Web Host Client

Set up your operations the best way right from the start, and

you'll minimize your frustration and enjoy using Collect!. This is

especially true when you enter Clients and their Debtors into your

working database. The right way to do this is to start from the Client

form.

Make sure you set up your Company Details, Dunning letters,

Operators, Transaction Types and a Contact Plan, if applicable,

before you begin to enter Client and Debtor information. If these

areas are taken care of first, all their settings and information are

readily available to you when you enter your clients and debtor

accounts.

To add a new client, click the ADD A CLIENT button in the toolbar.

Fill in the applicable fields on the form.

Click each of the orange buttons on the left to fill in the following:

- General Information

- Advanced Settings

- Statement and Invoice Setup

- Commission Settings

- Tax Settings

- Credit Bureau Reporting Settings

A description of each of the sections and fields is available below.

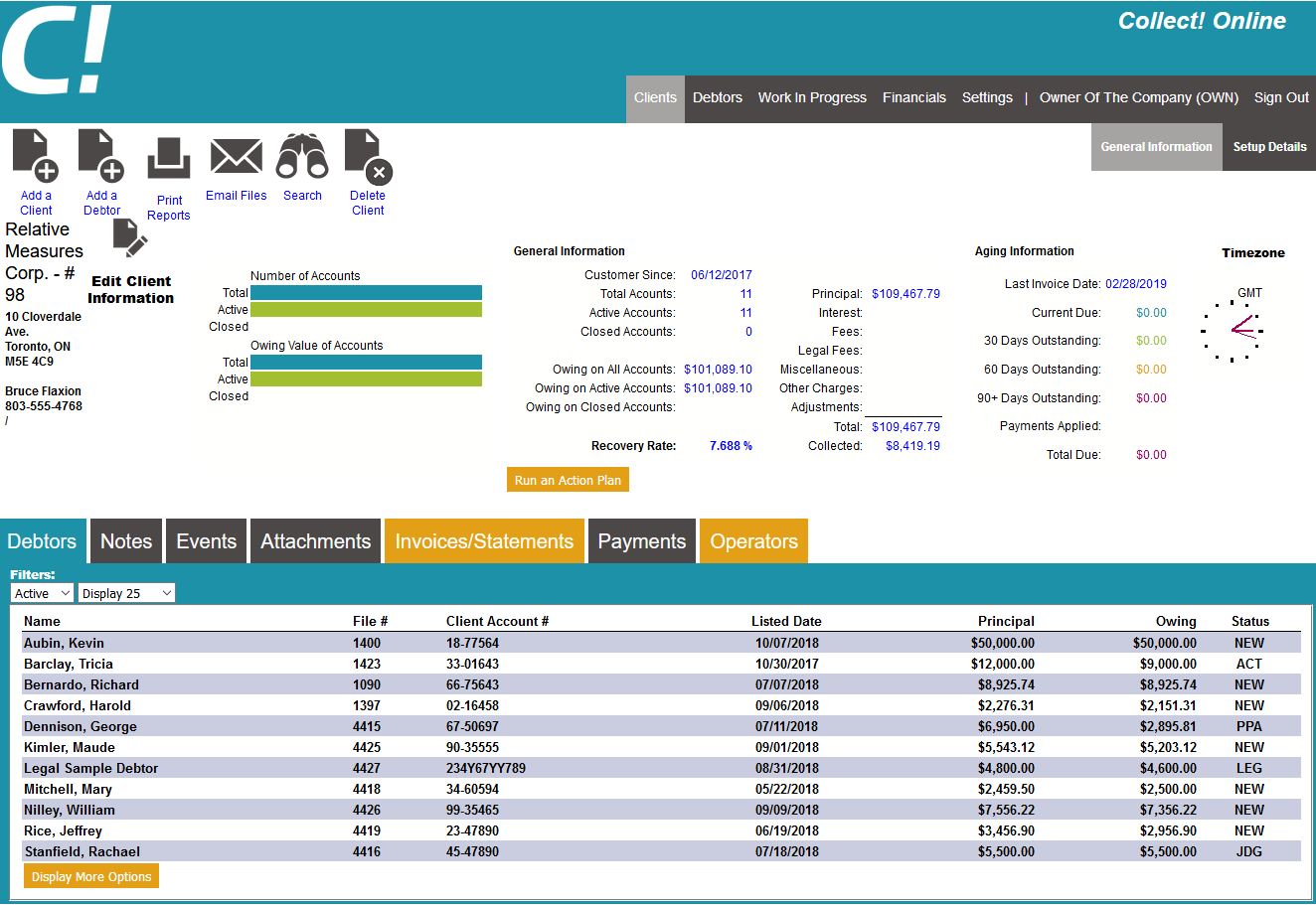

The Client form shows Client information and the accounts listed

by the Client.

Debtor

The Client Settings form contains many settings that

will determine how Debtors, Payments, Invoices and

Credit Bureau Reporting are handled for this Client.

After you have entered your basic personal information for

this Client, select the EDIT CLIENT INFORMATION button to open the

Client Settings form. It is very important to set up this

information correctly right from the start. The information you

set will be automatically entered into all related forms - Debtors,

Payments, Invoices and CBR. This will save a considerable

amount of time and reduce errors.

Most of the information below is available on the main Client view,

but for organizational purposes, we will go through the fields

based on where they appear in the 'Edit Client Information' view.

