How To Understand Credit Bureau Reporting

Credit Bureau Reporting (CBR) allows you to send account information to credit bureaus in a standard

format.

WARNING: Credit reporting affects people's credit history and is not to be taken lightly. YOU

ARE RESPONSIBLE FOR THE DATA YOU SEND. These instructions help you control the

information you publish about a person's credit history. Instructions in no way replace

thinking! Never send data if errors or warnings are displayed when publishing your credit

report. Always verify the data that you think the bureau received by pulling credit reports

on accounts you have reported. Do not assume!

WARNING: Credit reporting affects people's credit history and is not to be taken lightly. YOU

ARE RESPONSIBLE FOR THE DATA YOU SEND. These instructions help you control the

information you publish about a person's credit history. Instructions in no way replace

thinking! Never send data if errors or warnings are displayed when publishing your credit

report. Always verify the data that you think the bureau received by pulling credit reports

on accounts you have reported. Do not assume!

Introduction

Collect! supports both credit grantors and third party collection agency credit reporting.

To understand Credit reporting, we can break it down into its constituent parts and look at the basic

conditions that apply. This can help us understand and control our operations more effectively.

Accounts have a life. They start by being opened, they live a while, and then eventually they are

closed. Hopefully, they are paid in full by then. Accounts live two simultaneous lives. They exist

in the Collect! database and they can also exist in the credit bureau databases. You control the

Credit Bureau Reporting (CBR) life of an account with the credit reporting controls in Collect!

When you close an account in Collect! this does not remove any data from the credit bureau

databases. You must specifically send a Close CBR status to the credit bureaus when you want

to report an account paid in full or closed for any other reason.

When you close an account in Collect! this does not remove any data from the credit bureau

databases. You must specifically send a Close CBR status to the credit bureaus when you want

to report an account paid in full or closed for any other reason.

Basic Credit Reporting Operation

The three states in the CBR life of an account are:

- Creation

- Existence

- Closure

Credit reporting information is sent to the credit bureaus periodically, typically at least once per

month. You manually tell Collect! to generate the files for each bureau. When you create the CBR

files, Collect! will check each account to help catch obvious errors in your data and will report

any errors to you.

You create a CBR account when you first turn on CBR reporting on the account. The account must first

exist in the Collect! database. Collect! uses the default CBR settings from the Credit Bureau Preferences

screen to fill in the new account CBR settings. You can change the settings on an account by account

basis to accurately reflect the information reported to the credit bureaus.

When you turn on CBR reporting on an account, Collect! transmits the CBR information with the next

batch of data you send to the bureaus.

During its CBR life, you can control the status of the account to reflect the payment history.

Depending on how Collect! and the account are configured, Collect! may also automatically set

certain values for credit reporting. Collect! calls a special Check Metro Report function whenever

the account balance is changed. This is described more fully below.

One very important piece of information is the 'Delinquency Date' on the debtor dialog. This

affects a person's credit rating so use it carefully.

One very important piece of information is the 'Delinquency Date' on the debtor dialog. This

affects a person's credit rating so use it carefully.

Once you send a 'Close' status to the bureaus, no further reports are transmitted by Collect!. Your

credit ratings set the final payment rating of the account when you close the account.

Several CBR status codes reflect closed accounts. Collect! ignores accounts with closed CBR

status codes and does not transmit any further CBR data after an account has a CBR closed

status. CBR status codes 13 and 61 - 65 are considered closed CBR accounts. Once a credit

report is sent on one of these account status codes, Collect! will not send any more reports

to the bureau on that account.

Several CBR status codes reflect closed accounts. Collect! ignores accounts with closed CBR

status codes and does not transmit any further CBR data after an account has a CBR closed

status. CBR status codes 13 and 61 - 65 are considered closed CBR accounts. Once a credit

report is sent on one of these account status codes, Collect! will not send any more reports

to the bureau on that account.

If the status code is not one of the closed types, then Collect! can automatically report your

account information to the bureaus monthly or as needed.

Agents And Third Party Collectors

If you are a third party collector (you don't own the accounts yourself) you need to ensure the

Credit Grantor switch is turned OFF in the Credit Bureau Preferences form.

