Month End Process

Month End is comprised of a few fast, easy steps. Once you have

posted all transactions; including client payments, debtor fees,

debtor payments and adjustments you are ready to begin. From

the Main Menu choose Month End.

The Month End menu is made up of six aspects.

Generate Statements

Select Generate Statements. You will see a default

date range, typically the first day of the month to the

last day of the month. If you need a different date span

you may select it at this time by picking dates from the

calendar. Note of caution: If you alter the default dates one

month you need to be very careful that you select the

correct dates in each successive month. See

Troubleshooting Month End for more information.

When generating statements, Collect! looks at last month's

statements and adds in any balances which were due from

your client, then calculates any debtor payments and fees

which you have posted. Collect! notes if the payments

were received by you or by your client. The commissions have

already been calculated when you posted the transaction and

at this stage, the generating process will separate accordingly

to benefit you or your client. Of the fees you have collected

the ones which have been marked for you will be added to

your benefit. Conversely the fees you have collected for your

client will be slated for your client's benefit. Lastly, the

payments you have received from your clients will be deducted

and Collect! will give you a current amount owing, indicating

whether you owe funds to your client or your client owes you.

Browse Statements

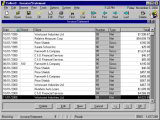

From the Month End menu, select Browse Statements.

This is an opportunity to have a look at the bottom line on

each statement you have just generated and look for any

glaring errors or omissions.

Open a statement and you can see the basic process of

calculations on the left. On the right is a box displaying

each transaction posted for the period for that client.

Each line item (transaction) can be viewed in detail by

clicking on the line and opening the transaction. These

details are a very useful way to confirm that you are

getting the results you expect when generating your

statements.

If you find a posting error, you must go to the actual

transaction listed in the Invoice Line, make your

correction and re-generate the statement. See

Troubleshooting Month End for more in-depth information.

Print Statements

From the Month End menu, select Print Statements.

You have already indicated in the Client Settings if each

Client's Statement is net or gross remittance. When you

browsed the invoices, you saw the actual amounts calculated

in a generic format. When you print statements in a batch,

Collect! looks at the statement type you have chosen and prints

accordingly. Statements will always be stored dated one day

after your selected date of generation. (i.e. If you generate

statements for the period from the first to the last day of

June, the date on the actual statement will be the first of July.)

If you print one statement at a time from within the Statement

form, you have a choice of which template type to use.

Caution is advised. If your statements look very strange and you

have printed one at a time, it is likely that you have simply selected

the wrong template. See Troubleshooting Month End for

more information.

Print Checks

From the Month End menu, select Print Checks. Collect! will

print the checks for your clients automatically. The information to

be printed is taken directly from the Statement totals and applies

only to the clients which you owe, ignoring those that have a balance

owing to the agency. Collect! uses the Form #1000 form as a template

to produce very professional-looking checks. There is a bit of information

that needs to be setup before you begin to print checks. Please refer to

How To Setup Check and GCheck for details.

The Form #1000 forms are available at any office supplier

or online.

The Form #1000 forms are available at any office supplier

or online.

Even if you write your checks manually, you do not need to post any

entries to tell Collect! that you have made the payment to your client.

Because of legislation and laws in all areas, we have designed Collect!

to assume that you have made payment to your client and no balances

in which you owe your client will be pulled forward into the next month's

statements.

Receivables Report

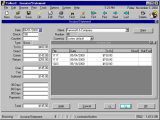

From the Month End menu, select Receivables Report. You have the

opportunity to select a Date Range, a Client Range and a Billing Period

type. The report is printed by gathering information from your statement

balances. Only the statements in which your client owes you are

reported at this time.

Payables Report

From the Month End menu, select Payables Report. You have the

opportunity to select a Date Range, a Client Range and a Billing Period

type. The report is printed by gathering information from your statement

balances. Only the statements in which you owe your client reported at

this time. Typically you will enter only the information which pertains to

the Date Range you are working on. Ideally, you would have generated

statements using the default dates and will not need to change the date

on this form at all.

Analysis Reports

Typically, accounting departments want a variety of analysis reports to

make a comparative analysis. There are a variety of report templates

available in Collect! any of which may easily be modified.

If you are not happy with the results of your Month End please see

Troubleshooting Month End for information on common misconceptions

and errors.

See Also

- Accounting Topics

- Daily Administration

- Introduction To Printing Checks

- Financial Reports Basics - Introduction/Accessing

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org