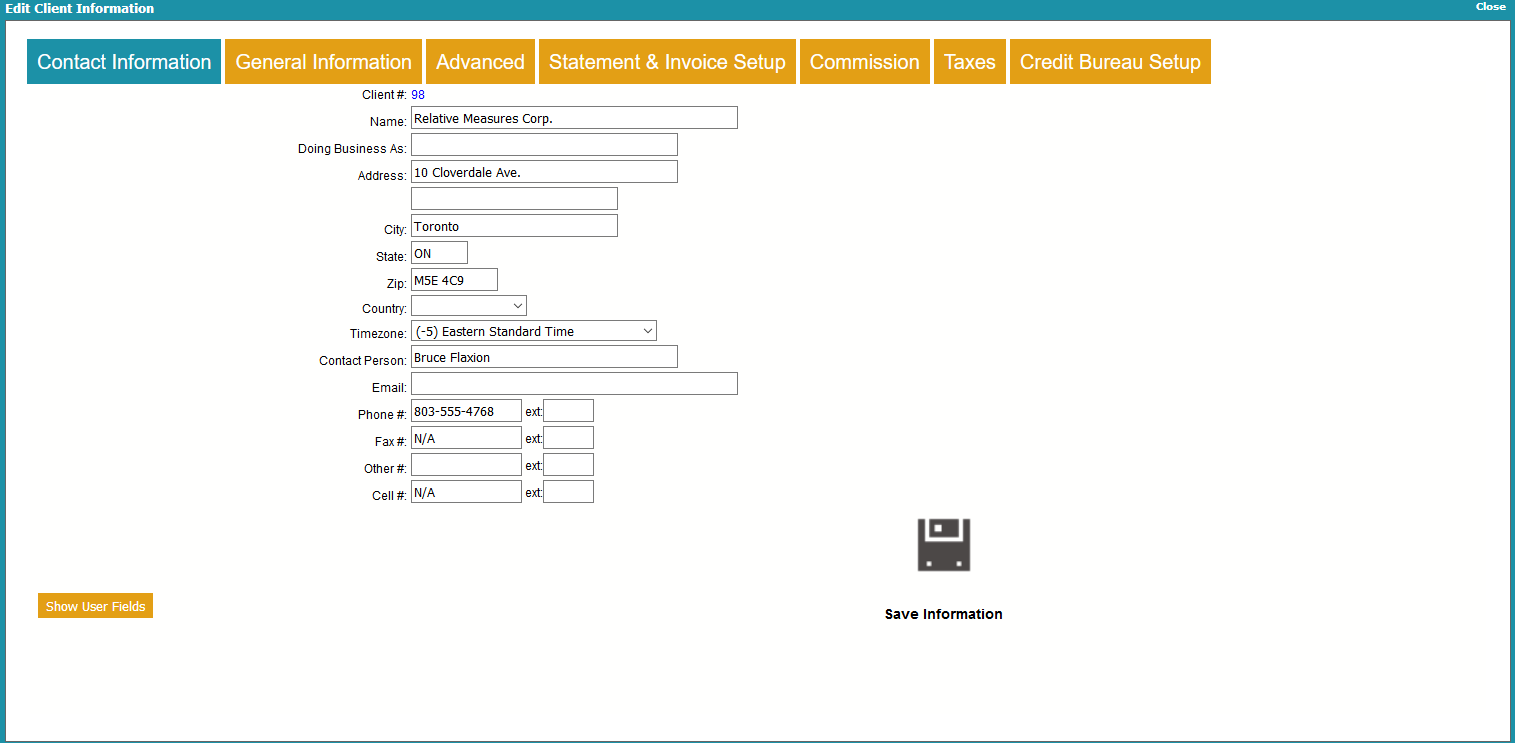

Client Contact Information

Client #

This is the Client ID number as assigned by Collect!.

This number may hold only digits and is used by

Collect! whenever the Client is referenced. If you have

another ID that you would like to use, please enter it in

the field labeled Alt Client #.

This field has additional functions when used with

Account Access Control and Operator Security.

This field is INDEXED.

Name

This is the actual name of the Client or company.

This field is indexed.

Doing Business AS

This is an alternate name that you may use in reports.

Perhaps the Client has requested that you refer to

them with a pseudonym.

Address

First line of the mailing address of the company. All

invoices will be sent to this address, by default. This

is first line to begin typing the address.

Address 2

Second line of the mailing address of the company. All

invoices will be sent to this address, by default. This is

another line to type the address.

City

Use this field to break out the City from the Client

address.

State

Use this field to break out the State from the Client

address.

ZIP

Use this field to break out the Postal Code from

the Client address.

Country

Use this field to break out the Country form the Client

address.

Time Zone

This field holds a POSITIVE or NEGATIVE integer

indicating the Timezone of this Client.

Timezones are standard integer

values calculated from

GMT (Greenwich Mean Time).

Timezones are standard integer

values calculated from

GMT (Greenwich Mean Time).

Contact Person

The name of the contact person or Representative

for this Client.

Email

This is the Client's email address. Select the Email icon

to the right of this field to open the Send Mail window

which allows you to create an email and send it to the

Client.

Phone

The phone number of the Client. Enter the phone number as

you would manually dial it.

Phone Extension

The phone extension. Enter the extension as you

would manually dial it.

Fax

The fax number of the Client. Enter the fax number as you

would dial it manually.

Fax Extension

The fax extension. Enter the extension as you

would manually dial it.

Other

Another phone number for the Client. Enter the phone number

as you would manually dial it.

Other Extension

The other extension. Enter the extension as you

would manually dial it.

Cell

The cellular or other phone number of the Client. Enter the

number as you would dial it manually.

Cell Extension

The cell extension. Enter the extension as you would

manually dial it.

User 1

This field is for your own definition and use. This field is indexed.

User 2

This field is for your own definition and use.

FOR CBR: If you are reporting to Credit Bureaus

by client, Trans Union codes go here.

Please refer to How to Setup Credit Bureau Reporting

for details.

User 3

This field is for your own definition and use.

FOR CBR: If you are reporting to Credit Bureaus

by client, Trans Union codes go here.

Please refer to How to Setup Credit Bureau Reporting

for details.

User 4

This field is for your own definition and use.

FOR CBR: If you are reporting to Credit Bureaus

by client, Trans Union codes go here.

Please refer to How to Setup Credit Bureau Reporting

for details.

