Recurring ACH Payments

WARNING: This document applies to the legacy payment processing

module. For the current payment processing module,

please go to Payment Processing Setup.

WARNING: This document applies to the legacy payment processing

module. For the current payment processing module,

please go to Payment Processing Setup.

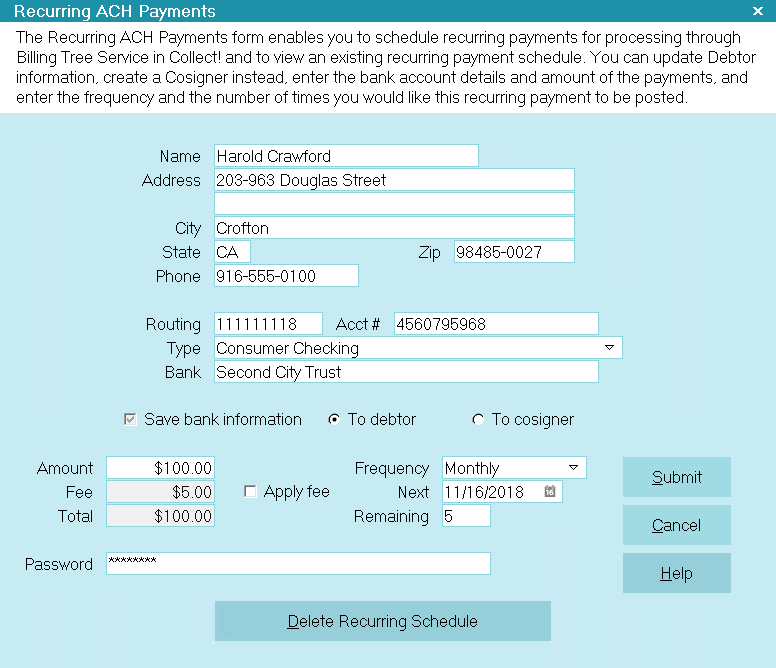

For create a cyclic ACH arrangement on a fixed interval,

click the ACH button in the lower right of the debtor

screen and select Recurring Payments from the ACH Payment

Tasks menu. This window once completed will initiate series

of automations in Collect!.

In addition to entering new arrangements, this screen is

used for all of the following:

- View existing arrangements

- Modify/update existing arrangement terms

- Modify/update debtor details (i.e. demographic, banking)

- Substitute a Cosigner/ACH Payer name in place of the debtor

As soon as the Recurring ACH Payments window opens,

Collect! queries to see if there is already a recurring

payment schedule set up for this account. If one exists,

then the bank account, financial and scheduling details

of the existing arrangement are auto-filled for you.

Recurring ACH Payments

You can create a new payment schedule by

deleting the existing one. Only ONE recurring

payment schedule may exist on an account at

any given time.

You can create a new payment schedule by

deleting the existing one. Only ONE recurring

payment schedule may exist on an account at

any given time.

