How To Setup Credit Bureau Reporting

Once you have set up your account with the Credit Bureau(s) of your choice, you should have the

information needed to set up credit reporting in Collect!.

This Help topic describes how to setup the credit reporting features and how Collect!'s credit

reporting functions work. This requires familiarity with setting up Company Details and Debtors in

Collect!, as well as experience using Collect! in your day to day business operations.

When you set up your credit bureau reporting correctly, Collect! takes care of all the details by

automatically scheduling a Metro contact for each debtor that you want to report. After you report,

Collect! forwards this contact for the next reporting period. Collect! tracks changes in the debtor's

profile for credit bureau purposes and reports the correct codes to the bureau.

The Credit Bureau Reporting module is optional and must be purchased prior to use for

reporting credit.

The Credit Bureau Reporting module is optional and must be purchased prior to use for

reporting credit.

You can easily send credit reports to the major credit bureaus using the standard Metro2

(426 character format) file format.

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity you are reporting.

We will go through several steps in this topic:

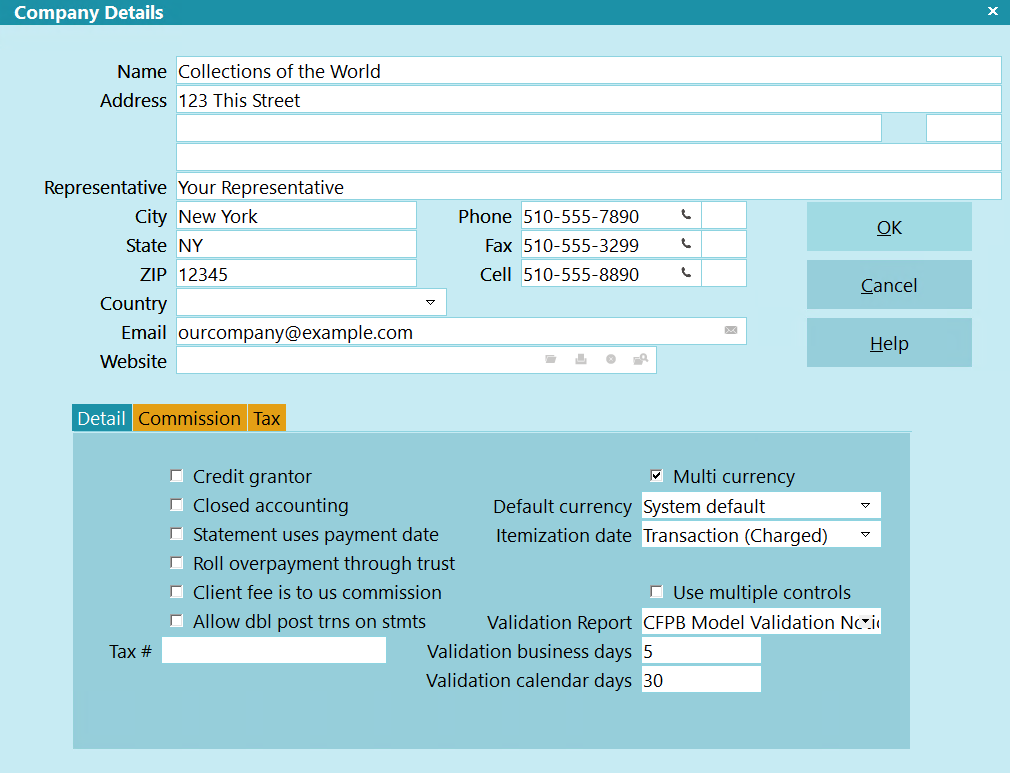

Setting Company Details

Your Company Details need to be entered. Some of this information is output to the credit bureau

file. Also, in the DETAIL tab for the Company Details form there is one setting you need to use

ONLY IF you are a Credit Grantor.

Click Here to View this Form.

Click Here to Close this Form.

The Company Details form stores name and address information

about your company. This can be printed on reports and letters

and is used in credit bureau reporting. Some Client Settings

values are set up automatically for you based on information you

enter in the additional fields on this form.

Company Details

The Company Details form is a very convenient way to store and

access your company information. Any field of the Company Details

form can be pulled into a report or letter from anywhere in the

system because all the Company Detail information is loaded into

memory when you sign into Collect! Name, Address and Phone

lines are used for credit bureau reporting. You can run multiple

companies by logging into different databases. Each database

stores its own company details.

Name

Enter the name of your company as you would

like it to appear on reports and letters. If you

are using the credit reporting module,

please enter your company's name as you would

like it to appear in credit bureau Metro2

output file header records.

Address

Enter your Street Address. There are three

address lines on this screen. The

information you enter in these lines

can be pulled into reports and letters.

The information in these three lines is

also included in header record of your credit

bureau Metro2 output files.

The format with which you enter your

information is up to each agency. However,

we recommend using Postal Addressing

Standards that are applicable to your

country. These are generally available

by looking up the website of the postal

service for your region.

Example:

Name - Your Company Name Goes Here

Address - Your Company Address

Address 2 - Company Addr2

Address 3 - Company Addr3, or Website Address

Representative - Default Report Name or Leave Blank

City - Your Company City

State - Your 2 Position State/Province Code

Zip - Your Zip/Postal Code

Country - Choose From Pick List or Leave Blank

Email - Any Company Email Address or Leave Blank

Address 2

This address field can hold your second

address line or other information you may

wish to store for later use/output to

reports or letters.

Address 3

This address field can hold your third

address line or other information you may

wish to store for later use/output to

reports letters.

Representative

Optional. Enter the name of your company

representative. This may be the Owner

or President's name. Some of the sample

letters and reports have this field built in

as a placeholder, but these can also be

removed or commented out of the report by

placing two slashes in front of the printable

field code: i.e //@cd.re<

State

Enter your agency's State Code.

ZIP

Enter your agency's ZIP/Postal Code.

Country

Optional. Use the drop-down arrow pick

list to select your Country OR leave blank

if you do not wish to see this field

expressed in reports/letters.

Email

Optional. This field is used to enter your

agency's central email address or the email

address of your main representative.

Website

Optional. This field is used to enter your

agency's website address.

Phone

Enter your main office Phone number.

This Phone number field is pulled into

many of the sample reports and letters.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all lookups by phone

in your system. Lookups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

You can switch ON 'Only numerics in phone

fields' "System\Preferences\Options, Sounds

and Colors\Screen and Messages" so that the

system will disallow non-numeric data in

your phone fields.

If you use the Credit Bureau module, the

Phone number is required and is output

to the header record of the Metro2 formatted

text file when created. The Credit Bureau

module will strip out any non-numeric data

automatically and will use a maximum of 10

digits in compliance with the Metro2 File

Format specifications.

Phone Ext

Optional. This field can be used to enter

an extension for the Phone field, left blank

or re-purposed for user-defined storage of

other data.

Fax

This Fax number field is pulled into

many of the sample reports and letters.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all look ups by phone

in your system. Look ups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

You can switch ON 'Only numerics in phone

fields' "System\Preferences\Options, Sounds

and Colors\Screen and Messages" so that the

system will disallow non-numeric data in

your phone fields.

Fax Ext

Optional. This field can be used to enter

an extension for the Fax field, left blank

or re-purposed for user-defined storage of

other data.

Cell

Optional. The Cell number is another phone

number for your company. It is not included

in default shipping sample reports/letters.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all look ups by phone

in your system. Look ups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

You can switch ON 'Only numerics in phone

fields' "System\Preferences\Options, Sounds

and Colors\Screen and Messages" so that the

system will disallow non-numeric data in

your phone fields.

Cell Ext

Optional. This field can be used to enter

an extension for the Fax field, left blank

or re-purposed for user-defined storage of

other data.

Detail

Press F1 for help with Detail Tab system switch

settings and fields which will define key

software behaviors by setting your cursor into

any of the displayed items for selection.

Commission

If all your clients use the same Commission

Rates, you may set a global system default that

will be applied to all clients in the Commission

Tab. Press F1 for detailed help from any field

in this tab.

