How To Run A Credit Bureau Report

When the Credit Bureau Setup is complete and you have set up debtors to be reported, you are ready

to report to the Credit Bureaus.

The credit reporting functions of Collect! operate mostly behind the scenes, requiring little or no

user intervention. However, sending reports to credit bureaus requires attention to detail. It is

your responsibility to make sure that the information you send is accurate and complete, and that

all the required information is included for the Metro standard that you are using.

This topic can only be used after the Credit Bureau Setup is complete. Please refer to

How To Setup Credit Bureau Reporting if you are not sure you are ready to run a credit bureau report.

This topic can only be used after the Credit Bureau Setup is complete. Please refer to

How To Setup Credit Bureau Reporting if you are not sure you are ready to run a credit bureau report.

Please be aware that there may minimum number of debtors and a minimum dollar value that

credit bureaus will accept. Please check with your representative to determine these

requirements.

Please be aware that there may minimum number of debtors and a minimum dollar value that

credit bureaus will accept. Please check with your representative to determine these

requirements.

Aged Out Accounts

Some locations require that you close out your accounts that have aged out as per legislation.

In the Member Center, we have included a couple versions of the CBR 7 Year Age Out Report that can

be used to flag accounts with the Delete Account (DA) status.

The default report simply looks at listed date and payment date. If an account is listed more than

7 years ago and has not made a payment in 7 years, then it will be flagged for removal.

WARNING: If you decide to update the report, you do so at your own risk.

WARNING: If you decide to update the report, you do so at your own risk.

Run the report before running the CBR process to update the accounts. See below for more

information.

The Member Center contains an automatic version of this report that an be run with the

Collect! Scheduler.

The Member Center contains an automatic version of this report that an be run with the

Collect! Scheduler.

Report Debtors To The Credit Bureau

WARNING: Reporting Credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being absolutely

sure about your legal rights and the legal rights of the person you are reporting.

WARNING: Reporting Credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being absolutely

sure about your legal rights and the legal rights of the person you are reporting.

At the Collect! Main Menu, select Tools from the top menu bar and then select Credit Reporting

from the drop-down choices.

Tools Menu - Credit Reporting

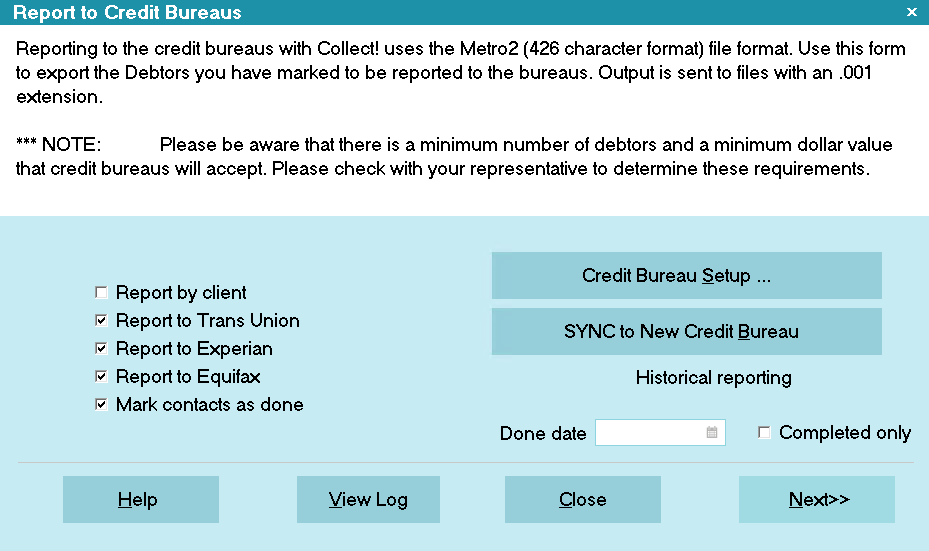

This will display the Report To Credit Bureaus form.

Age Out Report

If you didn't run the Age Out Report first, and this process applies to you, select the Age Out Report.

You can select either the report with output, or the automated version without output.

Click Here to View this Form.

Click Here to Close this Form.

Reporting to the credit bureaus with Collect! uses the

Metro2 (426 character format) file format. Use this form

to export the Debtors you have marked to be reported to the

bureaus. Output is sent to files with an .001 extension.

Please be aware that there is a minimum number of

debtors and a minimum dollar value that credit bureaus will accept.

Please check with your representative to determine these

requirements.

Please be aware that there is a minimum number of

debtors and a minimum dollar value that credit bureaus will accept.

