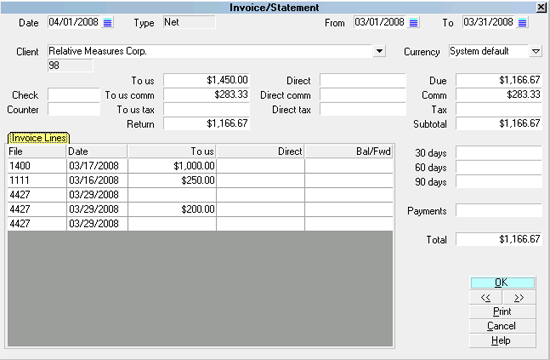

Invoice/Statement

The Invoice/Statement form displays a summary of all

billable transactions for a client over a specific time period.

Invoice/Statement form

Please refer to Invoice/Statement Basics for steps to

access this form.

Please refer to Invoice/Statement Basics for steps to

access this form.

Statements are created when you choose the

Generate Statements option in the Month End menu. You

can select Print from the top menu bar and then select

Monthly Reports from the drop-down choices. This will

display a submenu. Select Generate Statements to

calculate all invoice/statement information for the period

and create the invoices. This information and is displayed

in the Invoice/Statement form to be used when you print

the statements and checks.

Checks can be printed for statements with a positive

balance owing, that is, you owe the client.

After you generate statements, use the Month End

menu to print statements. This menu can be accessed

from the Main Menu. You can also select Print from the

top menu bar and then select Monthly Reports from the

drop-down choices. Then select Statements from the

submenu that is displayed. This will begin the process

to print the invoices that you generated earlier. You can

also create invoices manually, edit the invoices yourself

if you need to make some changes, and print individual

invoices, if needed.

You must generate statements before you

can print them.

You must generate statements before you

can print them.

Click here to view sample

of printed statement

See Also:

- Month End Process

- Troubleshooting Month End

Date

This is the statement date of the invoice. Statements

are usually dated for the 1st of the month.

When generating statements you are prompted for a

date range, usually from the 1st to the last of the previous

month. The statement date is set to one day after the last

date the statements are generated for.

For example, if you generate statements for January 1st

through 31st, the statement date is February 1st.

Type

This displays the type of invoice, whether Gross or

Net or Combined remit.

This setting is read from the Client when generating

statements. The Client Settings form, available from

the Client form, has an option to control the Gross

or Net or Combined remit.

This setting also determines the name of the report

used when printing the statement batch.

Net Remit statements use the report called 'STATEMENT'

while Gross Remit statements print the 'GSTATEMENT'

report. The Combined statements print the 'CSTATEMENT'.

Calculations are also altered by this switch. The fields

explained below have more details about the different

calculations.

From

This is the From Date for the Date range selected

when this Statement was generated.

To

This is the To Date for the Date range selected

when this Statement was generated.

Client

This is the name of the Client this statement is for.

Number

This field displays the Client ID number.

Check

This is a check number generated by Collect!,

if you entered a check number when prompted.

Collect! prompts you for a starting check number

when printing checks. Each statement in which you

owe the client money will have a check number

inserted, starting with the number you enter.

This field can be used as a check register to

keep track of the checks sent to your clients.

See Help topic, Print Checks, for details.

Counter

This field can be activated to begin a numbering

sequence for statements.

Please refer to How To Setup Invoice Numbering

for details.

To Us

This field shows the total month's payments paid

by debtors to the agency.

This is the sum of all To Us amounts in the line

items for this statement.

To Us Comm

This field shows the total billing period commission

payable by the client on monies collected by the agency.

This is the total of the commissions in all To Us items

in this invoice.

To Us Tax

This field displays the total of tax on commissions for

moneys collected by the agency during the billing period.

The tax amount is totaled from the tax amount displayed

on each To Us transaction covered in the billing period.

This is calculated from the debtor's tax rate.

Net Remit will withhold tax amount from total

that is returned to the client. Gross remit will

add this tax amount to the remit requested

from the client.

Net Remit will withhold tax amount from total

that is returned to the client. Gross remit will

add this tax amount to the remit requested

from the client.

Return

This is the amount of money returned to the client

during the billing period for this invoice.

It is defined as the total payments to the agency

plus the total direct payments to the client, minus

the total commissions paid.

Direct

This is the total month's payments paid by debtors

directly to the client.

Direct Comm

This field shows the total billing period commission

payable by the client on monies paid directly to the

client. This is the total of the commissions in all Direct

items in this invoice.

Direct Tax

This field displays the total of tax on commissions for moneys

paid directly to the client during the billing period. The tax

amount is totaled from the tax amount displayed on each

Direct transaction covered in the billing period. This is calculated

from the debtor's tax rate.

Net Remit will withhold tax amount from total

that is returned to the client. Gross remit will

add this tax amount to the remit requested

from the client.

Net Remit will withhold tax amount from total

that is returned to the client. Gross remit will

add this tax amount to the remit requested

from the client.

