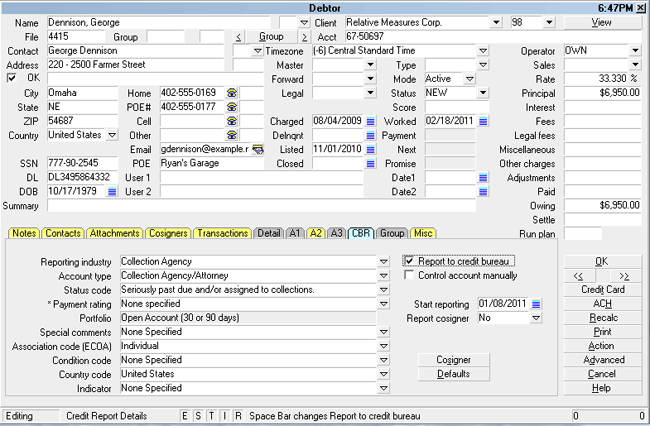

Credit Report Details

The Credit Report Details form is used to set credit

reporting details for a debtor and cosigners.

Credit Report Details form

Please refer to Credit Report Details Basics for steps to

access this form.

Please refer to Credit Report Details Basics for steps to

access this form.

Options used as default values when you report Debtor credit

are set in the Credit Report Preferences form. These settings

can be changed here, at the individual Debtor level, if necessary.

In most cases, the defaults should be fine. You may need to

set the Association field on an individual level.

If you are having trouble deciding what values should be set,

contact your local credit bureau representative.

Choices provided are for normal collection and credit

management agencies. You can choose an item from the pick

list to enter its corresponding code in the credit report settings.

Choices provided are for normal collection and credit

management agencies. You can choose an item from the pick

list to enter its corresponding code in the credit report settings.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending is

accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal rights

of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending is

accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal rights

of the person or entity you are reporting.

Reporting Credit With Collect!

When you setup your credit bureau reporting correctly, Collect!

takes care of all the details by automatically scheduling a Metro

contact for each debtor that you want to report. After you report,

Collect! forwards this contact for the next reporting period. Collect!

tracks changes in the debtor's profile for credit bureau purposes

and reports the correct codes to the bureau.

The Credit Report Details form is where you keep track of the

debtor's status for credit reporting purposes. Changes that you

make to the settings on this form will be reflected in your

credit bureau report.

Report To Credit Bureau

When this flag is checked, the Debtor is set to be reported to

the credit bureaus.

Please make sure you have permission from

your client to report this debtor. You may want

to visit the Client Settings to ensure that

credit bureau reporting is enabled.

Please make sure you have permission from

your client to report this debtor. You may want

to visit the Client Settings to ensure that

credit bureau reporting is enabled.

Control Account Manually

When this is switched ON, Collect! will not change the

credit reporting Account Status when processing Metro

contacts for reporting to credit bureaus. This means

you will have to manually select the required Status from

the pick list when the account's status changes.

By default, the Account Status for reporting,

such as "Seriously past due" or "Paid in full,"

changes depending on the reporting industry

and the state of the account. Ordinarily, you

do not need to control accounts manually.

Collect! puts additional information into the

Payment Rating field where necessary to

retain information, (e.g. 30-60-90 days

overdue for credit grantors).

By default, the Account Status for reporting,

such as "Seriously past due" or "Paid in full,"

changes depending on the reporting industry

and the state of the account. Ordinarily, you

do not need to control accounts manually.

Collect! puts additional information into the

Payment Rating field where necessary to

retain information, (e.g. 30-60-90 days

overdue for credit grantors).

This is useful for special requirements, such as

changing an ECOA Association Code at a

later date, after the Account is Paid in Full.

Or, setting the Account Status to Paid in Full

when posting Early Payoff or adjustments with

advanced Interest settings.

This is useful for special requirements, such as

changing an ECOA Association Code at a

later date, after the Account is Paid in Full.

Or, setting the Account Status to Paid in Full

when posting Early Payoff or adjustments with

advanced Interest settings.

Only switch this ON if you are sure that Collect! cannot

correctly handle your reporting requirements automatically

with the built-in functionality of credit bureau reporting.

Start Reporting

Press F2 while in this field to bring up the calendar, where

you can select the date that you wish to start reporting this

Debtor to the bureau. You may also enter a date in the

MM/DD/YY format.

