How To Read The Metro2 Format

Metro2 Format is the current standard format for reporting credit. It meets all the requirements of

the Fair Credit Reporting Act (FCRA), the Fair Credit Billing Act (FCBA), and the

Equal Credit Opportunity Act (ECOA). It allows most accurate and complete information on consumers'

credit history.

Collect! provides the internal functions to report credit correctly using Metro2 in the 426 character

format. However, there are a few rules to be handled by you as you report your debtors to the bureaus.

- Report all accounts on a monthly basis.

- Report all accounts with a final status code when they are ultimately paid or closed.

- Credit grantors must report accounts at the close of each cycle.

When you run credit bureau reporting in Collect! a file is produced for you to send to the credit

bureau. This file has one long line of data for each account that is reported. It is actually made

up of several segments. Each one is described below. Select the link to open the detailed page for

each segment.

Metro2 Format - Header Record

The Header Record is the first segment of a credit reporting file. It contains information necessary

to identify the reporting entity or agency. It also identifies the credit bureau the file has been

produced for and the reporting date.

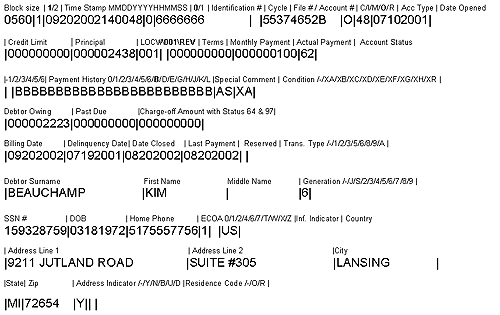

In the image below, the fields in the Header Record are partitioned and identified. Actually, this

is one long string of data in the reporting file.

In the tables below:

- Field is the Metro2 Format Field number

- Field Name is taken from the Metro2 Format. Refer to the Field Number and Field Name when you

are trying to determine CBR requirements for particular areas.

- Length and Position can be used as reference points when you are examining actual data in the

report as Collect! generates it.

- Source is the field in Collect! where the information is pulled from, or some sort of internal value, as indicated.

| Field |

Field Name |

Length |

Position |

Source |

| 1 |

Record Descriptor |

4 |

1-4 |

Line Length |

| 2 |

Record Identifier |

6 |

5-10 |

Header |

| 3 |

Cycle Number |

2 |

11-12 |

Cycle Reporting -- BLANK |

| 4 |

CCA Identifier |

10 |

13-22 |

BLANK |

| 5 |

Equifax Identifier |

10 |

23-32 |

Credit Bureau Setup: Equifax Credit Grantor # |

| 6 |

Experian Identifier |

5 |

33-37 |

Credit Bureau Setup: Experian Control # |

| 7 |

Trans Union Identifier |

10 |

38-47 |

Credit Bureau Setup: TU Credit Grantor # |

| 8 |

Activity Date |

8 |

48-55 |

Last update to account balances |

| 9 |

Date Created |

8 |

56-63 |

Credit Report Date |

| 10 |

Program Date |

8 |

64-71 |

Internal Program Date |

| 11 |

Program Revision Date |

8 |

73-79 |

Internal Program Date |

| 12 |

Reporter Name |

40 |

80-119 |

Company Details: Name |

| 13 |

Reported Address |

96 |

120-215 |

Company Details: Address Lines 1-3 |

| 14 |

Reporter Phone |

10 |

216-225 |

Company Details: Phone |

| 15 |

Reserved |

201 |

226-426 |

Program Creator and Version -- Help About |

Collect! uses the 426 character format when creating the credit reporting file in

Metro2 Format.

Collect! uses the 426 character format when creating the credit reporting file in

Metro2 Format.

For more information, please refer to your credit reporting manual or consult with your credit

bureau representative.

Metro2 Format - Base Segment

The Base Segment is the second segment of a credit reporting file. It contains the primary consumer's

identification information and the account transactional information.

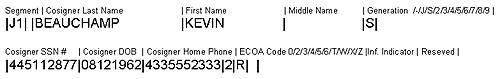

In the image below, the fields in the Base Segment are partitioned and identified. Actually, this

is one long string of data in the reporting file.

In the tables below:

- Field is the Metro2 Format Field number

- Field Name is taken from the Metro2 Format. Refer to the Field Number and Field Name when you

are trying to determine CBR requirements for particular areas.

- Length and Position can be used as reference points when you are examining actual data in the

report as Collect! generates it.