Currency

This is the currency the debtor account is recorded in.

By default, this field is blank or is set to the System

Default. Collect! reads your Regional Settings and uses

whatever you've set your computer to.

This means that if you've set up your computer for North

America, you'll see the $ symbol displayed in currency

fields. Other countries will show different currency

symbols.

If you select a currency, statements are printed in the

selected currency rather than the system default.

The debtor's currency records the currency of the

account.

Collect! does no calculations using

exchange rates and currencies yet.

These fields are provided for your own

informational purposes only.

Collect! does no calculations using

exchange rates and currencies yet.

These fields are provided for your own

informational purposes only.

This field is visible only when Multi Currency is switched

ON in the Company Details form, available from the

Options pull-down menu.

Due

This is the amount due FROM or TO the client,

depending on how many payments were sent

directly to the client vs. payments made to the

agency.

POSITIVE amounts are OWED TO THE CLIENT,

while NEGATIVE amounts, displayed in parentheses,

are OWED TO THE AGENCY by the Client.

For Net Remit statements, this is the amount

due from the agency to the client. This amount is

calculated as the total payments to the agency (not

to the client), minus total commissions on all

payments, whether to agency or Direct to client.

The Due amount is positive when the agency

received debtor payments exceeding the total

amount of commissions earned. This means that

the agency will need to send money to the client.

For Gross Remit statements, the Due amount is

the commission amount due from the client to the

agency. It is the total commissions earned on all

payments. It represents the amount the client must

send to the agency.

Combined statements read the To Us, Direct

and Commission fields and the totals are summarized

when you print the 'CStatement'.

Combined statements read the To Us, Direct

and Commission fields and the totals are summarized

when you print the 'CStatement'.

Comm

This field shows the total billing period commission

payable by the client.

This is the total of the commissions in all line items

in this invoice.

To view Invoice details. press F5 to

activate the list of individual invoice

lines and F5 again to review details

for an individual invoice line item.

To view Invoice details. press F5 to

activate the list of individual invoice

lines and F5 again to review details

for an individual invoice line item.

AGENCY COMMISSION

This is the total amount of commission earned by

the agency during the invoice billing period. It is the

total of all commission entries in all transactions over

the period.

When most payments were Direct to the client, the

Comm amount will exceed the total payments to the

agency, and the Due amount will be negative. In this

case, the agency doesn't have to send money to the

client, but instead, the client must send money to

the agency.

Tax

This field displays the total of tax on commissions for

the billing period. The tax amount is totaled from the

tax amount displayed on each transaction covered in

the billing period. This is calculated from the debtor's

tax rate.

Note that Net Remit is handled differently from Gross Remit

tax when the Subtotal is calculated.

Subtotal

This is the total payable to or from the client.

For Net Remit statements, this amount is calculated as

the Due amount minus the tax owing on agency

commission earned.

For Gross Remit statements, this amount is calculated as

the Due amount plus the tax owing on agency commissions

earned.

Combined statements read the To Us, Direct

and Commission fields and the totals are summarized

when you print the 'CStatement'.

Combined statements read the To Us, Direct

and Commission fields and the totals are summarized

when you print the 'CStatement'.

30 Days

This is the amount outstanding from the last statement.

Client payments are credited toward the 30 days

owing only after the 60 and 90 days owing amounts (if any)

have been paid.

60 Days

This is the amount outstanding from between 31

and 60 days.

Client payments are credited toward the 60 days

owing only after the 90 days owing amounts (if any)

have been paid.

90 Days

This field displays the amount outstanding from

between 61 and 90 days. Any amount owing for

longer than 90 days will also show up in this field.

Payments

Payments made by the client during the last

billing period.

Payments are credited toward outstanding (30/60/90 days)

owing amounts, then, to the current amount due.

Total

This field shows the Total Amount to be paid

by the client to the agency or vice versa.

For NET Remit clients, if the amount is POSITIVE,

your company must pay the client this amount.

A NEGATIVE value indicates that the client owes

this amount to the agency.

For GROSS Remit clients, this is the amount

the client owes you.

Combined statements read the To Us, Direct

and Commission fields and the totals are summarized

when you print the 'CStatement'. The Invoice Total

represents the net amount that you are actually

paying your client. It is actually a combination of

what you are remitting to them and what they are

remitting to you, as summarized in the CStatement.

Combined statements read the To Us, Direct

and Commission fields and the totals are summarized

when you print the 'CStatement'. The Invoice Total

represents the net amount that you are actually

paying your client. It is actually a combination of

what you are remitting to them and what they are

remitting to you, as summarized in the CStatement.

Invoice Lines

This is the list of individual Invoice Line items

in this statement.

Press F5 to open the list and F5 again to

open individual line items.

OK

Select this button to save any data you have entered

and return to the previous form.

<<

Selecting this button will take you back

to another record.

>>

Selecting this button will take you forward

to another record.