Creating Collection Accounts

Upon creating the account, its CBR status should be initially set to status '93 - collection account'.

The next CBR report you produce will contain any new accounts you created during the reporting period.

Working Collection Accounts

During the CBR life of the account, when something is changed on the account, Collect! recalculates

the account total Owing and then calls the Check Metro Report function. The CBR status is set to

93 if the amount owing is $1.00 or more. If the owing is less than $1.00, the CBR status is set to

'62 - paid in full collection account'.

The next CBR report you produce will contain any changes to your accounts.

CBR status codes other than 93 and 62 are not supported in Agent and Third Party operation.

Closing Collection Accounts

You can manually set the CBR status to close an account, or Collect! will automatically set the CBR

status to '62 - paid in full collection account' when the account balance falls below $1.00. The

next CBR report you send will contain the Closed status for the account and Collect! will not send

any further credit reports on that account.

Credit Grantors

When you own the accounts yourself, you can track the whole life of the account. Your Company Details

are reported in the K1 segment.

The Credit Grantor switch should be turned on in the Credit Bureau Preferences form.

A perfect account would start as status '11 - current account' and close with status code

'13 - paid in full' with nary a change in between. Sadly accounts don't always follow such an

excellent payment history. Various CBR status codes are used to report the delinquency of an account.

Depending on the interest settings of an account, Collect! can help manage account CBR status

reporting. Interest calculation modes are described below. Collect! manages account status for

accounts with compound interest. Collect! sets the delinquency date on compound interest accounts

whenever an account is 31 days or more overdue. Accounts that are not using compound interest can

use other mechanisms to set delinquency dates.

Creating Credit Accounts

Upon creating the account, its CBR status should be initially set to status '11 - current account'.

The next CBR report you produce will contain any new accounts you created during the reporting period.

Working Credit Accounts

During the CBR life of the account, when something is changed on the account, Collect! recalculates

the account total Owing and then calls the Check Metro Report function.

The Check Metro Report function only changes CBR settings if the existing account status is one of

11, 71, 78, 80 and 82 - 84. Any status outside that range is considered manually set, and Collect!

does not affect manually set CBR status codes.

Collect! sets the CBR status codes on managed accounts based on the delinquency date of the account.

The status is set to Current account, 30, 60, 90,120, 150 and 180 Days delinquent.

Current Accounts

When a debtor makes payments on time, the Delinquency date should be clear, and all CBR status

reports should reflect status '11 - Current account'.

Delinquent Accounts

The delinquency date in Collect! is used to determine account delinquency status.

For compound interest accounts with a fixed monthly payment amount, Collect! calculates the

delinquency date. On other types of interest accounts, you can manually set the delinquency date,

or you can use promise contacts or pending transactions to automatically calculate the

delinquency date.

When you post a payment, Collect! checks the delinquency date and sets the account CBR status

accordingly.

Closing Credit Accounts

When an account is paid in full (CBR status 13) the last CBR status before the close status was set

is used to determine the Payment Rating of the account. If they had been late in paying and then,

suddenly, paid the account off, then the payment rating will reflect the delinquency status before

the final payment in full.

When an account that is CBR status '11 - current account' is closed or paid in full, it should have

a payment rating of ' 0 ' to indicate the account was current when it was closed.

Only accounts with Amortized compound interest are automatically closed by Collect!

When you close an account with no interest or other manual types of interest, you will want to set

the Payment Rating in the Credit Bureau form to accurately reflect the delinquency at the time you

manually close the account.

No Interest

A No Interest account is considered by Collect! to be a revolving account, and the default CBR

status code is '11 - Current account' unless a delinquency date is set. A zero balance results in

a CBR status code 11.

A No Interest account is only considered closed to CBR if you manually set the account status to 13

or 61 - 65.

If the last CBR status was a 13 or 61 - 65 (any closed status) it ignores the account for CBR

purposes as the account has been reported as closed to the bureaus.

When an account has one of the automated status codes, Collect! checks the account status and

updates the CBR status code to reflect current account conditions as follows:

If the account does not have the delinquency date set, then the CBR status is set to

'11 - Current Account'.