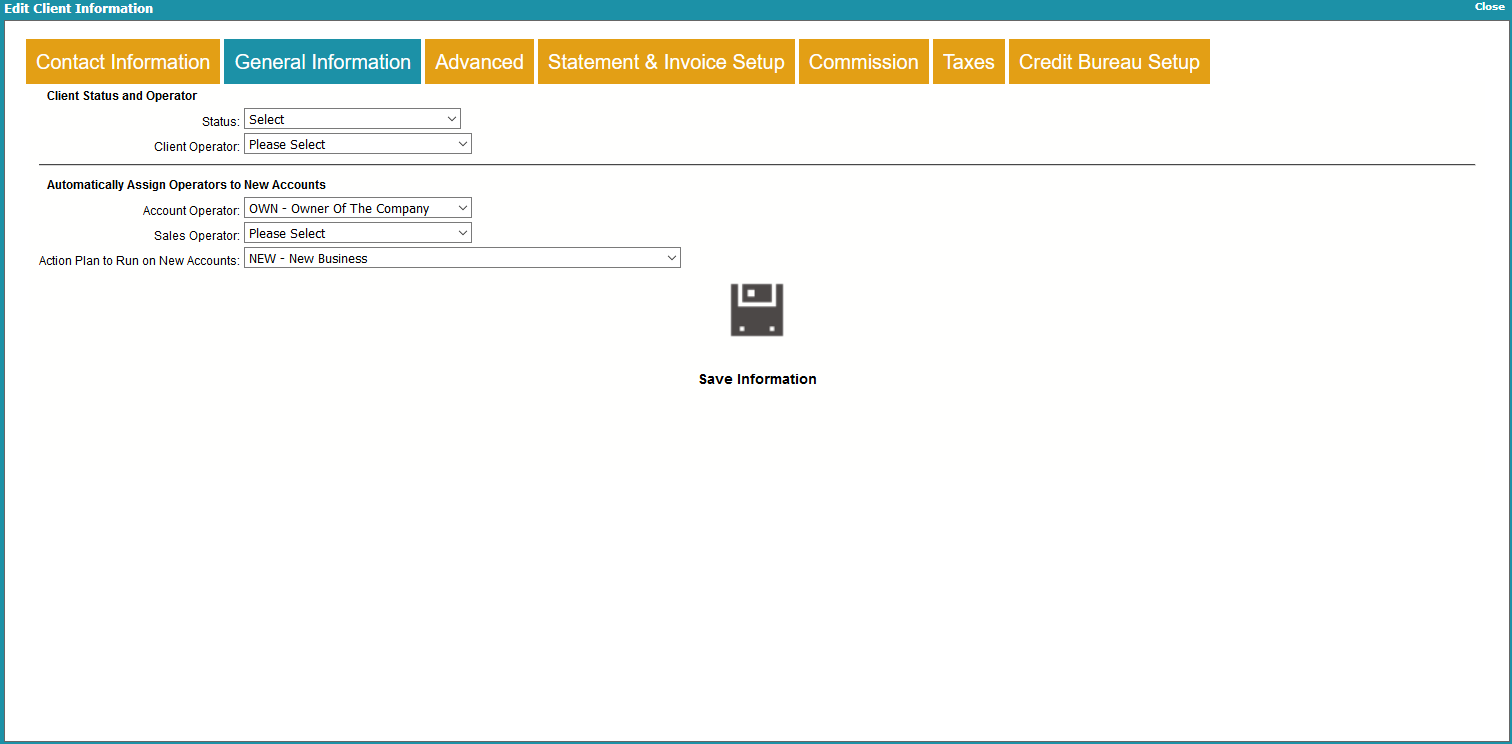

Client General Information

Status

Select a Status from the Debtor Status code pick list

to apply to this Client.

This field uses the same pick list as the

Debtor does for Status Codes. If you

have codes that apply specifically to

your clients, simply add them to the list

of Debtor Status Codes.

This field uses the same pick list as the

Debtor does for Status Codes. If you

have codes that apply specifically to

your clients, simply add them to the list

of Debtor Status Codes.

Client Operator

Select an Operator from the Operator pick list to

assign to this Client.

This field uses the same pick list as the

Debtor does for Operators. If you have

Operators who only work Clients,

simply add them to the list of

Operators.

This field uses the same pick list as the

Debtor does for Operators. If you have

Operators who only work Clients,

simply add them to the list of

Operators.

Account Operator

This Operator ID will be assigned to all new accounts

recorded for this client. It will be copied to the

Debtor's record automatically. The Operator ID is

very important for following up on a debtor's account,

scheduling contacts and reviewing account activity.

Sales Operator

This Sales ID will be assigned to all new accounts

recorded for this client. It will be copied to the

Debtor record automatically and then the information

can be tracked for salesperson status and for

commission reporting.

Action Plan To Run On New Accounts

Whenever a new account is entered, this plan will run

automatically. For instance, you could schedule a

phone call or a review for each new account.

Client Advanced Information

Alternate Client #

This field is for your own use. You may enter

an alternate Client Number to reference on reports.

Perhaps your Client has given you an alphanumeric

code to use. This field is indexed.

Owned By Client

This field is for your own use. You may enter the

Client Number for a "master" client. This enables you

to group client accounts for account security, for

auditing and for reporting.

The Search functionality for Parent Clients is also tied to a

hierarchical client ownership system. This enables you

to set a Client # in this field that will then be used

when applying Account Access Control.

Clients restricted to a particular Client # will

be able to freely search for records in your database.

However, they will only be able to find records within the

Client # or client ownership hierarchy to which they belong.

For instance, clients who own other clients will be able to

see all records in their hierarchical tree, but no others.

You should not set the "Owned By Client" to

the same Client # as the Client itself. This

might cause details to be hidden erroneously

for accounts that should be visible to the

Operator. For example, Client #94 should not

have "94" entered in its "Owned By Client" field.

