In many cases, when you begin to report credit, you start off reporting to a single credit bureau.

Perhaps you have been reporting to this bureau for quite a while. Now, you would like to begin sending

reports to a new additional bureau. The accounts are considered new accounts as far as this new bureau

is concerned. In Collect! your accounts will have to be flagged as new accounts for your first report

to the new credit bureau. Yet this does not change their status as current accounts with the original

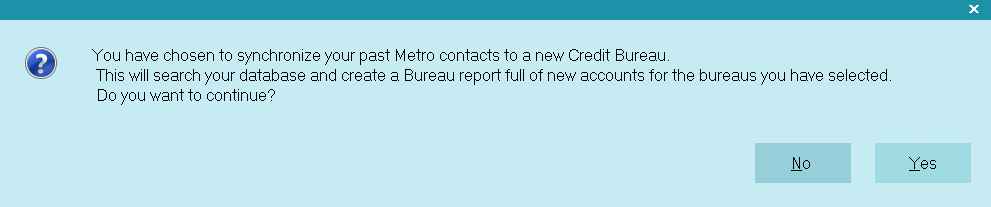

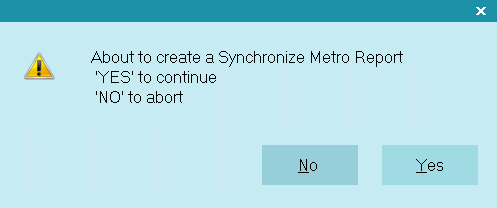

bureau. To accomplish this, Collect! uses the Sync To New Credit Bureau function.

A few steps are necessary to synchronize your credit bureau reporting. This only has to be done once,

the first time you report to a new bureau. Before synchronizing, do your normal credit bureau

report to the bureau you are already reporting to and make sure you mark the contacts done.

