Debtor Basics

This document will introduce you to the Debtor form.

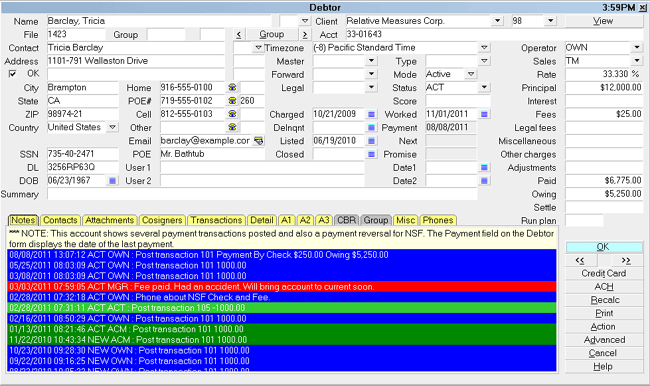

The Debtor record is the heart of Collect!. Ninety percent

of your work takes place here. A Debtor record is attached

to an appropriate Client record. Then, any financial

information that affects the balance of the debtor is recorded

from the Debtor record. Contact events, letters, financial

transactions, cosigners or others, are all attached to the

debtor account.

Simply put, a Debtor record can be any information at all that

you would like to keep as a historical account of actions, as

well as any financial information, such as fees, interest,

payments and so forth.

Generally, two important areas of information relate to your

Debtor. One is debtor demographics and the other is money.

We will use these two separate categories to familiarize you

with the Debtor form.

Debtor Information

The Debtor form itself stores all address and personal information

about the account. There are fields for address, phones, SSN and

so forth. Additional fields provide account tracking with Mode,

Status, Operator, Sales and several Date fields, such as Listed,

Worked and Promise.

You should press F1 when you are viewing the Debtor

form to see an explanation for each one of the fields on the form.

You should press F1 when you are viewing the Debtor

form to see an explanation for each one of the fields on the form.

For debtor information that doesn't seem to fit on the Debtor form,

Collect! has several extra records that you can use. These

are accessed through the tabs at the bottom of each Debtor

record.

Debtor form

Notes contains free form comments with Date, Operator and

Status stamp.

Debtor Detail is generally used for storing bank account information.

Cosigners or other related parties may be stored in the Debtor

Cosigner form.

The Attachment form can store many fields of related information.

You can have multiple types of attachments for all sorts of

information.

Contacts can be created for working the account and these

may be viewed through the tab labeled Contacts.

The Misc tab contains extra fields and switches for additional

customized uses.

Debtor records may also be grouped together for easily tracking

information for accounts entered previously, either for the same

client or belonging to different clients. The Group tab displays

all the members in the group.

Debtor Financials

Collect! excels in its flexible handling of debtor financial details.

This is an area where you can create a "paper trail" for anything

that affects the account financially.

There are several fields on the Debtor form that display

financial values for the account.

Principal and Judgement, Interest, Fees, and Rate are stored

in the Financial Detail form, accessed by selecting the Principal

field.

Any transaction posted to the account may be entered and

viewed through the Transactions tab. Transactions are totaled

and displayed in the appropriate field.

There are six financial types that you can use when posting

transactions to the account. Each one has its own totals

field on the Debtor form.

Paid displays payment type transaction totals. The Payment

field displays the date of the last payment.

The Adjustments field is populated with the total of all

transactions that are flagged as adjustments.

The Fees field is populated with the total of all transactions

that are flagged as fees.

Legal, Miscellaneous and Other fields are populated with

totals for the corresponding transactions flagged as those

types when posted to the account.

And finally, the Owing field is populated with the result of all

the other financial field values.

When you select the Owing field, a Debtor Financial Summary

appears. This form summarizes the totals, paid to date values,

and remaining amount owing on the account. Interest and/or

an outstanding promise can be found in the Current column,

as amounts needed to bring the account to current.

Accessing Debtor

The Debtor form may be accessed in many ways. Providing you

have access to the various menus and forms, you can use one

of the following ways to get to the Debtor form.

1. Using the menu bar at the top of Collect!, select

Browse to display the drop-down menu. Select All Debtors,

Active Debtors or Closed Debtors from this menu and the

list of the appropriate Debtors will appear.

2. From the Main Menu, select the Daily Administration

button to display the Daily Administration menu. Select

the New Business button to display the New Business menu.

Select the button labeled Debtors to display the list

of existing debtors currently in your database.

3. Using the methods listed in Accessing Client, open

a Client form. With the Client form on the screen, simply

select the window labeled Debtors to activate the

client Debtors list for this client.

4. Using the menu bar at the top of Collect!, select

Browse to display the drop-down menu. Select Find By

from this menu and a submenu will display with various

fields listed to search by. Select one of the search

types and follow the prompts to gain access to the list

of successful matches.

5. On any other form that has a drop-down selection field

to access a debtor, simply press F2 or select the down

arrow to the right of the field to display a list of debtors in

your system currently.

See Also

- How To Enter A New Debtor

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org