Please check with your representative to determine these

requirements.

Credit Reporting is a three step process. First, print a Summary

Report to review the accounts being reported. Second, select the

bureaus you want to send to and create the disk files or save the

file to your hard drive, e.g. C:\ N.B. Be sure

to check the log to correct any errors. It is most important to

correct errors before sending to Credit Bureau. Finally, you can

mark the contacts done. Please note that you must correct

all errors before marking as done.

Before using the Report To Credit Bureaus form, setup

the details of your reporting specifications using the

Credit Bureau Setup form, the Credit Report Preferences form

and the information given you by your credit reporting agency.

Before using the Report To Credit Bureaus form, setup

the details of your reporting specifications using the

Credit Bureau Setup form, the Credit Report Preferences form

and the information given you by your credit reporting agency.

You can also schedule credit bureau reports to run

using Collect!'s Scheduler.

You can also schedule credit bureau reports to run

using Collect!'s Scheduler.

Credit Reporting Process

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

This is a high-level overview of the process. For more information, please

refer to the Help topic How to Run a Credit Bureau Report.

Step 1

Select Tools from the top menu bar and then select

Credit Reporting from the drop-down choices. This will

display the Report to Credit Bureaus dialog.

First, print a Summary Report. It is important to review the output

to be sure the desired accounts are being reported. This creates

a report that you can print and keep for your records.

Step 2

Next, if applicable, select the Age Out report that you want

to run to mark older accounts for deletion from the credit

bureaus.

Step 3

Next, select the bureaus you want to send to, and create the

files. Ensure that the log is free of errors.

During this step, you have a chance to correct any

errors the system detects in your credit reporting information.

These errors can be invalid addresses, incorrect or missing

dates, and any other information.

During this step, you have a chance to correct any

errors the system detects in your credit reporting information.

These errors can be invalid addresses, incorrect or missing

dates, and any other information.

During this step, you typically want to send the output to

drive C (see the Help on Credit Bureau Setup), and only

select one bureau to send to. After the file has been created,

select the View Log button to review any errors. The files in which

the errors are found are listed in the log. Go to each file listed and

correct the error.

Only after you have corrected all errors should you make a final

pass to create the files you will send to the credit bureaus.

Then you can proceed to step 3

Step 4

Finally, you can Mark the Contacts as Done so the system

knows they have been reported.

WARNING: Only take this step after you have completed

step 2 and all errors have been corrected.

WARNING: Only take this step after you have completed

step 2 and all errors have been corrected.

Age Out Report

After a period of time, you may have to close accounts due to

their age. If this applies to you, you can select a report here

to run you process to mark the accounts for deletion from the

credit bureaus. This process will run first, then proceed with

the rest of the export process.

The report that you use must Start On Anywhere in the

Report Definition and there must not be any tagged

records in the background.

The report that you use must Start On Anywhere in the

Report Definition and there must not be any tagged

records in the background.

Report By Client

If report by client is switched ON, a client list will appear.

Select the client to report for.

Tagging multiple clients will not work. Please select

only one Client.

Tagging multiple clients will not work. Please select

only one Client.

Before doing this you must set up the Client User2, User3, and

User4 fields with values specific to the credit bureau being

reported to.

User 2 = Trans union codes

User 3 = Experian codes

User 4 = Equifax codes

Each user field should contain 4 numbers separated by commas

(control number[5]) , (grantor code[10]), (center code[3]), (area

code[3]), (identification number[10]) The number in brackets

represents the maximum number of characters for each code. You do

not need to put spaces before or after the commas.

Examples:

TRANS UNION

Client User 2 = 12345,1234567890,123,123,1235467890

EXPERIAN

Client User 3 = 54321,0987654321,321,321,0987654321

EQUIFAX

Client User 4 = 35125,5328598124,451,271,5328598124

If any numbers at the end are left out, the defaults will be used

from the Credit Bureau Setup dialog. If there is only a Control

Number present then it will be used, and the remaining 3 values

will be default ones. This applies only to values missing at the

end of the list.

Please do not simply supply a Grantor Code, for

instance, and expect it to work. The first number in

the list is always assumed to be the Control Number,

the second is always assumed to be the Grantor

Code, etc.

Please do not simply supply a Grantor Code, for

instance, and expect it to work. The first number in

the list is always assumed to be the Control Number,

the second is always assumed to be the Grantor

Code, etc.

