How To Setup Collect!

Setting up your Collect! software is the most important aspect of preparing to use Collect!. It is

very important that you understand the basics so that the transition from using your existing system

to using Collect! is easy and efficient.

These setup tips are guaranteed to save you from needless frustration. Please take the time to print

this page. You will want to review the sections you need in your day to day operations.

Introduction

By default, Collect! is set to run an average Collection Agency. Your way of conducting business may

be different. Perhaps you plan to use Collect! to track your delinquent Accounts Receivable, in a

Credit Union, for Contact Management, or a variety of other businesses. Collect! is readily modified

to suit your needs. The average Collect! user utilizes only a portion of Collect!'s power.

Most system users have collection strategies which work for them. Collect! is extremely flexible and

can be modified to use your strategies. You don't have to change the way you do business; instead

Collect! will change to suit your needs.

This checklist shows how you can control Collect! for your own use. It is divided into sections

representing the main operations you perform.

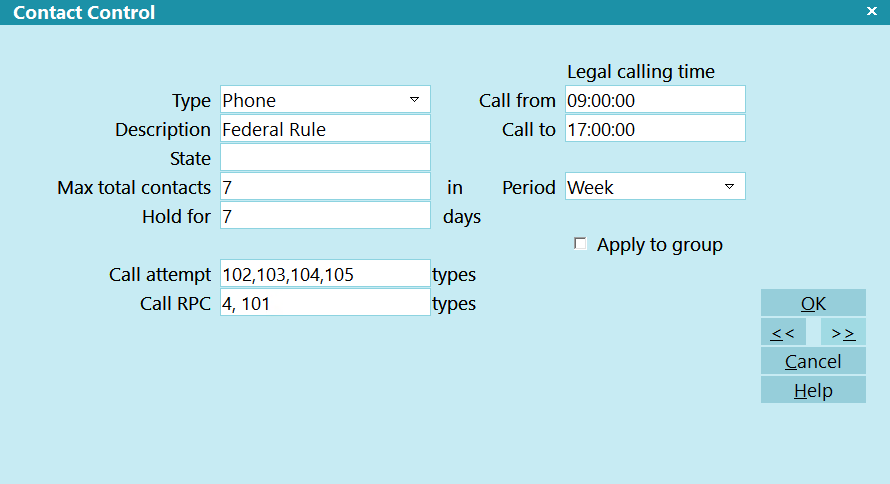

Contact Management

Contact Management tasks include all the day to day operations you perform to work your accounts.

Work queues, letter printing, entering new accounts, and batch processing are examples. To use these

functions efficiently in Collect!, set up the following areas right from the start.

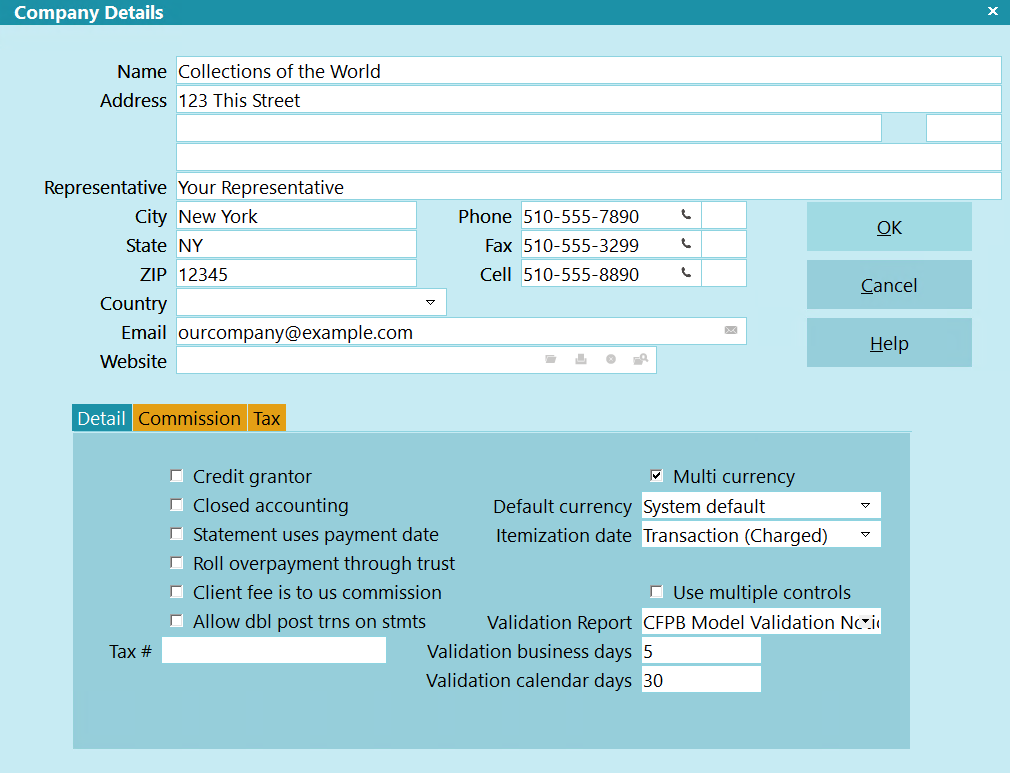

Company Details

Enter information about your company in the Company Details form. When you enter your company information,

please be aware that, by default, this information is printed on a variety of reports and letters.

You may change the information as needed. Access your Company Information by selecting System from

the top menu bar. Then select Company Details from the list of choices that is displayed. Alternatively,

through the Main Menu, select System Administration, Setup and Configuration.

Click Here to View this Form.

Click Here to Close this Form.

The Company Details form stores name and address information

about your company. This can be printed on reports and letters

and is used in credit bureau reporting. Some Client Settings

values are set up automatically for you based on information you

enter in the additional fields on this form.

Company Details

The Company Details form is a very convenient way to store and

access your company information. Any field of the Company Details

form can be pulled into a report or letter from anywhere in the

system because all the Company Detail information is loaded into

memory when you sign into Collect! Name, Address and Phone

lines are used for credit bureau reporting. You can run multiple

companies by logging into different databases. Each database

stores its own company details.

Name

Enter the name of your company as you would

like it to appear on reports and letters. If you

are using the credit reporting module,

please enter your company's name as you would

like it to appear in credit bureau Metro2

output file header records.

Address

Enter your Street Address. There are three

address lines on this screen. The

information you enter in these lines

can be pulled into reports and letters.

The information in these three lines is

also included in header record of your credit

bureau Metro2 output files.

The format with which you enter your

information is up to each agency. However,

we recommend using Postal Addressing

Standards that are applicable to your

country. These are generally available

by looking up the website of the postal

service for your region.

Example:

Name - Your Company Name Goes Here

Address - Your Company Address

Address 2 - Company Addr2

Address 3 - Company Addr3, or Website Address

Representative - Default Report Name or Leave Blank

City - Your Company City

State - Your 2 Position State/Province Code

Zip - Your Zip/Postal Code

Country - Choose From Pick List or Leave Blank

Email - Any Company Email Address or Leave Blank

Address 2

This address field can hold your second

address line or other information you may

wish to store for later use/output to

reports or letters.

Address 3

This address field can hold your third

address line or other information you may

wish to store for later use/output to

reports letters.

Representative

Optional. Enter the name of your company

representative. This may be the Owner

or President's name. Some of the sample

letters and reports have this field built in

as a placeholder, but these can also be

removed or commented out of the report by

placing two slashes in front of the printable

field code: i.e //@cd.re<

State

Enter your agency's State Code.

ZIP

Enter your agency's ZIP/Postal Code.

Country

Optional. Use the drop-down arrow pick

list to select your Country OR leave blank

if you do not wish to see this field

expressed in reports/letters.

Email

Optional. This field is used to enter your

agency's central email address or the email

address of your main representative.

Website

Optional. This field is used to enter your

agency's website address.

Phone

Enter your main office Phone number.

This Phone number field is pulled into

many of the sample reports and letters.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all lookups by phone

in your system. Lookups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

You can switch ON 'Only numerics in phone

fields' "System\Preferences\Options, Sounds

and Colors\Screen and Messages" so that the

system will disallow non-numeric data in

your phone fields.

If you use the Credit Bureau module, the

Phone number is required and is output

to the header record of the Metro2 formatted

text file when created. The Credit Bureau

module will strip out any non-numeric data

automatically and will use a maximum of 10

digits in compliance with the Metro2 File

Format specifications.

Phone Ext

Optional. This field can be used to enter

an extension for the Phone field, left blank

or re-purposed for user-defined storage of

other data.

Fax

This Fax number field is pulled into

many of the sample reports and letters.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all look ups by phone

in your system. Look ups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

You can switch ON 'Only numerics in phone

fields' "System\Preferences\Options, Sounds

and Colors\Screen and Messages" so that the

system will disallow non-numeric data in

your phone fields.

Fax Ext

Optional. This field can be used to enter

an extension for the Fax field, left blank

or re-purposed for user-defined storage of

other data.

Cell

Optional. The Cell number is another phone

number for your company. It is not included

in default shipping sample reports/letters.

Decide on a phone format for your company.

Such as, with hyphens or with parenthesis

around area codes or all numerics/no spaces.

You will find establishing a phone format

convention will ease all look ups by phone

in your system. Look ups read the field

exactly as entered.

Some format examples:

123-456-7890

123.456.7890

(123)456-7890

18004567890

1234567890

You can switch ON 'Only numerics in phone

fields' "System\Preferences\Options, Sounds

and Colors\Screen and Messages" so that the

system will disallow non-numeric data in

your phone fields.

Cell Ext

Optional. This field can be used to enter

an extension for the Fax field, left blank

or re-purposed for user-defined storage of

other data.

Detail

Press F1 for help with Detail Tab system switch

settings and fields which will define key

software behaviors by setting your cursor into

any of the displayed items for selection.

Commission

If all your clients use the same Commission

Rates, you may set a global system default that

will be applied to all clients in the Commission

Tab. Press F1 for detailed help from any field

in this tab.

Tax

If all your clients are subject to the same

rate of Tax on your collection services, you

may set a global system default that will

be applied to all clients in the Tax Tab.

Press F1 for detailed help from any field

in this tab.

Tax Rate

Enter the tax rate, if applicable. This

rate will be entered automatically in the

client settings for every new client that

you enter in your system.

If your agency services multiple regions with

different taxation percentages, do NOT enter

data in this tab on the Company Details.

Instead, fill out the Tax tab on a per client

basis to ensure the correct rate is passed from

the Advanced Client Settings to the debtor

accounts as you enter them.

Tax Rate is a percentage field: i.e. if the

rate is 7%, you would enter 7.0. Tax is

calculated on the commissions that you earn,

not on the total amount you recover.

If you are in a region that has two types of

tax, such as Canada, enter the sum total

percentage tax which you are required to

charge into the Rate 1 field.

The Tax Rate field holds up to 6 digits

(or 5 digits and a period, e.g. 7.4563)

and is referenced in reports by using

the Printable Field Code @cd.tr

The system provides a field to enter a

Taxation # that is alpha numeric, allowing

you input a brief descriptor as well:

(EX:GST# 1050505050505).

Leave the Tax tab blank if you do not

charge tax OR if you have specific rates

that are input into Client Tax Tabs on a

per client basis.

Don't Calculate Tax

Switch this ON if you do not calculate tax.

OK

Click this button to save your changes

and return you to the previous screen.

Cancel

Click this button to ignore any changes

made and return to the previous screen.

Help

Click this button for help on the Company

Details window and links to related topics.

Client Setup

Clients are entered into Collect! before debtors. Once the client information and the appropriate

settings are in place, it is easy to enter the new debtors through the Client dialog. Entering

information in this order minimizes data entry, because each time you create a new debtor through

the Client dialog, basic information is automatically placed in the appropriate fields.

It is very important that you understand the client setup to facilitate any special requirements

each client may have for debtor records and reports.

Click Here to View this Form.

Click Here to Close this Form.

If you are new to the system, we recommend keeping your "Enable pop up help" function ON while you

are acclimating to the system. It will help you become familiar with key Fields of special

importance so that you can make operational decisions as to how your company wishes to use particular

settings or user-defined Fields with special properties.

On any screen, there are two types of online Help:

- Dynamic link to online Help Docs on our website. By pressing F1 while clicked

into a target field of interest on your screen, you will see your web browser open and take

you directly to the spot in our online Help Docs which describes that field in detail. You

will find yourself on a page that relates entirely to the screen you are working in. Links for

additional pages of possible interest appear at the bottom of the page you are taken to, if

applicable.

- Pop up Help screens. This requires that you have your online Help function

enabled via the menu path \Help\Enable Pop up Help. To use Pop up help, allow

your mouse to hover a few seconds over any field, and a help box will appear on the screen with

information about that field or screen you are on. To disable pop up help, click the menu path

"Help\Disable pop up help".

Before you are ready to enter the Client into your system, there are preliminary key details about

your Client's operational preferences that must be determined and decisioned within the software

prior to data entry of the Client information.

For example:

- What are the contingency terms?

- Commission rate plan structure

- Legal/collection cost handling

- Remittance type Net/Gross/Combined

- Remittance Schedule Monthly/Weekly/Biweekly/Daily

- New or different regional taxes to be applied

- Are there specific Securities or Portfolio staffing mandates?

- Portfolio isolation

- Multiple accounts group within Client only OR across full database

- Collectors for the project are general or project-specific with security settings

- Are there custom letter or report requirements?

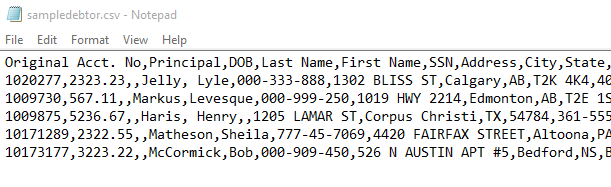

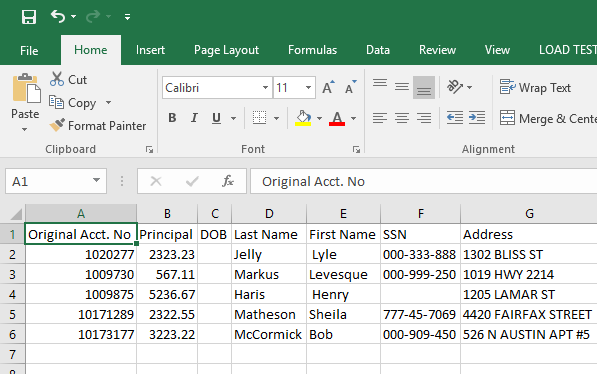

- Do they intend to assign accounts on manual listing sheets OR will they be giving you a text

or spreadsheet file for electronic data import?

- Do they require electronic reporting, such as payment or account activity data files in a

specific layout from you on a fixed or ad hoc basis?

- Do they require a real-time login to your system to review/audit their own Debtor accounts?

- Will their accounts be reported to the Credit Bureau(s)?