If the account has a delinquency date, then the CBR status code is set to 11, 71, 78, 80, 82, 83

or 84 depending on the number of days between the delinquency date and the date the file is being

reviewed.

To automatically set delinquency date, create a promise type contact. The due date of the promise

contact is the promise date on the debtor form. If the promise date is 31 days or more overdue,

the delinquency date is calculated as promise date plus 31 days.

Simple Interest

A Simple Interest account is considered by Collect! to be a revolving account, and the default

CBR status code is '11 - Current account' unless a delinquency date is set. A zero balance results

in a CBR status code 11.

A Simple Interest account is only considered closed to CBR if you manually set the account status

to 13 or 61 - 65.

If the last CBR status was a 13 or 61 - 65 (any closed status) it ignores the account for CBR

purposes as the account has been reported as closed to the bureaus.

When an account has one of the automated status codes, Collect! checks the account status and

updates the CBR status code to reflect current account conditions as follows:

If the account does not have the delinquency date set, then the CBR status is set to

'11 - Current Account'.

If the account has a delinquency date then the CBR status code is set to 11, 71, 78, 80, 82, 83

or 84, depending on the number of days between the delinquency date and the date the file is being

reviewed.

To automatically set delinquency date, create a promise type contact. The due date of the promise

contact is the promise date on the debtor form. If the promise date is 31 days or more overdue,

the delinquency date is calculated as promise date plus 31 days.

Revolving Compound Interest

A Revolving Compound Interest account is considered by Collect! to be a revolving account, and the

default CBR status code is '11 - Current account' unless a delinquency date is set. A zero balance

results in a CBR status code 11.

A Revolving Compound Interest account is only considered closed to CBR if you manually set the

account status to 13 or 61 - 65.

If the last CBR status was a 13 or 61 - 65 (any closed status) it ignores the account for CBR

purposes as the account has been reported as closed to the bureaus.

When an account has one of the automated status codes, Collect! checks the account status and

updates the CBR status code to reflect current account conditions as follows:

If the account does not have the delinquency date set then the CBR status is set to

'11 - Current Account'.

If the account has a delinquency date then the CBR status code is set to 11, 71, 78, 80, 82, 83

or 84, depending on the number of days between the delinquency date and the date the file is being

reviewed.

To automatically set delinquency date, create a promise type contact. The due date of the promise

contact is the promise date on the debtor form. If the promise date is 31 days or more overdue,

the delinquency date is calculated as promise date plus 31 days.

Normal Amortized Loan

This is considered an open account by Collect!

The default CBR status code is '11 - Current account' unless a delinquency date is set. A zero

balance results in a CBR status code 13.

If the last CBR status was a 13 or 61 - 65 (any closed status) Collect! ignores the account for

CBR purposes as the account has been reported as closed to the bureaus.

When an account has one of the automated status codes, Collect! checks the account status and

updates the CBR status code to reflect current account conditions as follows:

If the account does not have the delinquency date set then the CBR status is set to

'11 - Current Account'.

If the account has a delinquency date then the CBR status code is set to 11, 71, 78, 80, 82, 83

or 84, depending on the number of days between the delinquency date and the date the file is being

reviewed.

Delinquency date is set by the interest calculation routines.

Rule of 78 Amortized Loan

This is considered an open account by Collect!

The default CBR status code is '11 - Current account' unless a delinquency date is set. A zero

balance results in a CBR status code 13.

If the last CBR status was a 13 or 61 - 65 (any closed status) Collect! ignores the account for

CBR purposes as the account has been reported as closed to the bureaus.

When an account has one of the automated status codes, Collect! checks the account status and

updates the CBR status code to reflect current account conditions as follows:

If the account does not have the delinquency date set then the CBR status is set to

'11 - Current Account'.

If the account has a delinquency date then the CBR status code is set to 11, 71, 78, 80, 82, 83

or 84, depending on the number of days between the delinquency date and the date the file is being

reviewed.

Delinquency date is set by the interest calculation routines.