Examples:

INPUT (CONTROL NUMBER)

control number = overrides default

grantor code = default

center code = default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE)

control number = overrides default

grantor code = overrides default

center code = default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE, AREA CODE)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = overrides default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE, AREA CODE, IDENTIFICATION NUMBER)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = overrides default

identification = overrides default

It will only work in the order specified above. You

cannot override the Center Code unless the Grantor

Code and Control Number are also overridden. In other

words, you can only override a code if the codes prior

to it are overridden as well.

It will only work in the order specified above. You

cannot override the Center Code unless the Grantor

Code and Control Number are also overridden. In other

words, you can only override a code if the codes prior

to it are overridden as well.

Report AS Client

WARNING: This option is only for 3rd party agencies that are reporting on behalf of their

client. When the above Report by Client box is selected, this box is visible.

Select a client to report as them. The Client must have the applicable credit

bureau settings in the applicable user 2 to 4 fields as outlined above.

WARNING: This option is only for 3rd party agencies that are reporting on behalf of their

client. When the above Report by Client box is selected, this box is visible.

Select a client to report as them. The Client must have the applicable credit

bureau settings in the applicable user 2 to 4 fields as outlined above.

Report To Trans Union

A check in this field tells the system to use the values

defined for Trans Union in the Credit Bureau Setup, and

to export the Debtors in the metro tape format. The name

of the output file will be {dbname}_TU.001. If a file with

this name exists, it will be overwritten.

Report To Experian

A check in this field tells the system to use the values

defined for Experian in the Credit Bureau Setup and to

export the Debtors in the metro tape format. The name

of the output file will be {dbname}_EXP.001. If a file with

this name exists, it will be overwritten.

Report To Equifax

A check in this field tells the system to use the values

defined for Equifax in the Credit Bureau Setup, and to

export the Debtors in the metro tape format. The name

of the output file will be {dbname}_EFX.001. If a file with

this name exists, it will be overwritten.

Equifax also requires that the Client details (K1 segment)

be sent with each Debtor. This can be set by selecting the

check box labeled Send Client Detail in Reports

in the Client Settings form.

Mark Contacts AS Done

A check in this field tells the system that it is OK to mark

all Metro contacts as done. When you have successfully

completed your credit bureau report, you will be prompted to

mark the contacts as done. This step has to be taken to

insure that proper reporting has taken place.

If the system reports errors, choose View Log

to find the errors. Fix them and run your report

again.

If the system reports errors, choose View Log

to find the errors. Fix them and run your report

again.

The next time a transaction takes place, if the Debtor has a

check in the Report to credit bureau field, a new Metro

contact is automatically scheduled. Access the

Credit Report Details form by selecting the CBR tab

on the Debtor form. The Report to credit bureau switch is

in the Credit Report Details form.

WARNING: Only take this step after you have

completed step 2 and all errors have been

corrected. Press F1 for details.

WARNING: Only take this step after you have

completed step 2 and all errors have been

corrected. Press F1 for details.

Accounts To Report

Select which accounts to include in the report. The default

is All. If All is selected, the standard behavior will occur

where all accounts are run to a single Metro2 file. If

Consumer is selected, then only accounts where the Legal Entity

is 0 (not set) or greater than 99 will be processed and outputted

to a file post-fixed with _CON in the filename. If Commercial

is selected, then only accounts where the Legal Entity is between

1 and 99 will be processed and outputted to a file post-fixed with

_COM in the filename.

Credit Bureau Setup

Selecting this will take you to the Credit Bureau Setup form

where you can enter settings for reporting to credit bureaus.

Sync To New Credit Bureau

Select this to run your first credit report to an additional

bureau. There are a few steps to this procedure so please

refer to help documentation first.

Historical Reporting

There are times when you may want to report to credit

bureaus in a fashion that is not covered by the normal

scheduled events. For instance, you may need to rerun

a report that was already completed.

The historical reporting section is designed to handle these

anomalous reporting procedures. You can specify a date

and run your report on completed or uncompleted contacts.

Done Date

Done Date is used only for historical reporting.

It works with the Completed Only switch to

determine historical reporting behavior.

If you switch ON 'Completed Only', then Collect! will

look for Metro contacts that were marked DONE on

the particular date you select here.

If you leave 'Completed Only' switched OFF, then

Collect! will look for IN PROGRESS Metro contacts

PRIOR to the particular date you select here.

Completed Only

Completed Only is used only for historical

reporting.

Switch this ON to include only completed Metro

contacts in this historical credit bureau report.

Leave this switch OFF to include only In Progress

Metro contacts in this historical credit bureau report.

Help

Press this button for help on the Report To Credit Bureaus

dialog and links to related topics.

