How To Take ACH Payments

This page is the guide for processing ACH payments in Collect! via the integrated Payment Processing

module.

Payment Processing ACH Setup

There are two preliminary steps to complete before being able to access and use the ACH interface:

- You require licensing from Comtech Systems Inc. to enable the Payment Processing Module for

your site. For pricing information and acquisition, please contact us at 250-391-0466

or email sales@collect.org.

- You require an active ACHNow account with a Payment Provider. They will

provide you with all the login credentials necessary for the module to connect to the ACH

Gateway automatically. You may also use your login credentials for direct/external access to

the Gateway via your Internet browser.

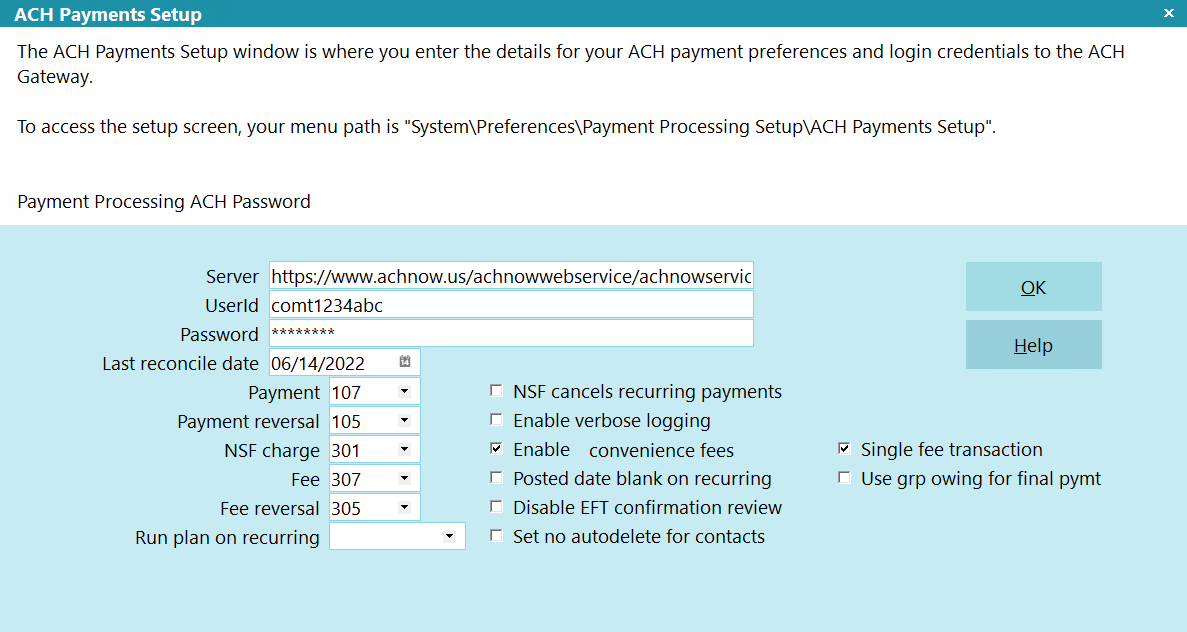

ACH Payments Setup Form

Click Here to View this Form.

Click Here to Close this Form.

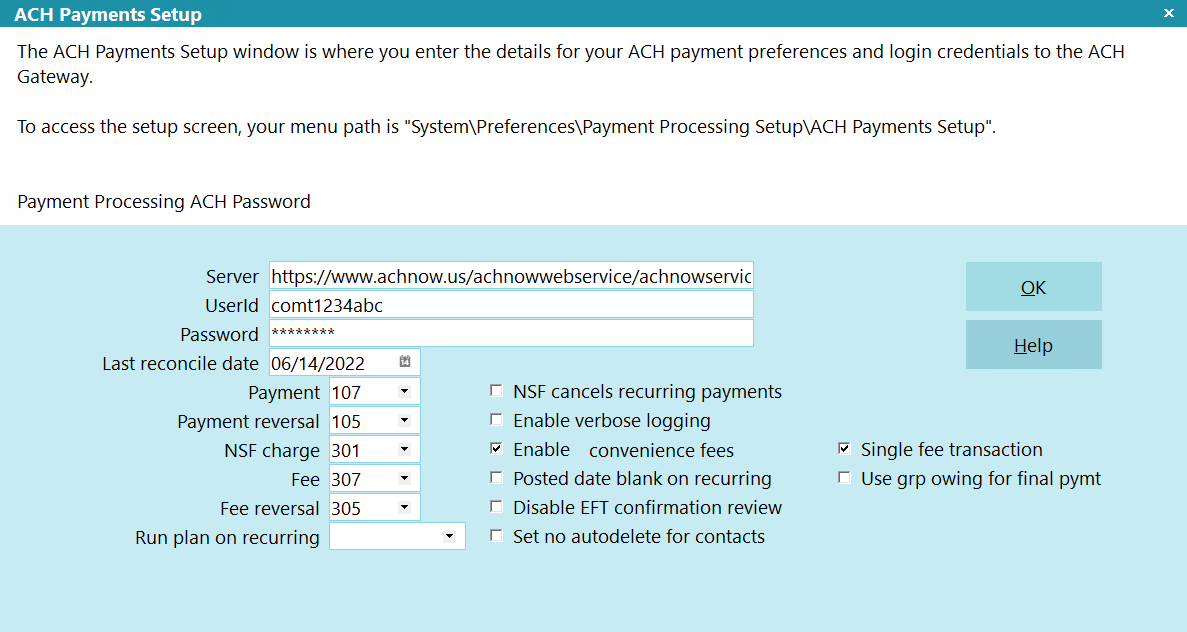

The ACH Payments Setup window is where you enter the details

for your ACH payment preferences

and login credentials to the ACH Gateway.

To access the setup screen, your menu path is

"System\Preferences\Payment Processing Setup\ACH Payments Setup".

Payment Processing ACH Password

Per Session ACH Logins

You can set up different user accounts at the Payment Provider if

you need to set different transaction limits for your collectors.

For example, if entry level collectors are not to be permitted to

set up an ACH payment amount higher than $500, then this can be

controlled at the Payment Provider login level. Advise your

Payment Provider Representative of your requirements in this regard when you

set up your account with so that you have enough logins to meet your

needs.

If you use multiple signons with the module, you will need to run a

batch Reconcile ACH History for EACH login, SEPARATELY, that your

company uses.

Server

This is where you enter the url (web address)

of the ACH Gateway.

https://www.achnow.us/achnowwebservice/achnowservice.asmx?WSDL

Userid

Enter your assigned UserID.

Password

Enter your assigned Password.

Last Reconcile Date

This is the last date that Reconcile ACH

History was run successfully. If you have never

run "Reconcile ACH History," enter today's

date. Future reconcile attempts will query

transactions between this date and the day

that they are run, inclusively.

Collect! updates this field automatically

when you complete your reconciles successfully.

Except for a new module initialization, there

is not an occasion you shouldn't have

enter/modify the date you see in this field.

New module initializations should enter the

date immediately BEFORE the actual date

you start to use the module/start entering

payments.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will prompt you during the reconciliation

process to confirm that you want to proceed.

If you run the task via the Task Scheduler,

Collect! will not run the reconciliation

and will put an entry in the Application Log

that the task failed.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will prompt you during the reconciliation

process to confirm that you want to proceed.