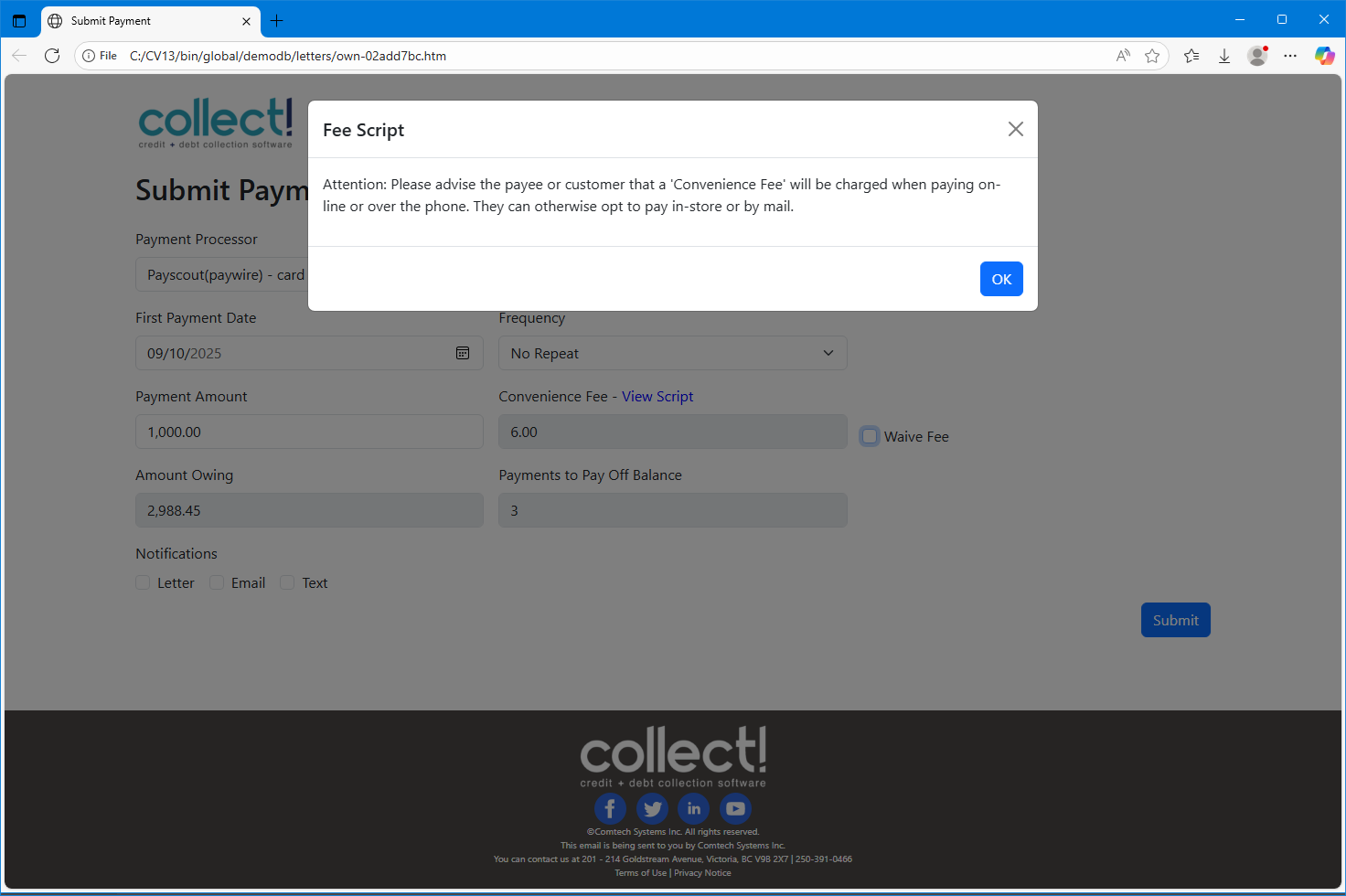

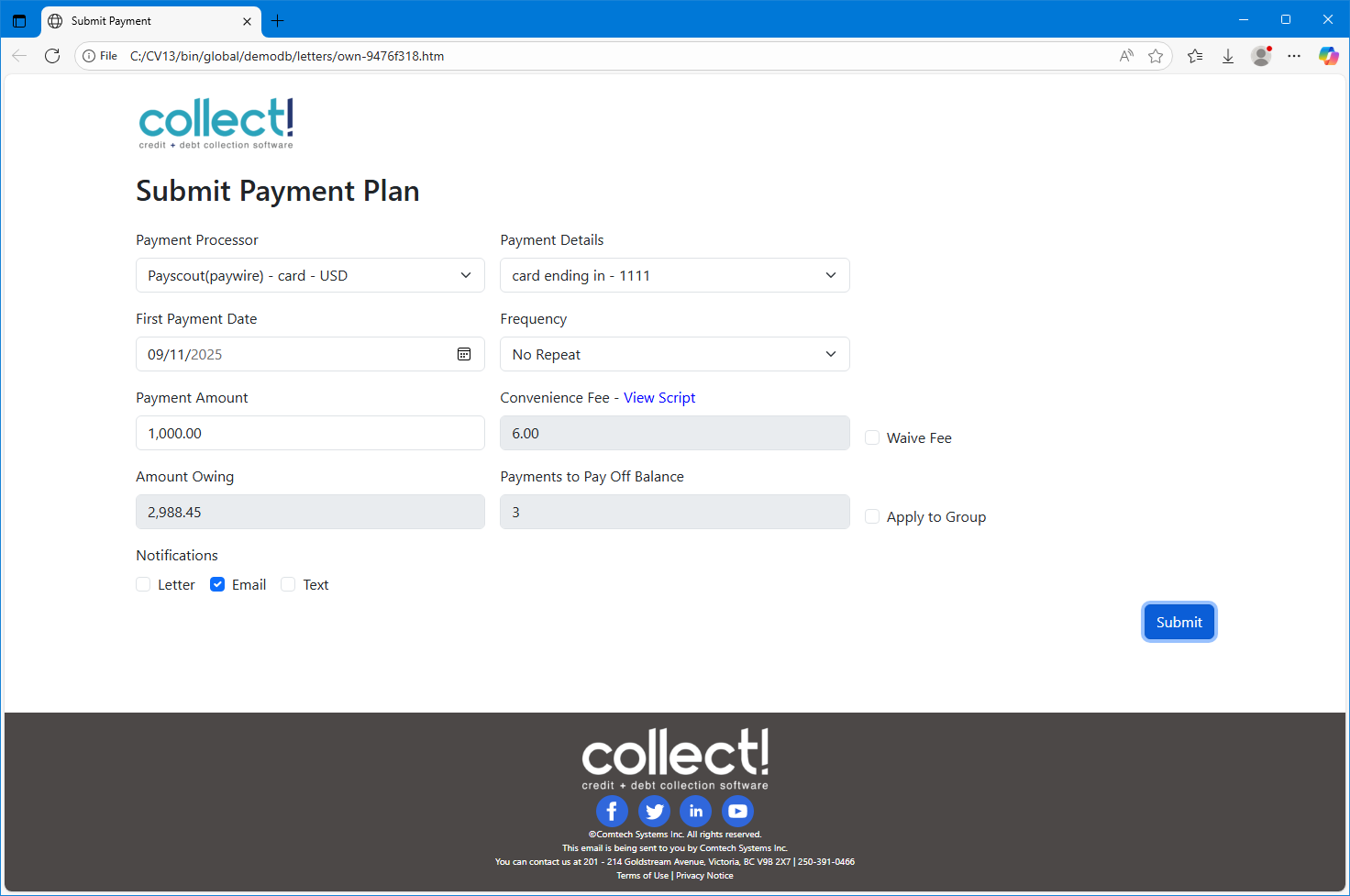

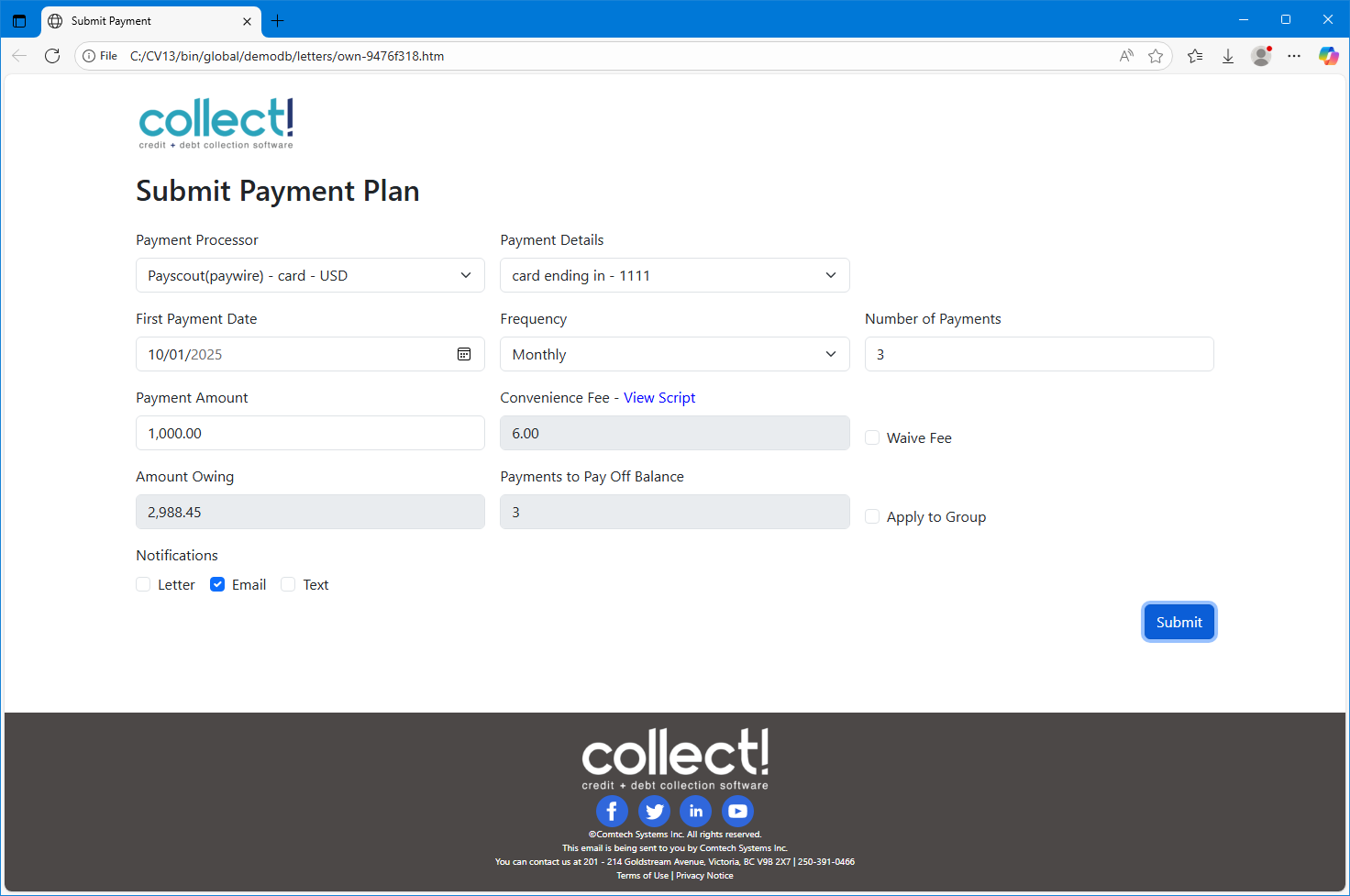

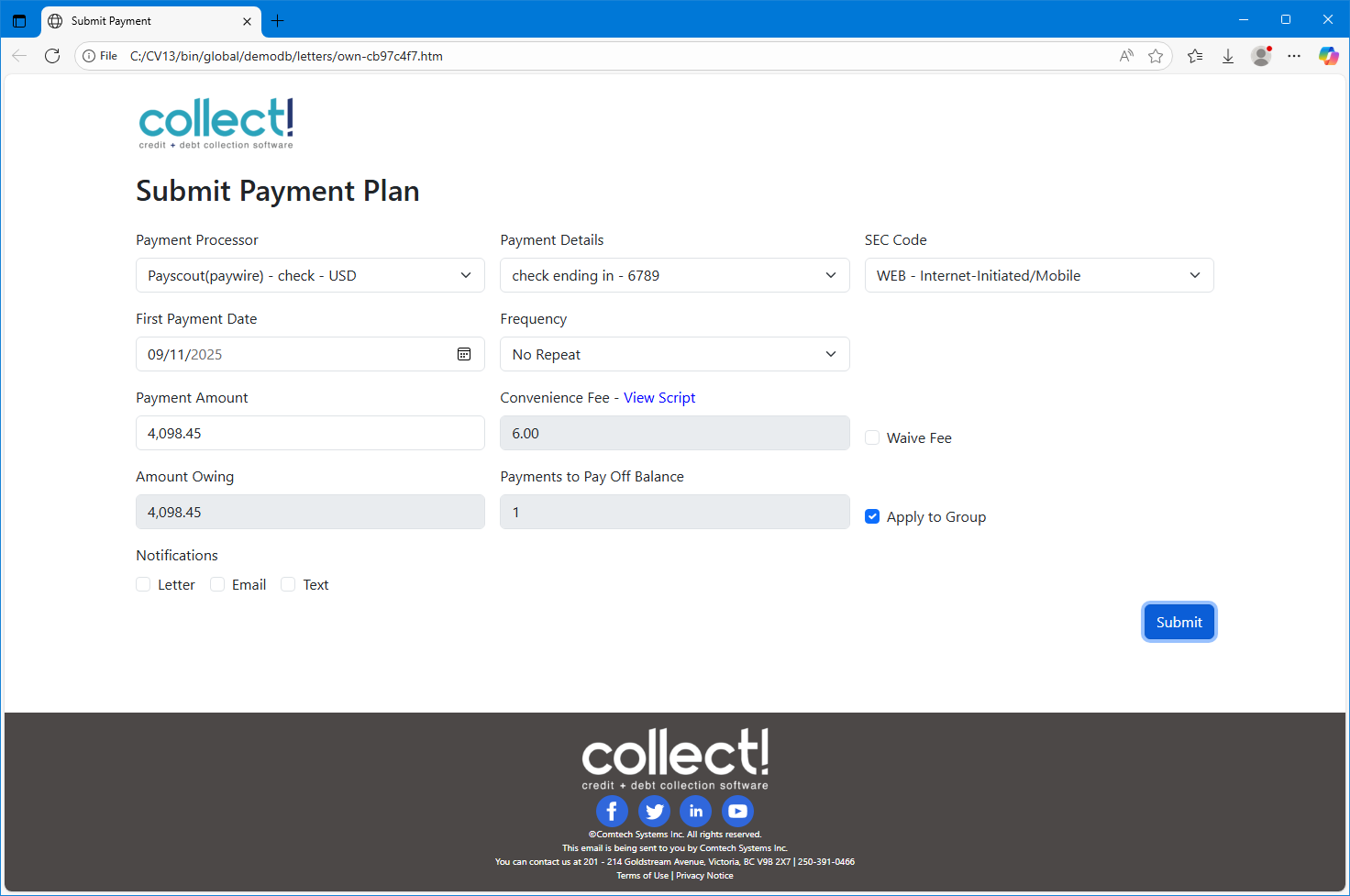

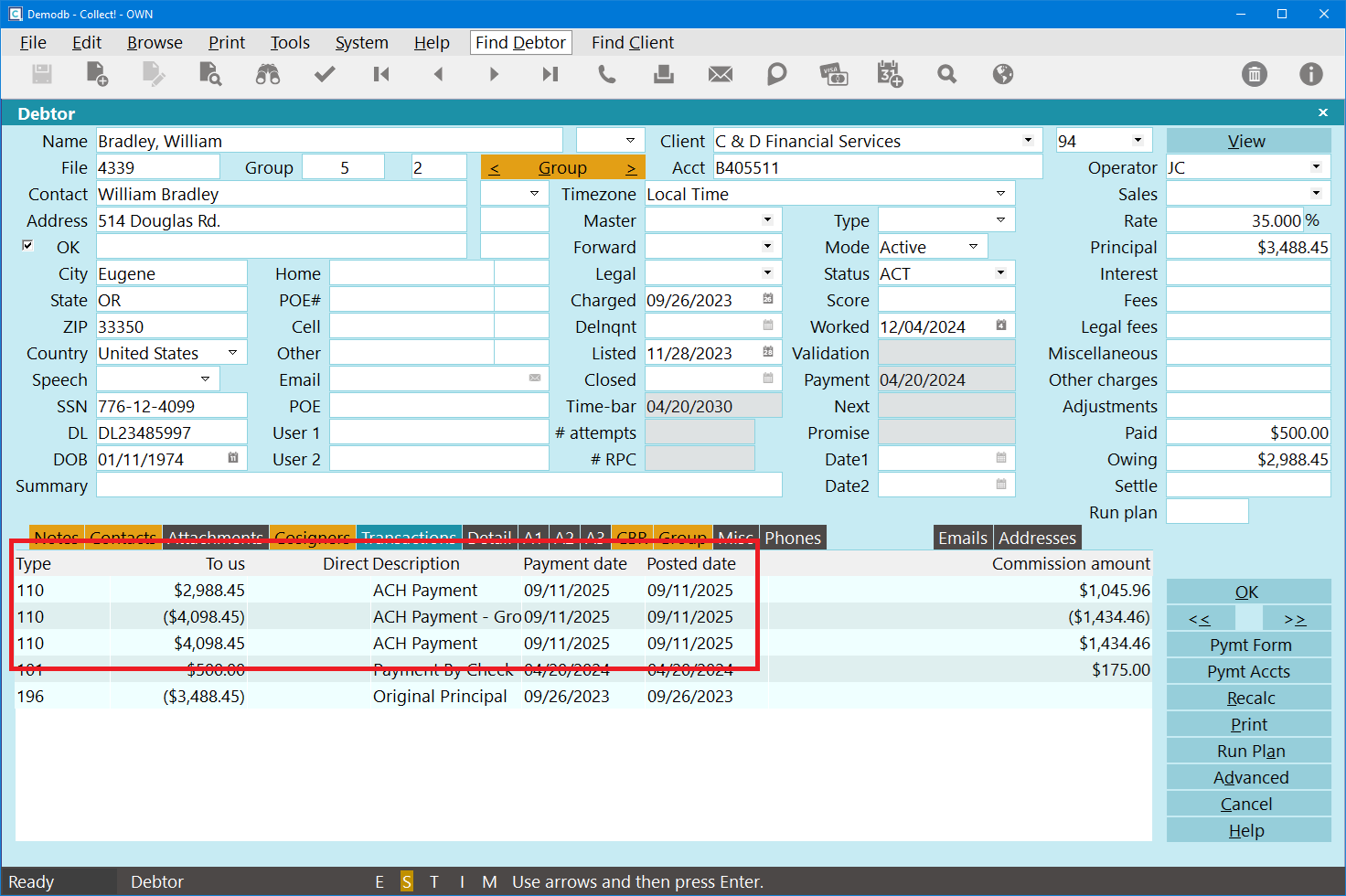

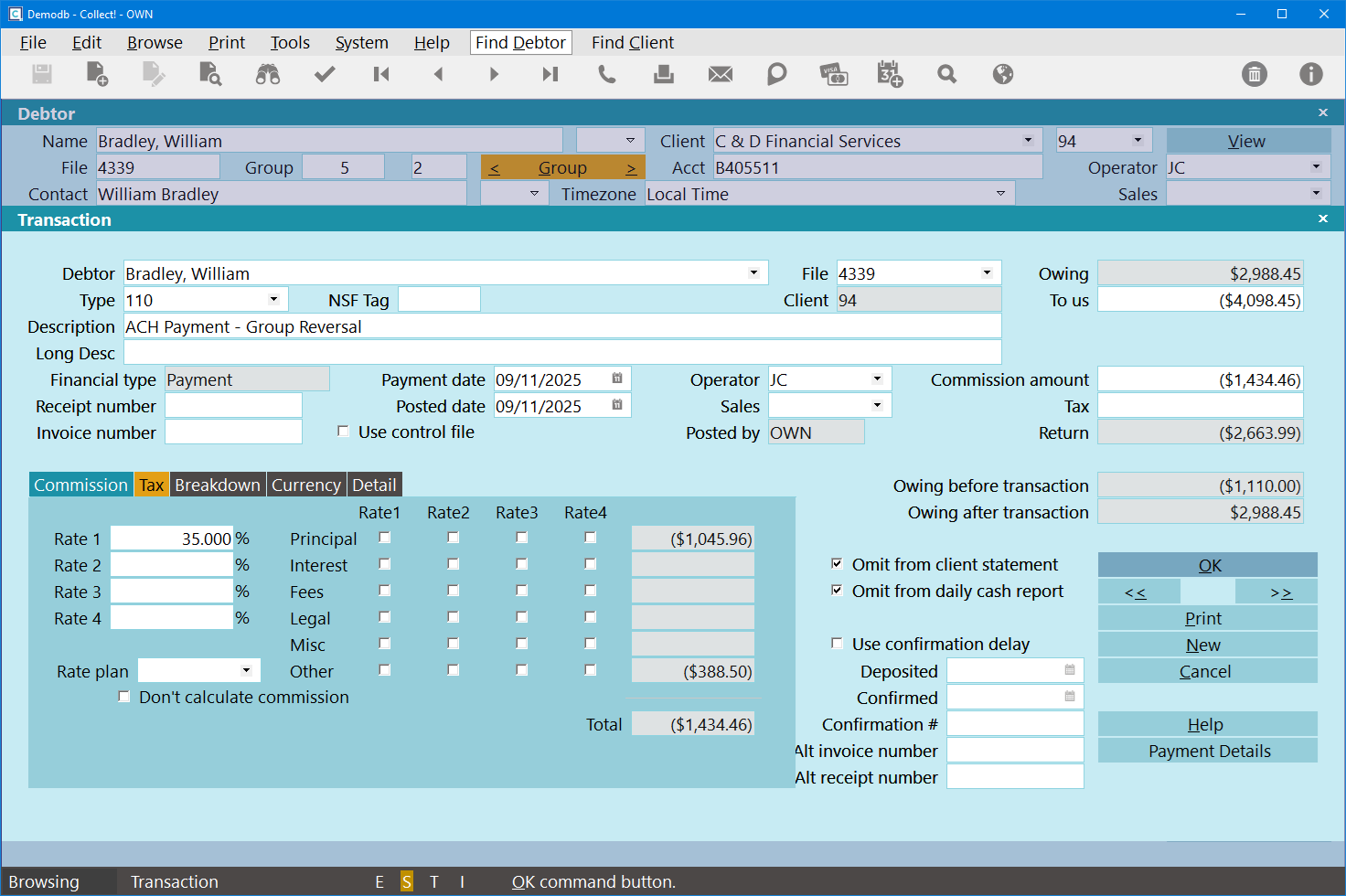

- If your Agency uses an Electronic Payment Processing company for Credit Cards or ACH

checks/debits, does the Client permit or prohibit convenience fee charges?

- Are there contractual work flow requirements or guarantees for frequency of:

- Account activity

- Manager review

- Compliance audits

- Do any of these requirements necessitate the creation of Client-specific Contact (Action)

Plans to ensure that workstandards with Milestone Triggers reach the key personnel responsible

for those functions?

The answers to these questions determine how the Client is set up in the system and what areas of

the software will require specific configuration to meet the Client's needs as well as Project

Requirements.

Many default Operator IDs, Letters and Contact Plans ship with Collect!. Upon review, you

may find that these provide the building blocks you need to get started, OR, that you have

a need to modify these stock shipping items to suit your specific operational needs. New

items can be created and changes can be made as needed.

Many default Operator IDs, Letters and Contact Plans ship with Collect!. Upon review, you

may find that these provide the building blocks you need to get started, OR, that you have

a need to modify these stock shipping items to suit your specific operational needs. New

items can be created and changes can be made as needed.

It is your responsibility to ensure that any letters you send to Debtors or contact plan

automations you enact with the system are compliant to legislation and regulations in your

region with respect to format, content and actions launched. SAMPLE letters shipped with

Collect! or available on the Member Center are SAMPLE only and intended to be rudimentary

templates for your own modification(s).

It is your responsibility to ensure that any letters you send to Debtors or contact plan

automations you enact with the system are compliant to legislation and regulations in your

region with respect to format, content and actions launched. SAMPLE letters shipped with

Collect! or available on the Member Center are SAMPLE only and intended to be rudimentary

templates for your own modification(s).

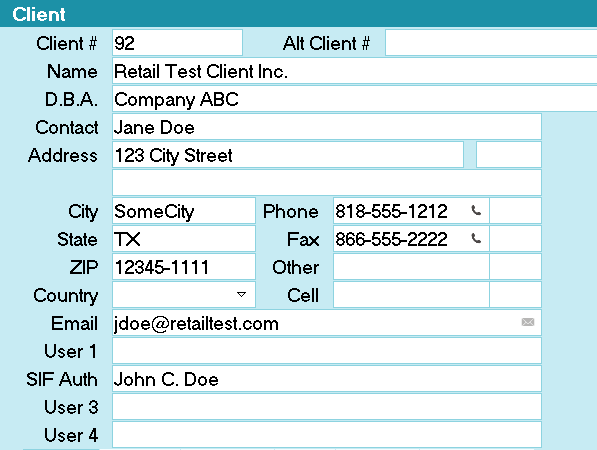

Client Form

Entering The Client

Having gathered all the information that you will need to completely configure your new Client, you

can proceed with their entry into the system.

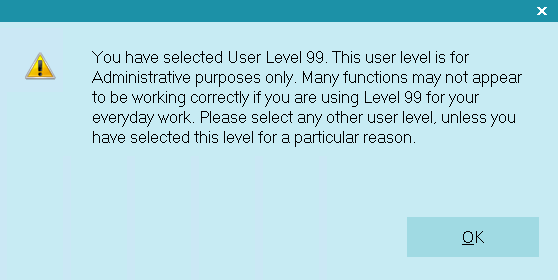

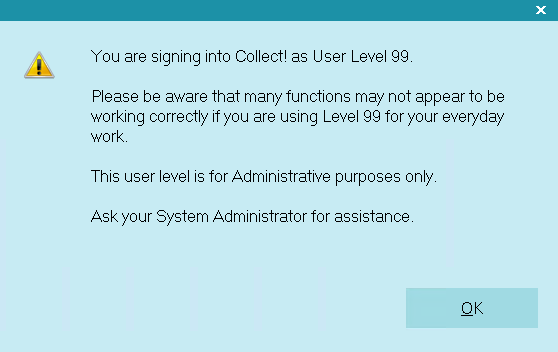

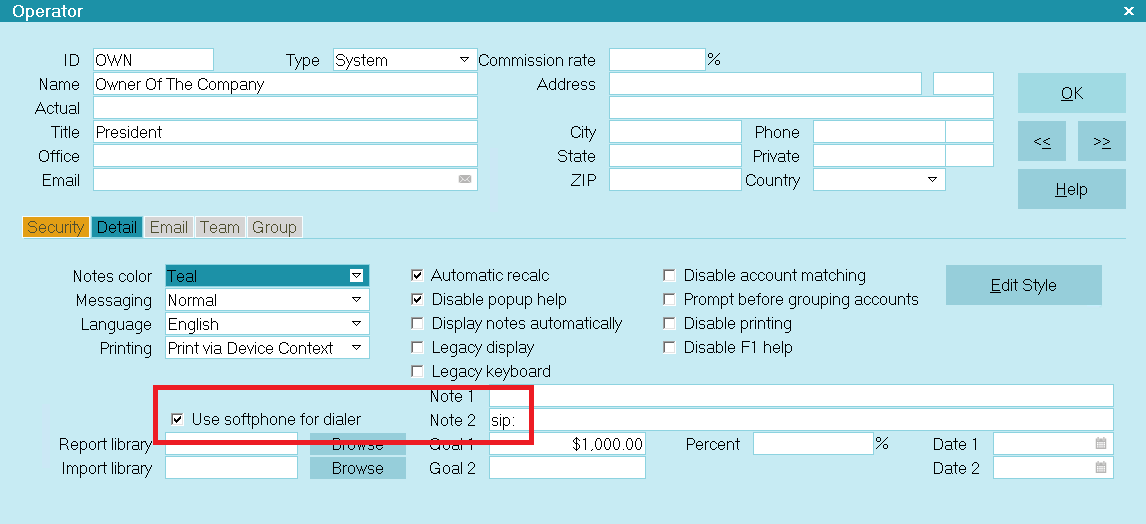

- If you have not yet created your own login, sign into the system with the login ID "OWN" and

the Password "own". The password is case sensitive. This login ships with the system and is

available when you receive the product. It is configured with Level 10 set

of access rights/permissions.

- Click the menu path \Browse\Clients from the menu bar at the top of the screen.

This will display the list of all Clients in your database. Press F3 or the NEW button

at the bottom of this list to open an empty Client setup screen.

The Client Number field fills itself as the system keeps track of what your

next available number is. It is important to make sure you don't allow duplicate Client

Numbers. This will cause data integrity corruption because the database will have no way

to distinguish between the two unrelated Clients and the data for both of them will be

intertwined.

- Fill in the business information that you have for this Client along the left side of the

screen. Navigate through the basic intake Fields using your TAB or ENTER keys.

When you are done entering in your basic intake information, your screen should look like this:

Client Basic Intake Information

The following are descriptions of Fields with special characteristics or usages in Collect!:

D.B.A.

This acronym stands for "Doing Business As". Some Clients have a corporate name to whom you are

contracted but operate under a trade or business name that is different. Use this field to store

that information.

If your Client uses this field and it is to be displayed in Client reports and remittances, you

must make sure that the field @cl.dba is expressed in the requisite documents. Similarly, if your

Client requires that their name be fully expressed with the corporate name and the D.B.A. trade name,

then you must make sure that any letters you send to their Debtors contain the Printable field Code

@cl.dba beside the field Code which outputs the Client name (@cl.na) for every instance in letters

you generate to their Debtors.

Contact

Use this field to input the name of the individual who is the primary contact inside the Client

company to communicate with your Agency or receive statements/reports issued to the Client.

Remember to edit your reports to include an "Attention: @cl.co<" line if you wish your

reports to show an individual's name with the company name/address that mailings are to be

directed to upon delivery.

Remember to edit your reports to include an "Attention: @cl.co<" line if you wish your

reports to show an individual's name with the company name/address that mailings are to be

directed to upon delivery.

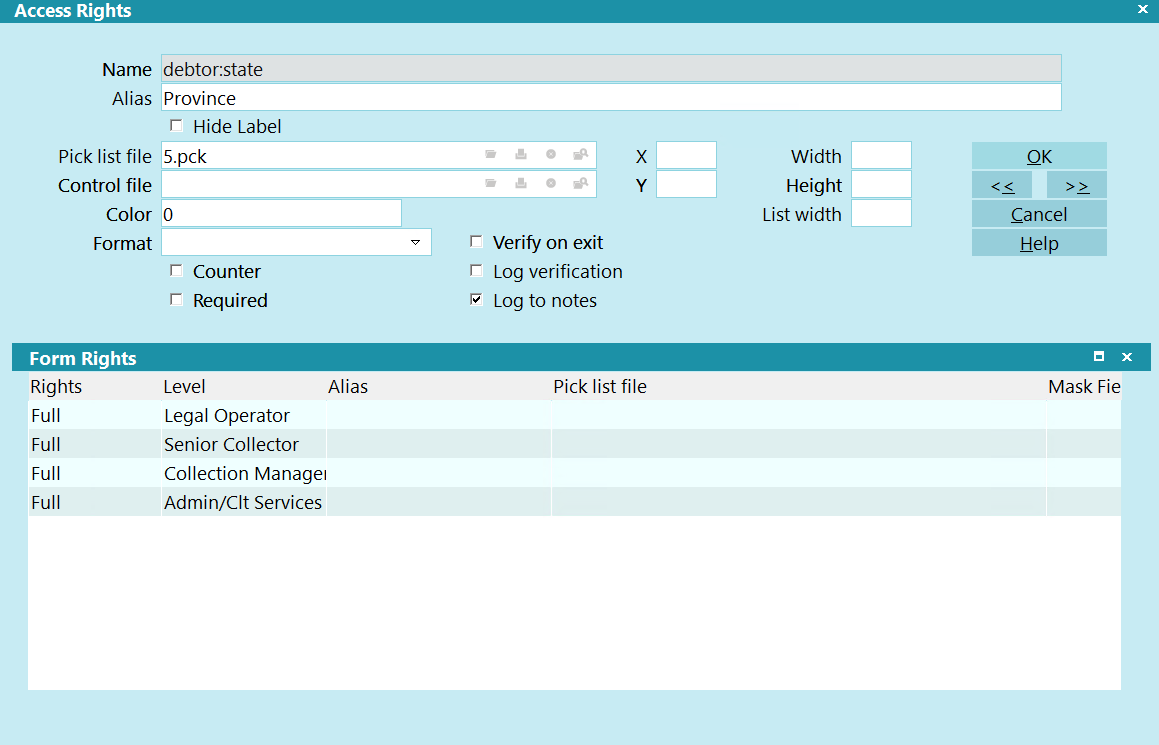

User 2 to User 4

These are free-form Fields which you may use for any purpose you require. You can relabel these

fields by mousing into the field of interest and right-clicking. The pop up offers you the

highlighted choice "Properties". Enter or click on selection to enter the Access

Rights window for this field. Relabel the field by entering what you want to display in

the "Alias" field.

In the following example, the User 2 field was renamed "SIF Auth" to indicate

that a separate individual for this Client is to be contacted for settlement authorizations.

User 2 Field Aliased as SIF Auth

The User 2 to 4 fields on the Client screen are not tied or committed to any other system

functionality and are open for site specific user defined entry, unless you are reporting to the

Credit Bureau. Please refer to How to Setup Credit Bureau Reporting for details.

Owned By Client

Use this field when you have a Client which has multiple Client Numbers in your office and they

require any of:

- A single Invoice/Statement and Check for all their Client Numbers.

- A single report to reflect inventory reporting, performance metrics or other data that is

compiled from information being derived from multiple client account numbers sources.

- Access for "master" clients via the Web Host to view sub-clients.

Timezone

Collect! ships with embedded control files (scripts) that read the area code of phone numbers on

file for Clients and Debtors. This logic will constantly make the comparison between what is the

timezone known constant for your location and the Client (or Debtor) now on the screen. Your

calculated local time for the Client (or Debtor) currently on your screen is displayed in title

bar of the active window, on the extreme right side. The title bar is the color tinted stripe

which says "Client" (or "Debtor").

Type

If you will be sending this Client's Debtors to any of the Credit Bureaus, (Equifax, Trans Union

or Experian), it is required that you set the "Type" field in the upper right corner of the screen

by selecting one of the choices in the pick list.

These choices should NOT be modified as they represent all the VALID Creditor Classification

types that are defined by, and recognized by the Credit Bureaus for reporting in a standard Metro2

file format.

General Figure and Financial Fields Visible

As you complete the basic intake information on the left hand side of the main Client screen, you

will note that the Financial Fields on the right hand side of the screen appear grayed out/Read

Only. They are blank this way when you do not have any Debtors entered.

It is recommended to run the batch process Recalculate Client Totals daily to keep your

figures up-to-date on-screen. It is also possible to recalculate an individual Client

ad hoc by clicking the Recalc button in the lower right corner.

It is recommended to run the batch process Recalculate Client Totals daily to keep your

figures up-to-date on-screen. It is also possible to recalculate an individual Client

ad hoc by clicking the Recalc button in the lower right corner.

Additional Setup Screens And Button Functions

In the lower right corner of the main Client Screen, you will see a bank of buttons. Their purpose

and general operation is described as follows:

OK

Click here when you have completed entering all your Client information to save any new or updated

information you have entered.

<< AND >>

The double arrow buttons will quick key you to the next Client forwards and backwards in your

Client list.

Recalc

Click this button to initiate an individual Client figure recalculation of all financial Fields

on the Client screen.

It is recommended that you update your Client figures regularly but in particular, before

running reports or letters which will draw upon the data in the Client stored figure buckets.

This may be done as a batch process through the menu path \Daily Administration\

Daily Batch Processing\Calculate All Totals\Recalculate Client Totals. Examples of

processes that affect financials that require process Recalc are new business entry, mass

closeouts, write back reports used to adjust commissions.

It is recommended that you update your Client figures regularly but in particular, before

running reports or letters which will draw upon the data in the Client stored figure buckets.

This may be done as a batch process through the menu path \Daily Administration\

Daily Batch Processing\Calculate All Totals\Recalculate Client Totals. Examples of

processes that affect financials that require process Recalc are new business entry, mass

closeouts, write back reports used to adjust commissions.

If you prefer keyboard navigation to mouse point/click, then observe which letter is underlined

when entering menus or needing to make a button choice. The letter in the item title that is

underlined is a quick key to enter the menu or screen. Quick key options are not case sensitive.

Example - to fast path into the Daily Administration menu from the Main Menu, keyboard "D" or "d".

If you prefer keyboard navigation to mouse point/click, then observe which letter is underlined

when entering menus or needing to make a button choice. The letter in the item title that is

underlined is a quick key to enter the menu or screen. Quick key options are not case sensitive.

Example - to fast path into the Daily Administration menu from the Main Menu, keyboard "D" or "d".

Advanced Client Settings

The Client Settings screen contains the many software switches and preference settings that will

determine how Collect! manages this Client's data. Having these preferences auto-managed streamlines

your operations, optimizing both time efficiency and quality control.

The Advanced screen must be completed before you begin entering new Debtors.

The Advanced screen must be completed before you begin entering new Debtors.

Setting entries or updates made to Clients do not retroactively update the Debtors already in the

system. Instead of trying to find a mass process or create a custom write back report after-the-fact,

better to make sure you have thoroughly entered all the requisite information for this Client from

the outset.

Client Settings Form

The Advanced Settings Screen looks as follows:

Advanced Client Settings

Before proceeding, it is necessary to have the following areas preset as pertains to the Client you

are about to enter so that the information is readily available to the system and usable in this setup

where applicable. All of these should be accomplished prior to entry of any Debtors for this Client.