Tax

If all your clients are subject to the same

rate of Tax on your collection services, you

may set a global system default that will

be applied to all clients in the Tax Tab.

Press F1 for detailed help from any field

in this tab.

Tax Rate

Enter the tax rate, if applicable. This

rate will be entered automatically in the

client settings for every new client that

you enter in your system.

If your agency services multiple regions with

different taxation percentages, do NOT enter

data in this tab on the Company Details.

Instead, fill out the Tax tab on a per client

basis to ensure the correct rate is passed from

the Advanced Client Settings to the debtor

accounts as you enter them.

Tax Rate is a percentage field: i.e. if the

rate is 7%, you would enter 7.0. Tax is

calculated on the commissions that you earn,

not on the total amount you recover.

If you are in a region that has two types of

tax, such as Canada, enter the sum total

percentage tax which you are required to

charge into the Rate 1 field.

The Tax Rate field holds up to 6 digits

(or 5 digits and a period, e.g. 7.4563)

and is referenced in reports by using

the Printable Field Code @cd.tr

The system provides a field to enter a

Taxation # that is alpha numeric, allowing

you input a brief descriptor as well:

(EX:GST# 1050505050505).

Leave the Tax tab blank if you do not

charge tax OR if you have specific rates

that are input into Client Tax Tabs on a

per client basis.

Don't Calculate Tax

Switch this ON if you do not calculate tax.

OK

Click this button to save your changes

and return you to the previous screen.

Cancel

Click this button to ignore any changes

made and return to the previous screen.

Help

Click this button for help on the Company

Details window and links to related topics.

Report AS Credit Grantor

The 'Credit Grantor' field is only switched ON if you are reporting as a Credit Grantor. This setting

affects othercredit reporting settings so only switch it ON if you are a Credit Grantor.

When you set this switch, the Delinquency Date is used to report the Date of Occurrence for all

status codes except 4, 10, 13 and 61 to 68. In those cases, the date the contact was scheduled is

sent as the date of occurrence. When you leave this switch off, the Date of Occurrence is always

taken from the Delinquency date, regardless of status code.

Leave this switch off if you are operating a collection agency.

If you are not sure if you are a credit grantor, discuss this with your CBR representative.

If you are not sure if you are a credit grantor, discuss this with your CBR representative.

Delinquency Date For Credit Grantor

When you have switched ON 'Report as credit grantor' in the Company Details form, an unmet promise

will show up as delinquent in the debtor's Delnqnt field.

You must also switch ON 'Calculate delinquency date' in the debtor's Financial Detail form.

The 'Calculate delinquency date' check box is visible only when you are in Credit Grantor mode.

You must also switch ON 'Calculate delinquency date' in the debtor's Financial Detail form.

The 'Calculate delinquency date' check box is visible only when you are in Credit Grantor mode.

If you are a Credit Grantor, a number of things affect the Delinquency Date based on your settings.

The Delinquency Date is normally set to 31 days after the promise date. Thus, if you set a promise

contact on the account and no payment is received, when 31 days have lapsed, the Delinquency Date

will be set to the promise date plus 31 days.

Promise contacts contain a dollar Amount, and the promise is only satisfied when the full Amount

has been paid. Set the term Payment Amount in the Interest Detail form and Collect! can manage

payments, underpayments and overpayments. Please refer to How To Manage Contacts for details.

Promise contacts contain a dollar Amount, and the promise is only satisfied when the full Amount

has been paid. Set the term Payment Amount in the Interest Detail form and Collect! can manage

payments, underpayments and overpayments. Please refer to How To Manage Contacts for details.

In the Credit Bureau Setup form, you can switch ON 'No posted date mods delinquency'. When this is

switched ON, Collect! uses the Payment Date of the promise transaction as the ' Delinquency Date '

for the account, rather than allowing the default 31 day delay in determining delinquency.

Credit Bureau Setup

The Credit Bureau Setup form holds many global settings for your Credit Bureau information.

When you set up your Account/Contract with the Credit Bureau of you choice, they supply some

information that will help you set up the fields in the Credit Bureau Setup form.

When you set up your Account/Contract with the Credit Bureau of you choice, they supply some

information that will help you set up the fields in the Credit Bureau Setup form.

Open the Credit Bureau Setup form form System/Preference/Credit Bureau Setup.

Click Here to View this Form.

Click Here to Close this Form.

You can send credit reports to major credit reporting agencies

using the Metro2 (426 character format) standard. Each reporting

bureau requires specific ID codes to identify your company. This

may be referred to as your "Subscriber" number with the bureau

you report to and it should be confirmed with your bureau

representative whether they wish you to place this into the

'Credit Grantor' or 'Identification #' fields in the setup screen.

Both write to different positions in the header record of the

Metro2 file. The bureaus' ability to correctly identify your

company will determine if your reporting files are accepted or

rejected. Please discuss the requirements with your

credit reporting agency.

Credit Bureau Setup

Once you start reporting to the credit bureaus, the Debtor's file

number must not change while the account is being reported on.

Click here for more

information.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

Credit Reporting Agencies

Collect! provides for reporting to the three major credit

reporting agencies:

- Trans Union

- Experian

- Equifax

The Metro2 is a standard format. The bureaus above

simply read their identification information from

the header record. If you have another bureau, such

as a country outside North America, and they support

the Metro2 format, you can still use this module to

report to them.

The Metro2 is a standard format. The bureaus above

simply read their identification information from

the header record. If you have another bureau, such

as a country outside North America, and they support

the Metro2 format, you can still use this module to

report to them.

Reporting Credit With Collect!

There are 3 phases in Credit Reporting in Collect!:

- Setups

- Global settings from the \Preferences\Credit Bureau Reporting,

generally done once and not updated again

- Advanced Client Settings, on a per client basis

- Initialization of NEW accounts to report OR

modification of bureau 'condition' or 'status' on per

account and batch of accounts levels for accounts

already reporting

- Creation of the Metro2 text file to send to your bureau(s).

Reporting companies are responsible for deleting accounts

which have exceeding the allowable reporting period. To

this end, we provide a report called the 7 Yr Age Out List,

with instructions for use that should be part of every

reporting company's Phase 3 process on a regular basis.

From the point that you have setup your credit bureau reporting

correctly, Collect! will take care of the accounts

automatically thereafter:

- If you have the Report all accounts switch ON, it will

report the account each time you run a CBR process to

output the Metro2 file, and continue to report until

such time as you officially send a Delete Metro (DA) on

the account, which will terminate further reporting.

- If you have the Report all accounts switch OFF, after

reporting the account the first time, it will only

report again if there has been a change to the account

details or balance. You are required to be compliant

with legislation and regulations in your region.

Effective 09/01/2016, it became required for USA

companies to report all accounts (full file) each time

they furnish a credit reporting file.

- Automatically updates the bureau status to PIF (AS62)

if the balance owing becomes $0.00

If you are a credit reporting company, UNLESS an

adjustment to make the balance owing zero is intended

to reflect a PIF reporting to the bureau, you should

not adjust balances owing to zero prior to closing an

account in Collect!.

If you are a credit reporting company, UNLESS an

adjustment to make the balance owing zero is intended

to reflect a PIF reporting to the bureau, you should

not adjust balances owing to zero prior to closing an

account in Collect!.

Default Values

It is important to fill in all fields for the credit bureau(s) of your choice

in the Credit Bureau Setup form. USE THE DEFAULT VALUES listed

below, if you have not been supplied an actual value from your

credit bureau.

Control Number

The Program Identifier or Control Number contains a

unique identification number assigned to you by the

credit reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Uc

TRANS UNION PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Wco

EXPERIAN PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Xco

EQUIFAX PROGRAM IDENTIFIER

This is a unique number assigned to you by the credit

reporting agency.

Unless otherwise specified, fill this field with 00001.

(Alpha-numeric, length 5)

Credit Grantor

This is called the Subscriber Code in Trans Union terminology.