View Log

Selecting this will display the results of your credit bureau

reporting session. If the system reported errors, you can

find the details by viewing this Log and fix them.

If you don't usually clear the contents of this log

when asked to "Clear Log" after viewing it,

you may need to scroll to the bottom of the

log to see the most recent session entries.

If you don't usually clear the contents of this log

when asked to "Clear Log" after viewing it,

you may need to scroll to the bottom of the

log to see the most recent session entries.

Close

Select this button to close this form without reporting to

credit bureaus and return to the previous screen.

Next

Selecting this will take you to the next step of the credit

bureau reporting session, depending on the selection you

have made. Either the report will be processed or a summary

report will be printed.

You will notice several check boxes on the left side of the form. We want to know how many In Progress

Metro contacts we have for Collect! to process.

If you would like to print the summary report, you can go to Print -> Reports and Letters

and select the Credit Report List report before proceeding to the next step. The

Credit Report List outputs all of the pending Metro contacts. It does NOT output the accounts

to be reactivated. You can run the CBR process to reactivate the accounts first, cancel the

process, then run the Credit Report List report.

If you would like to print the summary report, you can go to Print -> Reports and Letters

and select the Credit Report List report before proceeding to the next step. The

Credit Report List outputs all of the pending Metro contacts. It does NOT output the accounts

to be reactivated. You can run the CBR process to reactivate the accounts first, cancel the

process, then run the Credit Report List report.

The Sync Credit Report List report will output the accounts that are set to synchronized to

the new bureau.

The Sync Credit Report List report will output the accounts that are set to synchronized to

the new bureau.

If report by client is switched ON, a client list will appear. Select the client to report for.

Tagging multiple clients will not work. Please select only one Client.

Tagging multiple clients will not work. Please select only one Client.

Before doing this you must set up the Client User2, User3, and User4 fields with values specific to

the credit bureau being reported to.

User 2 = Trans Union codes

User 3 = Experian codes

User 4 = Equifax codes

Each user field should contain 4 numbers separated by commas (control number[5]) , (grantor code[10]),

(center code[3]), (area code[3]), (identification number[10]) The number in brackets represents the

maximum number of characters for each code. You do not need to put spaces before or after the commas.

Examples:

Trans Union

Client User 2 = 12345,1234567890,123,123,1234567890

Experian

Client User 3 = 54321,0987654321,321,321,0987654321

Equifax

Client User 4 = 35125,5328598124,451,271,5328598124

If any numbers at the end are left out, the defaults will be used from the Credit Bureau Setup dialog.

If there is only a Control Number present then it will be used, and the remaining 3 values will be

default ones. This applies only to values missing at the end of the list.

Please do not simply supply a Grantor Code, for instance, and expect it to work. The first

number in the list is always assumed to be the Control Number, the second is always assumed

to be the Grantor Code, etc.

Please do not simply supply a Grantor Code, for instance, and expect it to work. The first

number in the list is always assumed to be the Control Number, the second is always assumed

to be the Grantor Code, etc.

Examples:

INPUT (CONTROL NUMBER)

control number = overrides default

grantor code = default

center code = default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE)

control number = overrides default

grantor code = overrides default

center code = default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE, AREA CODE)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = overrides default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE, AREA CODE, IDENTIFICATION NUMBER)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = overrides default

identification = overrides default

It will only work in the order specified above. You cannot override the Center Code unless

the Grantor Code and Control Number are also overridden. In other words, you can only

override a code if the codes prior to it are overridden as well.

It will only work in the order specified above. You cannot override the Center Code unless

the Grantor Code and Control Number are also overridden. In other words, you can only

override a code if the codes prior to it are overridden as well.

Choosing The Credit Bureau To Report To

You should be looking at the Report To Credit Bureaus form. Notice that are three names of Credit

Bureaus on the left side of the form.

- Please place a check mark in the box next to the Credit Bureau you are reporting to. Put a

check mark for at least one credit bureau.

You can report to one Bureau only or all of them. If you select more than one Bureau, Collect!

will produce three separate files, one for each bureau, one after the other. The prescan

routine used by Collect! will be done only once even if you are reporting to more than one

bureau.

You can report to one Bureau only or all of them. If you select more than one Bureau, Collect!

will produce three separate files, one for each bureau, one after the other. The prescan

routine used by Collect! will be done only once even if you are reporting to more than one

bureau.

- Place a check mark in the box labeled 'Mark contacts as done'.