If you run the task via the Task Scheduler,

Collect! will not run the reconciliation

and will put an entry in the Application Log

that the task failed.

Payment

Select the Transaction Type that you want

Collect! to use for your ACH payments.

This Transaction Type must already

exist in your list of Transaction Types and it

must be set up as a Financial Type "Payment".

You may wish to use the shipping default

transaction type 107.

Payment Reversal

Select the Transaction Type that you want

Collect! to use for transactions created to

offset previously posted payments when they

are returned as NSF. This Transaction Type

must already exist in your list of

Transaction Types and it must be a Financial

Type "Payment". You may wish to use the

shipping default transaction type 105.

NSF Charge

Select the Transaction Type that you want

Collect! to use for transactions created to

charge an NSF fee to the Debtor's account

when a payment reversal is posted. This

Transaction Type must already exist in

your list of Transaction Types and it should

be a Financial Type "Fee". You may wish

the shipping default transaction type 301.

Leave this field blank if you do not want

to charge an NSF fee for transactions

returned NSF.

Convenience Fees

Collect! enables you to add a convenience

fee to the ACH transaction you are processing.

This is a default setting that may be

overridden on an individual basis.

To charge convenience fees, it is each site's

responsibility to ensure that they are

allowed to do this in your jurisdiction

and according to your agreement with

your Clients.

If your company is going to be charging convenience fees

to debtors for ACH payments, in addition to enabling the

feature in the ACH Setup window, you do need to enable an

indicator in each client Advanced Settings screen in order

to enable the fees for that specific client.

Click the Advanced button in the lower right corner of the

client screen and you will see a screen as follows, and

the "ACH convenience fees" switch is shown in the red box.

Client Settings screen

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

Enable

Click to switch this ON with a check mark if

you want to allow the addition of a Convenience

Fee when processing ACH payments. You must also

select a Transaction Type to use for the fee.

If you switch this ON, you must also switch ON

the "ACH convenience fees" located in the

Advanced Client Settings screen in your

client setup screens. Contact our office if

you have a volume of clients to turn on for

assistance with a handy bulk write back report

to do them all at once.

Fee

Select the Transaction Type that you want

Collect! to use for your ACH Convenience Fee.

This Transaction Code must already exist in your

list of Transaction Types and it must be a

Financial Type "Fee" with the fee amount

entered. You may wish to use the shipping

default transaction type 307.

Fee Reversal

Select the Transaction Type that you want

Collect! to use to offset previously posted

fees when a payment reversal is posted.

This Transaction Type must already exist in

your list of Transaction types and it must be

a Financial Type "Fee" with the fee amount

entered. You may wish to use the shipping

default transaction type 305.

Run Plan On Recurring

Whenever a recurring plan is setup, this plan will run

automatically.

NSF Cancels Recurring Payments

Switch this ON with a check mark to tell

Collect! to remove any future dated

"Payment" type transactions from the

Debtor's account when any recurring ACH

payments are returned NSF.

If you have enabled EFT notification,

then any pending EFT notification letters

will also be deleted.

Enable Verbose Logging

Click to switch this ON with a check mark

to enable verbose message logging to the

Application Log for troubleshooting your

ACH payment processes.

It is recommended to enable logging

on a new install of the module so that any

system-to-system handshaking issues are

detailed in the Application Log and

available to the Comtech and Payment Provider

technicians. Both sides will be able to

more readily identify and solve any issues

which may arise if the Log information is

available.

Posted Date Blank On Recurring

This switch provides the preference option

to either have the interface (a) write the

date the arrangement was set up into the

the Posted Date OR (b) leave the Posted Date

blank for each transaction written into the

transaction tab for a Recurring ACH

arrangement.

If you leave the switch unchecked, it will

use the date the arrangement was set up.

If you use this preference, you should also

see Company Details, "Statement uses payment

date" preference switch to decision how your

system will select which transaction date range

to include on your client Remittance

Statements: (i) the Payment Date range or the

(ii) Posted Date range. If you do not check

this Company Detail switch ON when leaving this

ACH Setup switch OFF, then a consequence would

be inclusion of ACH payments that have not taken

place yet and showing up on a single month's

client Statement/Invoice.

If you check this switch ON, then your

Recurring ACH arrangements will be written

to the Transaction Tab with the applicable

Payment Dates and Posted Dates will remain

blank until the payment is finalized/processed

via Reconcile ACH History. At that time, the

blank Posted Date field will be updated

to be the actual Posted Date. If you use

this preference, and all your transactions

of any type contain an actual Posted Date,

then you would also want to leave the

Company Detail switch for "Statement uses

payment date" switched OFF (unchecked).

Disable EFT Confirmation Review

Click this ON with a check mark to stop Collect!

from creating the review contact that is dated

2 days before the payment is due with the description

of "Confirm EFT plan authorization."

Set No Autodelete For Contacts

Click this ON with a check mark to enable Collect!

to check the 'Do not autodelete' box on all contacts

created for recurring payments.

Single Fee Transaction

Switch this ON with a check mark if you want

to only post one fee transaction for the fee

amount. The payment will reflect the full

amount of the payment.

Switch this OFF if you want the system to post

the fee transaction, the a payment to fee, then

the payment transaction separately with payment

amount less the fee.

Use Grp Owing For Final Payment

When setting up the post-date transactions, if

the running balance for the Owing gets below the

payment amount, Collect! will adjust the final

payment down to match the payment amount.

Click this ON with a check mark to have Collect! use

the Group Owing instead of the Debtor's owing.

OK

Select OK to close the ACH Payments Setup

screen.

Help

Click the HELP button to be auto-navigated

to our webpage, Help Documents, for more info

on ACH Payments and related topics.

Single ACH Transaction

There are two choices with which to post ACH Payments: single transactions and

recurring arrangements.

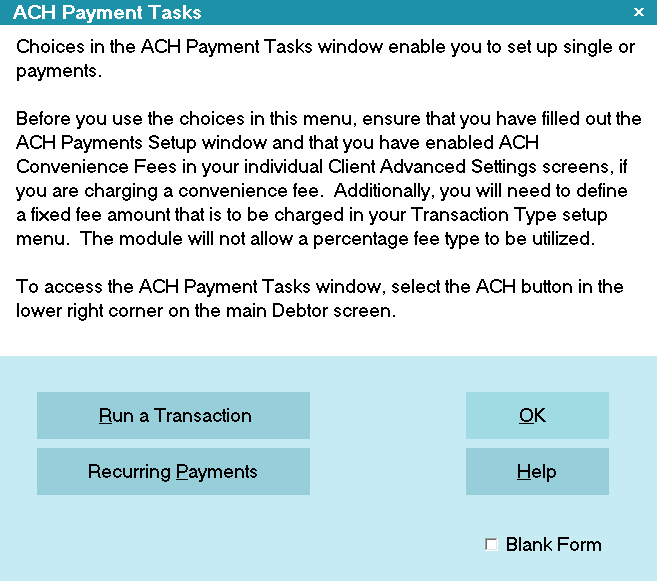

Click the ACH button in the lower right corner of the Debtor screen to access the ACH Payment Tasks

window.

Select the ACH button

If you have not entered a Username or Password on the ACH Setup form, you will be prompted

to enter your ACH UserID and Password.

If you have not entered a Username or Password on the ACH Setup form, you will be prompted

to enter your ACH UserID and Password.