(Alpha numeric, length 10)

This is called the Subscriber Code in Experian terminology.

(Alpha numeric, length 10)

This is called the Membership Number in Equifax terminology.

For Equifax subscribers, enter the 10 character ID code

provided by Equifax here. (Alpha numeric, length 10)

Your unique subscriber codes will be placed at the top of the

file that Collect! creates for you to send to the credit bureau.

If reporting to Equifax and/or Trans Union, place the

Subscriber ID they give you into the Credit Grantor field.

Ug

TRANS UNION CREDIT GRANTOR

This is called the Subscriber Code in Trans Union terminology.

(Alpha numeric, length 10)

Wg

EXPERIAN CREDIT GRANTOR

This is called the Subscriber Code in Experian terminology.

(Alpha numeric, length 10)

Xg

EQUIFAX CREDIT GRANTOR

This is called the Membership Number in Equifax terminology.

For Equifax subscribers, enter the 10 character ID code

provided by Equifax here. (Alpha numeric, length 10)

Center Code

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Uce

TRANS UNION COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Wce

EXPERIAN COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Xce

EQUIFAX COMPUTER CENTER CODE

The Computer Center Code uniquely identifies which

data processing center generated the tape.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Area Code

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Ua

TRANS UNION AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Wa

EXPERIAN AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Xa

EQUIFAX AREA CODE

The Area Code is used only if the data processing center

produces files for more than one location. It contains an

identity code, which should be developed by the subscribe

for the location whose data is being reported.

Unless otherwise specified fill with 001.

(Alpha numeric, length 3)

Identification #

The Identification Number is used to uniquely identify a

credit grantor. Report your internal code to identify each

branch, office and/or credit center where information is

verified. This number must be unique and at least five digits

long. Note that the entire field should never be zero, blank

or 9 filled. This field must be consistent on a month to

month basis. Notify your credit bureau representative before

changing this code.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 7)

UID

TRANS UNION IDENTIFICATION/VENDOR #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 10)

Wid

EXPERIAN IDENTIFICATION/VENDOR #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 10)

Xid

EQUIFAX IDENTIFICATION/VENDOR #

The Identification Number is used to uniquely identify a

credit grantor. Press F1 for details.

Unless otherwise specified fill with 0000001.

(Alpha numeric, length 10)

Days From Validation Sent

This is the number of days after the Model Validation notice

has been sent when a Debtor can be reported to the Credit

Bureau. When the Model Validation is Printed, Emailed, or

Texted, that date plus this value is used to determine when

reporting will start.

If a letter is returned, then unchecking the Debtor's

Address OK box will disable reporting, ONLY IF the Debtor

has not already been reported. Once a Debtor has been reported,

reporting will continue, regardless of address status.

If you have a longer delay specified in the Delay Report

field below or on the Client Settings, then that date will

still take precedence on the delay. For example, if you

have a delay of 14 days for the Model Validation and a

delay of 180 days for Medical debt, then the first report

will be after 180 days.

If you have a longer delay specified in the Delay Report

field below or on the Client Settings, then that date will

still take precedence on the delay. For example, if you

have a delay of 14 days for the Model Validation and a

delay of 180 days for Medical debt, then the first report

will be after 180 days.

Report

This is the name of the summary report listing all Debtors

sent to the credit bureaus. The default report lists Debtor

name, principal, owing etc. You can edit the report to suit

your needs.

This is strictly for internal informational purposes and

is not necessary to generate. It is equally simple to

open the actual Metro2 output file in a pure text reader

such as Notepad and view your file contents if you wish

to see how many accounts you are reporting.

TU.001, EFX.001, EXP.001 text files that you remit

to the bureaus should NOT be opened in any word

processing program (including Wordpad) as these will

change the pure text format, making the files

unreadable by the bureaus. Notepad / Notepad++, and

UltraEdit are 2 common pure text editors that are fine

for the purpose of opening/viewing credit reporting

files before you deliver them to the bureaus.

TU.001, EFX.001, EXP.001 text files that you remit

to the bureaus should NOT be opened in any word

processing program (including Wordpad) as these will

change the pure text format, making the files

unreadable by the bureaus. Notepad / Notepad++, and

UltraEdit are 2 common pure text editors that are fine

for the purpose of opening/viewing credit reporting

files before you deliver them to the bureaus.

Optional SSN And Date Of Birth

Switch ON 'Optional SSN and Date of Birth' to prevent

Collect! from checking the debtor for a valid SSN

or DOB when reporting to the bureau. When checked,

Collect! will NOT stop accounts that are missing an

SSN and also missing a DOB from being reported.

WARNING: As of 2017, US Credit Bureaus require

that any accounts being submitted must

have either an SSN or DOB. If you are

in the US, do not enable this option.

This option is for non-US customers

where the SSN and DOB are not a

requirement.

WARNING: As of 2017, US Credit Bureaus require

that any accounts being submitted must

have either an SSN or DOB. If you are

in the US, do not enable this option.

This option is for non-US customers

where the SSN and DOB are not a

requirement.

Report AS Credit Grantor

This switch is connected to a field in the Company Details

window, labeled Credit grantor. Checking this switch

ON (or OFF) in either window will perform the same step

in both locations (checking or unchecking the box).

Whether this switch is ON/OFF in both places has an

effect on where information is sourced from on the Debtor

accounts when fields are being written into the Metro2

text file.

Only companies who are 1st party credit grantors should

check this switch. Collection Agencies and Attorney

Offices should not check this box ON from either

Company Details or Credit Bureau Setup screens.

When this switch is turned ON, the Delinquency Date

is used to report the Date of Occurrence for all bureau

status codes except 4, 10, 13 and 61 to 68. In those

cases, the date the Contact was scheduled is sent as the

date of Occurrence. See your Metro2 handbooks from your

credit bureaus for more information regarding bureau

status codes.

When the this switch OFF, the Date of Occurrence is

always taken from the Delinquency Date.

Report By Industry

The default setting is Collection Agency/Attorney. 1st

party credit grantors are the only companies that should

modify this setting, and in so doing, choose the Industry

type available that most closely reflects the nature of

their business. The pick list may NOT be modified with

any custom insertions as these values are hard-coded

'as is' by the Metro2 layout acceptable to the bureaus

Enter the Industry Code you wish to include in this

report. Only Debtors with this setting in the

Credit Report Details Reporting Industry field will be

processed for reporting.

This enables you to keep all your Collections accounts

together in one report and all your Mortgage Loan accounts

in a different report, for instance.

Please refer to How To Setup Credit Bureau Reporting

for more details.

Valid Industry Codes are:

0 - Check Credit

1 - Collection Agency

2 - Credit Card

3 - Credit Union

4 - Debt Counselor

5 - Educational

6 - Family Support

7 - Government Agency

8 - Installment Loan

9 - Loan Finance

A - Mortgage Loan

B - Retail

C - Sales Finance

D - Savings And Loans

E - Service And Professionals

Delay Report

Check this box ON to cause Metro Contact Event

Due Dates to be Delayed by a fixed number of days from

the current date. The field to enter the number of days

to be added to the current date (i.e. 30 days, 45 days)

will appear only when the switch to Delay report has been

checked.

Some of our USA collection agencies often utilize this

feature to encompass the FDCPA validation/dispute

period, only after which they will commence credit

reporting. Other Collect! users find that this feature

allows them to be compliant with specific client

directives, where they are bound by contractual agreement

with the creditor not to report the accounts for 'x'

days from listing.

This switch controls whether an account is eligible to

be reported effective the day it is initialized/turned

ON for reporting,

OR

should be put off for a prescribed number of days from

the date it is turned it ON. This is a global setting

that will apply to ALL accounts initialized UNLESS there

is a different number of Delay Days selected on a per

client basis: the Delay Days in Advanced Client Settings

overrides the global setting.

The Advanced Client Settings override is in place as

well to allow companies to be compliant with upcoming

credit reporting requirements for Medical accounts in

effect as of 09/15/2017.