Report To Credit Bureaus Settings

- Select whether you are reporting All accounts, Consumer accounts, or Commercial accounts.

- When you are ready, select the NEXT button to proceed.

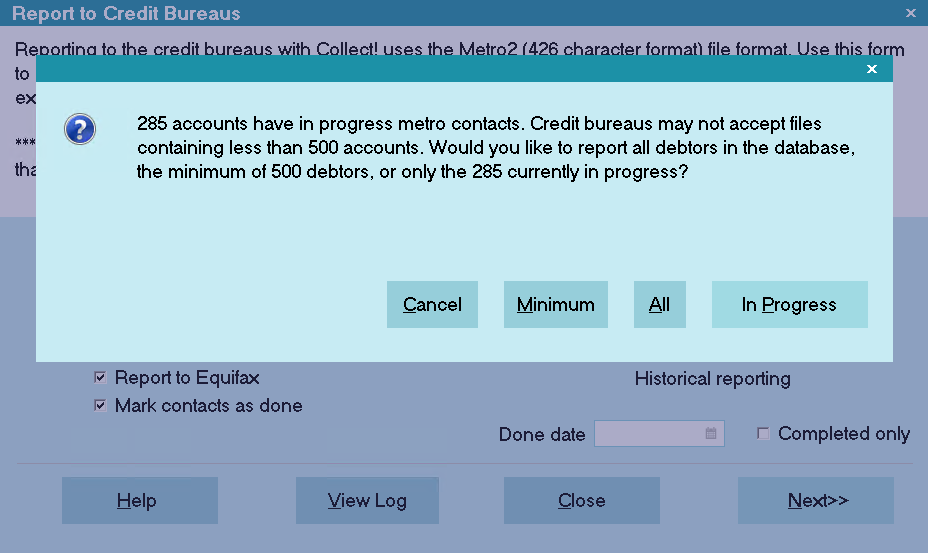

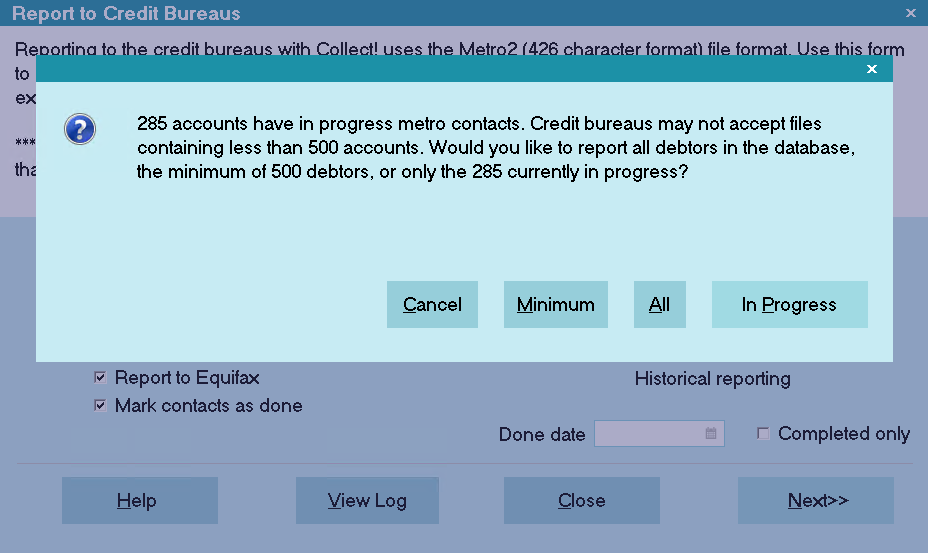

Collect! will quickly count your active Metro contacts and present you with the results.

If you have fewer than 500 accounts actively being reported to bureaus, and you do not have

REPORT ALL ACCOUNTS selected on the Credit Bureau Setup form, you will be prompted for further action.

Report Minimum 500 Required Accounts

Please refer to the section below entitled "Reactivate Metros" for information about the

choices that are presented to you.

Please refer to the section below entitled "Reactivate Metros" for information about the

choices that are presented to you.

Select ALL or IN PROGRESS when the prompt is displayed.

If you are reporting all accounts, Collect! will reactivate accounts create a METRO contact on the

accounts that don't have one.