Payment Processing ACH Password

If applicable, enter your UserID and Password.

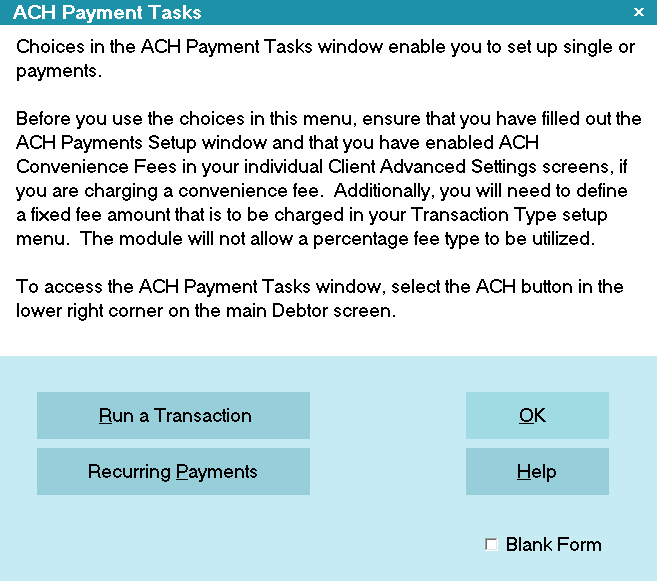

ACH Payment Tasks

Click RUN A TRANSACTION to open the Single ACH Transaction window.

Single ACH Transaction

Some of the fields will be auto-filled for you on the screen. Banking information is stored in the

Debtor Detail tab. If you already have banking information for this debtor

correctly entered into the right fields in the Detail tab, you should see the banking fields also

auto-fill with data.

This

will post the transaction on the server. To stop the payment from happening, you will need

to delete the applicable transaction in Collect! and say YES to the prompt asking if you want

to remove the transaction from the payment processor.

This

will post the transaction on the server. To stop the payment from happening, you will need

to delete the applicable transaction in Collect! and say YES to the prompt asking if you want

to remove the transaction from the payment processor.

Save Bank Information

The switch to "Save bank information" invokes a write back of information as you entered it into the

Payment intake window and stores it in the Debtor Detail Tab.

You also have the ability to designate whether this information will save to the main Debtor or into

a Cosigner window, with the Class designation of ACH Payer. Older versions of Collect! use "Other"

as the Class.

Bank Information Saved to Debtor Detail

Bank is the payer's Bank.

Account is the payer's Bank Account Number.

Transit Number is the Bank ABA routing number.

Detail 1 is the Bank Account type.

The module will overwrite any information that is currently stored in the Debtor Detail

Bank, Account, ABA and Debtor Detail 1 fields.

The module will overwrite any information that is currently stored in the Debtor Detail

Bank, Account, ABA and Debtor Detail 1 fields.

If your company has any data storage convention that uses areas in the Detail Tab, you may

wish to contact Technical Services to discuss your options to migrate this information into

a special Attachment Tab window we can create for you BEFORE you roll out live with the

module.

If your company has any data storage convention that uses areas in the Detail Tab, you may

wish to contact Technical Services to discuss your options to migrate this information into

a special Attachment Tab window we can create for you BEFORE you roll out live with the

module.

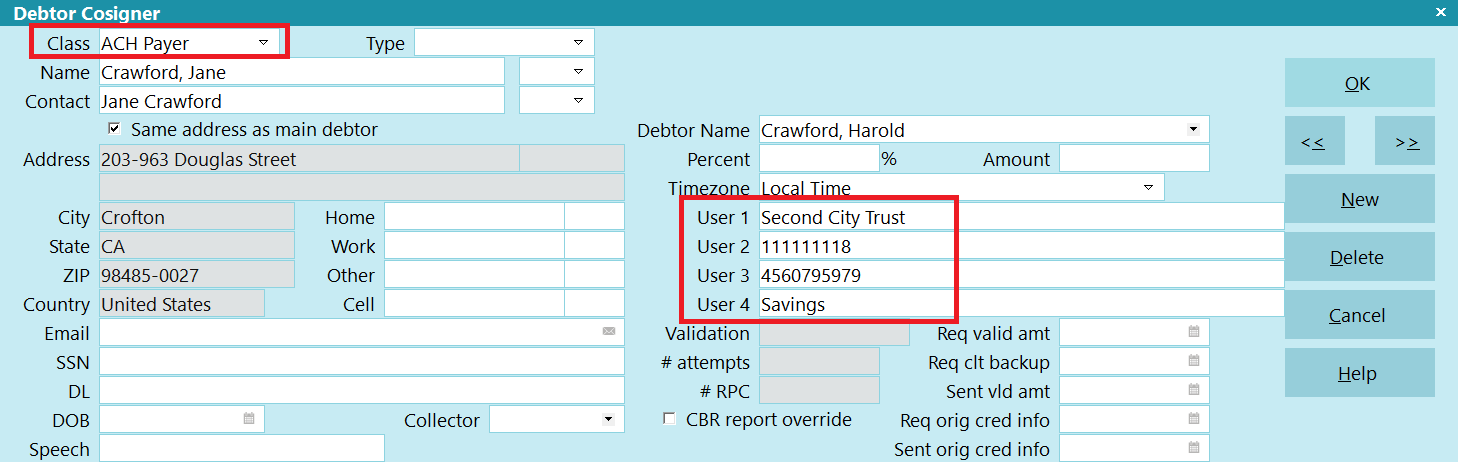

Save Bank Information To Cosigner

Alternatively, you can save the banking information to a Cosigner window with the Class designation

ACH Payer. Older versions of Collect! use "Other" as the Class.:

Name, Address and Bank Information Saved to Cosigner

User 1 is the payer's Bank.

User 2 is the Bank ABA routing number.

User 3 is the payer's Bank Account Number.

User 4 is the Bank Account type.

If you wish to charge a convenience fee, you must have enabled ACH convenience fees in your

ACH Setup screen and also for the individual Clients in the Advanced Settings screen.

If you wish to charge a convenience fee, you must have enabled ACH convenience fees in your

ACH Setup screen and also for the individual Clients in the Advanced Settings screen.

Client Settings

If enabled, you will be able to check the Apply Fee box and the designated fee amount will

auto-populate.

The Apply Fee check-box and Fee amount field both remain appear grayed out if the convenience fee

is not enabled.

You may then fill in other details such as save the banking and address information to the Debtor

or Cosigner and submit the payment.

Ready to Submit Single ACH Transaction

Collect! then posts the payment, and fee if applicable.

Single ACH payments are submitted to the Payment Provider immediately. Any transactions that

go NSF will be reversed in Collect! when you run Reconcile ACH History.

Single ACH payments are submitted to the Payment Provider immediately. Any transactions that

go NSF will be reversed in Collect! when you run Reconcile ACH History.