You should not set the "Owned By Client" to

the same Client # as the Client itself. This

might cause details to be hidden erroneously

for accounts that should be visible to the

Operator. For example, Client #94 should not

have "94" entered in its "Owned By Client" field.

Class

This field is for your own definition and use.

Category

A user defined category. This is used to indicate Client

records that represent third parties, such as other

agencies, attorneys or client prospects. You can add

additional types to this pick list.

If you are setting up Legal Offices or Parent Clients,

you should set the values in this field accordingly.

Debtor Sort Order

These switches display the order used to sort this

client's debtors. This is the order in which they will

be displayed when statements are generated.

If the Sort Order option is not set, then Collect! is

using the default Sort Order set by sorting all

debtors by Name or Account #.

Disable Metafiles

Switch this ON with a check mark if you do not want

to save METAFILES when letters are printed through

Collect!. Ordinarily, when printing from the Debtor or

Client, or in a scheduled letter batch, Collect! creates

and attaches a METAFILE to the Letter contact.

The "Disable metafiles" switch enables you to control

this at the Client level.

Metafiles are created when printing via the Collect!

desktop application, not the web application.

Caw Enabled

This switch enables you to flag accounts for use

with Client Access Web.

Success Calculation

Collect! provides two automatic processes for calculating

success rate for each given client. Either your success

can be based on only closed accounts, or on all the

accounts listed for the Client.

All Accounts

This calculation method is based on all accounts that

belong to this Client. The Success Rate is total

payments to date over total listed dollar value. This is

the default calculation method.

Closed Accounts

This calculation method evaluates only closed accounts.

It gives you a more accurate performance figure over

long periods of time, but ignores any active accounts.

So it is less current that the All Accounts calculation.

This Success Rate is calculated using total payments

made on closed accounts over total listed dollar value

for the closed accounts.

Client Statement Information

Billing Period

This is the interval for generating invoice/statements

for this client. For instance, if you bill your clients on

a monthly basis, MONTHLY is the Billing Period that

you would choose.

Collect! uses MONTHLY as the default, but please

make a definite choice here. In order to generate

statements, Collect! needs to know what billing

period you have agreed upon with your client.

For our Lite users, we setup the process to

generate statements monthly. If you are using

other billing periods, please let us know so

we can set your batch processes up accordingly.

For our Lite users, we setup the process to

generate statements monthly. If you are using

other billing periods, please let us know so

we can set your batch processes up accordingly.

Remit AS Nets Funds With Invoice

If you retain commission and taxes yourself and only

return the remaining funds to the client, then select this

switch. At period end, Collect! will correctly

calculate the amount owed to the client, or what the

client owes your company based on the payments

received during the billing period.

Remit AS Gross Funds With Invoice

All funds collected on behalf of a client are returned to the

client at the end of the billing period. The invoice sent to the

client at the same time lists all commission and taxes due

and payable by the client.

Combined Invoice

Switch this on to generate combined Net/Gross invoices

for this client. When you print your statements, Collect!

will use the Statement report to break out the agency

and client portions of the total remit and return.

For more Information on Remittance Types, please refer to the

Help Topic How To Understand Net Or Gross Or Combined Remittances

for more information.

Variable Interest Rates File

This field is only used when you are using the

Variable Interest extension module. Enter the

exact name of the file containing your interest

rates table.

Please refer to Help topic, How to Use Variable Interest

for details.

Do Not Charge An Automatic Fee For New Accounts

Turn this switch ON when you don't want to charge

a fixed fee to the client or the debtor.

Fee Amount

This is the amount of the fixed fee, and should be a

dollar amount. This is billed to either the client or the

debtor, depending on the Charge to Client or Debtor

options described above. If you turn the No Fixed Fees

switch ON, this value is ignored.

Charge Fee To Debtor

Turn this switch ON and enter the amount of the fixed fee.

When you add a new debtor to this client, the fixed fee

amount is copied to the Debtor record. When you edit the

debtor's Fee field, you can verify the amount and then

Collect! posts a fee transaction to the debtor's account,

the fee amount to the debtor.

Charge Fee To Client

Turn this switch ON and enter the amount of the fixed fee.

When you add a new debtor to this client, the fixed

fee amount is copied to the Debtor record. At period end,

when you generate statements for your client, this fee will

be included in the statement to your client.

Credit Card Convenience Fees

Switch this ON with a check mark if this Client permits

you to charge a convenience fee when using Collect!'s

Payment Processing module for credit card payments.

To implement credit card convenience fees

you must set up your credit card convenience

fee Transaction Types. Please refer to

Help topic, Credit Card Setup for details.

To implement credit card convenience fees

you must set up your credit card convenience

fee Transaction Types. Please refer to

Help topic, Credit Card Setup for details.

ACH Convenience Fees

Switch this ON with a check mark if this Client permits

you to charge a convenience fee when using Collect!'s

Payment Processing module for ACH payments.

To implement ACH convenience fees you

must set up your ACH convenience fee

Transaction Types. Please refer to Help

topic, ACH Payments Setup for details.

To implement ACH convenience fees you

must set up your ACH convenience fee

Transaction Types. Please refer to Help

topic, ACH Payments Setup for details.