- Company details

- Dunning letters

- Operators

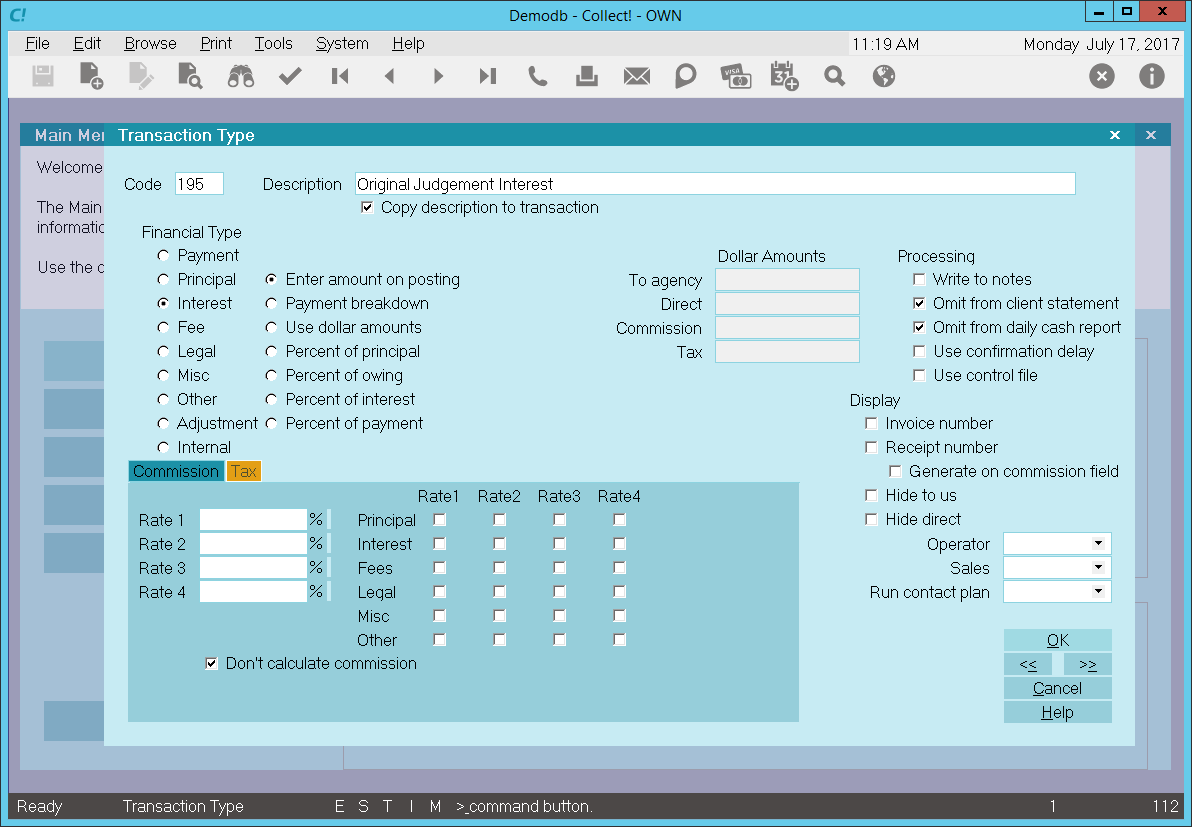

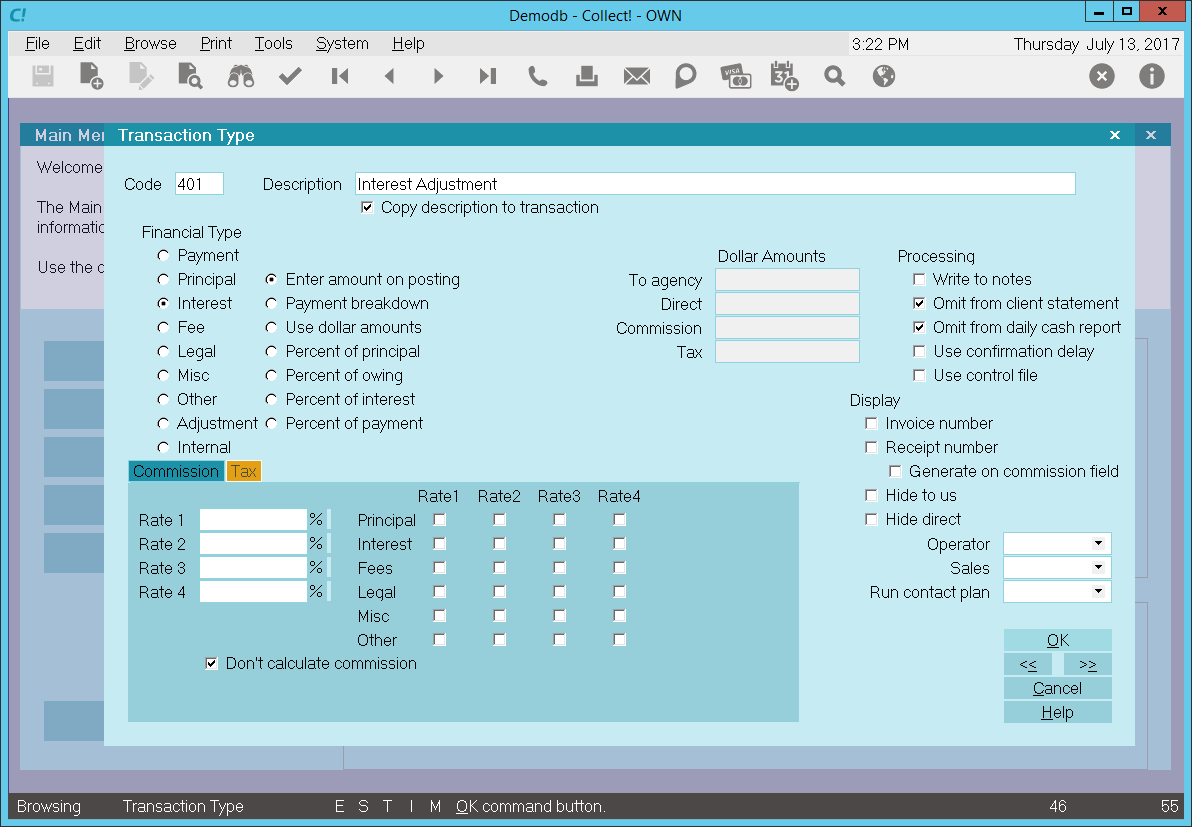

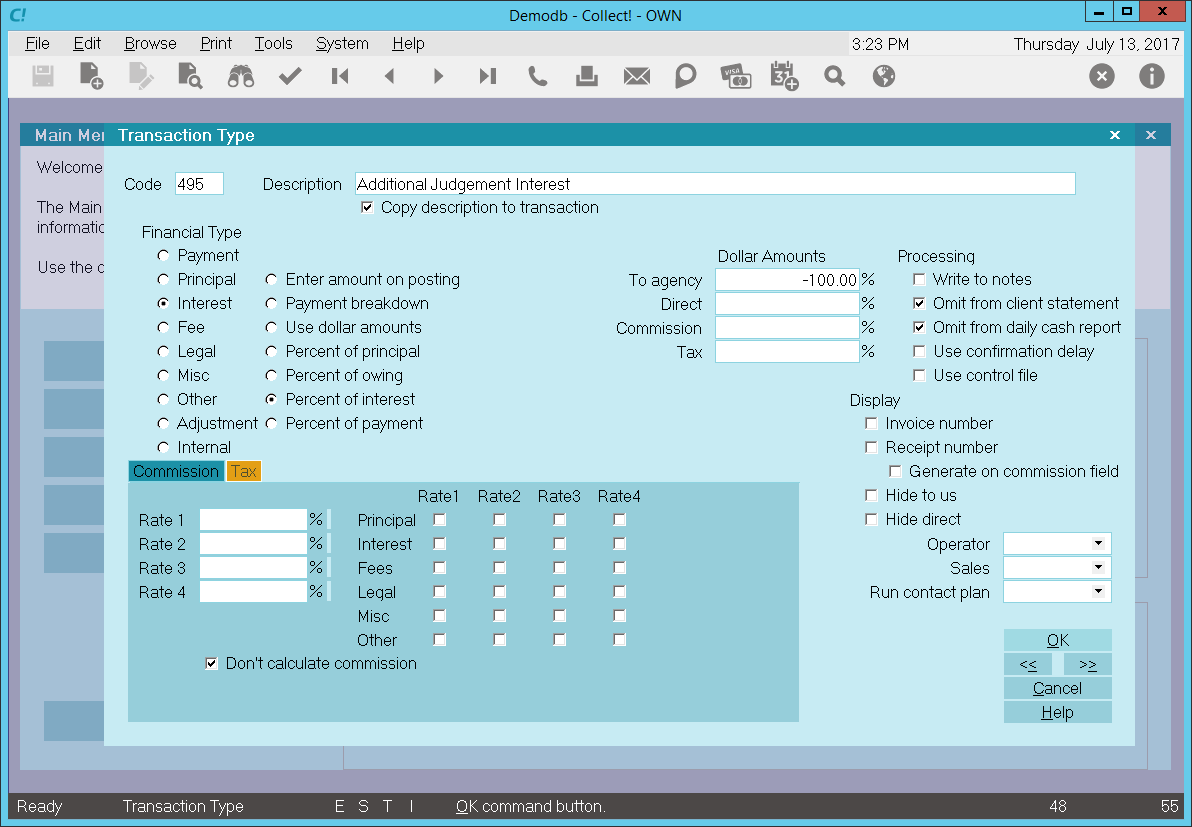

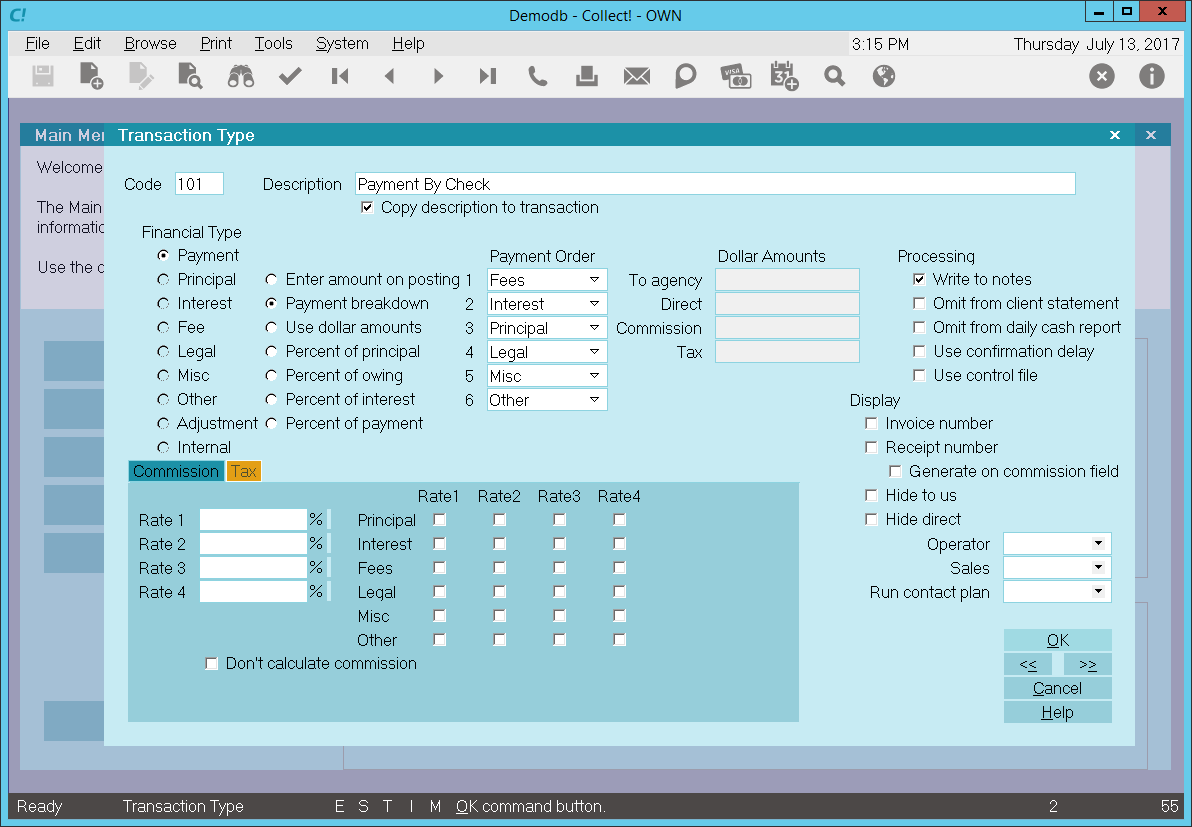

- Transaction types

- Contact plans

Many default Operator IDs, Letters and Contact Plans ship with Collect!. These are SAMPLE

only. Some may be usable for your purposes as is OR you can use the samples to assist in

creating your own customized items.

Many default Operator IDs, Letters and Contact Plans ship with Collect!. These are SAMPLE

only. Some may be usable for your purposes as is OR you can use the samples to assist in

creating your own customized items.

It is your responsibility to ensure that any letters you send to Debtors or contact plan

automations you enact with the system are compliant to legislation and regulations in your

region with respect to format, content and actions launched. SAMPLE letters shipped with

Collect! or available on the Member Center are SAMPLE only and intended to be rudimentary

templates for your own modification(s).

It is your responsibility to ensure that any letters you send to Debtors or contact plan

automations you enact with the system are compliant to legislation and regulations in your

region with respect to format, content and actions launched. SAMPLE letters shipped with

Collect! or available on the Member Center are SAMPLE only and intended to be rudimentary

templates for your own modification(s).

Getting Started

If you are not already situated on a Client Advanced Settings screen, click the menu path of

\Browse\Clients, select an existing demo Client or create a New Client. Click the Advanced

button in the lower right corner of the main Client screen.

Be sure to have all your Client requirements available as covered in the Overview section of this topic.

Specifically,

- Details of your contingency terms for commission

- Requirements for charges, fees, and taxes

- Remittance Type and Frequency

- Credit bureau reporting requirements

The Client-specific defaults you select in the Client Settings screen are automatically applied as

applicable for every Debtor entered under that Client and all processes which access this Client's

data for output of key information.

Billing, Reporting And Fees

You will notice that the left-most and middle columns of the Client Settings window pertain to

details of your contractual agreement with your Client.

Remittance Options

Billing Period

This identifies which Remittance frequency on which your Client wishes to receive their Invoice/Statement

and Checks.It is NOT recommended to leave this field blank. Even if your current Client base is the

same cycle, there may be a future point in time where you have Clients with different remittance

cycles and have need for reporting purposes to have this field populated in all your Clients.

The default Remit Type in the system is Net. There is no tangible switch to

set this preference. It is presumed in the absence of either Combined or Gross being selected.

Choose to remit Net if your Client has not stipulated otherwise. This means you deduct your

commission right away on the current Invoice/Statement instead of billing your client for

your fees and having to wait to be paid by them.

Choose to remit Net if your Client has not stipulated otherwise. This means you deduct your

commission right away on the current Invoice/Statement instead of billing your client for

your fees and having to wait to be paid by them.

The calculation of the Net Remit is:

Check Sent to Client = Total Paid Agency - (Commissions + Fees due Agency + Taxes + Balances Past Due)

Net remittances use documents called "Statement" and "Check" in your Print menu to create their

output when invoked.

There are times when you will have a Client who is going to want to change their billing

type. There are differences between the types in terms of how accounting calculations are

computed. Please see below on changing billing types.

There are times when you will have a Client who is going to want to change their billing

type. There are differences between the types in terms of how accounting calculations are

computed. Please see below on changing billing types.

Remit as Gross Funds

All funds paid to the Agency are returned to the Client at the end of the billing period and they

are billed for any commission/fees/charges/taxes due to the Agency as calculated on collections

both 'To Agency' and 'To Client' direct. The system will create a check for the gross collections

recovered to be remitted to the Client.

If you use this setting, you must have a GStatement and a GCheck

report in your Print Menu.

This switch becomes nullified if you have checked Remit as Combined Funds.

There are times when you will have a Client who is going to want to change their billing

type. There are differences between the types in terms of how accounting calculations are

computed. Please see below on changing billing types.

There are times when you will have a Client who is going to want to change their billing

type. There are differences between the types in terms of how accounting calculations are

computed. Please see below on changing billing types.

Bill Client for Negative To Us

By default with a Gross Client, when reversals (negative payments) are posted, the system will not

recover the funds from the Client. When you receive the re-payment from the Debtor, it is expected

that you would check the Omit from Client Statement box on the Transaction to prevent double paying

your Client.

To get around that you can switch this ON for a Gross Client when you need your statements to reflect

amounts owed to you for transactions posted with a NEGATIVE To Us amount.

WARNING: We recommend that this box is always on and should only be unchecked if you do not want

your clients to see reversals.

WARNING: We recommend that this box is always on and should only be unchecked if you do not want

your clients to see reversals.

Remit as Combined Funds

Check this box if your Client requires the type of remittance which treats Paid Agency

funds as "Net" while treating the Paid Client directs as "Gross". This

means all Paid Agency transactions are handled first with the Total Paid Agency amount calculated.

From that amount, any commissions/fees/charges/taxes due the Agency will be subtracted and a check

will be written for the Net difference. The Client will be invoiced for any commissions/fees/

charges/taxes due to the Agency as a result of any Paid Client directs reported in the same billing

period.

If you use this setting, you must have a CStatement and a CCheck

report in your Print menu to use when generating statements for this Client.

There are times when you will have a Client who is going to want to change their billing

type. There are differences between the types in terms of how accounting calculations are

computed. Please see below on changing billing types.

There are times when you will have a Client who is going to want to change their billing

type. There are differences between the types in terms of how accounting calculations are

computed. Please see below on changing billing types.

Bill Commission to Debtor

This switch is used if you add your commission to all Debtors' balances as a Collection Charge for

this Client.

You are responsible for using this switch ONLY if it is permissible by law to apply

Collection Charges in your region.

You are responsible for using this switch ONLY if it is permissible by law to apply

Collection Charges in your region.

Client is Tax Exempt

With this switch enabled, Collect! will not calculate tax on any commission amounts from monies

collected for this Client. This can be overridden at the Debtor or Transaction level.

Switching A Client To A Different Remittance Type

Switching from one billing type to another is as simple as checking or unchecking the applicable

boxes described above.

Gross and Combined invoice records stored receivables as a positive value and payables as a negative

values. Net stores receivables as a negative value and payables as a positive

value. For this reason, when you switch to or from Net, the system will invert the value TOTAL

field on the last invoice so the Receivables and Payables calculations for the next period will be

correct.

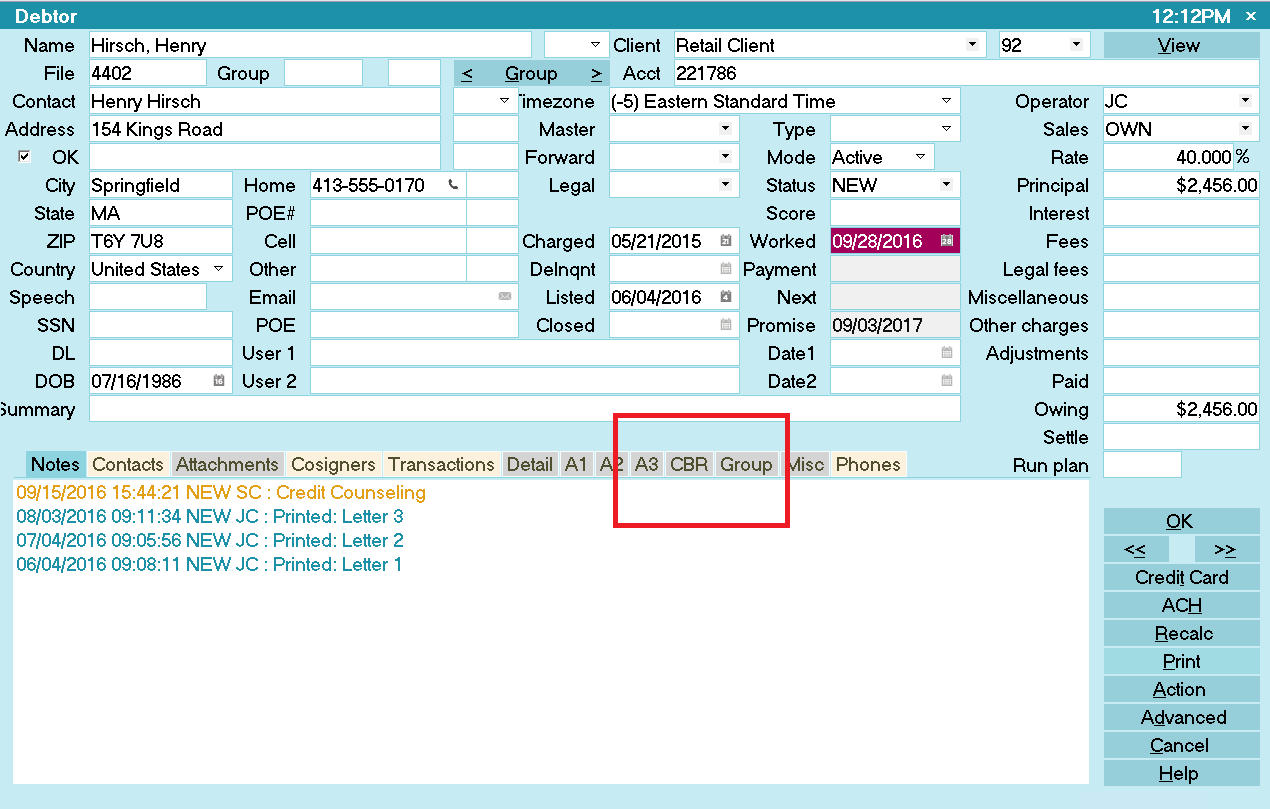

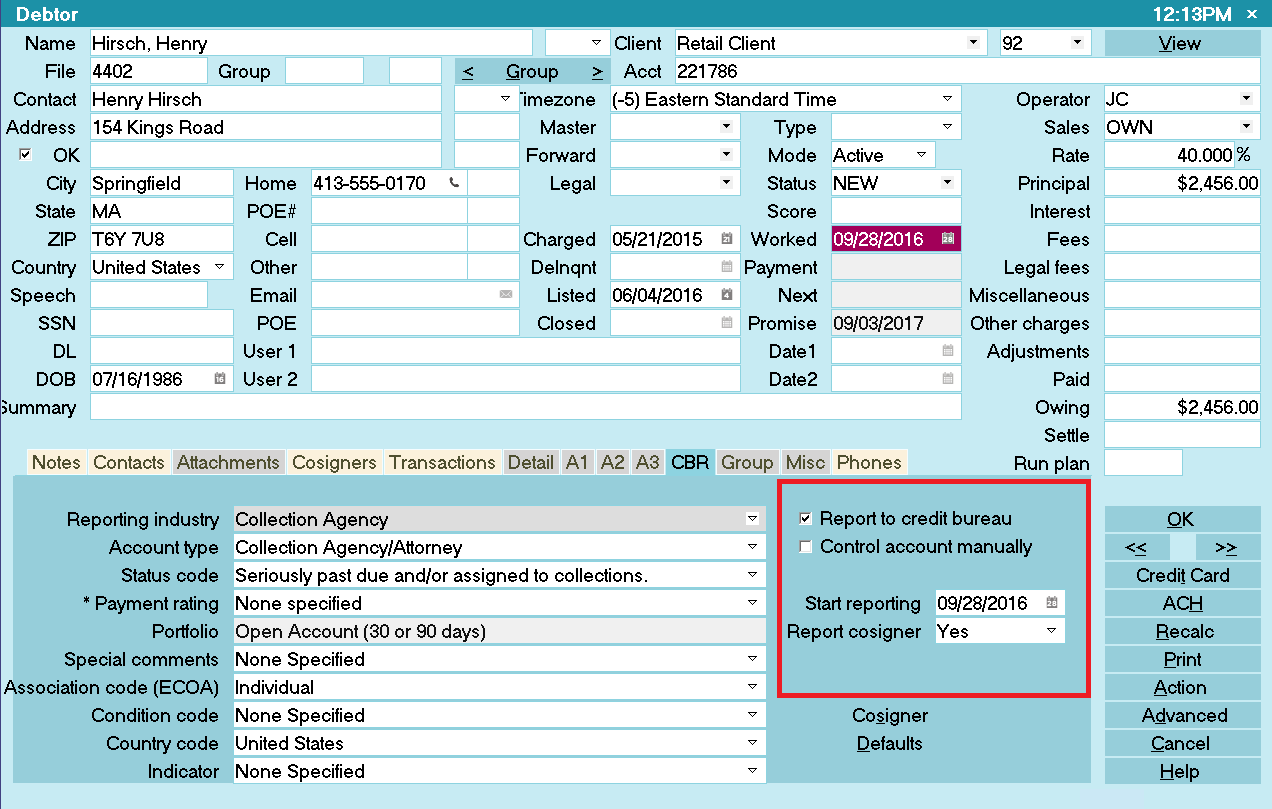

Report To Credit Bureaus

Report Accounts to Bureaus

This switch functions as an indicator that for this Client ONLY, you are permitted to report Debtors

to Credit Bureaus as having an open Collection Item with your office.

It does NOT function as the trigger to activate accounts for credit reporting when new

accounts are entered for this Client, UNLESS you have the Auto-Activate CBR setting enabled

on the Credit Bureau Setup form.

It does NOT function as the trigger to activate accounts for credit reporting when new

accounts are entered for this Client, UNLESS you have the Auto-Activate CBR setting enabled

on the Credit Bureau Setup form.

These are the ways to activate an account for credit reporting:

- Manually enter the CBR tab on a Debtor screen and check the "Report to Credit Bureau" box.

- Via the batch process, "Prepare accounts for reporting to credit bureaus"

- Enabling the Auto-Activate CBR setting on the Credit Bureau Setup form, which will enable

credit reporting after accounts are entered manually, via import, or via the web portal.

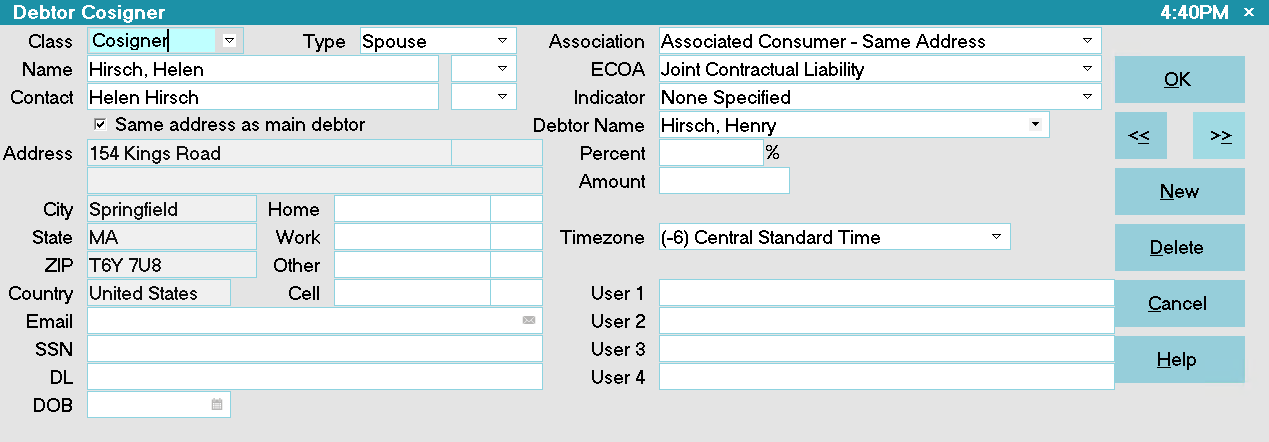

At all times, Cosigners that you wish to report MUST be manually activated in both the CBR

tab AND in the Cosigner window. The automated processes activates ONLY the primary Debtor

on the account.

At all times, Cosigners that you wish to report MUST be manually activated in both the CBR

tab AND in the Cosigner window. The automated processes activates ONLY the primary Debtor

on the account.

For more information on setting up credit reporting, refer to Credit Bureau topics.

Send Client Detail to Bureaus

You must switch ON "Send Client detail to bureaus" if you are reporting as a Collection Agency.

This is for legislative compliance to include the identity of the original creditor with each Debtor

that your Agency reports to the Credit Bureau. In the Metro2 credit reporting

record layout, this is known as the F1 segment.

If you are the original Creditor and are reporting as first party, you would leave this switch

unchecked in the OFF position. You would additionally need to ensure you have checked the "Report

as credit grantor" in the menu path "Tools\Credit Reporting\Credit Bureau Setup".

Original Creditor is in User 1 or User 2

If your company is a Debt Purchaser AND you do not have the original Creditor name entered in the

Client Name field in Collect!, check this switch ON to meet your F1

segment compliance requirement. When you manually data enter OR electronically import new

Debtors, this switch relies on the original creditor name being stored in the User 1 or

User 2 fields respectively on the main Debtor screen.

Delay From and Delay Days

These fields are intertwined. If you have "Delay Report" enabled on the Credit Bureau Setup form,

then the system will use these settings.

The Delay From should always be entered first as the next field is dependent on this value. Select

the date to use as the starting point for calculating the delay.

The Delay Days is an override to the same field on the Credit Bureau Setup form. If blank, the global

value is used. If populated, this value is used.

WARNING: When you enter or change the value, you will receive a prompt asking if you want to update

your existing accounts. If this is a new client, then you can select either option as

there are no accounts to update. If there are accounts that are setup to report, then

select the option that applies to you.

WARNING: When you enter or change the value, you will receive a prompt asking if you want to update

your existing accounts. If this is a new client, then you can select either option as

there are no accounts to update. If there are accounts that are setup to report, then

select the option that applies to you.

Min Value Of and Min Balance

These fields are intertwined. If you have "New Bus - Ignore Reporting Owing Less Than" enabled on

the Credit Bureau Setup form, then the system will use these settings.

The Min Value Of should always be entered first as the next field is dependent on this value. Select

the balance field to use for calculating the owing threshold. Balance and Total Principal are the

values at the time the account is activated for reporting, whether it be day 0 or day 100. Original

Principal is the value in the field of the same name on the Debtor's Assignment tab.

The Min Balance is an override to the "Less Than" field on the Credit Bureau Setup form. If blank,

the global value is used. If populated, this value is used.

WARNING: When you enter or change the value, you will receive a prompt asking if you want to update

your existing accounts. If this is a new client, then you can select either option as

there are no accounts to update. If there are accounts that are setup to report, then

select the option that applies to you.

WARNING: When you enter or change the value, you will receive a prompt asking if you want to update

your existing accounts. If this is a new client, then you can select either option as

there are no accounts to update. If there are accounts that are setup to report, then

select the option that applies to you.

Success Rate

On the main Client setup screen, you will notice that there is a grayed out/read-only field labeled

"Success Rate" that contains a percentage figure. This is a system-generated liquidation rate and

you have control of the equation that calculates this figure. There are software switches in the

Advanced screen which offer you three ways to calculate this field. The chosen calculation and

results displayed do not impact liquidation percentages calculated elsewhere in reports. It is an

internal measure for your company to gauge performance that is meaningful to your Profitability

Analysis on a per Client basis.

The three options from which you can select your calculation preferences are:

Calculate Using All Accounts

This calculation uses data from all files assigned.

Equation: Gross Paid X 100 / ((All Listed + All Fees) - Adjustments)

- "All Listed" includes figures from closed accounts

- "All fees" includes Debtor and Client fees

- "Adjustments" includes all transaction series types 300's, 400's and 500's, if you are using the stock

Transaction Types that ship with Collect!

Use Closed Accounts Only

This calculation uses data from MODE CLOSED accounts ONLY. An example of where this calculation

might be meaningful is if this Client is a Pre-collect/Cure type portfolio where it isn't until an

account is closed that it is considered liquidated, this would be the internal metric to use.

Equation: (All Paid (closed accounts) / All Listed (closed accounts)) X 100

Custom Success Rate

If you need your own custom calculation for liquidation rate, click the radio button beside "Custom"

and create a Control File on the Client Form that performs the calculation / write back to the

Success Rate field for this Client. When the custom option is set, Collect! will not update the

Success Rate field at all.

You may also use a Report that starts on Client to update the Success Rate to Clients in batch.

You may also use a Report that starts on Client to update the Success Rate to Clients in batch.

Fixed Fees

These switches govern whether there are any special fee handling requirements for this Client.

Use this switch if you have contractual agreement with your Client to impose a charge on them for

each account assigned OR if you are charging the Debtors for a specific fee.

You are responsible for ensuring that any fees you charge a Debtor are permitted by law

in your region.

You are responsible for ensuring that any fees you charge a Debtor are permitted by law

in your region.

No Fixed Fees

This is the default setting that should be selected if there are no special fee handling

requirements for this Client.

Charge Fee to Client

When you enter a new Debtor, the system will automatically post a Transaction Type 397

for the amount determined here that will appear on statements as a 'due Agency' charge

billed to your Client.

You will not see this fee in the Debtor balance breakdown.

You can see this charge if you click the Principal field on the main Debtor screen and enter the

"Financial Details\Fee" Tab.

Charge Fee to Debtor

When you enter a new Debtor, the system will automatically post a Transaction Type 398 for the amount

determined here that will appear in the Debtor balance breakdown. You will see it in the "Fee" field

on the main Debtor screen. This amount does become included in the Debtor's balance owing.

Commission And Tax

Commission and tax tabs in the lower portion of the Client Settings screen are used in calculating

the contingency amounts due you when your run statements for this Client.

Commission

If your contingency agreement with your Client has hierarchical conditions for what rates are to be

applied on what segment of a balance is being paid (i.e. Principal versus Interest verses Fees etc.),

you may enter custom Client rate plans with up to four levels of rates on a per Client basis in

this tab.

These settings are embedded into each new Debtor you enter into the system for the Client. If there

are reasons to do so, the default settings you affix to this Client can be overridden at the Debtor

or Transaction level on a per posting basis.

Rate

Decision which of the three possible methods for attaching your contingency terms with your Client

is the most applicable:

Individual, custom rate structure

To assign a flat commission rate for all accounts, enter the commission percentage amount into the

field under the label Rate. You do not have to enter anything below this amount

if you have only one rate that will be charged.

To differentiate between where the money is being applied with respect to the Debtors owing breakdown

(i.e. principal, interest, fees etc.), enter the applicable rate and check the box for the financial

type that rate is to apply against. For example:

- Rate: 25% on Rate 1: Principal

- Rate: 100% on Rate 2: Interest

- Rate: 0% on Rate 3: Fees

Company-wide flat commission rate

If your company charges all Clients the same flat rate, you can fast path your Client and new Debtor

entry by including this flat contingency rate in your Company Details. If entered there, you will

see the Rate field populate automatically for every Client and Debtor entered into the system,

reducing the number of keystrokes required to set them up.