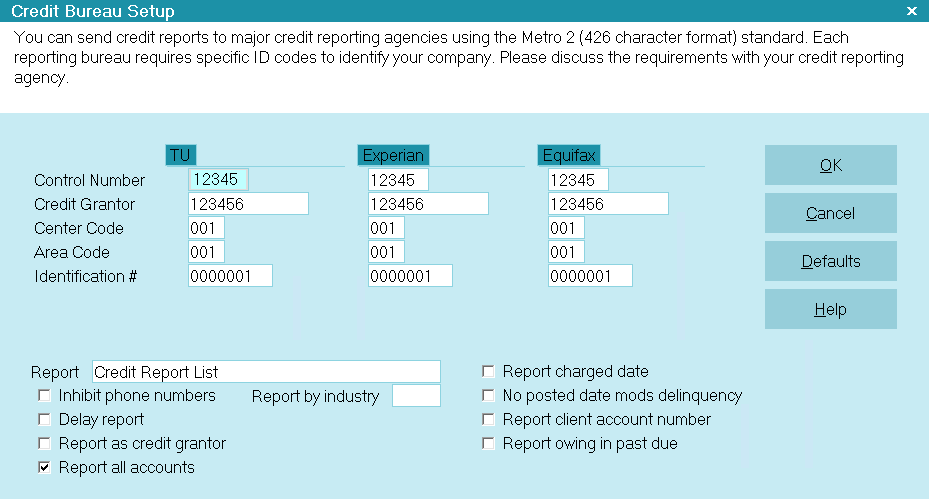

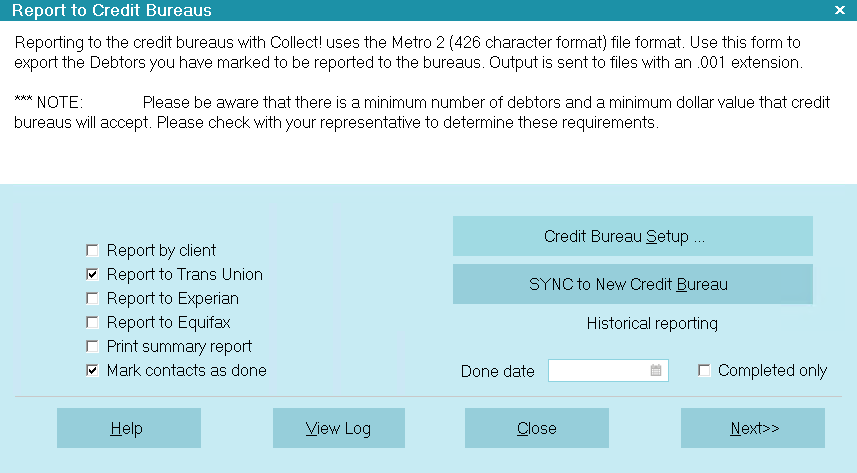

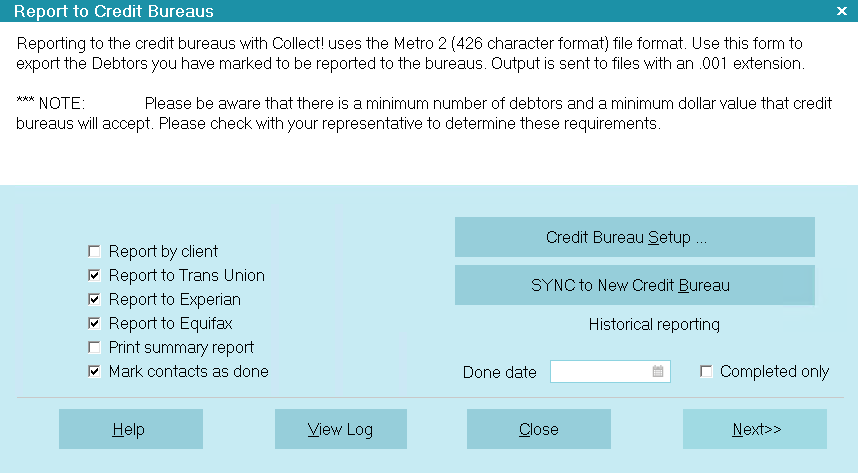

Sign into Collect! Select Tools from the top menu bar. This will display a list of choices. Select

Credit Report from the list to display the Report To Credit Bureaus form. Select the button labeled

Credit Bureau Setup to display the Credit Bureau Setup form. Enter setup information for the new

credit bureaus as shown below. We have used default settings for each area as an example.

Click Here to Close this Form.

You can send credit reports to major credit reporting agencies

using the Metro2 (426 character format) standard. Each reporting

bureau requires specific ID codes to identify your company. This

may be referred to as your "Subscriber" number with the bureau

you report to and it should be confirmed with your bureau

representative whether they wish you to place this into the

'Credit Grantor' or 'Identification #' fields in the setup screen.

Both write to different positions in the header record of the

Metro2 file. The bureaus' ability to correctly identify your

company will determine if your reporting files are accepted or

rejected. Please discuss the requirements with your

credit reporting agency.

Credit Bureau Setup

Once you start reporting to the credit bureaus, the Debtor's file

number must not change while the account is being reported on.

Click here for more

information.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

Credit Reporting Agencies

Collect! provides for reporting to the three major credit

reporting agencies:

- Trans Union

- Experian

- Equifax

The Metro2 is a standard format. The bureaus above

simply read their identification information from

the header record. If you have another bureau, such

as a country outside North America, and they support

the Metro2 format, you can still use this module to

report to them.

The Metro2 is a standard format. The bureaus above

simply read their identification information from

the header record. If you have another bureau, such

as a country outside North America, and they support

the Metro2 format, you can still use this module to

report to them.

Reporting Credit With Collect!

There are 3 phases in Credit Reporting in Collect!:

- Setups

- Global settings from the \Preferences\Credit Bureau Reporting,

generally done once and not updated again

- Advanced Client Settings, on a per client basis

- Initialization of NEW accounts to report OR

modification of bureau 'condition' or 'status' on per

account and batch of accounts levels for accounts

already reporting

- Creation of the Metro2 text file to send to your bureau(s).

Reporting companies are responsible for deleting accounts

which have exceeding the allowable reporting period. To

this end, we provide a report called the 7 Yr Age Out List,

with instructions for use that should be part of every

reporting company's Phase 3 process on a regular basis.

From the point that you have setup your credit bureau reporting

correctly, Collect! will take care of the accounts

automatically thereafter:

- If you have the Report all accounts switch ON, it will

report the account each time you run a CBR process to

output the Metro2 file, and continue to report until

such time as you officially send a Delete Metro (DA) on

the account, which will terminate further reporting.