By default, this field will show Today's Date unless there is

an In Progress Metro Contact on the account. In that case,

it will display the date of the Metro Contact, instead.

If the 'Delay Report' switch is ON in the

Credit Bureau Setup form, the Delay Days

value will be reflected here. The extra days are

only added to Today's Date if this is the first

time you are setting up credit bureau reporting

on this account. You can select a different date

if you wish.

If the 'Delay Report' switch is ON in the

Credit Bureau Setup form, the Delay Days

value will be reflected here. The extra days are

only added to Today's Date if this is the first

time you are setting up credit bureau reporting

on this account. You can select a different date

if you wish.

Reporting Industry

This field contains the industry type that classifies the

reporting agency. The list of default industries provided

by Collect! covers normal collection and credit

management. When you select one of the industries

in the list, other pick lists change to enable you to set

the account type based on the industry.

Please refer to your Metro 2 Manual for help

in choosing from the pick list.

Account Type

This field contains the account type code that identifies the

account classification. The list of default account types

provided by Collect! covers normal collection and credit

management. The choices for this field change depending

on the industry selected for the Reporting Industry.

Please refer to your Metro 2 Manual for help

in choosing from the pick list.

Status Code

This field contains the status code that properly identifies

the current condition of the account. The list of default status

codes provided by Collect! covers normal collection and

credit management. Please refer to your Metro 2 Manual for

help in choosing from the pick list.

Payment Rating

This field contains settings for specifying whether

or not an account is Current or Past Due. It is only

visible for certain Status Codes that Collect! does

not handle automatically. Please refer to

Credit Reporting Functional Description for details.

Portfolio

This field contains the type of the debt. The pick list offers

choices for common credit and loan types. Please refer to

your Metro 2 Manual for help in choosing from the pick list.

Special Comments

This field is used in conjunction with the Account Status

to further define the account. Special comment codes,

when found, will however take precedence over the value

in Account Status.

The list of default choices provided by Collect! covers

normal collection and credit management. Please refer

to your Metro 2 Manual for help in choosing from the

pick list.

Association Code

This is used to designate an account in compliance with

the ECOA. This setting can be changed for an individual

Debtor while you are on the Credit Report Details form

accessed from the Debtor form.

The list of default choices provided by Collect! covers

normal collection and credit management. Please refer

to your Metro 2 Manual for help in choosing from the

pick list.

Condition Code

This field allows for reporting of a condition that is

required for legal compliance; e.g., according to the

Fair Credit Reporting Act (FCRA). Please refer to your

Metro 2 Manual for help in choosing from the pick list.

Country Code

This is the country that the Debtor lives in.

The list of default country codes provided by Collect!

shows only a few of the most used country codes.

Please refer to your Metro 2 Manual for help in choosing

from the pick list or adding to it.

Indicator

This field contains a value indicating a special bankruptcy

condition which applies to the debtor cosigner. Please

refer to your Metro 2 Manual for help in choosing from the

pick list.

Report Cosigner

This is used to determine if the Debtor has a

cosigner to be reported.

Cosigner

Selecting this button will take you to the Debtor Cosigner form.

Pressing F1 from the Debtor and Cosigner

forms will bring up help for each field in those

forms. This help includes credit bureau reporting

details for entering information in each field that

pertains to credit reporting. Please read this help

carefully, as information sent to credit bureaus must

be in an EXACT format.

Pressing F1 from the Debtor and Cosigner

forms will bring up help for each field in those

forms. This help includes credit bureau reporting

details for entering information in each field that

pertains to credit reporting. Please read this help

carefully, as information sent to credit bureaus must

be in an EXACT format.

Defaults

When reporting a Debtor to the Credit Bureaus, there are

certain settings that need to be reported to the bureaus.

Select this button to display the Credit Report Preferences

form where you can choose default credit reporting settings

at the system level. When you flag a Debtor to be reported

to the Credit Bureau, these default settings will automatically

apply to the Debtor.

You can override these defaults on an individual Debtor level

through the Credit Report Details dialog.

Help

Press this button for help on the Credit Report Details

form and links to related topics.

Cancel

Selecting this button will ignore any changes you have

made and return you to the previous form.

OK

Selecting this button will save any changes

you may have made and return you to the

previous form.

See Also

- Credit Report Details Basics - Introduction/Accessing

- Credit Bureau Reporting Topics

- Credit Reporting Functional Description

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org