a DOB from being reported.

WARNING: As of 2017, US Credit Bureaus require

that any accounts being submitted must

have either an SSN or DOB. If you are

in the US, do not enable this option.

This option is for non-US customers

where the SSN and DOB are not a

requirement.

WARNING: As of 2017, US Credit Bureaus require

that any accounts being submitted must

have either an SSN or DOB. If you are

in the US, do not enable this option.

This option is for non-US customers

where the SSN and DOB are not a

requirement.

Inhibit Phone Numbers

Switch ON 'Inhibit phone numbers' to prevent Collect!

from sending phone numbers to the credit bureau.

The output file will contain all zeroes in the phone

number position. This ensures debtor privacy if

you have unlisted phone numbers in your database.

This is a global setting, it cannot be set on an

individual account basis.

Delay Report

When you first report credit on an account, you can

schedule for the report to be sent later, rather than

immediately. The date can be changed manually.

To delay reporting, put a check in the box by pressing

the spacebar or left-clicking with your mouse. The

Delay Days field will now be visible for you to enter the

number of days you wish to delay before sending this

report.

To have reporting start immediately, leave the box empty.

Delay Days

When you switch ON 'Delay report' you can optionally

select the amount of days you would like to delay

by putting in the numbers in this box.

Report As Credit Grantor

When this is switched ON with a check mark, the

Delinquency Date is used to report the Date of Occurrence

for all status codes except 4, 10, 13 and 61 to 68. In those

cases, the date the Contact was scheduled is sent as the

date of occurrence.

When you leave this switch OFF, the Date of Occurrence

is always taken from the Delinquency Date, regardless

of status code. Leave this switch OFF if you are operating

a Collection Agency.

Report All Accounts

When this is switched ON with a check mark, Collect! will

report all debtors in your database that have been setup

for credit bureau reporting. With this box unchecks,

Collect! will only report accounts that have been changed.

This box is on by default to comply with the

2016 USA reporting requirements change requiring

This box is on by default to comply with the

2016 USA reporting requirements change requiring

all accounts to be included in a credit report.

Report By Industry

Enter the Industry Code you wish to include in this

report. Only Debtors with this setting in the

Credit Report Details Reporting Industry field will be

processed for reporting.

This enables you to keep all your Collections accounts

together in one report and all your Mortgage Loan accounts

in a different report, for instance.

Please refer to How To Setup Credit Bureau Reporting

for more details.

Report Charged Date

Switch this ON to report the Charged Date instead of

the Listed Date as the credit bureau report's Date Opened.

This switch works when you are reporting as a

credit grantor. The 'Credit Grantor' switch is enabled

through the System menu. Select Company Details from

the drop-down choices to open the Company Details

form and switch on 'Credit Grantor' if this applies to you.

If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date for

credit bureau reporting. Also Collect!

automatically reports the Charged Date when

you are reporting NSF checks. You do not

need to switch on 'Report Charged Date'.

If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date for

credit bureau reporting. Also Collect!

automatically reports the Charged Date when

you are reporting NSF checks. You do not

need to switch on 'Report Charged Date'.

No Posted Date Mods Delinquency

When this is switched ON, Collect! uses the Payment Date

of the promise transaction as the Delinquency Date rather

than allowing the default 30 day delay in determining

delinquency.

This is used only in Credit Grantor mode.

This is used only in Credit Grantor mode.

Report Client Account Number

By default, Collect! uses the Debtor File Number as the

ID for credit bureau reporting. It is recommended that

you leave Report Client Account Number switched OFF

and let Collect! report using the Debtor File Number,

unless you are sure you need to do otherwise.

When this switch is ON, the Client Account Number

field (Acct on the Debtor form) is transmitted as the

account identifier to the Credit Bureaus.

Please refer to How To Setup Credit Bureau Reporting

for details.

Report Owing In Past Due

Switch this ON with a check mark to report the Debtor's Owing

in the Past Due position of the CBR file. Normally, this field is

zero filled if you are not a credit grantor, but you can use

this switch to fill it with the Owing.

New Bus - Ignore Reporting Owing

This field applies to the 'Prepare Accounts for Credit Bureau

Reporting' batch processes. If this field is checked, then

debtors being reported for the first time will not be enabled

if their owing is less than the value in the LESS THAN field.

Less Than

This field is used by the NEW BUS - IGNORE REPORTING OWING

field above and only applies to the 'Prepare Accounts for

Credit Bureau Reporting' batch processes. If the above field

is checked, then debtors being reported for the first time

ill not be enabled if their owing is less than the value in

this field.

Help

Press this button for help on the Credit Bureau Setup

form and links to related topics.

Defaults

When reporting a Debtor to the Credit Bureaus, there are

certain settings that need to be reported to the bureaus.

Select this button to display the Credit Report Preferences

form where you can choose default credit reporting settings.

When you flag a Debtor to be reported to the Credit Bureau,

these default settings will automatically apply to the Debtor.

You can override these defaults on an individual Debtor level

through the Credit Report Details dialog. To access this

dialog, select the CBR tab on the Debtor form.

Cancel

Selecting this button will ignore any changes you have

made and return you to the previous form.

OK

Selecting this button will save any changes you may have

made and return you to the previous form.

See Also

- How To Run A Credit Bureau Report

- Credit Bureau Reporting Topics

- Credit Reporting Functional Description

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org