Print

Choose a report to print from a list of reports relating to

invoices and statements.

You can easily print an individual statement from this

Print button. Choose the 'Statement' report from the

list to print for Net clients, or 'GStatement' for a Gross

Remit client.

It is important to pick the correct type of

report for Net or Gross remit clients.

It is important to pick the correct type of

report for Net or Gross remit clients.

Cancel

Select this button to ignore any changes you may

have made and return to the previous form.

Help

Press this button for help on the Invoice/Statement

form and links to related topics.

Delete

This button is visible only on the list of all

statements. Select this to delete the highlighted

item from the database.

Edit

This button is visible only on the list of all statements.

Select this to open and modify the highlighted item

from the database.

New

This button is visible only on the list of all statements.

Select this to open a new blank statement form.

Examples Of Net And Gross Remit

Some examples of Net and Gross Remit calculations

are given here.

Example 1:

The agency collects $1000 for the client.

The money is paid to the agency, the commission

is 30% and tax rate is 10%.

At month end, the client owes the agency

the $300 commission plus 10% tax on $300 for

a total of $330.

If this is a Net Remit statement, and the

agency received a check for $1000, they will

need to send back $670 (that's $1000 minus $330)

to the Client while keeping the remaining $330.

If this is a Gross Remit statement, the agency

will send back the whole $1000, and the Client

is billed $330.

Example 2:

The agency collects $1000 for the Client.

The money is paid Direct to the client, the

commission is 30% and tax rate is 10%.

At month end, the client owes the agency

the $300 commission plus 10% tax on $300

for a total of $330.

If this is a Net Remit statement, and the

client received a check for $1000, the agency

has no money due the Client, and instead the

client is billed the $330 commission amount.

If this is a Gross Remit statement, the agency

sends nothing to the Client and the Client

is billed $330.

Combined Statements

Combined statements read the To Us, Direct and

Commission fields and the totals are calculated

when you print the 'CStatement'. With Combined,

the agency keeps its share of commissions only

on amounts paid to the agency. Then the agency

requests a payment of commission on amounts

paid directly to the client.

For example:

The Agency receives $100 and gets a commission

of 15%. In the same period, the Client receives $100 and

must return $15 commission to the agency.

The statement will indicate enclosing a check for $85

and requesting a check for $15. This enables your

clients to keep a completely separate account of the

amounts received by you and those received directly

by them.

Create A Statement For A Client

1. From the Main Menu, choose the Month End option.

This will open the Month End menu.

2. Choose Generate Statements.

3. Accept the default date range or select different FROM

and TO dates. All transactions posted over that date

range will be analyzed when building the statements.

The statement date will be one day after the TO date.

4. Leave the Client# blank.

5. Click OK.

6. If invoices already exist and Collect! prompts, click YES

to delete them.

7. Enter a starting Check Number when prompted.

8. Collect! will tell you when it's done.

Print The Statement You Just Created

1. Open the Month End menu again, as described above.

2. Choose Print Statements.

3. Accept the default date range or select a different date.

If you generated statements for January 1st

to 31st, the statements will be dated February 1st. Therefore, you

must choose 1 day after the last date you generated statements for,

when printing the statements. Both FROM and TO should

contain the same date.

If you generated statements for January 1st

to 31st, the statements will be dated February 1st. Therefore, you

must choose 1 day after the last date you generated statements for,

when printing the statements. Both FROM and TO should

contain the same date.

4. Leave the Client# blank.

5. Click OK. A prompt will display.

6. Click the LETTERS button at the bottom of the message screen.

7. Click the PRINT button in the Print dialog to print the statement.

Print Any Statement In The System

You can print any statement that you have previously generated.

Also, you can print a check if you owe your client an outstanding

amount.

1. Select BROWSE from the top menu bar and

a drop-down menu will display.

2. Select Statements. The list of all your Statements/Invoices

will display.

3. Click on the statement you want to print. This will display the

Statement form.

4. Select PRINT from the top menu bar and a drop-down menu

will display a list of choices.

5. Select REPORTS AND LETTERS from the list. This will display

a list of all reports that you can print now.

6. Select the 'Statement' report for a NET client or 'GStatement'

report for a GROSS client. You will advance to the

REPORT OUTPUT OPTIONS dialog.

7. Press the PRINT button to print your statement.

OR

If you owe your client, you can select the Select the 'Check'

or 'GCheck' report and Collect! will print a check for you.

Collect!'s default check-printing uses Form #1000

forms. This is an attractive standard for printing checks. Please

refer to How To Setup Check and GCheck for details.

Collect!'s default check-printing uses Form #1000

forms. This is an attractive standard for printing checks. Please

refer to How To Setup Check and GCheck for details.

See Also

- Invoice/Statement Basics - Introduction/Accessing

- How To Setup Check And Gcheck

- How To Setup Invoice Numbering

- How To Start Using Collect!

- How To Remit Gross Or Net Funds

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org