To cause Metro Contact Event Due Dates to reflect the

current date when you turn ON Debtor accounts for

CBR reporting, do NOT the check Delay report switch.

Delay Days

This field is only displayed when you have checked

Delay report ON and is where you input the number of days

you want to wait before the account is eligible to be

reported.

For example, if today's date is 01/01/2018 and your

Delay days is set to 30, when you turn a debtor ON for

CBR reporting, the Due Date on the Metro Contact event

will be 01/31/2018.

If a client has a separate Delay days set to 60 when

the global setting is 30, then turning a debtor ON for

CBR reporting under that client on 01/01/2018 would

result in that account's Metro Contact having a

Due Date of 03/02/2018.

Inhibit Phone Numbers

Switch ON 'Inhibit phone numbers' to prevent Collect!

from sending phone numbers to the credit bureau.

The output file will contain all zeroes in the phone

number position. This ensures debtor privacy if

you have unlisted phone numbers in your database.

This is a global setting, it cannot be set on an

individual account basis.

Report All Accounts

When this is switched ON with a check mark, Collect! will

report all debtors in your database that have been setup

for credit bureau reporting. With this box unchecks,

Collect! will only report accounts that have been changed.

This box is on by default to comply with the

2016 USA reporting requirements change requiring

all accounts to be included in a credit report.

This box is on by default to comply with the

2016 USA reporting requirements change requiring

all accounts to be included in a credit report.

Disable Contact Control Notes

Switch this ON to disable the note lines that are

written for accounts that are skipped when exporting

due to the account failing to qualify for reporting

due to a Contact Control rule.

The account will still appear in the CBR Log

so you can review before submitting to the bureaus.

Accounts that are skipped are usually due to the

Model Validation notice not being sent out.

If you have not defined a Model Validation notice,

then your accounts will be reported normally.

The account will still appear in the CBR Log

so you can review before submitting to the bureaus.

Accounts that are skipped are usually due to the

Model Validation notice not being sent out.

If you have not defined a Model Validation notice,

then your accounts will be reported normally.

Backup Log File

When this is switched ON with a check mark, Collect! will

make a copy of the cbrlog.txt into the cbr\backup folder

after the CBR process is complete. The name of the file

will be formatted as yyyymmdd_cbrlog.txt.

When this switch is ON, you will not be prompted

to clear the log file after reviewing it.

When this switch is ON, you will not be prompted

to clear the log file after reviewing it.

Report Charged Date

This switch is intended for credit grantors ONLY who have

also turned ON the Credit grantor switch in

Company Details / Credit Bureau Reporting Setups.

Check this ON to report the account's Charged Date as the

debtor's Date Opened, instead of the Listed Date.

Even if checked ON, this switch will not function if the

company is a 3rd party collection agency / attorney's

office, which is not identified in setups as being a

credit grantor.

If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date for

credit bureau reporting. Also Collect!

automatically reports the Charged Date when

you are reporting NSF checks. You do not

need to switch on 'Report Charged Date'.

If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date for

credit bureau reporting. Also Collect!

automatically reports the Charged Date when

you are reporting NSF checks. You do not

need to switch on 'Report Charged Date'.

No Posted Date Mods Delinquency

When this is switched ON, Collect! uses the Payment Date

of the promise transaction as the Delinquency Date rather

than allowing the default 30 day delay in determining

delinquency.

This is used only in Credit Grantor mode.

This is used only in Credit Grantor mode.

Report Client Account Number

By default, Collect! uses the Debtor File Number as the

ID for credit bureau reporting. It is recommended that

you leave Report Client Account Number switched OFF

and let Collect! report using the Debtor File Number,

unless you are sure you need to do otherwise.

It is necessary to make a global decision for the company:

will you report accounts by your Client's Account Number

(Acct on the Debtor screen) or by your Office's

File Number on the Debtor screen. Once this decision is

made and you begin reporting, you cannot change this

setting again.

Check Report client account number ON if you will use

the client's account number,

OR

do NOT check this switch if you will report by the

debtors' file numbers as assigned by Collect! when

entered into your system. Reporting by File number is

the more popular selection as some creditors do not

provide an account number and the bureaus reject debts

reported without a reference number associated with

the debt.

WARNING: Reporting accounts by one setting, i.e.

client's account number followed by a change

(perhaps accidental) to report with your company's

file number will result in the same account

appearing twice on a debtor's credit report as though

they were different accounts completely; the bureaus

cannot differentiate when the debt is reported with

different 'account numbers' insofar as Metro2 layout

is concerned. This creates a serious situation between

your company and the bureaus that requires drastic

steps to resolve.

WARNING: Reporting accounts by one setting, i.e.

client's account number followed by a change

(perhaps accidental) to report with your company's

file number will result in the same account

appearing twice on a debtor's credit report as though

they were different accounts completely; the bureaus

cannot differentiate when the debt is reported with

different 'account numbers' insofar as Metro2 layout

is concerned. This creates a serious situation between

your company and the bureaus that requires drastic

steps to resolve.

To avoid the possibility of the above occurrence, this

switch will become Read Only for all User Levels after

you have run your first report. Even where the switch is

being left unchecked in the OFF position, meaning you are

reporting by File number, it will still make the field

Read Only so a user doesn't inadvertently turn it ON at

some future point in time.

Report Owing In Past Due

Switch this ON with a check mark to report the Debtor's Owing

in the Past Due position of the CBR file. Normally, this field is

zero filled if you are not a credit grantor, but you can use

this switch to fill it with the Owing.

New Bus - Ignore Reporting Owing

If this field is checked, then debtors being reported for the

first time will not be enabled if their owing is less than the

value in the LESS THAN field.

Less Than

This field is used by the NEW BUS - IGNORE REPORTING OWING

field above. If the above field is checked, then debtors being

reported for the first time will not be enabled if their owing

is less than the value in this field.

Auto Activate New Accounts

Switch this ON with a check mark to automatically enable an

account for reporting to the credit bureaus. This feature

works on manually created accounts and imported accounts.

This feature only works if the Client is setup to report

to the bureaus in the Client Settings.

Exclude Log Warnings

Switch this ON with a check mark to exclude any Info and

Warning messages from the CBR log where the accounts were

still sent.

Force Age Out

If populated, the System will automatically stop reporting accounts

to the credit bureau after the specified time.

Enter a value, in YEARS, into this field.

The date that the system uses to calculate the period is the same

date that is put into the Base Segment in Position 25.

For non-Credit Grantors, it will be the Delinquency Date. If that is

not populated, then it will be the Charged Date.

For Credit Grantors, it will always be the Delinquency Date.

Help

Press this button for help on the Credit Bureau Setup

form and links to related topics.

Defaults

When reporting a Debtor to the Credit Bureaus, there are

certain settings that need to be reported to the bureaus.

Select this button to display the Credit Report Preferences

form where you can choose default credit reporting settings.