- If you have the Report all accounts switch OFF, after

reporting the account the first time, it will only

report again if there has been a change to the account

details or balance. You are required to be compliant

with legislation and regulations in your region.

Effective 09/01/2016, it became required for USA

companies to report all accounts (full file) each time

they furnish a credit reporting file.

- Automatically updates the bureau status to PIF (AS62)

if the balance owing becomes $0.00

If you are a credit reporting company, UNLESS an

adjustment to make the balance owing zero is intended

to reflect a PIF reporting to the bureau, you should

not adjust balances owing to zero prior to closing an

account in Collect!.

If you are a credit reporting company, UNLESS an

adjustment to make the balance owing zero is intended

to reflect a PIF reporting to the bureau, you should

not adjust balances owing to zero prior to closing an

account in Collect!.

Default Values

It is important to fill in all fields for the credit bureau(s) of your choice

in the Credit Bureau Setup form. USE THE DEFAULT VALUES listed

below, if you have not been supplied an actual value from your

credit bureau.

Control Number

The Program Identifier or Control Number contains a

unique identification number assigned to you by the

credit reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Uc

TRANS UNION PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Wco

EXPERIAN PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Xco

EQUIFAX PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Credit Grantor

This is called the Subscriber Code in Trans Union terminology.

(Alpha numeric, length 10)

This is called the Subscriber Code in Experian terminology.

(Alpha numeric, length 10)

This is called the Membership Number in Equifax terminology.

For Equifax subscribers, enter the 10 character ID code

provided by Equifax here. (Alpha numeric, length 10)

Your unique subscriber codes will be placed at the top of the

file that Collect! creates for you to send to the credit bureau.

If reporting to Equifax and/or Trans Union, place the

Subscriber ID they give you into the Credit Grantor field.

Ug

TRANS UNION CREDIT GRANTOR

This is called the Subscriber Code in Trans Union terminology.

(Alpha numeric, length 10)

Wg

EXPERIAN CREDIT GRANTOR

This is called the Subscriber Code in Experian terminology.

(Alpha numeric, length 10)

Xg

EQUIFAX CREDIT GRANTOR

This is called the Membership Number in Equifax terminology.

For Equifax subscribers, enter the 10 character ID code

provided by Equifax here. (Alpha numeric, length 10)

Center Code

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Uce

TRANS UNION COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Wce

EXPERIAN COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Xce

EQUIFAX COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Area Code

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Ua

TRANS UNION AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Wa

EXPERIAN AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Xa

EQUIFAX AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Identification #

The Identification Number is used to uniquely identify a

credit grantor. Report your internal code to identify each

branch, office and/or credit center where information is

verified. This number must be unique and at least five digits

long. Note that the entire field should never be zero, blank

or 9 filled. This field must be consistent on a month to

month basis. Notify your credit bureau representative before

changing this code.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 7)

UID

TRANS UNION IDENTIFICATION/VENDOR #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 10)

Wid

EXPERIAN IDENTIFICATION/VENDOR #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 10)

Xid

EQUIFAX IDENTIFICATION/VENDOR #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 10)

Days From Validation Sent

This is the number of days after the Model Validation notice

has been sent when a Debtor can be reported to the Credit

Bureau. When the Model Validation is Printed, Emailed, or

Texted, that date plus this value is used to determine when

reporting will start.

If a letter is returned, then unchecking the Debtor's

Address OK box will disable reporting, ONLY IF the Debtor

has not already been reported. Once a Debtor has been reported,

reporting will continue, regardless of address status.

If you have a longer delay specified in the Delay Report

field below or on the Client Settings, then that date will

still take precedence on the delay. For example, if you

have a delay of 14 days for the Model Validation and a

delay of 180 days for Medical debt, then the first report

will be after 180 days.

If you have a longer delay specified in the Delay Report

field below or on the Client Settings, then that date will

still take precedence on the delay. For example, if you

have a delay of 14 days for the Model Validation and a

delay of 180 days for Medical debt, then the first report

will be after 180 days.

Report

This is the name of the summary report listing all Debtors

sent to the credit bureaus. The default report lists Debtor

name, principal, owing etc. You can edit the report to suit

your needs.