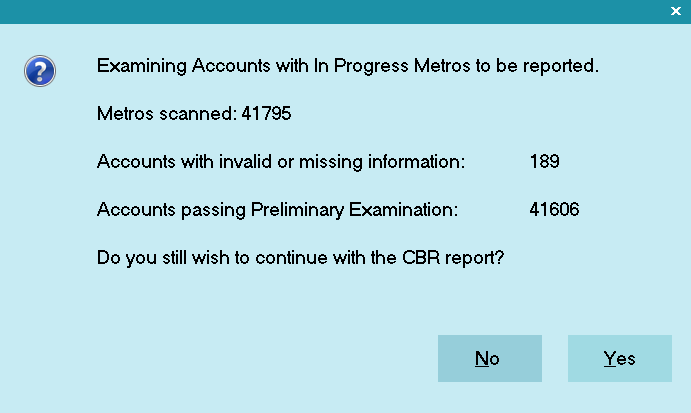

At this stage, Collect! will analyze your accounts to determine if any accounts cannot be reported.

These include accounts with missing SSN or DOB values. You can select whether or not to continue.

Examining Accounts for Invalid Metros

- Collect! will display the bureau file it is creating, the name and location where the file may

be found. If you are reporting to more than one bureau, this prompt will display for each

bureau as shown below.

The screen shot below shows that Collect! will create a credit report file for the credit bureaus

to the C:\Collect\Log Files\cbr folder with the following filenames, depending on whether you

selected All, Consumer, or Commercial on the Report to Credit Bureaus screen:

| Bureau |

All Accounts |

Consumer Accounts |

Commercial Accounts |

| Trans Union |

{dbname}_TU.001 |

{dbname}_TU_CON.001 |

{dbname}_TU_COM.001 |

| Experian |

{dbname}_EXP.001 |

{dbname}_EXP_CON.001 |

{dbname}_EXP_COM.001 |

| Equifax |

{dbname}_EFX.001 |

{dbname}_EFX_CON.001 |

{dbname}_EFX_COM.001 |

Export Data for Credit Bureaus

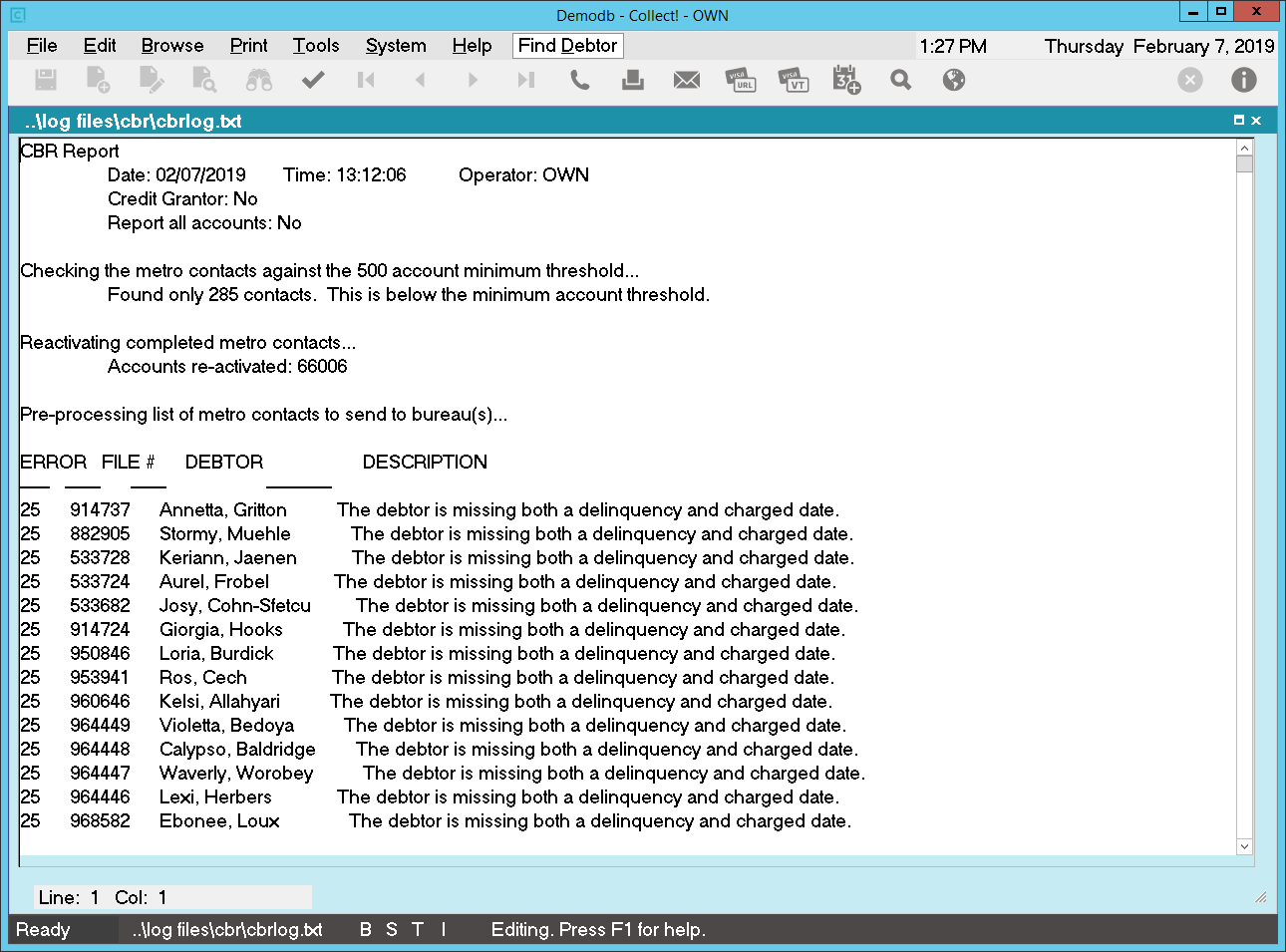

- After this Collect! displays the CBR Log for you. If there are any errors, they will be reported

in this log. You can examine it for details and file numbers if you have errors to correct.

One common error is no Delinquency Date.

The viewed log message below shows examples of errors that you may see. Please go back to these

debtors and add the necessary information and run your report again. You may even have to run a report

a few times to correct all errors.

Errors Reported In CBR Log

If you don't usually clear the contents of this log when asked to "Clear Log" after viewing

it, you may need to scroll to the bottom of the log to see the most recent session entries.

If you don't usually clear the contents of this log when asked to "Clear Log" after viewing

it, you may need to scroll to the bottom of the log to see the most recent session entries.

After viewing the log of your results, if there are no reported errors, you can now close the log.

You will be prompted to clear the log. Choose YES or NO.

After you have corrected any errors, run your report again. When you have no errors, you can say

YES when asked if you are done with the credit reports on the next screen.

- This is a very important step. When you are finished reporting each month, you MUST

mark the Metro contacts as done BUT only if you are really finished with the

report!

When you run your report and it shows no errors, you are ready to send your file or files to the

bureaus.

It is very important that contacts are marked done as the last step. It is also important that they

are not marked done if you still have errors to correct and you want to include all the accounts in

the final file that you create.

Select YES to Mark Contacts Done

If you have errors to correct, select NO. Correct your errors and run your report again.

If you are running a TEST file, select NO. Submit the test file to your bureaus. You will mark the

the Contacts as complete when the live report is done.

Select YES only if you have no errors to correct and you want to mark the Metro contacts as

done and send the file or files that Collect! just finished creating. If there are reported

errors, the Metro contacts for these debtors will not be marked done.

When you select YES, Collect! marks all the Metro contacts as Done EXCEPT any outstanding

errors. Metro contacts on accounts that could not be reported due to errors are left

In Progress.

When you select YES, Collect! marks all the Metro contacts as Done EXCEPT any outstanding

errors. Metro contacts on accounts that could not be reported due to errors are left

In Progress.

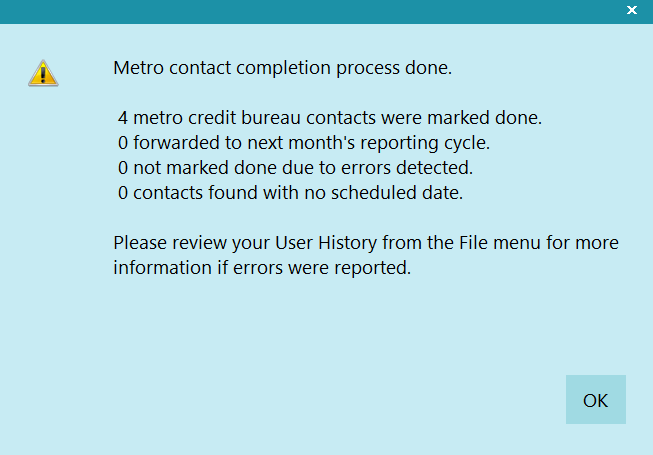

When you create a Metro2 credit report file, Collect! scans through all Metro contacts scheduled for

today and the past. For each contact, Collect! sends the Debtor information to the Metro file, and

marks the contact as done, setting its Done Date to today so you know when they were reported.

Collect! will automatically take care of creating next month's Metro contacts for your accounts, if

appropriate. A final summary window will display the number of Metro contacts marked done and the

number forwarded.