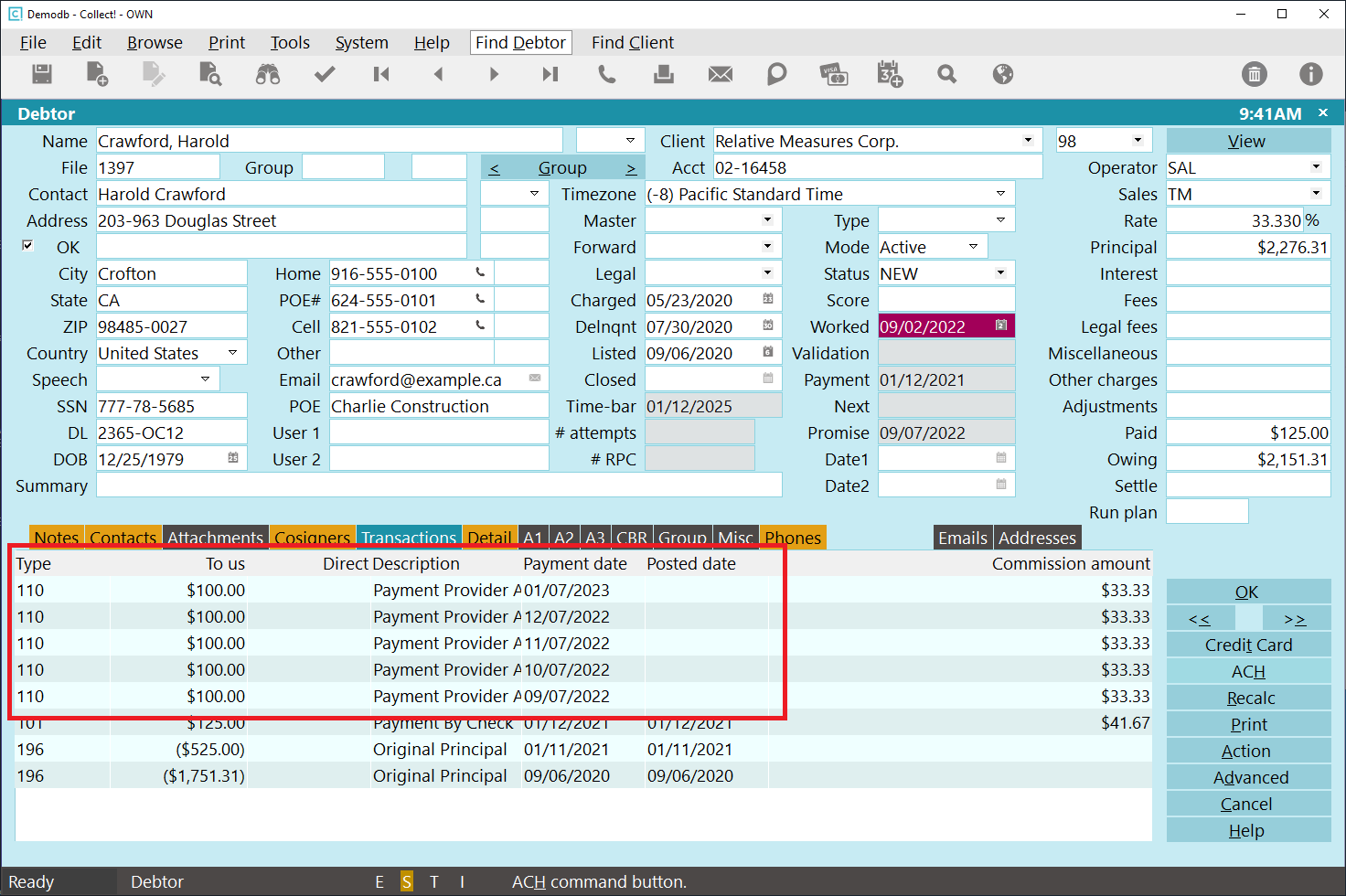

When you schedule recurring ACH payments for processing,

Collect! posts a transaction for each payment. The Payment

Dates entered reflect the arrangement due dates. The Posted

Date is populated with the date you entered the arrangement,

OR, if you are running the most current version of Collect!

in 2015, you have the option to choose to leave the Posting

Date blank until the transaction is finalized by the Payment Provider

on its due date via Reconciliation. This option is located

in your ACH Setup options in your System\Preferences menu

path.

Whether blank or reflecting the date the arrangement was

data entered, the Posted Dates are updated to the actual

processing date upon the payment's submission to the

Payment Provider.

WARNING: If you are not using the ACH Setup option

to leave the posted dates blank, you

will want to set the Company Details switch

for "Statement uses payment Date" to ensure

that entire arrangements not yet realized

do not get expressed on your client remittances.

As well, ensure you have Reconciled all your

ACH transactions prior to running your client

Statements, encompassing the same outside date

that you will use in your From/To statement date

range.

WARNING: If you are not using the ACH Setup option

to leave the posted dates blank, you

will want to set the Company Details switch

for "Statement uses payment Date" to ensure

that entire arrangements not yet realized

do not get expressed on your client remittances.