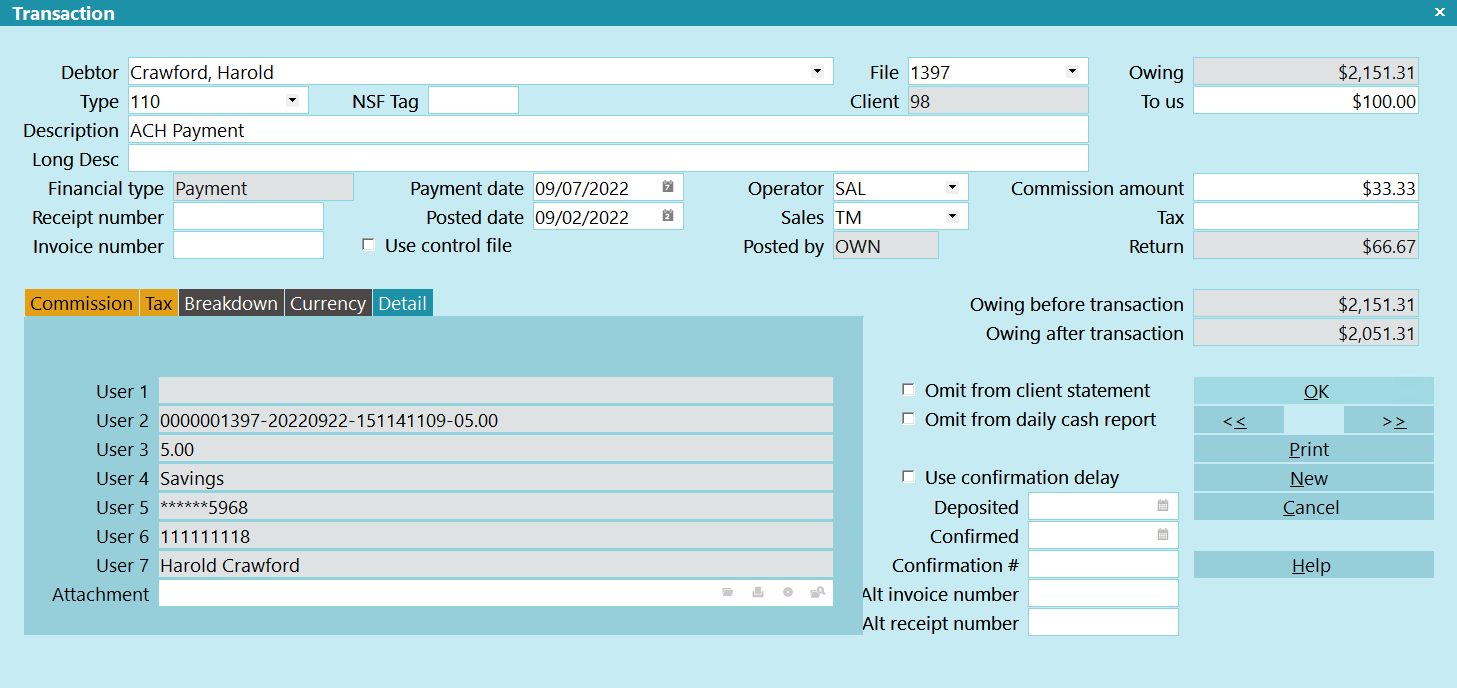

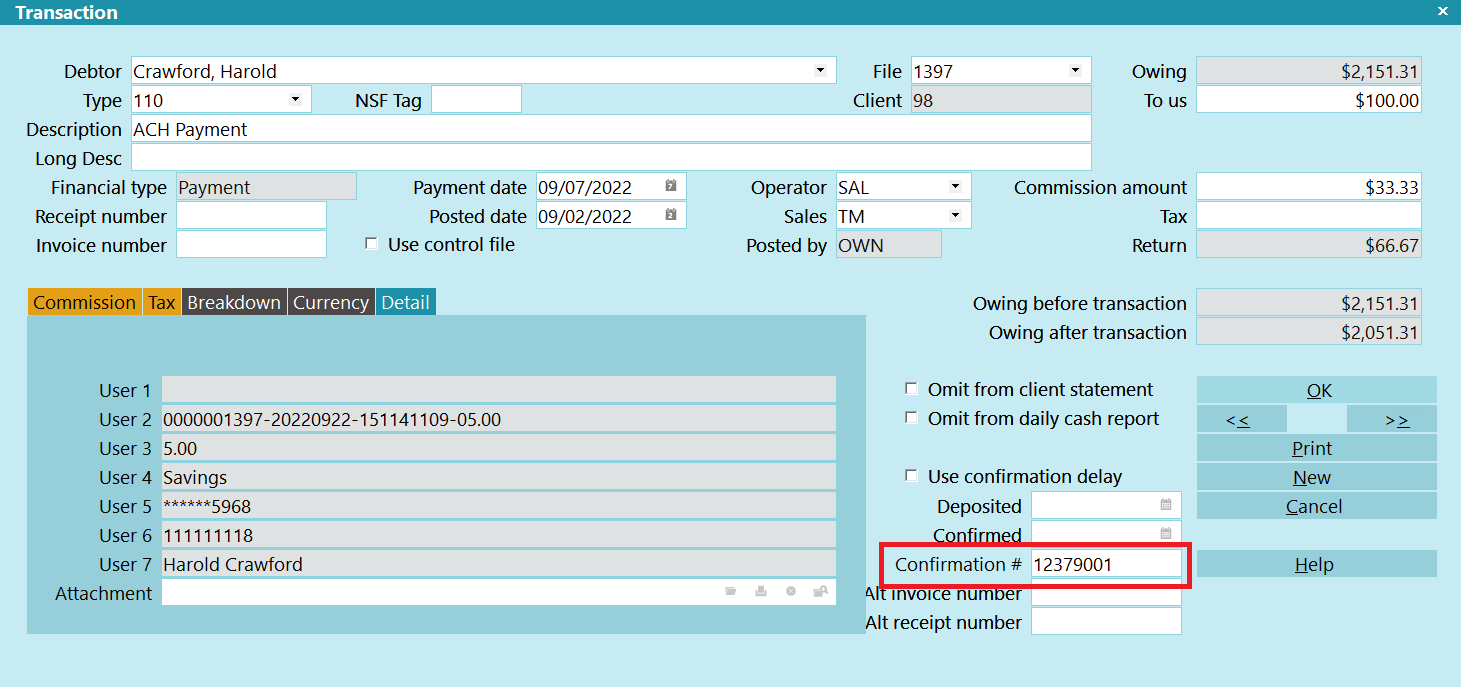

Transaction Details

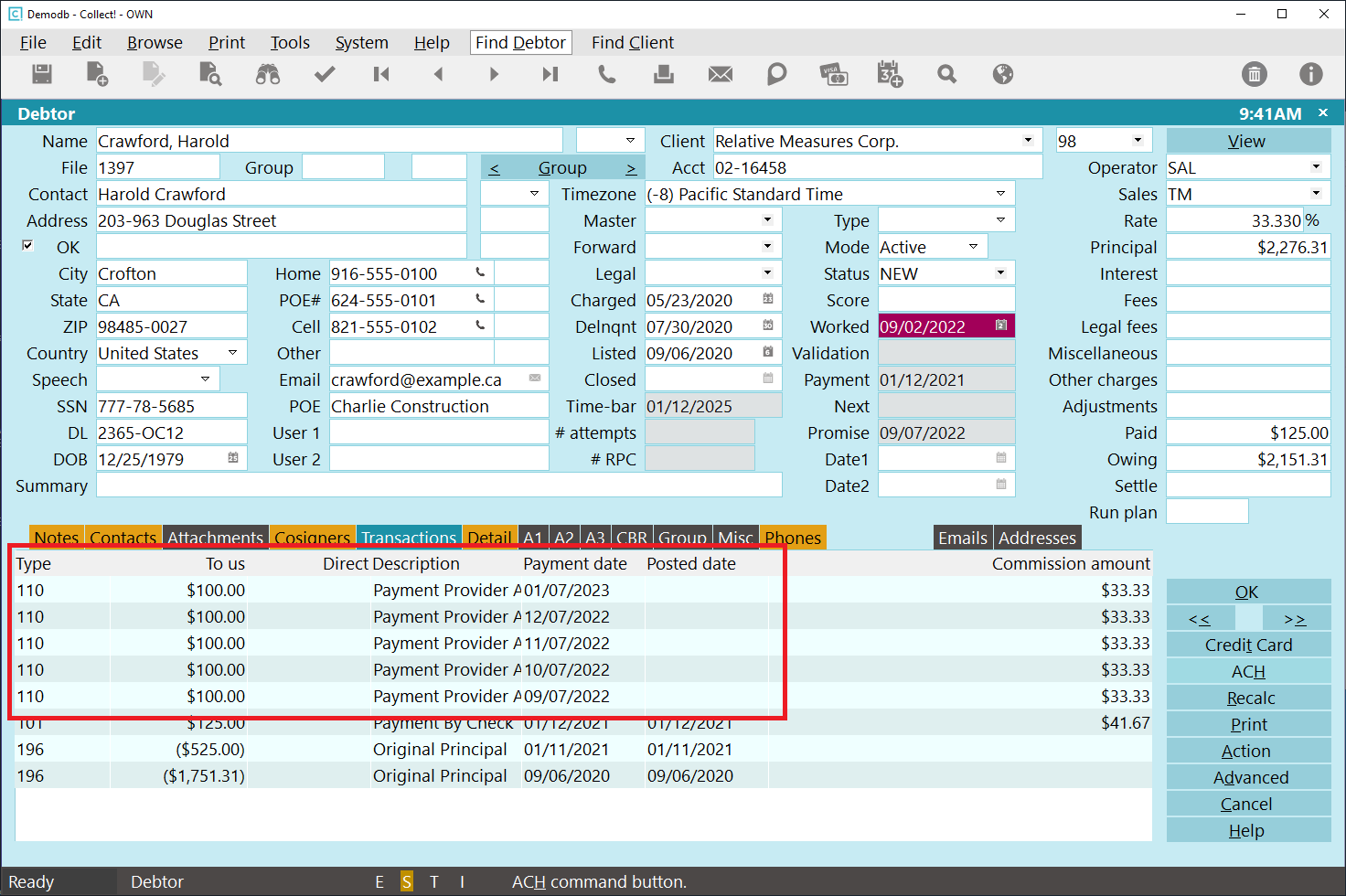

ACH Transactions Posted

When ACH payments are reconciled, the Payment Provider uploads confirmations to your system and

stores the confirmation details to the Transaction Details Tab for the line item it matches for the

debtor. This information will come as a result of Reconcile ACH History on either a per debtor or

company-wide batch process.

Transaction Details

Banking unique tracking and confirmation details are stored on each debtor record as follows:

User 2 is a unique Reference # {filenumber-date-time-fee}.

User 3 is the fee amount.

User 4 is the Bank Account type.

User 5 is the masked Bank Account Number.

User 6 is the Bank's ABA routing number.

User 7 is the Payer, either the Debtor or the Cosigner.

Confirmation # is a unique Transaction ID assigned to this ACH payment during the