This is strictly for internal informational purposes and

is not necessary to generate. It is equally simple to

open the actual Metro2 output file in a pure text reader

such as Notepad and view your file contents if you wish

to see how many accounts you are reporting.

TU.001, EFX.001, EXP.001 text files that you remit

to the bureaus should NOT be opened in any word

processing program (including Wordpad) as these will

change the pure text format, making the files

unreadable by the bureaus. Notepad / Notepad++, and

UltraEdit are 2 common pure text editors that are fine

for the purpose of opening/viewing credit reporting

files before you deliver them to the bureaus.

TU.001, EFX.001, EXP.001 text files that you remit

to the bureaus should NOT be opened in any word

processing program (including Wordpad) as these will

change the pure text format, making the files

unreadable by the bureaus. Notepad / Notepad++, and

UltraEdit are 2 common pure text editors that are fine

for the purpose of opening/viewing credit reporting

files before you deliver them to the bureaus.

Optional SSN And Date Of Birth

Switch ON 'Optional SSN and Date of Birth' to prevent

Collect! from checking the debtor for a valid SSN

or DOB when reporting to the bureau. When checked,

Collect! will NOT stop accounts that are missing an

SSN and also missing a DOB from being reported.

WARNING: As of 2017, US Credit Bureaus require

that any accounts being submitted must

have either an SSN or DOB. If you are

in the US, do not enable this option.

This option is for non-US customers

where the SSN and DOB are not a

requirement.

WARNING: As of 2017, US Credit Bureaus require

that any accounts being submitted must

have either an SSN or DOB. If you are

in the US, do not enable this option.

This option is for non-US customers

where the SSN and DOB are not a

requirement.

Report AS Credit Grantor

This switch is connected to a field in the Company Details

window, labeled Credit grantor. Checking this switch

ON (or OFF) in either window will perform the same step

in both locations (checking or unchecking the box).

Whether this switch is ON/OFF in both places has an

effect on where information is sourced from on the Debtor

accounts when fields are being written into the Metro2

text file.

Only companies who are 1st party credit grantors should

check this switch. Collection Agencies and Attorney

Offices should not check this box ON from either

Company Details or Credit Bureau Setup screens.

When this switch is turned ON, the Delinquency Date

is used to report the Date of Occurrence for all bureau

status codes except 4, 10, 13 and 61 to 68. In those

cases, the date the Contact was scheduled is sent as the

date of Occurrence. See your Metro2 handbooks from your

credit bureaus for more information regarding bureau

status codes.

When the this switch OFF, the Date of Occurrence is

always taken from the Delinquency Date.

Report By Industry

The default setting is Collection Agency/Attorney. 1st

party credit grantors are the only companies that should

modify this setting, and in so doing, choose the Industry

type available that most closely reflects the nature of

their business. The pick list may NOT be modified with

any custom insertions as these values are hard-coded

'as is' by the Metro2 layout acceptable to the bureaus

Enter the Industry Code you wish to include in this

report. Only Debtors with this setting in the

Credit Report Details Reporting Industry field will be

processed for reporting.

This enables you to keep all your Collections accounts

together in one report and all your Mortgage Loan accounts

in a different report, for instance.

Please refer to How To Setup Credit Bureau Reporting

for more details.

Valid Industry Codes are:

0 - Check Credit

1 - Collection Agency

2 - Credit Card

3 - Credit Union

4 - Debt Counselor

5 - Educational

6 - Family Support

7 - Government Agency

8 - Installment Loan

9 - Loan Finance

A - Mortgage Loan

B - Retail

C - Sales Finance

D - Savings And Loans

E - Service And Professionals

Delay Report

Check this box ON to cause Metro Contact Event

Due Dates to be Delayed by a fixed number of days from

the current date. The field to enter the number of days

to be added to the current date (i.e. 30 days, 45 days)

will appear only when the switch to Delay report has been

checked.

Some of our USA collection agencies often utilize this

feature to encompass the FDCPA validation/dispute

period, only after which they will commence credit

reporting. Other Collect! users find that this feature

allows them to be compliant with specific client

directives, where they are bound by contractual agreement

with the creditor not to report the accounts for 'x'

days from listing.