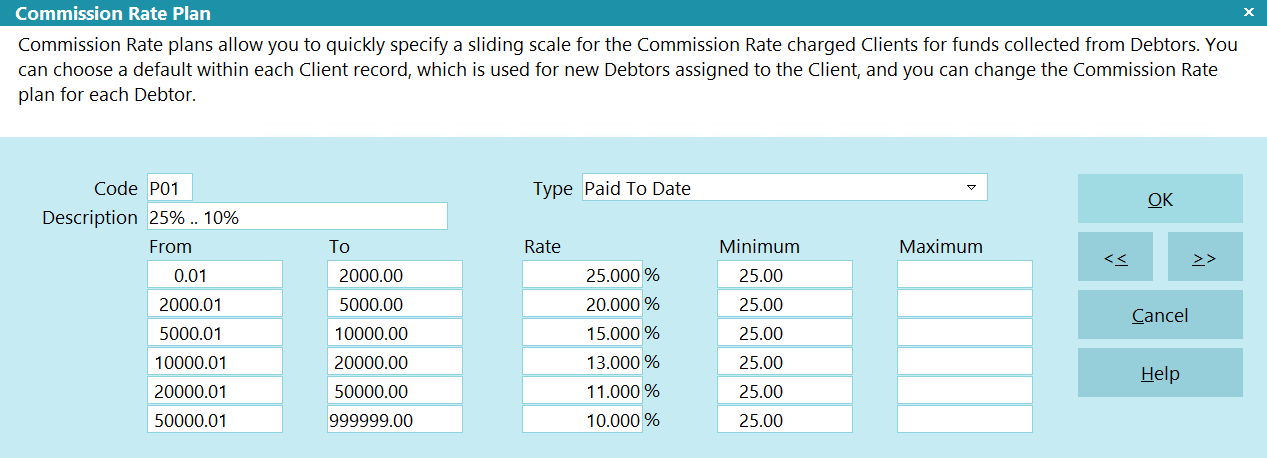

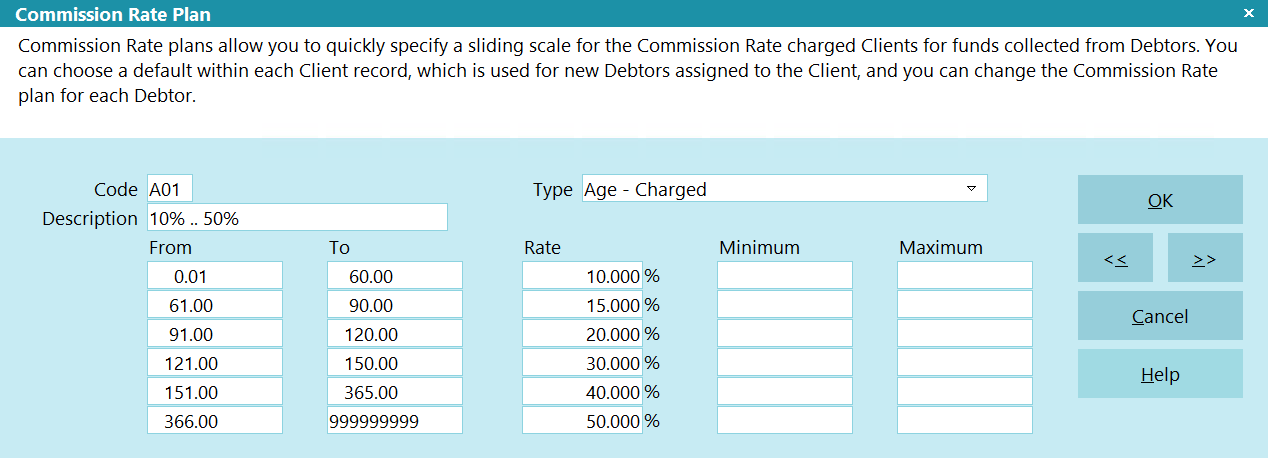

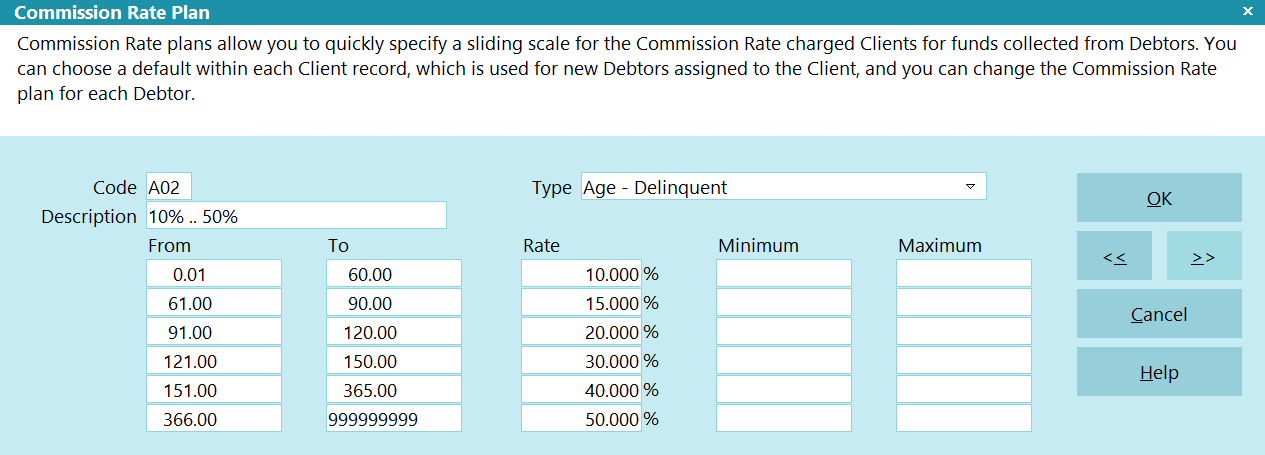

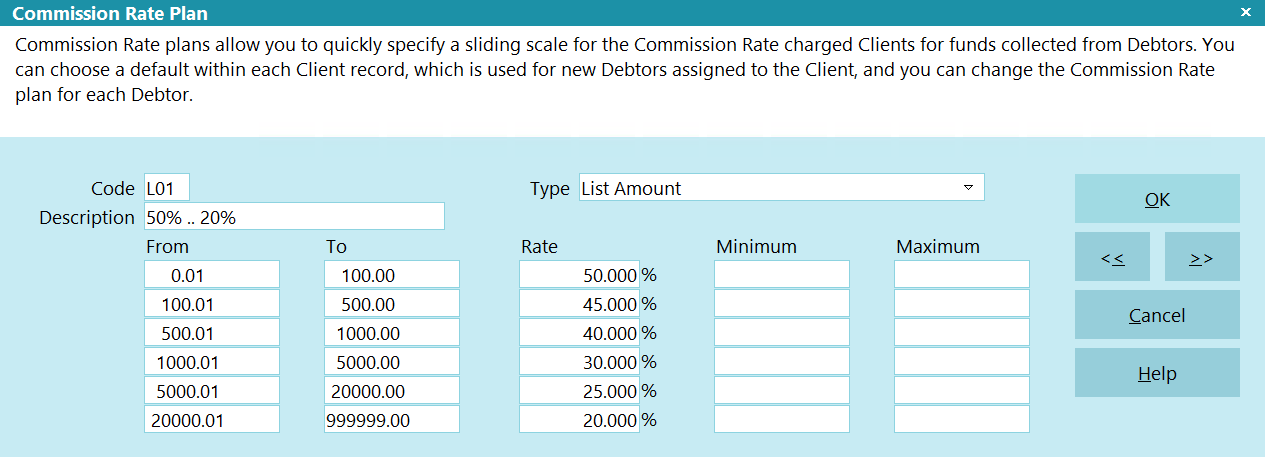

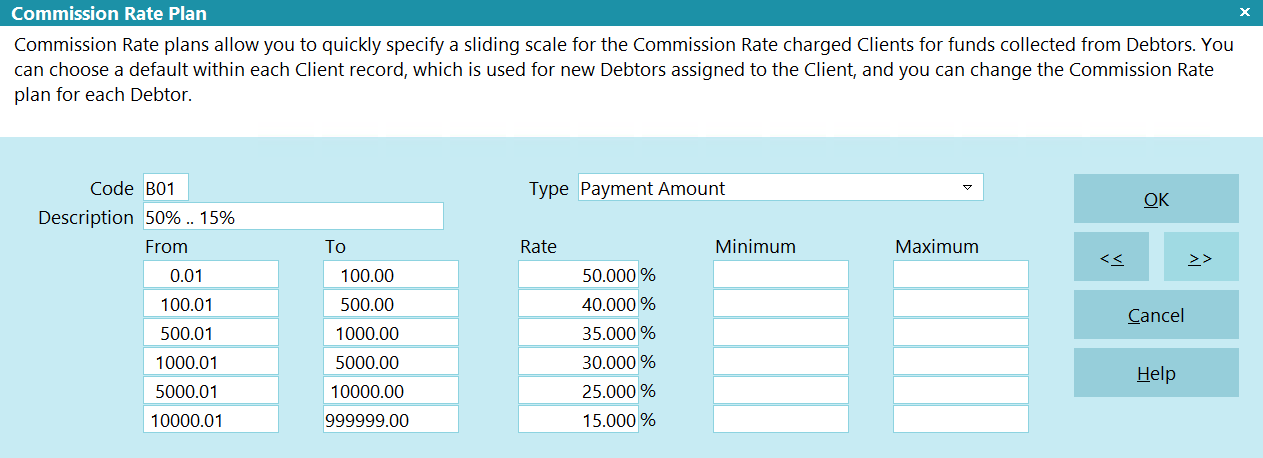

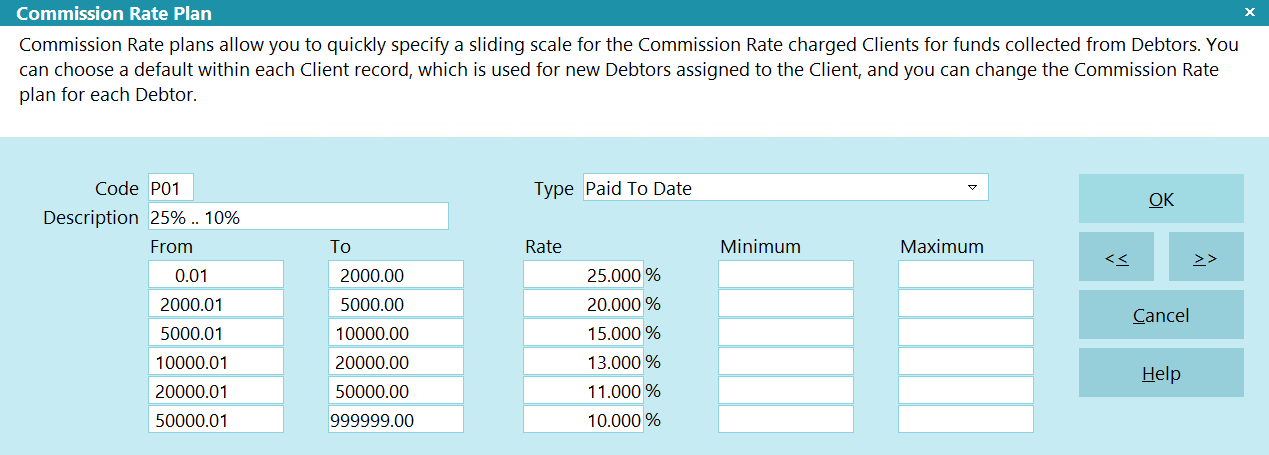

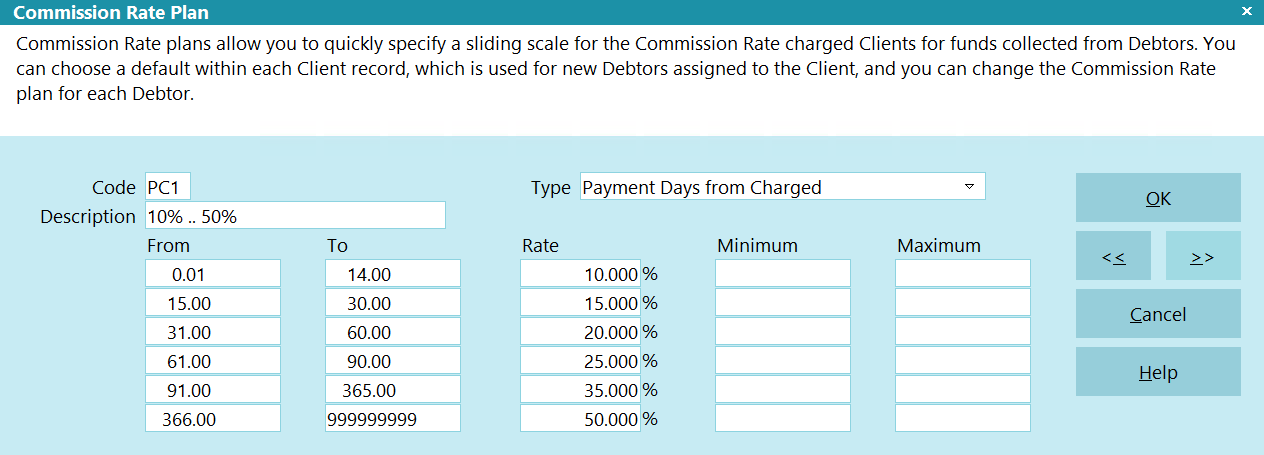

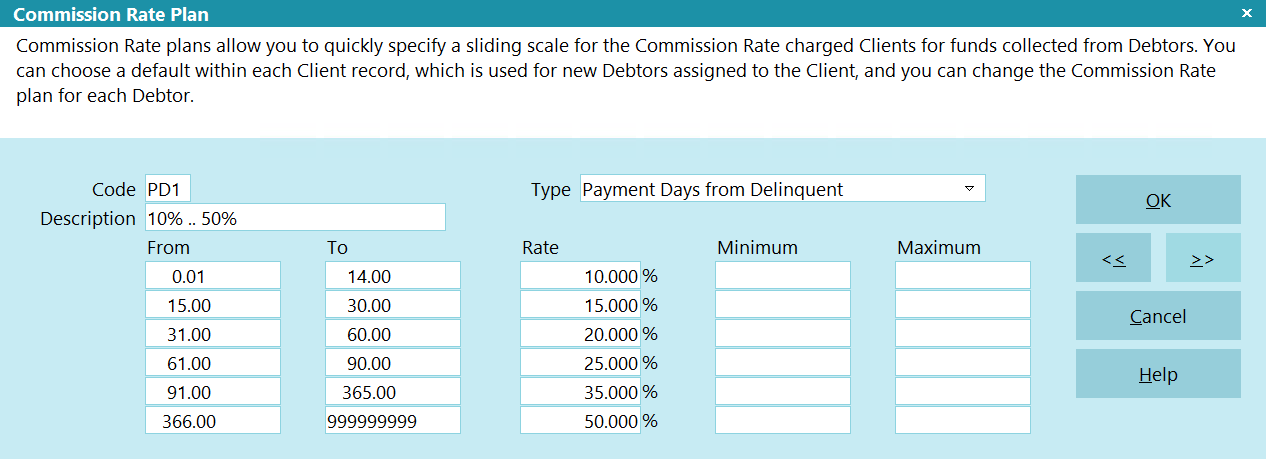

Rate Plan

If you wish to define your commission structures in rate plans that allow considerable fine tuning

for contingencies on the basis of assigned balance, remaining balance, age of account, paid to date

etc., you can set up such terms in the menu path "System\Financial Settings\Commission Rate Plan"

then select the code for that plan using the pick list on this field.

It is recommended to use a Rate Plan as defined by setup outside of the Client screen when

there are more than two rates to be applied.

It is recommended to use a Rate Plan as defined by setup outside of the Client screen when

there are more than two rates to be applied.

If you are using method #1 or #3 above, it is important to NOT input both a rate plan and

a manual commission structure in the Fee tab on the same Client. Leave the Rate plan field

blank if you are not using a plan.

If you are using method #1 or #3 above, it is important to NOT input both a rate plan and

a manual commission structure in the Fee tab on the same Client. Leave the Rate plan field

blank if you are not using a plan.

Tax

The rules for setting up tax percentages follow the same logic as discussed above for Commission.

You have three methods for how you want to affix a tax schedule:

- company-wide in Company Details

- on each Client separately

- at the Debtor payment level on a per transaction basis

In some regions, taxes may not be applicable and should be left blank. In other regions, you may

have different tax percentage rates based on where the Debtor lives.

It is each Agency's responsibility to ensure that they are compliantly charging and

remitting taxes to governing bodies in their region as per the laws of their areas in which

they do business.

It is each Agency's responsibility to ensure that they are compliantly charging and

remitting taxes to governing bodies in their region as per the laws of their areas in which

they do business.

Currency And Statement Currency

These Fields are only visible if you selected to turn ON the "Multi-Currency" switch in the "System\

Preferences\Company Details"screen. If that switch is turned OFF, neither of these two fields are

visible in the Advanced Client setup screen.

At present, both serve informational display purposes only. The default is "System Default" for both.

What the Multi-Currency switch in Company Details does presently do if you have it turned ON, is it

will auto-print North American "$" signs before monetary Fields printed in reports and letters. The

dollar sign must be manually embedded if the "Multi-Currency" switch in Company Details is turned OFF.

For any Client, Debtor, or Transaction that is set to system default, Collect! will use the

regional settings of the server to display the currency symbols.

For any Client, Debtor, or Transaction that is set to system default, Collect! will use the

regional settings of the server to display the currency symbols.

Sales ID

If your Company tracks revenue by Inside Sales Rep, this field is where you will enter the

salesperson's Operator ID for tracking purposes. House Clients can be identified by using the

owner's ID or HSE as the salesperson.

This field may remain blank (or be used for alternate tracking meaningful to your company) if you

do not utilize in-house sales staff.

Operator ID

If all new accounts are initially assigned to any of the following you may wish to enter that ID

here to save steps when new accounts are entered:

- one Collector

- one Collection Team defined by a Team Operator ID

- one New Business Feeder/Pool desk

If there is an Operator ID on the Client, all new listings will be assigned to that Operator when

you enter them manually or via import.

Operator ID settings embedded by the Client when new accounts are listed may be overridden

by BOTH selection of a different ID at time of manual or import entry.

Operator ID settings embedded by the Client when new accounts are listed may be overridden

by BOTH selection of a different ID at time of manual or import entry.

It is not mandatory to input anything into this field if you utilize Account Toss batch processing

to distribute your new accounts to multiple collectors.

Contact Plan For New Accounts

It is not mandatory that a Contact Plan be run on new assignments. However, if you wish to batch

process a series of perfunctory initialization steps, it is helpful to create a NEW Contact Plan

that does the minimum number of housekeeping steps. Example:

- Set Mode to Active

- Set Status to NEW

- Queues up your first dunning letter

- Inserts a Review or Phone contact so that the account will appear in a collector's WIP list.

If you enter accounts either manually or by electronic import and do not insert a Review or

Phone contact on the account, then you are creating Orphaned Accounts which

are on desks but NEVER appear in any body's WIP list. ALL accounts expected to appear in a

WIP list MUST have an In Progress contact event in one of the default types being Review,

Phone, Promise or Other.

If you enter accounts either manually or by electronic import and do not insert a Review or

Phone contact on the account, then you are creating Orphaned Accounts which

are on desks but NEVER appear in any body's WIP list. ALL accounts expected to appear in a

WIP list MUST have an In Progress contact event in one of the default types being Review,

Phone, Promise or Other.

It is your responsibility to ensure that any letters you send to Debtors or Contact Plans

you enact with the system are compliant to legislation and regulations in your region with

respect to format, content and actions launched. SAMPLE letters shipped with Collect! or

available on the Member Center are SAMPLE only and intended to be modified by each site

before usage.

It is your responsibility to ensure that any letters you send to Debtors or Contact Plans

you enact with the system are compliant to legislation and regulations in your region with

respect to format, content and actions launched. SAMPLE letters shipped with Collect! or

available on the Member Center are SAMPLE only and intended to be modified by each site

before usage.

Debtor Sort Order

This switch determines how accounts with payments will be presented on Client Statements. Some

Creditors have a preference which they require their agencies adhere to. If your Client wants

alphabetic sorting on their statements, click the radio button beside "Debtor Name". If your

Client wants their statements to be numerically sorted by their own account number, click the radio

button beside "Debtor Account".

Client Tabs - Description, Purpose And Use

All multi-part screens in Collect! with a Tab section will evidence a visual signal indicating

whether there is, or is not, any data contained inside that tab. A Grey tab contains no data. A

Yellow tab means there is data inside. A convenient way to train staff to watch for this is to

suggest if the Tab 'light' is ON, then something is in there that can be viewed.

Debtors Tab

The left-most tab is labeled 'Debtors'. This is where you can most directly access all Debtors

for the Client that are not Archived. There are four key ways that this tab is time-saving for

staff in areas of Clerical/Accounting, Administration, Client Services, Sales and

Operational/Project Management:

- It is possible to manually data enter new business for the Client from the Debtor Tab. The

Fields pertaining to Client Name and Client Number in your system will be auto-filled, saving

your entry operator the redundant time of repeatedly entering the Client detail with each piece

of new business.

- It is the fastest way to create ad hoc batch letters for Debtors belonging ONLY to a certain

Client or run reports that will query the Debtor File to gather data for a specific Client.

- It is the fastest way to run Contact Plans and Batch Processes (such as Collector desk reshuffles,

etc.) that pertain only to Debtors under a specific Client number.

- It is also the most convenient way for your Sales/Client Services team to access Debtor accounts

when Clients call in to request or provide info about one of their accounts.

Invoices Tab

This tab contains the invoice/statement history of the Client. The invoice/statement screens display

all the line items from each remittance as well as the 30/60/90 Accounts Receivable balance forward(s)

which the Client may have with your office. From this tab, you are able to reprint a specific statement

for a Client, if needed.

You can adjust your List View options to add the 30/60/90 Fields so that from a Browse List of

Invoice/Statements, you are able to see at a glance if your Client owes you any money and the age

of that Receivable. To do this, click into the tab so that you have a scrollable list showing you

have entered the sub-menu Invoices tab. Then Right click in the list column header line to obtain

the pop up that prompts you to do any of Edit/Move/Insert/Remove/Restore Default.

The option to enable invoice #s to appear on your remittances on a per Client basis is controlled

from the invoice screens contained in this tab. This latter is a 3-step process discussed in detail

under How To Setup Custom Invoice Numbering.

Payments Tab

This is your historical listing of all Client payments, Client reversals/charges and where you can

post new Client transactions. Please refer to the Help topic How To Enter A Client Payment to

learn how to post payments.

Notes Tab

This tab is a free-form note area where you can copy/paste email correspondence to/from the Client

as well as keep a comprehensive log of any information pertaining to individual Clients. Your Sales

Personnel and Client Services Reps can store their contact notes from Client conversations in this

tab.

Contacts Tab

This functions like the Contact tab on the Debtor screen, and pertains to Client issues. In this

tab you can schedule Client mailings/emailings, reviews to CSRs who have follow-up calls they want

to make etc. Review and Phone events would create a working WIP list and appear for the Operator

for whom the the contact event was assigned to. In this way, your staff in any of

Admin/Accounting/Client Services/Sales can use Collect! to schedule Client specific tasks within

the software without having to rely on external calendars to prompt them.

This tab functions for Clients like the Contact tab does on Debtor accounts. If your sales or CSR

staff want to create a WIP list for themselves regarding Clients, they can enter Review or Phone

Contacts on the Clients for whom they have reason to follow up.

This type of queuing can also be used for Client balance due follow-up calls.

Letter/Report contacts can also be scheduled in this tab. Example, if a Client requires a

Client Status Report every month, you can set up a repeating contact to automatically queue

up this report every month and have it created through Batch Processing, Schedule Batch Letters

for Clients whenever you are ready to print them after each month end.

Attachments Tab

This tab functions the same as it does on Debtor accounts. You may use the free-form entry Fields

in whatever manner you choose and the tab provides a place to affix Client correspondence or

documents received that need to be accessible on the Client's file history with your company.

You can customize the contents of this tab to suit your needs. Unlimited Attachment entries

categorized by user defined Class, with or without the sub-category Type can be created.

If you wish to make a global change to an Attachment field label, meaning a

designated field will be renamed for all Attachment entries, then mouse into the field of interest

and Right click. You will get a pop up asking you to select what you want to do. Click on

"Properties" to gain entry.

A more advanced utilization of this feature is for the field name labels to be contingent on a

specific Class, meaning the same field can be used for different purposes depending on a logic

condition such as Class is "Contract" or Class is "Correspondence". This is accomplished by

creating a script/control file which defines what field Alias names are displayed as a function

of what Class of Attachment is selected.

Depending on what you need, you may find a script/control file that is very close to your need on

the Member Center which you can download and install. Alternatively, if you would like Tech Support

to create a custom script/control file for you, contact us for pricing.

Keep your Alias label names short enough to fit in the physical screen space allotted for

that field to avoid cut off portions of word(s) and congested visuals presented to your

staff. Cluttered screens are hard on the eyes and make it difficult to locate the information

at-a-glance.

Keep your Alias label names short enough to fit in the physical screen space allotted for

that field to avoid cut off portions of word(s) and congested visuals presented to your

staff. Cluttered screens are hard on the eyes and make it difficult to locate the information

at-a-glance.

To make additions and customizations to the Class and/or Type pick-lists, refer to "How To Use Pick

Lists" for more detailed instructions.

If you put a url in the File field, the system will call your web browser and take you

directly to the website when you click on the 'File Folder' icon (that you'd normally use

to Open an attached file) at the end of the File Name line.

If you put a url in the File field, the system will call your web browser and take you

directly to the website when you click on the 'File Folder' icon (that you'd normally use

to Open an attached file) at the end of the File Name line.

Associates Tab

This section has the same layout as the Debtor's Cosigners tab. This tab is intended to store addition

contact people for a Client. You can also setup Associates to be included in Batch Letters or Emails.

Phones, Emails, Addresses Tabs

These sections behave the same as the Debtor. When you enter Phone numbers, Addresses, or Emails on

the Client form, applicable records are also created or updated here.

You can also manually create records here for situations where users have multiple contact information

such as Billing Address versus Shipping Address.