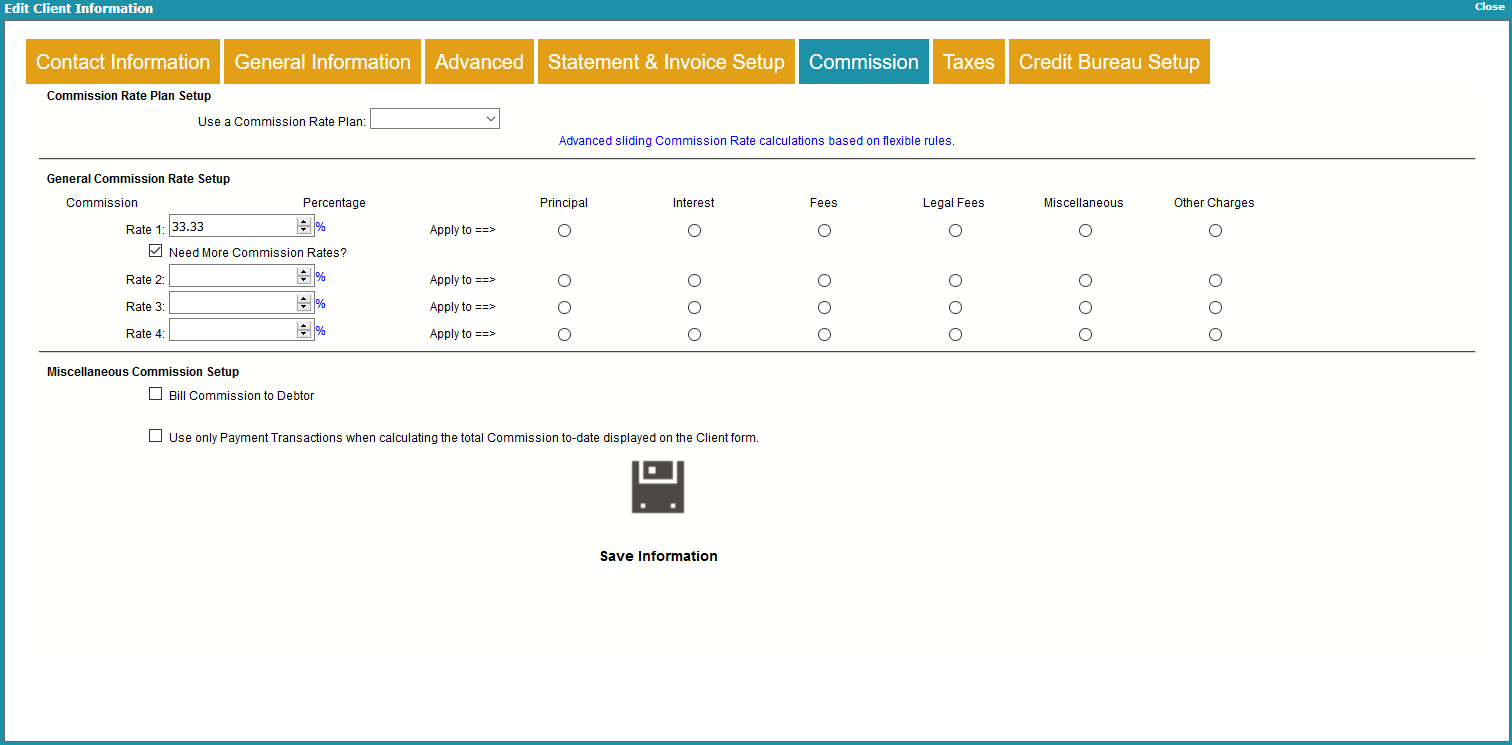

Client Commission Information

The Commission Rates form stores the commission rates

you charge your clients for payments received from debtors.

Whenever you post a payment transaction, these settings

are used to calculate commission charges.

Up to four commission rates may be set on the account.

Breakdown settings enable you to apply separate

commission rates to various types of transactions.

Please see the

Commission and Breakdown example here for details.

Use A Commission Rate Plan

The commission that is charged on the debtor's payments will

be calculated based on the rates in the plan that you choose.

When a payment transaction is posted, the dollar

amount of the applicable commission is calculated using the

rate chosen in this field. The actual commission amount is

entered automatically into the transaction's Commission field.

Do not enter both a fixed rate and a rate plan.

Use one or the other only.

Do not enter both a fixed rate and a rate plan.

Use one or the other only.

Rate 1

Enter a percentage here. This is a fixed amount. It is

the portion of the debtor's payment that your agency

charges as a fee for services. When a payment transaction

is posted, the dollar amount of the a

applicable commission is calculated using the percentage

in this field. This amount is entered automatically into

the transaction's Commission field.

Enter a fixed commission amount here OR select a

sliding scale rate plan in the Commission Rate Plan

field.

Do not enter both a fixed rate and a rate

plan. Use one or the other only.

Do not enter both a fixed rate and a rate

plan. Use one or the other only.

Select the type of payment this rate is applied to by

putting a check mark in the appropriate column next

to this field.

Rate 2

You can enter a percentage here if you need to charge

a different commission rate for the breakdown type that

is check marked for Rate 2.

Rate 3

You can enter a percentage here if you need to charge

a different commission rate for the breakdown type that

is check marked for Rate 3.

Rate 4

You can enter a percentage here if you need to charge

a different commission rate for the breakdown type that

is check marked for Rate 4.

Principal

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Principal.

Interest

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Interest.

Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Fees.

Legal Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Legal.

Miscellaneous

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Misc.

Other Charges

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Other.

Bill Commission To Debtor

When this switch is set, the Commission amount is added

to the debtor's Owing.

Normally debtors cannot be charged the

collection expenses. You can only check

the box labeled 'Bill Commission to Debtor'

if you have the legal right in your

jurisdiction to charge the debtor for

incurred collection expenses.

Normally debtors cannot be charged the

collection expenses. You can only check

the box labeled 'Bill Commission to Debtor'

if you have the legal right in your

jurisdiction to charge the debtor for

incurred collection expenses.

Collect! calculates the commission amount and creates

a fee transaction with Transaction Type 399 debiting the

commission amount from the debtor's account. Collect!

uses the information from your Transaction Type 399

settings to determine how to calculate the fees. If this

transaction type is not in the system, you are prompted

to create it in your transaction types.

Please be aware that adding commission to owing alters

the calculation of commission on each payment that is

posted on the account.