- Source is the field in Collect! where the information is pulled from, or some sort of internal

value, as indicated.

| Field |

Field Name |

Length |

Position |

Source |

| 1 |

Record Descriptor |

4 |

1-4 |

Record length |

| 2 |

Processing Indicator |

1 |

5 |

Processing instruction |

| 3 |

Time Stamp |

14 |

6-19 |

Contact created Date and Time |

| 4 |

Correction Indicator |

1 |

20 |

Internal |

| 5 |

Identification Number |

20 |

21-40 |

Credit Bureau Setup: Identification # |

| 6 |

Cycle Identifier |

2 |

41-42 |

Cycle Reporting -- BLANK |

| 7 |

Consumer Account Number |

30 |

43-72 |

Debtor: File # or Client Account # |

| 8 |

Portfolio Type |

1 |

73 |

Credit Report Details: Portfolio |

| 9 |

Account Type |

2 |

74-75 |

Credit Report Details: Account Type |

| 10 |

Date Opened |

8 |

76-83 |

Debtor: Listed Date |

| 11 |

Credit Limit |

9 |

84-92 |

ZERO FILL |

| 12 |

Highest Credit or Original Loan Amount |

9 |

93-101 |

Debtor: Assignment Amount (If Assignment Amount is 0.00, then Principal is used) |

| 13 |

Terms Duration |

3 |

102-104 |

1 |

| 14 |

Terms Frequency |

1 |

105 |

BLANK |

| 15 |

Scheduled Monthly Payment Amount |

9 |

106-114 |

ZERO FILL |

| 16 |

Actual Payment Amount |

9 |

115-123 |

Sum of Payment Transactions Amount since Last Month, Same Day |

| 17A |

Account Status |

2 |

124-125 |

Credit Report Details: Status Code |

| 17B |

Payment Rating |

1 |

126 |

BLANK |

| 18 |

Payment History Profile |

24 |

127-150 |

B - No Payment History |

| 19 |

Special Comment |

2 |

151-152 |

Credit Report Details: Special Comments |

| 20 |

Compliance Condition Code |

2 |

153-154 |

Credit Report Details: Condition Code |

| 21 |

Current Balance |

9 |

155-163 |

Debtor: Owing |

| 22 |

Amount Past Due |

9 |

164-172 |

ZERO FILL |

| 23 |

Original Charge-off Amount |

9 |

173-181 |

ZERO FILL |

| 24 |

Billing Date |

8 |

182-189 |

Credit Report Date |

| 25 |

FCRA Compliance/Date of First Delinquency |

8 |

190-197 |

Debtor: Delnqnt or zero filled if Current |

| 26 |

Date Closed |

8 |

198-205 |

Metro Contact: Date or zero filled if not Closed |

| 27 |

Date of Last Payment |

8 |

206-213 |

Debtor: Payment |

| 28 |

Reserved |

17 |

214-230 |

BLANK |

| 29 |

Consumer Transaction Type |

1 |

231 |

Internal |

| 30 |

Surname |

25 |

232-256 |

Debtor: Name |

| 31 |

First Name |

20 |

257-276 |

Debtor: Name |

| 32 |

Middle Name |

20 |

277-296 |

BLANK |

| 33 |

Generation Code |

1 |

297 |

Debtor: Generation |

| 34 |

Social Security Number |

9 |

298-306 |

Debtor: SSN |

| 35 |

Date of Birth |

8 |

307-314 |

Debtor: DOB |

| 36 |

Telephone Number |

10 |

315-324 |

Debtor: Home |

| 37 |

ECOA Code |

1 |

325 |

Credit Report Details: Association Code (ECOA) |

| 38 |

Consumer Information Indicator |

2 |

326-327 |

Credit Report Details: Indicator |

| 39 |

Country Code |

2 |

328-329 |

Debtor: Country |

| 40 |

First Line of Address |

32 |

330-361 |

Debtor: Address |

| 41 |

Second Line of Address |

32 |

362-393 |

Debtor: Address Line 2 |

| 42 |

City |

20 |

394-413 |

Debtor: City |

| 43 |

State |

2 |

414-415 |

Debtor: State |

| 44 |

Postal/Zip Code |

9 |

416-424 |

Debtor: Zip |

| 45 |

Address Indicator |

1 |

425 |

Debtor: Address OK |

| 46 |

Residence Code |

1 |

426 |

BLANK |

Metro2 Format - J1 Segment

The J1 Segment accommodates the requirements of ECOA when reporting credit. It is included in the

reporting file if the cosigner is being reported. The J1 Segment applies when the associated

consumer resides at the same address as the individual being reported. It is included every time

the account is reported.

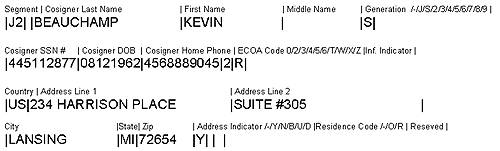

In the image below, the fields in the J1 Segment are partitioned and identified. Actually, this is

one long string of data in the reporting file.

In the tables below:

- Field is the Metro2 Format Field number

- Field Name is taken from the Metro2 Format. Refer to the Field Number and Field Name when you

are trying to determine CBR requirements for particular areas.

- Length and Position can be used as reference points when you are examining actual data in the

report as Collect! generates it.