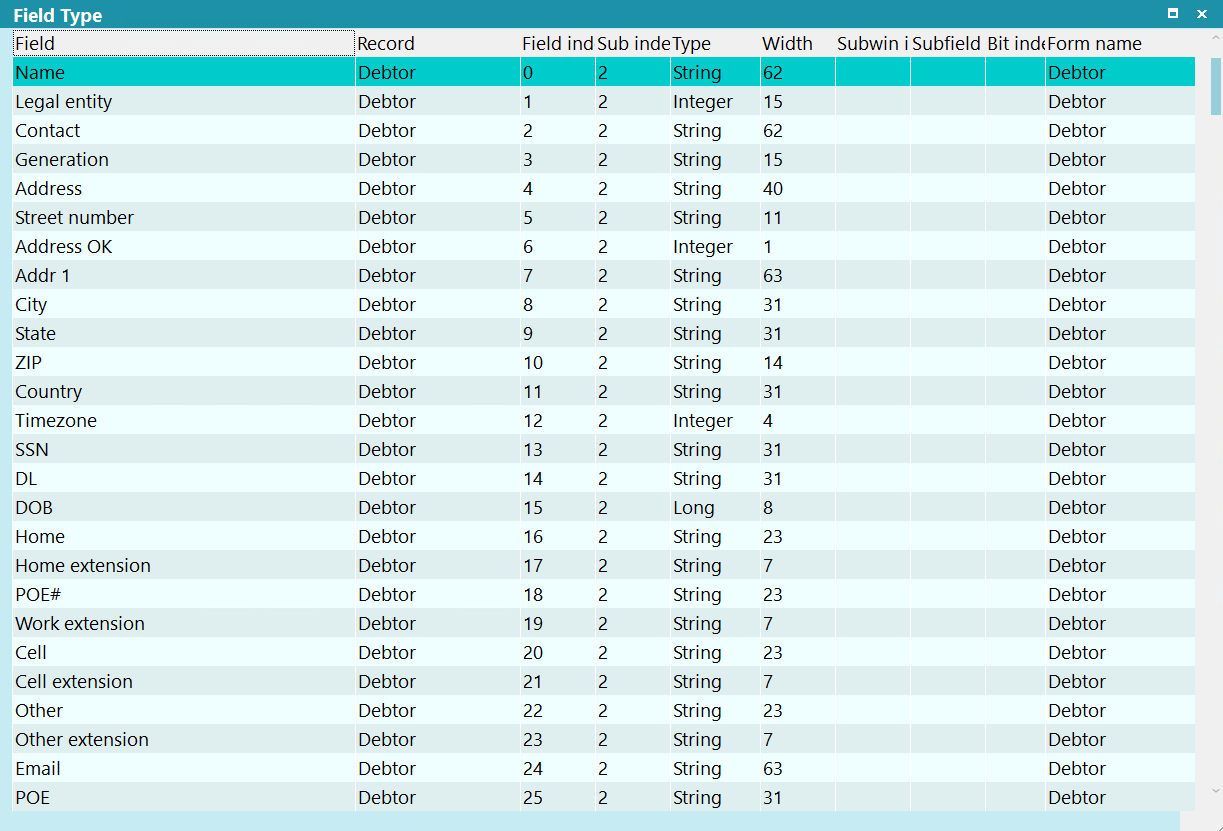

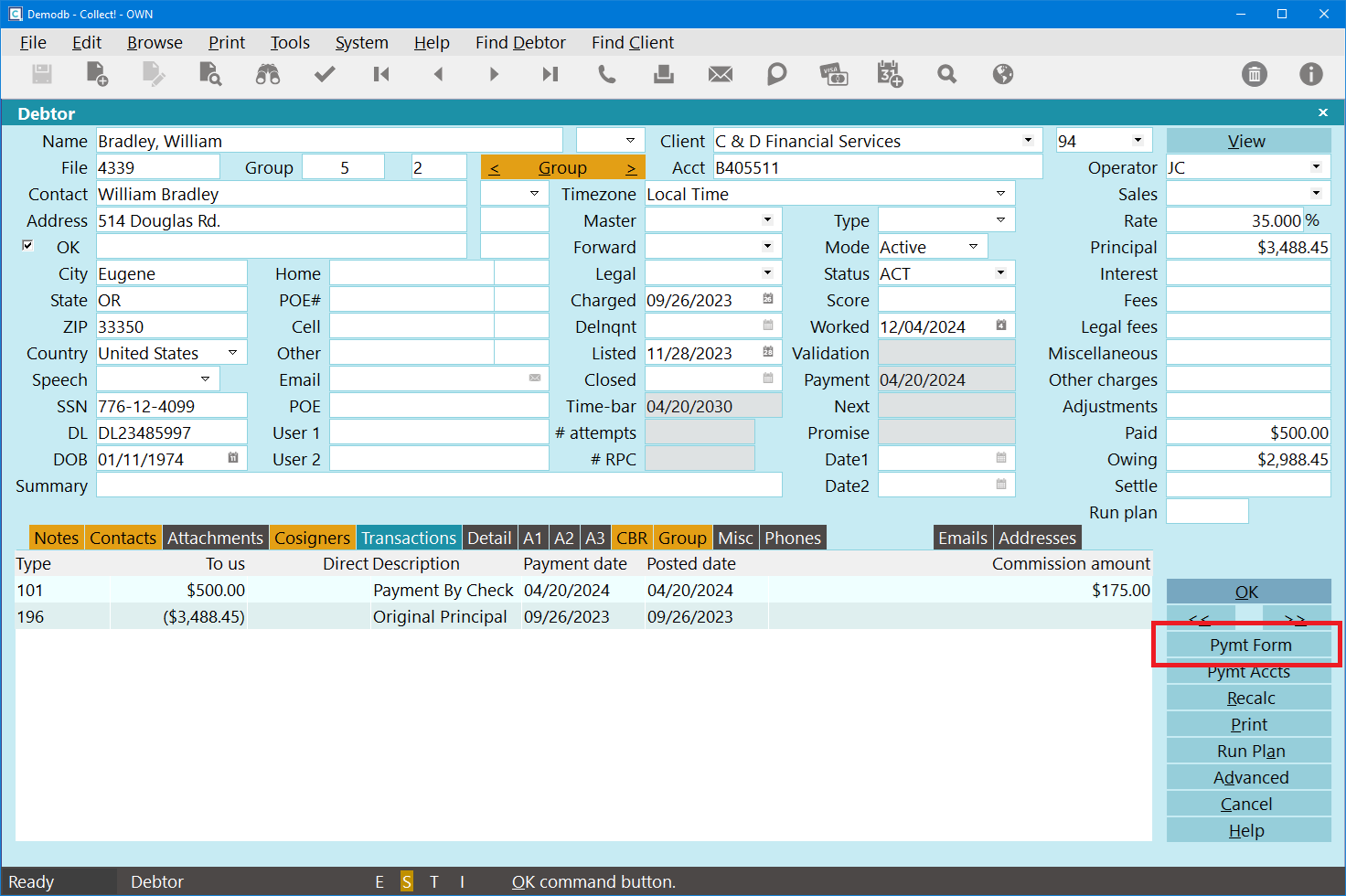

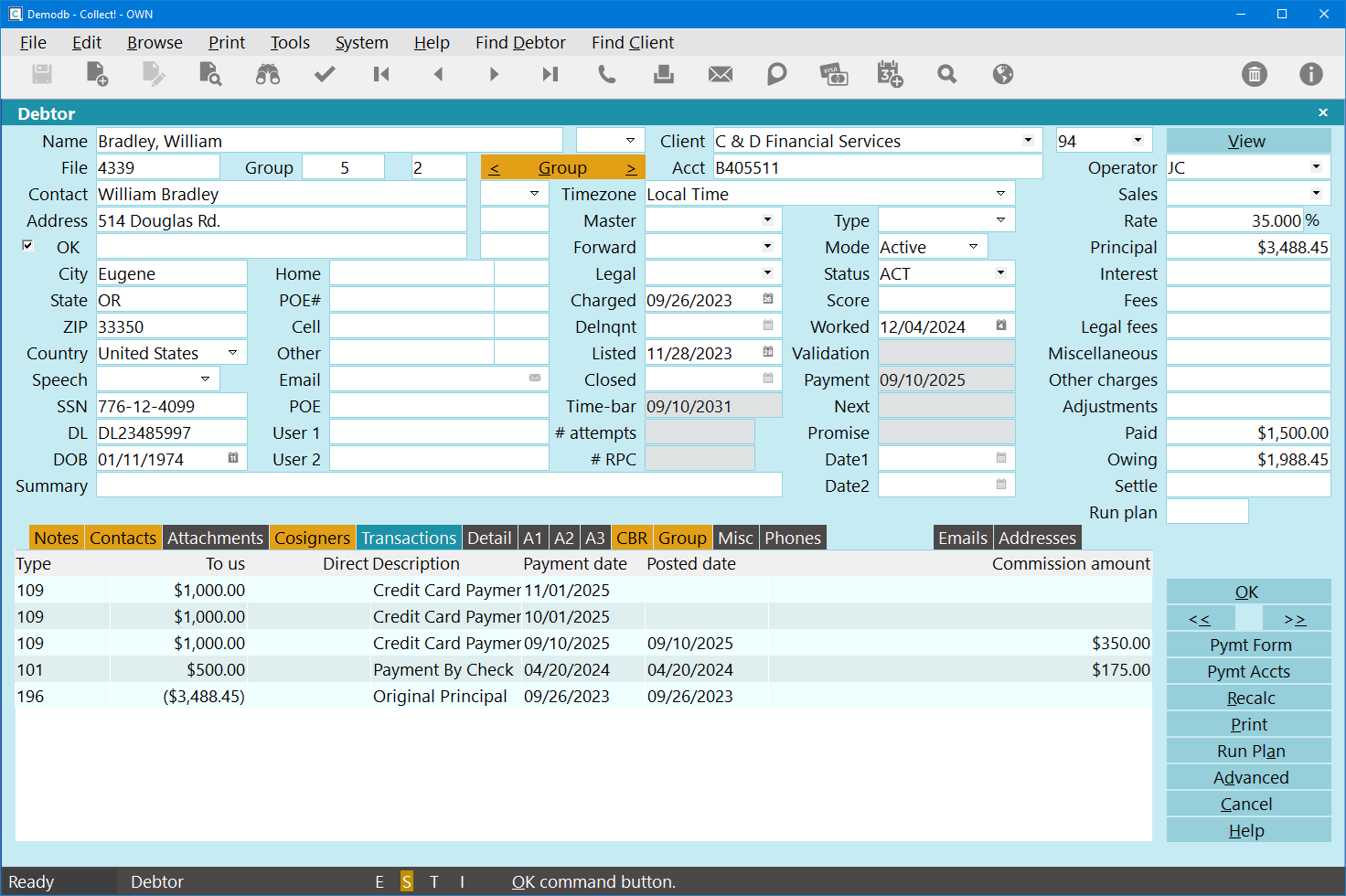

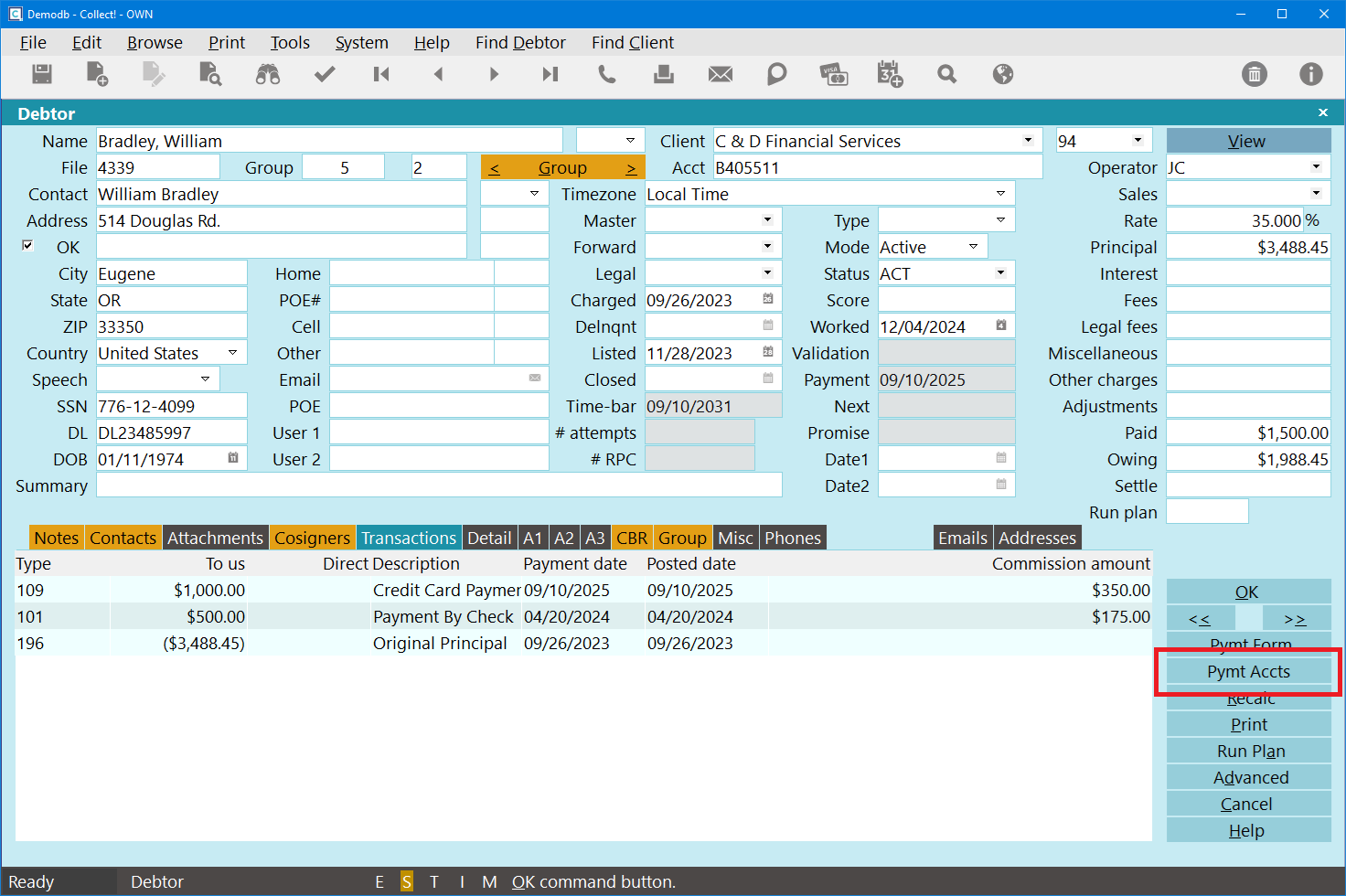

Debtor Setup

The Debtor form is used to store all account information. All account related information is stored

in areas accessible from the Debtor screen.

Entering new debtors and setting them up requires a good understanding of each information field in

the Debtor form. This is particularly important when planning your letters and reports because the

bulk of reported information is pulled directly from this form.

Click Here to View this Form.

Click Here to Close this Form.

This document discusses entering a new Debtor in your Collect! database. It is assumed that you have

signed into Collect! as a user with access rights to enter information into the fields on the Debtor

form.

Opening The Debtor Form

There are 2 ways to access the Debtor form to create a new account:

- Browse Debtors

- From the Client Screen

We are going to use the Client's Debtor list in this walk through.

Debtors must be attached to a Client so that all the month end financials will calculate

correctly when you are figuring your commission and what you owe your clients.

Debtors must be attached to a Client so that all the month end financials will calculate

correctly when you are figuring your commission and what you owe your clients.

- Select Browse from the top menu bar and then select Clients from the drop-down choices. The

list of all clients will be displayed.

- Choose the Client whose new Debtor you are about to enter.

- When the correct Client form is displayed, you can select the ADVANCED button on the Client

form, if necessary, to enter, modify or simply verify the settings, such as Commission Rate,

Tax Rate, Operator assigned to new accounts, and other settings you may need. When you are

finished with the Client Settings form, select the OK button to close it and return to the

Client form.

- Click into the Debtor List, then click the NEW button. A new Debtor form will be displayed.

An important question will help you to enter your debtor information correctly right from the

start. Will you ever need to report the information to a credit bureau? If so, you will need

to pay special attention to the fields on the Debtor form. Many are related to information

that will be sent to the credit bureaus when you produce a CBR file. You will notice that

some fields have a FOR CBR note attached to them when you view the pop up help for the field.

These are fields where information must be entered in a particular way if you ever intend to

report this debtor to credit bureaus. These fields have additional information in the field

help that outlines the proper formats required.

An important question will help you to enter your debtor information correctly right from the

start. Will you ever need to report the information to a credit bureau? If so, you will need

to pay special attention to the fields on the Debtor form. Many are related to information

that will be sent to the credit bureaus when you produce a CBR file. You will notice that

some fields have a FOR CBR note attached to them when you view the pop up help for the field.

These are fields where information must be entered in a particular way if you ever intend to

report this debtor to credit bureaus. These fields have additional information in the field

help that outlines the proper formats required.

Debtor Form

Print, PDF, or keep this section handy as you will need to populate the Debtor fields correctly.

Default Fields Populated

Some fields on the Debtor form are filled in automatically by Collect! when you create a new account

for an existing Client.

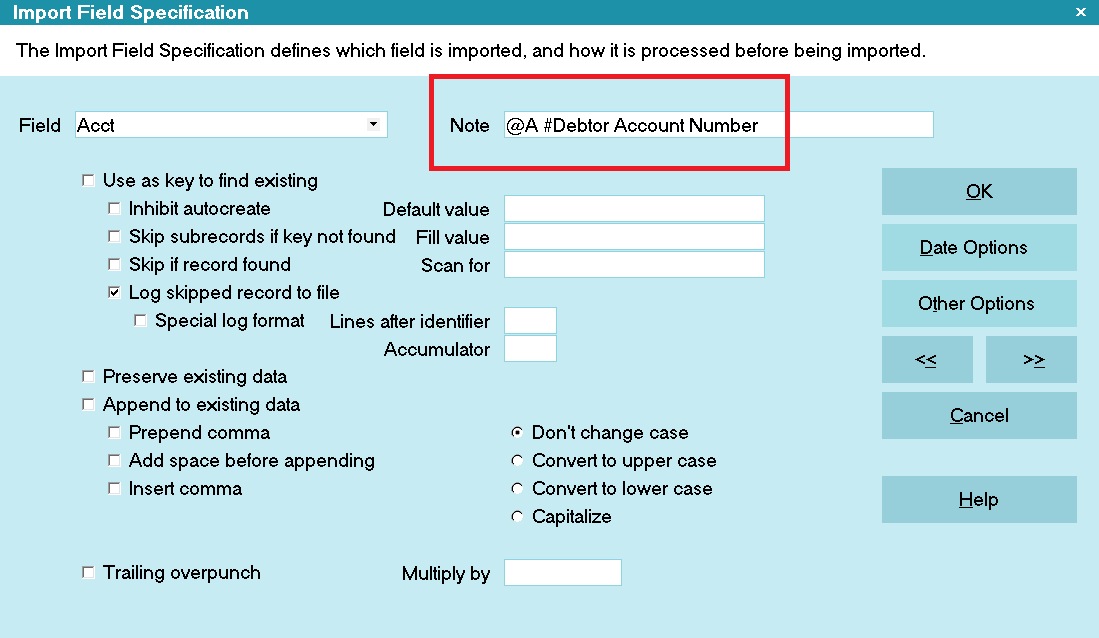

- Locate the File field and notice the number that Collect! has assigned to this account.

WARNING: The File Number is an auto-generated unique identifier for this account and should not

be confused with the Client's Account number in the Acct field.

WARNING: The File Number is an auto-generated unique identifier for this account and should not

be confused with the Client's Account number in the Acct field.

- The Client field and next to it, the Client's number, will have the client that you created

the account from.

WARNING: The Client Name or Number will need to be populated manually if you added the account

from the Browse Debtor list.

WARNING: The Client Name or Number will need to be populated manually if you added the account

from the Browse Debtor list.

- The Mode field is filled with 'Active'. This is the correct Mode for all accounts that you are

actively working. It ensures correct calculations of financials an enables your operators to

work the accounts from their WIP Lists.

- The Listed field will have today's date.

- The Rate field will show the Commission Rate based on the Client's settings.

- The Operator and Sales fields will show the account assignment.

- The Run Plan field will have the Contact Plan scheduled to run, if one is set on the

Client Settings. Do NOT empty this field, or the Plan will not run.

- If you have set any fields to populate with a Control File, they will be set now.

Popup Help

In addition to the Debtor form information above, you can also enable the Popup while you are learning

how to enter a new Debtor. Many fields require special formatting if you intend to report to credit

bureaus and popup help alerts you to them.

Select Help from the top menu bar and then select 'Enable popup help' from the drop-down choices.

If it is already enabled, you do not have to do anything to begin to use it. Simply hold your mouse

over the field of your choice and help will display.

Entering Debtor Identity And Demographic Information

Use the information from the Debtor Form section above as you fill the fields on the Debtor form,

or hold your mouse over each field to read the details for that particular field, if you enabled

the popup Help.

When looking at the Debtor form, there is a pseudo division line between the identity and demographic

information on the left and the account information on the right, starting with the Dates.

- Enter the Debtor's name. It must be in "Last Name, First Middle" format.

- Select a Legal Entity if you want to track commercial accounts or report commercial accounts

to the credit bureaus.

- Pay special attention to all references to credit bureau (FOR CBR) in the Debtor help for

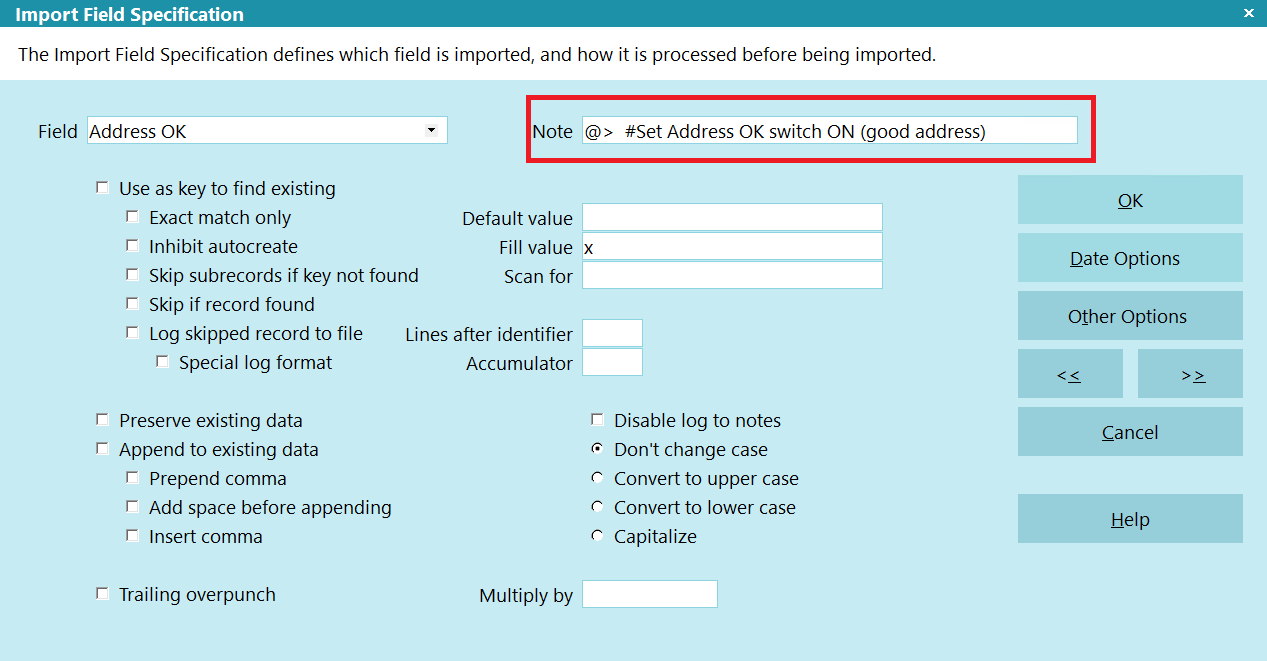

addresses. If you ever intend to report this Debtor to credit bureaus, enter the address

information in the correct format.

- After filling in the Zip, the system will automatically check the Address OK box. This needs

to be checked for letters to go out in Batch Printing.

- Fill in all other identity and demographic fields as you require.

If you have account matching enabled, you may receive a prompt on the applicable fields

like name or SSN asking if you want to add this account to the Group. If you select YES,

Collect! can copy the identity and demographic information from the group to the newly

entered account.

If you have account matching enabled, you may receive a prompt on the applicable fields

like name or SSN asking if you want to add this account to the Group. If you select YES,

Collect! can copy the identity and demographic information from the group to the newly

entered account.

The Timezone field should populate automatically, if you are using a Control File that sets

it when the Phone or Zip fields are updated.

The Timezone field should populate automatically, if you are using a Control File that sets

it when the Phone or Zip fields are updated.

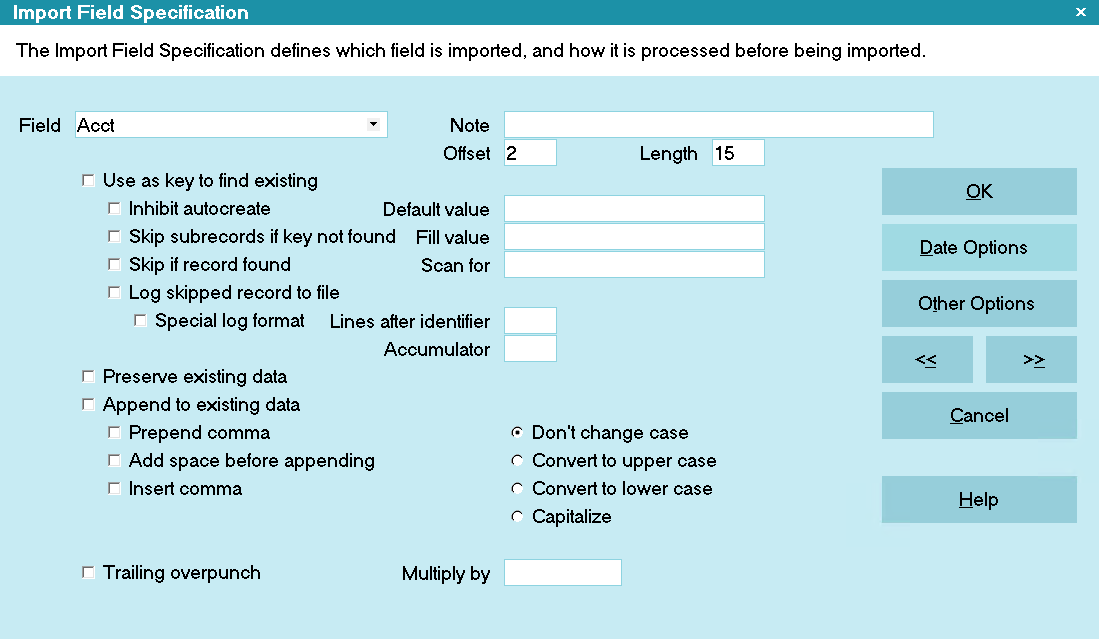

Entering Account Financials And Assignment Information

- Enter the Client's Account Number/Identifier into the Acct field.

Depending on how you organize your accounts, if you receive the same account number multiple

times, but for different invoices, you can store the account number here and the invoice

number in another field, or vice versa.

Depending on how you organize your accounts, if you receive the same account number multiple

times, but for different invoices, you can store the account number here and the invoice

number in another field, or vice versa.

- Forward and Legal are used for tracking, if you are outsourcing collections or legal activity.

- Type is optional and used for your own tracking purposes.

- Status is usually set in the initial Contact Plan; otherwise, enter one.

- If not already set, select an Operator.

- Click either the PRINCIPAL field or ADVANCED button.

- On the Assignment tab, enter the applicable dates from your client.

WARNING: For USA: Your Client must supply you with all applicable dates that match their selected

Itemization Date.

WARNING: For USA: Your Client must supply you with all applicable dates that match their selected

Itemization Date.

For Credit Bureau Reporting, you must enter a Delinquency Date.

For Credit Bureau Reporting, you must enter a Delinquency Date.

- Enter the Original Principal.

- If supplied, entered any other Original financials.

- If this account is contracted for Interest, go to the Interest tab.

- Set the Interest Type

- Set the Annual Interst Rate

- Set the Calculate Interest From Date

For more information, please refer to the How To section of the Help for setting up Simple,

Compound, or Variable Interest.

For more information, please refer to the How To section of the Help for setting up Simple,

Compound, or Variable Interest.

- Click on the Commission Tab at the top to validate the information.

- Click on the Tax Tab at the top to validate the information.

- Click on the Fees Tab at the top to validate the information.

- Click OK to return to the main Debtor screen.

Navigate The Tabs

- Enter any Notes for the account, including any Client Notes.

- Contacts, like Phone call follow ups, are usually set by the initial Contact Plan; otherwise,

create a Phone contact.

If you are not using a New Business workflow (Contact or Action Plan), then you should also

print or schedule the initial Letter. You should also consider creating a New Business

Contact Plan to automate several of the steps of creating a new account.

If you are not using a New Business workflow (Contact or Action Plan), then you should also

print or schedule the initial Letter. You should also consider creating a New Business

Contact Plan to automate several of the steps of creating a new account.

- If applicable attach any documents supplied by the Client. Attachments can also be used to

track other information like Assets or Health Insurance.

- Add any Related Parties, like Cosigner (Co-Debtors), Employers, or general contact people.

- The applicable transactions will have already been created. If there are more, like fees,

add them now.

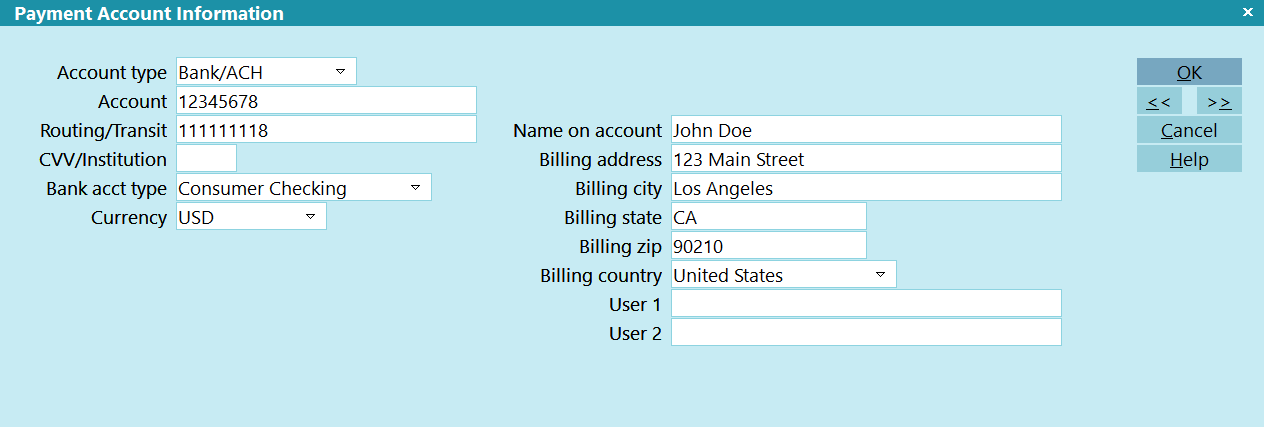

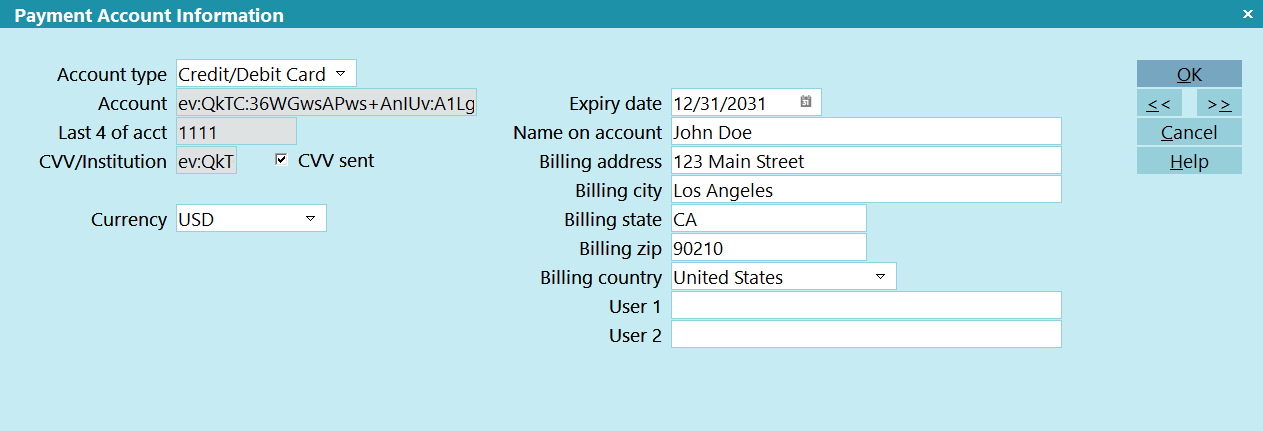

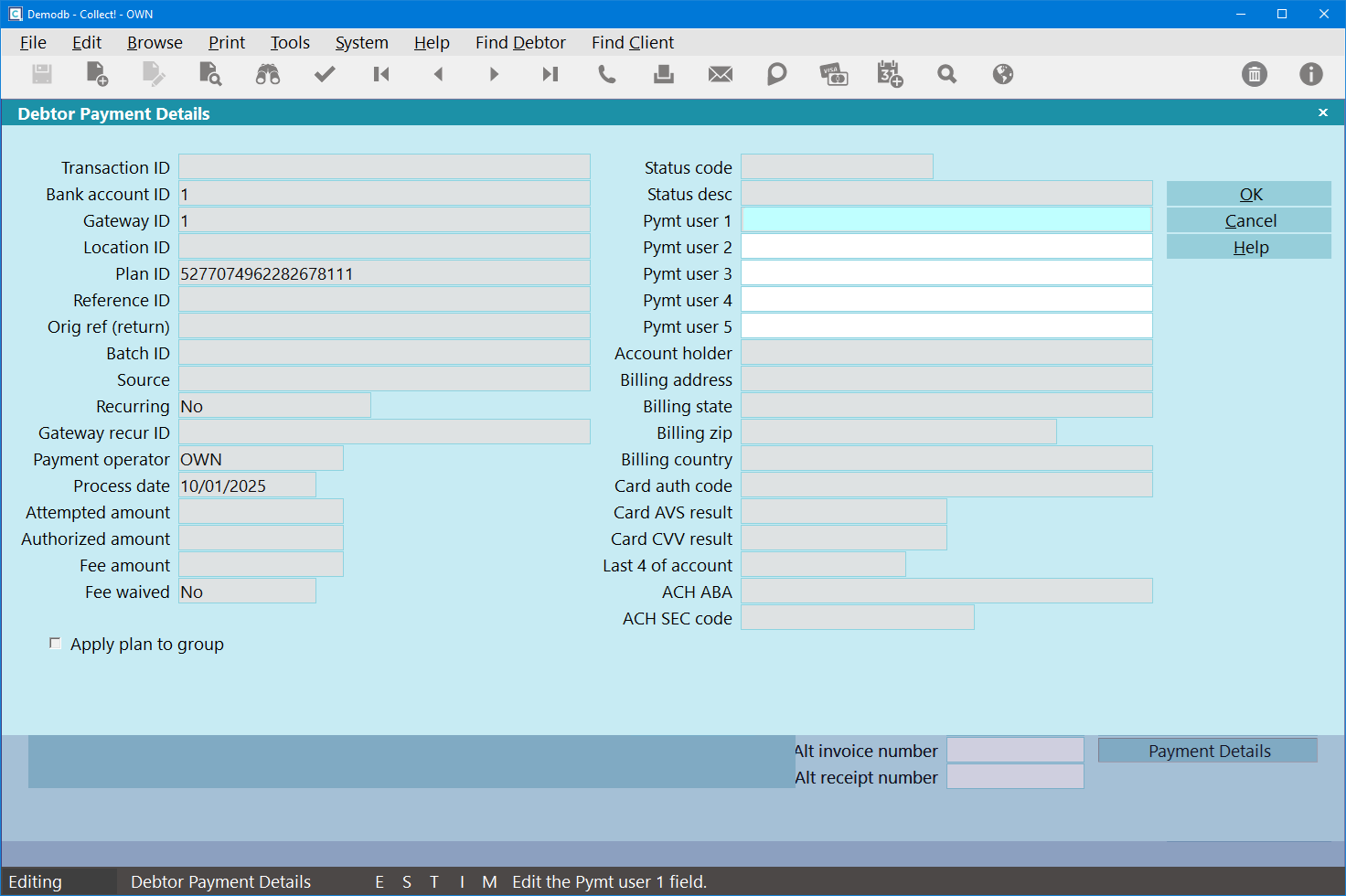

- If you take Checks by Phone, and the Client supplied banking information, enter it on the Detail

tab until you get permission from the Debtor to use it.

- If you report this client's accounts to the Credit Bureau, and you have not enabled the

Automatic Activation feature, go to the CBR tab and check the Report to Credit Bureau box.

- If this account was added to a group, go to the Group tab, click the Member Setup button and

review the settings.

Finalizing The Account

When you are satisfied that you have entered all the information that you want to enter, press OK

or F8 to save the record. At this time, any previously scheduled contact plan (the code showing up

in the Action field) will automatically run on the account. You will be returned to the Client form.