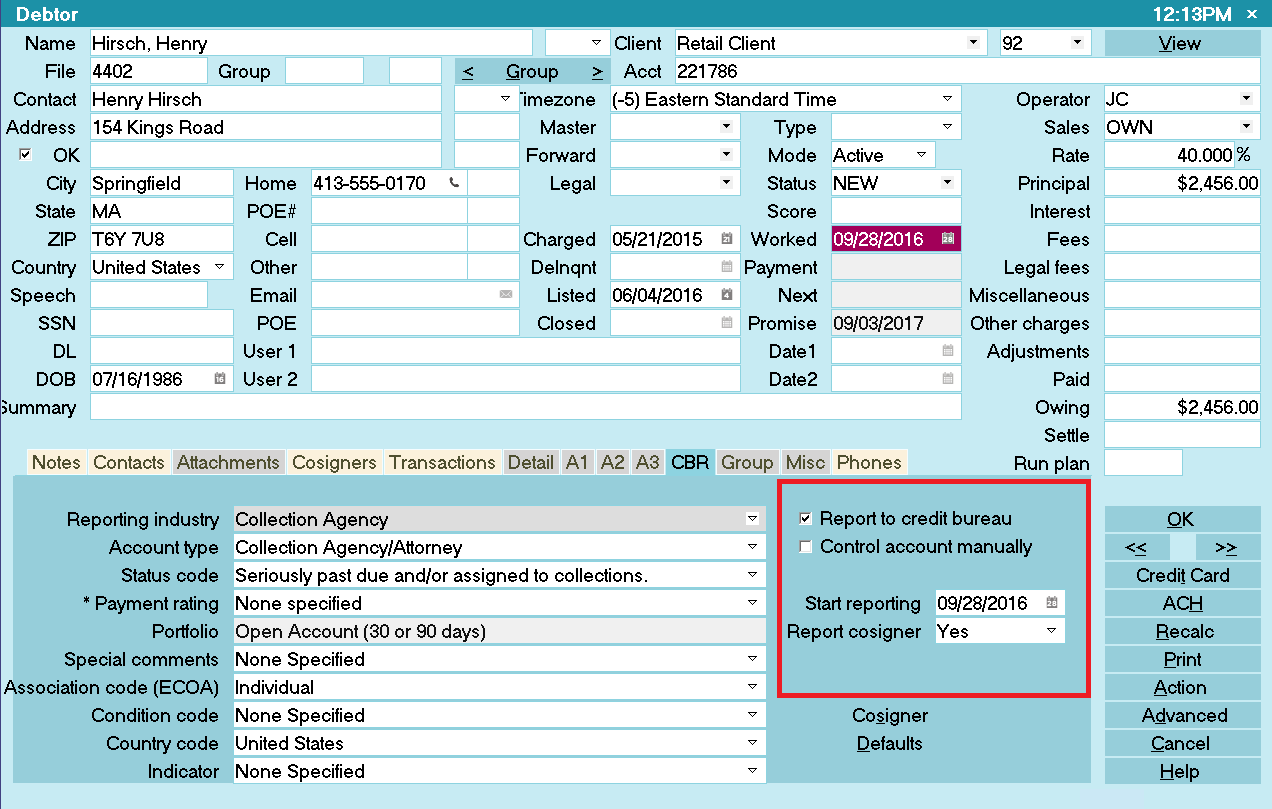

When you flag a Debtor to be reported to the Credit Bureau,

these default settings will automatically apply to the Debtor.

You can override these defaults on an individual Debtor level

through the Credit Report Details dialog. To access this

dialog, select the CBR tab on the Debtor form.

Cancel

Selecting this button will ignore any changes you have

made and return you to the previous form.

OK

Selecting this button will save any changes you may have

made and return you to the previous form.

Now that you are looking at the Credit Bureau Setup form, let's discuss the fields. You will notice

that there are 3 rows of fields called TU (Trans Union), Experian and Equifax.

These are the names of the Credit Bureaus. Here you will input your member information from the

Credit Bureau.

You can report to one or several bureaus. If you are reporting to Trans Union, you will fill in the

fields under TU. If you are reporting to Experian, you will fill in the fields under Experian. If

you are reporting to Equifax, you will fill in the fields under Equifax. Please refer to the

Credit Bureau Setup form in this link for more

details on each of the fields.

Before going on, make sure you know which Credit Bureau or Credit Bureaus you will be reporting

to and that you have the information the Credit Bureau supplied to you in front of you to

help you fill in the fields.

Before going on, make sure you know which Credit Bureau or Credit Bureaus you will be reporting

to and that you have the information the Credit Bureau supplied to you in front of you to

help you fill in the fields.

Default Values For CBR Settings

Your unique subscriber codes will be placed at the top of the file that Collect! creates for you to

send to the credit bureau.

- If reporting to Equifax and/or Trans Union, place the Subscriber ID they give you into

the "Credit Grantor" field.

- If reporting to Experian, place the D-Number into the "Control Number" field.

- Other fields are filled with defaults as shown in the screen shot.

It is important to fill in all fields for the credit bureau(s) of your choice in the Credit Bureau Setup

form. Only a few fields hold actual values as indicated below. The rest of the fields should be

filled with a default value, such as zeroes and one, as shown.

Credit Bureau Setup Settings

Credit Report Preferences

Credit Report Preferences

Select the DEFAULTS button on the Credit Bureau Setup form to view the Credit Report Preferences.

These default settings are used for every account you switch ON for reporting. They can be changed

globally or on a per debtor basis.

Click Here to View this Form.

Click Here to Close this Form.

Credit Report Preferences are used as default values when

you report Debtors to the bureau.

These default settings are used for every account you switch

ON for reporting. They can be changed globally or on a per

debtor basis. When you select an item from the pick list,

the corresponding code will be set in the Debtor's

Credit Report Details.

Credit Report Preferences

The pick lists on the fields are interdependent. You will notice

that the available choices change depending on what you

have selected for other fields.

Default values from the Metro2 Standard are

provided for normal collection and credit management

reporting. Please refer to your Metro2 Manual for help

selecting from the pick lists. If you are not sure which default

values you should use, please discuss with your credit

bureau representative.

Default values from the Metro2 Standard are

provided for normal collection and credit management

reporting. Please refer to your Metro2 Manual for help

selecting from the pick lists. If you are not sure which default

values you should use, please discuss with your credit

bureau representative.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

The Credit Report Preferences form is accessed by

selecting the DEFAULTS button on the Credit Bureau Setup

form.

Industry

This field contains the industry type that classifies the reporting

agency. Common examples of Industry are "Collection Agency"

and "Mortgage Loan."

Valid Industry Codes are:

0 - Check Credit

1 - Collection Agency

2 - Credit Card

3 - Credit Union

4 - Debt Counselor

5 - Educational

6 - Family Support

7 - Government Agency

8 - Installment Loan

9 - Loan Finance

A - Mortgage Loan

B - Retail

C - Sales Finance

D - Savings And Loans

E - Service And Professionals

This is the field that holds the value Collect! uses

if you want to "Report by Industry" as described

in Credit Bureau Setup.

This is the field that holds the value Collect! uses

if you want to "Report by Industry" as described

in Credit Bureau Setup.

Account Type

This field contains the account type code that identifies the

account classification. You will notice that the choices

depend on what you have selected as the "Industry" in

the previous field.

Status Code

This field contains the status code that properly identifies

the current condition of the account. Available Status Codes

change depending on the "Account Type." For instance,

a "Collection Agency/Attorney" reports statuses such

as "Seriously past due" and "Paid in Full." While an

accounts such as "Real Estate Mortgage" reports statuses

like "Current" or "150 days past due."

Collection Agencies will predominantly be reporting in

bulk as "Seriously past due and/or in collections"

unless they are specifically running a batch of Deletes,

or adjusting their reporting with a Special Comment

like Dispute (XB in the METRO2 file).

Collect! Debtor status codes and bureau status codes

are not in any way connected or interdependent.

A change in a Collect! debtor Status Code field

has NO CHANGE on a debtor's credit reporting file

scheduled for the next reporting date.

Collect! Debtor status codes and bureau status codes

are not in any way connected or interdependent.

A change in a Collect! debtor Status Code field

has NO CHANGE on a debtor's credit reporting file

scheduled for the next reporting date.

Payment Rating

This field contains settings for specifying whether

or not an account is Current or Past Due. It is only

visible for certain Status Codes that Collect! does

not handle automatically. Please refer to

How to Setup Credit Bureau Reporting for details.

Portfolio Type

This field contains the type of the debt. The pick list offers

choices for common credit and loan types. Examples of

Portfolio Type are "Open Account" and "Line of Credit."

Comments

This field is used in conjunction with the Account Status to

further define the account. Special comment codes, when

found, will however take precedence over the value in

Account Status.

Association

This is used to designate an account in compliance with the

ECOA. This setting can be changed for an individual Debtor

through the Credit Report Details form accessed from the

Debtor form.

Condition Code

This field allows for reporting of a condition that is required

for legal compliance; e.g., according to the

Fair Credit Reporting Act (FCRA).

Country Code

This is the country that the Debtor lives in.