reconciliation process.

WARNING: To prevent duplicate postings and charges to the debtor, the user fields are all set to

Read Only regardless of your user level.

WARNING: To prevent duplicate postings and charges to the debtor, the user fields are all set to

Read Only regardless of your user level.

Recurring ACH Payments

Click the ACH button in the lower right of the Debtor screen to enter the ACH Payment Tasks menu.

Select the ACH button

If you have not entered a Username or Password on the ACH Setup form, you will be prompted

to enter your ACH UserID and Password.

If you have not entered a Username or Password on the ACH Setup form, you will be prompted

to enter your ACH UserID and Password.

Payment Processing ACH Password

If applicable, enter your UserID and Password.

ACH Payment Tasks

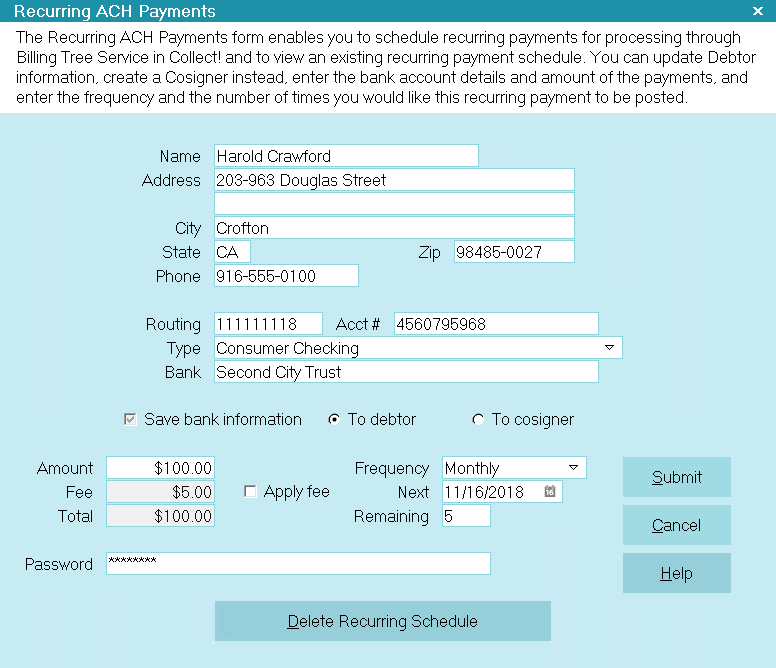

Click the RECURRING PAYMENTS button to open this entry window.