If this is a new Client or Contact Plan, go back in to the account to ensure that the

Contact Plan ran as expected.

If this is a new Client or Contact Plan, go back in to the account to ensure that the

Contact Plan ran as expected.

If needed, add more accounts, repeating the steps above.

Debtor Status Codes

What are Status Codes? Is the debtor bankrupt (BNK), have they skipped (SKP), or are they active (ACT)?

Use a basic three character code to tell you the current state of each account. It is important to

put some thought into this aspect so that you can define status codes which have meaning for you.

With status codes, you can select clearly defined groups of debtors and perform specific actions on

their accounts. This information may be accessed to produce debtor information reports based on

assigned status.

Click Here to View this Form.

Click Here to Close this Form.

Debtor Status codes are standard status values

that describe the state of the account, such as Active,

Paid in Full, Bankrupt, Skip Trace and others.

These codes can be used in reports and batch processing

to separate accounts into categories. Set an account's

Debtor Status either manually, or automatically using

contact plans.

To add, edit, or remove Status Codes, navigate to the

Top Menu -> System -> Contact Management Settings -> Status Codes

Debtor Status Codes

Code

This is a short code for the status. Limit to 3 or 4 characters.

Be aware that using the Status CLO (Closed) does

not remove the account from the Client record. It

only tags the account as Closed in your system.

Be aware that using the Status CLO (Closed) does

not remove the account from the Client record. It

only tags the account as Closed in your system.

Description

This is a brief description of the status condition.

WIP Priority

When sorting the Work in Progress list by Status via the

WIP Sort field on the WIP Options form, Collect!

will look at this field first and sort it descending, then

Ascending by Status Code.

Run Plan

Fill this field in with a Contact Plan code to run the

Contact Plan on the Debtor or Client when this Status is

selected.

Listing Reversal

Switch this ON to exclude any debtors with this status from

financial calculations on the client form. This would also

require the 'Exclude reversals from Recalc' option to be

enabled in the Client Settings of each client.

Switching this option on will also display reversals separately,

on the Day Sheet record. Listing reversals are meant to be

accounts that were placed in error.

OK

Select this button to save any

changes you have made and return you to

the previous form.

<<

Selecting this button will take you to the

previous record in the database.

>>

Selecting this button will take you to the

next record in the database.

Cancel

Selecting this button will ignore any changes

you have made and return you to the previous

form.

Help

Press this button for help on the Debtor Status

form and links to related topics.

Delete

This button is visible only on the list of all

Debtor Status Codes. Select this to delete

the highlighted item in the list.

Edit

This button is visible only on the list of all

Debtor Status Codes. Select this to open

and modify the highlighted item in the list.

New

This button is visible only on the list of all

Debtor Status Codes. Select this to open

a new blank Debtor Status form.

Reports And Letters

You may build your own reports and letters or modify the existing reports in the system. This

template driven system can print virtually any information you see in the program.

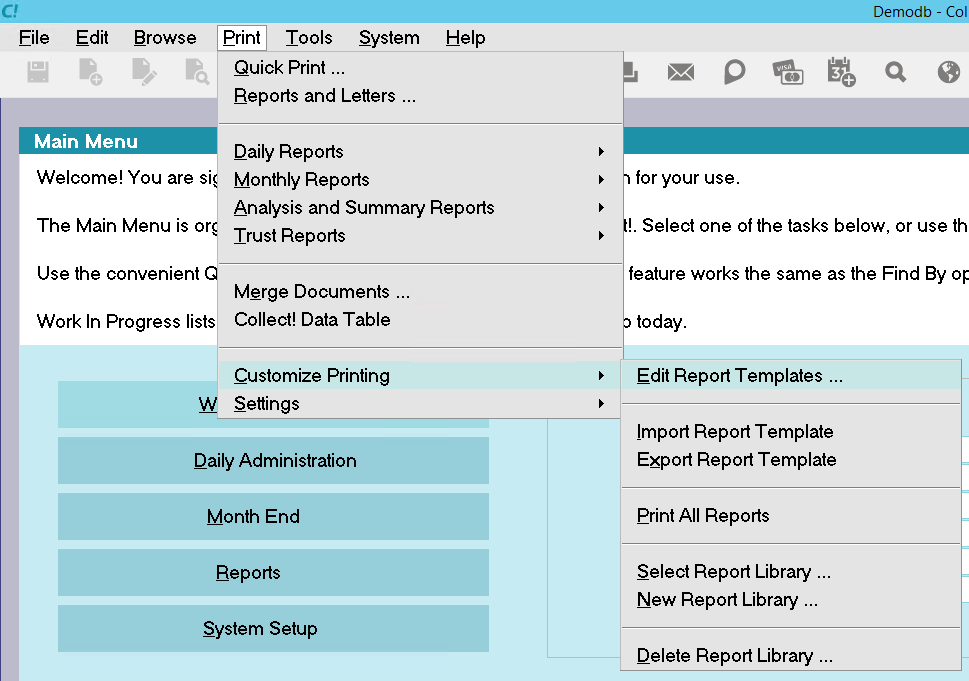

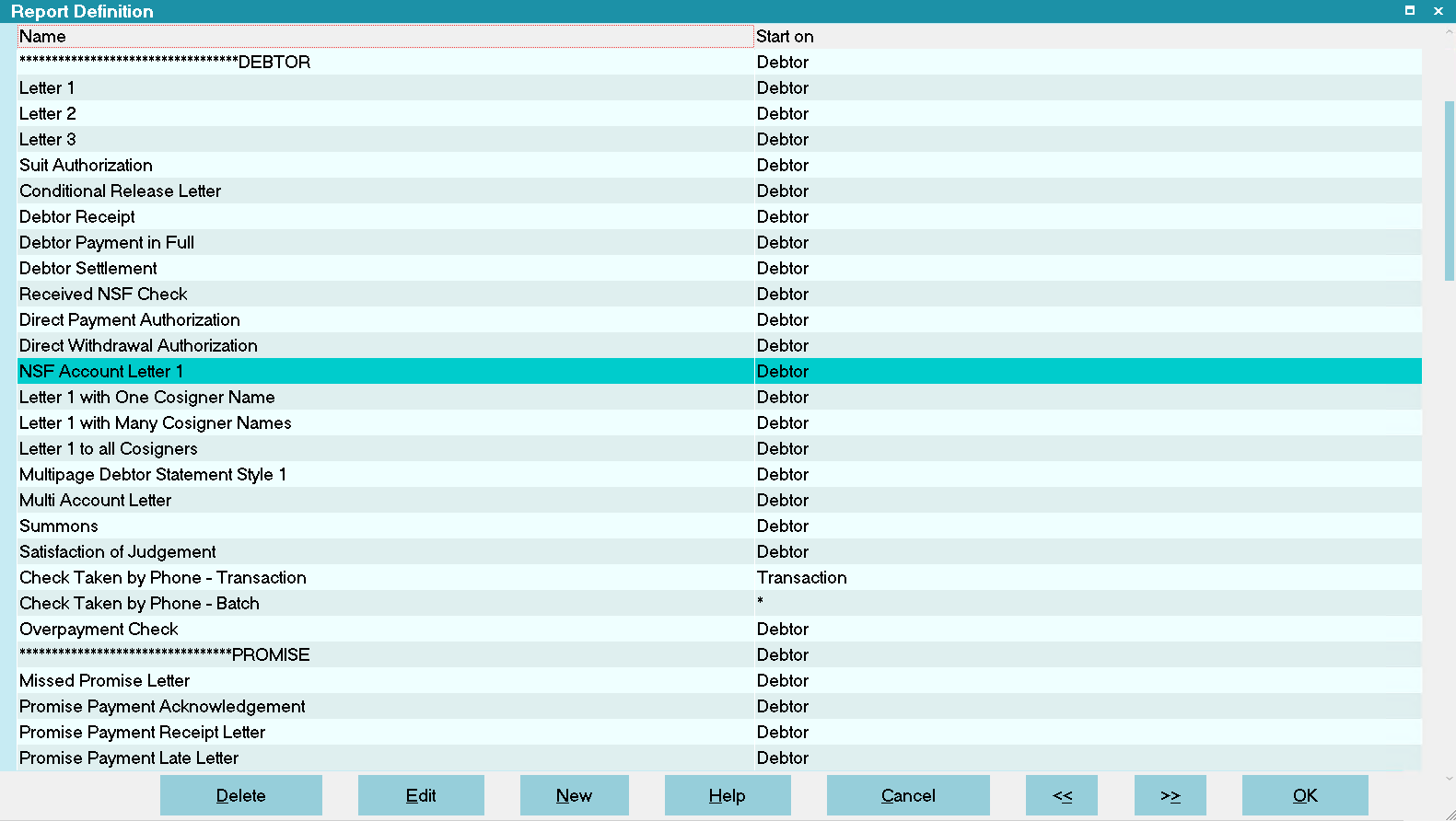

Create reports and letters to suit your business needs. Edit the existing Reports and Letters by

selecting Print from the top menu bar. Then select Customize Printing, Edit Report Templates and

select the report you wish to modify.

Particular emphasis on your initial collection letters that need to be ready to be inserted on new

accounts. The SAMPLE letters which ship with Collect! are NOT intended to be used as is; they are

exemplars of how to set letters up.

Click Here to View this Form.

Click Here to Close this Form.

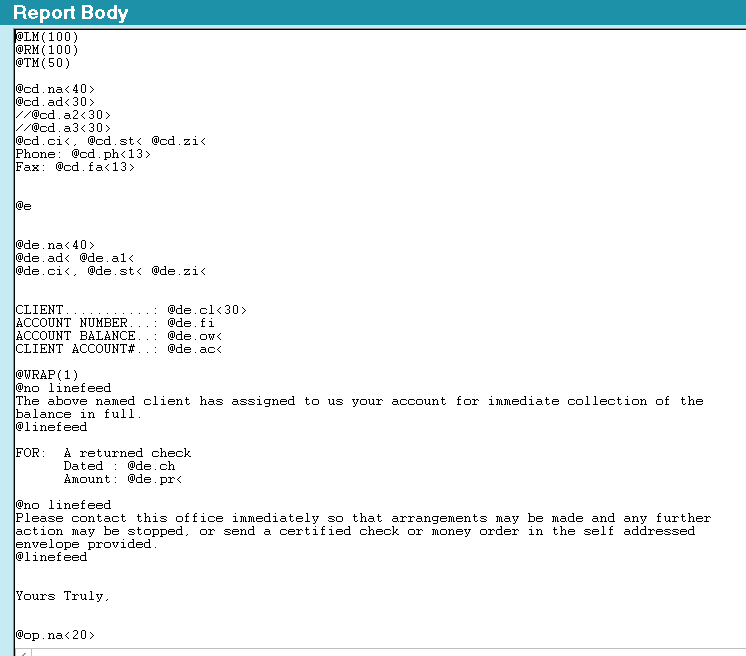

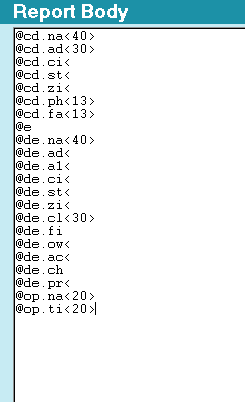

This topic covers the basic steps necessary to begin to create your own reports or letters in

Collect!.