When the Add Commission to Owing switch is ON, the

calculation is

commission = payment X (rate/100) / (1.0 + (rate/100))

When the commission is not added to the owing,

the default calculation is

commission = payment X rate/100

Basically, this is the logic:

If a Debtor owes you $100 and your commission rate is

30%, then the total owed is $130. But the commission

they owe you is still $30. So it is no longer 30% of the

total. It is not 30% of $130. It is actually 23.08% of $130.

To find this figure you divide the Commission Owed by

the Total Owed with the Commission added to

it. - $30/$130.

Do not set this switch unless you have a

signed agreement from the debtor on file, or

you are sure the laws in your region permit

you to charge the debtor collection fees.

Do not set this switch unless you have a

signed agreement from the debtor on file, or

you are sure the laws in your region permit

you to charge the debtor collection fees.

Use Only Payment Transactions For Commission To Date

Switch this ON with a check mark to tell Collect! to use

only Payment type transactions when calculating the

total Commission to Date displayed on the Client form.

When this switch is OFF, Collect! will total commissions

from any transaction that has a commission amount entered.

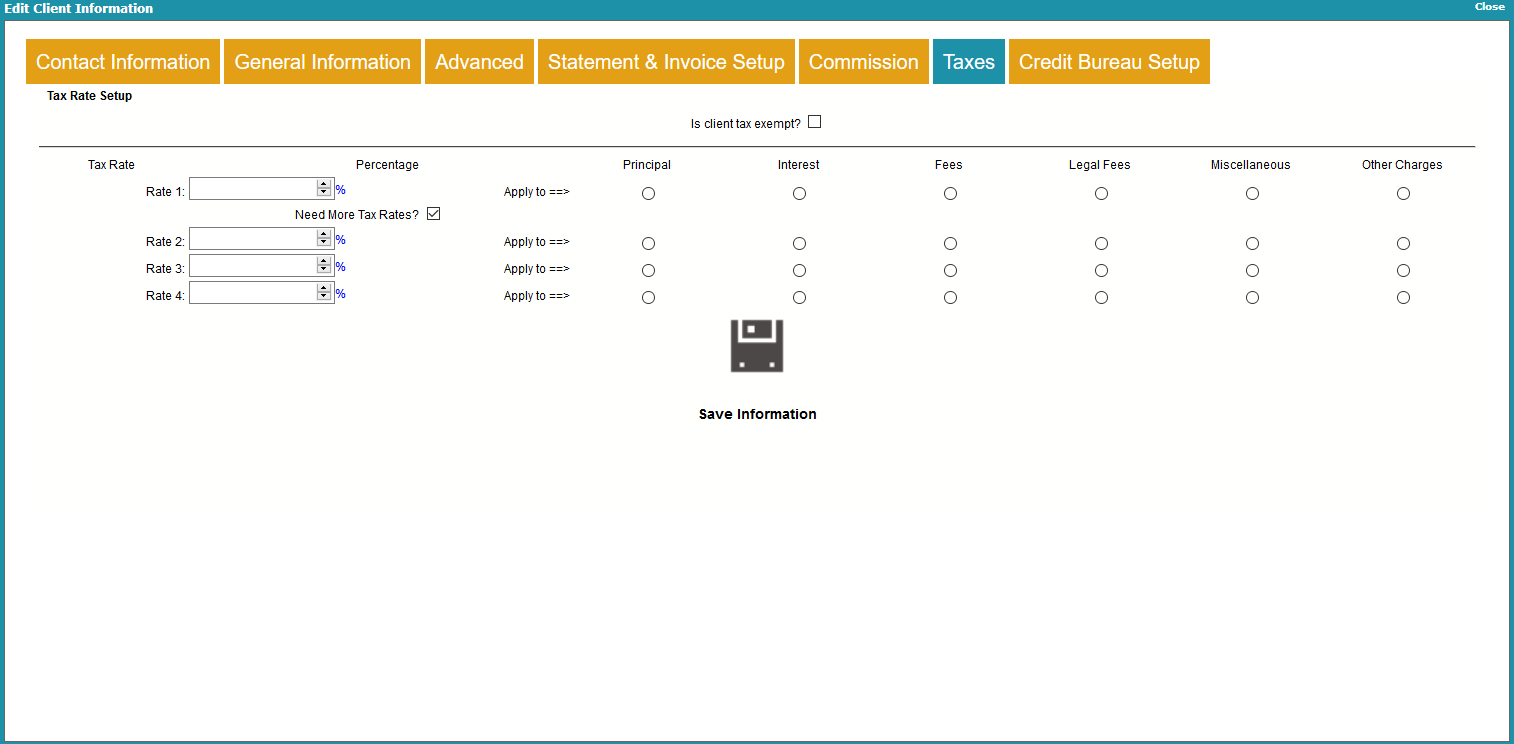

Client Tax Information

The Tax form stores your tax rates. Tax is calculated on the

commission you receive from your clients when you post

debtor payments. Whenever you post a payment transaction

with a commission amount, the settings in the Tax form

will be used to calculate any tax charges.

Up to four tax rates may be set on the account.

Breakdown settings enable you to apply separate

tax rates to various types of transactions.

Please see the

Tax and Breakdown example here for details.

Is Client Tax Exempt

This switch turns OFF the calculation of tax on all

transactions for this Debtor. If a Tax Rate has been

set previously, it will not display when a transaction

is posted.

When this switch is ON, tax will not be calculated

even if the "Don't Calculate Tax" switch is not ON

and there is a Tax percentage entered in the Tax

details for the account. Tax will not be calculated if

a transaction is posted with a Tax Rate in the

Transaction Type settings. Whenever a transaction

is posted, tax will not be calculated and the

transaction's Tax field should remain blank.

Rate 1

If you charge tax on commissions that you earn,

enter a percentage tax rate here. (e.g. Enter 7.0

for 7%) This is the tax charged on any commissions

that you receive for debtor payments. This rate is

automatically written into the Tax Rate field for any

transaction posted for this debtor when there is a

commission amount. Tax is calculated on the

commission amount only and is displayed in the

Tax field of the transaction.