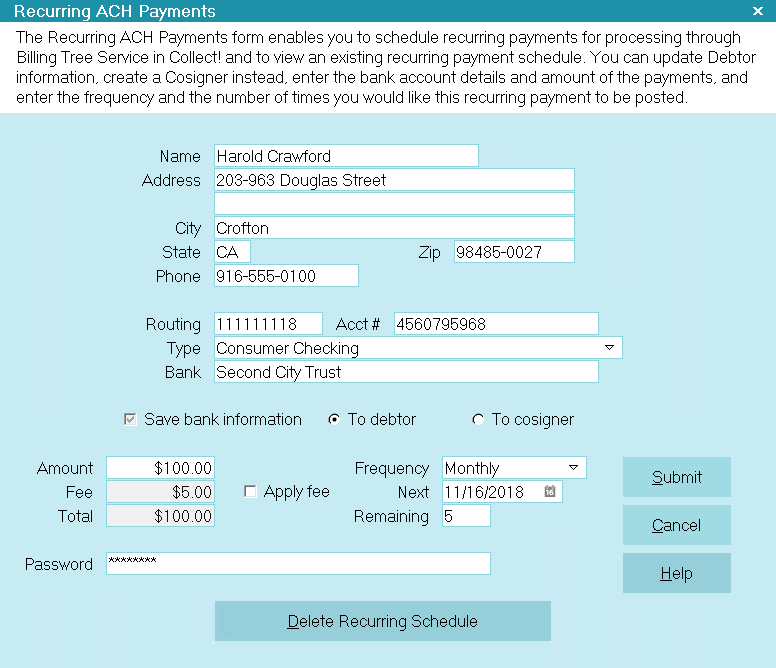

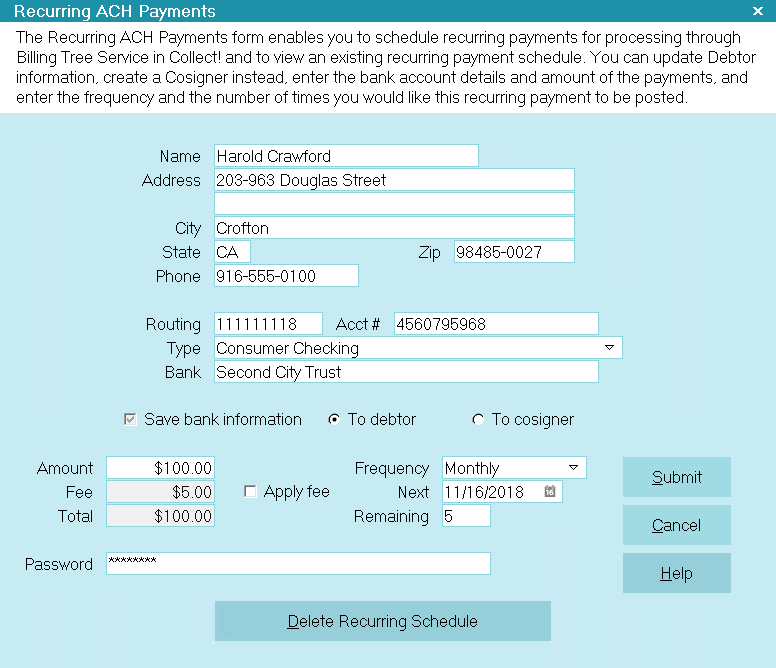

Recurring ACH Payments

Some of the fields will be auto-filled for you on the screen. Banking information is stored in the

Debtor Detail tab. If you already have banking information for this debtor correctly

entered into the right fields in the Detail tab, you should see the banking fields also auto-fill

with data.

If you wish to charge a convenience fee, you must have enabled ACH convenience fees in your

ACH Setup screen and also for the individual Clients in the Advanced Settings screen.

If you wish to charge a convenience fee, you must have enabled ACH convenience fees in your

ACH Setup screen and also for the individual Clients in the Advanced Settings screen.

Client Settings

It is the above preliminary setup steps that enable and control ability and amount to be charged per

transaction. Until you check the Apply Fee box, the Fee amount remains grayed out.

If the fee is not allowed at all or disallowed for certain clients, the Fee and Apply Fee fields will

be read-only/grayed out.

You can fill in other details as needed, save the banking and address information to the Debtor or

Cosigner and submit the payment.

Ready to Submit a Recurring ACH Schedule

Collect! posts the payment transactions with Payment Dates entered according to the schedule you set

up. The Posting Dates are filled with the date you initiated the recurring ACH arrangement UNLESS you

check the ACH Setup Field called "Posted date blank on recurring". This feature will leave the posted

date with no entry until the date the transaction is reconciled.

These post-dated transactions do not affect your current balance on account because the due dates

are in the future and the software doesn't consider them as finalized transactions until they have

been finalized by the module via Reconcile ACH History as they come due.

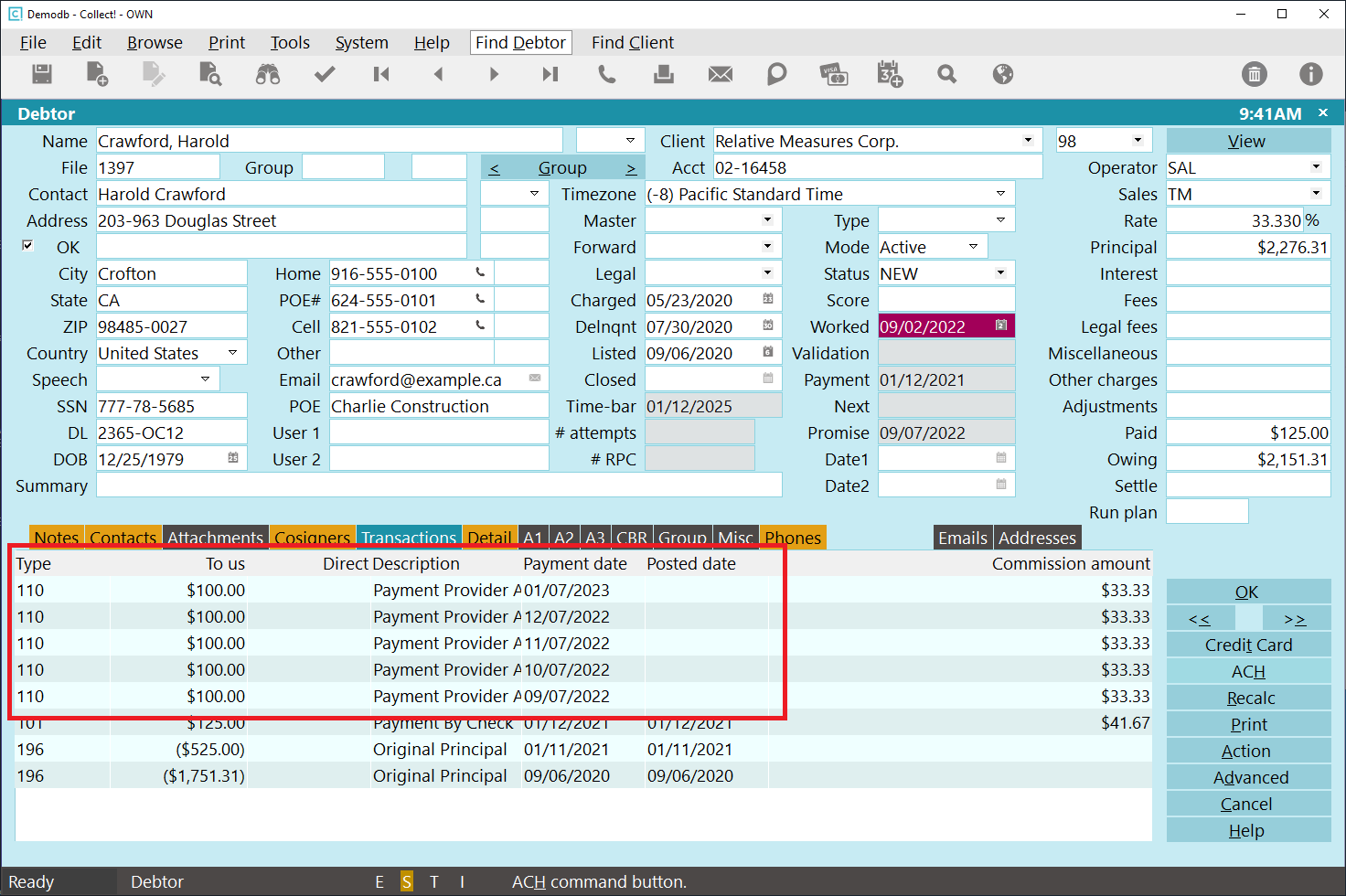

The whole post-dated arrangement is then posted in the Transaction tab on the Debtor account. This

is strictly an ACH recurring arrangement aspect. By comparison, Recurring Credit Card arrangements

are not stored in Collect! and do NOT appear in the Transaction tab until the payment comes due and

has been processed by the Payment Provider.