As well, ensure you have Reconciled all your

ACH transactions prior to running your client

Statements, encompassing the same outside date

that you will use in your From/To statement date

range.

We recommend that all sites run Reconcile ACH History on a daily

basis to keep all records up to date. This process not only

submits all recurring payments which have come due, but will

also download external payments, reversals and log any unmatched

transactions in your Collect\Log Files\payments\ACH folder.

Convenience fees are also posted when you run your

daily reconciliation.

The Scheduler Module has an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

The Scheduler Module has an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

The following are the mandatory fields which must be populated

in order for a valid ACH payment be be submitted and accepted

by the Payment Provider for processing.

Name

Enter the payer's name if it is different

from the name already auto-filled for you.

By default, this field is filled with the

Name from the Debtor screen. You can edit

this as needed for the transaction. If you

choose to save this information, the system

will update the Debtor screen for you. If

you are entering the info for a third party

payer, the system will include this Name.

Choose "To Cosigner" and the system will

save this information by creating a new

Cosigner window with the Class of "ACH

Payer". This will allow you to distinguish

the difference between a responsible party

and a potential unresponsible payer on the

account.

Address

Enter the payer's Street Address. By

default, this field is filled from the

Debtor account information.

You can edit this as needed for the

transaction. If you choose to save

this information, the system will update

the Debtor screen for you. If you are

entering the info for a third party payer,

the system will include this Address.

Choose "To Cosigner" and the system will

save this information by creating a new

Cosigner window with the Class of "ACH

Payer".

Address 2

This is an optional second Address line.

By default, this field is filled from the

Debtor account information.

You can edit this as needed for the

transaction. If you choose to save this

information, the system will update the

Debtor screen for you. If you are entering

the info for a third party payer, the

system will include this Address 2.

Choose "To Cosigner" and the system will

save this information by creating a new

Cosigner window with the Class of "ACH

Payer".

City

Enter the payer's City. By default, this

field is filled from the Debtor account

information.

You can edit this as needed for the

transaction. If you choose to save this

information, the system will update the

Debtor screen for you. If you are entering

the info for a third party payer, the system

will include this City. Choose "To

Cosigner" and the system will save this

information by creating a new Cosigner

window with the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

State

Enter the payer's two character State code.

By default, this field is filled from the

Debtor account information. This is a

required field and must be a valid 2-digit

code.

You can edit this as needed for the

transaction. If you choose to save

this information, the system will update

the Debtor screen for you. If you are

entering the info for a third party payer,

the system will include this State. Choose

"To Cosigner" and the system will save this

information by creating a new Cosigner

window with the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

ZIP

Enter the payer's ZIP code. By default,

this field is filled from the Debtor

account information. This is a required

field and must be a valid zip.

You can edit this as needed for the

transaction. If you choose to save this

information, the system will update the

Debtor screen for you. If you are entering

the info for a third party payer, the

system will include this Zip. Choose

"To Cosigner" and the system will save

this information by creating a new Cosigner

window with the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

Phone

Enter the payer's Phone number. By default,

this field is filled from the Home phone

number on the Debtor account information.

You can edit this as needed for the

transaction. If you choose to save this

information, the system will update the

Debtor screen for you. If you are entering

the info for a third party payer, the

system will include this Phone. Choose "To

Cosigner" and the system will save this

information by creating a new Cosigner

window with the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

Routing

Enter the Routing number for the Bank

that this ACH payment will be drawn from.

This is a 9-digit number and must match

the routing number of the payer's bank.

When this transaction is processed, it is

stored in the Debtor Detail Tab, ABA field,

if the payer is the Primary debtor, OR to

the Cosigner User2 field, if you chose to

"Save bank information" to Cosigner, with

the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

Acct #

Enter the payer's Bank Account Number. This

must be the account that the ACH payment

will be drawn from.

When this transaction is processed, it is

stored in the Debtor Detail Tab, Account

field if the payer is the Primary debtor,

OR to the Cosigner User3 field, if you

chose to "Save bank information" to

Cosigner, with the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

Type

Select the Type of bank account from the

pick list provided.