The list of default country codes provided by Collect! shows

only a few of the most used country codes. Please refer to

your Metro2 Manual if you need to use a different code.

Default Info Ind

This field provides for entering a value indicating a

bankruptcy condition that applies to the Debtor

cosigner.

Delay Before 1St Report

Switch this On to Delay before the first Credit Report. Enter

the number of days to delay in the Delay Days field.

This switch is used in conjunction with the

Credit Report Details form accessed from the

Debtor form. When you switch ON "Report to

credit bureau" in the Credit Report Details form,

the "Start reporting" date will be calculated

according the defaults you set here. You can

override these by choosing a new "Start

reporting" date in the Credit Report Details

form for a particular Debtor.

This switch is used in conjunction with the

Credit Report Details form accessed from the

Debtor form. When you switch ON "Report to

credit bureau" in the Credit Report Details form,

the "Start reporting" date will be calculated

according the defaults you set here. You can

override these by choosing a new "Start

reporting" date in the Credit Report Details

form for a particular Debtor.

Delay Days

Enter the number of days that you wish to delay before

reporting a new Debtor or an existing Debtor that you

choose to report to credit bureaus. The number you enter

here will be calculated into the "Start reporting" date in the

Credit Report Details form accessed from the Debtor form.

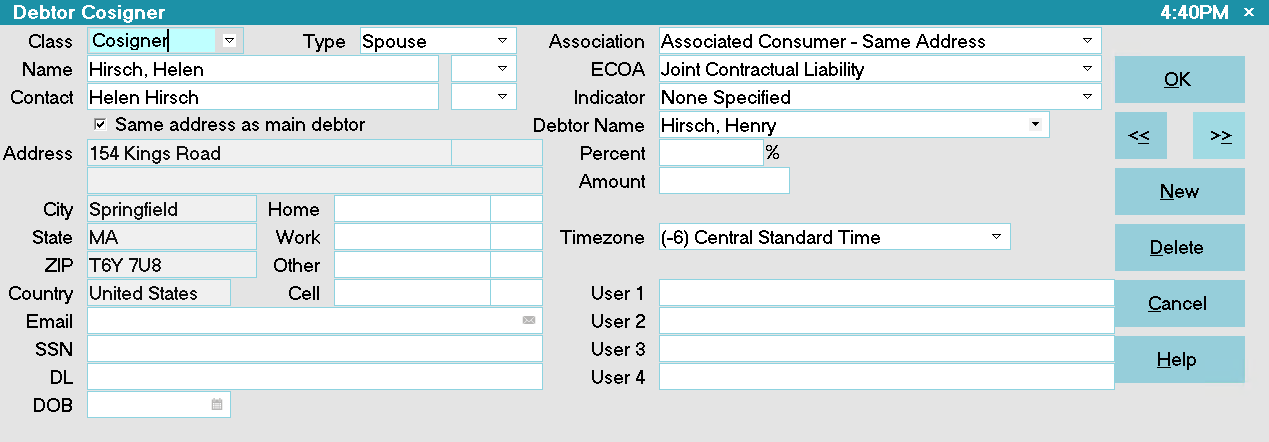

Cosigner

This field is used to determine if the Debtor has a cosigner

to be reported on. ECOA choices and details are filled in on

the Debtor Cosigner form. Select the Cosigners tab in the

Debtor form to access Cosigner information for the Debtor.

Press F1 when the Debtor Cosigner form is displayed. The

Help topic contains valuable information about credit bureau

reporting formats for each field.

Help

Press this button for help on the Credit Report Preferences

form and links to related topics.

Cancel

Selecting this button will ignore any changes you

have made and return you to the previous form.

OK

Selecting this button will save any changes

you may have made and return you to the

previous form.

Default values from the Metro2 Standard are provided for normal collection and credit management.

If you are not sure which default values you should use, please discuss with your credit bureau

representative.

Client Type

The Client Type field is used. In credit reporting terms, this is the Creditor Classification.

Open one of the Clients you wish to report and select the down arrow beside the Type field and pick

a Creditor Classification from the list of choices.

You must choose a valid creditor classification for each Client that you intend to report.

If the choice you need is not in this list, please discuss this with your representative as

these choices come directly from the Credit Reporting Guidelines.

You must choose a valid creditor classification for each Client that you intend to report.

If the choice you need is not in this list, please discuss this with your representative as

these choices come directly from the Credit Reporting Guidelines.

Client Settings

The Client Settings form stores several selections used by Collect! when reporting is switched ON

for a Debtor and when the file is produced.

- Open one of the Clients you wish to report and select the ADVANCED button.

Client Form

- Select ADVANCED and the Client Settings form will now be displayed.

Client Settings Form

You will notice in the Client Settings form, that on the right side, two of the boxes relating to

Credit Bureau reporting are checked.

Report accounts to bureaus When this is checked, Collect! knows that the Client

is set to report credit. When this Switch is off, Collect will warn you that it is not set up to

report credit.

Send client detail to bureaus When this is checked, the client's details will be

sent to the Bureau. This is a requirement for Collection Agency reporting.

WARNING: You must provide a delinquency date for all accounts reported to the Credit Bureau.

The delinquency date appears on the Debtor form and is defined as the date of the first

delinquency that led to the derogatory status being reported.

WARNING: You must provide a delinquency date for all accounts reported to the Credit Bureau.

The delinquency date appears on the Debtor form and is defined as the date of the first

delinquency that led to the derogatory status being reported.

K1 Segment Original Creditor Client Detail

If you are not a Credit Grantor, You must be sure put a check in the box labeled Send client

detail to bureaus in the Client Settings form to send the K1 segment.

The date an account is charged off or placed for collection is not the delinquency date. The

delinquency date should be the date the account became past due. The date of the delinquency is

necessary to purge accounts from the Credit Bureau database in accordance with the

Fair Credit Reporting Act (FCRA).

Debtor Information

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal rights of the person or entity you

are reporting.

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal rights of the person or entity you

are reporting.