- Source is the field in Collect! where the information is pulled from, or some sort of internal

value, as indicated.

| Field |

Field Name |

Length |

Position |

Source |

| 1 |

Segment Identifier |

2 |

1-2 |

J1 |

| 2 |

Consumer Transaction Type |

1 |

3 |

Internal |

| 3 |

Surname |

25 |

4-28 |

Debtor Cosigner: Name |

| 4 |

First Name |

20 |

29-48 |

Debtor Cosigner: Name |

| 5 |

Middle Name |

20 |

49-68 |

BLANK |

| 6 |

Generation Code |

1 |

69 |

Debtor Cosigner: Generation |

| 7 |

Social Security Number |

9 |

70-78 |

Debtor Cosigner: SSN |

| 8 |

Date of Birth |

8 |

79-86 |

Debtor Cosigner: DOB |

| 9 |

Telephone Number |

10 |

87-96 |

Debtor Cosigner: Home |

| 10 |

ECOA Code |

1 |

97 |

Debtor Cosigner: ECOA |

| 11 |

Consumer Information Indicator |

2 |

98-99 |

Debtor Cosigner: Indicator |

| 12 |

Reserved |

1 |

100 |

BLANK |

Metro2 Format - J2 Segment

The J2 Segment accommodates the requirements of ECOA when reporting credit. It is included in the

reporting file if the cosigner is being reported. The J2 Segment applies when the associated consumer

resides at a different address than the individual being reported. It is included every time the

account is reported.

In the image below, the fields in the J2 Segment are partitioned and identified. Actually, this is

one long string of data in the reporting file.

In the tables below:

- Field is the Metro2 Format Field number

- Field Name is taken from the Metro2 Format. Refer to the Field Number and Field Name when you

are trying to determine CBR requirements for particular areas.

- Length and Position can be used as reference points when you are examining actual data in the

report as Collect! generates it.

- Source is the field in Collect! where the information is pulled from, or some sort of internal

value, as indicated.

| Field |

Field Name |

Length |

Position |

Source |

| 1 |

Segment Identifier |

2 |

1-2 |

J1 |

| 2 |

Consumer Transaction Type |

1 |

3 |

Internal |

| 3 |

Surname |

25 |

4-28 |

Debtor Cosigner: Name |

| 4 |

First Name |

20 |

29-48 |

Debtor Cosigner: Name |

| 5 |

Middle Name |

20 |

49-68 |

BLANK |

| 6 |

Generation Code |

1 |

69 |

Debtor Cosigner: Generation |

| 7 |

Social Security Number |

9 |

70-78 |

Debtor Cosigner: SSN |

| 8 |

Date of Birth |

8 |

79-86 |

Debtor Cosigner: DOB |

| 9 |

Telephone Number |

10 |

87-96 |

Debtor Cosigner: Home |

| 10 |

ECOA Code |

1 |

97 |

Debtor Cosigner: ECOA |

| 11 |

Consumer Information Indicator |

2 |

98-99 |

Debtor Cosigner: Indicator |

| 12 |

Country Code |

2 |

100-101 |

Debtor Cosigner: Country |

| 13 |

First Line of Address |

32 |

102-133 |

Debtor Cosigner: Address Line 1 |

| 14 |

Second Line of Address |

32 |

134-165 |

Debtor Cosigner: Address Line 2 |

| 15 |

City |

20 |

166-185 |

Debtor Cosigner: City |

| 16 |

State |

2 |

186-187 |

Debtor Cosigner: State |

| 17 |

Postal/Zip Code |

9 |

188-196 |

Debtor Cosigner: Zip |

| 18 |

Address Indicator |

1 |

197 |

Debtor Cosigner: Address OK |

| 19 |

Residence Code |

1 |

198 |

BLANK |

| 20 |

Reserved |

2 |

199-200 |

BLANK |

Metro2 Format - K1 Segment

The K1 Segment contains the name of the Original Creditor and the Creditor Classification code. This

segment must be included whenever an account is reported by collection agencies, debt collectors,

factoring companies and others. This information is reported to help consumers identify the source

of accounts when they appear on credit reports. Without the original creditor names, consumers may

not know what the accounts represent.

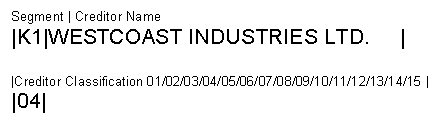

In the image below, the fields in the K1 Segment are partitioned and identified. Actually, this is

one long string of data in the reporting file.

In the tables below:

- Field is the Metro2 Format Field number

- Field Name is taken from the Metro2 Format. Refer to the Field Number and Field Name when you

are trying to determine CBR requirements for particular areas.

- Length and Position can be used as reference points when you are examining actual data in the

report as Collect! generates it.

- Source is the field in Collect! where the information is pulled from, or some sort of internal

value, as indicated.

| Field |

Field Name |

Length |

Position |

Source |

| 1 |

Segment Identifier |

2 |

1-2 |

K1 |

| 2 |

Original Creditor Name |

30 |

3-32 |

Client: Name |

| 3 |

Creditor Classification |

2 |

33-34 |

Client: Type |

Metro2 Format - Trailer Record

The Trailer Record is the last segment of the credit reporting file. It includes cumulative totals

of all records, all segments, all Metro2 status codes, SSN #'s, Dates of Birth, Phone Numbers and

other information. This information is used to verify that all records received have been processed.

The image below shows the Trailer Record. In the reporting file, this is one long string of data.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org