When this transaction is processed, it

is stored in the Debtor Detail Tab, field

label Detail 1 if the payer is the Primary

debtor, OR to the Cosigner User4 field,

if you chose to "Save bank information"

to Cosigner with the Class of "ACH Payer". Older

versions of Collect! use "Other" as the Class.

Bank

Enter the name of the Bank this ACH payment

will be drawn from.

When this transaction is processed, it is

stored in the Debtor Detail Tab, Bank field,

if the payer is the Primary debtor, OR to

the Cosigner User1 field, if you chose to

"Save bank information." to Cosigner, with

the Class of "ACH Payer". Older versions of

Collect! use "Other" as the Class.

Save Bank Information

Click the software switch to select this

option if you want to save the entered

bank information to the debtor's Detail

Tab, or to the Cosigner window with the

Class of "ACH Payer". Older versions of

Collect! use "Other" as the Class.

To Debtor

This option will update all information

which differs from the pre-filled fields

back to the main debtor screen as well as

save details to the Detail Tab if you

accept the selected radio button default

"To Debtor". It is important to make

sure your site has "Log to notes" checked

on the Access Rights preferences for any

field which could potentially be overwritten

by this auto-update if you want to save the

old info to your debtor Notes.

To Cosigner

Clicking the radio button for Cosigner will

only be accepted by the system if you have

entered a name that is different from the

auto-filled debtor name.

This will create a Cosigner window with

the Class "ACH Payer". The Class "ACH Payer"

must exist in your pick list for the Cosigner

"Class" Access Rights for this feature to

work correctly. Older versions of Collect!

use "Other" as the Class.

Amount

Enter the Amount of the ACH payment you are

about to process.

Date

Select the payment Date of the ACH payment

you are about to process.

Fee

This field displays the amount of the

Convenience Fee.

This field is Read Only. You must check

the "Apply fee" box FIRST for the amount

of the convenience fee to auto-fill.

Unless you have enabled each client to

allow ACH convenience fees, the Fee amount

will remain blank and the "Apply fee" check

box will remain Read Only and not

accessible. See "Advanced Client Settings"

for more information.

Apply Fee

Check this ON to activate the convenience

fee for this transaction and invoke display

of the fee amount to be applied when the

payment is processed.

If you have not enabled convenience fees

for this Client, then the Apply Fee field

will be grayed out/Read Only. See "Advanced

Client Settings" for details.

Total

This is the sum total of the (Amount +

convenience Fee, if any) that will be

drawn from the payer's bank account as

a SINGLE transaction on the debtor's side

of the bank records. If your site applies

convenience fees, you will see a total of

TWO transactions; the ACH Payment and the

convenience Fee are separate in Collect!.

Frequency

Select the payment frequency from the pick

list attached to this field.

If there is already a recurring ACH payment

schedule set up for this account, this field

will be populated with the payment frequency

when you open the Recurring ACH Payments screen.

Next

Select the date for the first payment.

If there is already a recurring ACH payment

schedule set up for this account, this field

will be populated with the date of the next

scheduled payment when you open the Recurring

ACH Payments screen.

Remaining

Enter the number of payments you wish to

schedule.

If there is already a recurring ACH payment

schedule set up for this account, this field

will be populated with the number of payments

remaining when you open the Recurring ACH

Payments screen.

Delete Recurring Schedule

Click this button at the bottom of the

Recurring ACH Payments window to remove an

existing recurring arrangement. The module

will automatically:

Remove all the future dated transactions

posted and pending in the Transaction Tab.

The Promise Contact for this payment

schedule will be marked as "Stopped" but

it will remain In Progress for your attention.

The Payment Processing Review Contact marking

the end of the payment schedule will have

its Due Date changed to the Date you deleted

the recurring schedule.

You will be prompted by popup asking

"Should I remove the Payment Processing scheduled

ACH Payments and notification letters?".

If you click yes, the system will

automatically remove any future due-dated

transactions in the Transactions Tab and

delete all future due-dated ACH Notification

letter Contacts currently scheduled.