This field must contain a value if you are calculating

tax on commissions for this debtor.

When a new debtor is entered, this field is filled

automatically from the Client Settings Tax Rate field.

You can change the rate for this particular debtor to

override the rate used generally for the client.

Select the type of transaction to apply this tax to

by placing a check mark in the appropriate box in

the columns next to this field.

Rate 2

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 2.

Rate 3

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 3.

Rate 4

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 4.

Principal

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Principal.

Interest

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Interest.

Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Fees.

Legal Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Legal.

Miscellaneous

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Misc.

Other Charges

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Other.

Debtor Miscellaneous Information

Report Accounts To Bureaus

Switch this ON when you wish to set up credit reporting for

a client.

Please be aware that this switch does not

automatically begin reporting debtors. You

must still switch ON credit bureau reporting

for each debtor that you want to report. Please

refer to How To Setup Credit Bureau Reporting

for details.

Please be aware that this switch does not

automatically begin reporting debtors. You

must still switch ON credit bureau reporting

for each debtor that you want to report. Please

refer to How To Setup Credit Bureau Reporting

for details.

You must also switch ON 'Send client detail to bureaus'

if you are reporting as a Collection Agency so that

Collect! can include the details when you run your report.

Creditor Classification Code / Client Type

This field contains a pick list of choices that can be used

to classify your clients by Type.

FOR CBR: If you are using METRO 2 format, it is

required that you enter a valid "creditor

classification" in this field. The list of

choices given is a standard CBR list of

creditor classifications.

If you are not reporting to credit bureaus, this field is for your

own definition and use.

Click the arrow to see the default pick list

attached to this field.

Click the arrow to see the default pick list

attached to this field.

FOR CBR: If the choice you need is not included in

the list, you can add it to the pick list.

Please check with your credit bureau to

ensure that it is a valid creditor classification

and let us know too, so we can add it to the

default list.

Send Client Detail To Bureaus

The FDCPA requires that the client details, K1 segment,

be sent with each debtor. FTC (Federal Trade Commission)

and ACB (Associated Credit Bureaus) policy stipulate that

the original creditor be identified.

When you switch ON 'Report accounts to bureaus', Collect!

will send the Client's Name in the K1 segment of data reported

to the credit bureaus. If you are reporting as a credit grantor

then this switch may be switched OFF.

If the credit grantor switch is OFF, the sending of K1

segments is UNCONDITIONAL regardless of the

setting in this field.

If the credit grantor switch is OFF, the sending of K1

segments is UNCONDITIONAL regardless of the

setting in this field.

Original Creditor Is In User 2

This switch may be used by portfolio purchasers who want to

use the Client record for tracking the portfolio, yet also want to

send the original creditor information to credit bureaus. Switch

this ON on a client by client basis and then place the original

creditor information into the User 2 field on the Debtor form.

When you check this box, a text field will be made visible. This

field is linked to the User 2 field. Anything entered here will

be written to the User 2 field.

Delay Days

When you first report credit on an account, you can

schedule for the report to be sent later, rather than

immediately. The date can be changed manually.

This is configured on the Credit Bureau Setup screen

by selecting the Delay Report option.

This field allows you to overwrite the global Delay Days

value to report sooner or later than your global setting.

To have this client reporting based on the global settings,

leave the box empty.

Days From Today

This field is used with the DELAY DAYS field to delay reporting

to the bureau. This field is the default selection. If this option

is selected, the reporting delay will be based on the date that you

prepared the Debtor to be reported to the bureau.

Days From Delinquent Date

This field is used with the DELAY DAYS field to delay reporting

to the bureau. If this option is selected, the reporting delay

will be based on the Debtor's Delnqnt date.

Days From Charged Date

This field is used with the DELAY DAYS field to delay reporting

to the bureau. If this option is selected, the reporting delay

will be based on the Debtor's Charged date.

Customer Since

When you enter a new Client in your system, Collect! fills

this field with the current date. You can modify this field

manually if desired, or use it to store the date you

entered the Client.

Total Accounts And Owing

The total number/value of debtors attached to this client.

Active Accounts And Owing

The number/value of debtors attached to this client

whose Mode is ACTIVE, SUSPEND, OR PRECOLLECT.

Closed Accounts And Owing

The number/value of debtors attached to this client

whose Mode is CLOSED.

Commission To Date

This field shows the total commission calculated on all

accounts for this client.

If you want Collect! to calculate this total

from Payment type transactions only, then

switch ON 'Only payments for comm to date'

in the Client Settings form.

If you want Collect! to calculate this total

from Payment type transactions only, then

switch ON 'Only payments for comm to date'

in the Client Settings form.

Success Rate

This is a percentage ratio of Paid to Listed accounts

and may be calculated using ALL accounts or only

CLOSED accounts, as set in Client Settings.

The success rate is calculated as

All Paid X 100 / ((All Listed + All Fees) - Adjustments)

Where All Paid is the client's Paid field, All Listed is the

client's Listed Field, All Fees is the sum of all the Fees

fields of the client's debtors, and Adjustments is the

sum of all the Adj fields of the client's debtors.

Principal

The total dollar value of Principal for all

accounts listed by this Client.

Interest

The total dollar value of Interest for all

accounts listed by this Client.

Fees

The total dollar value of Fees for all

accounts listed by this Client.

Legal Fees

The total dollar value of Legal Fees for all

accounts listed by this Client.

Miscellaneous

The total dollar value of Misc Fees for all

accounts listed by this Client.

Other Charges

The total dollar value of Other Charges for all

accounts listed by this Client.

Adjustments

The total amount of adjustments to debtors belonging

to this Client.

Total

This is the total of the above.

Collected

The sum of the Paid fields of all of the client's debtors.

Run An Action Plan

Enter a Contact Plan to run on this account.

Client Details

This area of the Client form contains tabs to sub-lists of

related Client information. The areas that may be

accessed are as follows.