All Status Codes

The following is a list of all CBR status codes.

05 - Account transferred to another office (Deprecated April 2022)

11 - Current account

13 - Paid in full

61 - Paid in full; voluntary surrender

62 - Paid in full; collection account or claim

63 - Paid in full; was a repossession

64 - Paid in full; was a charge off

65 - Paid in full; a foreclosure was started

71 - 30 days

78 - 60 days

80 - 90 days

82 - 120 days

83 - 150 days

84 - 180 days

88 - Filed with govt. for insured portion on balance on defaulted loan

89 - Deed received in lieu of foreclosure on a defaulted mortgage

93 - Seriously past due, and/or assigned to collections

94 - Foreclosure/credit grantor sold collateral to settle mortgage

95 - Voluntary surrender

96 - Merchandise taken back by grantor; may be a balance due

97 - Unpaid balance reported as a loss by credit grantor

DA - Delete entire account from credit bureau

DF - Delete entire account due to confirmed fraud (fraud investigation completed)

Managed Status Codes - Third Party Collections

The following status codes are supported by Collect! in Agency/Third Party Collections mode.

62 - Paid in full collection account or claim

93 - Seriously past due/assigned to collections

DA - Delete entire account from credit bureau

DF - Delete entire account due to confirmed fraud (fraud investigation completed)

Managed Status Codes - Credit Grantor

The following CBR status codes are managed by Collect! in Credit Grantor mode.

11 - Current account

13 - Paid in full

71 - 30 days

78 - 60 days

80 - 90 days

82 - 120 days

83 - 150 days

84 - 180 days

Closed Status Codes

Collect! ignores accounts with the following CBR status codes and considers the accounts closed for

CBR reporting.

05 - Account transferred to another office (Deprecated April 2022)

13 - Paid in full

61 - Paid in full; voluntary surrender

62 - Paid in full; collection account or claim

63 - Paid in full; was a repossession

64 - Paid in full; was a charge off

65 - Paid in full; a foreclosure was started

DA - Delete entire account from credit bureau

DF - Delete entire account due to confirmed fraud (fraud investigation completed)

Manual Status Codes - Credit Grantor

Collect! does not automatically change any credit reporting information on accounts with the

following CBR status codes. If you set an account to any one of these CBR status codes, you must

manually make changes to the account CBR status as needed. Collect! will not make any changes

even when an account is paid in full!

88 - Filed with govt. for insured portion on balance on defaulted loan

89 - Deed received in lieu of foreclosure on a defaulted mortgage

93 - Seriously past due, and/or assigned to collections

94 - Foreclosure/credit grantor sold collateral to settle mortgage

95 - Voluntary surrender

96 - Merchandise taken back by grantor; may be a balance due

97 - Unpaid balance reported as a loss by credit grantor

DA - Delete entire account from credit bureau

DF - Delete entire account due to confirmed fraud (fraud investigation completed)

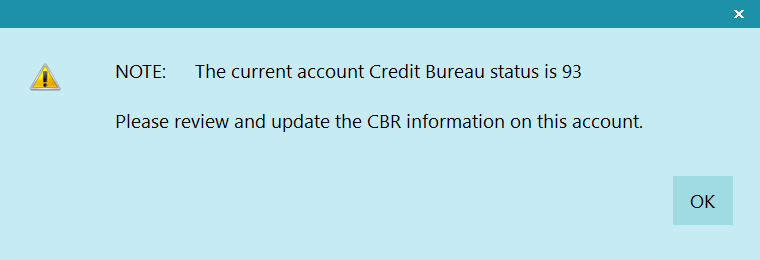

Paid Account in Full when Status was 93

Status Codes And Payment Ratings

| Status |

Payment Rating |

| 11 |

0 |

| 71 |

1 |

| 78 |

2 |

| 80 |

3 |

| 82 |

4 |

| 83 |

5 |

| 84 |

6 |

| DEFAULT - Any payment rating manually set on the account. |

Summary

This topic is meant to provide a high level overview of Credit Bureau Reporting.

Please refer to the Help Topic How To Setup Credit Bureau Reporting for more information.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org