When a change occurs that needs to be reported to the bureaus (such as a change in the Debtor's owing,

or you closing the account), Collect! schedules a new contact which contains the updated information.

The next time you run a credit report, the new contact is detected and the update is sent. That

contact is again marked as done, with its Done Date set appropriately, provided you have completed

the report with no errors.

Summary of Metro Contacts Processed

- Select OK to close the window.

- Once the files have been generated, you can now upload them to the respective Bureaus. The

files are located in the Collect\Log Files\cbr folder.

WARNING: Do not attempt to change the text in the Description field of the Metro Contact, or

INACCURATE REPORTING MAY OCCUR. This field is for display only. Collect uses it internally

for storing encoded credit reporting information.

WARNING: Do not attempt to change the text in the Description field of the Metro Contact, or

INACCURATE REPORTING MAY OCCUR. This field is for display only. Collect uses it internally

for storing encoded credit reporting information.

Reactivating Metros

Some credit bureaus will no longer process a file with fewer than 500 accounts. Collect!'s Credit

Bureau Reporting function handles this by giving you options to reactivate Metro contacts. You may

use these options to report as many of your CBR accounts as necessary to fulfill the bureau requirements.

If you have Report All Accounts checked on the Credit Bureau Setup screen, then you will not see

the following prompts. Collect! will reactivate all accounts automatically.

Without the Report All Accounts checked, you will see the following prompts.

If you have fewer than 500 accounts to report, you are presented with the option of reporting all

CBR accounts in the database, or reactivating as many accounts as needed to report 500 accounts.

Report Minimum 500 Required Accounts

Select Report In Progress to report only the accounts that have active Metro contacts.

Please be aware that the credit bureau may reject your file if they require a 500 account minimum report.

Select Report Minimum to reactivate the necessary number of Metro contacts to report

500 accounts. This process may take a while as Collect! browses your list of debtors to find accounts

with CBR switched ON.

Select Report All to reactivate all your Metro contacts and report all accounts with

CBR switched ON. This process may take a while as Collect! browses your list of debtors to find

accounts with CBR switched ON.

After Collect! determines which debtors have CBR switched ON, the required number will be reactivated.

After the Reactivate Metros function has completed, the credit report file is created.

Historical Reporting

There are times when you may want to report to credit bureaus in a fashion that is not covered by

the normal scheduled events. For instance, you may need to rerun a report that was already completed.

The historical reporting section of the Report To Credit Bureaus is designed to handle these

anomalous reporting procedures. You can specify a date and/or choose to run your report on completed

contacts.

DONE DATE

Choose a date to run a report on Metro contacts that were marked done on this particular date.

COMPLETED ONLY

Switch this ON to include only completed Metro contacts in this credit bureau report.

Historical reports are run following the same procedures outlined above, for regular credit reporting.

Financial Totals

Collect! manages all normal changes that you make to an account as it is paid and the Debtor's Owing

proceeds to zero. All credit reporting details are handled automatically.

If you make changes to an account that are different from the norm, for instance a Judgment or

Adjustment or Write Off or Settlement, then you will have to manually adjust your credit report

settings at the Debtor level.

Closing Accounts

Collect! manages credit bureau accounts if Paid In Full and will send the appropriate code to the

credit bureau and not report anymore. You can also set up Collect! to handle the non-CBR related

changes that you may want to make to such an account (such as Debtor Status and Mode.)

If you close an account for other reasons, you will have to manually adjust your credit report settings

at the Debtor level.

Canceling Credit Reporting On A Single Account

If you uncheck the Report to Credit Bureau box on the Credit Report Details screen before a report

has been sent to the bureaus, Collect! simply deletes the scheduled Metro contact. No report on the

Debtor will ever be sent.

If a debtor does not have a METRO contact that is marked DONE at the time you set the

Status Code in Credit Report Details to Delete Account from Credit Bureau, then Collect! will

assume the account has never been reported. Therefore Collect! simply deletes the Metro

contact and switches OFF CBR.

If a debtor does not have a METRO contact that is marked DONE at the time you set the

Status Code in Credit Report Details to Delete Account from Credit Bureau, then Collect! will

assume the account has never been reported. Therefore Collect! simply deletes the Metro

contact and switches OFF CBR.

If you choose to cancel reporting after having sent a report to the bureaus, select Delete from Bureau

on the Status field on the Credit Report Details screen, and Collect! will schedule a Metro contact

to tell the credit bureaus the account has been closed.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org