This switch controls whether an account is eligible to

be reported effective the day it is initialized/turned

ON for reporting,

OR

should be put off for a prescribed number of days from

the date it is turned it ON. This is a global setting

that will apply to ALL accounts initialized UNLESS there

is a different number of Delay Days selected on a per

client basis: the Delay Days in Advanced Client Settings

overrides the global setting.

The Advanced Client Settings override is in place as

well to allow companies to be compliant with upcoming

credit reporting requirements for Medical accounts in

effect as of 09/15/2017.

To cause Metro Contact Event Due Dates to reflect the

current date when you turn ON Debtor accounts for

CBR reporting, do NOT the check Delay report switch.

Delay Days

This field is only displayed when you have checked

Delay report ON and is where you input the number of days

you want to wait before the account is eligible to be

reported.

For example, if today's date is 01/01/2018 and your

Delay days is set to 30, when you turn a debtor ON for

CBR reporting, the Due Date on the Metro Contact event

will be 01/31/2018.

If a client has a separate Delay days set to 60 when

the global setting is 30, then turning a debtor ON for

CBR reporting under that client on 01/01/2018 would

result in that account's Metro Contact having a

Due Date of 03/02/2018.

Inhibit Phone Numbers

Switch ON 'Inhibit phone numbers' to prevent Collect!

from sending phone numbers to the credit bureau.

The output file will contain all zeroes in the phone

number position. This ensures debtor privacy if

you have unlisted phone numbers in your database.

This is a global setting, it cannot be set on an

individual account basis.

Report All Accounts

When this is switched ON with a check mark, Collect! will

report all debtors in your database that have been setup

for credit bureau reporting. With this box unchecks,

Collect! will only report accounts that have been changed.

This box is on by default to comply with the

2016 USA reporting requirements change requiring

all accounts to be included in a credit report.

This box is on by default to comply with the

2016 USA reporting requirements change requiring

all accounts to be included in a credit report.

Disable Contact Control Notes

Switch this ON to disable the note lines that are

written for accounts that are skipped when exporting

due to the account failing to qualify for reporting

due to a Contact Control rule.

The account will still appear in the CBR Log

so you can review before submitting to the bureaus.

Accounts that are skipped are usually due to the

Model Validation notice not being sent out.

If you have not defined a Model Validation notice,

then your accounts will be reported normally.

The account will still appear in the CBR Log

so you can review before submitting to the bureaus.

Accounts that are skipped are usually due to the

Model Validation notice not being sent out.

If you have not defined a Model Validation notice,

then your accounts will be reported normally.

Backup Log File

When this is switched ON with a check mark, Collect! will

make a copy of the cbrlog.txt into the cbr\backup folder

after the CBR process is complete. The name of the file

will be formatted as yyyymmdd_cbrlog.txt.

When this switch is ON, you will not be prompted

to clear the log file after reviewing it.

When this switch is ON, you will not be prompted

to clear the log file after reviewing it.

Report Charged Date

This switch is intended for credit grantors ONLY who have

also turned ON the Credit grantor switch in

Company Details / Credit Bureau Reporting Setups.

Check this ON to report the account's Charged Date as the

debtor's Date Opened, instead of the Listed Date.

Even if checked ON, this switch will not function if the

company is a 3rd party collection agency / attorney's

office, which is not identified in setups as being a

credit grantor.

If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date for

credit bureau reporting. Also Collect!

automatically reports the Charged Date when

you are reporting NSF checks. You do not

need to switch on 'Report Charged Date'.

If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date for

credit bureau reporting. Also Collect!

automatically reports the Charged Date when

you are reporting NSF checks. You do not

need to switch on 'Report Charged Date'.

No Posted Date Mods Delinquency

When this is switched ON, Collect! uses the Payment Date

of the promise transaction as the Delinquency Date rather

than allowing the default 30 day delay in determining

delinquency.

This is used only in Credit Grantor mode.

This is used only in Credit Grantor mode.

Report Client Account Number

By default, Collect! uses the Debtor File Number as the

ID for credit bureau reporting. It is recommended that

you leave Report Client Account Number switched OFF

and let Collect! report using the Debtor File Number,

unless you are sure you need to do otherwise.

It is necessary to make a global decision for the company:

will you report accounts by your Client's Account Number

(Acct on the Debtor screen) or by your Office's

File Number on the Debtor screen. Once this decision is

made and you begin reporting, you cannot change this

setting again.