Recurring ACH payments are stored in Collect! immediately, but they are NOT uploaded to the

Payment Provider until a transaction in the series has become current-dated AND your site

has run its batch Reconcile ACH History process. This is opposite of how the module manages

recurring Credit Card arrangements. With recurring credit card plans, the schedule is held

exclusively on the Payment Provider Gateway for PCI compliance and is uploaded to them once

you click Submit.

Recurring ACH payments are stored in Collect! immediately, but they are NOT uploaded to the

Payment Provider until a transaction in the series has become current-dated AND your site

has run its batch Reconcile ACH History process. This is opposite of how the module manages

recurring Credit Card arrangements. With recurring credit card plans, the schedule is held

exclusively on the Payment Provider Gateway for PCI compliance and is uploaded to them once

you click Submit.

ACH Transaction Schedule Posted

Recurring ACH payments are not finalized in Collect! until you run Reconcile ACH History.

Recurring ACH payments are not finalized in Collect! until you run Reconcile ACH History.

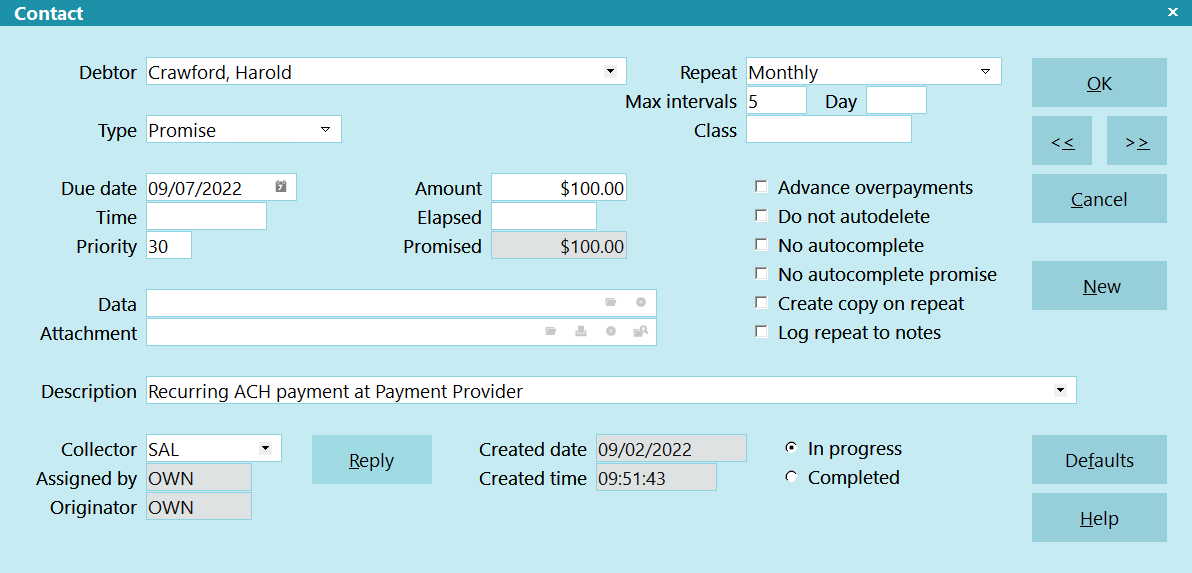

The module creates a Promise Contact that will stay in the Collector's WIP to assist in keeping track

of the the payment schedule.

Promise Contact for Recurring ACH Payments

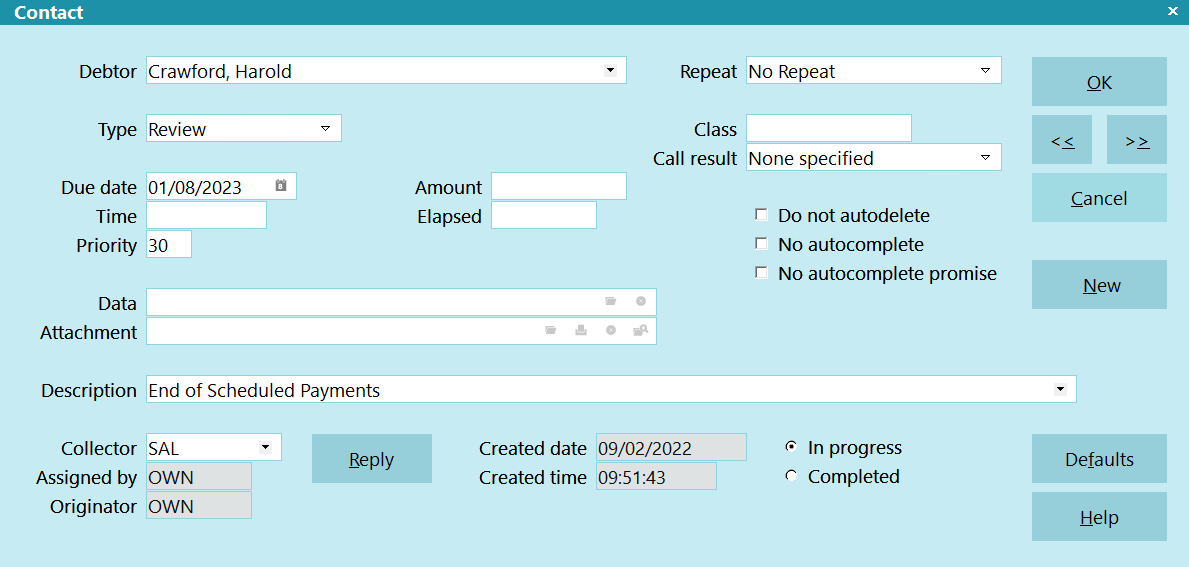

Collect! automatically sets up a Review Contact to remind you of the end of the payment schedule.

Review Contact for Recurring ACH Payments

Change Payment Information

On the Debtor, click the ACH button.

Click the RECURRING PAYMENTS button to open this entry window.

Click the DELETE RECURRING SCHEDULE to remove all the posted-dated transactions from Collect! and

cancel the contract with the Payment Provider.

Setup a new payment arrangement as per How to schedule recurring

payments.

Recurring ACH Payments

EFT Notices

The module includes an EFT Notice Setup which allows you to be able to schedule all pre-payment

reminder and/or authorization letters which you may be legislatively required to send to your debtors

making Electronic Funds Transfer payments by reliably sending them out "X" days ahead of the payment

due dates.

EFT Notices and Reviews

In compliance with EFT requirements, the Payment Processing Module enables you to automatically

schedule authorization letters and EFT notices for recurring credit card and recurring ACH payments.

You can access this setup screen from the Payment Processing Setup menu.

EFT Notices Setup

It is your responsibility to ensure that any letters you send to debtors are compliant in

format and content with legislation and regulations in your region.

It is your responsibility to ensure that any letters you send to debtors are compliant in

format and content with legislation and regulations in your region.

When you submit a recurring ACH payment schedule, Collect! will automatically schedule letters and

Review Contact events according to your setup and arrangement parameters.