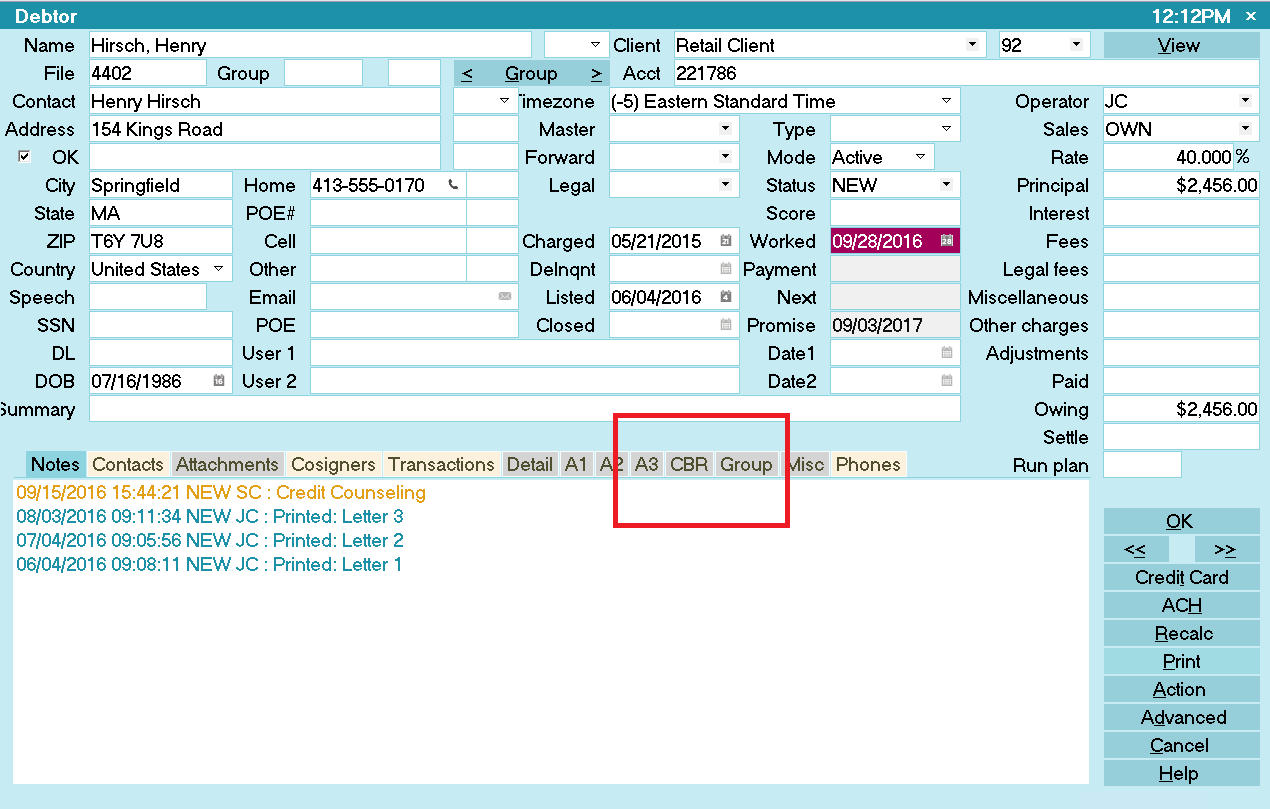

Many fields on the Debtor form are included in the credit report, so you need to make sure they are

filled in correctly.

When sending reports to credit bureaus, it is the user's responsibility to make sure that the name

and the address fields are in the required format.

The following information is entered in the Debtor form.

Click Here to View this Form.

Click Here to Close this Form.

The Debtor form stores all information that you need to work

and manage your accounts. Personal, financial and in-house

management information is displayed on the form. Tabs enable

you to open sub-forms to access various types of related

information, such as contacts scheduled for the debtor,

financial transactions posted, bank information and other

debtor details, cosigners and attachments. When you select

financial fields on the Debtor form, additional financial details

are displayed in summary screens.

Debtor

Collect! uses the information entered in the Debtor form to:

- Help you manage your collectors' workloads

- Perform financial calculations

- Print a broad array of reports

- Keep track of all activity on each account

Information on the Debtor form can be loaded automatically

for each new Debtor that you create. This speeds up data entry

and minimizes errors. First, the settings and details are entered

into the other areas of Collect!. Then they are readily available

when each new Debtor is entered.

Name

The Name of the debtor entered as 'Last, First / Middle initial'.

Please ensure your spelling is correct. This field is INDEXED.

If you type a comma in the name, Collect! will split first and

last names automatically and put the result into the Contact

field below. For example, JONES, SAM = Sam Jones.

If you do not place a comma between the last and first name,

Collect! will assume the name is a business name.

FOR CBR: Hyphenate multiple last names,

e.g. 'Van-Deusen, Jack'.

FOR CBR: Please put ONE Debtor name ONLY

in this field. If you have a Cosigner,

use the Cosigner form.

FOR CBR: Don't include Generation titles in the

name here. Use the Generation field.

FOR CBR: When reporting Commercial accounts,

Collect! can detect a business name as long

as there is no comma in the Name. If there

are commas in the business name, please

ensure that you switch ON "Business/Commercial"

in the ECOA designation when setting up this

account for reporting.

Legal Entity

Press F2 or select the arrow to pick the Legal Entity

title of the Debtor. For example, Jr, Sr, II, III, Ltd. or Inc.

This field is optional.

FOR CBR: If there is a Legal Entity title for this

Debtor, it MUST go here, NOT in the

Name field.

File

The File Number of this account is automatically created

by Collect!. It looks at the highest numbered debtor and

adds 1 for numbering a new debtor. File Number is a

UNIQUE identifier for each account, up to 9 digits in

length. You must not have duplicate File Numbers in

your database.

Collect! uses this File Number for several functions, such

as storing Attachment and Data records attached to the

account. It is also sent as the UNIQUE identifier when

processing accounts for credit bureaus, letter service

and 3rd party data exchanges.

This field is INDEXED.

FOR CBR: The File Number must not change

while the account is being reported.

Collect! does allow you to modify the File

Number, if needed. Remember that you can

use up to 9 digits here. Each account must

have a UNIQUE File Number.

Collect! does allow you to modify the File

Number, if needed. Remember that you can

use up to 9 digits here. Each account must

have a UNIQUE File Number.

Contact

This is the name of the Contact person at the address

or phone number. This field is INDEXED. Unless you enter

a different name manually, Collect! uses the information in

the Debtor Name field to construct the Contact name.

Generation

Press F2 or select the arrow to pick the Generation of the

contact person. (Jr, Sr, II, III etc.) This field is optional.

Address

This is the Address of the debtor, if it is known. Two lines are

available. If you enter text into the first line, the Print switch

(Address OK) will be set automatically. This will enable printing

notices to this debtor using contact plans and action codes.

When you change an existing debtor Address line, the old

address line will be written automatically to the debtor's Notes.

*** IMPORTANT *** If you ever intend to report to

Credit Bureaus, you must use one of the

following address formats or an error will result.

FOR CBR: There are two acceptable formats:

Format 1:

Address = street address, suite or apartment number

Addr1 = blank

City = city

State = state

Zip = zip

Country = country code

Format 2:

Address = street address

Addr1 = suite or apartment number

City = city

State = state

Zip = zip

Country = country code

Street Number

Optionally, you can enter the Street Number here. This

provides a means of searching and/or filtering by street name.

This field is optional.

FOR CBR: Do not use this field if you intend to

report to the credit bureaus.

Addr 1

This is another Address line for the debtor. Use this line to enter

Suite or Apartment number if you intend to report to credit bureaus.

If you have a data file that you want to import that combines

city, state, and zip into one field or string

(Example: Los Angeles CA 90210), you can import it into the

Addr 1 field and the import module will separate the string

into the applicable city, state, and zip fields. In order for

this to work, the city, state, and zip fields can not have any

existing data in the fields.

If you have a data file that you want to import that combines

city, state, and zip into one field or string

(Example: Los Angeles CA 90210), you can import it into the

Addr 1 field and the import module will separate the string

into the applicable city, state, and zip fields. In order for

this to work, the city, state, and zip fields can not have any

existing data in the fields.

Street Type

Optionally, you can enter the Street Type here. This field

is a numeric field.

You can add a pick list to this field for your own

needs.

You can add a pick list to this field for your own

needs.

FOR CBR: The information in this field is not sent to

credit bureaus.

Address OK

The Print Notice (Address OK) switch controls whether or not

letters are printed to this debtor. If the box contains a check mark,

letters will be printed. If it is blank, letters will NOT be printed for

the debtor. Only set this switch to print (by clicking into the box

to create a check mark), if you have a valid address to send notices

and letters to. Collect! checks the first line of the address. If it

finds an address, it will turn this switch ON automatically by

entering a check mark in it.

FOR CBR: Entering the correct address status

is important if you are reporting to CBR.

If this box is blank or you remove the check mark

from the box by clicking into it, the address fields

in the Debtor form change color. This is to alert the

operator that there is no valid address for this

debtor. This is the first step in skip tracing.

If this box is blank or you remove the check mark

from the box by clicking into it, the address fields

in the Debtor form change color. This is to alert the

operator that there is no valid address for this

debtor. This is the first step in skip tracing.

You can fine-tune Address OK functionality for

printing your daily letter batch. Please refer to

Help topic, Required Address Fields for

additional options for validation addresses.

You can fine-tune Address OK functionality for

printing your daily letter batch. Please refer to

Help topic, Required Address Fields for

additional options for validation addresses.

City

Enter the City Name here.

This field is INDEXED.

FOR CBR: truncate the rightmost positions

in this field to 20 characters. Alternatively,

you can use the standard 13-character

U.S. Postal Service city abbreviations.

State

Enter the State Name or Code here.

This field is INDEXED.

FOR CBR: You must enter State Codes in this

field. Refer to your CBR manual for

correct State Codes.