- Debtors

- Notes

- Events

- Attachments

- Invoices/Statements

- Payments

- Sub-Clients

- Operators

Each of these sub-forms allow you to view records

related to this client and add new ones. If the tab is

displayed as ORANGE that means there are records in

that area.

Debtors

Select this tab to display the list of all debtors listed by

this Client. All Debtors with ACTIVE or CLOSED mode

can be displayed.

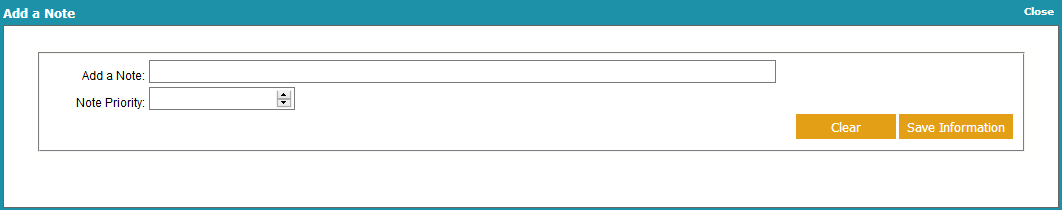

Notes

Select this tab to display this Client's notes or

add a new line.

To edit a note line, click on the note line.

To add a new note line, click ADD A NOTE.

The Add a Note text box is the text associated with the note line.

The priority will set a sort order for the note. Notes are sorted in

descending order on priority, date, then time.

Add a Note Line

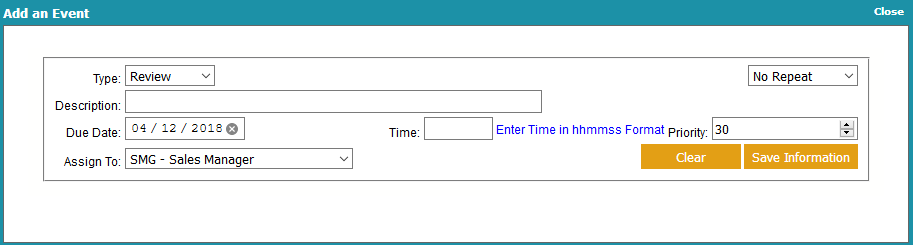

Events

Select this tab to display this Client's events or add

a new one.

To edit an event, click on the event.

To add a new event, click ADD AN EVENT.

Select the type of event that you want to create:

- Review - general review event

- Phone - indicates a phone action

- Other - miscellaneous event type

- Promise - indicates that money is expected to be received

- Letter - schedule a letter

- Action Plan - schedule an action plan

If promised is selected, the Amount field will be visible to enter the

expected amount of the payment.

Fill in the repeat field if you want the event to repeat. This is

generally used for promises, letters, or action plans.

Fill in a description for the Event. If Phone, Letter, or Action Plan

is selected, this field will be replaced with a drop down list for

the applicable event type.

Fill in the Due Date for the event.

If the time is filled in, Collect! will popup a notice in the

Work in Progress at the time the event is due to be worked.

Fill in the priority of the event.

Assign the event to an operator.

Add an Event

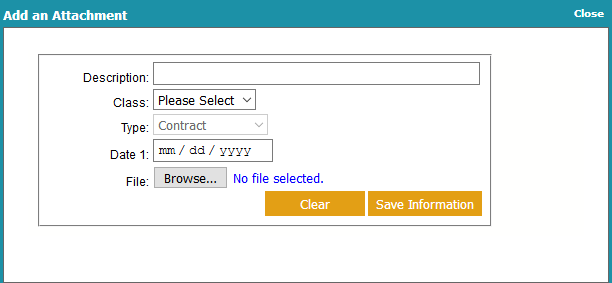

Attachments

Select this tab to display this Client's attachments or add

a new one.

To edit an attachment, click on the attachment.

To add a new attachment, click ADD AN ATTACHMENT.

Fill in a description for the attachment.

Select the class of contact that you want to create.

Once the attachment is saved, there will be more options

available associated with the type.

Fill in a Date for the attachment. This is optional.

Browse to a file to be associated with the attachment.

This needs to be done here as once the attachment record

is created, a file cannot be associated with it later.

Add an Attachment

Invoices/Statements

Select this tab to display the list of Invoice/Statements

generated for this Client.

Click on VIEW CURRENT TRANSACTIONS to display a list

of transactions that will appear on the next statement.

Click on a statement to open it up in a new tab for printing.

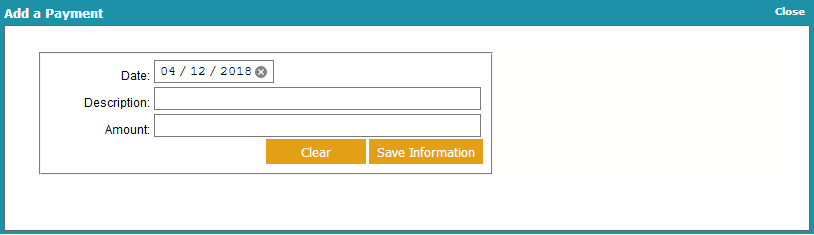

Payments

Select this tab to display the list of Client Payments

attached to this Client.

To edit a payment, click on the payment.

To add a new payment, click ADD A PAYMENT.

Fill in the date of the payment.

You cannot enter a date for a period where a statement

has already been generated.

You cannot enter a date for a period where a statement

has already been generated.

Fill in a description for the payment.

Fill in the amount of the payment.

Add an Attachment

Sub-Clients

This tab is only visible when viewing a Parent Client.

Select this tab to display the list of Sub-Clients

attached to this Client.

To view a sub-client's details, click on the sub-client.

Operators

Select this tab to display the list of Operators

attached to this Client. These are operators that

are or have been allowed to sign in via the web

portal.

To view an operator's details, click on the operator.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org