Requirements

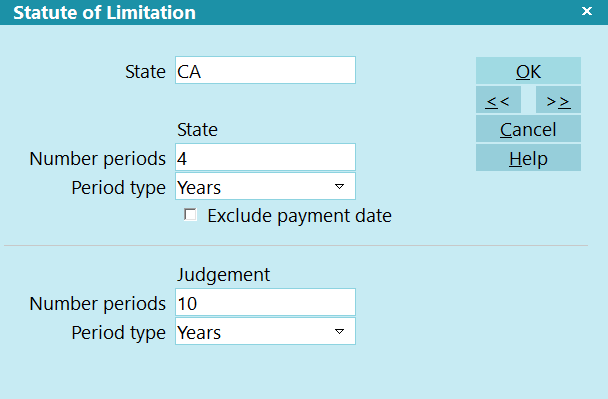

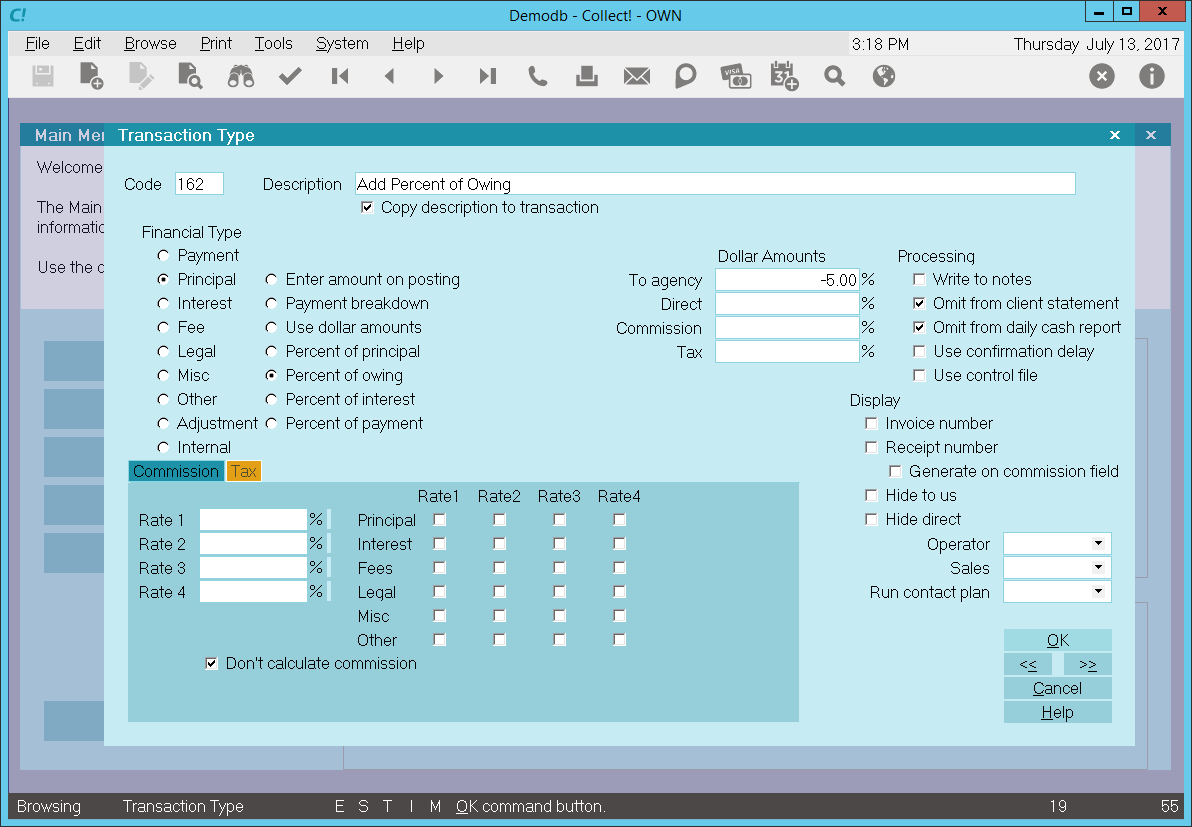

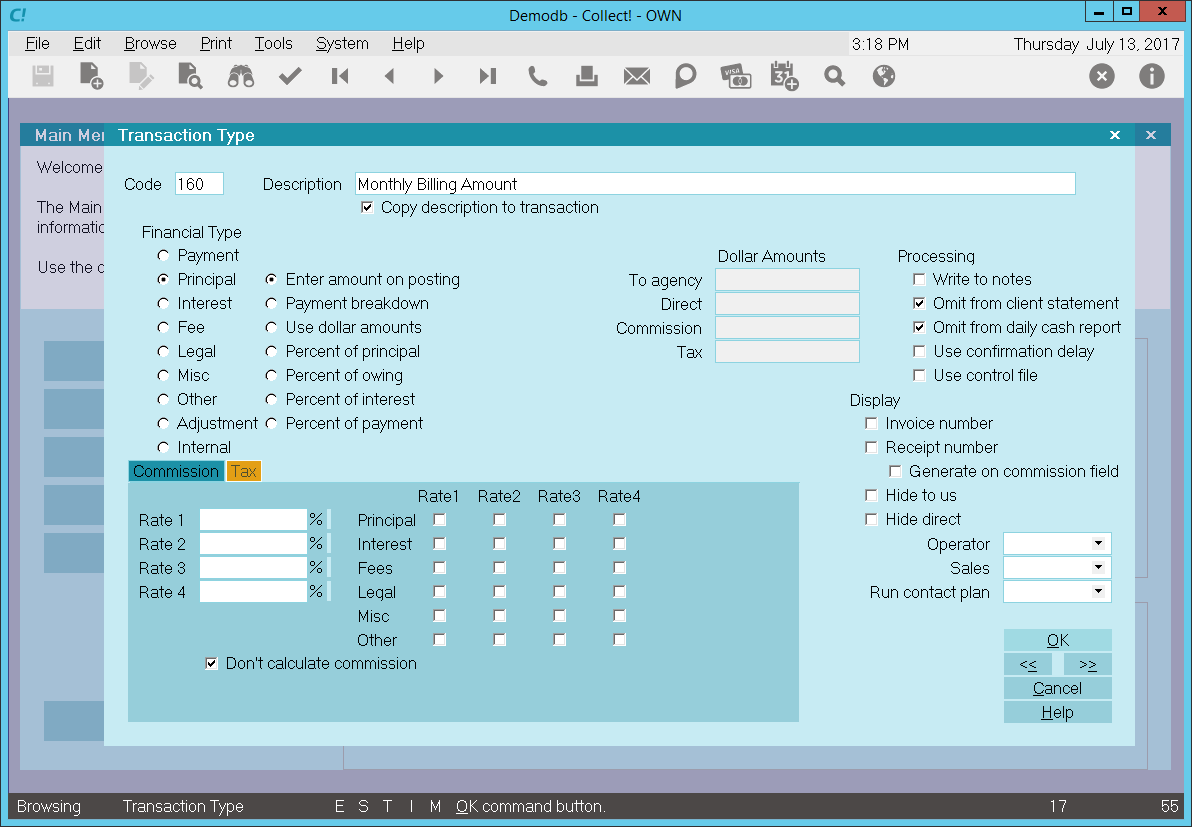

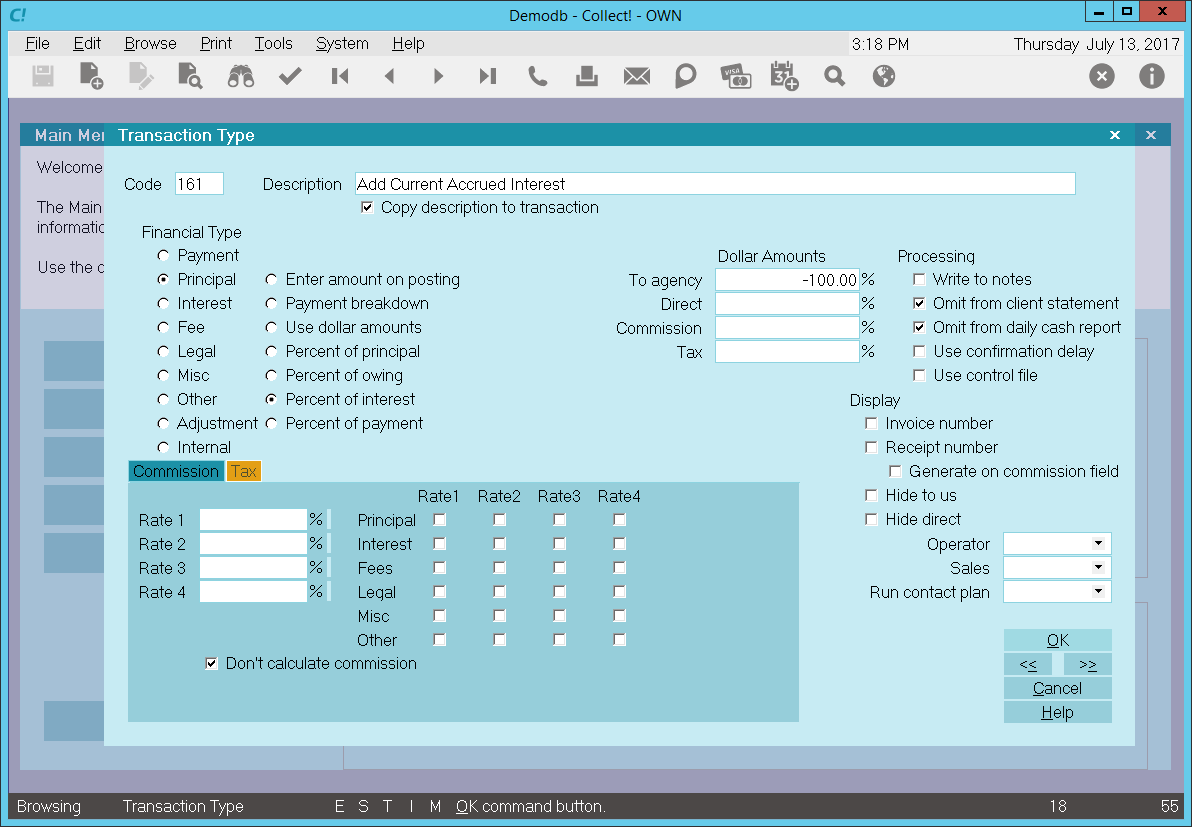

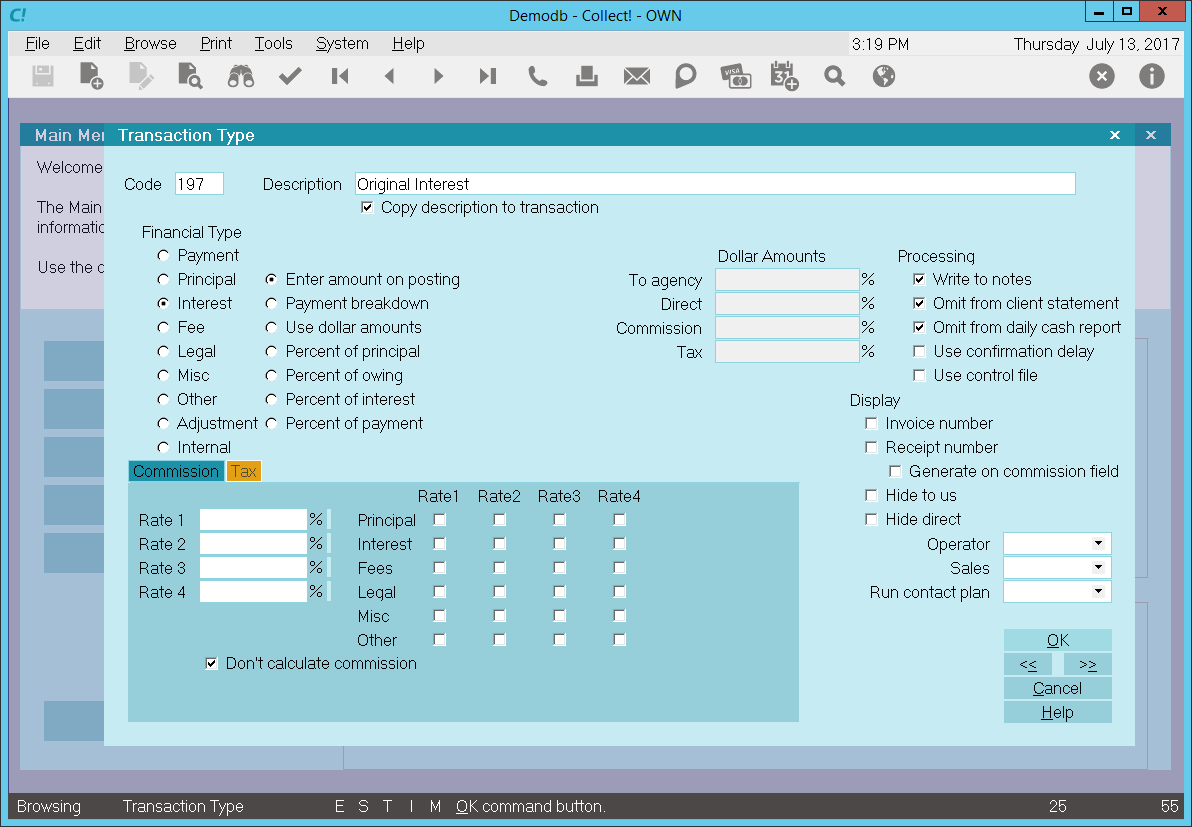

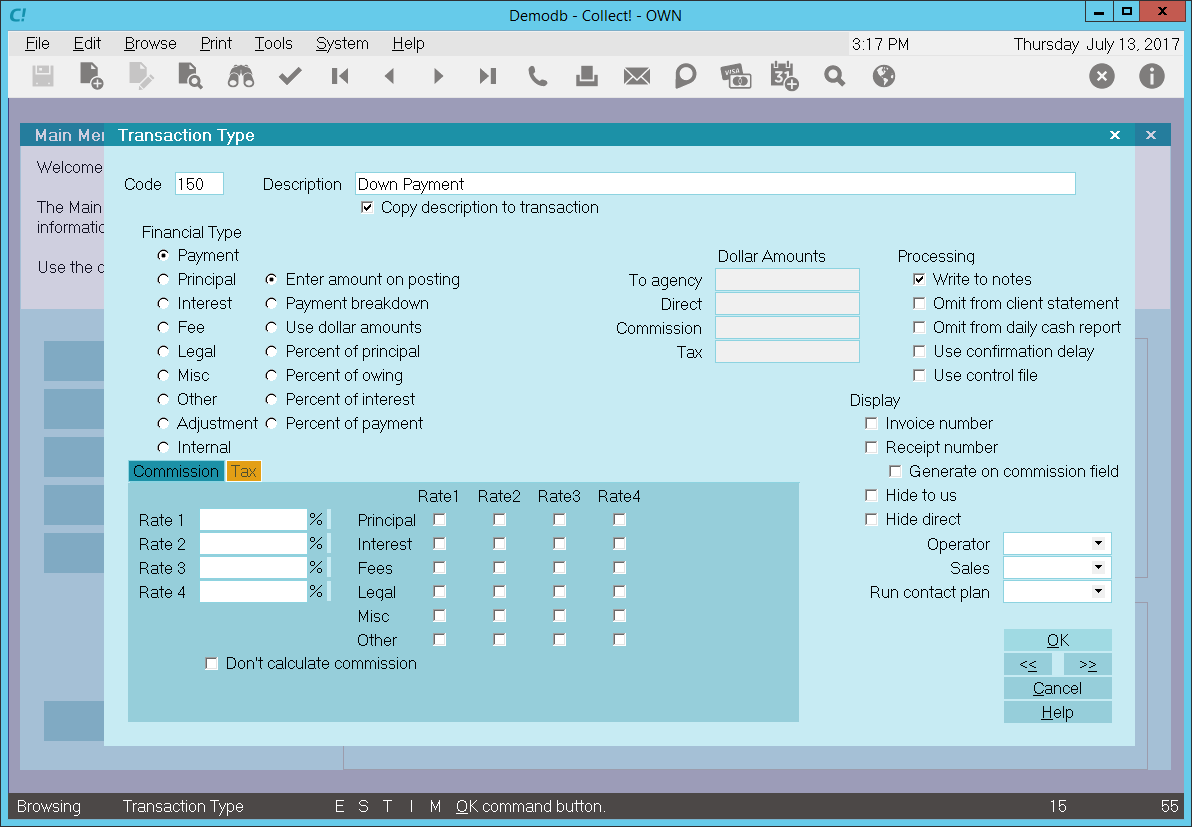

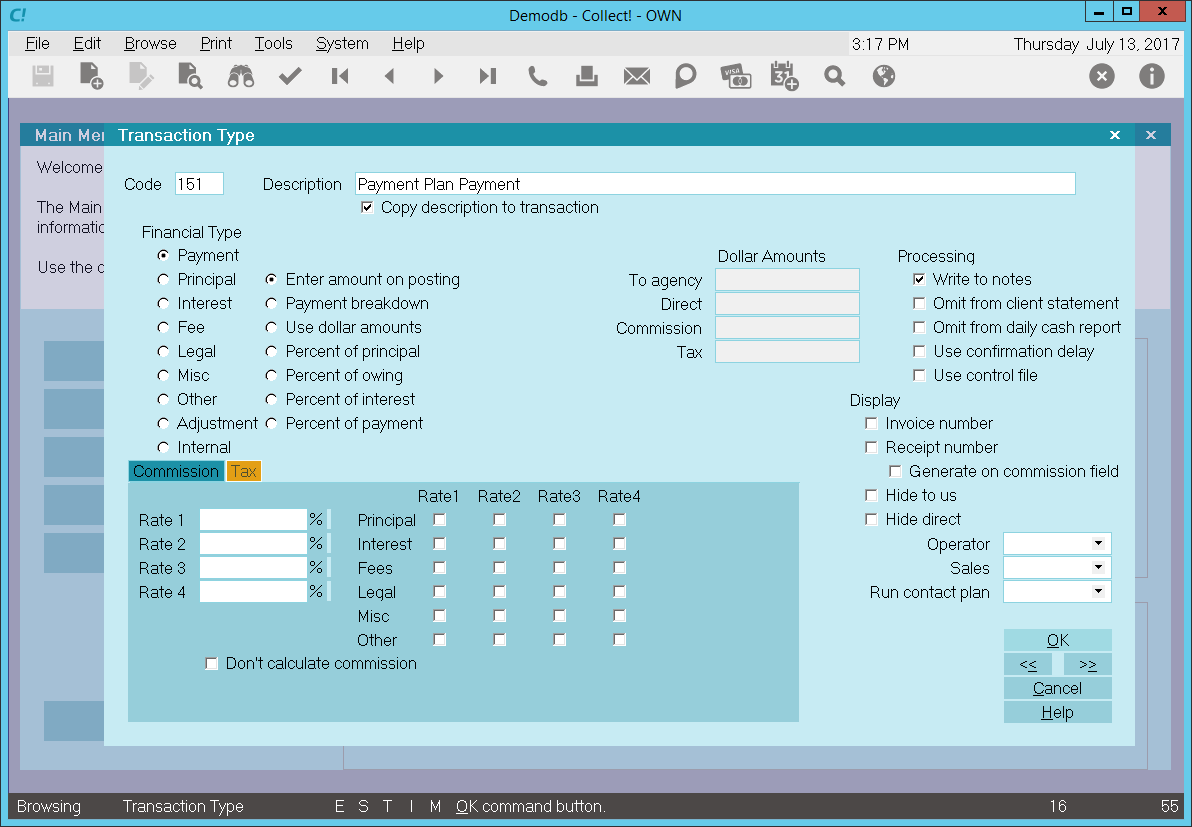

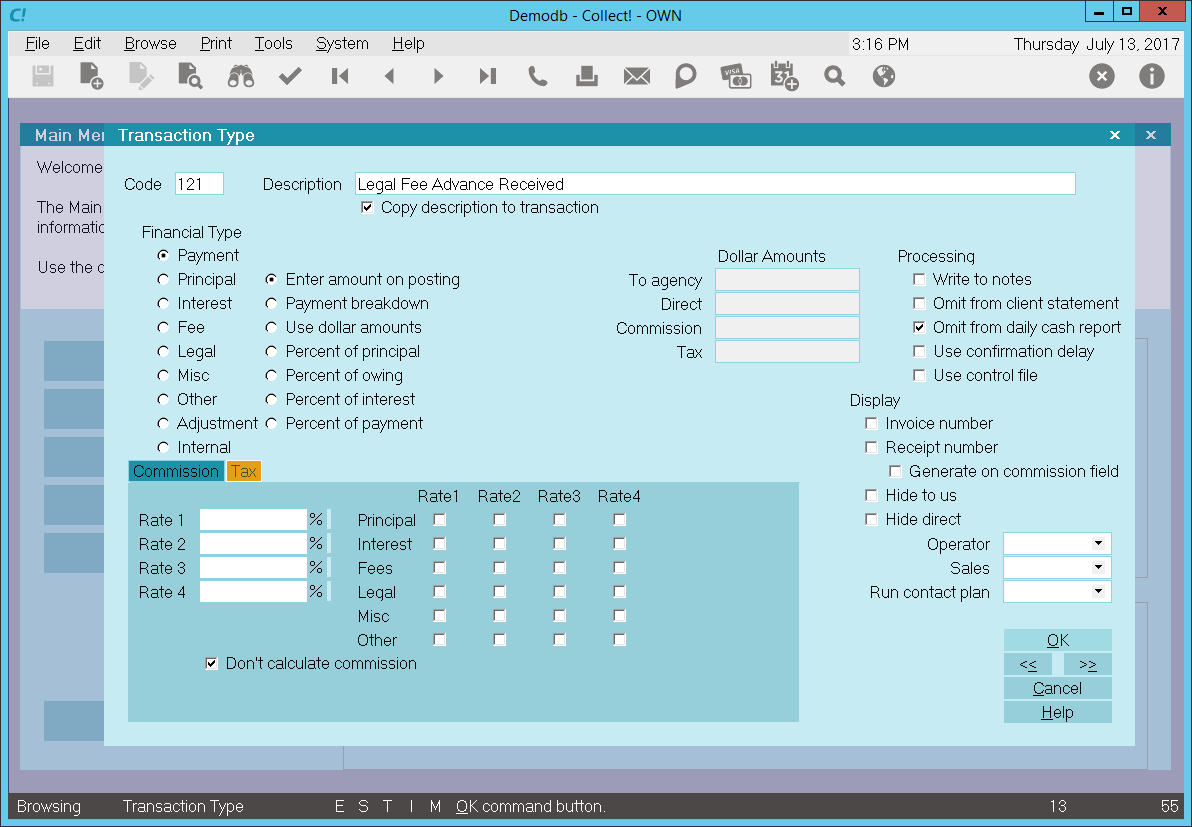

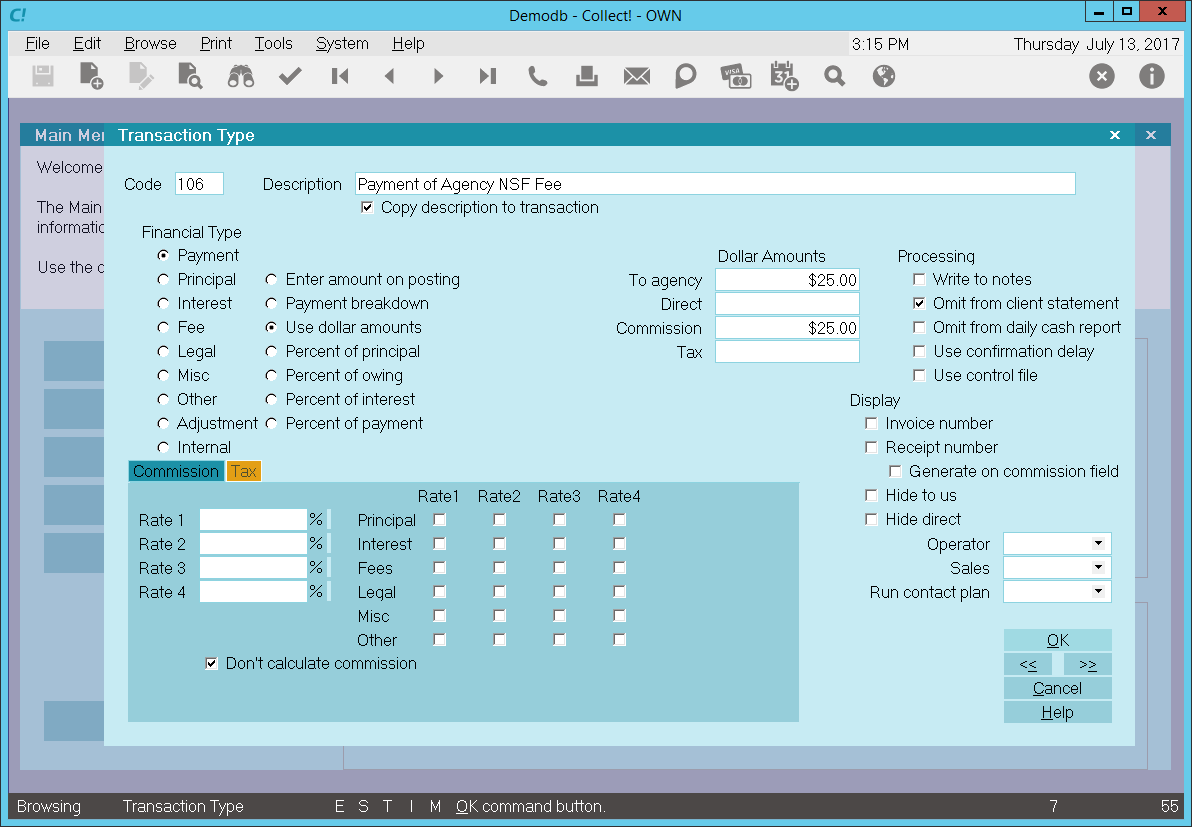

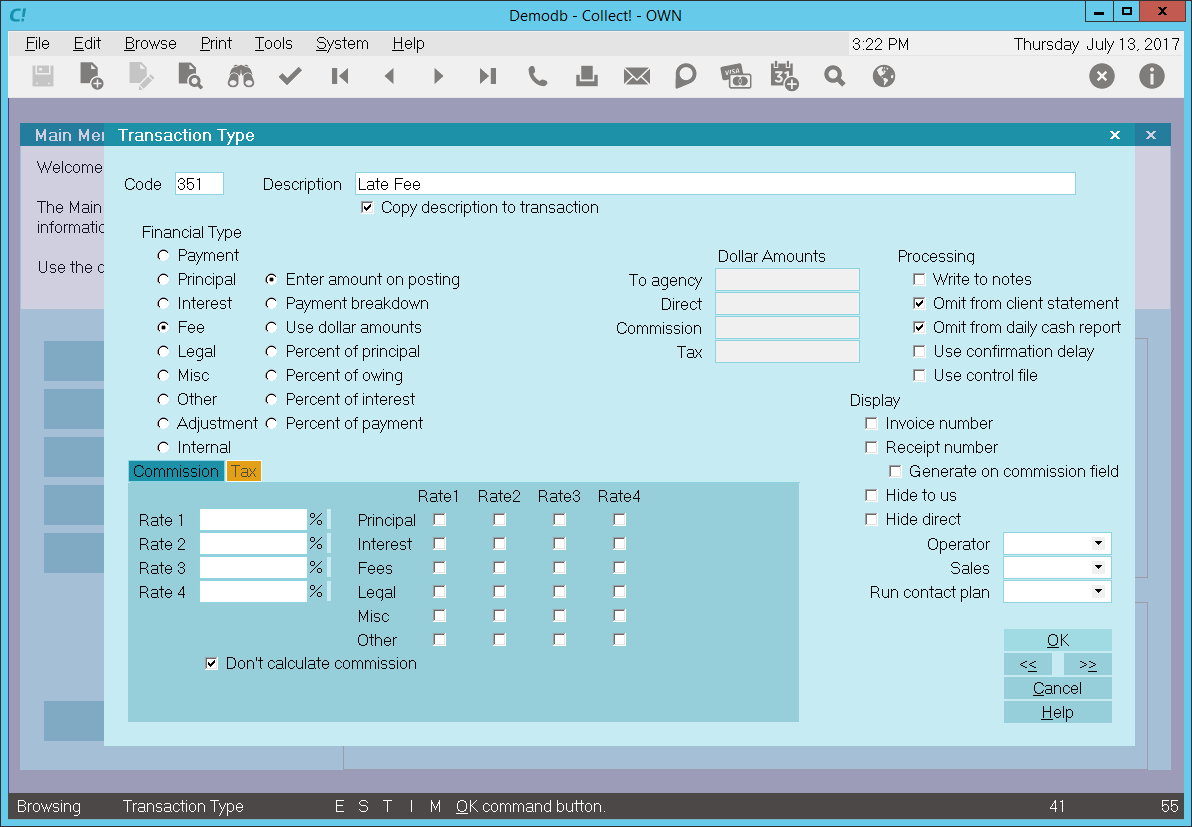

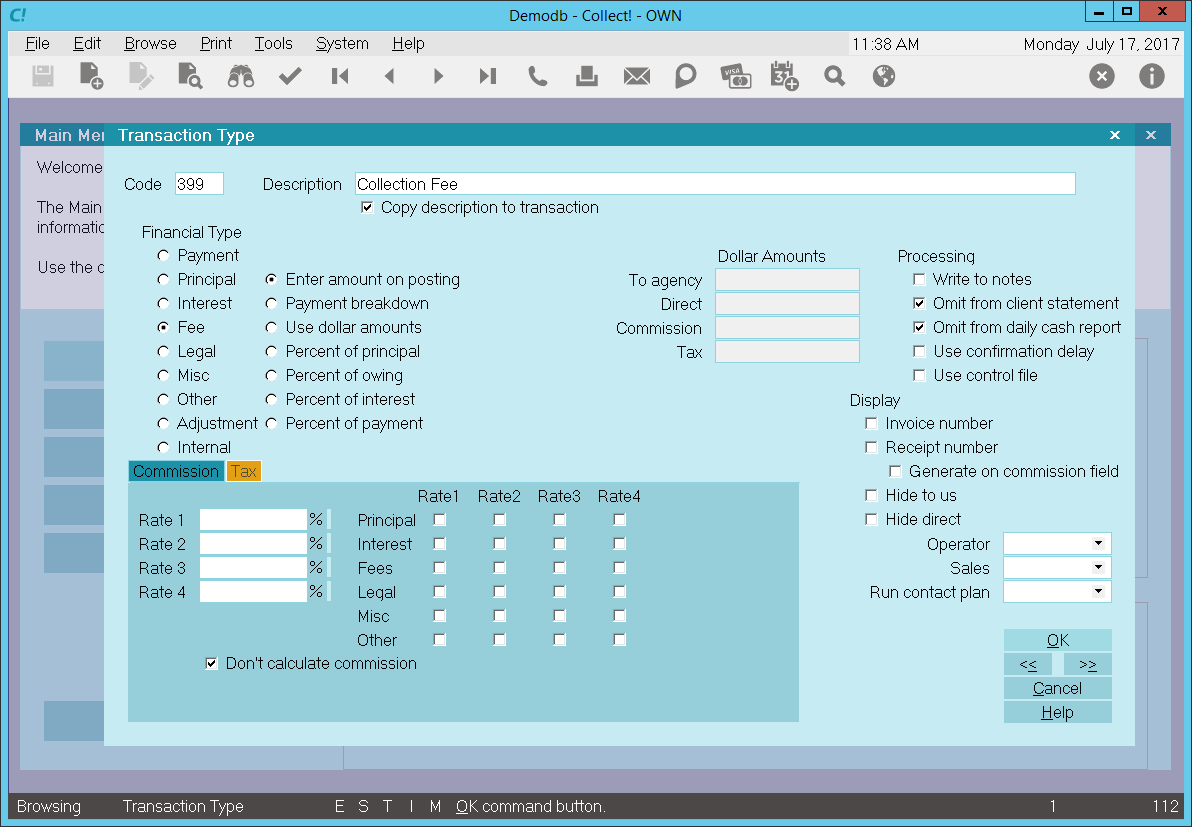

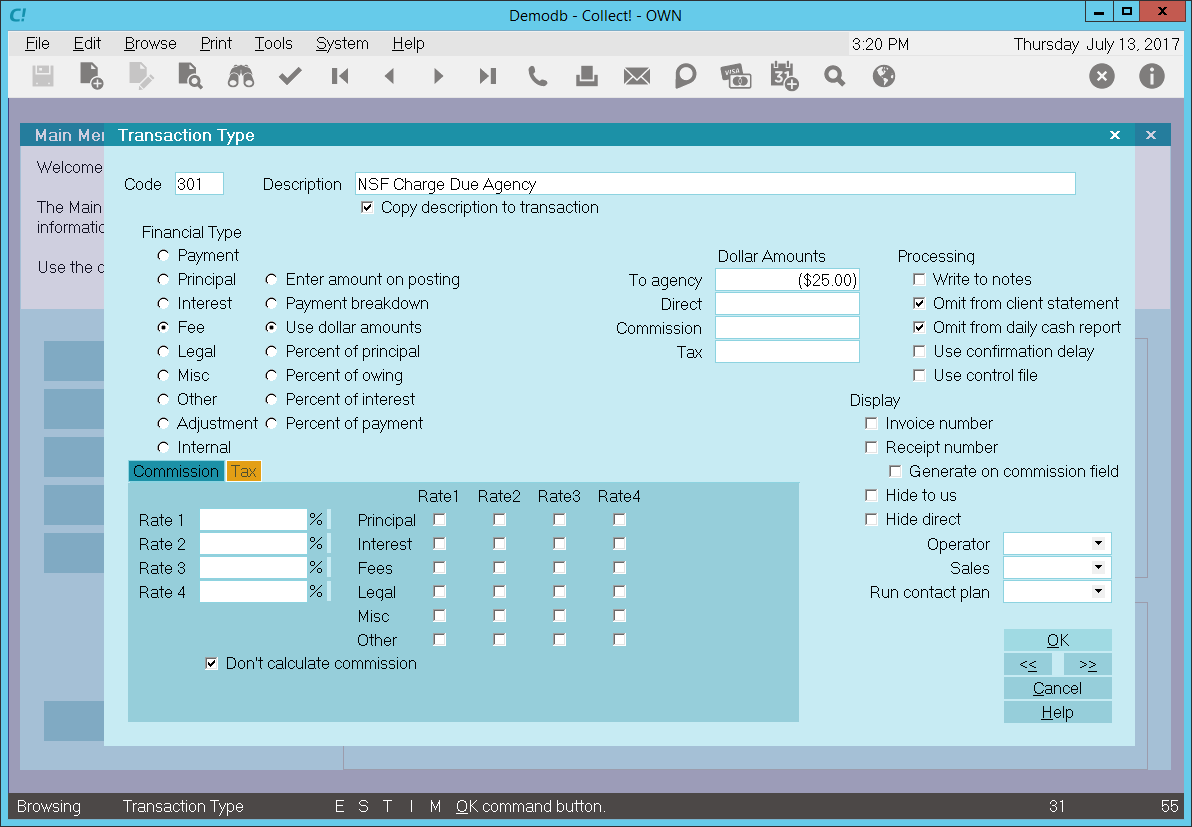

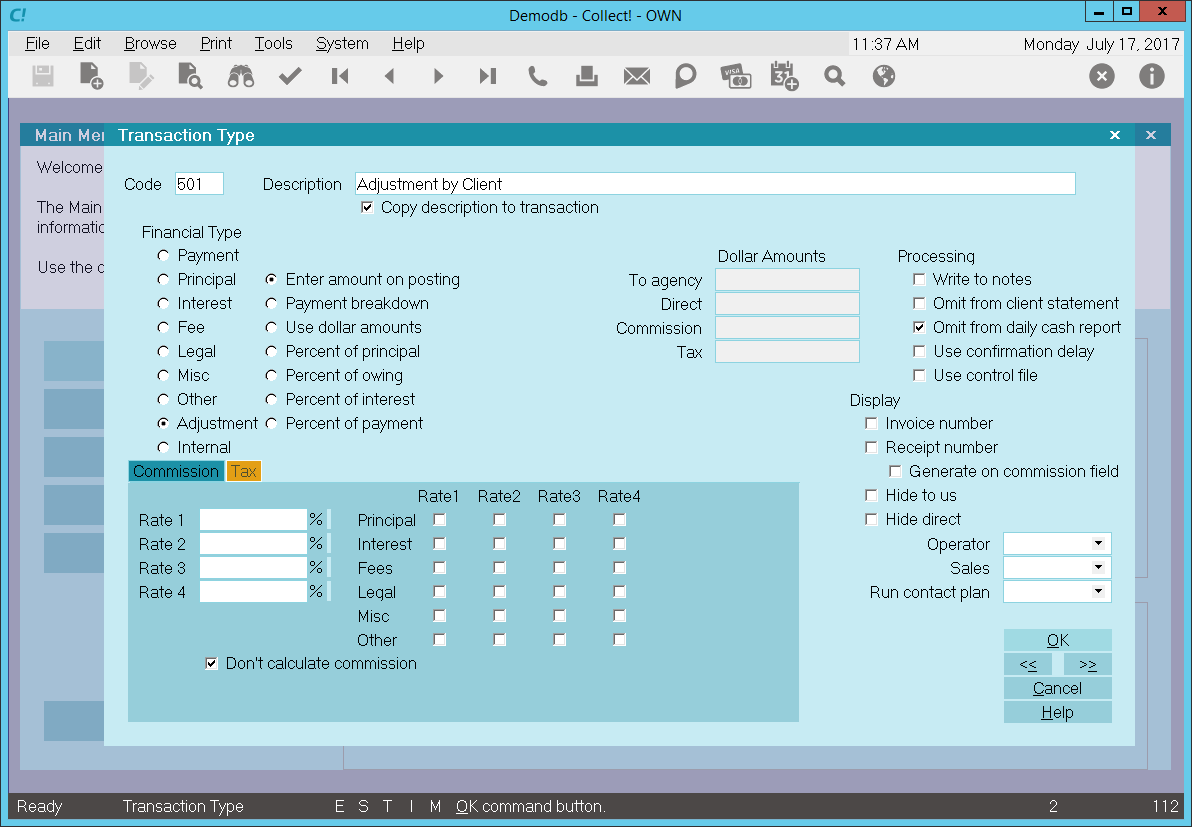

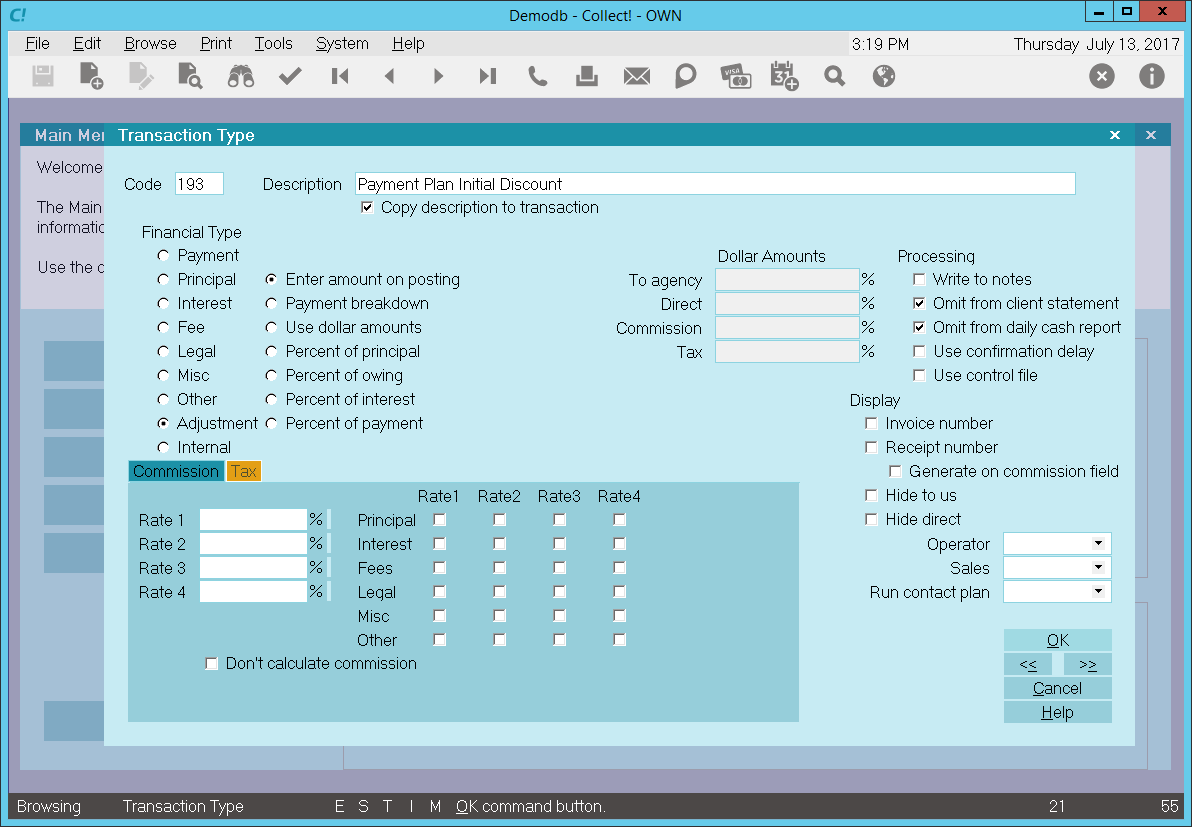

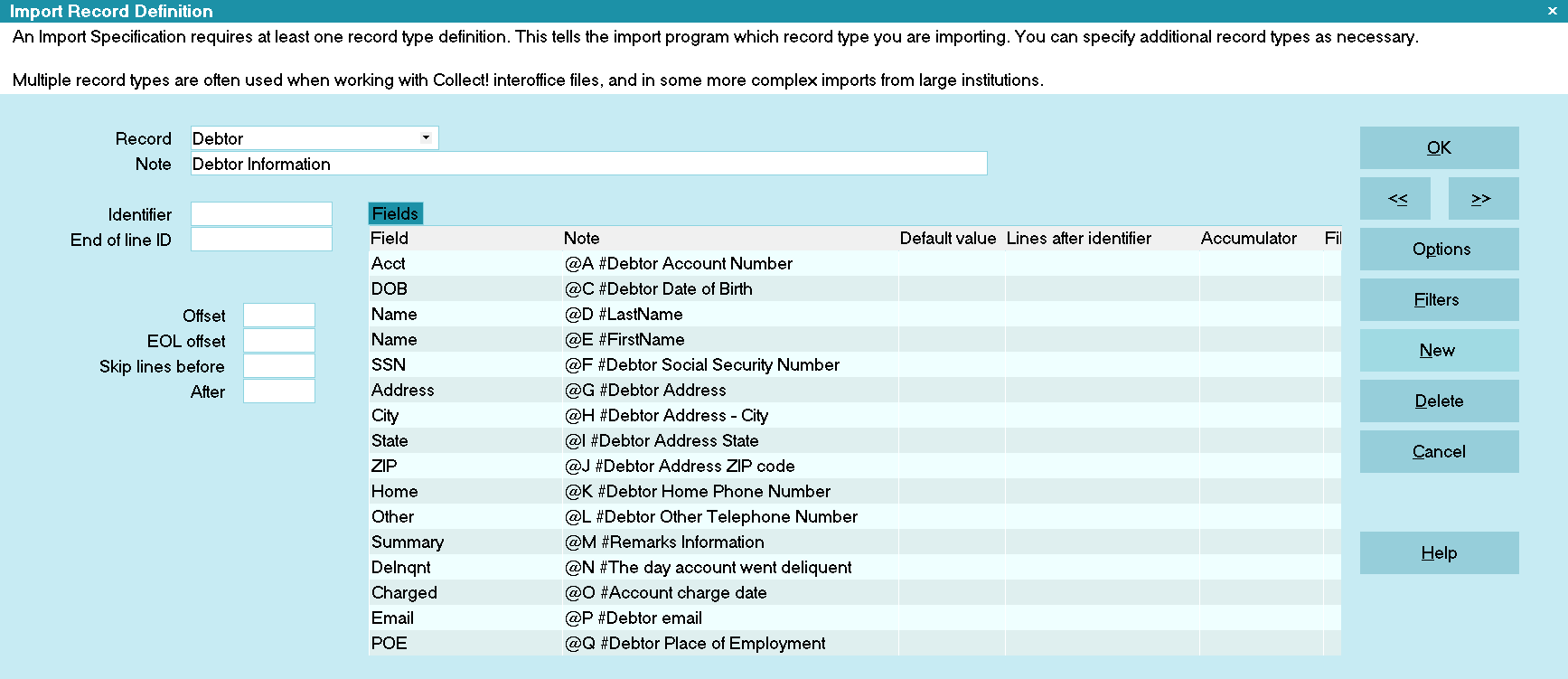

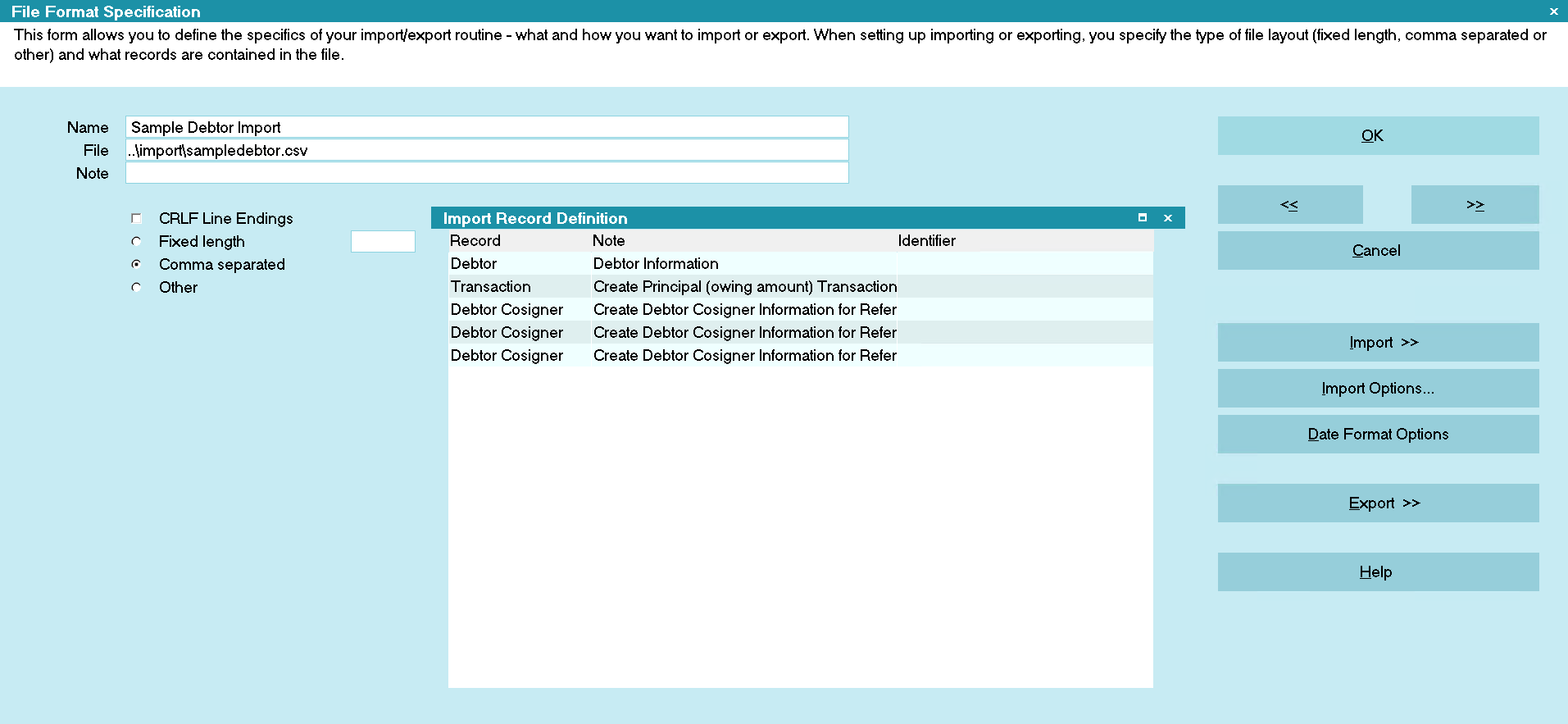