ZIP

Enter the Zip or Postal Code here.

This field is INDEXED.

FOR CBR: The zip or postal code must be entered

and it must be correct. The zip code may

be either 5 or 9 digits for U.S. zip codes,

or 6 digits for Canadian postal codes.

For example: 12345-6789 or 123456789 for U.S.and

X2Y 3Z4 or X2Y3Z4 for Canada.

Country

Enter the Country where the Debtor lives.

This field is INDEXED.

FOR CBR: The Country Code is read from the

Country Code field in Credit Report Details

for the debtor. Collect! uses standard

two-character country abbreviations

specified in the Metro 2 manual.

If you are not doing Credit Bureau Reporting, this field is optional.

Speech

This field allows you to track the language that the Debtor speaks.

This is a string field.

Timezone

This field holds a POSITIVE or NEGATIVE integer

indicating the Timezone of this Debtor. Timezones

are standard integer values calculated from GMT

(Greenwich Mean Time). You can use the value in

this field to load contacts in the operator's

work queue according to the account's local time.

Please refer to Reload Work In Progress List for

details.

The control file that manages Debtor timezones

is called setzone.ctf and is stored in your

"\Collect\masterdb\control" folder.

When the timezone is not "Local Time," the

title bar displays the Debtor's current

time.

When the timezone is not "Local Time," the

title bar displays the Debtor's current

time.

SSN

This is the Social Security Number of the Debtor.

If you are NOT reporting to credit bureaus, you

can use this field for other purposes.

This field is INDEXED.

FOR CBR: Either this field or DOB should be filled in.

Some locations require either DOB or SSN to

be populated. By default, accounts with both

fields blank will not be included in the report.

Please refer to How To Setup Credit Bureau Reporting

for more information. If SSN is not known,

LEAVE BLANK. Although the bureaus do accept

0 or 9 filled positions, filling a placeholder

value could disrupt Account Matching and Find By.

DL

Debtor's Driver's License. You can use this

field for other purposes. This field is INDEXED.

DOB

This is the Debtor's Date of Birth.

This field is INDEXED.

Press F2 or select the small calendar icon. Select a

Date from the calendar that is displayed. Use the arrows

to scroll through years. Or type the date as MM DD YY.

If you are not reporting to credit bureaus, you can use

this field for other purposes. This field is INDEXED.

FOR CBR: Either this field or SSN should be filled in.

Some locations require either DOB or SSN to

be populated. By default, accounts with both

fields blank will not be included in the report.

Please refer to How To Setup Credit Bureau Reporting

for more information. If DOB is not known,

LEAVE BLANK.

Group

The Group button allows you to group this debtor. When the

Debtor is in a group, the Group will display a Group ID

number and a Group Member number. All members in the

group share the same Group ID. The Group ID is INDEXED.

If the debtor is already grouped, the Group button will display

as orange, instead of gray, and will display the debtor's

Group ID and Member number. To view other debtors in the

group, click the forward or backward arrow or press the Group

button to view Matching Accounts, or select the GROUP

tab.

If the debtor is not part of a group, you will be

prompted to choose debtors to form a group.

If the debtor is already part of a group, then

Matching Accounts information displays.

If the debtor is not part of a group, you will be

prompted to choose debtors to form a group.

If the debtor is already part of a group, then

Matching Accounts information displays.

Pressing the "G" key on your keyboard

will prompt you to add this account to

a group.

Pressing the "G" key on your keyboard

will prompt you to add this account to

a group.

Group Member

If this debtor is grouped, it will be assigned a

sequential number based on the order in which it

was added to the group.

If your Group Member IDs are no longer

sequential due to removing members from

the group, you can run the Tools, Utilities,

Group Member Renumbering utility to

restore sequential numbering to each group.

Home

This is the Home or Personal Telephone Number of the debtor.

This field is INDEXED.

When you change an existing phone number, the

old number will automatically be written to the debtor's

notes. Select the telephone icon to initiate the

Phone Dialer to dial this number.

If your system is not setup for using

the Phone Dialer, you will not be able to

use this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Home Extension

This field is used to enter an Extension to the phone

number if needed. It might also be used to enter an

ID number.

POE#

This is the Work or Business Telephone Number of the debtor.

This field is INDEXED.

When you change an existing phone number, the old

number will automatically be written to the debtor's notes.

Select the telephone icon to initiate the Phone Dialer

to dial this number.

If your system is not setup for using

the Phone Dialer, you will not be able

to use this feature.

If your system is not setup for using

the Phone Dialer, you will not be able

to use this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Work Extension

This field is used to enter an Extension to the phone

number if needed. It might also be used to enter an

ID number.

Cell

This is the Cellular or other number where you can reach the

debtor. This field is INDEXED.

Select the telephone icon to initiate the Phone Dialer to

dial this number.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Cell Extension

This field may be used to enter an Extension

to the phone number if needed. It might also

be used to enter a Cellular ID number.

Other

Use this field for an additional Phone Number. This field is

INDEXED. Select the telephone icon to initiate the

Phone Dialer to dial this number.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Other Extension

This field may be used to enter an Extension

to the phone number if needed. It might also

be used to enter an ID number.

Email

This field is used to enter the debtor's Email

Address. This field is INDEXED. Select

the field icon to open the Send Mail form

where you can compose an email and send it

to this debtor.

POE

Place of employment.

User 1

This field is for your own definition and use.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

User 2

This field is for your own definition and use, but it may have

another function if you are reporting to credit bureaus.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

Client

Enter the Name of the Client in this field. You can

pick from your list of clients by pressing the F2 key

when the Client field is highlighted.

Your clients MUST be set up before

you begin to enter debtors.

Your clients MUST be set up before

you begin to enter debtors.

Only Clients with the INACTIVE switch

OFF will appear in this list.

Only Clients with the INACTIVE switch

OFF will appear in this list.

Acct

This is the Reference Number assigned to this debtor by

the client. This is printed on statements to your clients.

This field is INDEXED.

Client Number

This is the Client Number assigned by Collect!.

When you select a Client for the Client field,

the Client Number displays in this field. Also,

you may select a Client by selecting the pick

list attached to this field.

This field will change automatically if you change

the client's Number in the Client form.

You must set up clients before you

begin to enter Debtor information.

You must set up clients before you

begin to enter Debtor information.

Only Clients with the INACTIVE switch

OFF will appear in this list.

Only Clients with the INACTIVE switch

OFF will appear in this list.

View

Select this button to open the Client form for

this Debtor's client. This enables you to quickly

view the client's information with a single click.

Master

Click the arrow to view clients that you may select from for

this field. This list will only display clients with a

category of MASTER.

WARNING: This field is limited to 4 characters only.

If you are using longer Client Numbers

you may want to use the Client Owner

feature instead to create a Client with

a shorter client Number.

WARNING: This field is limited to 4 characters only.

If you are using longer Client Numbers

you may want to use the Client Owner

feature instead to create a Client with

a shorter client Number.

Client ownership is a hierarchical system that

allows you to use the "Owned by client"

in the Client form.

Client ownership is a hierarchical system that

allows you to use the "Owned by client"

in the Client form.

Forward

Click the arrow to view clients to whom you can forward this

account. This list will only display clients with a category

of FORWARD.

Legal

The Legal field gives you a place to put an attorney that

you may want to forward this account to. Click the arrow

to display a list of clients. This list will only display

clients with a category of LEGAL.

You will have to setup your attorney client

first so that it shows up in the list of all clients.

Please refer to the How To Post Attorney Fees section

on the How to Post a Transaction page

for information about setting up an attorney

client.

You will have to setup your attorney client

first so that it shows up in the list of all clients.

Please refer to the How To Post Attorney Fees section

on the How to Post a Transaction page

for information about setting up an attorney

client.

Charged

This is the date the debt was originally incurred by the debtor.

This date is also used when applying an age-based

commission rate plan to the account. In that case, both Listed

and Charged dates are required to calculate the account age.

FOR CBR: If you do not enter a Delinquency Date, Collect!