Check Report client account number ON if you will use

the client's account number,

OR

do NOT check this switch if you will report by the

debtors' file numbers as assigned by Collect! when

entered into your system. Reporting by File number is

the more popular selection as some creditors do not

provide an account number and the bureaus reject debts

reported without a reference number associated with

the debt.

WARNING: Reporting accounts by one setting, i.e.

client's account number followed by a change

(perhaps accidental) to report with your company's

file number will result in the same account

appearing twice on a debtor's credit report as though

they were different accounts completely; the bureaus

cannot differentiate when the debt is reported with

different 'account numbers' insofar as Metro2 layout

is concerned. This creates a serious situation between

your company and the bureaus that requires drastic

steps to resolve.

WARNING: Reporting accounts by one setting, i.e.

client's account number followed by a change

(perhaps accidental) to report with your company's

file number will result in the same account

appearing twice on a debtor's credit report as though

they were different accounts completely; the bureaus

cannot differentiate when the debt is reported with

different 'account numbers' insofar as Metro2 layout

is concerned. This creates a serious situation between

your company and the bureaus that requires drastic

steps to resolve.

To avoid the possibility of the above occurrence, this

switch will become Read Only for all User Levels after

you have run your first report. Even where the switch is

being left unchecked in the OFF position, meaning you are

reporting by File number, it will still make the field

Read Only so a user doesn't inadvertently turn it ON at

some future point in time.

Report Owing In Past Due

Switch this ON with a check mark to report the Debtor's Owing

in the Past Due position of the CBR file. Normally, this field is

zero filled if you are not a credit grantor, but you can use

this switch to fill it with the Owing.

New Bus - Ignore Reporting Owing

If this field is checked, then debtors being reported for the

first time will not be enabled if their owing is less than the

value in the LESS THAN field.

Less Than

This field is used by the NEW BUS - IGNORE REPORTING OWING

field above. If the above field is checked, then debtors being

reported for the first time will not be enabled if their owing

is less than the value in this field.

Auto Activate New Accounts

Switch this ON with a check mark to automatically enable an

account for reporting to the credit bureaus. This feature

works on manually created accounts and imported accounts.

This feature only works if the Client is setup to report

to the bureaus in the Client Settings.

Exclude Log Warnings

Switch this ON with a check mark to exclude any Info and

Warning messages from the CBR log where the accounts were

still sent.

Force Age Out

If populated, the System will automatically stop reporting accounts

to the credit bureau after the specified time.

Enter a value, in YEARS, into this field.

The date that the system uses to calculate the period is the same

date that is put into the Base Segment in Position 25.

For non-Credit Grantors, it will be the Delinquency Date. If that is

not populated, then it will be the Charged Date.

For Credit Grantors, it will always be the Delinquency Date.

Help

Press this button for help on the Credit Bureau Setup

form and links to related topics.

Defaults

When reporting a Debtor to the Credit Bureaus, there are

certain settings that need to be reported to the bureaus.

Select this button to display the Credit Report Preferences

form where you can choose default credit reporting settings.

When you flag a Debtor to be reported to the Credit Bureau,

these default settings will automatically apply to the Debtor.

You can override these defaults on an individual Debtor level

through the Credit Report Details dialog. To access this

dialog, select the CBR tab on the Debtor form.

Cancel

Selecting this button will ignore any changes you have

made and return you to the previous form.

OK

Selecting this button will save any changes you may have

made and return you to the previous form.

Select the OK button to return to the Report To Credit Bureaus dialog. Place a check mark in the box

next to the new credit bureau you about to synchronize. (You can synchronize two if you wish. This

is a good idea if you intend to report to the third one in the future.) Also put a check mark beside:

Mark contacts as done

Print the summary report to the printer. Complete the steps to generate the report and

mark the contacts done.

If you see the message "The report 'Sync Credit Report List' was not found," it means you do not

have the proper summary reports to use with the Synchronize Metros function.

You can download the reports from our web site samples or request them from Collect! Technical Services.

To try out this feature, it is best to use a copy of your database or use the Demonstration

database. You should be familiar with credit bureau reporting and already be reporting to

at least one credit bureau.

To try out this feature, it is best to use a copy of your database or use the Demonstration

database. You should be familiar with credit bureau reporting and already be reporting to

at least one credit bureau.

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org