Help

Click the HELP button to be auto-navigated

to our webpage, Help Documents, for more

info on ACH Payments and related topics.

Cancel

Select the CANCEL button to close this window

without submitting the payment schedule.

Submit

Select the SUBMIT button when you have

completed entering the requisite fields.

If you have missed a mandatory field or

entered invalid data (i.e. zip code), you

will receive a popup advising of why the

transaction(s) cannot be submitted. Simply

follow the directions and resubmit.

Transaction Details

After you have successfully processed a

single ACH payment, you can view the

results immediately in the Transaction

record, Details Tab.

User 2 is a unique Reference # with a naming

convention of "filenumber-date-time-fee".

User 3 is the convenience Fee amount, if any.

User 4 is the Bank Account type.

User 5 is the masked Bank Account Number.

User 6 is the Bank's ABA routing number.

User 7 is the ACH Payer name.

Confirmation # is a unique Transaction ID

assigned by the Payment Provider. You will see

this number on the main Transaction screen,

just above the "Posted by" ID in the lower

right side of the window.

NSF Payments

When you reconcile ACH history, the module

will download any reversals for payments

previously confirmed and auto-post them

for you if you have reversal transaction

codes entered in your ACH Setup options.

Any Unmatched reversals will be found in the

Collect\Log Files\payments\ACH folder for manual

review and handling.

Promise Details

When you schedule recurring ACH payments, AND if you

have enabled 'Automatically manage promises when posting'

in your ' Payment Posting Options' Setup, then Collect!

will auto-manage the Promise contact it creates at

the time you entered the recurring arrangement. This

includes auto-advancing the next Promise Due Date when a

payment is finalized by Reconciliation.

If you delete a recurring schedule, the Promise Contact

will be marked as "Stopped" but it will remain In Progress

for your attention.

Review Details

When you schedule recurring ACH payments, Collect!

creates a Review with a Due Date matching the last

Payment Date in your payment schedule.

If you delete a recurring schedule, the Payment Processing Review

Contact marking the end of the payment schedule will have its

Due Date changed to the Date you deleted the recurring

schedule.

Transaction Details

After you have successfully scheduled recurring ACH

payments, you can view the resulting ACH payment

transactions posted in Collect!. Each transaction has

a Payment Date calculated from the values in the

Frequency, Next and Remaining fields. The Transaction

Detail tab of each transaction entry contains the

banking details.

ACH Transaction Schedule Posted

When you run Reconcile ACH History, any payments that

have come due will be processed. Convenience fees will

be posted, if applicable. The visible verification that

the payment has been processed successfully by the

Payment Provider, is evidenced by the tracking information and

confirmation number that will now be in the individual

transaction record itself (Confirmation #) and within

the Transaction Detail tab.

Recurring ACH Payment

Recurring ACH Payments are not processed by

the Payment Provider until you run Reconcile ACH

History.

Recurring ACH Payments are not processed by

the Payment Provider until you run Reconcile ACH

History.

The Scheduler Module has an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

The Scheduler Module has an enhanced automation

with the addition of the Reconcile process being added

to the Scheduler Task list of options. You may run this

process offline and unattended. Contact us at

sales@collect.org for module pricing.

EFT Notices Details

If you set up and enabled ACH authorization and notification

letters in the EFT Notices Setup window, Collect! will create a

letter schedule that matches the payment dates in your

schedule. Collect! uses the " Days Prior" setting in the EFT

Notices Setup to calculate the Due Date for each letter.

If you delete a recurring schedule, Collect! will delete any

remaining authorization and notification Letter Contacts from your

Contacts tab.

NSF Payments

When you reconcile ACH history, Collect! posts a reversal for

any payments that are returned for any reason (i.e. NSF,

account closed, any stops or holds on the account). The convenience

fee payment is also reversed. If you switched ON "NSF cancels

recurring payments" in the ACH Payments Setup, Collect!

also removes all details of the recurring ACH payment schedule

from the account, including post-dated transactions and

EFT notices.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org