EFT Notices and Reviews

View EFT Notices

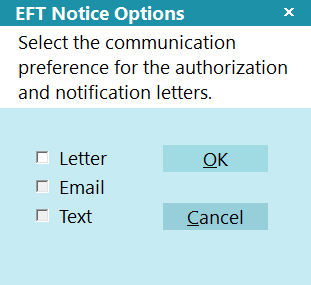

You can configure EFT notices to be sent via Letter, Email, and Text. If multiple communication

methods have been configured, the below EFT Notice Options form will appear to allow you to select

the method that the Debtor prefers.

EFT Notice Options

Run A Contact Plan

If you set a contact plan in the 'Run plan on recurring' field on the ACH Payments Setup form, it

will run when the recurring payments is posted.

Reconcile ACH History

The Reconcile ACH History function uploads payments which have now become currently due to the ACH

Gateway. It is a batch process that will also download any new NSFs/chargebacks, as well as any

payments a debtor may have made on their own directly at the Payment Provider portal that your office

is as yet unaware of.

You can Reconcile ACH History once per day or multiple times as you wish. The system keeps track

of reported payments and will not duplicate a transactions which has already been posted.

WARNING: If the last reconcile date is more than 7 days into the past, Collect! will prompt you

during the reconciliation process to confirm that you want to proceed. If you run the

task via the Task Scheduler, Collect! will not run the reconciliation and will put an

entry in the Application Log that the task failed.

WARNING: If the last reconcile date is more than 7 days into the past, Collect! will prompt you

during the reconciliation process to confirm that you want to proceed. If you run the

task via the Task Scheduler, Collect! will not run the reconciliation and will put an

entry in the Application Log that the task failed.

If you have set the check-box in ACH Setup for 'Posted date blank on recurring', this download process

is what will write the Posted Date into your processed item in the Transaction Tab.

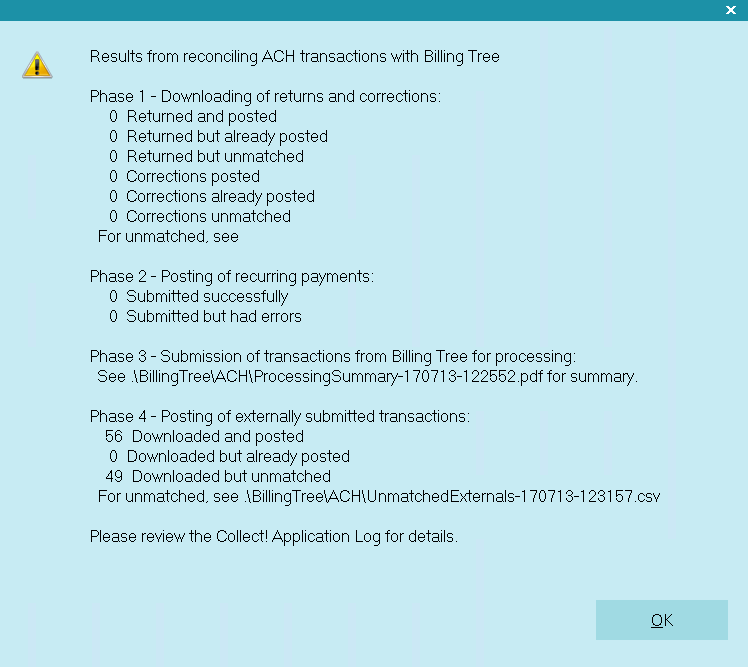

Reconcile ACH History

Collect! displays a summary screen to let you know what actions were taken, how many of each kind of

transaction was uploaded and/or downloaded. It also writes an exception file if any transactions

cannot be matched.

Reconcile ACH Summary of Results

If unmatched returns are downloaded, you will find the exception reports located in the folder located

via the path Collect\Log Files\payments\ACH.

It downloads any external payments (made by debtors at the ACH Gateway directly and not through your

office) that it has received and which are not posted yet on your system. If there are any

transactions which cannot be matched to a Collect! file number, it writes an exception report and

stores it in the path "Collect\Log Files\payments\ACH\UnmatchedExternals". The file name

"UnmatchedExternals" will include a date/time stamp associated with the download so that each

exception report has a unique file name.

Users who are also licensed for the Scheduler Module have an enhanced automation with the

Reconcile process being available in the Scheduler Task list of options. You may run this

process unattended. Contact us at sales@collect.org for module pricing.

Users who are also licensed for the Scheduler Module have an enhanced automation with the

Reconcile process being available in the Scheduler Task list of options. You may run this

process unattended. Contact us at sales@collect.org for module pricing.

Viewing Results

The module does the following tasks as triggered by data or events related to the reconcile ACH

history process:

ACH payments whose payment due dates have come due now are submitted to the Payment Provider.

To recap the initiating event, when you first create a recurring ACH payment schedule, the module

creates a transaction for each payment.

ACH Payment Transactions

The Transaction Detail for these transactions looks like this:

Recurring ACH Payment

The User 2 field of the Transaction Detail Tab is populated with a unique

Reference # that is downloaded from the Payment Provider.

Reference # in User 2

The Confirmation # field in the lower right corner of the of the Transaction Detail Tab is populated

with the Payment Provider's unique Transaction ID.

Transaction ID in Confirmation #

If the ACH payment schedule includes a convenience fee, this transaction will appear posted on the

account once a recurring payment is processed successfully.

Convenience Fee Transaction

If any previous payments come back as NSF, the system is triggered to reverses the

payment and any convenience fee charged according to your ACH Setup preferences. Also, depending

on your Transaction Type settings, if you have an NSF Contact Plan in place on

Transaction Type 105, the actions in that contact plan will be executed on any ACH

reversals as well when you next run your " Process automatic contacts previously scheduled" in your

Daily Batch Processing, if that includes charging an NSF to the debtor as well, then you will see

the application of that charge after you have run your "Process automatic contacts previously

scheduled" anytime subsequent to the Reconcile ACH History process.

ACH Payments Setup

If you have the "NSF cancels recurring payments" switch enabled in your ACH Setup, then receipt of

an NSF through the Reconcile ACH History process will trigger an automatic stop of the schedule by

deleting out all the details of the recurring payments including deleting EFT Notices.

If any payments have been posted at the Payment Provider rather than through Collect!, they are also

processed when you reconcile. If they cannot be matched to debtors in your database, a file is stored

with all relevant information so that you can process the payments as required. It is stored in the

"Collect\Log Files\payments\ACH\UnmatchedExternals-180519-163821.csv", where the numeric part of the

file name are the date (May 19, 2018) and the time was HH:MM:SS being 16:38:21 when the exception

report was created.

A processing summary PDF is stored for each reconcile that you run. It is also stored in the

"Collect\Log Files\payments\ACH\ProcessingSummary-180519-164459.pdf" folder, where the date is

May 19, 2018 at 16:44:69 time stamp when the file was downloaded.

Viewing Application Log Entries

If the Reconcile ACH History results reported any errors, these can be examined in the

Application Log, accessed in the menu path "System\Diagnostics\Application Log".

Application Log Entry for Payment Processing ACH Error

Switch ON " Misc" and "Error" in the Collect! Log Viewer settings to quickly filter the

Application Log for Payment Processing Module entries. Use "ACH" to see the ACH log.

Switch ON " Misc" and "Error" in the Collect! Log Viewer settings to quickly filter the

Application Log for Payment Processing Module entries. Use "ACH" to see the ACH log.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org