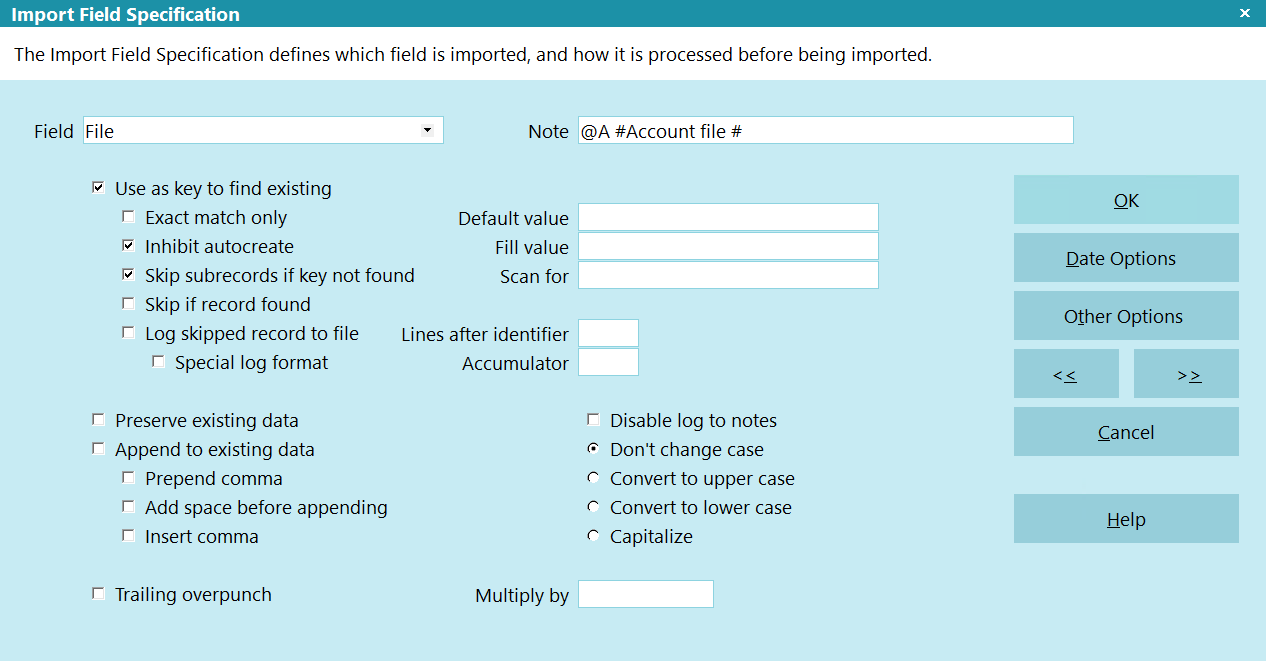

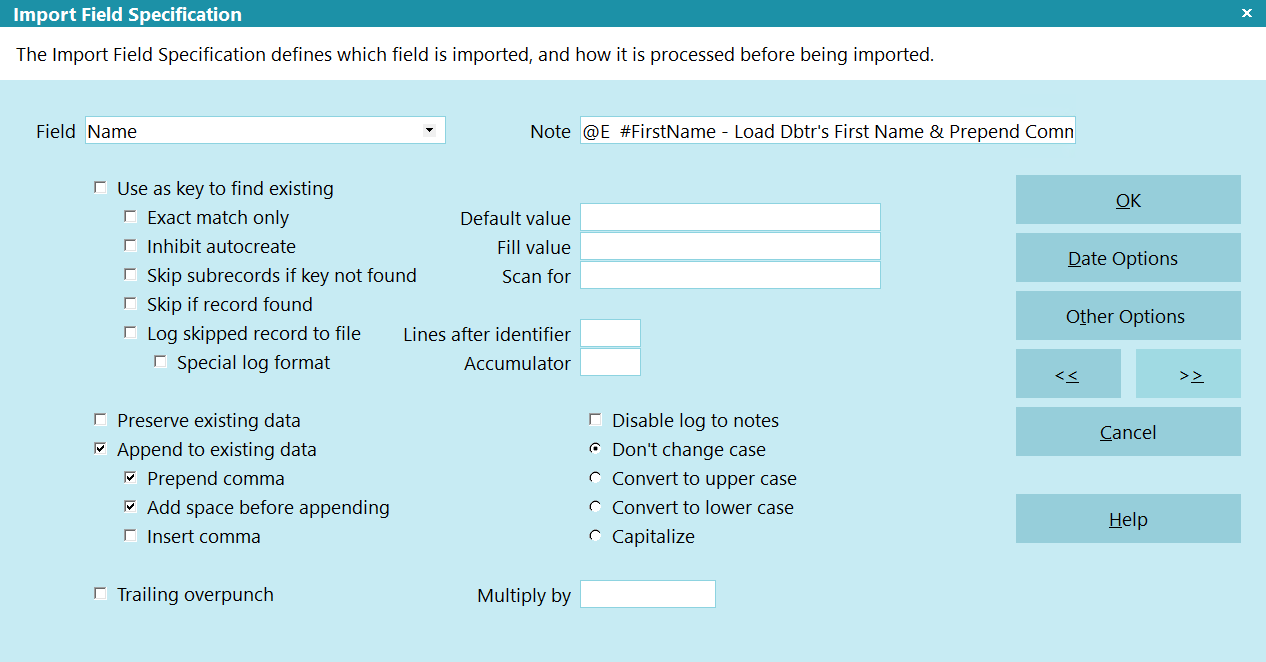

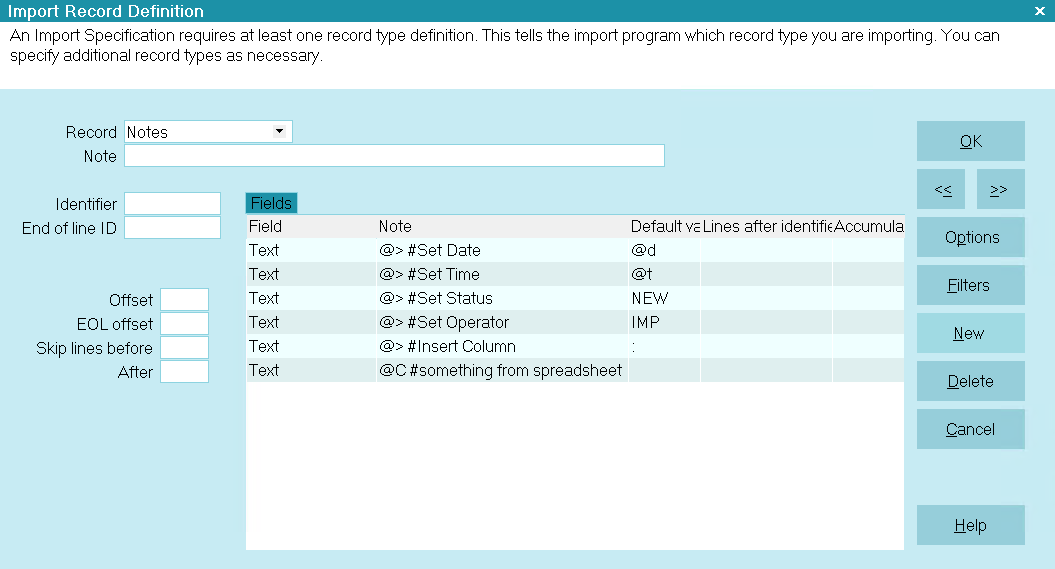

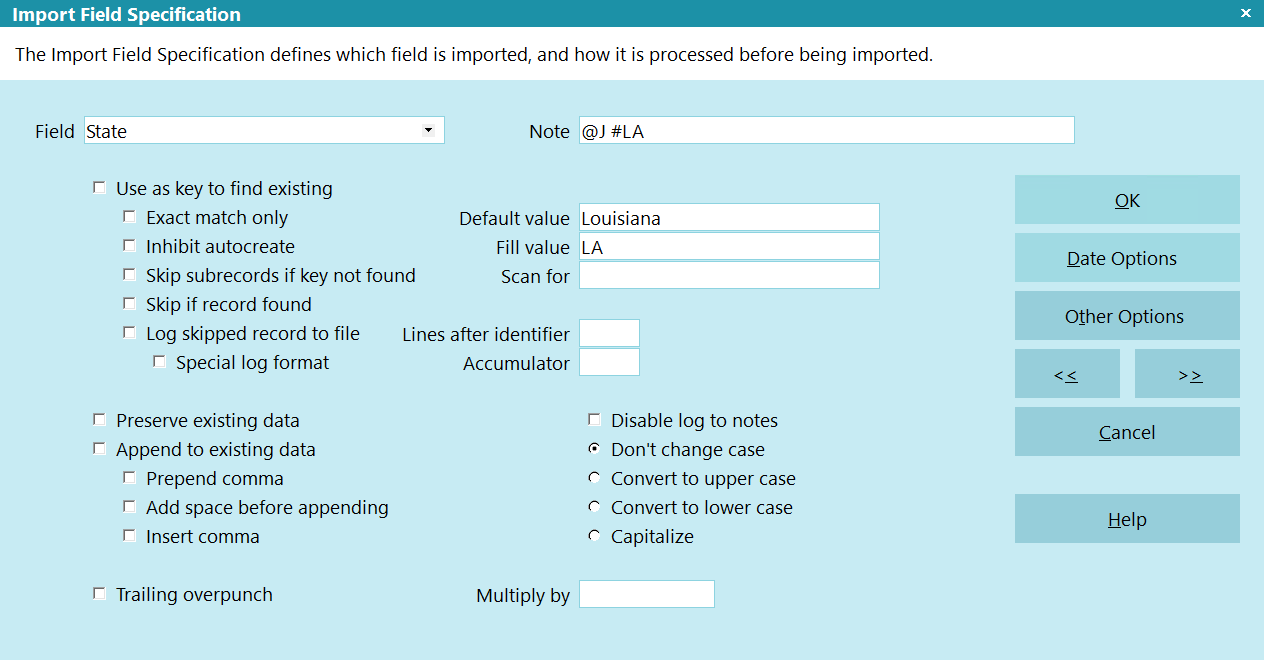

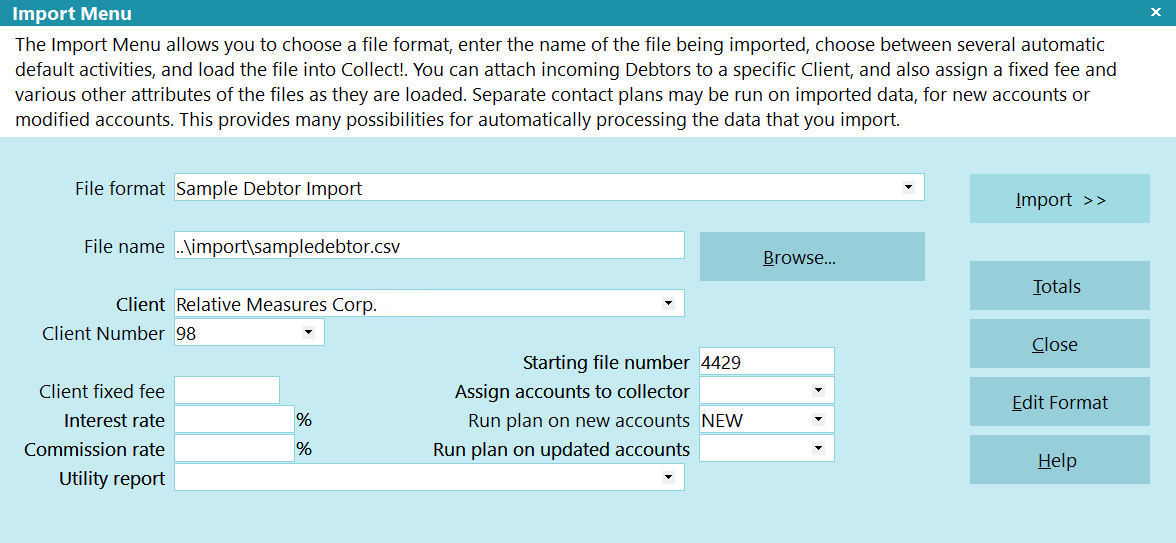

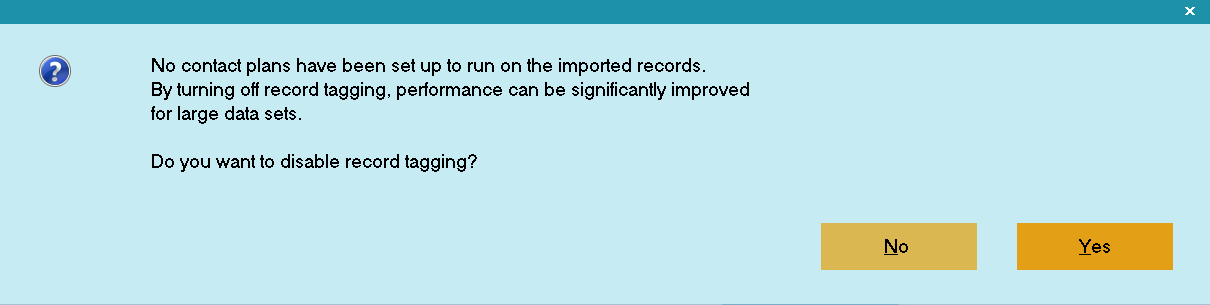

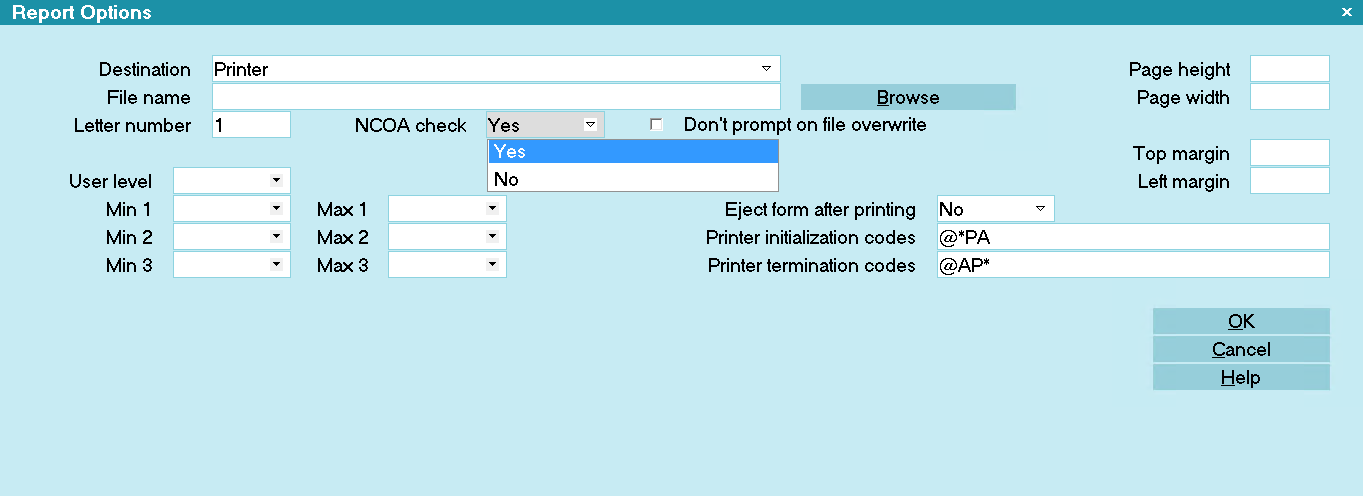

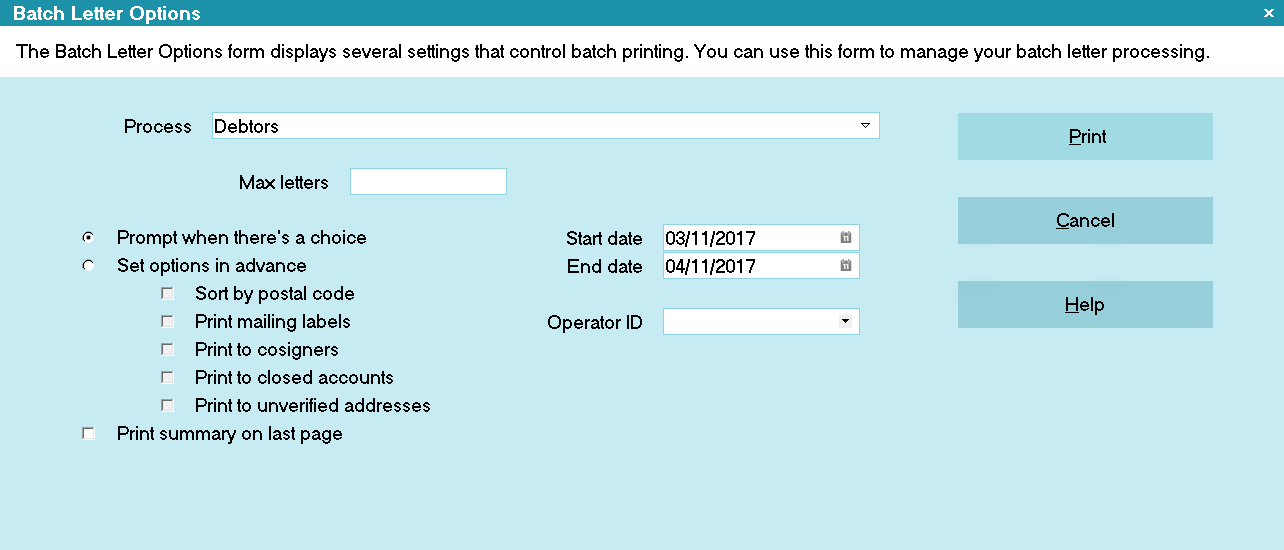

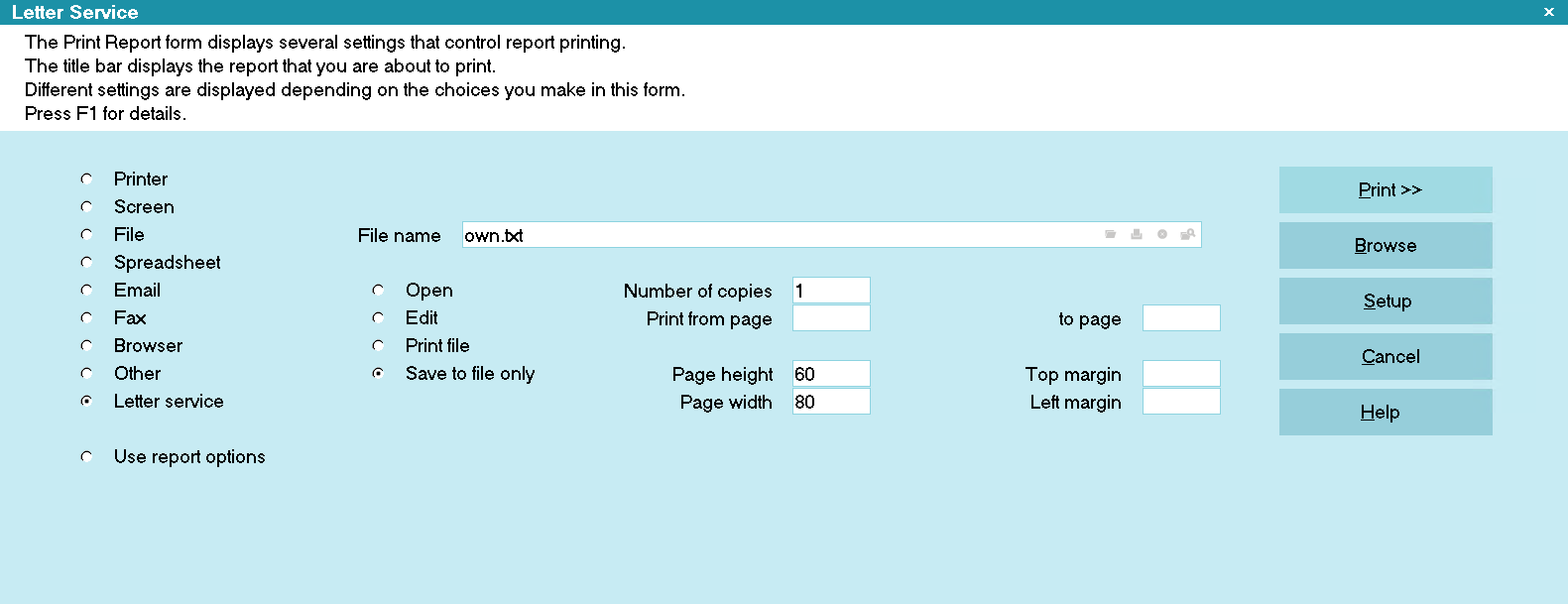

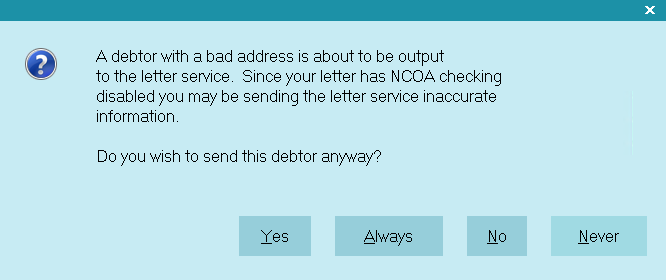

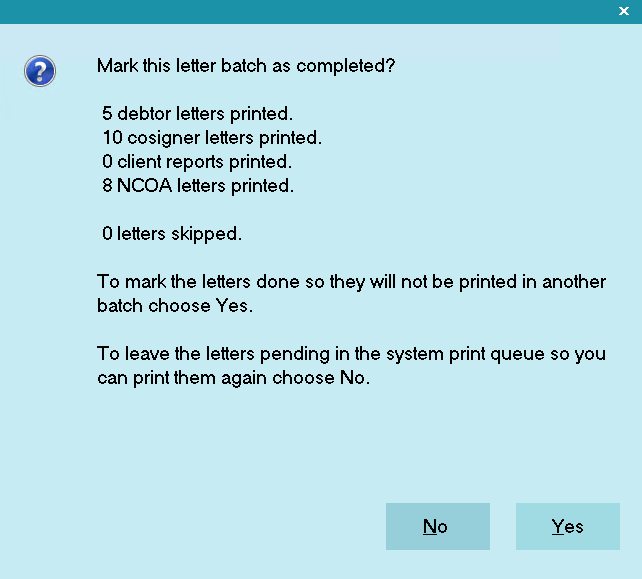

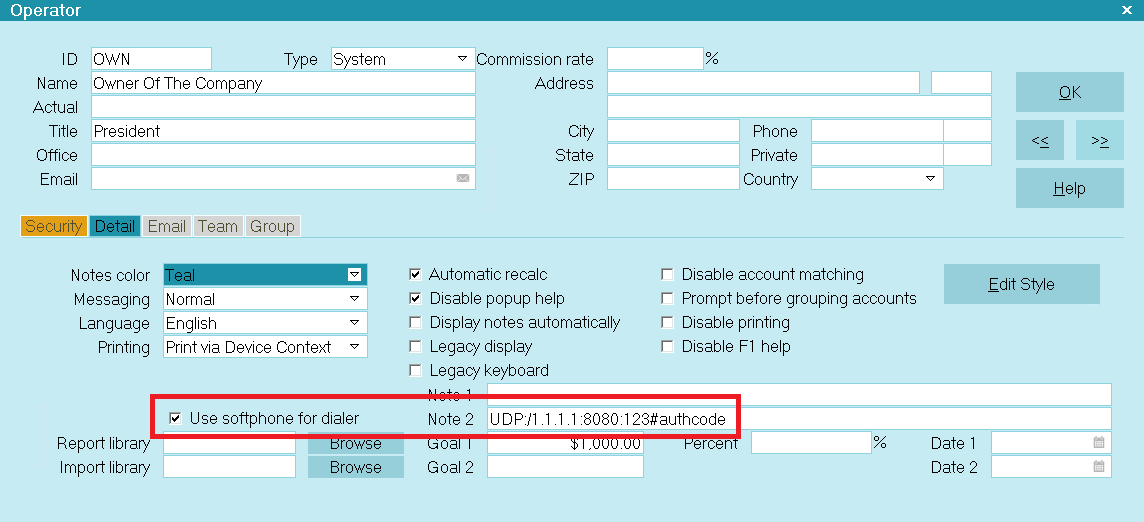

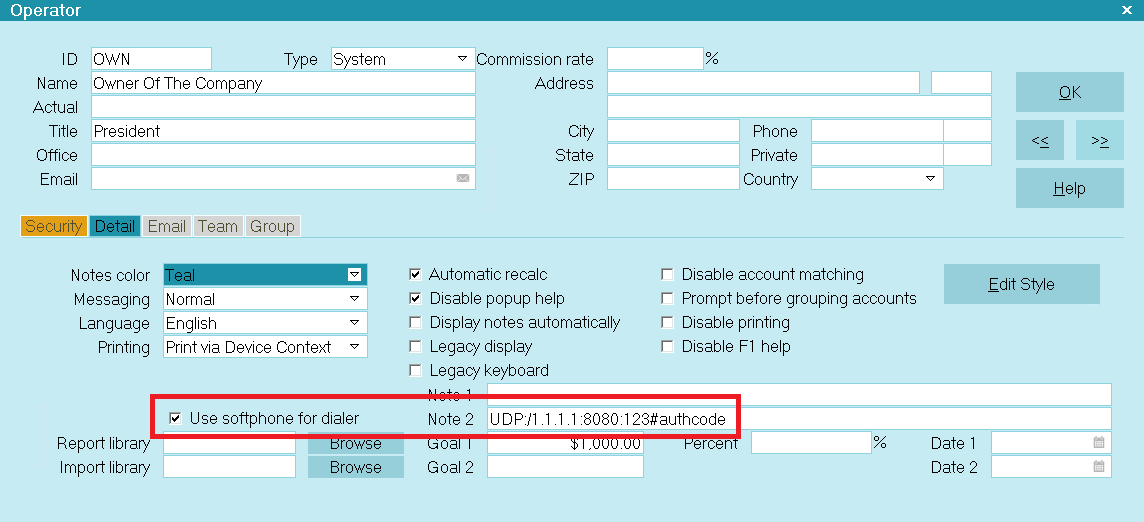

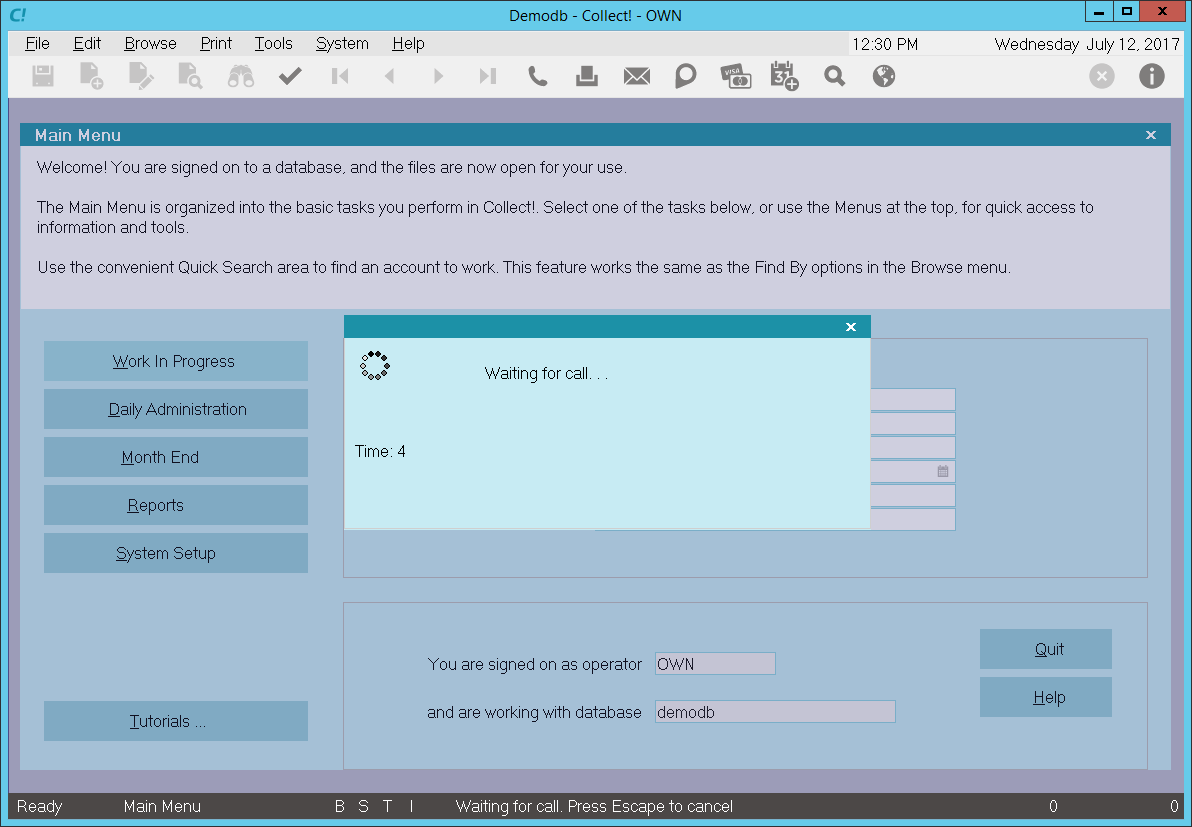

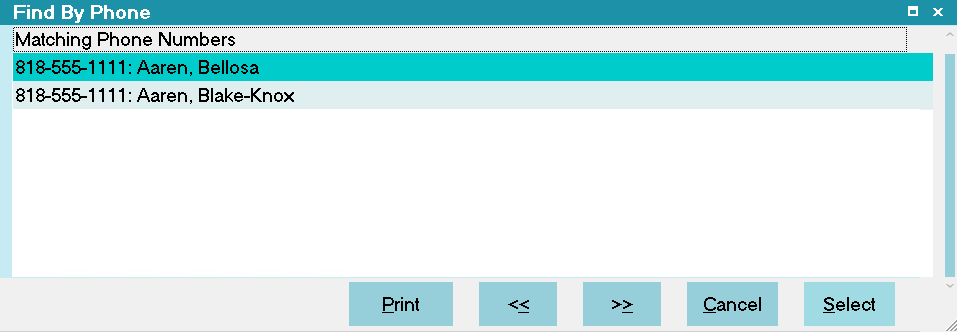

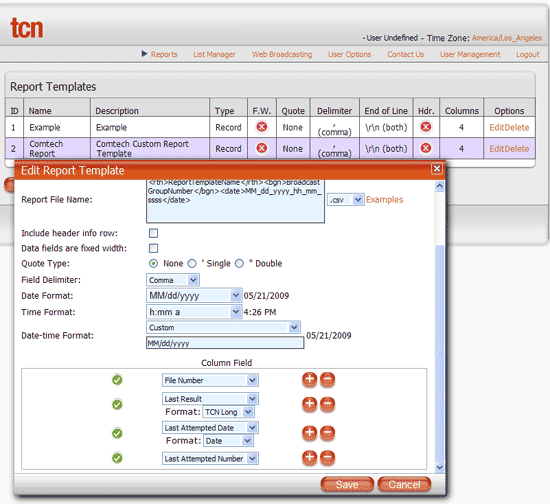

- Setup Company Details